Professional Documents

Culture Documents

Akaun

Uploaded by

aisyahCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Akaun

Uploaded by

aisyahCopyright:

Available Formats

FALL2015

INTRODUCTION TO FINANCIAL ACCOUNTING (USAC 21)

WRITTEN ASSIGNMENT 1 (15%)

Question1

Keep Cool Corporation was established in January 2014. The following business transactions are

related to its business during the first three months of its operations.

January 4

Owners issued 50,000 shares to public at $3 per share. The par value of each

share is $1.

January 5

Acquired inventory worth, $20,000 with the cash payment of $8,000 (10/20,

n/30).

January 5

Paid freight cost on the inventory purchase transaction worth $100.

January 6

Paid rent expense in advance for January, February and March 2014, $3,000.

January 6

Paid insurance policy to cover the business for 6 months, $12,000.

January 9

Acquired supplies to be used in the current period for cash worth $5,000.

January 24

The company paid its debt on Accounts Payable.

February 2

Sold goods on open account, $50,000 with the cost of goods sold of $10,000

(15/25, n/60).

February 2

Paid freight cost on the sales transaction worth $110

February 4

Returned inventory purchased for cash to suppliers worth, $150.

February 10

Took a long term loan from a financial institution, $100,000 with the interest rate

of 12% per annum. The interest expense is payable every 6 months.

February 12

Customers returned back inventory sold to them worth $1,000. The cost of

inventory returned was $200.

February 16

Bought inventory on credit, $35,000 (10/20, n/45).

February 25

Credit customers pay their debts to the company.

February 28

Acquired office equipment worth $40,000 and received a note to evidence the

debt worth $25,000.

FALL2015

February 28

March 5

Made a return of inventory to supplier worth, $900 (Refer transaction on

February 16).

Loaned $80,000 cash to workers with the repayment period of 5 years. Interest

rate of 6% is payable by the workers on every December 31. The company

issued a promissory note to the workers.

March 7

The company paid its debt for the credit purchases made on February 16.

March 8

Made sales of $90,000 with comprise of cash sales worth $18,000. The

inventories sold were purchased at a cost of $31,000.

March 10

The company gave cash refund of $100 to the customers for the inventory

returned from cash sales ((Refer transaction on March 8). The cost of inventory

returned was $40.

March 11

Paid advertising expense of $19,000.

March 16

Paid selling expense of $12,300.

March 17

The company made collection from credit sales of March 8.

March 20

The company sold inventory on open account, $5,000 with the cost of goods sold

of $1,000.

March 23

Received cash in advance worth $5,000 for goods to be delivered on March 31,

2014 to customers.

March 31

The amount of supplies used by the business during the current period was

$1,200.

March 31

Depreciation expense of office equipment worth $2,000.

March 31

Incurred but unpaid wages and salaries expense worth $8,000.

March 31

Incurred but unpaid utilities expense worth $2,000.

March 31

Declared but unpaid cash dividends of the first three months worth $6,000.

March 31

The accounts receivable from March 20s transaction was declared as bad debts

due to the death of credit customer.

FALL2015

March 31

The goods from March 23s transaction was delivered successfully to customers.

The cost of goods sold was $1500.

Required:

1) Record all transactions, including adjusting entries in general journal

2) Post journal entries to ledgers

3) Prepare a trial balance

4) Prepare financial statements of the company as at March 31, 2014

Question 2

MMP Corporation was incorporated on January 1, 2013. The company closes its accounts on

December 31 each year. As at December 31, 2014 the company reported its accounts receivable

at $180,000. It is the policy of the company to estimate 6% of its accounts receivable as

uncollectible. When the company started its operation in 2015, the company has identified one of

its customers was declared as bankrupt. Therefore, the accounts receivable of the customer

worth $2,500 was written-off on March 3, 2015. Unexpectedly, on August 10, 2015 the

customers financial position was recovered slowly and he is able to pay part of his debt worth

$1,000 to the business.

Requirement:

Record the transactions happened on the following dates in general journal:

1) December 31, 2014

2) March 3, 2015

3) August 10, 2015

Question 3

Given is the trial balance of Fly High Company as at March 31, 2014. The company uses

calendar year as its accounting period.

FALL2015

Supplies

Prepaid Insurance

Accrued Rent Revenue

Equipment

Cash

Notes Receivable

Inventory

Accounts Payable

Income Tax Payable

Notes Payable

Unearned Revenue

Accumulated Depreciation- Equipment

Paid In Capital

Retained Earnings

DEBIT ($)

1,600

9,600

3,200

45,000

100,000

18,000

5,000

CREDIT ($)

8,000

5,000

60,000

10,000

3,000

90,000

6,400

Adjustments at March 31, 2014:

1) Unused supplies is $6,000

2) Unearned revenue that remains unearned is $7,000

3) Prepaid insurance is a one-year policy, paid on January 4, 2014

4) The loan was taken out on March 5 with the annual interest rate of 12%. Interest expense

is payable annually

5) Accrued rent revenue is paid by the tenants

6) Unrecorded depreciation expense of $1,000

7) The notes receivable carries 10% interest which is accrued for 2 months

8) Salaries expense worth $8,000 is paid every Friday for the works done on Monday to

Friday. During the current year, March 31, 2014 in on Thursday

9) Utilities expense is accrued for $1,800

10) Advertising expense was incurred but still unpaid as at the closing date, $500

11) Accrued revenue of $11,000 with the cost of goods sold worth $4,000

12) Received cash of $20,000 for goods to be delivered during June 2014

Required:

1) Record all adjustments in general journal

2) Post adjusting entries to ledgers

3) Prepare an adjusted trial balance of Fly High Company

You might also like

- ACCT 211 Introductory Accounting I Mock Final Exam 2016Document4 pagesACCT 211 Introductory Accounting I Mock Final Exam 2016Nguyễn Ngọc MaiNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Trading Account Objectives and ImportanceDocument3 pagesTrading Account Objectives and ImportanceRirin GhariniNo ratings yet

- Financial Accounting Chapter 3Document5 pagesFinancial Accounting Chapter 3NiraniyaNo ratings yet

- AssignmentDocument8 pagesAssignmentNegil Patrick DolorNo ratings yet

- Journal Ledger and Trial BalenceDocument14 pagesJournal Ledger and Trial BalenceMd. Sojib KhanNo ratings yet

- Epler Consulting ServicesDocument3 pagesEpler Consulting ServicesAmmad Ud Din SabirNo ratings yet

- Chapter 3-Adjusting The AccountsDocument26 pagesChapter 3-Adjusting The Accountsbebybey100% (1)

- Finance Practice ProblemsDocument54 pagesFinance Practice ProblemsMariaNo ratings yet

- DepreciationDocument18 pagesDepreciationAhmad Hafiz100% (1)

- Financial Accounting and Accounting StandardsDocument31 pagesFinancial Accounting and Accounting StandardsIrwan JanuarNo ratings yet

- 2009 SUA Waren Sports Supply Check Figures ADocument1 page2009 SUA Waren Sports Supply Check Figures ABrandon A. KroonNo ratings yet

- Advance Cost AccountingDocument37 pagesAdvance Cost Accountingashish_20kNo ratings yet

- Accounting Communicates Business ResultsDocument60 pagesAccounting Communicates Business Resultsharish100% (1)

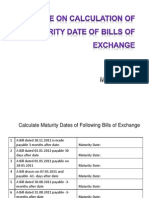

- Calculation of Maturity DateDocument4 pagesCalculation of Maturity Dateyogeshdhuri22No ratings yet

- True and Fair View of Financial StatementsDocument2 pagesTrue and Fair View of Financial StatementsbhaibahiNo ratings yet

- 2.recording ProcessDocument30 pages2.recording Processwpar815No ratings yet

- SUA 8th Fall 2015 Grading Rubric Student Answer FormDocument14 pagesSUA 8th Fall 2015 Grading Rubric Student Answer FormRamizNo ratings yet

- Accounting CycleDocument1 pageAccounting CycleMary100% (3)

- Exam 1 QuestionsDocument16 pagesExam 1 QuestionsArumugamm Ratheeshan100% (1)

- E-14 AfrDocument5 pagesE-14 AfrInternational Iqbal ForumNo ratings yet

- Accounting Tutorial: Chapter 1: Introduction To AccountingDocument71 pagesAccounting Tutorial: Chapter 1: Introduction To AccountingNansie MarianoNo ratings yet

- CH 05Document4 pagesCH 05vivienNo ratings yet

- Financial Management Cost AccountingDocument187 pagesFinancial Management Cost AccountingMoramba100% (1)

- Terminology Balance SheetDocument3 pagesTerminology Balance SheetMarcel Díaz AdriàNo ratings yet

- Mod08 - 09 10 09Document37 pagesMod08 - 09 10 09Alex100% (1)

- DipIFR June 2015 - QuestionsDocument10 pagesDipIFR June 2015 - QuestionsSoňa SlovákováNo ratings yet

- Intro to Financial Accounting Ch 1Document9 pagesIntro to Financial Accounting Ch 1Jon garciaNo ratings yet

- Chapter 3 AccountingDocument11 pagesChapter 3 AccountingĐỗ ĐăngNo ratings yet

- Accounting For Managers-Assignment MaterialsDocument4 pagesAccounting For Managers-Assignment MaterialsYehualashet TeklemariamNo ratings yet

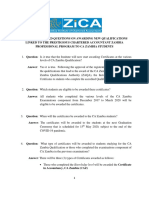

- FAQs On CA Zambia CertificationDocument3 pagesFAQs On CA Zambia CertificationHUMPHREY KAYUNYINo ratings yet

- Financial Accounting Managers GuideDocument13 pagesFinancial Accounting Managers GuideMohit TripathiNo ratings yet

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityFrom EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityNo ratings yet

- Intermediate Accounting 15th Edition Chapter 5Document9 pagesIntermediate Accounting 15th Edition Chapter 5homeworkquick100% (1)

- CH 16Document102 pagesCH 16cmlimNo ratings yet

- Notes On Financial AccountingDocument11 pagesNotes On Financial AccountingAbu ZakiNo ratings yet

- "Accounting Principles: Managerial Accounting" (2011)Document316 pages"Accounting Principles: Managerial Accounting" (2011)textbookequity100% (2)

- Click Here For Answers: ACC 400 Final ExamDocument4 pagesClick Here For Answers: ACC 400 Final Examclickme12No ratings yet

- Homework 4: Computing Deferred Income Tax (Supplement B)Document5 pagesHomework 4: Computing Deferred Income Tax (Supplement B)Dev SharmaNo ratings yet

- c06 895867Document34 pagesc06 895867api-246246921No ratings yet

- Strategic Financial Management GLIM GURGAON 2012-13Document11 pagesStrategic Financial Management GLIM GURGAON 2012-13Yeshwanth Babu100% (1)

- Basic of AccountingDocument35 pagesBasic of AccountingArdian MustofaNo ratings yet

- Analyzing Interactive Quiz QuestionsDocument6 pagesAnalyzing Interactive Quiz Questionsummara_javedNo ratings yet

- Partnership AccountingDocument18 pagesPartnership AccountingSani ModiNo ratings yet

- Double Entry BookkeepingDocument19 pagesDouble Entry BookkeepingCanduman NhsNo ratings yet

- Acquisition of Bonds Using Effective InterestDocument2 pagesAcquisition of Bonds Using Effective InterestTin BatacNo ratings yet

- NVCC Accounting ACC 211 EXAM 1 PracticeDocument12 pagesNVCC Accounting ACC 211 EXAM 1 Practiceflak27bl2No ratings yet

- Depreciation Accounting Part 2 PDFDocument37 pagesDepreciation Accounting Part 2 PDFShihab MonNo ratings yet

- Szabist Ibf Spring08 Lec1Document38 pagesSzabist Ibf Spring08 Lec1api-3712641100% (1)

- Chapter 4 Completing Accounting CycleDocument40 pagesChapter 4 Completing Accounting CycleShihab AhmedNo ratings yet

- Prelim AccountingDocument19 pagesPrelim AccountingNadiaIssabellaNo ratings yet

- Accounting theory approaches and perspectivesDocument11 pagesAccounting theory approaches and perspectivesatikahgaluhNo ratings yet

- Financial Accounting December 2009 Exam PaperDocument10 pagesFinancial Accounting December 2009 Exam Paperkarlr9No ratings yet

- Financial Accounting 2012 Exam PaperDocument28 pagesFinancial Accounting 2012 Exam PaperJane Fondue100% (1)

- AccountingDocument12 pagesAccountingsunlightNo ratings yet