Professional Documents

Culture Documents

RRetail Invoice 38

Uploaded by

Aditya Raj VermaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RRetail Invoice 38

Uploaded by

Aditya Raj VermaCopyright:

Available Formats

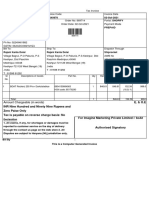

//DELIVERY ADDRESS//

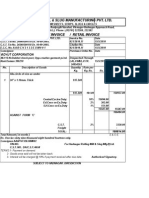

RETAIL INVOICE

NOI/S02

ADITYA RAJ VERMA

INFOGAIN INDIA PVT LTD PLOT NO :A 21 SECTOR 60 NOIDA

NEAR UFLEX

CITY NOIDA / STATE UTTAR PRADESH

PIN 201310

MOBILE 9990006882

DELHIVERY

PREPAID

*11189449532*

INVOICE NUMBER :SA3A3D/14-15/1343

INVOICE DATE :18-FEB-2015

SELLER

BUYER

S S S ENTERPRISES

ADITYA RAJ VERMA

COMPANY'S VAT TIN : 08602162692

COMPANY'S CST NO. : 08602162692

DISPATCHED VIA DELHIVERY

ITEM NAME AND SKU

QTY

VALUE PER QTY

COLLECT

S.NO.

Iball Tv Tuner Claro Lcd/Led/Crt

SS19

1460

N/A

Seller TIN Number - 08602162692 | Shipping Charges Rs. 0 | COD Charges Rs. 0

//SNAPDEAL REFERENCE NO.//

*SLP255558556*

S S S ENTERPRISES

//SHIPPER ADDRESS

//

115, prathavi raj nagar

maharani farm

Jaipur, Rajasthan - 302018

INFOGAIN INDIA PVT LTD PLOT NO :A 21 SECTOR

60 NOIDA

NEAR UFLEX

CITY NOIDA / STATE UTTAR PRADESH

PIN 201310

MOBILE 9990006882

115, PRATHAVI RAJ NAGAR

MAHARANI FARM

CITY JAIPUR / STATE RAJASTHAN

PIN 302018

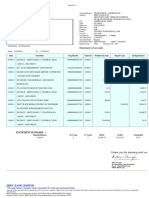

ITEM DESCRIPTION

IBALL TV TUNER CLARO

LCD/LED/CRT

ORDER NO.: 4990771522

SUBORDER NO.: 6615792989

DISPATCH DOC. NO. (AWB) 11189449532

QTY

RATE

TAX(CST)

AMOUNT

1390.48

69.52

(5.0 %)

1460.0

TOTAL

Rs. 1460

AMOUNT IN WORDS : INDIAN RUPEES ONE THOUSAND FOUR HUNDRED SIXTY ONLY

DECLARATION

We declare that this invoice shows actual price of the goods and that all particulars are true and

correct.

CUSTOMER ACKNOWLEDGEMENT

?I ADITYA RAJ VERMA hereby confirm that the above said product/s are being purchased for my

internal / personal consumption and not for re-sale.

THIS IS A COMPUTER GENERATED INVOICE AND DOES NOT REQUIRE SIGNATURE

ordered via snapdeal.com

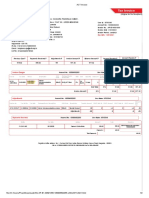

TO WHOM IT MAY CONCERN

It is hereby being declared that the Goods accompanying this sale voucher has been ordered

for personal use by the purchaser. All statutory Taxes (as applicable on the transaction) have

been paid by the Seller. Being for personal use no Road Permit is mandatory as per Proviso

to Section 50 (1) of the UPVAT Act reproduced below:Provided that where the importer intends to bring, import or otherwise receive such goods

otherwise than in connection with business, he may, at his option, in the like manner obtain

the prescribed form of certificate.

TO WHOM IT MAY CONCERN

It is hereby being declared that the Goods accompanying this sale voucher has been ordered

for personal use by the purchaser. All statutory Taxes (as applicable on the transaction) have

been paid by the Seller. Being for personal use no Road Permit is mandatory as per Proviso

to Section 50 (1) of the UPVAT Act reproduced below:Provided that where the importer intends to bring, import or otherwise receive such goods

otherwise than in connection with business, he may, at his option, in the like manner obtain

the prescribed form of certificate.

You might also like

- Invoice Trolley SnapdealDocument3 pagesInvoice Trolley SnapdealPrashant AdhikariNo ratings yet

- PackslipAndInvoice CalcuttaDocument4 pagesPackslipAndInvoice CalcuttavinaykumarjainNo ratings yet

- Delivery address and invoice for school suppliesDocument1 pageDelivery address and invoice for school suppliesJames PrinceNo ratings yet

- Retail Invoice: JSP/JSPDocument4 pagesRetail Invoice: JSP/JSPRohan SinghNo ratings yet

- Amount Chargeable (In Words)Document1 pageAmount Chargeable (In Words)Varun GopalNo ratings yet

- Deenas InvoiceDocument272 pagesDeenas Invoicevai27No ratings yet

- Delivery address and invoice for Jyoti Pathak BiharDocument1 pageDelivery address and invoice for Jyoti Pathak BiharPankaj ShaRmaNo ratings yet

- NCX-Myanmar Company Provides Motorcycle Repair and SalesDocument14 pagesNCX-Myanmar Company Provides Motorcycle Repair and SalesRt OpNo ratings yet

- Cartage Advice With Receipt - TB00606076Document2 pagesCartage Advice With Receipt - TB00606076CP KrunalNo ratings yet

- InvoiceDocument2 pagesInvoiceFantania BerryNo ratings yet

- TAX INVOICE No. MH1910011658: 5247723962 Bill To: 1434529Document1 pageTAX INVOICE No. MH1910011658: 5247723962 Bill To: 1434529Dushyant ShuklaNo ratings yet

- Invoice Kodak TVDocument1 pageInvoice Kodak TVTeotia0% (1)

- Vendor Registration Form - FKF1J.v2Document2 pagesVendor Registration Form - FKF1J.v2Ryzen AnimationNo ratings yet

- 5a.hdfc Aug2013Document1 page5a.hdfc Aug2013Nanu PatelNo ratings yet

- Nandy Sewing Solutions Private Limited 1668 28-Apr-23: Tax InvoiceDocument1 pageNandy Sewing Solutions Private Limited 1668 28-Apr-23: Tax InvoiceManish ShawNo ratings yet

- Srinivas InvoiceDocument1 pageSrinivas InvoiceKanchanapalli SrinivasNo ratings yet

- Keyboard InvoiceDocument1 pageKeyboard InvoiceMohit SharmaNo ratings yet

- Ajay Kumar Invoice 1308 PDFDocument1 pageAjay Kumar Invoice 1308 PDFbeast night100% (1)

- InsuranceDocument1 pageInsurancesubhrajit.omNo ratings yet

- Tax invoice receipt FUP25Mbps package renewalDocument1 pageTax invoice receipt FUP25Mbps package renewalDipam HalderNo ratings yet

- Complete Report OAPR-77102 Praveen 29aug2019Document13 pagesComplete Report OAPR-77102 Praveen 29aug2019Praveen MNNo ratings yet

- InvoiceDocument1 pageInvoiceUNo ratings yet

- Sanjeev House TaxDocument1 pageSanjeev House TaxShyam RawatNo ratings yet

- UmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceDocument2 pagesUmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceNSTI AKKINo ratings yet

- FranceDocument3 pagesFranceKelz YouknowmynameNo ratings yet

- Interpretation: LPL - Production Test Collection Centre Sector - 18, Block-E Rohini DELHI 110085Document4 pagesInterpretation: LPL - Production Test Collection Centre Sector - 18, Block-E Rohini DELHI 110085Anonymous oQWqJ5OwZNo ratings yet

- Tax Invoice: Duplicate For BuyerDocument1 pageTax Invoice: Duplicate For BuyerakhlaquemdNo ratings yet

- Updated SDHW20190830 Proforma Invoice For D12.42 Engine Assy.Document1 pageUpdated SDHW20190830 Proforma Invoice For D12.42 Engine Assy.Misra AbdoNo ratings yet

- TAX-INVOICEDocument1 pageTAX-INVOICERonak JainNo ratings yet

- Proforma InvoiceDocument4 pagesProforma InvoiceheruNo ratings yet

- Site RequirementsDocument1 pageSite RequirementsAbdullah RafeekNo ratings yet

- Parag MergedDocument614 pagesParag MergedHemantNo ratings yet

- Aditya Vision Tax Invoice for HP Printer SaleDocument9 pagesAditya Vision Tax Invoice for HP Printer SaleAditya ChapraNo ratings yet

- Bank Invoice 0105 REVISEDDocument1 pageBank Invoice 0105 REVISEDFarah GoganNo ratings yet

- InvoiceDocument1 pageInvoiceKeshav ShandilyaNo ratings yet

- Metronaut Men Light Blue Trousers: Grand Total 5800.00Document7 pagesMetronaut Men Light Blue Trousers: Grand Total 5800.00prince GoriaNo ratings yet

- Diwa One Plus 5Document1 pageDiwa One Plus 5kunal.nitw100% (1)

- ACT Invoice FOR JANDocument2 pagesACT Invoice FOR JANphani raja kumarNo ratings yet

- 2.atlassian Quote AT-152621027Document3 pages2.atlassian Quote AT-152621027Raheel KaziNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Anil KumarNo ratings yet

- Tax Invoice GST DetailsDocument1 pageTax Invoice GST Detailsshakeel ansari5518No ratings yet

- PolycyDocument10 pagesPolycyShivamDave100% (1)

- Amount Chargeable (In Words)Document1 pageAmount Chargeable (In Words)Rajani Kanta Dolai 3366No ratings yet

- Royal Stationery & Xerox: Santosh CorporationDocument8 pagesRoyal Stationery & Xerox: Santosh CorporationMrunali kadamNo ratings yet

- Order FL0179101992: Mode of Payment: CODDocument1 pageOrder FL0179101992: Mode of Payment: CODChandu NaiduNo ratings yet

- For Medical Bil LDocument1 pageFor Medical Bil LSrikanth ReddyNo ratings yet

- Tax Invoice for HeadphonesDocument1 pageTax Invoice for HeadphonesNavneet NigamNo ratings yet

- Tax Invoice for Automotive RepairsDocument2 pagesTax Invoice for Automotive Repairsnamitjain98No ratings yet

- Invoice PDFDocument1 pageInvoice PDFAnonymous a8BGieNo ratings yet

- Tax Invoice for Bluewud Concepts Pvt. LtdDocument1 pageTax Invoice for Bluewud Concepts Pvt. LtdNavdeep MinhasNo ratings yet

- Sanitiser Tax InvoiceDocument1 pageSanitiser Tax InvoiceSanjeev RanjanNo ratings yet

- Energy SDocument1 pageEnergy SROHIT SHARMA DEHRADUNNo ratings yet

- (Original) : Freight Invoice / Tax InvoiceDocument8 pages(Original) : Freight Invoice / Tax InvoiceEdith Olivera NozupNo ratings yet

- Rittal India Private Limited Control Panel QuotationDocument8 pagesRittal India Private Limited Control Panel QuotationAfreen KhanNo ratings yet

- HMSI Motorcycle Sale ReceiptDocument3 pagesHMSI Motorcycle Sale ReceiptKishore ChakrabortyNo ratings yet

- InvoiceDocument1 pageInvoiceRajan BuradNo ratings yet

- Complete TV Protection (3 Years) : Grand Total 629.00Document1 pageComplete TV Protection (3 Years) : Grand Total 629.00VasanthKumarNo ratings yet

- Your Reliance Bill: Summary of Current Charges Amount (RS)Document3 pagesYour Reliance Bill: Summary of Current Charges Amount (RS)enot06No ratings yet

- General Terms Conditions CFRDocument3 pagesGeneral Terms Conditions CFRAnonymous cQ13WWeNo ratings yet

- Lut BondDocument4 pagesLut BondprabinkumarsNo ratings yet

- Unofficial Guide To The IIFT CV FormDocument5 pagesUnofficial Guide To The IIFT CV FormSushanth Pai0% (1)

- FormE Nomination FormDocument2 pagesFormE Nomination FormAditya Raj VermaNo ratings yet

- Prepaid Order StatementDocument1 pagePrepaid Order StatementAditya Raj VermaNo ratings yet

- Online Exam Booking System - Aug 2012 PDFDocument1 pageOnline Exam Booking System - Aug 2012 PDFAditya Raj VermaNo ratings yet

- IndiGo boarding pass and travel detailsDocument1 pageIndiGo boarding pass and travel detailsAditya Raj VermaNo ratings yet

- 10th Marksheet - JPG PDFDocument1 page10th Marksheet - JPG PDFAditya Raj VermaNo ratings yet

- 2010 - Impact of Open Spaces On Health & WellbeingDocument24 pages2010 - Impact of Open Spaces On Health & WellbeingmonsNo ratings yet

- Mtle - Hema 1Document50 pagesMtle - Hema 1Leogene Earl FranciaNo ratings yet

- Exercises 6 Workshops 9001 - WBP1Document1 pageExercises 6 Workshops 9001 - WBP1rameshqcNo ratings yet

- Nokia MMS Java Library v1.1Document14 pagesNokia MMS Java Library v1.1nadrian1153848No ratings yet

- KPMG Inpection ReportDocument11 pagesKPMG Inpection ReportMacharia NgunjiriNo ratings yet

- Attributes and DialogsDocument29 pagesAttributes and DialogsErdenegombo MunkhbaatarNo ratings yet

- Obstetrical Hemorrhage: Reynold John D. ValenciaDocument82 pagesObstetrical Hemorrhage: Reynold John D. ValenciaReynold John ValenciaNo ratings yet

- Circular Flow of Process 4 Stages Powerpoint Slides TemplatesDocument9 pagesCircular Flow of Process 4 Stages Powerpoint Slides TemplatesAryan JainNo ratings yet

- CIT 3150 Computer Systems ArchitectureDocument3 pagesCIT 3150 Computer Systems ArchitectureMatheen TabidNo ratings yet

- CMC Ready ReckonerxlsxDocument3 pagesCMC Ready ReckonerxlsxShalaniNo ratings yet

- Controle de Abastecimento e ManutençãoDocument409 pagesControle de Abastecimento e ManutençãoHAROLDO LAGE VIEIRANo ratings yet

- Pre Job Hazard Analysis (PJHADocument2 pagesPre Job Hazard Analysis (PJHAjumaliNo ratings yet

- Oracle Learning ManagementDocument168 pagesOracle Learning ManagementAbhishek Singh TomarNo ratings yet

- Maverick Brochure SMLDocument16 pagesMaverick Brochure SMLmalaoui44No ratings yet

- NAT Order of Operations 82Document39 pagesNAT Order of Operations 82Kike PadillaNo ratings yet

- Thin Film Deposition TechniquesDocument20 pagesThin Film Deposition TechniquesShayan Ahmad Khattak, BS Physics Student, UoPNo ratings yet

- Marketing Plan for Monuro Clothing Store Expansion into CroatiaDocument35 pagesMarketing Plan for Monuro Clothing Store Expansion into CroatiaMuamer ĆimićNo ratings yet

- Agricultural Engineering Comprehensive Board Exam Reviewer: Agricultural Processing, Structures, and Allied SubjectsDocument84 pagesAgricultural Engineering Comprehensive Board Exam Reviewer: Agricultural Processing, Structures, and Allied SubjectsRachel vNo ratings yet

- Catalogoclevite PDFDocument6 pagesCatalogoclevite PDFDomingo YañezNo ratings yet

- Rubber Chemical Resistance Chart V001MAR17Document27 pagesRubber Chemical Resistance Chart V001MAR17Deepak patilNo ratings yet

- Instrumentation Positioner PresentationDocument43 pagesInstrumentation Positioner PresentationSangram Patnaik100% (1)

- MID TERM Question Paper SETTLEMENT PLANNING - SEC CDocument1 pageMID TERM Question Paper SETTLEMENT PLANNING - SEC CSHASHWAT GUPTANo ratings yet

- 20 Ua412s en 2.0 V1.16 EagDocument122 pages20 Ua412s en 2.0 V1.16 Eagxie samNo ratings yet

- Krok2 - Medicine - 2010Document27 pagesKrok2 - Medicine - 2010Badriya YussufNo ratings yet

- Last Clean ExceptionDocument24 pagesLast Clean Exceptionbeom choiNo ratings yet

- ESA Knowlage Sharing - Update (Autosaved)Document20 pagesESA Knowlage Sharing - Update (Autosaved)yared BerhanuNo ratings yet

- Log File Records Startup Sequence and Rendering CallsDocument334 pagesLog File Records Startup Sequence and Rendering CallsKossay BelkhammarNo ratings yet

- UTP3-SW04-TP60 Datasheet VER2.0Document2 pagesUTP3-SW04-TP60 Datasheet VER2.0Ricardo TitoNo ratings yet

- Forensic Science From The Crime Scene To The Crime Lab 2nd Edition Richard Saferstein Test BankDocument36 pagesForensic Science From The Crime Scene To The Crime Lab 2nd Edition Richard Saferstein Test Bankhilaryazariaqtoec4100% (25)

- Hyper-Threading Technology Architecture and Microarchitecture - SummaryDocument4 pagesHyper-Threading Technology Architecture and Microarchitecture - SummaryMuhammad UsmanNo ratings yet