Professional Documents

Culture Documents

WSKT

Uploaded by

chriscivil12Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

WSKT

Uploaded by

chriscivil12Copyright:

Available Formats

Page 1 of 1

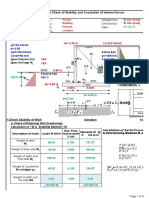

Quantitative Equity Report | Release Date: 17 September 2015 | Reporting Currency: IDR | Trading Currency: IDR

Waskita Karya (Persero) Tbk Class B WSKT

Last Close

Quantitative Fair Value Estimate

Market Cap (Bil)

Sector

Industry

1,620.00

1,467.09

15,763.2

p Industrials

Engineering & Construction

Waskita Karya (Persero) Tbk is engaged in the construction

business in Indonesia. The Company is focused on the projects

that are based on specialization such as Civil, Building, EPC as

well as region.

Country of Domicile

IDN Indonesia

Price Versus Quantitative Fair Value

2011

2012

2013

2014

2015

2016

1,768

Sales/Share

Forecast Range

Forcasted Price

Dividend

Split

1,326

Momentum:

Standard Deviation:

Quantitative Fair Value Estimate

2,210

Total Return

Quantitative Scores

Scores

All Rel Sector Rel Country

Quantitative Moat

None

Valuation

Overvalued

Quantitative Uncertainty High

Financial Health

Strong

14

8

95

79

12

9

95

76

21

4

98

87

884

781.65

52-Wk

1,900.00

442

WSKT

IDN

Undervalued

Fairly Valued

Overvalued

Valuation

Sector

Median

Country

Median

0.89

17.1

13.9

9.8

16.6

2.32

1.6

0.8

0.84

12.3

12.8

6.4

9.7

2.45

1.1

1.1

Current 5-Yr Avg

Sector

Median

Country

Median

11.1

4.6

0.0

13.3

5.1

0.9

Current 5-Yr Avg

Price/Quant Fair Value

Price/Earnings

Forward P/E

Price/Cash Flow

Price/Free Cash Flow

Dividend Yield %

Price/Book

Price/Sales

1.08

25.5

0.63

2.2

1.4

Profitability

Return on Equity %

Return on Assets %

Revenue/Employee (Bil)

13.0

4.4

8.6

23.8

4.0

8.0

Score

100

Quantitative Moat

80

60

40

20

0

2008

2009

2010

2011

2012

2013

2014

Financial Health

Current 5-Yr Avg

Distance to Default

Solvency Score

Assets/Equity

Long-Term Debt/Equity

2015

Sector

Median

Country

Median

0.6

492.5

1.8

0.2

0.5

561.3

2.1

0.3

0.7

4.4

0.4

5.9

0.4

1-Year

3-Year

5-Year

10-Year

6.2

23.6

35.9

443.3

18.2

88.5

12.2

31.6

-82.4

-77.4

18.0

19.7

-82.1

Growth Per Share

Revenue %

Operating Income %

Earnings %

Dividends %

Book Value %

Stock Total Return %

-9.5

-29.9

265.8

269.1

13.5

14.9

0.0

0.0

0.52

20.8

0.6

0.78

37.5

1.4

0.63

25.5

1.4

Total Return %

+/ Market (Morningstar World

Index)

Dividend Yield %

Price/Earnings

Price/Revenue

Undervalued

Fairly Valued

Overvalued

Monthly Volume (Thousand Shares)

Liquidity: High

172,205

Financials (Fiscal Year in Bil)

Revenue

% Change

2010

2011

2012

2013

2014

TTM

5,853

30.3

7,274

24.3

8,808

21.1

9,687

10.0

10,287

6.2

11,090

7.8

383

24.7

124

486

26.8

172

460

-5.3

254

611

32.9

368

756

23.6

502

860

13.8

612

Operating Income

% Change

Net Income

-23

-171

-2.9

-63

-169

-2.3

-82

-268

-3.0

-229

-614

-6.3

-329

-418

-4.1

-462

-975

-8.8

Operating Cash Flow

Capital Spending

Free Cash Flow

% Sales

6,734.90

-97.6

9,335.85

38.6

37.13

-99.6

-37,296.00

37.32

0.5

-68.04

50.71

35.9

-6.50

62.29

22.8

-99.24

EPS

% Change

Free Cash Flow/Share

25

9,858

65.98

9,858

2.06

213.41

9,956

11.20

242.71

9,914

10.08

714.56

9,914

Dividends/Share

Book Value/Share

Shares Outstanding (Mil)

31.6

3.5

2.1

1.64

9.1

32.1

3.7

2.4

1.58

8.3

19.3

3.8

2.9

1.31

4.2

16.8

4.3

3.8

1.13

3.7

19.2

4.7

4.9

0.96

4.4

13.0

4.4

5.5

0.80

2.6

Profitability

Return on Equity %

Return on Assets %

Net Margin %

Asset Turnover

Financial Leverage

9.9

6.6

9.1

6.7

8.3

5.2

747

9.4

6.3

748

10.8

7.4

1,246

11.5

7.8

1,171

Gross Margin %

Operating Margin %

Long-Term Debt

450

39.5

620

42.2

2,007

40.7

2,382

29.6

2,843

19.8

7,084

16.8

Total Equity

Fixed Asset Turns

Quarterly Revenue & EPS

Revenue (Bil)

Mar

Jun

Sep

2015

1,402.8 2,581.5

2014

1,034.6 2,146.7 2,099.3

2013

957.4 2,051.4 2,139.7

2012

806.1 1,921.7 1,974.1

Earnings Per Share

2015

1.20

16.72

2014

0.68

5.46

6.91

2013

0.55

5.19

6.24

2012

44.94 1,960.50 3,571.39

Revenue Growth Year On Year %

Dec

Total

5,006.2 10,286.8

4,538.2 9,686.6

4,106.5 8,808.4

37.54

25.34

5.56

50.71

37.32

37.13

35.6

20.3

6.7

8.4

10.5

8.1

10.3

4.6

-1.9

2013

2014

2015 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information

contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution

is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

2015

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Retaining Wall With Counterfort - Rev00 - 05-Apr-2014Document9 pagesRetaining Wall With Counterfort - Rev00 - 05-Apr-2014chriscivil12No ratings yet

- Best Tank Calculation SheetDocument88 pagesBest Tank Calculation Sheetchriscivil12No ratings yet

- Rosewood Case SpreadsheetDocument2 pagesRosewood Case Spreadsheetjbuckley7485% (20)

- Principles of Marketing Test Bank CHP 1Document20 pagesPrinciples of Marketing Test Bank CHP 1Bad idea97% (31)

- Cantilever Retaining WallDocument5 pagesCantilever Retaining Wallchriscivil12No ratings yet

- Tows Matrix: Strengths WeaknessesDocument4 pagesTows Matrix: Strengths WeaknessesAmina100% (2)

- M04p - Organizational Strategies and The Sales FunctionDocument30 pagesM04p - Organizational Strategies and The Sales Functionkillu87No ratings yet

- KCC Floor Coating GuideDocument16 pagesKCC Floor Coating Guidechriscivil12No ratings yet

- CPIDetailDocument7 pagesCPIDetailchriscivil12No ratings yet

- Industry PerfDocument8 pagesIndustry Perfchriscivil12No ratings yet

- XLQ OnlyDocument45 pagesXLQ Onlychriscivil12No ratings yet

- PAMPAS Company Profile Since 2000Document6 pagesPAMPAS Company Profile Since 2000chriscivil12No ratings yet

- Sisi ProductionDocument1 pageSisi Productionchriscivil12No ratings yet

- RSStocksDocument28 pagesRSStockschriscivil12No ratings yet

- Revit Tutorial Segment 3Document20 pagesRevit Tutorial Segment 3Budega100% (10)

- Brosur HidrostalDocument2 pagesBrosur Hidrostalchriscivil12No ratings yet

- DPT Kolam Retensi H 3.8m (No Water)Document6 pagesDPT Kolam Retensi H 3.8m (No Water)chriscivil12No ratings yet

- IndexDocument8 pagesIndexSengottu VelusamyNo ratings yet

- Scafolding Set PDFDocument2 pagesScafolding Set PDFchriscivil12No ratings yet

- Teknik Perencanaan Irigasi dan Rawa Dep. UNDIPDocument2 pagesTeknik Perencanaan Irigasi dan Rawa Dep. UNDIPchriscivil12No ratings yet

- Perhitungan Valuasi FADocument2 pagesPerhitungan Valuasi FAchriscivil12No ratings yet

- Sakaled Frameless Led 40wDocument1 pageSakaled Frameless Led 40wchriscivil12No ratings yet

- Watertreatmentplant 150602145903 Lva1 App6892Document172 pagesWatertreatmentplant 150602145903 Lva1 App6892chriscivil12100% (2)

- Manual of SurvivingDocument1 pageManual of SurvivingKristi GonzalesNo ratings yet

- Cantilever Sheet Pile Wall, SI Units (DeepEX 2015) PDFDocument13 pagesCantilever Sheet Pile Wall, SI Units (DeepEX 2015) PDFchriscivil12No ratings yet

- Award Report TemplateDocument3 pagesAward Report TemplatekulukundunguNo ratings yet

- Media 111415 enDocument30 pagesMedia 111415 enchriscivil12No ratings yet

- Restricted Commercial Framework AwardDocument3 pagesRestricted Commercial Framework Awardchriscivil12No ratings yet

- AISC Properties ViewerDocument3 pagesAISC Properties Viewerchriscivil12No ratings yet

- Daftar Isian Alat IA LabDocument2 pagesDaftar Isian Alat IA Labchriscivil12No ratings yet

- KCC FLOOR COATING (Catalogue) PDFDocument16 pagesKCC FLOOR COATING (Catalogue) PDFchriscivil12No ratings yet

- TM 5 809 12 PDFDocument54 pagesTM 5 809 12 PDFchriscivil12No ratings yet

- PremierInsight 170116Document3 pagesPremierInsight 170116chriscivil12No ratings yet

- KCC Floor Coating (Catalogue)Document16 pagesKCC Floor Coating (Catalogue)chriscivil120% (2)

- DTC Participant Report Alphabetical ListDocument16 pagesDTC Participant Report Alphabetical ListCarlos Alberto Chavez AznaranNo ratings yet

- Kerastase System Professional E-commerce Market ResearchDocument6 pagesKerastase System Professional E-commerce Market ResearchAna Maria PetreNo ratings yet

- CB Insights Tech IPO Pipeline 2019Document38 pagesCB Insights Tech IPO Pipeline 2019Tung NgoNo ratings yet

- MODULE 8 EntreprenureDocument10 pagesMODULE 8 EntreprenureQuiel Jomar GarciaNo ratings yet

- Swot Analysis For OlaCabsDocument2 pagesSwot Analysis For OlaCabsMS Nag100% (1)

- About Fixed Coupon Central Government Securities (Also Called Gsecs or Gilts)Document19 pagesAbout Fixed Coupon Central Government Securities (Also Called Gsecs or Gilts)Parv SalechaNo ratings yet

- Igloo Business PlanDocument26 pagesIgloo Business PlanpratimNo ratings yet

- ECON1101 Microeconomics 1 PartsAandB S12016Document17 pagesECON1101 Microeconomics 1 PartsAandB S12016sachin rolaNo ratings yet

- Rice Mill Current BillDocument4 pagesRice Mill Current BillCharandas KothareNo ratings yet

- Market Power: Monopoly and Monopsony ExplainedDocument13 pagesMarket Power: Monopoly and Monopsony ExplainedAneeqUzZamanNo ratings yet

- Analisis Pengaruh Promosi, Desain Produk, Dan Kelompok Referensi Terhadap Keputusan Pemebelian Dengan Citra Merek Sebagai Variabel InterveningDocument12 pagesAnalisis Pengaruh Promosi, Desain Produk, Dan Kelompok Referensi Terhadap Keputusan Pemebelian Dengan Citra Merek Sebagai Variabel InterveningdeniasNo ratings yet

- Case Analysis of NikeDocument6 pagesCase Analysis of NikeZackyNo ratings yet

- Current asset optimizationDocument33 pagesCurrent asset optimizationBrian Daniel BayotNo ratings yet

- Group 13 - Sec F - Does It Payoff Strategies of Two BanksDocument5 pagesGroup 13 - Sec F - Does It Payoff Strategies of Two BanksAlok CNo ratings yet

- Economics Class X Chapter 4 (MBOSE)Document4 pagesEconomics Class X Chapter 4 (MBOSE)M. Amebari NongsiejNo ratings yet

- Avari Ramada Hotel Case Study ReportDocument6 pagesAvari Ramada Hotel Case Study ReportAvishek Hota100% (1)

- Predictive MarketsDocument20 pagesPredictive MarketsAnubhav AggarwalNo ratings yet

- Market StructuresDocument32 pagesMarket StructuresEricNyoni100% (2)

- Kooli 1Document3 pagesKooli 1Tanel KurbasNo ratings yet

- Urban Economics NotesDocument18 pagesUrban Economics Notespink1231No ratings yet

- Candy and Chocolate India (CCI)Document12 pagesCandy and Chocolate India (CCI)Nikhil JoyNo ratings yet

- Crafting The Neoliberal StateDocument15 pagesCrafting The Neoliberal StateAsanijNo ratings yet

- DepartmentationDocument29 pagesDepartmentationPrashant MishraNo ratings yet

- Lecture Notes On Brand RepositioningDocument4 pagesLecture Notes On Brand Repositioningmahekii kingraniNo ratings yet

- Equity ValuationDocument36 pagesEquity ValuationANo ratings yet