Professional Documents

Culture Documents

Housing Prices: More Room To Fall? March 2010

Uploaded by

FloridaHossOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Housing Prices: More Room To Fall? March 2010

Uploaded by

FloridaHossCopyright:

Available Formats

Housing Prices:

Prakash Loungani

From a

I

N 1625, Pieter Fransz built a house in in value in 10 years, only to begin another

Amsterdam’s new Herengracht neigh- sharp decline. This recent run-up and cor-

historical borhood. As the Dutch Republic rose rection in prices in Amsterdam was part of a

perspective, to global power in the 1620s—with

Amsterdam developing the world’s first

global boom and bust in house prices. House

prices soared in the United States, fueled by

it is not the major stock market as well as commodities innovations in housing finance. They also

trend but and futures markets—the price of the house

doubled in less than a decade. Over the suc-

rose in Ireland, coinciding with a historic

growth surge; in Spain and Australia, buoyed

the volatility ceeding three centuries, the price of Fransz’s by immigration; and in Iceland as part of a

in housing house was knocked down by wars, recessions, boom induced by a tremendous expansion in

and financial crises and rose again in their the country’s financial sector. In 2006, house

prices that is aftermaths (Shorto, 2006). When the house prices started to fall, first in the United States

distinctive changed hands in the 1980s, its real value,

Loungani

and then elsewhere (see Chart 2).

that is after inflation, had

only doubled over the course

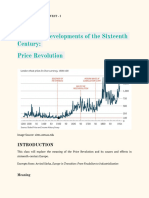

Chart 1

of 350 years––offering a very

modest rate of return on the The long view

investment. Between 1628 and 2008 house prices in the Herengracht

Indeed, viewed over the long neighborhood rose and fell, but on average the real price

course of history, the distinc- doubled.

tive feature of house prices (1628 = 100)

in Herengracht has been not 400

the trend but the cycles (see 350

Chart 1): innovations and good Long-term average

300

times raised the price for years 250

at a time and—seemingly just

200

when the conviction had taken

150

root that this time would be

100

different—shocks came along

to knock prices back down. 50

Starting in the late 0

1628 1728 1828 1928 68 80 2000 08

1990s, prices of houses in

Source: Eicholtz, Piet M.A. , 1997, “The Long Run House Price Index: The Herengracht

Herengracht, and more gen- Index, 1628–1973,” Real Estate Economics, updated to 2008 by Eicholtz.

erally in Amsterdam, doubled

16 Finance & Development March 2010

The Herengracht, Amsterdam, Pieter Fransz’s neighborhood.

More Room to Fall?

This boom-bust cycle is commonly seen as a major con-

The house price cycle

tributor to the global financial crisis, itself generally recog-

nized as the most dangerous economic threat the world has The upturn in house prices in 18 advanced economies1 that started

in the mid-1990s and continued for a decade eclipsed that of

faced since the Great Depression. Understanding the causes

earlier cycles. The downturn that began three years ago continues.

of house price cycles and how to moderate them is important

Upturn Downturn

for the maintenance of macroeconomic stability, both at the

Cycle Duration Price swing2 Duration Price swing3

national and global levels.

1970–mid-1990s 21 quarters +40 percent 18 quarters –22 percent

What do we know about the incidence and amplitude

Mid-1990s–present 41 quarters +114 percent 13 quarters –15 percent

(price swings from peak to trough and vice versa) of house

Source: Igan and Loungani (forthcoming).

price cycles in countries across the globe? What are the driv- 1The 18 countries are Australia, Canada, Denmark, Finland, France, Germany, Ireland, Italy, Japan,

ing forces behind these cycles? And what does this analysis Korea, the Netherlands, New Zealand, Norway, Spain, Sweden, Switzerland, the United Kingdom, and

the United States.

tell us about the future of house prices? 2Real prices, from trough to peak.

3Real prices, from peak to trough.

Loungani

Chart 2 Facts about housing cycles

Up until it is not Establishing the turning points in a

During 2000–06 housing prices in most advanced economies rose. The decline since 2007 series of economic data—“dating”

has been just as widespread. cycles—is more reliable the farther

(percent) (percent) back in time the series extends.

100 10 House price data going back to the

House price change 2000–06 House price change 2007–09

80 5 1600s, such as for the Herengracht

60 0 neighborhood in Amsterdam, are

40 –5 the exception and not the rule. But

20 –10 for many members of the Organi-

0 –15

zation for Economic Cooperation

and Development (OECD), na-

–20 –20

tional house price data do extend

–40 –25

back to 1970, which is long enough

Ireland

Denmark

United States

Spain

United Kingdom

New Zealand

France

Japan

Italy

Finland

Germany

Korea

Netherlands

Norway

Canada

Sweden

Australia

Switzerland

Spain

France

United Kingdom

New Zealand

Ireland

Denmark

Sweden

Australia

Canada

Norway

Italy

United States

Finland

Netherlands

Korea

Switzerland

Germany

Japan

to permit reliable dating of house

price cycles.

Between 1970 and the mid-1990s,

Source: Organization for Economic Cooperation and Development. the average upturn in house prices

in 18 OECD economies lasted

Finance & Development March 2010 17

Housing prices: Fundamentals or bubbles? In contrast, Yeshiva University economist James Kahn, in

Robert Shiller is well known for predicting the U.S. stock mar- work done with coauthor Robert Rich at the Federal Reserve

ket crash of 2000–01 (see F&D, September 2008). In 2003, he Bank of New York, asserts that the surge in U.S. house prices can

warned that U.S. house prices too contained a “bubble”; that be explained by economic fundamentals, particularly expecta-

is, they had risen far beyond what was warranted by funda- tions of income growth. Kahn’s work suggests that the surge in

mental driving forces such as income growth, interest rates, house prices from the mid-1990s to 2007 was based on a belief

demographic change, and building costs. Shiller showed that that productivity growth would lead to continued growth in

the ratio of house prices to both rents and incomes was the incomes. The dynamic reversed in 2007 when productivity

highest it had been in a century. growth was perceived to have slowed, thereby stifling the hous-

Shiller thinks that such bubbles form because expectations ing boom and the viability of mortgages predicated on sustained

of asset prices are often formed by stories and social percep- increases in house prices. Though U.S. productivity growth had

tions of reality and by excessive confidence in positive out- begun to decelerate in 2004, the perception of that deceleration

comes. Corrupt and antisocial behavior by some can act to caught up with reality only in 2007, according to Kahn.

magnify the bubble. In the context of U.S. housing markets, Kahn also argues that because of the relatively inelastic

Shiller argues, people became attached to the perception that nature of the housing supply, house prices can grow faster than

house prices never fall or that this time would be different. The incomes in periods of above-average economic growth and

marketing of mortgage loans to people with manifest inabil- fall sharply when growth slows. The resulting amplification

ity to repay and the repackaging of such loans into marketable of price responses to underlying changes in the fundamental

securities served to magnify the consequences of these false determinants manifests itself very much like the bubble-and-

perceptions. bust scenario that recently took place.

just over five years, during which real (inflation-adjusted) Driving forces behind house price cycles

prices increased an average of 40 percent (see table). The Why do house prices go through the cycles shown in the

subsequent downturn typically lasted four and a half years, table? Both long-run relationships and short-run forces are

and prices fell about half as much as they rose during the at work.

upturn. Long-run relationships: Economic theory asserts that house

The past offers a prism through which to view the pres- prices, rents, and incomes should move in tandem over the

ent house price cycle, which started sometime between the long run. Why? Consider house prices and rents first. Buying

mid-1990s and early 2000s for most countries. The upturn and renting are alternate ways of meeting the need for shel-

in this most recent cycle lasted twice as long on average as ter. In the long run, therefore, house prices and rents cannot

those in the past (41 quarters compared with 21 quarters) get out of sync. Were that to happen, people would switch

and was more pronounced, with prices rising nearly three between buying and renting, bringing about adjustments

times as much. The ongoing downturn is approaching the both in prices and rents to bring them back in line. Likewise,

duration of past downturns, and the fall in house prices thus in the long run, the price of houses cannot stray too far from

far is nearing the amplitude of past downturns. But because people’s ability to afford them––that is, from their income.

prices rose much more sharply than in earlier upturns, their Take, for example, these long-run relationships in the

Lounganimight eclipse those observed in the past.

decline United States and Loungani

the United Kingdom (see Chart 3). The

Chart 3 Chart 4

Joined at the gables Propelling house prices

In the United States and the United Kingdom, as in many countries, rents and incomes Strong income and population growth can

move with house prices. give a mighty push to real house prices as

(ratio) (ratio) happened in Ireland after 1992.

(average annual growth, percent)

1.35 1.65 United Kingdom

United States 25 1.6

1.30 1.55 GDP (left scale)

Population (right scale) 1.4

1.25 1.45 20

House price–to-rent ratio House price–to-income ratio

1.20 House prices (left scale) 1.2

1.35

1.15 1.25 15 1.0

Long-term

1.10 Long-term average average 0.8

1.15

10 0.6

1.05 1.05

1.00 0.95 0.4

5

0.95 0.85 0.2

0.90 0.75 0 0.0

1970–91 1992–06

1970 80 90 2000 08 1970 80 90 2000 08

Sources: Author’s calculations based on IMF and Organization

Source: Organization for Economic Cooperation and Development. for Economic Cooperation and Development data.

18 Finance & Development March 2010

Loungani

One reason house prices go up so

Chart 5

rapidly is that the supply of housing

How low can they go? cannot be adjusted quickly. Another

Despite sizable declines, the ratio of house prices to rents and incomes remains above reason lies in the interaction of hous-

long-term averages in most advanced economies. ing and financial markets. Because

(ratio) (ratio) houses serve as collateral, an increase in

1.0 0.6

House price–to-rent ratio House price–to-income ratio house prices can have a feedback effect:

0.8 0.4 once collateral values increase, banks

0.6 0.2 are willing to lend even more to house-

0.4 0 holds, which feeds the house price

0.2 –0.2

Long-term average boom. This feedback effect can arise

0 –0.4 regardless of what caused house prices

–0.2 –0.6

Long-term average to go up in the first place—demand

–0.4 –0.8 momentum, government policies such

–0.6 –1.0 as low interest rates, or institutional

New Zealand

Australia

Spain

Netherlands

United Kingdom

Ireland

France

Canada

Norway

Denmark

Sweden

Italy

Finland

United States

Switzerland

Japan

Germany

Korea

Sweden

Canada

Spain

Australia

Ireland

Norway

France

New Zealand

Finland

United Kingdom

Netherlands

Italy

Denmark

United States

Korea

Switzerland

Germany

Japan

changes that increase the availability of

mortgage credit.

Moreover, fundamental driving

Source: Organization for Economic Cooperation and Development.

forces do not fully explain all price

Note: Long-term average represents 1970–2000. Current ratios are as of end-2009. movements in all countries at all times.

As Yale University economist Robert

Shiller and others assert, house prices

ratio of house prices to rents in the United States reverted to may be determined by psychological and sociological factors;

its long-run average four times between 1970 and the early these factors may also amplify the response of house prices to

2000s. House prices increased far more than rents in the fundamentals (see box).

1970s, but between 1980 and 2000 the price-to-rent ratio fell

to a little below its long-run average. Between 2000 and 2006, More room to fall?

the ratio of house prices to rents rose dramatically above the Though there are some signs of stabilization, the global cor-

long-run average and has been moving back toward it since rection in housing markets continued through 2009. House

prices in the OECD economies fell on average about 5 percent

in real terms between the fourth quarter of 2007 and the third

One reason house prices go up so quarter of 2009.

rapidly is that the supply of housing How low can prices go? There are a number of factors to

consider.

cannot be adjusted quickly. First, house prices in most countries still remain well

above the levels observed at the beginning of the upturn in

the early 2000s. Second, house prices remain above rents and

then. Thus by this metric too, as with past cycles’ amplitude, incomes, which, as discussed above, often serve as long-run

there may be more correction yet to come. In the United anchors for prices. Chart 5 shows how much farther the ratio

Kingdom it is a similar story for the ratio of house prices to of house prices to rents and incomes would have to fall in

income. Between 1970 and 2000, the ratio hovered around its each country to bring it down to its long-run average. Third,

long-run average, albeit with a couple of sharp swings away econometric models show that house prices increased during

from it. Since 2006, the ratio has begun descending toward its 2000–06 to a greater degree than can be explained by either

long-run average, although it still remains well above it. short-run driving forces or long-run relationships: the cor-

Short-run determinants: Whereas the long-run relation- rections thus far have not erased all of the excesses generated

ships act as an anchor, in the short run house prices do by the house price increases.

drift away, often quite strongly and for long periods. Strong That leads to an uncomfortable conclusion: house prices

demand momentum leads to increases in house prices, and in many countries still have room to fall. n

often the increase is more than can be explained fully by the

underlying driving forces. Ireland is a good illustration (see Prakash Loungani is an Advisor in the IMF’s Research

Chart 4). During 1992–2006 Ireland enjoyed robust income Department.

growth of more than 10 percent a year, more than twice the

average of the preceding two decades. Population growth also References:

picked up after 1992. The rise in house prices was more than Igan, Deniz, and Prakash Loungani, forthcoming, “Global Housing

commensurate with these factors—prices increased nearly 20 Cycles,” IMF Working Paper (Washington: International Monetary Fund).

percent a year between 1992 and 2006, 10 times the rate of Shorto, Russell, 2006, “This Very, Very, Old House,” The New York

the previous two decades. Times Magazine, March 5.

Finance & Development March 2010 19

You might also like

- Great Florida Birding Trail Map - South SectionDocument40 pagesGreat Florida Birding Trail Map - South SectionFloridaBirdingTrailNo ratings yet

- Exercise 2 - CVP Analysis Part 1Document5 pagesExercise 2 - CVP Analysis Part 1Vincent PanisalesNo ratings yet

- The Death of Inflation Roger BootleDocument5 pagesThe Death of Inflation Roger BootleFrederico SoteroNo ratings yet

- Macro Economics: Session - 1: Dr. Prema BasargekarDocument25 pagesMacro Economics: Session - 1: Dr. Prema BasargekarAkriti ShahNo ratings yet

- Great Depression-Great Recession Tercer CorteDocument11 pagesGreat Depression-Great Recession Tercer CorteDaniel AvellanedaNo ratings yet

- The 172 Year CycleDocument5 pagesThe 172 Year CycleCharles Barony100% (2)

- Financial Crisis of 1825Document24 pagesFinancial Crisis of 1825ktalwarNo ratings yet

- Eco - Economic BubblesDocument9 pagesEco - Economic BubblesHaiNgoNo ratings yet

- The Great Wave: Price Revolutions and The Rhythm of History by David Hackett FisherDocument47 pagesThe Great Wave: Price Revolutions and The Rhythm of History by David Hackett FisherNick13ro100% (1)

- CF Project CONT KRRRISHDocument13 pagesCF Project CONT KRRRISHkrrish khemaniNo ratings yet

- Ensuring Price StabilityDocument36 pagesEnsuring Price StabilityAdeel SabirNo ratings yet

- 2003b Bpea CaseshillerDocument64 pages2003b Bpea Caseshillerarash saberianNo ratings yet

- Great Depression: Economic IndicatorsDocument4 pagesGreat Depression: Economic IndicatorsNikki ElejordeNo ratings yet

- Great Depression & Great RecessionDocument28 pagesGreat Depression & Great RecessionFarahTabassumRuzmilaNo ratings yet

- 1 From State To Market - ArndtDocument11 pages1 From State To Market - ArndtJoão VideiraNo ratings yet

- A Broom Cupboard of One's Own: The housing crisis and how to solve it by boosting home-ownershipFrom EverandA Broom Cupboard of One's Own: The housing crisis and how to solve it by boosting home-ownershipNo ratings yet

- Great Depression of 1929Document19 pagesGreat Depression of 1929Pradeep GuptaNo ratings yet

- Price RevolutionDocument6 pagesPrice RevolutionanjalikumarigupNo ratings yet

- The Great DepressionDocument7 pagesThe Great DepressionBhavya ShahNo ratings yet

- Summary Economic History 2nd PartialDocument28 pagesSummary Economic History 2nd PartialAlexis BabakoffNo ratings yet

- PW Anatomy of The BearDocument8 pagesPW Anatomy of The BeargodlionwolfNo ratings yet

- Britain and The Politics of The EuropeanDocument35 pagesBritain and The Politics of The EuropeanFanisNo ratings yet

- EES The New Dark AgeDocument11 pagesEES The New Dark AgeElite E Services FXNo ratings yet

- Macro Chpter 1Document15 pagesMacro Chpter 1Taha SabirNo ratings yet

- Great Depression 1920sDocument14 pagesGreat Depression 1920sPradeep GuptaNo ratings yet

- Housing Fact 2005 07Document5 pagesHousing Fact 2005 07feliciafarmNo ratings yet

- Great Depression and KeynesDocument7 pagesGreat Depression and KeynesOwaish AhamedNo ratings yet

- This Time Its DifferentDocument13 pagesThis Time Its Differentpurav31No ratings yet

- A History of UK and US Equity Valuation Techniques - From Dividend Yield To Discounted Cash Flow - Janette RutterfordDocument32 pagesA History of UK and US Equity Valuation Techniques - From Dividend Yield To Discounted Cash Flow - Janette Rutterforda_alok25No ratings yet

- Credit Suisse Long Term AnalysisDocument64 pagesCredit Suisse Long Term Analysiscclaudel09No ratings yet

- The Great Depression (1929Document4 pagesThe Great Depression (1929qinque artNo ratings yet

- Week 11 Causes and Effects The Greate Economic DepressionDocument8 pagesWeek 11 Causes and Effects The Greate Economic DepressionTayyaba HameedNo ratings yet

- Global Real Estate Trends (Oct 2009)Document10 pagesGlobal Real Estate Trends (Oct 2009)mintcornerNo ratings yet

- The Skyscraper Index: A Foreshadowing of Economic CrisisDocument1 pageThe Skyscraper Index: A Foreshadowing of Economic CrisisMengni SunNo ratings yet

- Great Dep - Keynes and MonetarismDocument10 pagesGreat Dep - Keynes and MonetarismAdan MirzaNo ratings yet

- Epartl 2Document13 pagesEpartl 2api-3705874No ratings yet

- Olivier de La Grandville-Bond Pricing and Portfolio Analysis-The MIT Press (2000)Document473 pagesOlivier de La Grandville-Bond Pricing and Portfolio Analysis-The MIT Press (2000)João Henrique Reis MenegottoNo ratings yet

- Death and The Stock Market International Evidence From The Spanish FluDocument10 pagesDeath and The Stock Market International Evidence From The Spanish FluRuhma ZainabNo ratings yet

- List of Recessions in The United States - WikipediaDocument19 pagesList of Recessions in The United States - WikipediaCarlos JesenaNo ratings yet

- Globalization: Massachusetts Institute of TechnologyDocument14 pagesGlobalization: Massachusetts Institute of TechnologyHa LinhNo ratings yet

- Great DepressionDocument13 pagesGreat DepressionJefferson Alzate CabobosNo ratings yet

- Shen Great DepressionDocument5 pagesShen Great DepressionShen DongNo ratings yet

- FlerDocument56 pagesFlerrdescabarteNo ratings yet

- imDocument10 pagesimRajan shahNo ratings yet

- Consequences of The Great Depression 23Document7 pagesConsequences of The Great Depression 23Lamar AkashiNo ratings yet

- Great DepressionDocument33 pagesGreat DepressionMAITE TRONCOSONo ratings yet

- Household Expenditure Cycles and Economic Cycles, 1920 - 2010Document32 pagesHousehold Expenditure Cycles and Economic Cycles, 1920 - 2010wingdings3895No ratings yet

- Princeton Economics Archive Three-Faces-Inflation PDFDocument3 pagesPrinceton Economics Archive Three-Faces-Inflation PDFadamvolkovNo ratings yet

- Apuntes Chapter 5Document7 pagesApuntes Chapter 5Jaime Ruiz-SalinasNo ratings yet

- The Four Wheels of GrowthDocument2 pagesThe Four Wheels of Growthmattvincent loisaga100% (1)

- War's Profound Impact on Economic HistoryDocument6 pagesWar's Profound Impact on Economic HistoryMohsinNo ratings yet

- Financial Market Reviewer 1Document6 pagesFinancial Market Reviewer 1MyunimintNo ratings yet

- Prof John Munro Lecture on Economic Changes in Medieval Europe 1300-1520Document39 pagesProf John Munro Lecture on Economic Changes in Medieval Europe 1300-1520kimjimNo ratings yet

- Fetters of Gold and Paper: Barry Eichengreen and Peter TeminDocument15 pagesFetters of Gold and Paper: Barry Eichengreen and Peter TeminZ_JahangeerNo ratings yet

- Inflation and DearthDocument9 pagesInflation and Dearthisabel teixeiraNo ratings yet

- HyperinflationDocument22 pagesHyperinflationTaneeza BhojaniNo ratings yet

- Lecture Morys Great DepressionDocument17 pagesLecture Morys Great DepressionAntonio AguiarNo ratings yet

- The Worldly PhilosophersDocument9 pagesThe Worldly Philosophersapi-26021962No ratings yet

- Summary: The Great Depression Ahead: Review and Analysis of Harry S. Dent, Jr.'s BookFrom EverandSummary: The Great Depression Ahead: Review and Analysis of Harry S. Dent, Jr.'s BookNo ratings yet

- When Credit Money (Far) Eclipses the Money Supply: A Money-Supply View of 21St Century Economic DisastersFrom EverandWhen Credit Money (Far) Eclipses the Money Supply: A Money-Supply View of 21St Century Economic DisastersNo ratings yet

- FLORIDA Severe Weather Guide 2011Document36 pagesFLORIDA Severe Weather Guide 2011FloridaHoss100% (1)

- IMF: ESTONIA Staff Report - February 2011Document59 pagesIMF: ESTONIA Staff Report - February 2011FloridaHossNo ratings yet

- FLORIDA Food Stamp Program - Updated December 2010Document5 pagesFLORIDA Food Stamp Program - Updated December 2010FloridaHossNo ratings yet

- EURO Money Market Study - ECB, December 2010Document76 pagesEURO Money Market Study - ECB, December 2010FloridaHossNo ratings yet

- 2011 REMINGTON Catalog - All ProductsDocument112 pages2011 REMINGTON Catalog - All ProductsFloridaHossNo ratings yet

- IMF: IRELAND Staff Report - December 2010Document105 pagesIMF: IRELAND Staff Report - December 2010FloridaHossNo ratings yet

- A Study of Real Estate Markets in Declining CitiesDocument84 pagesA Study of Real Estate Markets in Declining Citiesim_isolatedNo ratings yet

- IMF: HUNGARY Staff Report - February 2011Document58 pagesIMF: HUNGARY Staff Report - February 2011FloridaHossNo ratings yet

- IMF: ALGERIA Staff Report - February 2011Document41 pagesIMF: ALGERIA Staff Report - February 2011FloridaHossNo ratings yet

- FDIC SEIZURE: First Commercial Bank of Florida, Orlando, FL - 7-JAN-2011Document2 pagesFDIC SEIZURE: First Commercial Bank of Florida, Orlando, FL - 7-JAN-2011FloridaHossNo ratings yet

- WITNESS SHEET: HOW TO REPORT A WILDLIFE VIOLATION - Fla. Fish & Wildlife CommissionDocument1 pageWITNESS SHEET: HOW TO REPORT A WILDLIFE VIOLATION - Fla. Fish & Wildlife CommissionFloridaHossNo ratings yet

- IMF: GREECE Staff Report - December 2010Document135 pagesIMF: GREECE Staff Report - December 2010FloridaHossNo ratings yet

- IMF: DENMARK Staff Report - December 2010Document68 pagesIMF: DENMARK Staff Report - December 2010FloridaHossNo ratings yet

- 2011 FORD EXPLORER BrochureDocument23 pages2011 FORD EXPLORER BrochureFloridaHossNo ratings yet

- The Fallacy of A Pain-Free Path To A Healthy Housing Market - FedResBank Dallas ResearchDocument4 pagesThe Fallacy of A Pain-Free Path To A Healthy Housing Market - FedResBank Dallas ResearchFloridaHossNo ratings yet

- ECB Financial Stability Review - 9-DEC-2010Document210 pagesECB Financial Stability Review - 9-DEC-2010FloridaHossNo ratings yet

- IMF: CANADA Staff Report - December 2010Document58 pagesIMF: CANADA Staff Report - December 2010FloridaHossNo ratings yet

- Ecb Monthly Bulletin - 9-Dec-2010Document218 pagesEcb Monthly Bulletin - 9-Dec-2010FloridaHossNo ratings yet

- IMF: LATVIA Staff Report - December 2010Document71 pagesIMF: LATVIA Staff Report - December 2010FloridaHossNo ratings yet

- EUROGROUP/ECOFIN Ministers - Statement On Irish Financial Assistance, 21-Nov-2010Document1 pageEUROGROUP/ECOFIN Ministers - Statement On Irish Financial Assistance, 21-Nov-2010FloridaHossNo ratings yet

- IMF: THAILAND Staff Report - December 2010Document52 pagesIMF: THAILAND Staff Report - December 2010FloridaHossNo ratings yet

- IMF: UNITED KINGDOM - Staff Report, November 2010Document72 pagesIMF: UNITED KINGDOM - Staff Report, November 2010FloridaHossNo ratings yet

- ARE HOUSING PRICES RISING TOO FAST IN CHINA ? IMF Working Paper, Dec-2010Document32 pagesARE HOUSING PRICES RISING TOO FAST IN CHINA ? IMF Working Paper, Dec-2010FloridaHossNo ratings yet

- ECB: MONTHLY BULLETIN - November 2010Document218 pagesECB: MONTHLY BULLETIN - November 2010FloridaHossNo ratings yet

- FDIC: SEIZURE of First Bank of Jacksonville, Jacksonville, FL - 22-Oct-2010Document2 pagesFDIC: SEIZURE of First Bank of Jacksonville, Jacksonville, FL - 22-Oct-2010FloridaHossNo ratings yet

- IMF: HONG KONG Staff Report - December 2010Document35 pagesIMF: HONG KONG Staff Report - December 2010FloridaHossNo ratings yet

- ECB: STATISTICS Pocket Book - November 2010Document58 pagesECB: STATISTICS Pocket Book - November 2010FloridaHossNo ratings yet

- IMF: AUSTRALIA Staff Report - October 2010Document47 pagesIMF: AUSTRALIA Staff Report - October 2010FloridaHossNo ratings yet

- HAMP Servicer Performance Report Through Sept 2010Document14 pagesHAMP Servicer Performance Report Through Sept 2010FloridaHossNo ratings yet

- A Case On Local Entrepreneur 368Document7 pagesA Case On Local Entrepreneur 368Nur-A- Alam Kader Parag -171012084No ratings yet

- Forbes - Tony ElumeluDocument8 pagesForbes - Tony ElumeluFanele Chester50% (2)

- BPI Vs PosadasDocument2 pagesBPI Vs PosadasCarlota Nicolas VillaromanNo ratings yet

- New England Compounding Center (NECC) Case Study.Document7 pagesNew England Compounding Center (NECC) Case Study.onesmusnzomo20No ratings yet

- Overview of Franchising Activities in VietnamDocument5 pagesOverview of Franchising Activities in VietnamNo NameNo ratings yet

- Ethical Obligations and Decision Making in Accounting Text and Cases 2nd Edition Mintz Test BankDocument41 pagesEthical Obligations and Decision Making in Accounting Text and Cases 2nd Edition Mintz Test Bankhungden8pne100% (29)

- Annual Report: Petrochina Company LimitedDocument276 pagesAnnual Report: Petrochina Company LimitedDư Trần HưngNo ratings yet

- 35 - 11 Years of Supreme CourtDocument42 pages35 - 11 Years of Supreme CourtKiran RaviNo ratings yet

- Accenture Service Design Tale Two Coffee Shops TranscriptDocument2 pagesAccenture Service Design Tale Two Coffee Shops TranscriptAmilcar Alvarez de LeonNo ratings yet

- Process Analysis: SL No Process Proces S Owner Input Output Methods Interfaces With Measure of Performance (MOP)Document12 pagesProcess Analysis: SL No Process Proces S Owner Input Output Methods Interfaces With Measure of Performance (MOP)DhinakaranNo ratings yet

- Lembar Jawaban 1-JURNALDocument9 pagesLembar Jawaban 1-JURNALClara Shinta OceeNo ratings yet

- Citi Bank in BangladeshDocument2 pagesCiti Bank in BangladeshSSN073068No ratings yet

- Presentation 6Document14 pagesPresentation 6Akshay MathurNo ratings yet

- MBSA1523 Managerial Economic and Policy Analysis: Page - 1Document16 pagesMBSA1523 Managerial Economic and Policy Analysis: Page - 1HO JING YI MBS221190No ratings yet

- Republic Act No. 11360: Official GazetteDocument1 pageRepublic Act No. 11360: Official GazetteKirk BejasaNo ratings yet

- 3I Group PLC Annual Report 2018 PDFDocument160 pages3I Group PLC Annual Report 2018 PDFKarina Indus KahwagiNo ratings yet

- Fina 402 - NotesDocument28 pagesFina 402 - NotespopaNo ratings yet

- DHL TaiwanDocument25 pagesDHL TaiwanPhương VõNo ratings yet

- Institutional Framework For Small Business DevelopmentDocument59 pagesInstitutional Framework For Small Business DevelopmentNishantpiyooshNo ratings yet

- Inmon vs Kimball Data Warehouse ApproachesDocument3 pagesInmon vs Kimball Data Warehouse ApproachesDeepanshu KatariaNo ratings yet

- PPGE&C Payroll 22 022422gDocument1 pagePPGE&C Payroll 22 022422gjadan tupuaNo ratings yet

- As and Guidance NotesDocument94 pagesAs and Guidance NotesSivasankariNo ratings yet

- Squash StickDocument56 pagesSquash StickDanah Jane GarciaNo ratings yet

- Aguila, Paulo Timothy - Cis c10Document5 pagesAguila, Paulo Timothy - Cis c10Paulo Timothy AguilaNo ratings yet

- Enterprise Goverment - AssignmentDocument2 pagesEnterprise Goverment - AssignmentLokeraj RupnarainNo ratings yet

- Portfoli o Management: A Project OnDocument48 pagesPortfoli o Management: A Project OnChinmoy DasNo ratings yet

- Running Head: Ethical and Legal Principles On British AirwaysDocument8 pagesRunning Head: Ethical and Legal Principles On British AirwaysDyya EllenaNo ratings yet

- Latihan Uas-1Document3 pagesLatihan Uas-1Ajeet KumarNo ratings yet

- Going: ForwrdDocument340 pagesGoing: ForwrdAngel MaNo ratings yet