Professional Documents

Culture Documents

Plethora of Exemptions To Government Companies!! - Corporate Law

Uploaded by

kumar_anil666Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Plethora of Exemptions To Government Companies!! - Corporate Law

Uploaded by

kumar_anil666Copyright:

Available Formats

6/16/2015

Plethoraofexemptionstogovernmentcompanies!!CorporateLaw

(http://bit.ly/1MkyQt8)

Plethoraofexemptionstogovernmentcompanies!!

VijayaAgarwala(../profile.asp?member_id=1434203)

on11June2015

(../profile.asp?

member_id=1434203)

ThankUser(../forum/thanks_user.asp?hash=359068984296217&thanks_to=1434203&item_id=24072&module_name=articles&thanks_say=1)

SendMsg(../user_send_pm.asp?pm_to=1434203)

(../report_abuse.asp?module=articles)

Ever since the draft notifications were placed before the Parliament, companies have been eagerly waiting for the approval and promulgation of the same. Finally the

exemptionnotificationssawthelightofdaywithMCAreleasing4exemptionnotificationsinbulkonJune05,2015.Amongthefournotifications,onenotificationpertainsto

GovernmentCompanies(Govt.cos.)whereintheCentralGovernment(CG)inthepublicinteresthascomeoutwithsomeexemption/modification/exception/adaptationto

certainprovisionsofCompaniesAct,2013(Act)forGovt.cos.

Wediscusshereinbelow,theexemptions&modificationsinbrief:

Sl.

Section

No.

Exception/Modification/Adaptations Impact

To be Omitted: In case of a public

Chapter II Section 4 limited company, or the last words

Clause(a)

Private Limited in the case of a

privatelimitedcompany:

(Memorandum)

TheMemorandum

of all companies

shall state the

name

of

the

company with last

wordLimited.

Remark

Private

company will

not have to

write Private

limited.

To Be inserted after proviso: The

conditionwithrespecttostampingand

execution of Govt. bonds is no longer

applicabletoaGovt.co.

Only an intimation by the transferee

specifying his name, address and

Chapter IV, Section 56

occupation, if any is made to the

Subsection1

company along with the certificate

relatingtothebondshallsuffice.

(Transfer

and

transmission

of

If no such certificate is in existence

securities)

letter of allotment of bond shall be

annexed.

Compliancenorms

for Govt. bond

have

been

relaxed.

Provided also that the provisions of

this subsection shall not apply to a

Govt co. in respect of securities held

bynomineesofthegovt.

Chapter VII, Section 89

Exemption:

&90

(Declarationinrespectof

beneficial

3

interestinanyshare)

(Investigation

of

beneficial ownership of

sharesincertaincases.)

Since

declaration

of beneficial

1. No declaration form is required

interest need

Unnecessary

to be filed in respect of

not

be

compliance

disclosed,

beneficial interest held in the procedure

has

the

beenremoved.

sharesofaGovt.co.

investigation

2. No need to appoint competent

of the same

shallalsonot

person to investigate beneficial

apply.

ownershipforGovtcos.

http://www.caclubindia.com/articles/plethoraofexemptionstogovernmentcompanies24072.asp#.VYAROPmUcuc

1/11

6/16/2015

Plethoraofexemptionstogovernmentcompanies!!CorporateLaw

Modification: Govt. cos. can hold

Annual General Meeting with CG General Meeting

Chapter VII, Section

approvaloutsidethecity,villagewhere norms have been

96,subsection(2)

theregisteredofficeofthecompanyis relaxed.

situated.

Chapter VIII, Section

123,second proviso to Exemption: Govt. co. in which entire Government

sharecapitalisheldbytheCGorany

subsection(1)

cannot

declare

state government (SG) or by the CG

dividendtoitself.

andoneormoreSG.

(Declarationofdividend)

Exemption: Govt. co. in which entire

Chapter VIII, Section sharecapitalisheldbyCGoranySG

123,second proviso to by the CG and one or more SG shall

subsection(4)

need not deposit amount of dividend

includinginterimdividendinaseparate

(Declarationofdividend) scheduledbankaccountwithin5days

ofdeclarationofsuchdividend.

Government

companies

with

no

shares being

held by any

outsider,

shall

not

have

to

follow

the

perfunctory

dividend

distribution

system.

Exemption: CG has exempted the

requirement of section 129 i.e.,

financial statement to the extent of

application of AS17 (Segment

Reporting) to the companies engaged

indefenceproduction.

Previously

Section 129

was also not

applicable to

Reporting under

Insurance

AS17shallnotbe

company,

requiredanymore.

Electricity

company,

and Banking

company

ChapterIX,Section129

8

(FinancialStatements)

Exemption: Board of director of govt

Chapter IX, Section company shall not be required to

134,subsection(3),clause submit a report on companys policy

(e)

on directors appointment and

remuneration including criteria for

(Financial Statements & determining qualifications, positive

attributes, independence of a director

BoardsReportetc.)

andothermattersatitsAGM.

10

Exemption: If director are evaluated

Chapter IX, Section

by Ministry or Department of Central

134,subsection(3),clause

Government which is administrative in

(p)

charge of the company or by the SG

as

per

its

own

evaluation

(Financial Statements & methodology, the Board of Directors

BoardsReportetc.)

shall not be required to attach to the

Boards Report, the manner in which

formal evaluation has been made by

theboard.

11

Now

govt

company

can

Chapter XI, Section 149 Exempted: Requirement of special

appoint more than

(1)(b) and 1st proviso of resolution for appointment of directors

15

directors

subsection(1)

morethan15isremoved.

without

passing

specialresolution.

12

Self disclosure is

nolongerrequired

as in Govt. cos.

generally directors

are identified and

appointed by the

Govt.itself.

Govt

has

been easing

out

unnecessary

compliance

provisions.

Similar

exemption

has

also

beengranted

to Section 8

companies.

Modification: To be qualified as an

Chapter XI Subsection Independent director he must be

(6)Clause(a)ofSection opined by the Ministry or Department Identification and

149

of

Central

Government/state appointment

by

governmentwhichisadministrativelyin the Board is not

http://www.caclubindia.com/articles/plethoraofexemptionstogovernmentcompanies24072.asp#.VYAROPmUcuc

2/11

6/16/2015

Plethoraofexemptionstogovernmentcompanies!!CorporateLaw

(CompanytohaveBoard charge of the company that he is a required.

ofDirectors)

person of integrity and possess

relevantexpertiseandexperience.

13

Chapter XI Section 149 Exemption: To be an independent

Subsection(6)Clause(c) director of a Govt. co. any pecuniary

relationship with company, its holding

subsidiary or associate company, or

(CompanytohaveBoard their promoters or directors is not

ofDirectors)

relevant.

He

can

be

appointed as an

independent

director even if he

has

pecuniary

relationship with

such companies

or person at any

periodoftime.

14

Chapter XI Section 152 Exemption:If appointment of director

subsection(5)

ismadebyCG,consentofdirectorcan

be filed beyond 30 days and no

(Appointment

of explanatory statement need to be

attachedforsuchappointment

Directors)

Explanatory

statement for

suchdelayinfiling

shall

not

be

required

15

Exemption:Theprovisionofperiodof

office for rotational director and

Chapter XI Section 152 provision for retirement is no longer

subsection(6)&(7)

applicable to govt companies in which Applicable to all

entire paid up share capital held by other

public

(Appointment

of CG/SGorCGandoneormoreSGc. companies.

Directors)

Or a wholly owned subsidiary of a

Govt.co.

Exemption: The provision of sending

14 days prior notice along with

depositingmoneyofRs.1lacetc.are

(Rightof

not required for application of fresh

candidature as director to govt. co. in

persons other than whichentirepaidupsharecapitalheld

retiringdirectorstostand by CG/SG or CG and one or more

SGs.

for

ChapterXISection160

16

directorship)

17

The provision has

been

made

inapplicable

for

privatecompanies

Or a wholly owned subsidiary of a

Govt.co.

Exemption: The requirement single

resolution for appointment of each

director or where more than one

directors are appointed by a single

ChapterXISection162 resolution without a vote against such

motionisnotrequiredforapplicationof

fresh candidature as director to govt

(Appointment

of

directors to be voted companies in which entire paid up

share capital held by CG /SG or CG

individually)

andoneormoreSGs.

Company

can file the

return

of

appointment

evenafter30

days.

Outsiders

cannot

propose for

directorship

in

government

owned

companies

anymore.

One or more

directors can be

appointed by a

singleresolutionin

such

govt

companies

in

which entire paid

up share capital

held by CG /state

govt or CG and

one or more state

govts.

Or a wholly owned subsidiary of a

Orawhollyowned

Govt.Co.

subsidiary of a

govtcompany

ChapterXISection163

Exemption: Govt Company in which Govt cos. not

to

adopt entirepaidupsharecapitalheldbyCG required

appoint directors

/SGorCGandoneormoreSGs.

through principle

of

proportional

proportional

Orawhollyownedsubsidiaryofagovt representation

company shall not required to appoint Even if article of

directors

through

principle

of govt

representationfor

company

proportionalrepresentation.

statessuch.

(Option

to

principleof

18

appointmentofdirectors)

http://www.caclubindia.com/articles/plethoraofexemptionstogovernmentcompanies24072.asp#.VYAROPmUcuc

3/11

6/16/2015

Plethoraofexemptionstogovernmentcompanies!!CorporateLaw

Exemption:Disqualification pertaining

toaCompany:

a. which has not filed financial

statementsorannualreturnsfor

The

disqualification

financialyears

shall not render a

b. or which has failed to repay the director ineligible

for appointment in

deposits accepted by it or pay

a

government

interest thereon or to redeem ownedcompany

anydebenturesontheduedate

any continuous period of 3

19

Chapter XI Section 164

SubSection(2)

or pay interest due thereon or

pay any dividend declared and

such failure to pay or redeem

continuesfor1yearormore.

Exemption:Govt.Cos.inwhichentire

paidupsharecapitalheldbyCG/State

Government or CG and one or more

&Section171

State Governments need not keep at

its registered office a register

(Register of directors containing details of securities held by

and key managerial its directors and key managerial

personnel and their personnel in the company or its

shareholding)

holding, subsidiary, fellow subsidiaries

orassociatecompanies.

Since,

the

register will

not

be

maintained,

the question

of inspecting

the same u/s

171

also

does

not

arise.

ChapterXISection170

20

(Members

inspect)

22

23

right

Register

of

directors and key

managerial

personnel

and

their shareholding

under Section 170

need

not

be

maintained.

to

The

word

Chapter XII Section 177 Modification:

Subsection(4)Clause(i) recommendation, for appointment,

remuneration

and

terms

of

appointment replaced with words

(AuditCommittee)

recommendationforremuneration

Modification:

Nomination

and

RemunerationCommittee(NRC)ofa

Chapter XII Section 178 Govt.Co.willnotformulateanycriteria

Subsection(2)(3)&(4) for determining qualification, positive

attributes, independence of director

and recommend to the board a policy

Nomination

and relating to remuneration of directors

Remuneration

and key managerial personnel other

Committee

Now

Audit

Committee

of

Government

Companies

will

only recommend

remuneration of

auditors and not

appointment

of

and terms of their

appointment.

remunerationonly.

Power of the NRC

is now restricted

only

to

appointment

of

Senior

Management

Personnel

and

otheremployee.

Although the

Section has

been made

inapplicable

altogether. It

isdoubtfulas

to whether

filing of DIR

12isalsonot

required.

The intent of

the

law

maker could

not

have

been

to

exempt DIR

12.

Scope

of

Audit

Committee

has

been

narrowed.

Since

the

identification

and

appointment

ofdirectorsis

to be done

by the CG,

the scope of

http://www.caclubindia.com/articles/plethoraofexemptionstogovernmentcompanies24072.asp#.VYAROPmUcuc

4/11

6/16/2015

Plethoraofexemptionstogovernmentcompanies!!CorporateLaw

than for appointment of Senior

Management Personnel and other

employees.

Exemption: Government Companies

now can give loan to its directors and

person in whom such director is

interested and can give guarantee or

provide security in respect of loan

taken by such person with prior

approval of Ministry or Department of

CG which is administratively in charge

of company or State Government as

thecasemaybe.

Government

Companies now

can give loan or

give

any

guarantee

or

provide security

with

prior

approval.

This is a

major

change.

Even private

companies

are

not

completely

out of the

ambit of the

Section.

Exemption: Govt. Cos. engaged in

defence production and Govt. Cos.

other than listed companies can give

any amount of loan or guarantee or

ChapterXIISection186 security to any person or body

corporateandcanacquiresecuritiesof

(Loan and Investment any other body corporate if such

company obtains prior approval of

MadeByCompany)

MinistryorDepartmentofCGwhichis

administratively in charge of company

orStateGovernmentasthecasemay

be.

Any amount of

loanorInvestment

can made if prior

approval

is

undertaken before

such loan or

investment

is

beingmade.

Other

provision

contained in

said section

becomes

ineffectivefor

such eligible

companies.

ChapterXIISection185

24

(LoantoDirectors,Etc)

25

NRC

has

been

revised.

Exemption:

The section shall not apply to the

following:

For

such

transactions,

prior

has entered in to a contract or Transaction

between

approval of

arrangement with another Govt.

Government

member by

Coor

Companies

is special

b. a Govt. Co. other than a listed made easier by resolution is

easing

out not required

company entered in to a

compliance

irrespective

contract or arrangement with norms.

of

amount

involved

any other person with prior

therein.

approvalMinistryorDepartment

a. Where a Government Company

Chapter XII 1st and 2nd

provisotoSection188

26

(Related

Transaction)

Party

of Central Government which is

administratively in charge of

company or State Government

asthecasemaybe.

a. Whole time

directors,

managing

directors

and

mangers of

a Govt. Co.

Exemption:

can

a. Govt. Co. can appoint or

Chapter XII Section 196

Section(2)(4)&(5)

reappoint a whole time director

or

managing

director

or

manager for a term exceeding

27

(Appointment

of

Managing

Director,

Whole time Director or

Manager)

5yearsatatime

b. Also approval of Board and

Share holders at next Annual

General Meeting for terms and

condition

of

appointment,

be

appointed

or

Appointment

reappointed of

managerial

for a term

personnel is

exceeding 5 no

more

years

at subjecttothe

compliances

time.

of

Section

b. Government 196.

has done

away

with

http://www.caclubindia.com/articles/plethoraofexemptionstogovernmentcompanies24072.asp#.VYAROPmUcuc

5/11

6/16/2015

Plethoraofexemptionstogovernmentcompanies!!CorporateLaw

remuneration

is

no

longer

requirement

required.

of approval

of

board

and

its

subsequent

ratification

by

share

holders.

ChapterXIISection197

Govt.

Co.

Directorsand

KMPs shall

now

enjoy

fulsome

remuneration

irrespective

of the profit

making

capacity of

the

company.

28

Exemption: Government Companies

(Overall

maximum

are can give any amount of

managerial

remuneration to its directors even if

remuneration

and

thereislossorinadequateprofit.

managerial

remunerationinabsence

orinadequacyofprofits)

Government has

done away with

ceiling limits of

overall maximum

managerial

remuneration.

29

Chapter XII Section 203 Modification: The provision of Sub

SubSection(1)(2)(3)& section(1)(2)(3)&(4)ofSection203

(4)

willnotapplytoaManagingdirectoror

Chief Executive Officer or Manager

(Appointment of Key and in their absence a Whole time

DirectorofGovernmentCompany.

ManagerialPersonnel)

Appointment

of

KMPs shall not be

subject to the

minimum number

ofofficesheldand

the time period of

appointment

subsequent to a

vacationofoffice.

Govt.

Co.

KMPs

can

now

be

appointed as

a KMP in

more than

one

Govt.

Co.

Court will not take

cognizance

of

offence

if

compliant is made

bytheRegistraror

a shareholder of

Company.

Thepowerof

SEBI

to

complain

against the

company or

any of its

officers

relating

to

offence

of

issue

and

transfer of

securities

and

non

payment of

dividend has

been

retained

intactincase

ofGovt.cos.

30

Court

will

take

Chapter XXIX Section Modification:

cognizanceofoffencewhichisalleged

439SubSection(2)

tohavebeencommittedbyacompany

or any officer thereof if compliant is

(Offence to be non madeinwritingbyapersonauthorised

cognizable

byCG.

Whereatonesidetheprivatecompanyexemptionnotificationwasutterlydisappointing,thepartialGovernmentseemstohavebestowedallitsaffectiononitsownentities.A

balance of grace on either side would have been a more welcome step. On one hand administrators are unnecessarily burdening the private entities with senseless

compliances,attheotherhandGovernmententitiesarebeingrelievedofmajorcompliancerequirements.

PublishedinCorporateLaw(article_display_list_by_category.asp?cat_id=7)

Views:2080

OtherArticlesbyVijayaAgarwala(article_display_list_by_member.asp?member_id=1434203)

22

Previous(check_next.asp?article_id=24072&mode=0)

Next(check_next.asp?article_id=24072&mode=1)

(http://www.caclubindia.com/coaching/278strategic

financialmanagement.asp)

http://www.caclubindia.com/articles/plethoraofexemptionstogovernmentcompanies24072.asp#.VYAROPmUcuc

6/11

6/16/2015

Plethoraofexemptionstogovernmentcompanies!!CorporateLaw

RecentComments

Total:2

AddNewComment

Submit

komal(../profile.asp?member_id=1451080)13June2015

Thanksforthisinformation.

pankajchandel(../profile.asp?member_id=1393766)13June2015

Thanks

Related Articles

SnapshotofchangesinoperativeprovisionsbytheCompanies(Amendment)Act,2015(../articles/snapshotofchangesinoperativeprovisionsbythecompanies

amendmentact201523830.asp)

TheCompanies(Amendment)Bill,2014(../articles/thecompaniesamendmentbill201423846.asp)

UnderstandingSection185ofCompaniesAct,2013(../articles/understandingsection185ofcompaniesact201323860.asp)

CircularResolutionunderCompaniesAct,2013(../articles/circularresolutionundercompaniesact201323863.asp)

TheCompaniesAmendmentAct,2015(../articles/thecompaniesamendmentact201523945.asp)

RelatedpartytransactionsaspernewCompaniesAct,2013(../articles/relatedpartytransactionsaspernewcompaniesact201323963.asp)

DepreciationunderCompaniesAct,2013(../articles/depreciationundercompaniesact201323965.asp)

KeymanagerialpersonnelunderCompaniesAct,2013Ananalysis(../articles/keymanagerialpersonnelundercompaniesact2013ananalysis24008.asp)

Keyhighlightsofcompaniesamendmentact2015(../articles/keyhighlightsofcompaniesamendmentact201524038.asp)

Nomercykillingforcompaniesact,2013(../articles/nomercykillingforcompaniesact201324051.asp)

More(article_display_list_by_category.asp?cat_id=7)

Other Latest Articles

Reportingundercostauditalignedwitheightdigitcentralexcisetariffcode(/articles/reportingundercostauditalignedwitheightdigitcentralexcisetariffcode

24114.asp)

HamariAadhuriKahani.NonreceiptofIncomeTaxRefund!(/articles/hamariaadhurikahaninonreceiptofincometaxrefund24115.asp)

Anoverviewonecommercetransactions(/articles/anoverviewonecommercetransactions24119.asp)

FAQonNewCompaniesAct,2013Auditor'sRotation(/articles/faqonnewcompaniesact2013auditorsrotation24116.asp)

SS1Acriticalanalysis(/articles/ss1acriticalanalysis24113.asp)

Fromhotelroomtosemifinalsofthefrenchopen(/articles/fromhotelroomtosemifinalsofthefrenchopen24105.asp)

Giveyourmindthecreativekick(thatitbadlyneeds)(/articles/giveyourmindthecreativekickthatitbadlyneeds24103.asp)

Utilizationoftimeafterexam(/articles/utilizationoftimeafterexam24100.asp)

Positioningofinternalauditincorporateframework(/articles/positioningofinternalauditincorporateframework24098.asp)

ExemptionstoprivatelimitedcompaniesunderCo.Act,2013(/articles/exemptionstoprivatelimitedcompaniesundercoact201324095.asp)

More(default.asp)

You may also like

http://www.caclubindia.com/articles/plethoraofexemptionstogovernmentcompanies24072.asp#.VYAROPmUcuc

7/11

6/16/2015

Plethoraofexemptionstogovernmentcompanies!!CorporateLaw

Compliancerelatedtochangeofname..(compliancerelatedtochangeofname23614.asp)

ALTERATIONINTHENAMECLAUSE1.Section13(2)Providesthatanychangeinthenameofacompanyshallbesubjecttotheprovisionsofsubs...

ViewfullArticle(compliancerelatedtochangeofname23614.asp)

DirectorreportunderCompaniesAct,2013..(directorreportundercompaniesact201323616.asp)

ReportofBoardofDirectorsshouldbeATTACHEDtotheBalanceSheetlaidbeforetheAGM.Adirectorsreportisintendedtoexplaintoshare...

ViewfullArticle(directorreportundercompaniesact201323616.asp)

DepreciationunderCompaniesAct,2013..(depreciationundercompaniesact201323965.asp)

SCHEDULEIIOFTHECOMPANIESACT,2013(DEPRECIATION)ANDTHEPRACTICALIMPLICATIONSoFriends,thetimeforPreparationofthefirstfinancia...

ViewfullArticle(depreciationundercompaniesact201323965.asp)

Analysisondirectorreport..(analysisondirectorreport24022.asp)

Itismandatoryforeverycompany,toforwardtoitsmembers,alongwithitsannualFinancialStatementtheBoardofDirectorsreport.Repo...

ViewfullArticle(analysisondirectorreport24022.asp)

http://www.caclubindia.com/articles/plethoraofexemptionstogovernmentcompanies24072.asp#.VYAROPmUcuc

8/11

6/16/2015

Plethoraofexemptionstogovernmentcompanies!!CorporateLaw

BriefofGSTbill,2015..(briefofgstbill201523673.asp)

TheGST(GoodsandserviceTax)Billrollingoutthecountry'sbiggestindirecttaxreformsince1947hasbeensubjecttoheateddebatesinc...

ViewfullArticle(briefofgstbill201523673.asp)

ProcessforincorporationofLLPunderCo.Act,2013..(processforincorporationofllpundercoact201323682.asp)

PROCESSFORINCORPORATIONOFLLPINCORPORATIONOFLLPUNDERCOMPANIESACT,2013RecentlymostentrepreneurshavestartedoptingforLimitedL...

ViewfullArticle(processforincorporationofllpundercoact201323682.asp)

CCI Articles

Youcanalsosubmityourarticlebysendingtoarticle@caclubindia.com

Submitarticle(article_list_add.asp)

GO

SearchArticles

Featured Articles

Tipsforagoodresume(/articles/tipsforagoodresume23898.asp)

Impactofincreaseinservicetaxrateto14%(/articles/impactofincreaseinservicetaxrateto1423878.asp)

7Principlestobesuccessfulprofessionalorstudent(/articles/7principlestobesuccessfulprofessionalorstudent23811.asp)

Howdowemanagetravelcosts?(/articles/howdowemanagetravelcosts23806.asp)

AllaboutGST(/articles/allaboutgst23777.asp)

BriefofGSTbill,2015(/articles/briefofgstbill201523673.asp)

ServiceTaxonECommercetransactionunderAggregatorModel(/articles/servicetaxonecommercetransactionunderaggregatormodel23763.asp)

viewmore(articles_featured.asp)

BrowsebyCategory(article_category_stats.asp)

RecentComments(recent_comments.asp)

PopularArticles(articles_popular.asp)

http://www.caclubindia.com/articles/plethoraofexemptionstogovernmentcompanies24072.asp#.VYAROPmUcuc

9/11

6/16/2015

Plethoraofexemptionstogovernmentcompanies!!CorporateLaw

Popular

MostCommented

Impactofincreaseinservicetaxrateto14%(/articles/impactofincreaseinservicetaxrateto1423878.asp)

TDSonRentu/s194I(/articles/tdsonrentus194i23920.asp)

HarshPenaltyforPropertyTransactioninCashofRs.20,000ormorew.e.f.1stJune,2015(/articles/harshpenaltyforpropertytransactionincashofrs20000or

morewef1stjune201523902.asp)

TDSAmendments(/articles/tdsamendments24027.asp)

AmendmentsinCEandSTwef1stJune2015(/articles/amendmentsinceandstwef1stjune201523908.asp)

Exemptiontoprivatelimitedcompany(/articles/exemptiontoprivatelimitedcompany24045.asp)

RequirementofForm15CA&Form15CB(/articles/requirementofform15caform15cb24080.asp)

Impactof14%STrate(/articles/impactof14strate23880.asp)

ServiceTaxAmendmentsapplicablew.e.f14thMay2015(/articles/servicetaxamendmentsapplicablewef14thmay201523843.asp)

Tipsforagoodresume(/articles/tipsforagoodresume23898.asp)

More(articles_popular.asp)

SubscribetoArticlesFeed

(http://feedproxy.google.com/CaclubindiacomArticles)

http://www.caclubindia.com/articles/plethoraofexemptionstogovernmentcompanies24072.asp#.VYAROPmUcuc

10/11

6/16/2015

Plethoraofexemptionstogovernmentcompanies!!CorporateLaw

kumar.anil666@gmail.com

Submit

Browse by Category

IncomeTax(article_display_list_by_category.asp?cat_id=3)

Accounts(article_display_list_by_category.asp?cat_id=1)

Career(article_display_list_by_category.asp?cat_id=41)

Audit(article_display_list_by_category.asp?cat_id=2) Students(article_display_list_by_category.asp?cat_id=8)

Custom(article_display_list_by_category.asp?cat_id=4) VAT(article_display_list_by_category.asp?cat_id=5)

ServiceTax(article_display_list_by_category.asp?cat_id=6)

CorporateLaw(article_display_list_by_category.asp?cat_id=7)

Excise(article_display_list_by_category.asp?cat_id=11)

LAW(article_display_list_by_category.asp?cat_id=46)

InfoTechnology(article_display_list_by_category.asp?cat_id=9)

Shares&Stock(article_display_list_by_category.asp?cat_id=44) Exams(article_display_list_by_category.asp?cat_id=45)

ProfessionalResource(article_display_list_by_category.asp?cat_id=51)

UnionBudget(article_display_list_by_category.asp?cat_id=53)

Others(article_display_list_by_category.asp?cat_id=10)

Taxpayers(article_display_list_by_category.asp?cat_id=52)

OurNetworkSites

(http://www.lawyersclubindia.com)

(http://www.mbaclubindia.com)

2015CAclubindia.com.Letusgrowstrongerbymutualexchangeofknowledge.

About(../about_us.asp) WeareHiring(http://www.interactivemedia.co.in/jobs/) Blog(http://www.caclubindiablog.com/) Advertise(../advertise_with_us.asp)

TermsofUse(../terms_of_use.asp)

Disclaimer(../disclaimer.asp) PrivacyPolicy(../privacy_policy.asp) ContactUs(../contact_us.asp)

(https://itunes.apple.com/in/app/caclubindia/id891671199?

mt=8&uo=4)(https://play.google.com/store/apps/details?

id=com.interactivemedia.caclubindia)

(http://twitter.com/caclubindia)

(http://www.facebook.com/caclubindia)

(http://www.linkedin.com/groups?gid=752057)(../rss/)

(https://plus.google.com/u/0/114999955736441418677)

(https://www.youtube.com/caclubindia?sub_confirmation=1)

http://www.caclubindia.com/articles/plethoraofexemptionstogovernmentcompanies24072.asp#.VYAROPmUcuc

11/11

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Entrepreneurship by Hisrich, Shepherd, Peters Chapter 1 MCQs and QuestionsDocument6 pagesEntrepreneurship by Hisrich, Shepherd, Peters Chapter 1 MCQs and QuestionsTooba100% (5)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Project Report On Installation of Unit For Fabrication of Shuttering/scaffolding MaterialDocument8 pagesProject Report On Installation of Unit For Fabrication of Shuttering/scaffolding MaterialEIRI Board of Consultants and Publishers0% (2)

- Kennedy Geographic Consulting Market Outlook 2014 Latin America SummaryDocument8 pagesKennedy Geographic Consulting Market Outlook 2014 Latin America SummaryD50% (2)

- Emerson Electric Financial Statement AnalysisDocument6 pagesEmerson Electric Financial Statement Analysismwillar08No ratings yet

- On Career As A Company Secretary - 12.02.2024Document16 pagesOn Career As A Company Secretary - 12.02.2024kumar_anil666No ratings yet

- Lockdown Instructisons On Maid ServantsDocument1 pageLockdown Instructisons On Maid Servantskumar_anil666No ratings yet

- LinkedIn receipt title for documentDocument1 pageLinkedIn receipt title for documentkumar_anil666No ratings yet

- List of Labour Laws: Compiled by P.velu CA (Final)Document20 pagesList of Labour Laws: Compiled by P.velu CA (Final)santoshiyerNo ratings yet

- Adhoc Case LawDocument1 pageAdhoc Case Lawkumar_anil666No ratings yet

- Tax Updates For June 2015 Examination - 20!03!15Document37 pagesTax Updates For June 2015 Examination - 20!03!15kumar_anil666No ratings yet

- FileDocument8 pagesFilekumar_anil666No ratings yet

- CV AnilDocument3 pagesCV Anilkumar_anil666No ratings yet

- 1 2 Name of The Company CINDocument16 pages1 2 Name of The Company CINkumar_anil666No ratings yet

- Lawcet2014 5yearDocument28 pagesLawcet2014 5yearsarmasarmateja100% (1)

- Annual Report - 2012-13Document12 pagesAnnual Report - 2012-13kumar_anil666No ratings yet

- TSSPDCL Hiring Company Secretary Rs.40KDocument1 pageTSSPDCL Hiring Company Secretary Rs.40Kkumar_anil666No ratings yet

- Holiday List 2014Document1 pageHoliday List 2014kumar_anil666No ratings yet

- ACLPDocument734 pagesACLPkumar_anil666No ratings yet

- Pandagalu MuhurthaluDocument61 pagesPandagalu MuhurthaluMallikaarjjuna MunagapatiNo ratings yet

- Lawcet&pglcet 2014Document1 pageLawcet&pglcet 2014kumar_anil666No ratings yet

- Guidelines To Prepare A Workbook: Question Should Force Him/her To Learn Rather Than Depend On Past MemoryDocument6 pagesGuidelines To Prepare A Workbook: Question Should Force Him/her To Learn Rather Than Depend On Past Memorykumar_anil666No ratings yet

- Business Communication & Soft Skills: Sample QuestionsDocument2 pagesBusiness Communication & Soft Skills: Sample Questionskumar_anil666No ratings yet

- Kamakya Temple PhampletDocument1 pageKamakya Temple Phampletkumar_anil666No ratings yet

- Mahalaya PakshaDocument4 pagesMahalaya Pakshakumar_anil666No ratings yet

- CS Test One - ExecutiveDocument1 pageCS Test One - Executivekumar_anil666No ratings yet

- Ayurvedam March-2008Document36 pagesAyurvedam March-2008kumar_anil666No ratings yet

- Compounding of OffencesDocument49 pagesCompounding of Offenceskumar_anil6660% (1)

- Ayurvedam February 2008Document36 pagesAyurvedam February 2008kumar_anil666100% (1)

- 0901 Om-Ii (Mb2e4)Document32 pages0901 Om-Ii (Mb2e4)api-19916064No ratings yet

- Stamps BillDocument1 pageStamps Billkumar_anil666No ratings yet

- ICSI MagazineDocument19 pagesICSI Magazinekumar_anil666No ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word Documentkumar_anil666No ratings yet

- Panchangam2013 2014Document37 pagesPanchangam2013 2014atreya757No ratings yet

- Amazon Service Marketing Case StudyDocument36 pagesAmazon Service Marketing Case StudyAbhiNo ratings yet

- Denali Investors Partner Letter - 2014 Q2Document6 pagesDenali Investors Partner Letter - 2014 Q2ValueInvestingGuy100% (1)

- Agency v4Document59 pagesAgency v4Roxanne Daphne Ocsan LapaanNo ratings yet

- Case 1 Is Coca-Cola A Perfect Business PDFDocument2 pagesCase 1 Is Coca-Cola A Perfect Business PDFJasmine Maala50% (2)

- StyleCracker's Service Marketing and Relationship BuildingDocument26 pagesStyleCracker's Service Marketing and Relationship BuildingShagun PoddarNo ratings yet

- CV of Faysal AhamedDocument2 pagesCV of Faysal AhamedSyed ComputerNo ratings yet

- 1019989-Industrial Trainee-Publishing and Product License SupportDocument2 pages1019989-Industrial Trainee-Publishing and Product License SupportSravan KumarNo ratings yet

- Isaca Cisa CoursewareDocument223 pagesIsaca Cisa Coursewareer_bhargeshNo ratings yet

- Microeconomics Principles and Policy 13Th Edition Baumol Test Bank Full Chapter PDFDocument67 pagesMicroeconomics Principles and Policy 13Th Edition Baumol Test Bank Full Chapter PDFVeronicaKellykcqb100% (8)

- Solar Power Forecast: Weather. Impact On Your BusinessDocument2 pagesSolar Power Forecast: Weather. Impact On Your BusinessCamilo DiazNo ratings yet

- Math and Logic Problems with Multiple Choice AnswersDocument4 pagesMath and Logic Problems with Multiple Choice AnswersTamara Gutierrez100% (3)

- CDM Regulations EbookDocument14 pagesCDM Regulations EbookZeeshan BajwaNo ratings yet

- FM11 CH 10 Capital BudgetingDocument56 pagesFM11 CH 10 Capital Budgetingm.idrisNo ratings yet

- Cheniere Energy Valuation ModelDocument11 pagesCheniere Energy Valuation Modelngarritson1520100% (1)

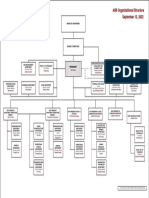

- AIIB Organizational StructureDocument1 pageAIIB Organizational StructureHenintsoa RaNo ratings yet

- KYC - FidelityDocument2 pagesKYC - FidelityMohammad Munazir AliNo ratings yet

- SBR Res QcaDocument3 pagesSBR Res QcaAlejandro ZagalNo ratings yet

- Operations and Supply Chain Management B PDFDocument15 pagesOperations and Supply Chain Management B PDFAnonymous sMqylHNo ratings yet

- Solutions To All Assigned Practice Problems (W502)Document27 pagesSolutions To All Assigned Practice Problems (W502)donjazonNo ratings yet

- Synd - 7 Business Eco EMBA 59A Decision Time at The Aromatic Coffee CoDocument18 pagesSynd - 7 Business Eco EMBA 59A Decision Time at The Aromatic Coffee CoTiwi Movita FitrianaNo ratings yet

- BSC Hospital 1Document24 pagesBSC Hospital 1sesiliaNo ratings yet

- Lgu Naguilian HousingDocument13 pagesLgu Naguilian HousingLhyenmar HipolNo ratings yet

- Partnership Accounting BreakdownDocument13 pagesPartnership Accounting BreakdownHoneylyne PlazaNo ratings yet

- ThelerougecandycompanyDocument4 pagesThelerougecandycompanyAreeba.SulemanNo ratings yet

- Approval of Permit To Use Loose-Leaf BooksDocument3 pagesApproval of Permit To Use Loose-Leaf BooksJohnallen MarillaNo ratings yet

- Cape, Jessielyn Vea C. PCBET-01-301P AC9/ THURSAY/ 9:00AM-12:00PMDocument5 pagesCape, Jessielyn Vea C. PCBET-01-301P AC9/ THURSAY/ 9:00AM-12:00PMhan jisungNo ratings yet