Professional Documents

Culture Documents

RE KV Sathasivam

Uploaded by

Aw Jyh JingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RE KV Sathasivam

Uploaded by

Aw Jyh JingCopyright:

Available Formats

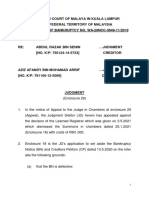

[2004] 5 CLJ

Re KV Sathasivam;

ex p Phileoallied Bank (Malaysia) Bhd

549

RE KV SATHASIVAM;

EX P PHILEOALLIED BANK (MALAYSIA) BHD

HIGH COURT MALAYA, MELAKA

LOW HOP BING J

[BANKRUPTCY NO: 29-619-2000]

18 FEBRUARY 2004

BANKRUPTCY: Notice - Substituted service - Alleged irregularities in

substituted service - Admission by debtor that bankruptcy notice was brought

to his notice - Whether object of substituted service achieved - Whether service

deemed good and sufficient

BANKRUPTCY: Notice - Understatement of debt due - Failure by debtor to

dispute notice on the basis of proviso (ii) to s. 3(2) of the Bankruptcy Act

1967 - Whether debtor misled, embarrassed or perplexed - Whether bankruptcy

notice valid

BANKRUPTCY: Practice and procedure - Substituted service - Alleged

irregularities in substituted service - Admission by debtor that bankruptcy

notice was brought to his notice - Whether object of substituted service

achieved - Whether service deemed good and sufficient

BANKRUPTCY: Judgment - Execution more than six years after judgment Execution on judgment within 12 years - Interest claimed on judgment

calculated exactly six years from date of judgment - Failure by creditor to

obtain leave of court to execute - Technical non-compliance with rules of court

- Whether bankruptcy notice valid

CIVIL PROCEDURE: Rules of court - Non-compliance - Non-compliance with

O. 46 r. 2(3) RHC 1980 - Whether court is to have regard to the justice of

the case and not only to technical non-compliance with rules of court - RHC

1980, O. 1A, O. 2 r. 3, O. 46 r. 2(2)

The registrar allowed the judgment debtors (JD) application to set aside the

bankruptcy notice taken out by the judgment creditor (JC). The JC appealed

to the High Court. The High Court had to inter alia determine the following

issues: (a) whether the order for substituted service of the notice was irregularly

obtained; (ii) whether the bankruptcy notice was based on a lapsed judgment;

and (iii) whether an understatement of interest in the bankruptcy notice

invalidated the notice. The JD further raised a technical objection to the effect

that the JC had not complied with O. 46 r. 2(3) of the RHC 1980.

CLJ

550

Current Law Journal

Supplementary Series

[2004] 5 CLJ

Held (allowing the JCs appeal with costs):

[1] Practice Note 1 of 1968 must be read in light of O. 62 r. 5(1) of the

RHC 1980 which gives the court the power to make an order for

substituted service of a document if it appears impracticable for any reason

to serve the document personally. The object of substituted service is to

bring the bankruptcy notice to the knowledge of the debtor and if that

object is achieved, the service must be deemed good and sufficient. On

the facts, the debtor admitted that the bankruptcy notice was brought to

his knowledge. Thus the High Court was unable to uphold the contention

that the order for substituted service had been wrongly obtained or that

the service thereof was bad. (p 555 a, f-g)

[2] On the facts, the impugned bankruptcy notice dated 30 June 2000 based

on the judgment obtained on 22 October 1988 was clearly within the period

of 12 years, and which judgment would only lapse on 21 October 2000.

In the instant appeal, the impugned bankruptcy notice specifically stated

that interest was calculated up to 2190 days, ie, exactly six years from

the date the judgment was granted and was therefore valid. (pp 556 c &

558 b)

[3] In administering the rules of the court, the court or judge should have

regard to the justice of the particular case and not only to the technical

non-compliance with the rules. On the facts the technical objection raised

by the JD in relation to the JCs non-compliance with O. 46 r. 2(3) had

been superseded by amendments to the RHC, notably O. 1A and O. 2 r. 3

which came into effect on 16 May 2002 vide PU(A) 197/2002. (p 558 f-g)

[4] There was clearly an understatement of the interest due in the bankruptcy

notice. However, this understatement of interest could not have misled,

embarrassed or perplexed the JD. The bankruptcy notice made it clear what

was required to be paid, secured or compounded by the JD in order to

avoid an act of bankruptcy. Further, as the JD had not disputed the

bankruptcy notice on the basis of proviso (ii) to s. 3(2) of the Bankruptcy

Act 1967, the bankruptcy was not invalidated. (pp 559 d-e & 560 d)

Case(s) referred to:

Beauford Baru Sdn Bhd v. Gopalan Krishnan VK Gopalan [2002] 3 CLJ 686 HC

(refd)

Datuk Mohd Sari Datuk Hj Nuar v. Norwich Winterthur Insurance (M) Sdn Bhd

[1992] 4 CLJ 1798; [1992] 1 CLJ (Rep) 68 SC (refd)

J Raju M Kerpaya v. Commerce International Merchant Bankers Bhd [2000] 3 CLJ

104 CA (refd)

Kamaruddin Mohamed v. United Motor Works (M) Sdn Bhd [1982] 1 MLJ 126 (refd)

Koh Thong Kuang v. United Malayan Banking Corp Bhd [1994] 4 CLJ 488 FC (refd)

CLJ

[2004] 5 CLJ

Re KV Sathasivam;

ex p Phileoallied Bank (Malaysia) Bhd

551

Megat Najmuddin Dato Seri (Dr) Megat Khas v. Bank Bumiputra Malaysia Bhd

[2002] 1 CLJ 6 FC (refd)

Megnaway Enterprise Sdn Bhd v. Soon Lian Hock [2003] 5 CLJ 103 HC (refd)

Re Amarjit Kaur Bakhshis Singh, ex p BSN Commercial Bank (Malaysia) Bhd [2001]

1 CLJ 412 HC (refd)

Re Hj Ahmad Lazim & Anor, ex p Bank Kerjasama Rakyat (M) Bhd [1999] 2 CLJ

101 HC (refd)

Re Ismail Daud & Anor, ex p Universal Life & General Insurance Sdn Bhd [1990]

1 MLJ 118 HC (refd)

Re Pg Ahmad Pg Hj Abdullah; ex p Oriental Bank Bhd [1991] 3 CLJ 2899; [1991]

3 CLJ (Rep) 463 HC (refd)

Re S Nirmala Muthiah Selvarajah; ex p The New Straits Times Press (Malaysia)

Bhd [1987] 1 CLJ 413; [1987] CLJ (Rep) 799 HC (refd)

Re Liew Kong Ken Ex P Sucorp Enterprise Sdn Bhd [1998] 2 CLJ Supp 508 HC

(refd)

Re Lim Kim Guan, ex p Four Seas Bank Ltd [1991] 1 MLJ 330 (refd)

Re V Gopal; ex p Bank Buruh (M) Berhad [1987] 1 CLJ 602; [1987] CLJ (Rep)

602 HC (refd)

Re Yau Kin Mun; ex p Public Bank Bhd [1999] 5 MLJ 497 HC (refd)

Sovereign General Insurance Sdn Bhd v. Koh Tian Bee [1988] 1 CLJ 155; [1988]

1 CLJ (Rep) 277 SC (refd)

Terrance Simon Marbeck v. Kerajaan Malaysia [2003] 6 CLJ 120 HC (refd)

United Malayan Banking Corp Bhd v. Ernest Cheong Yong Yin [2001] 2 CLJ 31

CA (refd)

United Malayan Banking Corporation Bhd v. Ernest Cheong Yong Yin [2002] 2 CLJ

413 FC (refd)

Wee Chow Yong t/a Vienna Music Centre v. Public Finance Bhd [1990] 1 CLJ 176;

[1990] 3 CLJ (Rep) 349 HC (refd)

Legislation referred to:

Bankruptcy Act 1967, ss. 3(1)(i), (2), (2)(ii), 6(3)

Rules of the High Court 1980, O. 1A, O. 2 r. 3, O. 46 r. 2(1)(a), (b), (3), O. 62

r. 5(1)

For the judgment debtor - Siti Aishah Aziz; M/s Mohd Ali & Co

For the judgment creditor - SG Lingam; M/s SG Lingam & Co

Reported by AC Simon

JUDGMENT

Low Hop Bing J:

Appeal

This is an appeal in encl. (14) filed by the judgment creditor (the JC) against

the decision of the learned registrar who on 21 January 2002 allowed the

application of the judgment debtor (the JD) in encl. (8) to set aside the

bankruptcy notice dated 30 June 2000 (the impugned bankruptcy notice).

CLJ

Current Law Journal

Supplementary Series

552

[2004] 5 CLJ

Factual Background

On 22 October 1988, the JC obtained default judgment against the JD, which

judgment has not been set aside, although para 8 of the JDs affidavit in support

reserved his right to do so. The JD further alleged that he has not been

personally served with the impugned bankruptcy notice, although he believed

that the JC did inform the JD of the JCs intention to personally serve the

impugned bankruptcy notice on the JD sometime in August 2001, when the

JD was undergoing medical treatment and so could not meet the JCs agent to

accept service thereof.

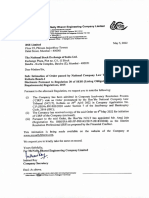

Subsequently, the JCs solicitors sent a letter dated 8 August 2000 to the JD

in connection with an appointment on 17 August 2000 in order to effect service

of the impugned bankruptcy notice on the JD.

The context of that letter merits reproduction as follows:

CERTIFICATE OF POSTING

Mr. K V Sathasivam @ Kumarasamy

No. 429, Lorong Satu

Ujung Pasir

75050 Melaka

Dear Sir,

MALACCA HIGH COURT BANKRUPTCY NO. 29-619-2000

PHILEOALLIED BANK (MALAYSIA) BERHAD - vs- KV SATHASIVAM

@ KUMARASAMY

We act for PhileoAllied Bank (M) Berhad in respect of the above matter.

Our clerk had called over at your address to effect service of the Bankruptcy

Notice on you on the 20th and 25th July, 2000 but as you were not in, service

could not be effected.

Now, we write to inform you that our clerk shall be calling again at your

address on 17th August, 2000 (Thursday) at 3.00 p.m. to effect service of

the Bankruptcy Notice on you.

If the said appointment date is not suitable to you kindly call us at least one

day before the appointment so that a suitable date can be fixed.

Kindly be informed that if you fail to keep the appointment as above or as

on the date proposed by you, we shall obtain a court order to effect service

of the Bankruptcy Notice by substituted service upon you by way of causing

an advertisment in any local newspaper and/or by any other means the Court

deems proper in which event you shall be liable for the additional costs

incurred.

CLJ

[2004] 5 CLJ

Re KV Sathasivam;

ex p Phileoallied Bank (Malaysia) Bhd

553

Yours faithfully,

sgd.

S.G Lingam & Co

However, a member of the JDs family informed the JCs solicitors that the

appointed date was not suitable.

Vide letter dated 18 August 2000 addressed to the JD, the JCs solicitors

confirmed that the JDs son had spoken to one of the JCs solicitors Ms Ratha,

on 16 August 2000 and that the JDs son would inform the JCs solicitors

once the JD had returned home sometime in mid-September 2000, after the

medical treatment, in order to accept service of the impugned bankruptcy notice,

failing which the JCs solicitors shall proceed to obtain an order for substituted

service (ss).

On 27 September 2000, the JCs process server filed an affidavit of non service.

On 31 October 2000, the JC obtained an order for ss to effect service of

the impugned bankruptcy notice by posting a copy thereof on the notice board

of the Melaka High Court and an advertisement in The Star and that such

service shall be deemed to be good service seven days after such posting and

advertisement.

The particulars of the sum claimed in the impugned bankruptcy notice are as

follows:

BUTIR-BUTIR TUNTUTAN

[PARTICULARS OF THE CLAIM]

(a) Jumlah Penghakiman seperti dalam

Penghakiman bertarikh 22hb Oktober

1988 melalui Mahkamah Tinggi Kuala

Lumpur Guaman Sivil No. D2-23-1036-88

RM

812,188.06

g

[Judgment sum as in Judgment dated 22nd

October 1988 vide High Court Kuala Lumpur

Civil Suit No. D2-23-1036-88]

(b) Faedah ke atas RM812,188.06 pada kadar

15% setahun dari 1hb Mac 1988 sehingga

30hb Jun 2000 (2190 hari)

RM

730,969.25

[Interest on RM812,188.06 at the rate of

15% per annum from 1 March 1988 to

30 June 2000 (2190 days)

i

CLJ

Current Law Journal

Supplementary Series

554

(c) Kos

RM

(Costs)

[2004] 5 CLJ

225.00

______________

Jumlah tertunggak setakat

30hb Jun 2000

[Total arrears as at 30th June 2000]

RM 1,543,382.31

=============

Bertarikh pada haribulan 30 Jun 2000.

[The translation in English appears in the brackets]

JDs Grounds

The grounds enumerated in encl. (8) ie, JDs application are that:

1. the order for ss was irregularly obtained;

2. the impugned bankruptcy notice:

2.1 was based on a judgment that has lapsed;

2.2 claimed interest which was time-barred;

2.3 not in accordance with the terms of the judgment; and

2.4 cited a party which is different from the JC

The learned registrar dismissed two of the JDs grounds viz para 2.2 pertaining

to time-barred interest; and para 2.4 pertaining to citation of a different party.

The JD did not cross-appeal against those two grounds and so they are nonissues in relation to the JCs appeal before me. I shall now consider the other

grounds viz. relating to ss, lapsed judgment and terms of the judgment.

Counsels Submissions And Decision On Appeal

1. Substituted Service

This was the JDs first ground, in which learned counsel, Cik Siti Aishah bt

Aziz relied on paras 5, 6 and 7 of Practice Note No. 1 of 1968 (the Practice

Note); Re S. Nirmala a/p Muthiah Selvarajah t/a Shamin Properties; Ex Parte

The New Straits Times Press (Malaysia) Bhd. [1987] 1 CLJ 413; [1987] CLJ

(Rep) 799 HC.

En. S.G. Lingm, learned counsel for the JC, argued that the order for ss has

been properly obtained.

Koh Thong Kuang v. United Malayan Banking Corp Bhd [1994] 4 CLJ 488

FC; Kamaruddin bin Mohamed v. United Motor Works (M) Sdn. Bhd. [1982]

1 MLJ 126; and Karen Ahmad Aliyuddin v. Standard Chartered, Mallals

Digest of Malaysian and Singapore Case Law Fourth Edition 1998 Reissue

para 4141 were cited in support.

CLJ

[2004] 5 CLJ

Re KV Sathasivam;

ex p Phileoallied Bank (Malaysia) Bhd

555

In my view, the Practice Note must be read in the light of O. 62 r. 5(1) of

the Rules of the High Court 1980 which gives the court the power to make

an order for ss of a document if it appears impracticable for any reason to

serve the document personally.

Order 62 r. 5(1) came up for judicial consideration in Re S. Nirmala, supra,

by VC George J (later JCA) who explained that the Practice Note is a

reproduction of the recommended guidelines found at p. 88 of the 1957 White

Book, so that a mere statement that the person to be served was evading service

was not sufficient to meet the requirement that it was impracticable to serve

the document.

The Supreme Court in Koh Thong Kuang, supra, unanimously held that the

Practice Note should not be applied blindly but mutatis mutandis the facts of

each situation. The bone of contention there was that the order for ss had

been improperly obtained. The facts revealed that the bank had obtained

judgment against the debtor and subsequently an order for ss of the bankruptcy

notice which was effected by posting a copy thereof on the notice board of

the court, on a conspicuous part of the debtors last known address in Bangsar,

Kuala Lumpur; and also in the Malay Mail. The effective date of the ss was

7 April 1993. On 9 April 1993, the debtor applied to set aside the bankruptcy

notice, contending that for the previous six years he had resided in England

and that the bank or the solicitors were fully aware. VC George J (later JCA)

in delivering judgment of the court held that the bank was justified in concluding

that the debtor was deliberately evading service and upheld the order for ss.

In Kamaruddin, supra, the Federal Court explained that the object of ss was

to bring the bankruptcy notice to the knowledge of the debtor and that if

achieved, the service must be deemed to be good and sufficient. Hence, although

a failure to effect the posting within the time prescribed in respect of the posting

at the debtors premises could not be said to have occasioned a failure of

justice, as the debtor has admitted in his affidavit that the bankruptcy notice

was brought to his knowledge (see also Karen Ahmad, supra).

In the circumstances, I am unable to uphold the contention that the order for

ss has been wrongly obtained nor was the service bad.

2. Bankruptcy Notice Based On Lapsed Judgment

Para 9 of the JDs affidavit in support stated that the impugned bankruptcy

notice was based on the judgment dated 22 October 1988 which has lapsed,

as 12 years had elapsed since the date of the judgment and therefore

unenforceable. That paragraph added that the JC obtained an order of the court

dated 6 November 1996 to execute the judgment and that the bankruptcy notice

should have been issued on or before 6 November 1997.

CLJ

556

Current Law Journal

Supplementary Series

[2004] 5 CLJ

Reliance was placed on O. 46 r. 2(3); Re V. Gopal; Ex parte Bank Buruh

(M) Berhad [1987] 1 CLJ 602; [1987] CLJ (Rep) 602, Re Liew Kong Ken

Ex P Sucorp Enterprise Sdn Bhd [1998] 2 CLJ Supp 508; Re Hj Ahmad Lazim

& Anor, Ex P Bank Kerjasama Rakyat (M) Bhd [1999] 2 CLJ 101; United

Malayan Banking Corporation Bhd v. Ernest Cheong Yong Yin [2002] 2 CLJ

413; and s. 3 Bankruptcy Act 1967.

The stand taken for the JC is that the impugned bankruptcy notice has been

issued within the period of 12 years. Support was sought in Wee Chow Yong

t/a Vienna Music Centre v. Public Finance Bhd [1990] 1 CLJ 176; [1990] 3

CLJ (Rep) 349; Re Yau Kin Mun; ex p Public Bank Bhd [1999] 5 MLJ 497.

It is my specific finding that the impugned bankruptcy notice dated 30 June

2000 on the basis of the judgment obtained on 22 October 1988 is clearly

within the period of 12 years, which would only lapse on 21 October 2000.

That being the case, the JCs contention on this ground is within merits.

d

I shall now consider the authorities cited for the JD.

In Re V. Gopal, supra, the bankruptcy notice was issued a few days before

six years had lapsed from the date of the relevant final judgment, but was only

served a few days after six years had elapsed. VC George J (later JCA) held,

inter alia, that on the date that the bankruptcy notice was served on the debtor,

the creditor did not have a judgment on which execution could be proceeded

with since to do so, by O. 46 r. 2(1)(a), leave of court had first to be obtained.

Therefore on that date the creditor did not have a final judgment within the

meaning of s. 3(1)(i) of the Bankruptcy Act 1967. The result was that the

bankruptcy petition which was founded on what did not amount to an act of

bankruptcy was dismissed with costs.

The predominant issue in Re Liew Kong Ken, supra, was whether leave should

have been obtained by the petitioning creditor to change its name pursuant to

O. 46 r. 2(1)(b) or other rules of the High Court. Richard Malanjum J (later

JCA) held that a change of name is within the meaning of the word otherwise

in O. 46 r. 2(1)(b), under which leave was required and that since the

petitioning creditor has failed to obtain leave to change its name, it could not

have proceeded to issue execution and if execution could not be issued at all,

no bankruptcy notice could have been issued.

In Re Hj. Ahmad Lazim, supra, the JC obtained judgment against the JD in

1987. Sometime in 1998, the JC served on the JD a bankruptcy notice founded

on that judgment, although six years have elapsed and leave has not been

obtained to execute that judgment. Clement Skinner JC (now J) held, inter alia,

the bankruptcy notice was irregularly issued and set it aside.

CLJ

[2004] 5 CLJ

Re KV Sathasivam;

ex p Phileoallied Bank (Malaysia) Bhd

557

In my view, the above judgments of the High Court concern the issue of noncompliance with O. 46 r. 2 and so must be read in the light of the amendments

to the Rules of the High Court 1980 vide PU(A) 197/2002 to which I shall

revert later in my judgment.

In United Malayan Banking Corporation Bhd, supra, the JC obtained summary

judgment against the JD on 15 October 1987. As no payment was made by

the JD, the JC on 24 January 1996 filed a bankruptcy notice against the JD

including accrued interest calculated up to six years ie, from the date of

judgment on 15 October 1987 to 14 October 1993. The JD filed a summons

in chambers to set aside the bankruptcy notice which was dismissed by the

learned registrar. However, the JD was successful in his appeal to the judge

in chambers who on 25 June 1996 held that the bankruptcy notice was invalid,

and the learned judges decision was affirmed by the Court of Appeal.

Leave to appeal to the Federal Court was granted to the JC on the following

question:

What is the proper construction of s. 6(3) of the Limitation Act 1953

(hereinafter the Act) in respect of the second limb, that is, No arrears of

interest of any judgment debt shall be recovered after the expiration of six

years from the date on which the interest became due?

Abdul Malek Ahmad FCJ in delivering judgment of the Federal Court dismissing

the appeal held that the second limb of s. 6(3) of the Act provides that an

action to recover arrears of interest must be brought within six years of the

judgment date and because of the word arrears, it cannot denote interest which

is still not due. It must, therefore, mean arrears of interest at the time of recovery

and cannot include future interest even if the amount due has not been paid.

The learned FCJ added at p. 427 e-f:

In effect, therefore, it is our finding that the bankruptcy notice is in order as

regards the amount claimed and the arrears of interest calculated in line with

s. 3(1)(i) of the Bankruptcy Act which states that a debtor commits an act of

bankruptcy if a creditor has obtained a final judgment or final order against

him for any amount and execution thereon not having been stayed has served

on him a bankruptcy notice under the said Act requiring him to pay the

judgment debt with interest quantified up to the date of the bankruptcy notice.

In relation to the question posed, the Federal Court said that in view of the

wording of the second limb of s. 6(3) of the Act, the act of recovery of the

arrears of interest in respect of the judgment debt must be within six years of

the judgment date and up to the date of the act of recovery. There was no

formal defect or irregularity there, the only error of the JC was to file the

bankruptcy notice out of time.

CLJ

558

Current Law Journal

Supplementary Series

[2004] 5 CLJ

At p. 418 f, his Lordship further held that:

At one glance, it is apparent to us that the learned senior assistant registrar

was correct in holding that the bankruptcy notice was valid, and both the High

Court and the Court of Appeal were wrong in holding otherwise, as the

particulars in the bankruptcy notice specifically limited the interest claimed

up to 14 October 1993 which is exactly six years from the date the summary

judgment was granted.

Similarly in the appeal before me, the impugned bankruptcy notice specifically

stated that the interest was calculated up to 2190 days ie, exactly six years

from the date the judgment was granted. Following the above dictum, I hold

that the impugned bankruptcy notice is valid.

The Federal Court did not feel the need to invoke O. 46 r. 2(3) in United

Malayan Banking Corporation Bhd, supra.

In any event, the contention for the JD that the JC has failed to comply with

O. 46 r. 2(3) is a technical point of procedure. It has been consistently stated

by our courts that technicalities should not be allowed to obstruct the process

of giving justice to the deserving: per Ahmad Fairuz JCA (now CJ Malaysia)

in United Malayan Banking Corp Bhd v. Ernest Chong Yong Yin [2001] 2

CLJ 31; per Mohtar bin Abdullah FCJ (as he then was) in Megat Najmuddin

Dato Seri (Dr) Megat Khas v. Bank Bumiputra Malaysia Bhd [2002] 1 CLJ

645. See also Beauford Baru Sdn Bhd v. Gopalan Krishnan VK Gopalan

[2002] 3 CLJ 686; Megnaway Enterprise Sdn Bhd v. Soon Lian Hock [2003]

5 CLJ 103; and Terrance Simon Marbeck v. Kerajaan Malaysia [2003] 6 CLJ

120, 125.

In administering any of the rules of the court, the court or judge shall have

regard to justice of the particular case and not only to the technical noncompliance with the rules: O. 1A and O. 2 r. 3 of the Rules of the High Court

1980 which came into effect on 16 May 2002 vide PU(A) 197/2002.

In the circumstances, I hold that the technical objection raised for the JD on

grounds of non-compliance with O. 46 r. 2(3) has been superseded by the

aforesaid amendments and is hereby overruled.

3. Bankruptcy Notice And Terms Of Judgment

In support of this contention, the JDs stand is that the judgment states that

... defendants do pay the plaintiff RM812,188.06 together with interest thereon

at the rate of 15% per annum on monthly rest from 1 March 1988 to date of

full settlement and default interest at 5% per annum on monthly rest on the

amount in excess of the approved limit of RM1,500,000 and RM225 costs,

while the impugned bankruptcy notice did not say so.

CLJ

[2004] 5 CLJ

Re KV Sathasivam;

ex p Phileoallied Bank (Malaysia) Bhd

559

JD sought reliance on Re Re Ismail bin Daud & Anor, ex p Universal Life &

General Insurance Sdn Bhd [1990] 1 MLJ 118; Low Mun, supra; J Raju M

Kerpaya v. Commerce International Merchant Bankers Bhd [2000] 3 CLJ 104;

Datuk Mohd Sari bin Datuk Haji Nuar v. Norwich Winterthur Insurance (M)

Sdn Bhd [1992] 4 CLJ 1798; [1992] 1 CLJ 68, Re Pg. Ahmad bin Pg. Haji

Abdullah; Ex Parte: Oriental Bank Bhd. [1991] 3 CLJ 2899; [1991] 3 CLJ

(Rep) 463.

For the JC, it was submitted that in the judgment the interest was at 15% per

annum and default interest at 5% per annum, while the impugned bankruptcy

notice merely claimed interest at 15% per annum, and so there was an

understatement of interest, in which case the JD was not prejudiced, relying

on Re Lim Kim Guan, ex p Four Seas Bank Ltd [1991] 1 MLJ 330; s. 3(2)

of the Bankruptcy Act 1967, and Sovereign General Insurance Sdn. Bhd. v.

Koh Tian Bee [1988] 1 CLJ 155; [1988] 1 CLJ (Rep) 277.

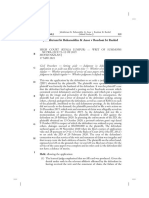

Upon a proper perusal of the terms of the judgment, it is obvious to me that

the interest rate was ordered at 15% per annum while the default interest was

ordered at 5% per annum. The impugned bankruptcy notice merely claimed the

interest of 15% per annum and abandoned the 5% default interest. There was

an understatement of the interest in the impugned bankruptcy notice. In my

view, this understatement of interest could not have misled, embarrassed or

perplexed the JD. The impugned bankruptcy notice had made it clear and certain

what was required to be paid, secured or compounded by the JD in order to

avoid an act of bankruptcy.

In Lim Kim Guan, supra, such an understatement of interest arose. LP Thean

J of the Singapore High Court held that it was not a defect which was

objectively capable of misleading the debtor. The learned judge dismissed the

JDs countention on this ground.

In Sovereign General Insurance, supra, Lee Hun Hoe CJ (Borneo) referred to

proviso (ii) to s. 3(2) of the Bankruptcy Act 1967 and held that a notice

demanding a greater amount would not be liable to be held to be bad. Proviso

(ii) to s. 3(2) of the Bankruptcy Act 1967 merits reproduction as follows:

3. Acts of bankruptcy

(2) A bankruptcy notice under this Act shall be in the prescribed form and

shall state the consequences of non compliance therewith and shall be served

in the prescribed manner:

CLJ

Current Law Journal

Supplementary Series

560

[2004] 5 CLJ

Provided that a bankruptcy notice:

(i) ...; and

(ii) shall not be invalidated by reason only that the sum specified in the

notice as the amount due exceeds the amount actually due unless the

debtor within the time allowed for payment gives notice to the creditor

that he disputes the validity of the notice on the ground of such mistake;

but if the debtor does not give such notice he shall be deemed to have

complied with the bankruptcy notice, if within the time allowed he takes

such steps as would have constituted compliance with the notice had the

actual amount due been correctly specified therein.

Proviso (ii) to s. 3(2) was considered by Abdul Aziz Mohamad J (now JCA)

in Re Amarjit Kaur Bakhshis Singh, Ex P BSN Commercial Bank (Malaysia)

Bhd [2001] 1 CLJ 412. The learned judge held that the proviso is very clear

and has been strictly worded, and to dispute the bankruptcy notice on the

ground that the amount specified in the notice actually due, notice to that effect

must be given to the judgment creditor within seven days after the service of

the bankruptcy notice under s. 3(1)(i). Otherwise, the notice shall not be

invalidated by reason only of the mistake of excessive demand.

As the JD has not disputed the impugned bankruptcy notice on the basis of

proviso (ii) to s. 3(2), I concur with the said dictum and apply it to the instant

appeal and hold that the impugned bankruptcy notice is not invalidated.

4. Conclusion

On the foregoing grounds, I am of the view that the learned registrar has erred

in dismissing the impugned bankruptcy notice. I therefore allow this appeal with

costs, set aside the order of the learned registrar and order that the impugned

bankruptcy notice be reinstated, to be heard by the present learned registrar

on its merits.

CLJ

You might also like

- 96 (2012) 2 CLJ Current Law JournalDocument19 pages96 (2012) 2 CLJ Current Law JournalMeeraNatasyaNo ratings yet

- Pacific Plumbing ConstructionDocument8 pagesPacific Plumbing ConstructionJacklyn YongNo ratings yet

- LNS 2017 1 1796 BC03609Document26 pagesLNS 2017 1 1796 BC03609Nizam BashirNo ratings yet

- Zamri NaimDocument21 pagesZamri Naimdenesh11No ratings yet

- ASM Development (KL) SDN BHD V EcopileDocument15 pagesASM Development (KL) SDN BHD V EcopileLinda AQNo ratings yet

- BANKRUPTCY - Abdul Razak Senin-Appeal Ag BN - PublishDocument12 pagesBANKRUPTCY - Abdul Razak Senin-Appeal Ag BN - Publishhafeez benignNo ratings yet

- The Bank of East Asia LTD Singapore Branch VDocument8 pagesThe Bank of East Asia LTD Singapore Branch Vkchue1No ratings yet

- Sivadevi A - P Sivalingam V CIMB Bank BHDDocument31 pagesSivadevi A - P Sivalingam V CIMB Bank BHDAmira Saqinah M. ZainiNo ratings yet

- Pembinaan Lian Keong SDN BHD v. Yip Fook Thai (2005) 6 CLJ 34Document27 pagesPembinaan Lian Keong SDN BHD v. Yip Fook Thai (2005) 6 CLJ 34IzaDalilaNo ratings yet

- GOV V KPM MODAL SDN BHDDocument19 pagesGOV V KPM MODAL SDN BHDmafiqmdNo ratings yet

- CompleteDocument34 pagesCompleteKomathy SomasakaranNo ratings yet

- (HC) (2001) 1 CLJ 746 - Angel Cake House SDN BHD & Ors V Bandaraya Development BHDDocument9 pages(HC) (2001) 1 CLJ 746 - Angel Cake House SDN BHD & Ors V Bandaraya Development BHDAlae KieferNo ratings yet

- In The High Court of Malaya at Kuala Terengganu in The State of Terengganu, Malaysia BANKRUPTCY NO: 29NCC-4238-03/2015Document4 pagesIn The High Court of Malaya at Kuala Terengganu in The State of Terengganu, Malaysia BANKRUPTCY NO: 29NCC-4238-03/2015Deeyla KamarulzamanNo ratings yet

- Ji Zhan Capital SDN BHDDocument17 pagesJi Zhan Capital SDN BHDAmila AhmadNo ratings yet

- Summary JudgmentDocument5 pagesSummary JudgmentAhgilah MitraNo ratings yet

- Amanah International Finance SDN BHD v. Medini Square SDN BHD & OrsDocument12 pagesAmanah International Finance SDN BHD v. Medini Square SDN BHD & OrsasyrafNo ratings yet

- Malayan Banking BHD V Chong Hin Trading Co SDocument14 pagesMalayan Banking BHD V Chong Hin Trading Co SSeow SeowNo ratings yet

- Prepared by Dr. Gita Radhakrishna & Mr. Wong Hua Siong © No Part of These Lecture Notes Shall Be Reproduced or Distributed in Any Manner WhatsoeverDocument43 pagesPrepared by Dr. Gita Radhakrishna & Mr. Wong Hua Siong © No Part of These Lecture Notes Shall Be Reproduced or Distributed in Any Manner WhatsoeverFaiz TaqiuddinNo ratings yet

- Standard Chartered Bank of Botswana v. Setlhake 2001 (2) BLR 286 (HC)Document4 pagesStandard Chartered Bank of Botswana v. Setlhake 2001 (2) BLR 286 (HC)rannonakarabo84No ratings yet

- CLJ 2008-9-243Document11 pagesCLJ 2008-9-243CYLNo ratings yet

- Azlin Bin Khalid V Mohamad Najib Ishak and oDocument16 pagesAzlin Bin Khalid V Mohamad Najib Ishak and oIzzat AmsyarNo ratings yet

- Challenge Arbitration Award On Question of Law PDFDocument30 pagesChallenge Arbitration Award On Question of Law PDFCG100% (1)

- 4 Josephine Banun CLJ - 2008 - 7 - 699Document16 pages4 Josephine Banun CLJ - 2008 - 7 - 699SaraNo ratings yet

- SANWELL CORP V TRANS RESOURCES CORP SDN BHD & ANOR - Take Step Filing Is Waiving Rights To ArbitrationDocument15 pagesSANWELL CORP V TRANS RESOURCES CORP SDN BHD & ANOR - Take Step Filing Is Waiving Rights To ArbitrationBellbell WongNo ratings yet

- By Seahomes SDN BHD V Perwira Habib Bank Malaysia BHDDocument16 pagesBy Seahomes SDN BHD V Perwira Habib Bank Malaysia BHDOnn YowNo ratings yet

- Juliafitriani BT Baharuddin & Anor V Rosdoni BT RashidDocument17 pagesJuliafitriani BT Baharuddin & Anor V Rosdoni BT RashidmafiqmdNo ratings yet

- Cassimjee V Minister of Finance (45511) (2012) ZASCA 101 (1 June 2012)Document13 pagesCassimjee V Minister of Finance (45511) (2012) ZASCA 101 (1 June 2012)musvibaNo ratings yet

- REMREV-Mercado Vs CADocument7 pagesREMREV-Mercado Vs CAGladys Bustria OrlinoNo ratings yet

- Must You Get A Judgment First Before You Can Invoke Section 218 of Companies Act 1965Document1 pageMust You Get A Judgment First Before You Can Invoke Section 218 of Companies Act 1965Sofiah OmarNo ratings yet

- CLJ 2010 2 1020Document17 pagesCLJ 2010 2 1020Alae KieferNo ratings yet

- Winding UpDocument20 pagesWinding UpSiti EdabayuNo ratings yet

- Abd Hamid Bin Jaafar (Trading As Sole Proprietor As BinDocument9 pagesAbd Hamid Bin Jaafar (Trading As Sole Proprietor As Binsyamil luthfiNo ratings yet

- 1992 01 27 1992 3 CLJ 1449 Malayan Banking BHD V Datuk Lim Kheng Kim 1 EdDocument17 pages1992 01 27 1992 3 CLJ 1449 Malayan Banking BHD V Datuk Lim Kheng Kim 1 EdAisyah BalkisNo ratings yet

- Aud - Discharge of BankruptDocument9 pagesAud - Discharge of BankruptAudrey LimNo ratings yet

- CLJ 2005 1 793Document26 pagesCLJ 2005 1 793Hui ZhenNo ratings yet

- SO SHEUNG HIN BEN V CHUBB LIFE INSURANCE CO LTD - (2018) 5 HKC 47Document16 pagesSO SHEUNG HIN BEN V CHUBB LIFE INSURANCE CO LTD - (2018) 5 HKC 47JYhkNo ratings yet

- HSBC V LH Timber SDN BHDDocument19 pagesHSBC V LH Timber SDN BHDJJNo ratings yet

- Ex Parte Motion For Order Shortening Notice Period andDocument22 pagesEx Parte Motion For Order Shortening Notice Period andChapter 11 DocketsNo ratings yet

- (V) App To Set Aside Was DismissedDocument9 pages(V) App To Set Aside Was DismissedayesyaNo ratings yet

- OCBC LOC CaseDocument8 pagesOCBC LOC CaseDamiaNo ratings yet

- CIMB Bank Berhad V Jaring Communications SDN BHDDocument23 pagesCIMB Bank Berhad V Jaring Communications SDN BHDVithyahNo ratings yet

- Tasja V Golden ApproachDocument16 pagesTasja V Golden Approachtankeyin8No ratings yet

- Mareva Injunction: Azhani Binti ArshadDocument20 pagesMareva Injunction: Azhani Binti ArshadJadeAmeerahNo ratings yet

- Boey Oi Leng v. Trans Resources Corporation SDN BHD: COMPANY LAW: Winding-Up - Petition - Striking Out - Whether A S. 218Document8 pagesBoey Oi Leng v. Trans Resources Corporation SDN BHD: COMPANY LAW: Winding-Up - Petition - Striking Out - Whether A S. 218Nurul Syahida HamssinNo ratings yet

- PEMBINAAN PURCON V ENTERTAINMENT VILLAGE (M)Document14 pagesPEMBINAAN PURCON V ENTERTAINMENT VILLAGE (M)Don NazarNo ratings yet

- Abd Hamid Jaafar V Shamsiah Dan Keluarga SDN BHD (2001) 5 CLJ 381Document10 pagesAbd Hamid Jaafar V Shamsiah Dan Keluarga SDN BHD (2001) 5 CLJ 381onyamNo ratings yet

- Ibrahim V Barclays Bank PLC and Another (2013) CH 400Document22 pagesIbrahim V Barclays Bank PLC and Another (2013) CH 400Y.D. SimNo ratings yet

- Petitioner vs. vs. Respondent: Second DivisionDocument21 pagesPetitioner vs. vs. Respondent: Second DivisionJoannah SalamatNo ratings yet

- TETUAN SULAIMAN & TAYE v. WONG POH KUN & ANOR AND ANOTHER APPEALDocument14 pagesTETUAN SULAIMAN & TAYE v. WONG POH KUN & ANOR AND ANOTHER APPEALdelliyNo ratings yet

- Aura Indah Jaya SDN BHD V. Ocbc Bank (Malaysia) BHD & Another ApplicationDocument24 pagesAura Indah Jaya SDN BHD V. Ocbc Bank (Malaysia) BHD & Another ApplicationChiayee AddFishNo ratings yet

- Lecture 6 - Discharge of A Bankrupt-StudentDocument54 pagesLecture 6 - Discharge of A Bankrupt-Student1181100577No ratings yet

- A - BANK NEGARA MALAYSIA v. MOHD ISMAIL ALI JOHOR - ORSDocument13 pagesA - BANK NEGARA MALAYSIA v. MOHD ISMAIL ALI JOHOR - ORSJamie TehNo ratings yet

- SEc 9 (3) FIODocument14 pagesSEc 9 (3) FIOSaddy ButtNo ratings yet

- Tutorial 3Document13 pagesTutorial 3Sharifah Aishah SofiaNo ratings yet

- Collateral SecurityDocument83 pagesCollateral SecuritySaddy MehmoodbuttNo ratings yet

- PDIC v. CADocument6 pagesPDIC v. CAAnonymous rVdy7u5No ratings yet

- Jaks Island Circle SDN BHDDocument20 pagesJaks Island Circle SDN BHDFaqihah FaidzalNo ratings yet

- John Kennedy Santiavo v. Great Eastern General Insurance Berhad & AnorDocument8 pagesJohn Kennedy Santiavo v. Great Eastern General Insurance Berhad & AnorJoey WongNo ratings yet

- CLJ 2009 1 419 Akco9313Document32 pagesCLJ 2009 1 419 Akco9313Alan KNo ratings yet

- Is Bad-Faith the New Wilful Blindness?: The Company Directors’ Duty of Good Faith and Wilful Blindness Doctrine Under Common Law Usa (Delaware) and Uk (England): a Comparative StudyFrom EverandIs Bad-Faith the New Wilful Blindness?: The Company Directors’ Duty of Good Faith and Wilful Blindness Doctrine Under Common Law Usa (Delaware) and Uk (England): a Comparative StudyNo ratings yet

- Trustee's Objection To Motion To Withdraw Reference - Beach FirstDocument12 pagesTrustee's Objection To Motion To Withdraw Reference - Beach FirstattygrimesNo ratings yet

- DecedentsEstates Outline Summer08Document47 pagesDecedentsEstates Outline Summer08Keith DyerNo ratings yet

- Registration of ChargeDocument5 pagesRegistration of ChargekinNo ratings yet

- Chapter 16 Incomplete Records Q1 SengDocument6 pagesChapter 16 Incomplete Records Q1 Sengmelody shayanwakoNo ratings yet

- Case Laws On IBCDocument4 pagesCase Laws On IBCsagarNo ratings yet

- Financially Troubled Ventures: Turnaround Opportunities? FocusDocument14 pagesFinancially Troubled Ventures: Turnaround Opportunities? FocusMuhammad Qasim A20D047FNo ratings yet

- 1991-1996 BAR Mercantile QuestionsDocument63 pages1991-1996 BAR Mercantile QuestionsasdgafsdgadfgNo ratings yet

- ECO Law MCQ PDFDocument48 pagesECO Law MCQ PDFManoj VenkatNo ratings yet

- Enforceability of Personal Guarantee by A DirectorDocument2 pagesEnforceability of Personal Guarantee by A DirectorSagar ChauhanNo ratings yet

- Intimation of Order Passed by National Company Law Tribunal NCLTDocument13 pagesIntimation of Order Passed by National Company Law Tribunal NCLTmecbecsNo ratings yet

- Credit Analysis ReportDocument11 pagesCredit Analysis ReportBlue MarryNo ratings yet

- Palm Tree Estates vs. PNBDocument2 pagesPalm Tree Estates vs. PNBJimi SolomonNo ratings yet

- UCC 1 Sheriff Chris NoccoDocument1 pageUCC 1 Sheriff Chris Noccohoward avigdor rayford lloyd elNo ratings yet

- Hilsen V Tate & Kirlin Associates Inc FDCPA Complaint MinnesotaDocument13 pagesHilsen V Tate & Kirlin Associates Inc FDCPA Complaint MinnesotaghostgripNo ratings yet

- AFAR - Corporate LiquidationDocument1 pageAFAR - Corporate LiquidationKent Raysil PamaongNo ratings yet

- Ziff Davis Bankruptcy FilingDocument23 pagesZiff Davis Bankruptcy FilingRafat AliNo ratings yet

- Republic Act No. 11057:: The Personal Property Security Act of 2018Document54 pagesRepublic Act No. 11057:: The Personal Property Security Act of 2018John PaulNo ratings yet

- 10000026360Document1,634 pages10000026360Chapter 11 DocketsNo ratings yet

- Hand Outs For RevalidaDocument97 pagesHand Outs For RevalidaMyrna B RoqueNo ratings yet

- Security CreationDocument28 pagesSecurity CreationHenna Vadhera100% (1)

- Business Ethics ReflectionDocument4 pagesBusiness Ethics ReflectionRon Edward Medina100% (1)

- Motion For New Trial Motion For ReconsiderationDocument10 pagesMotion For New Trial Motion For Reconsiderationrgtan3No ratings yet

- Examples of Credit InstrumentsDocument35 pagesExamples of Credit Instrumentsjessica anne100% (1)

- Business Law Cheat SheetDocument9 pagesBusiness Law Cheat Sheetisgigles157100% (1)

- Notes Kinds of ObligationsDocument14 pagesNotes Kinds of ObligationsMaryane AngelaNo ratings yet

- Doctrines AntichresisDocument15 pagesDoctrines AntichresisMargeNo ratings yet

- Belo v. PNBDocument1 pageBelo v. PNBTeff Quibod100% (1)

- Schedule 5-9 PDFDocument150 pagesSchedule 5-9 PDFRecordTrac - City of OaklandNo ratings yet

- 82.2 Francia V IACDocument1 page82.2 Francia V IACluigimanzanaresNo ratings yet

- Voluntary Petition For Non-Individuals Filing For BankruptcyDocument23 pagesVoluntary Petition For Non-Individuals Filing For BankruptcyMike McSweeneyNo ratings yet