Professional Documents

Culture Documents

MBA - Chapter 7

Uploaded by

GauravCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MBA - Chapter 7

Uploaded by

GauravCopyright:

Available Formats

Homework for Chapter 7

1. A riskfree asset

(a) has a return correlation coefficient with securities of 1.

(b) has a negative return covariance with each security.

(c) has a standard deviation of return of zero.

(d) has a positive return covariance with many securities.

(e) has a return correlation coefficient with securities of -1.

2. An investor has a planned holding period of one year. An instrument that would

qualify as a riskfree asset would be

(a) blue-chip common stock.

(b) corporate bond maturing in one year.

(c) six month insured C.D. from a bank.

(d) 30-day Treasury Bill.

(e) one-year Treasury Bill.

3. The purchase of a riskfree Treasury Bill

(a) is riskfree lending.

(b) is an acceptance of default risk.

(c) eliminates inflation-rate risk.

(d) is riskfree borrowing.

(e) still has reinvestment risk based on periodic interest receipts.

4. The change in market value for a long-term Treasury Bond occur from

(a) reinvestment-rate risk.

(b) market risk. (c) interest-rate risk.

(d) unique risk.

(e) default risk.

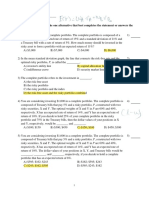

5. An investor develops a portfolio with 25% in a riskfree asset with a return of 6% and

the rest in a risky asset with expected return of 9% and standard deviation of 6%.

The standard deviation for the portfolio is:

(a) 20.3%. (b) 4.5%. (c) 0.0%. (d) 27.0%.

6. An investor has a portfolio with 60% in a riskfree asset with a return of 5% and the

rest in a risky asset with an expected return of 12% and a standard deviation of 10%.

Respectively, the expected return and standard deviation of the portfolio are

(a) 10.5%. (b) 9.7%. (c) 11.4%. (d) 12.6%.

7. An investor wishes to devise a portfolio consisting of a riskfree asset and a risk

portfolio. As his proportion placed in the riskfree asset increases, the expected

effects on the total portfolio's expected return and standard deviation would be to

(a) rise, rise.

(b) decline, rise.

(c) decline, remain the same.

(d) decline, decline.

(e) rise, remain the same.

8. The potential combinations of a riskfree lending with a risky portfolio results in a

plot of expected returns and standard deviations of

(a) straight line with negative slope.

(b) a nonlinear curve with increasing, positive slope.

(c) a flat line.

(d) a nonlinear curve with a decreasing, negative slope.

(e) straight line with positive slope.

9. The line connecting the riskfree return with the tangent point of the efficient set of

risky portfolios indicates combinations with

(a) lowest expected return for a given risk.

(b) an efficient level of risk.

(c) highest expected risk for a given expected return.

(d) highest expected return for a given risk.

10. An infinitely risk-averse investor will find his indifference curve tangent

(a) at the efficient risk portfolio.

(b) half way between the riskfree asset and the efficient risky portfolio.

(c) at the riskfree asset.

(d) to the northeast of the efficient risk portfolio.

11. Riskfree borrowing assumes

(a) the rate paid in equal to the rate earned on riskfree lending.

(b) the loan does not need to be repaid.

(c) the riskfree borrowing rate is greater than the riskfree lending rate.

(d) there is no interest charged for the loan.

12. Introducing riskfree borrowing into the model gives the investor the opportunity to

(a) repay former loans. (b) use margin.

(c) reduce leverage.

(d) sell short.

(e) put more money into the riskfree asset.

13. For an investor using margin

in the risky portfolio would

(a) zero.

(b)

(c) greater than 1.

(d)

to calculate the expected return, the proportion invested

be:

may be less than or greater than 1.

less than 1.

14. If the proportion invested in the riskfree asset is -.4, the proportion invested in

the risky portfolio is: (a) -1.4.

(b) 0.6.

(c) 0.0.

(d) 1.4.

(e) -0.6.

15. A margin user has a situation where the riskfree rate is 6% and the risky portfolio

has an expected return of 12% with a standard deviation of 15%. If the proportion in

risky portfolio is 1.8, the expected return is:

(a) 14.6%. (b) 19.2%. (c) 21.6%. (d) 16.8%.

16. A margin user has a proportion 1.3 invested in the risky portfolio that has .4 in A

with an expected return of 14%, .6 in B with an expected return of 18%. If the

riskfree rate is 5%, her expected return is

(a) 21.3%. (b) 16.4%. (c) 19.8%. (d) 18.2%.

17. The only person or organization eligible to borrow at the riskfree rate is

(a) the U.S. Treasury.

(b) a brokerage firm.

(c) a consumer with a good credit rating.

(d) a corporation with a high bond rating.

(e) a municipality.

18. Commercial paper is a source of short-term funds for

(a) the U.S. Treasury.

(b) municipalities.

(c) corporations with a good credit rating.

(d) consumers with poor credit rating.

(e) corporations with a poor credit rating.

You might also like

- Risk and Return: Name: - Grade and SectionDocument2 pagesRisk and Return: Name: - Grade and SectionWilhelmina L. RomanNo ratings yet

- Corporate Finance QuizDocument9 pagesCorporate Finance QuizRahul TiwariNo ratings yet

- The Cost of Capital: Multiple Choice QuestionsDocument26 pagesThe Cost of Capital: Multiple Choice QuestionsRodNo ratings yet

- McqsDocument4 pagesMcqsaashir ch0% (1)

- Soal Chapter 5Document5 pagesSoal Chapter 5Cherry BlasoomNo ratings yet

- Compared To Investing in A Single Security, Diversification Provides Investors A Way ToDocument8 pagesCompared To Investing in A Single Security, Diversification Provides Investors A Way ToDarlyn ValdezNo ratings yet

- DTTC, C7Document8 pagesDTTC, C7NhuNo ratings yet

- THE INVESTMENT SETTINGDocument74 pagesTHE INVESTMENT SETTINGMej Beit Chabab100% (1)

- Financial Management QuizDocument3 pagesFinancial Management QuizThea FloresNo ratings yet

- 8230 Sample Final 1Document8 pages8230 Sample Final 1lilbouyinNo ratings yet

- Homework 5Document9 pagesHomework 5mas888No ratings yet

- Multiple Choice at The End of LectureDocument6 pagesMultiple Choice at The End of LectureOriana LiNo ratings yet

- F&I Final AnswersDocument6 pagesF&I Final Answerstamer gendyNo ratings yet

- Mcqs Help FahadDocument7 pagesMcqs Help FahadAREEBA ABDUL MAJEEDNo ratings yet

- Chapter 4 - Q&ADocument19 pagesChapter 4 - Q&APro TenNo ratings yet

- Risk and Refinements in Capital Budgeting: Multiple Choice QuestionsDocument8 pagesRisk and Refinements in Capital Budgeting: Multiple Choice QuestionsRodNo ratings yet

- Fin QuestionsDocument20 pagesFin QuestionsMaria RahmanNo ratings yet

- Take Home QuizDocument8 pagesTake Home QuizJean CabigaoNo ratings yet

- FRM Test Portfolio ManagementDocument7 pagesFRM Test Portfolio Managementram ramNo ratings yet

- Act std4Document3 pagesAct std4Helen B. EvansNo ratings yet

- Investment Analysis (FIN 670) Fall 2009Document13 pagesInvestment Analysis (FIN 670) Fall 2009BAHADUR singhNo ratings yet

- Managerial Finance (NCC 5060) Sample Exemption ExamDocument9 pagesManagerial Finance (NCC 5060) Sample Exemption ExamStevent WongsoNo ratings yet

- Risk, Return & Capital BudgetingDocument12 pagesRisk, Return & Capital BudgetingIrfan ShakeelNo ratings yet

- IPOMDocument23 pagesIPOMmuskan200875No ratings yet

- Understanding risk and return in financial marketsDocument8 pagesUnderstanding risk and return in financial marketsNora RadNo ratings yet

- Mid-term investment questionsDocument10 pagesMid-term investment questionsZobia JavaidNo ratings yet

- Fin 072 Midterm ExamDocument10 pagesFin 072 Midterm ExamGargaritanoNo ratings yet

- Important Notice:: D. I, III and IV OnlyDocument12 pagesImportant Notice:: D. I, III and IV Onlyjohn183790No ratings yet

- ETS Finance Review QuizDocument4 pagesETS Finance Review QuizRaine PiliinNo ratings yet

- PortfolioDocument74 pagesPortfolioMega Pop LockerNo ratings yet

- Financial Risk Management Problem Set 1Document3 pagesFinancial Risk Management Problem Set 1Valentin IsNo ratings yet

- Finance MCQsDocument12 pagesFinance MCQsrajendraeNo ratings yet

- CH 7Document45 pagesCH 7yawnzz89100% (3)

- CPA Review Cost of CapitalDocument12 pagesCPA Review Cost of CapitalCarlito B. BancilNo ratings yet

- Quiz 1Document8 pagesQuiz 1HUANG WENCHENNo ratings yet

- Example Questions Finance 2016-2017Document6 pagesExample Questions Finance 2016-2017comllikNo ratings yet

- ĐTTC Duy LinhDocument21 pagesĐTTC Duy LinhThảo LêNo ratings yet

- CH 11Document49 pagesCH 11boodjo715No ratings yet

- Chapter 5Document5 pagesChapter 5Khue NgoNo ratings yet

- Chapter 6 Note 2Document41 pagesChapter 6 Note 2محمد الجمريNo ratings yet

- Practice Midterm 1Document6 pagesPractice Midterm 1dominicbcooper0603No ratings yet

- Chapter EightDocument9 pagesChapter EightAsif HossainNo ratings yet

- Homework 1 Due Thursday 04/11 (By 6pm London Time) One Copy Per GroupDocument5 pagesHomework 1 Due Thursday 04/11 (By 6pm London Time) One Copy Per GroupJosh GirnunNo ratings yet

- HW01Document5 pagesHW01lhbhcjlyhNo ratings yet

- MCQ CapitalrationingDocument2 pagesMCQ Capitalrationingvirendra kumarNo ratings yet

- Activity 6B CapStructure FinmaDocument4 pagesActivity 6B CapStructure FinmaDiomela BionganNo ratings yet

- Problem Set 1Document3 pagesProblem Set 1ikramraya0No ratings yet

- Demand for Risky Assets QuestionsDocument7 pagesDemand for Risky Assets QuestionsKc ToraynoNo ratings yet

- 308 Final Mock B F23Document18 pages308 Final Mock B F23juliarust7No ratings yet

- Management QuestionsDocument42 pagesManagement QuestionsRohit Rajput60% (5)

- Practice 1Document3 pagesPractice 1Shahida Akter 1520691631No ratings yet

- Basic: Problem SetsDocument4 pagesBasic: Problem SetspinoNo ratings yet

- Mock Cfe Fin072Document4 pagesMock Cfe Fin072lancelotroyal21No ratings yet

- Homework Fin InvestmentDocument5 pagesHomework Fin Investmentdamtuan11012000No ratings yet

- Security Analysis and Portfolio Management V1Document7 pagesSecurity Analysis and Portfolio Management V1solvedcareNo ratings yet

- Bond Yields and Prices Multiple Choice QuestionsDocument13 pagesBond Yields and Prices Multiple Choice QuestionsManuel BoahenNo ratings yet

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- CFA 2012: Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyFrom EverandCFA 2012: Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyRating: 3 out of 5 stars3/5 (2)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Counterparty Credit Risk: The new challenge for global financial marketsFrom EverandCounterparty Credit Risk: The new challenge for global financial marketsRating: 2.5 out of 5 stars2.5/5 (2)

- Linking Words PDFDocument2 pagesLinking Words PDFmanojkhadka23No ratings yet

- MGI Big Data Exec SummaryDocument20 pagesMGI Big Data Exec SummaryBaba PrasadNo ratings yet

- Data AggregationDocument68 pagesData AggregationGauravNo ratings yet

- Parallel Structure - Explanation and Exercises: Exercise #1: Complete The Following Sentences Using Parallel StructureDocument2 pagesParallel Structure - Explanation and Exercises: Exercise #1: Complete The Following Sentences Using Parallel StructureGauravNo ratings yet

- MBA - Futures, Multiple QuestionsDocument3 pagesMBA - Futures, Multiple QuestionsGauravNo ratings yet

- Cover Letter GuideDocument16 pagesCover Letter GuideGauravNo ratings yet

- Forensic Accounting Power PointDocument18 pagesForensic Accounting Power PointGaurav100% (2)

- Financial Statement Analysis: Presenter's Name Presenter's Title DD Month YyyyDocument30 pagesFinancial Statement Analysis: Presenter's Name Presenter's Title DD Month YyyyDammika MadusankaNo ratings yet

- Homework on Options Trading StrategiesDocument5 pagesHomework on Options Trading StrategiesGauravNo ratings yet

- Keywords to Highlight Skills & ExperienceDocument4 pagesKeywords to Highlight Skills & ExperienceTammy CollinsNo ratings yet

- Turkey Attractiveness 2013 PDFDocument60 pagesTurkey Attractiveness 2013 PDFSercan DemirelNo ratings yet

- Financial Statement Analysis: Presenter's Name Presenter's Title DD Month YyyyDocument30 pagesFinancial Statement Analysis: Presenter's Name Presenter's Title DD Month YyyyDammika MadusankaNo ratings yet

- Architecture Study in USDocument4 pagesArchitecture Study in USGauravNo ratings yet

- Business Objects PresentationDocument11 pagesBusiness Objects PresentationGauravNo ratings yet

- Emerging Tech: How Smart Dust Could Revolutionize Medicine and Environment MonitoringDocument31 pagesEmerging Tech: How Smart Dust Could Revolutionize Medicine and Environment MonitoringGauravNo ratings yet

- 2010-08-24 190659 PenisonifullDocument10 pages2010-08-24 190659 PenisonifullGauravNo ratings yet

- HDPP FinalDocument23 pagesHDPP FinalGauravNo ratings yet

- MCQ 2Document10 pagesMCQ 2GauravNo ratings yet

- Units Materials Conversion Percent Complete: Illinois CompanyDocument1 pageUnits Materials Conversion Percent Complete: Illinois CompanyGauravNo ratings yet

- Chapter 15 The Term Structure of Interest Rates A. Yield-To-MaturityDocument6 pagesChapter 15 The Term Structure of Interest Rates A. Yield-To-MaturityGauravNo ratings yet

- Krajewski Ism Ch4Document8 pagesKrajewski Ism Ch4GauravNo ratings yet

- MGRL Practice 2 ModDocument20 pagesMGRL Practice 2 ModAnn Kristine TrinidadNo ratings yet

- Test 2 Chapters 4-7Document10 pagesTest 2 Chapters 4-7GauravNo ratings yet

- Financial Accounting TEMA 1Document43 pagesFinancial Accounting TEMA 1adriamg95No ratings yet

- CBM2092 DatasheetDocument18 pagesCBM2092 DatasheetGauravNo ratings yet

- Arch Interview QuestionsDocument5 pagesArch Interview QuestionssuperECE100% (1)

- Comparative Assessment of Green Building ToolsDocument13 pagesComparative Assessment of Green Building ToolsGauravNo ratings yet

- Minors AgreementDocument12 pagesMinors AgreementDilip KumarNo ratings yet

- Dwnload Full Retailing 8th Edition Dunne Test Bank PDFDocument35 pagesDwnload Full Retailing 8th Edition Dunne Test Bank PDFjayden4r4xarnold100% (14)

- Customer preferences drive mobile choicesDocument12 pagesCustomer preferences drive mobile choicesNeha Kanak100% (2)

- Apa Sponsorship BookletDocument22 pagesApa Sponsorship BookletTrouvaille BaliNo ratings yet

- XUB 3rd Convocation 22nd March2017Document160 pagesXUB 3rd Convocation 22nd March2017Chinmoy BandyopadhyayNo ratings yet

- Steel Prospectus in GCCDocument4 pagesSteel Prospectus in GCCAshish AggarwalNo ratings yet

- Branding For Impact by Leke Alder PDFDocument22 pagesBranding For Impact by Leke Alder PDFNeroNo ratings yet

- Source of Wealth - NETELLERDocument2 pagesSource of Wealth - NETELLERTahsin Ove100% (1)

- How Organizations Change Over TimeDocument36 pagesHow Organizations Change Over TimeTareq Abu Shreehah100% (1)

- North America Equity ResearchDocument8 pagesNorth America Equity ResearchshamashmNo ratings yet

- Sally Yoshizaki Vs Joy Training Case DigestDocument5 pagesSally Yoshizaki Vs Joy Training Case DigestPebs DrlieNo ratings yet

- Chapter-I: Customer Service and Loan Activities of Nepal Bank LimitedDocument48 pagesChapter-I: Customer Service and Loan Activities of Nepal Bank Limitedram binod yadavNo ratings yet

- Project Profile On Automobile WiresDocument8 pagesProject Profile On Automobile WiresGirishNo ratings yet

- MCI BrochureDocument7 pagesMCI BrochureAndrzej M KotasNo ratings yet

- Etr - Siti Zubaidah Azizan M at 14 - 5Document5 pagesEtr - Siti Zubaidah Azizan M at 14 - 5Aziful AiemanNo ratings yet

- MAN Machine Material: Bottle Dented Too MuchDocument8 pagesMAN Machine Material: Bottle Dented Too Muchwaranya suttiwanNo ratings yet

- Ofada Rice ProductionDocument97 pagesOfada Rice ProductionPrince Oludare AkintolaNo ratings yet

- Acetic Acid Uses, Suppliers & PropertiesDocument46 pagesAcetic Acid Uses, Suppliers & PropertiesUsman DarNo ratings yet

- Economy in Steel - A Practical GuideDocument30 pagesEconomy in Steel - A Practical Guidechandabhi70No ratings yet

- Cases On CommodatumDocument10 pagesCases On CommodatumAlfons Janssen MarceraNo ratings yet

- HGHGKJDocument66 pagesHGHGKJHuyenDaoNo ratings yet

- Nike: The world's leading sportswear brandDocument20 pagesNike: The world's leading sportswear brandMohit ManaktalaNo ratings yet

- Kalyan Pharma Ltd.Document33 pagesKalyan Pharma Ltd.Parth V. PurohitNo ratings yet

- Bot ContractDocument18 pagesBot ContractideyNo ratings yet

- Chanakya Neeti on ManagementDocument19 pagesChanakya Neeti on ManagementShivamNo ratings yet

- Universidad de Lima Study Session 5 Questions and AnswersDocument36 pagesUniversidad de Lima Study Session 5 Questions and Answersjzedano95No ratings yet

- SEC - Graduate PositionDocument6 pagesSEC - Graduate PositionGiorgos MeleasNo ratings yet

- ENSP - Tender No.0056 - ENSP - DPE - AE - INV - 19 - Supply of A Truck Mounted Bundle ExtractorDocument2 pagesENSP - Tender No.0056 - ENSP - DPE - AE - INV - 19 - Supply of A Truck Mounted Bundle ExtractorOussama AmaraNo ratings yet

- Norkis Distributors v. CA (CD-Asia)Document4 pagesNorkis Distributors v. CA (CD-Asia)Pia GNo ratings yet

- ASSIGNMENT LAW 2 (TASK 1) (2) BBBDocument4 pagesASSIGNMENT LAW 2 (TASK 1) (2) BBBChong Kai MingNo ratings yet