Professional Documents

Culture Documents

Solution

Uploaded by

vanvunOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solution

Uploaded by

vanvunCopyright:

Available Formats

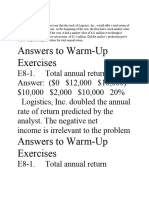

Solutions for Chapter 18: Questions and Problems

CHAPTER 18

EVALUATION OF PORTFOLIO PERFORMANCE

Answers to Questions

1.

The two major factors would be: (1) attempt to derive risk-adjusted returns that exceed a

naive buy-and-hold policy and (2) completely diversify - i.e., eliminate all unsystematic

risk from the portfolio. A portfolio manager can do one or both of two things to derive

superior risk-adjusted returns. The first is to have superior timing regarding market

cycles and adjust your portfolio accordingly. Alternatively, one can consistently select

undervalued stocks. As long as you do not make major mistakes with the rest of the

portfolio, these actions should result in superior risk-adjusted returns.

2.

Treynor (1965) divided a funds excess return (return less risk-free rate) by its beta. For a

fund not completely diversified, Treynors T value will understate risk and overstate

performance. Sharpe (1966) divided a funds excess return by its standard deviation.

Sharpes S value will produce evaluations very similar to Treynors for funds that are

well diversified. Jensen (1968) measures performance as the difference between a funds

actual and required returns. Since the latter return is based on the CAPM and a funds

beta, Jensen makes the same implicit assumptions as Treynor - namely, that funds are

completely diversified. The information ratio (IR) measures a portfolios average return

in excess of that of a benchmark, divided by the standard deviation of this excess return.

Like Sharpe, it can be used when the fund is not necessarily well-diversified.

3.

For portfolios with R2 values noticeably less than 1.0, it would make sense to compute

both measures. Differences in the rankings generated by the two measures would suggest

less-than-complete diversification by some funds - specifically, those that were ranked

higher by Treynor than by Sharpe.

4.

Jensens alpha () is found from the equation Rjt RFRt = j + j[Rmt RFRt] +ejt. The aj

indicates whether a manager has superior (j > 0) or inferior (j < 0) ability in market

timing or stock selection, or both. As suggested above, Jensen defines superior (inferior)

performance as a positive (negative) difference between a managers actual return and his

CAPM-based required return. For poorly diversified funds, Jensens rankings would more

closely resemble Treynors. For well-diversified funds, Jensens rankings would follow

those of both Treynor and Sharpe. By replacing the CAPM with the APT, differences

between funds actual and required returns (or alphas) could provide fresh evaluations

of funds.

138

Copyright 2010 by Nelson Education Ltd.

Solutions for Chapter 18: Questions and Problems

5.

The Information Ratio (IR) is calculated by dividing the average return on the portfolio

less a benchmark return by the standard deviation of the excess return. The IR can be

viewed as a benefit-cost ratio in that the standard deviation of return can be viewed as a

cost associated in the sense that it measures the unsystematic risk taken on by active

management. Thus IR is a cost-benefit ratio that assesses the quality of the investors

information deflated by unsystematic risk generated by the investment process.

6.

The difference by which a managers overall actual return beats his/her overall

benchmark return is termed the total value-added return and decomposes into an

allocation effect and a selection effect. The former effect measures differences in weights

assigned by the actual and benchmark portfolios to stocks, bonds and cash times the

respective differences between market-specific benchmark returns and the overall

benchmark return. The latter effect focuses on the market-specific actual returns less the

corresponding market-specific benchmark returns times the weights assigned to each

market by the actual portfolio. Of course, the foregoing analysis implicitly assumes that

the actual and benchmark market-specific portfolios (e.g., stocks) are risk-equivalent. If

this is not true the analysis would not be valid.

7.

When measuring the performance of an equity portfolio manager, overall returns can be

related to a common total risk or systematic risk. Factors influencing the returns achieved

by the bond portfolio manager are more complex. In order to evaluate performance based

on a common risk measure (i.e., market index), four components must be considered that

differentiate the individual portfolio from the market index. These components include:

(1) a policy effect, (2) a rate anticipation effect, (3) an analysis effect, and (4) a trading

effect. Decision variables involved include the impact of duration decisions, anticipation

of sector/quality factors, and the impact of individual bond selection.

139

Copyright 2010 by Nelson Education Ltd.

Solutions for Chapter 18: Questions and Problems

CHAPTER 18

Answers to Problems

1(a).

.15 .07

0.05

.20 .07

SQ

.10

.10 .07

SR

.03

.17 .07

SS

.06

.13 .07

Market

.04

SP

1(b).

TP

.15 .07 .08

.0800

1.00

1.00

TQ

.20 .07 .13

.0867

1.50

1.50

TR

.10 .07 .03

.0500

.60

.60

TS

.17 .07 .10

.0909

1.10

1.10

Market

.13 .07 .06

.0600

1.00

1.00

Sharpe

Treynor

P

Q

R

S

Market

1(c).

.08

1.60

.05

.13

1.30

.10

.03

1.00

.03

.10

1.67

.06

.06

1.50

.04

2

4

5

1

3

3

2

5

1

4

It is apparent from the rankings above that Portfolio Q was poorly diversified since

Treynor ranked it #2 and Sharpe ranked it #4. Otherwise, the rankings are similar.

140

Copyright 2010 by Nelson Education Ltd.

Solutions for Chapter 18: Questions and Problems

2(a).

Portfolio MNO enjoyed the highest degree of diversification since it had the highest R2

(94.8%). The statistical logic behind this conclusion comes from the CAPM which says

that all fully diversified portfolios should be priced along the security market line. R 2 is a

measure of how well assets conform to the security market line, so R 2 is also a measure

of diversification.

2(b).

Note the mean returns are net of the risk-free rate. Doing the calculations we obtain:

Fund

Treynor

Sharpe

Jensen

ABC

0.975(4)

0.857(4)

0.192(4)

DEF

0.715(5)

0.619(5)

-0.053(5)

GHI

1.574(1)

1.179(1)

0.463(1)

JKL

1.262(2)

0.915(3)

0.355(2)

MNO

1.134(3)

1.000(2)

0.296(3)

2(c).

Fund

ABC

DEF

GHI

JKL

MNO

t(alpha)

1.7455(3)

-0.2789(5)

2.4368(1)

1.6136(4)

2.1143(2)

Only GHI and MNO have significantly positive alphas at a 95% level of confidence.

3(a).

(Information ratio) IRj = j/u where u = standard error of the regression

IRA = .058/.533 = 0.1088

IRB = .115/5.884 = 0.0195

IRC = .250/2.165 = 0.1155

3(b).

Annualized IR = (T)1/2(IR)

Annualized IRA = (52)1/2(0.1088) = 0.7846

Annualized IRB = (26)1/2(0.0195) = 0.0994

Annualized IRC = (12)1/2(0.1155) = 0.4001

3(c).

The higher the ratio, the better. Based upon the answers to part a, Manager C would be

rated the highest followed by Managers A and B, respectively. However, once the values

are annualized, the ranking change. Specifically, based upon the annualized IR, Manger

A is rated the highest, followed by C and B. (In both cases, Manager B is rated last).

Based upon the Grinold-Kahn standard for good performance (0.500 or greater), only

Manager A meets that test.

4(a).

Overall performance (Fund 1) = 26.40% - 6.20% = 20.20%

Overall performance (Fund 2) = 13.22% - 6.20% = 7.02%

141

Copyright 2010 by Nelson Education Ltd.

Solutions for Chapter 18: Questions and Problems

4(b).

E(Ri) = 6.20 + (15.71 6.20)

= 6.20 + (9.51)

Total return (Fund 1) = 6.20 + (1.351)(9.51) = 6.20 + 12.85 = 19.05%

where 12.85% is the required return for risk

Total return (Fund 2) = 6.20 + (0.905)(9.51) = 6.20 + 8.61 = 14.81%

where 8.61% is the required return for risk

4(c)(i). Selectivity1 = 20.2% - 12.85% = 7.35%

Selectivity2 = 7.02% - 8.61% = -1.59%

4(c)(ii).Ratio of total risk1 = 1/m = 20.67/13.25 = 1.56

Ratio of total risk2 = 2/m = 14.20/13.25 = 1.07

R1 = 6.20 + 1.56 (9.51) = 6.20 + 14.8356 = 21.04%

R2 = 6.20 + 1.07 (9.51) = 6.20 + 10.1757 = 16.38%

Diversification1 = 21.04% 19.05% = 1.99%

Diversification2 = 16.38% 14.81% = 1.57%

4(c)(iii). Net Selectivity = Selectivity Diversification

Net Selectivity1 = 7.35% - 1.99% = 5.36%

Net Selectivity2 = -1.59% - 1.57% = -3.16%

4(d).

Even accounting for the added cost of incomplete diversification, Fund 1s performance

was above the market line (best performance), while Fund 2 fall below the line.

5.

a.

Year

1

2

3

4

5

6

7

8

9

10

Average

Std Dev

Mgr X

Return

-1.5

-1.5

-1.5

-1.0

0.0

4.5

6.5

8.5

13.5

17.5

4.5

6.90

Mgr Y Return

-6.5

-3.5

-1.5

3.5

4.5

6.5

7.5

8.5

12.5

13.5

4.5

6.63

142

Copyright 2010 by Nelson Education Ltd.

Solutions for Chapter 18: Questions and Problems

Semi-dev

0.65

4.20

Semi-deviation considers only the returns that are below the average.

b.

Sharpe ratio: (average return minus risk-free rate) / standard deviation

Mgr X:

0.435

Mgr Y:

0.452

Best performer

6.

6(a)(i). .6(-5) + .3(-3.5) + .1(0.3) = -4.02%

6(a)(ii). .5(-4) + .2(-2.5) + .3(0.3) = -2.41%

6(a)(iii). .3(-5) + .4(-3.5) + .3(0.3) = -2.81%

Manager A outperformed the benchmark fund by 161 basis points while Manager B beat

the benchmark fund by 121 basis points.

6(b)(i). [.5(-4 + 5) + .2(-2.5 + 3.5) + .3(.3 -.3)] = 0.70%

6(b)(ii). [(.3 - .6) (-5 + 4.02) + (.4 - .3) (-3.5 + 4.02) + (.3 -.1)(.3 + 4.02)] = 1.21%

Manager A added value through her selection skills (70 of 161 basis points) and her

allocation skills (71 of 161 basis points). Manager B added value totally through his

allocation skills (121 of 121 basis points).

7 (a). Dollar-Weighted Return

Manager L:

500,000 = -12,000/(1+r) - 7,500/(1+r)2- 13,500/(1+r)3 - 6,500/(1+r)4- 10,000/(1+r)5+

625,000/(1+r)5

Solving for r, the internal rate of return or DWRR is 2.75%

Manager M:

700,000 = 35,000/(1+r) + 35,000/(1+r)2+35,000/(1+r)3+35,000/(1+r)4+35,000/(1+r)5 +

625,000/(1+r)5

Solving for r, the internal rate of return or DWRR is 2.98%.

143

Copyright 2010 by Nelson Education Ltd.

Solutions for Chapter 18: Questions and Problems

7(b).

Time-weighted return

Manager L:

Periods

1

2

3

4

5

HPR

[(527,000 500,000) 12,000]/500,000 = .03

[(530,000 527,000) 7,500]/527,000 = -.0085

[(555,000 530,000) 13,500]/530,000 = .0217

[(580,000 555,000) 6,500]/555,000 = .0333

[(625,000 580,000) 10,000]/580,000 = .0603

TWRR = [(1 + .03)(1 - .0085)(1 + .0217)(1 + .0333)(1 + .0603)]1/5 - 1

= (1.143) 1/5 1= 1.02712 1 = .02712 = 2.71%

Manager M:

Periods

1

2

3

4

5

HPR

[(692,000 700,000) + 35,000]/700,000 = .03857

[(663,000 692,000) + 35,000]/692,000 = .00867

[(621,000 663,000) + 35,000]/663,000 = -.01056

[(612,000 621,000) + 35,000]/621,000 = .04187

[(625,000 612,000) + 35,000]/612,000 = .0784

TWRR = [(1 + .03857)(1 + .00867)(1 - .01056)(1 + .04187)(1 + .0784)]1/5 - 1

= (1.1646) 1/5 1= 1.03094 1 = .03094 = 3.094%

EV (1 DW)(Contribution)

144

Copyright 2010 by Nelson Education Ltd.

You might also like

- Evaluation of StockDocument48 pagesEvaluation of StockMd Zainuddin IbrahimNo ratings yet

- Evaluation of Portfolio PerformanceDocument141 pagesEvaluation of Portfolio PerformanceBhushan PatilNo ratings yet

- S S M M I T: Loan Chool of Anagement Assachusetts Nstitute of EchnologyDocument11 pagesS S M M I T: Loan Chool of Anagement Assachusetts Nstitute of Echnologyshanky1124No ratings yet

- A Mini Project On Security Analysis and Portfolio Management Evaluation of Portfolio PerformanceDocument7 pagesA Mini Project On Security Analysis and Portfolio Management Evaluation of Portfolio Performancecooolguyniu100% (1)

- Class NotesDocument16 pagesClass NotesAnika Tabassum RodelaNo ratings yet

- Measure Your Portfolio's Performance: Cathy ParetoDocument5 pagesMeasure Your Portfolio's Performance: Cathy ParetoShivani InsanNo ratings yet

- Investemnts Answers To Problem Set 6Document6 pagesInvestemnts Answers To Problem Set 6chu chenNo ratings yet

- Merrill Finch IncDocument7 pagesMerrill Finch IncAnaRoqueniNo ratings yet

- Evaluation of Portfolio PerformanceDocument10 pagesEvaluation of Portfolio PerformanceGourav Baid100% (1)

- Evaluation of Portfolio Performance: Presented By: Mba 2E University of Caloocan CityDocument26 pagesEvaluation of Portfolio Performance: Presented By: Mba 2E University of Caloocan CityCarlo Niño GedoriaNo ratings yet

- Chapter 11 &12 Tute SolsDocument9 pagesChapter 11 &12 Tute SolsRakeshNo ratings yet

- Sharpe Treynor N JensenDocument4 pagesSharpe Treynor N JensenjustsatyaNo ratings yet

- Solution ProblemSet3 TPDocument7 pagesSolution ProblemSet3 TPMustafa ChatilaNo ratings yet

- Tut11 Ans5Document3 pagesTut11 Ans5Brendan RongNo ratings yet

- Warm Up Chapter 8Document5 pagesWarm Up Chapter 8abdulraufdghaybeejNo ratings yet

- Assignment On Portfolio ManagementDocument13 pagesAssignment On Portfolio ManagementNahidul IslamNo ratings yet

- Grable, J. E., & Chatterjee, S. (2014) - The Sharpe Ratio and Negative Excess Returns The Problem and Solution. Journal of Financial Service Professionals, 68 (3), 12-13.Document3 pagesGrable, J. E., & Chatterjee, S. (2014) - The Sharpe Ratio and Negative Excess Returns The Problem and Solution. Journal of Financial Service Professionals, 68 (3), 12-13.firebirdshockwaveNo ratings yet

- Chapter 24: Portfolio Performance Evaluation: Problem SetsDocument13 pagesChapter 24: Portfolio Performance Evaluation: Problem SetsminibodNo ratings yet

- Stat Ratios - But Why?Document3 pagesStat Ratios - But Why?roshcrazyNo ratings yet

- Corporate Finance CH 12 Solutions WesterfieldDocument13 pagesCorporate Finance CH 12 Solutions WesterfieldSK (아얀)No ratings yet

- Tactical Asset Allocation: A Factor Regression Model TAA Team 01/20/2011Document17 pagesTactical Asset Allocation: A Factor Regression Model TAA Team 01/20/2011frank_z_jNo ratings yet

- Soln CH 24 Perf EvalDocument9 pagesSoln CH 24 Perf EvalSilviu TrebuianNo ratings yet

- Prob 14Document6 pagesProb 14LaxminarayanaMurthyNo ratings yet

- 2014 Mock Exam - AM - AnswersDocument25 pages2014 Mock Exam - AM - Answers12jdNo ratings yet

- Chapter 24Document9 pagesChapter 24Bineet JhaNo ratings yet

- BAC3684 Tutorial 6QDocument6 pagesBAC3684 Tutorial 6Q1191103342No ratings yet

- Portfolio AnalysisDocument18 pagesPortfolio Analysissubscription accountNo ratings yet

- Portfolio Revision and EvaluationDocument20 pagesPortfolio Revision and EvaluationManoj BansiwalNo ratings yet

- Portfolio Evaluation TechniquesDocument18 pagesPortfolio Evaluation TechniquesMonalisa BagdeNo ratings yet

- Treynor Performance MeasureDocument8 pagesTreynor Performance MeasureAshadur Rahman JahedNo ratings yet

- Portfolio Performance EvaluationDocument15 pagesPortfolio Performance EvaluationTushar AroraNo ratings yet

- PS 4Document7 pagesPS 4Gilbert Ansah YirenkyiNo ratings yet

- Final Review Session SPR12RปDocument10 pagesFinal Review Session SPR12RปFight FionaNo ratings yet

- Ch11 End of Chapter QuestionsDocument6 pagesCh11 End of Chapter QuestionsCatherine Wu0% (2)

- Chapter 12Document14 pagesChapter 12Sindhu JattNo ratings yet

- FIM - Special Class - 5 - 2020 - OnlineDocument22 pagesFIM - Special Class - 5 - 2020 - OnlineMd. Abu NaserNo ratings yet

- CH 22Document12 pagesCH 22williamnyxNo ratings yet

- Fin 6310-Investment Theory and Practice Homework 6: Chapter - 9Document5 pagesFin 6310-Investment Theory and Practice Homework 6: Chapter - 9Ashna AggarwalNo ratings yet

- Final Practice Questions and SolutionsDocument12 pagesFinal Practice Questions and Solutionsshaikhnazneen100No ratings yet

- Sortino - A "Sharper" Ratio! - Red Rock CapitalDocument6 pagesSortino - A "Sharper" Ratio! - Red Rock CapitalInterconti Ltd.No ratings yet

- Wagner's Angels: Case StudyDocument8 pagesWagner's Angels: Case StudyCamillaGeorgeonNo ratings yet

- Mock Exam - Section ADocument4 pagesMock Exam - Section AHAHAHANo ratings yet

- Chapter 10: Risk and Return: Lessons From Market History: Corporate FinanceDocument18 pagesChapter 10: Risk and Return: Lessons From Market History: Corporate FinancePháp NguyễnNo ratings yet

- Chapter 10: Risk and Return: Lessons From Market History: Corporate FinanceDocument15 pagesChapter 10: Risk and Return: Lessons From Market History: Corporate Financeirwan hermantriaNo ratings yet

- Analyzing Mutual Fund RiskDocument7 pagesAnalyzing Mutual Fund RiskSriKesavaNo ratings yet

- Risk, Returns and WACC: CAPM and The Capital BudgetingDocument41 pagesRisk, Returns and WACC: CAPM and The Capital Budgetingpeter sumNo ratings yet

- RevisionDocument5 pagesRevisionMaryam YusufNo ratings yet

- Sample Final Exam Larkin AnswersDocument18 pagesSample Final Exam Larkin AnswersLovejot SinghNo ratings yet

- Homework 4Document5 pagesHomework 4Mawin S.No ratings yet

- Equity Trading The Trouble With ValueDocument15 pagesEquity Trading The Trouble With Valueangelcomputer2No ratings yet

- Northern Forest ProductsDocument15 pagesNorthern Forest ProductsHương Lan TrịnhNo ratings yet

- Valuation Gordon Growth ModelDocument25 pagesValuation Gordon Growth ModelwaldyraeNo ratings yet

- FM11 CH 04 Mini-Case Old6Document19 pagesFM11 CH 04 Mini-Case Old6AGNo ratings yet

- Tutorial 5: An Introduction To Asset Pricing ModelsDocument49 pagesTutorial 5: An Introduction To Asset Pricing ModelschziNo ratings yet

- Module-5 Problems On Performance Evaluation of Mutual FundDocument4 pagesModule-5 Problems On Performance Evaluation of Mutual Fundgaurav supadeNo ratings yet

- Exercises On Chapter Five - Return & CAPM Oct. 19 - AnswerDocument10 pagesExercises On Chapter Five - Return & CAPM Oct. 19 - Answerbassant_hegaziNo ratings yet

- There Are 20 Questions in This Part. Please Choose ONE Answer For Each Question. Each Question Is Worth 0.2 PointsDocument8 pagesThere Are 20 Questions in This Part. Please Choose ONE Answer For Each Question. Each Question Is Worth 0.2 PointsThảo Như Trần NgọcNo ratings yet

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- Nature and Context of Research 2Document2 pagesNature and Context of Research 2vanvunNo ratings yet

- The Central Bank & Monetary Policy PDFDocument9 pagesThe Central Bank & Monetary Policy PDFvanvunNo ratings yet

- Investment Companies and Pension FundsDocument10 pagesInvestment Companies and Pension FundsvanvunNo ratings yet

- The Central Bank & Monetary Policy PDFDocument9 pagesThe Central Bank & Monetary Policy PDFvanvunNo ratings yet

- GK For Class TestDocument3 pagesGK For Class TestvanvunNo ratings yet

- Multiple Choice Questions On Ratio and ProportionDocument1 pageMultiple Choice Questions On Ratio and ProportionvanvunNo ratings yet

- Nature and Context of Research 1Document16 pagesNature and Context of Research 1vanvunNo ratings yet

- Notes For Students Amalgamation 2Document4 pagesNotes For Students Amalgamation 2vanvunNo ratings yet

- LBC 12Document4 pagesLBC 12vanvunNo ratings yet

- Logical ReasoningDocument3 pagesLogical ReasoningvanvunNo ratings yet

- Business LawDocument3 pagesBusiness LawvanvunNo ratings yet

- Business LawDocument3 pagesBusiness LawvanvunNo ratings yet

- Multiple Choice Questions On Ratio and ProportionDocument1 pageMultiple Choice Questions On Ratio and Proportionvanvun100% (3)

- Interdependence Between Micro and Macro EconomicsDocument1 pageInterdependence Between Micro and Macro Economicsvanvun0% (1)

- Costing and Cost AccountingDocument1 pageCosting and Cost AccountingvanvunNo ratings yet

- Notes For Students Amalgamation 1Document3 pagesNotes For Students Amalgamation 1vanvunNo ratings yet

- AmalgamationDocument8 pagesAmalgamationvanvunNo ratings yet

- DRDocument2 pagesDRvanvunNo ratings yet

- AmalgamationDocument8 pagesAmalgamationvanvunNo ratings yet

- Importance of OBDocument1 pageImportance of OBvanvunNo ratings yet

- Capital Gain TaxDocument3 pagesCapital Gain TaxvanvunNo ratings yet

- Capital Gain TaxDocument3 pagesCapital Gain TaxvanvunNo ratings yet

- Importance of OBDocument3 pagesImportance of OBvanvunNo ratings yet

- Concept of Commercial Banks of NepalDocument2 pagesConcept of Commercial Banks of Nepalvanvun100% (1)

- Teacher Vacant Announcement 1Document2 pagesTeacher Vacant Announcement 1vanvunNo ratings yet

- Implications of Baumol's Sales Revenue Maximization ModelDocument1 pageImplications of Baumol's Sales Revenue Maximization ModelvanvunNo ratings yet

- Importance of OBDocument1 pageImportance of OBvanvunNo ratings yet

- Concept of Commercial Banks of Nepa1Document8 pagesConcept of Commercial Banks of Nepa1vanvunNo ratings yet

- Concept of Commercial Banks of NepalDocument2 pagesConcept of Commercial Banks of Nepalvanvun100% (1)

- Liquidity Management in BanksDocument28 pagesLiquidity Management in BanksvanvunNo ratings yet

- Engineering Maths Curr3Document3 pagesEngineering Maths Curr3Musa MohammedNo ratings yet

- Prob-4 5Document8 pagesProb-4 5Vinh Do ThanhNo ratings yet

- Bits NozzlesDocument197 pagesBits Nozzlesiman100% (2)

- Kramer DriveDocument42 pagesKramer DriveSenthil Kumar100% (1)

- MA6351Document73 pagesMA6351Selva KumarNo ratings yet

- WoPhO 2011 S12Document12 pagesWoPhO 2011 S12TienMC GamerNo ratings yet

- Analysis of Time of Collapse of Steel Columns Exposed T o FireDocument12 pagesAnalysis of Time of Collapse of Steel Columns Exposed T o FireMurali Krishna Reddy ArikatlaNo ratings yet

- Free Tableau Certi Cation Exam Practice Test: ExplanationsDocument11 pagesFree Tableau Certi Cation Exam Practice Test: Explanationsyu zhao100% (1)

- Istat10w - ch04 Edited Ver 2Document107 pagesIstat10w - ch04 Edited Ver 2Zaisy RayyanNo ratings yet

- Engineering Drawing Module 3Document17 pagesEngineering Drawing Module 3Joe NasalitaNo ratings yet

- Quantitative - Methods Course TextDocument608 pagesQuantitative - Methods Course TextJermaine RNo ratings yet

- 10 - Pulse Amplitude Modulation (PAM) PDFDocument56 pages10 - Pulse Amplitude Modulation (PAM) PDFPankaj KumarNo ratings yet

- Heat and Wave EquationDocument4 pagesHeat and Wave EquationIvan ShaneNo ratings yet

- Detailed Lesson PlanDocument8 pagesDetailed Lesson PlanAmlorepava Mary50% (2)

- Google PDFDocument300 pagesGoogle PDFSupport TeamNo ratings yet

- Ramification (Mathematics) - WikipediaDocument7 pagesRamification (Mathematics) - WikipediabNo ratings yet

- Boxes Part V7Document70 pagesBoxes Part V7davidNo ratings yet

- M.Tech I.T Syllabus Software Engineering (Mt-103) : Part - ADocument16 pagesM.Tech I.T Syllabus Software Engineering (Mt-103) : Part - AppghoshinNo ratings yet

- Corporate Finance Outline, Spring 2013Document60 pagesCorporate Finance Outline, Spring 2013Kasem Ahmed100% (1)

- 4pm1 02r Que 20230121Document36 pages4pm1 02r Que 20230121M.A. HassanNo ratings yet

- Standard Functions in PI 7.0 - Process Integration - Community WikiDocument34 pagesStandard Functions in PI 7.0 - Process Integration - Community Wikifziwen100% (1)

- Full Download Essentials of Statistics 4th Edition Triola Solutions ManualDocument35 pagesFull Download Essentials of Statistics 4th Edition Triola Solutions Manualaphidcaterezpcw5100% (40)

- AnchoringDocument19 pagesAnchoringviboralunaNo ratings yet

- 04 - EGC3173 - EGC3113 - Selection StructuresDocument34 pages04 - EGC3173 - EGC3113 - Selection StructuresLudik CarvalhoNo ratings yet

- 6 CoordDocument58 pages6 Coordrosenthal elvis chimpay ariasNo ratings yet

- PSI 3 Course Material v2.1Document16 pagesPSI 3 Course Material v2.1sreenathNo ratings yet

- 100 Practical Exercises in Music Composition 0190057246 9780190057244 Compress 1Document50 pages100 Practical Exercises in Music Composition 0190057246 9780190057244 Compress 1Lê Thanh XuânNo ratings yet

- CVP SummaryDocument10 pagesCVP SummaryCj LopezNo ratings yet

- Twist RateDocument3 pagesTwist RateFernando ParabellumNo ratings yet

- 1 Density and Relative DensityDocument32 pages1 Density and Relative DensityOral NeedNo ratings yet