Professional Documents

Culture Documents

Fernandez Hermanos vs. Cir and Cta

Uploaded by

mwaike0 ratings0% found this document useful (0 votes)

523 views1 pageCase Digests on Taxation

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCase Digests on Taxation

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

523 views1 pageFernandez Hermanos vs. Cir and Cta

Uploaded by

mwaikeCase Digests on Taxation

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

FERNANDEZ HERMANOS, INC. v.

CIR and CTA

FACTS:

The taxpayer, Fernandez Hermanos, Inc., is a domestic corporation organized for the purpose

of engaging in business as an "investment company. The CIR assessed against the taxpayer the sums

of P13,414.00, P119,613.00, P11,698.00, P6,887.00 and P14,451.00 as alleged deficiency income

taxes for the years 1950, 1951, 1952, 1953 and 1954, respectively. Said assessments were the result

of alleged discrepancies found upon the examination and verification of the taxpayer's income tax

returns for the said years. The Tax Court sustained the Commissioner's disallowances of the following

losses: losses in or bad debts of Palawan Manganese Mines, Inc. in 1951, losses in Hacienda Samal in

1951 and 1952 and excessive depreciation of houses. It however overruled the Commissioners

disallowances of the other items. After the modifications, it was found that the total deficiency income

taxes due from the taxpayer for the years under review to amount to P123,436.00 instead of

P166,063.00 as originally assessed by the Commissioner. Both parties appealed from the respective

adverse rulings against them.

ISSUE:

Whether or not the Tax Court was correct in its ruling regarding the disputed items of

disallowances; and

HELD:

The CIR questions the Tax Court's allowance of the taxpayer's writing off as worthless

securities in its return the sum representing the cost of shares of stock of Mati Lumber Co. acquired

in1948, on the ground that the worthlessness of said stock in the year 1950 had not been clearly

established. The Commissioners contention was, although the said Company was no longer in

operation in 1950, it still had its sawmill and equipment which must be of considerable value. The

Court, however, found that "the company ceased operations in 1949 when its Manager and owner left

for Spain and subsequently died. When the company ceased to operate it was completely insolvent.

The information as to the insolvency of the Company reached the taxpayer in 1950. It properly

claimed the loss as a deduction in its 1950 tax return.

The same holds true in the case of the alleged increase in net worth of petitioner for the year

1951 in the sum of P1,382.85. It appears that certain items (all amounting to P1,382.85) remained in

petitioner's books as outstanding liabilities of trade creditors. These accounts were discovered in 1951

as having been paid in prior years, so that the necessary adjustments were made to correct the errors.

These increases in the taxpayer's net worth were not taxable increases in net worth, as they were not

the result of the receipt by it of unreported or unexplained taxable income, but were shown to be

merely the result of the correction of errors in its entries in its books relating to its indebtednesses to

certain creditors.

You might also like

- Fernandez Hermanos Case DigestDocument2 pagesFernandez Hermanos Case DigestLean Robyn Ledesma-Pabon100% (1)

- CIR Assessment of Net Worth Increases RejectedDocument2 pagesCIR Assessment of Net Worth Increases RejectedKim Lorenzo CalatravaNo ratings yet

- Helvering v. HorstDocument3 pagesHelvering v. HorstLeslie Joy PantorgoNo ratings yet

- CTA Dismissal of P&G Refund Claim ReversedDocument148 pagesCTA Dismissal of P&G Refund Claim ReversedMa. Consorcia GoleaNo ratings yet

- CIR vs. CTA and Smith Kline & French Overseas Co. (Philippine branch) deductibility of head office overhead expensesDocument1 pageCIR vs. CTA and Smith Kline & French Overseas Co. (Philippine branch) deductibility of head office overhead expensesscartoneros_1No ratings yet

- Cir v. MeralcoDocument2 pagesCir v. MeralcoKhaiye De Asis AggabaoNo ratings yet

- IBC Vs Amarilla Tax Case DigestDocument3 pagesIBC Vs Amarilla Tax Case DigestCJNo ratings yet

- (SPIT) (CIR v. Benguet Corp.)Document3 pages(SPIT) (CIR v. Benguet Corp.)Matthew JohnsonNo ratings yet

- Bpi V Cir DigestDocument3 pagesBpi V Cir DigestkathrynmaydevezaNo ratings yet

- CIR Vs Rufino Tax DigestDocument2 pagesCIR Vs Rufino Tax DigestML RodriguezNo ratings yet

- CIR Vs Bank of CommerceDocument2 pagesCIR Vs Bank of CommerceAster Beane AranetaNo ratings yet

- Collector V USTDocument4 pagesCollector V USTCamille Britanico100% (1)

- Limpan Vs CIRDocument5 pagesLimpan Vs CIRBenedick LedesmaNo ratings yet

- G.R. No. L-53961Document1 pageG.R. No. L-53961Jannie Ann DayandayanNo ratings yet

- Bpi vs. Cir G.R. No. 139736. October 17, 2005: HeldDocument7 pagesBpi vs. Cir G.R. No. 139736. October 17, 2005: HeldLAW10101No ratings yet

- Exclusions from gross income; compensation incomeDocument2 pagesExclusions from gross income; compensation incomeHomer SimpsonNo ratings yet

- CIR v. Hedcor Sibulan, Inc.Document2 pagesCIR v. Hedcor Sibulan, Inc.SophiaFrancescaEspinosa100% (1)

- CIR vs. Lednicky (1964)Document1 pageCIR vs. Lednicky (1964)Emil BautistaNo ratings yet

- CIR v. Isabela Cultural Corp.Document4 pagesCIR v. Isabela Cultural Corp.kathrynmaydevezaNo ratings yet

- SYSTRA PHILIPPINES vs. CIR tax credit carryover rulingDocument2 pagesSYSTRA PHILIPPINES vs. CIR tax credit carryover rulingArmstrong BosantogNo ratings yet

- CIR Vs General Foods DigestDocument3 pagesCIR Vs General Foods DigestGil Aldrick FernandezNo ratings yet

- ING Bank N.V. vs. CIR, 763 SCRA 359 (2015)Document2 pagesING Bank N.V. vs. CIR, 763 SCRA 359 (2015)Anonymous MikI28PkJc100% (2)

- UST Faculty of Civil Law Dean's Circle EventDocument2 pagesUST Faculty of Civil Law Dean's Circle EventBae IreneNo ratings yet

- Limpan Investment Corp. Vs CIRDocument2 pagesLimpan Investment Corp. Vs CIRKrish CasilanaNo ratings yet

- CIR vs CTA and Smith Kline - Deduction of Home Office Overhead Expenses Not Limited to Contract AmountDocument1 pageCIR vs CTA and Smith Kline - Deduction of Home Office Overhead Expenses Not Limited to Contract AmountMini U. SorianoNo ratings yet

- CIR vs. Filinvest Development Corp.Document2 pagesCIR vs. Filinvest Development Corp.Cheng Aya50% (2)

- RCBC Vs CIR, GR No. 168498, April 24, 2007Document1 pageRCBC Vs CIR, GR No. 168498, April 24, 2007Vel June De LeonNo ratings yet

- Medicard Phil Inc. vs. CIRDocument2 pagesMedicard Phil Inc. vs. CIRhigoremso giensdksNo ratings yet

- Contex Corp vs. CIRDocument3 pagesContex Corp vs. CIRKayelyn LatNo ratings yet

- Cir V Hantex Trading Co, Inc. G.R. NO. 136975: March 31, 2005 Callejo, SR., J.: FactsDocument2 pagesCir V Hantex Trading Co, Inc. G.R. NO. 136975: March 31, 2005 Callejo, SR., J.: FactsKate Garo100% (2)

- CIR v. FilinvestDocument4 pagesCIR v. FilinvestJoy Raguindin100% (1)

- 129 Cyanamid Philippines, Inc. v. CADocument3 pages129 Cyanamid Philippines, Inc. v. CAJustin Paras33% (3)

- CIR V CA, CTA & ANSCORDocument3 pagesCIR V CA, CTA & ANSCORBananaNo ratings yet

- Kuenzle Vs CIRDocument2 pagesKuenzle Vs CIRHaroldDeLeon100% (1)

- CA upholds non-VAT status for manufacturerDocument3 pagesCA upholds non-VAT status for manufacturerClarissa SawaliNo ratings yet

- Cir VS AvonDocument3 pagesCir VS AvonKrishianne Labiano100% (1)

- Commissioner vs. ManningDocument2 pagesCommissioner vs. Manningshinjha73100% (5)

- CIR v. RufinoDocument2 pagesCIR v. RufinoKrish CasilanaNo ratings yet

- CIR V StanleyDocument15 pagesCIR V StanleyPatatas SayoteNo ratings yet

- TAX 2: Digest - Winebrenner & Iñigo Insurance Brokers, Inc. v. CIRDocument2 pagesTAX 2: Digest - Winebrenner & Iñigo Insurance Brokers, Inc. v. CIRFaith Marie Borden100% (2)

- Cir Vs United Salvage and Towage Case DigestDocument1 pageCir Vs United Salvage and Towage Case DigestjovifactorNo ratings yet

- National Development Company Vs CIRDocument7 pagesNational Development Company Vs CIRIvy ZaldarriagaNo ratings yet

- 1 - Conwi vs. CTA DigestDocument2 pages1 - Conwi vs. CTA Digestcmv mendozaNo ratings yet

- Tax 2 Digest (0406) GR 108576 012099 Cir Vs CaDocument3 pagesTax 2 Digest (0406) GR 108576 012099 Cir Vs CaAudrey Deguzman100% (1)

- #33 CIR Vs British Overseas Airways CorporationDocument2 pages#33 CIR Vs British Overseas Airways CorporationTeacherEliNo ratings yet

- Legal Counselling Case Digest Feb 12Document30 pagesLegal Counselling Case Digest Feb 12angelicaNo ratings yet

- CIR vs. DKS - Case DigestDocument4 pagesCIR vs. DKS - Case DigestJenova Jireh0% (1)

- Smi-Ed vs. Cir - 2016Document2 pagesSmi-Ed vs. Cir - 2016Anny Yanong100% (3)

- Dizon V CTA DigestDocument2 pagesDizon V CTA DigestNicholas FoxNo ratings yet

- Digest San Juan Vs CastroDocument2 pagesDigest San Juan Vs CastroRyan AcostaNo ratings yet

- Pepsi Cola vs. Municipality of Tanauan, Leyte (Digest)Document2 pagesPepsi Cola vs. Municipality of Tanauan, Leyte (Digest)Bam BathanNo ratings yet

- CIR v. Hedcor Sibulan, Inc.Document2 pagesCIR v. Hedcor Sibulan, Inc.SophiaFrancescaEspinosa100% (1)

- Steag State Power, Inc. v. Commissioner of Internal Revenue, G.R. No. 205282, January 14, 2019 (Third Division)Document1 pageSteag State Power, Inc. v. Commissioner of Internal Revenue, G.R. No. 205282, January 14, 2019 (Third Division)John Kenneth JacintoNo ratings yet

- State Land Investment Corporation v. Cir DigestDocument2 pagesState Land Investment Corporation v. Cir DigestAlan Gultia100% (1)

- Domingo v. GarlitosDocument1 pageDomingo v. GarlitosJazz TraceyNo ratings yet

- 172 Fernandez Hermanos, Inc. v. CIR (Uy)Document4 pages172 Fernandez Hermanos, Inc. v. CIR (Uy)Avie UyNo ratings yet

- Tax Court Ruling on Deductions UpheldDocument16 pagesTax Court Ruling on Deductions UpheldEdwardArribaNo ratings yet

- Tax DigestsDocument7 pagesTax DigestsClaudine Allyson DungoNo ratings yet

- Collector vs. Bohol LTO, GR# L-13099 and L-13462, April 29, 1960Document1 pageCollector vs. Bohol LTO, GR# L-13099 and L-13462, April 29, 1960SURITA, FLOR DE MAE PNo ratings yet

- Limpan Vs CommDocument5 pagesLimpan Vs CommEller-jed M. MendozaNo ratings yet

- University of San Agustin vs. CirDocument1 pageUniversity of San Agustin vs. CirmwaikeNo ratings yet

- Gamboa vs. CruzDocument1 pageGamboa vs. CruzmwaikeNo ratings yet

- Commissioner of Internal Revenue vs. Wander PhilippinesDocument1 pageCommissioner of Internal Revenue vs. Wander PhilippinesmwaikeNo ratings yet

- YMCA Manila Tax ExemptionDocument1 pageYMCA Manila Tax ExemptionmwaikeNo ratings yet

- Pollo vs. Constantino-DavidDocument1 pagePollo vs. Constantino-DavidmwaikeNo ratings yet

- PNB vs. RemigioDocument1 pagePNB vs. RemigiomwaikeNo ratings yet

- University of San Agustin vs. CirDocument1 pageUniversity of San Agustin vs. CirmwaikeNo ratings yet

- REYES-RAYEL V. PLT HOLDINGS Due Process CaseDocument1 pageREYES-RAYEL V. PLT HOLDINGS Due Process CasemwaikeNo ratings yet

- Ust Hospital Employees Association vs. Sto. Tomas HospitalDocument1 pageUst Hospital Employees Association vs. Sto. Tomas HospitalmwaikeNo ratings yet

- People vs. BravoDocument1 pagePeople vs. Bravomwaike100% (1)

- Filipinas Synthetic Fiber Corporation vs. CA, Cta, and CirDocument1 pageFilipinas Synthetic Fiber Corporation vs. CA, Cta, and CirmwaikeNo ratings yet

- Govt of Hong Kong vs. OlaliaDocument1 pageGovt of Hong Kong vs. OlaliamwaikeNo ratings yet

- Gutierrez Vs CTADocument1 pageGutierrez Vs CTAmwaikeNo ratings yet

- Commissioner of Internal Revenue vs. MarubeniDocument1 pageCommissioner of Internal Revenue vs. Marubenimwaike100% (1)

- Gacad vs. ClapisDocument1 pageGacad vs. ClapismwaikeNo ratings yet

- Gamboa vs. CruzDocument1 pageGamboa vs. CruzmwaikeNo ratings yet

- In The Matter of Proceedings For Disciplinary Action Against AttyDocument1 pageIn The Matter of Proceedings For Disciplinary Action Against AttymwaikeNo ratings yet

- Gamboa vs. ChanDocument1 pageGamboa vs. ChanmwaikeNo ratings yet

- Rubi vs. Provincial Board of MindoroDocument1 pageRubi vs. Provincial Board of MindoromwaikeNo ratings yet

- Canoy vs. OrtizDocument1 pageCanoy vs. OrtizmwaikeNo ratings yet

- Aberca vs. VerDocument1 pageAberca vs. VermwaikeNo ratings yet

- Villaruel vs. FernandoDocument1 pageVillaruel vs. FernandomwaikeNo ratings yet

- OLBES Vs DeceimbreDocument1 pageOLBES Vs DeceimbremwaikeNo ratings yet

- In Re - Atty. Felizardo M. de GuzmanDocument1 pageIn Re - Atty. Felizardo M. de Guzmanmwaike100% (1)

- Laput vs. Remotigue Attorney Misconduct Case DismissedDocument1 pageLaput vs. Remotigue Attorney Misconduct Case DismissedmwaikeNo ratings yet

- Lorenzo Shipping CorpDocument4 pagesLorenzo Shipping CorpmwaikeNo ratings yet

- People vs Santiago examines oral defamation vs libelDocument1 pagePeople vs Santiago examines oral defamation vs libelmwaikeNo ratings yet

- Teresita Dio Versus STDocument2 pagesTeresita Dio Versus STmwaike100% (1)

- Nikko Hotel Manila Garden and Ruby Lim VsDocument2 pagesNikko Hotel Manila Garden and Ruby Lim VsmwaikeNo ratings yet

- McReath Original SolutionDocument2 pagesMcReath Original SolutionSuchi0% (1)

- F 941Document4 pagesF 941anon-125390No ratings yet

- Maryland Mortgage Program - Recapture TaxDocument12 pagesMaryland Mortgage Program - Recapture TaxNishika JGNo ratings yet

- MDDCore Lock FileDocument3 pagesMDDCore Lock FileShin LimNo ratings yet

- Chapter 8 - TaxationDocument35 pagesChapter 8 - Taxationancaye1962No ratings yet

- Calculation of Total Tax Incidence (TTI) for ImportsDocument1 pageCalculation of Total Tax Incidence (TTI) for ImportsRipul Nabi67% (3)

- Noorani Sales: Billed To: Shipped ToDocument1 pageNoorani Sales: Billed To: Shipped Tomakbulhusen lalaNo ratings yet

- Navneet Itr 23-24Document1 pageNavneet Itr 23-24mohitNo ratings yet

- Calculate Your Expenses - Home Office Expenses For Employees - Canada - CaDocument3 pagesCalculate Your Expenses - Home Office Expenses For Employees - Canada - CaBriar WoodNo ratings yet

- TSGENCO PAY SLIP NOVEMBER 2015Document2 pagesTSGENCO PAY SLIP NOVEMBER 2015yashodharrajuNo ratings yet

- CORRECTED 1098-TDocument2 pagesCORRECTED 1098-TVampire LadyNo ratings yet

- 9011496693Document3 pages9011496693RITVIK ARORANo ratings yet

- 32nd Parkview Plots Price List 08.01.2021Document1 page32nd Parkview Plots Price List 08.01.2021Zama KazmiNo ratings yet

- Number of Instalments and Payment Mode Received Date Coll. Br. Serv. Br. Premium/ Additional Premium Amount Service Tax / GST Amount ReceivedDocument1 pageNumber of Instalments and Payment Mode Received Date Coll. Br. Serv. Br. Premium/ Additional Premium Amount Service Tax / GST Amount ReceivedPadamNo ratings yet

- Salary AugDocument1 pageSalary AugdivanshuNo ratings yet

- Quotation: Quotation From Quotation ForDocument1 pageQuotation: Quotation From Quotation ForSandeepNo ratings yet

- SMR RV PDFDocument2 pagesSMR RV PDFRoselle ManaysayNo ratings yet

- Abc 2Document2 pagesAbc 2Kath LeynesNo ratings yet

- Challan No Itns 280 PDFDocument2 pagesChallan No Itns 280 PDFArvind Rathod50% (4)

- Value Added Tax in The PhilippinesDocument14 pagesValue Added Tax in The Philippinesagathe laurent100% (1)

- Brokerage Account Xxx9881 Consolidated Form 1099 2023Document10 pagesBrokerage Account Xxx9881 Consolidated Form 1099 2023gabriela.paradaNo ratings yet

- CIR Vs ST LukesDocument1 pageCIR Vs ST LukesMeAnn TumbagaNo ratings yet

- 23072600198046KVBL ChallanReceiptDocument2 pages23072600198046KVBL ChallanReceiptNaveen SNo ratings yet

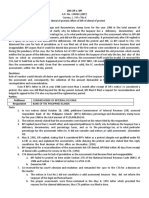

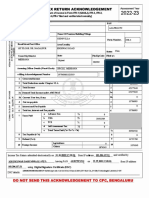

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementMitesh PatelNo ratings yet

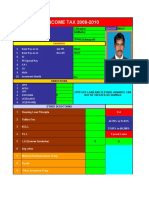

- Income Tax 2009-10Document7 pagesIncome Tax 2009-10gsreddyNo ratings yet

- SSS vs. Bacolod CityDocument1 pageSSS vs. Bacolod CityLawrence SantiagoNo ratings yet

- Payroll (VLOOKUP, Validation)Document8 pagesPayroll (VLOOKUP, Validation)into the unknownNo ratings yet

- Print For Perfect OneDocument1 pagePrint For Perfect OnenmbmNo ratings yet

- Work PaystubDocument1 pageWork Paystubjoelryan2019No ratings yet

- Time Card Cum Payslip For The Month of - April 2016 - 3402Document1 pageTime Card Cum Payslip For The Month of - April 2016 - 3402Sai Subrahmanyam PvkNo ratings yet