Professional Documents

Culture Documents

Income Tax

Uploaded by

blusangasulCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax

Uploaded by

blusangasulCopyright:

Available Formats

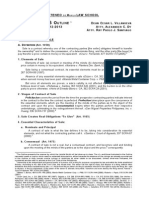

INCOME TAXATION OF INDIVIDUALS: CITIZENS

CITIZENS

RESIDENT

Definition

NON-RESIDENTS

Sec 22 (E)

1. A citizen of the Philippines who establishes to the satisfaction of the

Commissioner that fact of his physical presences abroad with definite

intention to reside therein.

2. A citizen of the Philippines who leaves the Philippines during the

taxable year to reside abroad, either as an immigrant or for

employment on a permanent basis.

3. A citizen of the Philippines who works and derives income from

abroad and whose employment thereat requires him to be physically

present abroad most of the time during the taxable year.

4. A citizen who has been previously considered as non-resident

citizen who arrives in the Philippines at any time during the taxable

year to reside permanently in the Philippines shall likewise be treated

as a nonresident citizen for the taxable year in which he arrives in the

Philippines with respect to his income derived from sources abroad

until the date of his arrival in the Philippines.

Tax Code Reference

Sec 24

Sec 24 ( income w/in the Philippines)

Sec 23 ( income outside Philippines)

Tax Base

taxable income earned from all sources taxable income from all sources within the Philippines

within and without the Philippines

Tax Rates - In general

5% - 34 % in 1998

5% - 34% in 1998 (for income w/in the Phils)

5% - 33% in 1999

5% - 33% in 1999

(for income w/in the Phils)

5% - 32% in 2000

5% - 32%

5%- 32% in 2000 (for income w/in

thereafter

the Phils)

5% - 32% thereafter (for income w/in the Phils)

Tax Rates - On Passive Incomes (subject to Final Taxes [FT])

Interest on any currency bank deposit and yield or any

other monetary benefit from deposit substitutes [Sec 22(Y)]

and from trust fund and similar arragements

Interest from a depository bank under the expanded

foreign currency deposit system [RR 10-98]

Interest on long term deposit or investment [Sec 22(FF)] in

the form of savings, common or individual trust funds,

deposit substitutes, investment management accounts and

other investments evidenced by certificates in such form

prescribed by the BSP

20% FT

20% FT

7.5% FT

EXEMPT [Sec 2.24 RR 10-98 ]

EXEMPT

EXEMPT

Pre-terminated long term investment (should actually

based on expired term)

4 yrs to < 5 years -- 5%FT

3 years to < 4 years -- 12%FT

Less than 3 years -20%FT

5% - 34%,

33%, 32%

5% - 34%, 33%, 32%

20% FT

10% FT

4 yrs to < 5 years -- 5%FT

3 years to < 4 years -- 12%FT

Less than 3 years -- 20%FT

5% - 34%, 33%, 32%

EXEMPT

20% FT

10% FT

Other interest income derived within the Philippines

Other interest income derived outside the Philippines

Royalties - in general

Royalties on books, other literary works and musical

compositions

Prizes - more than P10,000

20% FT

20% FT

Prizes - P10,000 or less

5% - 34%, 33%, 32%

5% - 34%, 33%, 32%

EXEMPT

EXEMPT

Prizes - PCSO & Lotto winnings

Other prizes or winnings within the Philippines

20% FT

20% FT

Other prizes or winnings outside the Philippines

5% - 34%, 33%, 32%

EXEMPT

Cash and/or Property Dividends from a domestic corp or

6% FT beginning Jan 1, 1998

6% FT beginning January 1, 1998

share in distributable net income after tax of a partnership

8% FT beginning

8% FT beginning January 1, 1999

(except general professional partnerhip), association, joint Jan 1, 1999

10% FT beginning January

account, or joint venture or consortium taxable as

10% FT beginning Jan 1, 2000

1, 2000

corporation

Other

Cash and/or Property Dividends (e.g. from a foreign

5% - 34%, 33%, 32%

5% - 34%, 33%, 32%

corp)

On domestic shares of stock not traded through local stock

5% / 10% FT

5% / 10% FT

exchange (based on net capital gains)

On shares of stock traded through local stock exchange

1/2 of 1% FT (Percentage Tax)

1/2 of 1% FT (Percentage Tax)

(based on gross selling price) [Sec 127(A) & (D)]

On real property (based on gross selling price or FMV

6% FT

6% FT

whichever is higher) - In general

On real property sold to the government - subj to option

6% FT or

6% FT or 5% - 34%, 33%, 32%

5% - 34% 33%, 32%

On real property sold to acquire or construct new principal

EXEMPT subj to certain conditions

EXEMPT subj to certain conditions

residence

Atty. Marissa O. Cabreros (Ateneo School of Law)

January 2011

INCOME TAXATION OF INDIVIDUALS: ALIENS

ALIENS

RESIDENT ALIEN

Definition

Sec 22 (F)

NON-RESIDENT ALIEN

ENGAGED IN BUSINESS

NOT ENGAGED IN

BUSINESS

Sec 22 (G) / Sec 25 (A)(1)

An individual whose residence is within the An individual whose residence is not

Philippines and who is not a citizen thereof. within the Philippines and who is not a

citizen thereof but stays in the

Philippines for an aggregate period of

more than 180 days during any

calendar year

Tax Code Reference

Tax Base

Tax Rates - In general

Sec 24

taxable income earned from all

sources within the Philippines

Sec 25 (A)

Sec 22 (G)

An individual whose residence is not

within the Philippines and who is not a

citizen thereof but stays in the

Philippines for an aggregate period of

or less than 180 days during any

calendar year

Sec 25 (B)

taxable income earned from gross income from all sources

all sources within the

within the Philippines

Philippines

5% - 34 % in 1998

5% - 34 % in 1998

5% - 33% in 1999

5% - 33% in 1999

5% - 32% in

5% - 32% in 2000

2000

5% - 32%

5% - 32% thereafter

thereafter

25%FT

Tax Rates - On Passive Income (subject to Final Tax [FT])

Interest on currency bank deposit and yield or any other monetary

benefit from deposit substitutes and from trust fund and similar

arragements

20% FT

20% FT

Interest from a depository bank under the expanded foreign

currency deposit system

7.5% FT

Interest on long term deposit or investment [Sec 22(FF)] in the

form of savings, common or individual trust funds, deposit

substitutes, investment management accounts and other

investments evidenced by certificates in such form prescribed by

the BSP

Pre-terminated

long term investment (should actually based on

expired term)

EXEMPT

EXEMPT

Sec 27(D)(3)

Sec 2.27(c)RR 10-98

EXEMPT

25% FT

EXEMPT

Sec 27(D)(3)

RR 10-98

25% FT

4 yrs to < 5 years -- 5%

5 yrs to < 5 years -- 5%

25% FT

3 years to < 4 years -- 12%

3 years to < 4 years -Less than 3 years 12%

Less

-- 20%

than 320%FT

years -- 20%

Other interest income derived within the Philippines

5% - 34%,

33%, 32%

25% FT

Other interest income derived outside the Philippines

EXEMPT

EXEMPT

EXEMPT

Royalties - in general

20% FT

20% FT

25% FT

Royalties on books, other literary works and musical compositions

10% FT

10% FT

25% FT

20% FT

25% FT

25% FT

Royalties on cinematographic films and similar works [Sec 28(B)

(2)]

Prizes - more than P10,000

20% FT

20% FT

25% FT

Prizes - P10,000 or less

5% - 34%, 33%, 32%

5% - 34%, 33%, 32%

25% FT

Prizes - PCSO and Lotto winnings

EXEMPT

EXEMPT

EXEMPT

Sec 27(D)(3)

RR 10-98

Other prizes or winnings within the Philippines

20% FT

20% FT

25% FT

Other prizes or winnings outside the Philippines

EXEMPT

EXEMPT

EXEMPT

Cash and/or Property Dividends from a domestic corp or share in 6% FT beginning Jan 1, 1998

20% FT

25% FT

distributable net income after tax of a partnership (except a

8% FT

general professional partnership), association, joint account, or

beginning Jan 1, 1999

joint venture or consortium taxable as corporation

10% FT beginning Jan 1, 2000

Other Cash and/or Property Dividends (e.g. from a foreign corp in

5% - 34%, 33%, 32%

5% - 34%, 33%, 32%

25%FT

the Philippines)

Other Cash and/or Property Dividends (e.g. from a foreign corp

EXEMPT

EXEMPT

EXEMPT

NOT in the Philippines)

On domestic shares of stock not traded through local stock

5% / 10% FT

5% / 10% FT

5% / 10% FT

exchange (based on net capital gains)

On shares of stock traded through local stock exchange (based on 1/2 of 1% FT (Percentage Tax)

1/2 of 1% FT (Percentage Tax) 1/2 of 1% FT (Percentage Tax)

gross selling price) [Sec 127(A) & (D)]

On real property (based on gross selling price or FMV whichever

6% FT

6% FT

6% FT

is higher) - In general

On real property sold to the government - subj to option

6% FT or

6% FT or

6% FT or

5% - 34% 33%, 32%

5% - 34% 33%, 32%

5% - 34% 33%, 32%

On real property sold to acquire or construct new principal

EXEMPT subj to certain conditions N/A

N/A

residence

RR 13-99

RR 13-99

Atty. Marissa O. Cabreors (Ateneo School of Law)

January 2011

INCOME TAXATION OF CORPORATIONS

Definition

Tax Code Reference

Tax Base

Tax Rates - In general

Tax Rates - on Passive Income (Subject to Final Tax [FT])

Interest on any currency bank deposit and yield or any other

monetary benefit from deposit substitutes and from trust

funds and similar arragements

Interest on foreign currency deposit system

Interest Income on Foreign Loans contracted on or after

August 1, 1986

Interest Income received by a FCDU

Income derived by a depository bank under the expanded

foreign currency deposit system from foreign currency

transactions with nonresidents, offshore banking units in

the Philippines, local commercial banks including

branches of foreign banks that may be authorized by the

Bangko Sentral ng Pilipinas (BSP) to transact business with

foreign

deposit

system

Interestcurrency

income from

foreign

currency loans granted by such

CORPORATIONS

RESIDENT

DOMESTIC

FOREIGN

Sec 22 (B) & (C )

Sec 22 (H)

Applies to corporation created Applies to foreign corporation

or organized in the Philippines engaged in trade or business

or under its laws

within the Philippines

Sec 27

taxable income from all

sources within and without

the Philippines

NON-RESIDENT

FOREIGN

Sec 22 (I)

Applies to a foregin corporation

not engaged in trade or

business within the Philippines

Sec 28 (A)

Sec 28 (B)

taxable income from all

gross income from all sources

sources within the Philippines

within the Philippines

34% in 1998

34% in 1998

33% in 1999

33% in 1999

32% in 2000-2005

32% in 2000-2005

35 % in

35 % in

2006-2008

2006-2008

30% in 2009 & thereafter

30% in 2009 & thereafter

34% in 1998

33% in 1999

32% in 2000-2005

35 % in

2006-2008

30% in 2009 & thereafter

20% FT

20% FT

34% in 1998

33% in 1999

32% in 2000-2005

35 % in

2006-2008

30% in 2009

& thereafter

EXEMPT

20% FT

7.5% FT

N/A

7.5% FT

N/A

EXEMPT [RA No. 9294]

EXEMPT [RA No. 9294]

N/A

10% FT

10% FT

N/A

N/A

EXEMPT [RA No. 9294]

N/A

N/A

10% FT

N/A

20% FT

20% FT

EXEMPT

EXEMPT

depository banks under said expanded system to residents

other than offshore banking units in the Philippines or

other depository banks under the expanded system

Interest Income received by an OBU

Income derived by a depository bank under the expanded

foreign currency deposit system from foreign currency

transactions with nonresidents, offshore banking units in

the Philippines, local commercial banks including

branches of foreign banks that may be authorized by the

Bangko Sentral ng Pilipinas (BSP) to transact business with

foreign

deposit

system

Interestcurrency

income from

foreign

currency loans granted to

residents other than offshore banking units or local

commercial banks, including local branches of foreign

banks that may be authorized by BSP to transact with

offshore

Royalties banking units

Dividends

Tax Rates - on capital gains

On shares of stock not traded (based on net capital gains)

On Land or Buildings (classified as capital assets)

Tax Rate - Minimum Corporate Income Tax (MCIT)

Tax Rate - Branch Profit Remittance Tax (BPRT)

Tax Rate - Improperly Accumulated Earnings Tax (Sec 29)

Atty. Marissa O. Cabreros (Ateneo School of Law)

5% / 10% FT

5% / 10% FT

6% FT

34% in 1998

based on gross selling price

33% in 1999

or FMV whichever is higher

32% in 2000-2005

35 % in

2006-2008

30% in 2009

2%

2%& thereafter

N/A

10%

15%

10%

34% in 1998

33% in 1999

32% in 2000-2005

35 % in

2006-2008

30%

in FT

2009

& thereafter

15%

(conditional)

5% / 10% FT

34% in 1998

33% in 1999

32% in 2000-2005

35 % in

2006-2008

30% in 2009

& thereafter

N/A

N/A

N/A

January 2011

INCOME TAXATION: SPECIAL RULES

SPECIAL RATES FOR CERTAIN ALIEN INDIVIDUALS

Alien Employed by Regional or Area Headquarters and 15%

5% - 34%, 33%, 32% [regular tax rate]

Regional Operating Headquarters of Multinational

on gross income

or

Companies [Sec 25 (C )]

on salaries, wages, FT rate for any other income earned from all other

annuities,

sources within the Philippines

compensation,

Alien Individual Employed by Offshore Banking Units

remuneration and

[Sec 25 (D)]

other emoluments

such as honoraria

Alien Individual Employed by Petroleum Service

and allowances

Contractor and Subcontractor [Sec 25(E)]

SPECIAL RATES FOR CORPORATIONS

DOMESTIC CORPORATION

Proprietary Educational Institutions and

Hospitals

10%

35%

GOCC, Agencies and Instrumentalities

32%

on taxable income

on entire taxable income, if total gross income from

unrealted trade, business, or activity exceed 50%

of total income

same tax rate upon their taxable income in a

similar business, industry or activity

GSIS / SSS / PHIC / PCSO

Depository Banks

EXEMPT

10%

RESIDENT FOREIGN CORPORATION

International Air Carriers

International Shipping

Offshore Banking Units

2 1/2 %

2 1/2 %

10%

on Gross Philippine Billings

on Gross Philippine Billings

any interest income derived from foreign currency

loans granted to residents other than offshore

banking units or local commercial banks, including

local branches of foreign banks that may be

authorized by the BSP to transact business with

offshore banking units

EXEMPT

income derived by offshore banking units

authorized by the Bangko Sentral ng Pilipinas

(BSP), from foreign currency transactions with

nonresidents, other offshore banking units, local

commercial banks, including branches of foreign

banks that may be authorized by the Bangko

Sentral ng Pilipinas (BSP) to transact business with

offshore banking units

Regional or Area Headquarters

Regional Operating Headquarters

NON RESIDENT FOREIGN CORPORATION

Cinematographic Film Owner, Lessor or Distributor

Owner or Lessor of Vessel Charted by Philippine

Nationals

Owner or Lessors of Aircraft, Machineries and Other

Equipment

Atty. Marissa O. Cabreros (Ateneo School of Law)

EXEMPT

10%

on interest income from foreign currency

transactions including interest income from foreign

loans

on taxable income

25%

4.5%

on Gross Income

on Gross Rentals

7.5%

on Gross Rentals

January 2011

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Instructions For A Cash Flows Statement Direct MethodDocument5 pagesInstructions For A Cash Flows Statement Direct MethodMary100% (8)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- InvoiceDocument1 pageInvoiceJanhvii tiwariNo ratings yet

- Quicknotes in Income TaxDocument13 pagesQuicknotes in Income TaxTrelle DiazNo ratings yet

- Domondon Tax Q&ADocument54 pagesDomondon Tax Q&AHelena Herrera0% (1)

- Best Ice Cream Business Plan WTH Financials PDFDocument11 pagesBest Ice Cream Business Plan WTH Financials PDFNishat Nabila80% (15)

- Criminal Law Survey of Cases - J. Villa-IgnacioDocument21 pagesCriminal Law Survey of Cases - J. Villa-IgnacioblusangasulNo ratings yet

- Econ 100.2 THC - Problem Set 4Document3 pagesEcon 100.2 THC - Problem Set 4TiffanyUyNo ratings yet

- Tax 5th Semeter Selected Questions PDFDocument40 pagesTax 5th Semeter Selected Questions PDFAvBNo ratings yet

- MCQ - Taxation Law ReviewDocument24 pagesMCQ - Taxation Law ReviewphiongskiNo ratings yet

- Philippine Health Providers Tax LiabilityDocument3 pagesPhilippine Health Providers Tax Liabilityana ortizNo ratings yet

- GBC Jot Case Study FINALDocument29 pagesGBC Jot Case Study FINALSharmin Lisa100% (1)

- Robles Notes on Conflict of Laws PrinciplesDocument49 pagesRobles Notes on Conflict of Laws PrinciplesblusangasulNo ratings yet

- RMO No. 8-2017Document5 pagesRMO No. 8-2017attyGezNo ratings yet

- Documentary RequirementsDocument1 pageDocumentary RequirementsblusangasulNo ratings yet

- Tax 1 Codal MapDocument1 pageTax 1 Codal MapblusangasulNo ratings yet

- Evidence Reviewer r128 To r130Document85 pagesEvidence Reviewer r128 To r130blusangasulNo ratings yet

- Finals NotesDocument31 pagesFinals NotesblusangasulNo ratings yet

- (CLV) Sales OutlineDocument52 pages(CLV) Sales OutlineblusangasulNo ratings yet

- Legres Aug.28Document8 pagesLegres Aug.28blusangasulNo ratings yet

- A133 6141 31 Enq Rev0 PDFDocument434 pagesA133 6141 31 Enq Rev0 PDFSatyajit C DhaktodeNo ratings yet

- Taxguru - In-How To Prepare Directors Report As Per Companies Act 2013Document9 pagesTaxguru - In-How To Prepare Directors Report As Per Companies Act 2013g26agarwalNo ratings yet

- FY 2019-20 Proposed BudgetDocument506 pagesFY 2019-20 Proposed BudgetMaritza NunezNo ratings yet

- Dr. Reddy's - 900011757Document1 pageDr. Reddy's - 900011757srinivaskurellaNo ratings yet

- Recto Vs RepublicDocument6 pagesRecto Vs RepublicCharlene GalenzogaNo ratings yet

- Pria Soft OrissaDocument40 pagesPria Soft OrissawkNo ratings yet

- Tax Guide EstoniaDocument9 pagesTax Guide EstoniaIvan RomeroNo ratings yet

- Work Opportunity Tax Credit Package: Employee InstructionsDocument3 pagesWork Opportunity Tax Credit Package: Employee InstructionsAnonymous K8H1CRR2mNo ratings yet

- Citizens Charter Provides Timelines for Tax ServicesDocument7 pagesCitizens Charter Provides Timelines for Tax ServicesAnonymous tmtyiZANo ratings yet

- ReviewerDocument8 pagesReviewerjescy pauloNo ratings yet

- KMC Property Tax FormDocument13 pagesKMC Property Tax FormbitunmouNo ratings yet

- Gasbill 2864608891 202307 20230721180052Document1 pageGasbill 2864608891 202307 20230721180052Shahhussain HussainNo ratings yet

- Risk Analysis ExampleDocument8 pagesRisk Analysis ExampleRyan SooknarineNo ratings yet

- The Common Chrysobulls'' of Cities and The Notion of Property in Late ByzantiumDocument18 pagesThe Common Chrysobulls'' of Cities and The Notion of Property in Late ByzantiumannboukouNo ratings yet

- 2023 Harmony Residential Rebate App PacketDocument2 pages2023 Harmony Residential Rebate App PacketSanta Teresa SumapazNo ratings yet

- Cooperative Code of The PhilippinesDocument16 pagesCooperative Code of The PhilippinesJeean BeldaNo ratings yet

- Monthly Documentary Stamp Tax Declaration/Return: For Bir Use Only BCS/ ItemDocument2 pagesMonthly Documentary Stamp Tax Declaration/Return: For Bir Use Only BCS/ ItemRomer Lesondato100% (1)

- Lass 12 Subject Economics Paper Set 1 With Solutions: (Macro Economics) Question 1: (Marks 1)Document10 pagesLass 12 Subject Economics Paper Set 1 With Solutions: (Macro Economics) Question 1: (Marks 1)sandeep11116No ratings yet

- Spar R61.16Document1 pageSpar R61.16Karen PillayNo ratings yet

- IT Card SaneepDocument4 pagesIT Card Saneephajabarala2008No ratings yet

- Baker McKenzie Doing Business in Thailand Updated As of September 2019Document228 pagesBaker McKenzie Doing Business in Thailand Updated As of September 2019lindsayNo ratings yet

- Direct Taxes Notes Mcom IIDocument236 pagesDirect Taxes Notes Mcom IIPoonamNo ratings yet