Professional Documents

Culture Documents

Nepal Budget 2071

Uploaded by

AyanilCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nepal Budget 2071

Uploaded by

AyanilCopyright:

Available Formats

NBSM & Associates

Chartered Accountants

NEPAL BUDGET 2071

TAX PRESPECTIVE

Nepal Budget 2071-Tax Perspective

Income Tax

WAIVERS OF TAX, PENALTY & INTEREST

-

Tax payers having annual turnover up to Rs. 20 lakhs or annual profit up to Rs. 2 lakhs and have not submitted

their Income Tax Return up to FY 2069/70, if they submit the Income tax return and pay tax thereon for the FY

2067/68, 2068/69 and 2069/70 by Paush End, 2071 then they are not required to submit the Income Tax Returns

of earlier years and also income tax, fine, interest and penalties of such earlier years shall be waived.

Tax payers like Doctors, Artists, Engineers, Lawyers, Auditor, Traders, Industrialists, Investors, Consultants,

Agents, Retired Persons, Employees, Teachers, Professors etc and any other persons/institutions who had

income for the FY 2069/70 or earlier years and have not paid tax and submitted Income Tax Returns for the FY

2069/70 and earlier years. If they obtain the PAN, Pay Tax and submit the Income Tax Return for the FY 2067/68,

2068/69 and 2069/70 within the end of Poush 2071 then they are not required to submit the Income Tax Returns

of earlier years and also income tax, fine, interest and penalties of such earlier years shall be waived.

Tax payers being Journalists and Media Houses who have not taken PAN, If they obtain the PAN, pay tax and

submit the Income Tax Return for the FY 2068/69 & 2069/70 within the end of Poush 2071 then they are not

required to submit the Income Tax Returns of earlier years. And provision for waiving income tax, penalty and

interest on the income of such years has been made.

Tax payers being Cooperatives other than Tax Exempted Cooperatives, if they get their books of accounts

audited and pay tax, submit the Income Tax Return for the FY 2067/68, 2068/69 and 2069/70 within the end of

Poush 2071 then they are not required to submit the Income Tax Returns of earlier years. And provision for

waiving income tax, penalty and interest on the income of such earlier years has been made.

Tax payers being exempted Cooperatives, if they get their books of accounts audited for the FY 2067/68, 2068/69

and 2069/70 and pay TDS, House Rent Tax and Advance Tax within the end of Poush 2071 then provision for

waiving penalty and interest on such liabilities has been made.

TAX RATES

PERSONAL TAX

A. For Resident Person

FY 2070/71

Particulars

Rs.

FY 2071/72

Tax Rate

Rs.

Tax Rate

250000

100,000

350,000

1%

15%

25%

300000

100,000

40,0000

1%

15%

25%

Assessed as Individual

First Tax slab

Next

Balance Exceeding

200,000

100,000

300,000

1%

15%

25%

Assessed as Couple

First Tax Slab

Next

Balance Exceeding

Disclaimer:

250000

100,000

350,000

1%

15%

25%

The information contained in this document is compiled by NBSM & Associates and is exclusively for the

information of its clients and staffs. However the detail study is recommended before taking any decisions on the

matters contained herein.

Nepal Budget 2071-Tax Perspective

In case the Taxable Salary of an Individual is more than Rs. 25 Lakhs,

additional tax at the rate of 40 percent shall be levied on the tax

applicable on the income above Rs. 25,00,000.

Notes:

1. Natural person working at remote areas are entitled to get deduction from taxable income to a maximum of Rs.

50000.

2. Natural person with pension income included in the taxable income shall be entitled to deduct from taxable income

an additional 25% of amount prescribed under first tax slab.

3. Incapacitated natural person shall be entitled to get deduction from taxable income an additional 50% of amount

prescribed under first tax slab.

4. A natural person who has procured life insurance and paid premium amount thereon shall be entitled to a deduction

of actual annual insurance premium or Rs. 20000 whichever is less from gross taxable income.

5. In case of the employee employed at the foreign diplomatic of Nepal only 25% of the foreign allowances are to be

included in the income from salary.

6. In case of the employee posted outside Nepal is getting foreign allowance will get 75% rebate of such allowance.

7. In case of the female employee whose taxable income is only from employment than 10% rebate is allowed on tax

liability.

8. In case of individual having income from export, tax rate of 15% is applicable in place of 25%.

B. For Non-Resident Person

S. N.

Nature of transaction

FY 2070/71

FY 2071/72

1.

Income earned from normal transactions.

Income earned from providing shipping, air transport or

telecommunication services, postage, satellite, optical fiber

project.

Income earned providing shipping, air transport of

telecommunication services through the territory of Nepal.

25% flat rate

25% flat rate

5%

5%

2%

2%

5%

5%

a.

b.

c.

Repatriation by Foreign Permanent Establishment.

CORPORATE TAX

S.

N.

1

1.1

Nature of entity

FY 2071/72

25%

25%

20%

(Normal Rate)

20%

(Normal Rate)

Company/Firm /Industry

Domestic income

Normal Rate (NR)

1.2

FY 2070/71

Other

Special industries (mainly manufacturing other than

alcoholic &tobacco producing industry)

II. Providing direct employment to Nepalese citizens:

I.

Disclaimer:

The information contained in this document is compiled by NBSM & Associates and is exclusively for the

information of its clients and staffs. However the detail study is recommended before taking any decisions on the

matters contained herein.

Nepal Budget 2071-Tax Perspective

a. For 300 or more by special industries and

information technology industries.

b. For 1200or more by Special industries.

c. To 100 Nepalese including 33% women, dalit

& disabled by Special industries.

90%Normal Rate

90%Normal Rate

80% Normal Rate

80% Normal Rate

80% Normal Rate

80% Normal Rate

100% Income is exempt from

tax for the first 5 years from

the date of commencement

of production and 50% of

income is exempt from tax

for next 3 years.

a. New Industries established with more

than ten million capital and provide direct

employment more than 500 peoples for a

complete year or,

III.

b. New Industry related to Tourism and

Aviation with more than twenty million

capital or,

c. Running

industry

with

substantial

expansion (at least 25% of existing

capacity) with capital not less than ten

million and provide direct employment

more than 500 peoples for complete year.

As per the Budget Speech, However the same

has not been reflected in the Finance Bill.

IV.

V.

Establishment of well facilitated hotel in the

bank/area of Rara lake and other famous lake of

Nepal

Industries establishment in very undeveloped areas

(sec 11.3.b) as defined in Industrial Enterprise Act.

Industries establishment in undeveloped areas

VI. (sec11.3.b) as defined in Industrial Enterprise Act

Established in underdeveloped areas (Sec 11.3.b).

VII. as defined in Industrial Enterprise Act

Industry established in 'Special Economic Zone'

VIII. recognized in mountain areas or hill

areas by the GON

Industry established in 'Special Economic Zone' other

than above locations

IX.

X.

100% exempt from income

tax for 10 years

Dividend distributed by the industry established in the

special economic zone

Income derived by the foreign investors from

investment in 'Special Economic Zone'( source of

XI.

income use of foreign technology, management

service fee and royalty)

Import income of information technology industries as

XII.

IT Park as declared by government.

XIII. Institution having licensed to generate, transmit, and

Disclaimer:

10% of the normal rate

(for 10yrs from the year of

establishment)

10% of the normal rate (for

10yrs from the year of

establishment)

20% of the normal rate

(for 10yrs from the year of

establishment)

30% of the normal rate

(for 10yrs from the year of

establishment)

Up to 10 years 100%

exempt and 50% rebate

in subsequent years

100% exempt up to first

five years and 50%

rebate in subsequent

years

Dividend Tax is 100%

exempt up to first five

years and 50% rebate in

subsequent 3 years

20% of the normal rate (for

10yrs from the year of

establishment)

30% of the normal rate (for

10yrs from the year of

establishment)

Up to 10 years 100% exempt

and 50% rebate in subsequent

years

50% of applicable tax rate

50% of applicable tax rate

50% of normal tax rates

50% of normal tax rates

100%

exempt

up

to

100% exempt up to first five

years and 50% rebate in

subsequent years

Dividend Tax is 100% exempt

up to first five years and 50%

rebate in subsequent 3 years

100% exempt up to seven

The information contained in this document is compiled by NBSM & Associates and is exclusively for the

information of its clients and staffs. However the detail study is recommended before taking any decisions on the

matters contained herein.

Nepal Budget 2071-Tax Perspective

XIV.

XV.

XVI.

XVII.

XVIII.

XIX.

distribute electricity shall be allowed if the

commercial activities started in terms of electricity

generation , generation and transmission, generation

and distribution or generation, transmission

distribution before B.S 2075 Chaitra and these

exemption shall also be available for solar, wind and

other alternative energy companies.

Income from export of goods produced by

manufacturing industries

Income from construction and operation of road,

Bridge, Airport and tunnel or income investment in

tram and trolley bus

Income manufacturing industry, tourism service

industry hydropower generation, distribution and

transmission industry listed in the security exchange

(i.e. capital market)

Industry established in least developed area

producing brandy, wine, side from fruits

Royalty from export of intellectual asset by a person

Income from sale by intellectual asset by a person

through transfer

Presumptive tax for Natural person carrying

Proprietorship

business

in

metropolitan,

XX. municipality and VDC

1.3

Development

Banks

and

60% of applicable tax rate

(i.e. 20%)

60% of applicable tax rate (i.e.

20%)

90% of applicable tax rate

90% of applicable tax rate

60% of applicable tax rate

up to 10 years

75% of applicable tax rate

60% of applicable tax rate up

to 10 years

75% of applicable tax rate

50% of applicable tax rate

50% of applicable tax rate

3500 for the person

conducting

business

within

Metropolitan Area

2000 for the person

conducting

business

within

Municipality and

1250 for the person

conducting

business anywhere

outside the limit of

Metropolitan Area

and

Municipality

Area

5000 for the

person

conducting

business

within Metropolitan Area

2500 for the person

conducting

business

within Municipality and

1500 for the person

conducting

business

anywhere outside the

limit

of

Metropolitan

Area and Municipality

Area

30%

30%

30%

30%

30%

30%

100% exempted up to

seven years and 50%

rebate on subsequent 3

years

100%exempted up to seven

years and 50% rebate on

subsequent 3 years

20%

20%

Petroleum Industries

Entity engaged in Petroleum business under Nepal

Petroleum Act , 2010

Institution having licensed to exploration for

petroleum or natural gas become commercial before

B.S 2075 Chaitra

1.6

75% of normal rate

Insurance business

General insurance business

1.5

75% of normal rate

years and 50% rebate on

subsequent 3 years.

Bank and Financial Institution

Commercial banks,

Finance companies

1.4

seven years and 50%

rebate on subsequent 3

years

Other Business Entities

-

Disclaimer:

Entity involves in construction of roads,

bridges, tunnels, Rope-ways, suspension

bridges etc.

Income earned by the natural person wholly

involved in special industry

The information contained in this document is compiled by NBSM & Associates and is exclusively for the

information of its clients and staffs. However the detail study is recommended before taking any decisions on the

matters contained herein.

Nepal Budget 2071-Tax Perspective

-

1.7

1.8

Income earned by the resident person

relating to export activities

Saving and Credit Co-Operatives established in rural

areas under Co-Operatives Act, 2048.

Saving and Credit Co-Operatives established in

Metropolitan City, Sub-Metropolitan City and areas

attached with above metropolitan city and submetropolitan city under Co-Operative Act, 2048.

Nil

Nil

20%

20%

TDS WITHHOLDING IN OTHER PAYMENTS

S. N.

A.

Nature of transaction

FY 2070/71

FY 2071/72

Interest income from deposit up to Rs 10000 under

'Micro Finance Program', 'Rural Development Bank',

'Postal Saving Bank' & Co-Operative (u/s-11(2) in

rural areas)

Exempt from tax

Exempt from tax

25%

25%

Nil

Nil

10%

10%

10%

10%

5%

10%

5%

10%

10%

15%

10%

15%

5% for both

5% for both

5%

5%

5%

5%

5%

5%

No TDS

No TDS

No TDS

No TDS

No TDS

No TDS

Wind fall gains

B.

C.

D.

Wind fall gains from Literature, Arts, Culture, Sports,

Journalism, Science & Technology and Public

Administration amount received up to 5 lacs

Payment of rent by resident person having source in

Nepal

Profit and Gain from Transaction of commodity future

market

Profit and Gain from Disposal of Shares:

In case of Individual

- Listed Shares

- Non Listed Shares

E.

Others

- Listed Shares

- Non Listed Shares

F.

G.

H.

I.

J.

K.

L.

Disclaimer:

On dividend paid by the resident entity.

- To Resident Person

- To Non Resident Person

On payment of gain in investment insurance

On payment of gain from unapproved retirement fund

On payment of interest or similar type having source

in Nepal to natural person [ not involved in any

business activity ] by Resident Bank, financial

institutions or debenture issuing entity, or listed

company

Payment made by natural person relating to

business or other payments relating to house rental

except house rent

Payment for articles published in newspaper,

question setting, answer evaluation

Interest payment to Resident bank, other financial

institutions

The information contained in this document is compiled by NBSM & Associates and is exclusively for the

information of its clients and staffs. However the detail study is recommended before taking any decisions on the

matters contained herein.

Nepal Budget 2071-Tax Perspective

M.

N.

O.

P.

Q.

R.

S.

T.

U.

V.

Interregional interchange fee paid to credit card

issuing bank

Interest or fees paid by Government of Nepal under

bilateral agreement

On payment of general insurance premium to

resident insurance company

On payment of premium to non-resident insurance

company

Contract payment exceeding Rs 50000 for a single

contract wtith in 10 days.

Interest & Dividend paid by Mutual Fund

Payment of consultancy fee:

- to resident person against VAT invoice

- to resident person against non VAT invoice

Payment on contract to Non Resident Person

- On service contract

- On repair of aircraft & other contract

- In cases other than above as directed by

IRD.

Gain on disposal of Interest in any resident entity

(both listed or unlisted) exchange (Taxable amount is

calculated under section 37)

- To resident natural person

- To others including non resident

TDS deducted on payment of dividend made by

Mutual fund to natural Person is final withholding

Tax.

No TDS

No TDS

No TDS

No TDS

No TDS

No TDS

1.5%

1.5%

1.5%

1.5%

Newly Introduced

No TDS

1.5%

15%

1.5%

15%

15%

5%

15%

5%

10%

15%

10%

15%

5%

5%

INCOME FROM INVESTMENT

S. N

1.

Particulars

Individual

Tax withholding on capital gain for natural person on transaction

exceeding Rs 3 million (to be made by land revenue office at the

time of registration)

- disposal of land or land & building owned for more than 5

years up to 10 years

- disposal of land or land & building owned for less than 5

years

Corporate

Income from disposal of non business chargeable assets (Capital

Gain)

2.

FY 2070/71

FY 2071/72

2.5%

2.5%

5%

5%

Normal Rate

Normal Rate

Value Added Tax

-

No changes in the existing rate of 13 percent for the fiscal year 2071/72 .

Tax payer who are not registered in VAT but his transaction fall under Vatable Transaction and turnover exceed

20 lakhs up to FY 2069/70, paid Presumptive Tax showing turnover less than 20 lakhs, if get registered in VAT

Disclaimer:

The information contained in this document is compiled by NBSM & Associates and is exclusively for the

information of its clients and staffs. However the detail study is recommended before taking any decisions on the

matters contained herein.

Nepal Budget 2071-Tax Perspective

within Poush End 2071, declare the actual turnover and pay Income Tax @ 2% and VAT @ 3% on the difference

of Turnover Value, then the amount of tax will be final to the extent of turnover declared by such taxpayer. But in

case of Taxpayer engaged in the business of cigarette and gas, if they pay 0.5% (in aggregate of income tax and

VAT) of difference of Turnover then the amount will be final to the extent of turnover declared by such taxpayer.

However, if the business is the VAT Exempted Business, if they pay 2% Income tax of difference of Turnover then

the amount will be final to the extent of turnover declared by such taxpayer.

-

Tax payers registered in VAT prior to FY 2069/70, who have not submitted the VAT Return, if they submit the

VAT Return and pay VAT thereon of such financial years within the end of Poush 2071 then penalties, Additional

fine and interest thereon shall be waived.

Tax payer engaged in the business of Education Consultancy who is not registered on VAT up to Ashad 2071, if

they register in VAT within Poush 2071, then they will be exempt from VAT, penalties and interest prior to the date

of registration.

Tax payer engaged in the business of Crusher Industry who is not registered on VAT up to Ashad 2071, if they

register in VAT within Poush 2071, then they will be exempt from VAT, penalties and interest prior to the date of

registration.

Excise Duty

The Budget 2071 has proposed higher Excise Duties on Tobacco and Liquor Items. The rates being applicable are

prescribed below:

Materials

KHUDO

SHAKHAR

Beer

Other cold drinks less than 12 % alcohol

Wine 12 % alcohol

Fine 12-17% alcohol

Wine more than 17 %

SIDER MAFE From Apple Juice

Raw material of wine and brandy

Raw materials of whisky, rum & TAFIA,

GIN & GENEVA, Vodka, liquors and other

alcohol including spirit

Rectified spirit and ENA

Brandy and wine, whisky, Rum and TAFAI,

GIN & GENEVA, vodka, liquors & cordials

25 UP strength

Brandy and wine, whisky, Rum TAFAI, GIN

& GENEVA, vodka, liquors & cordials 30

UP strength

Any other alcoholic drinks of 15 UP

strength

Any other alcoholic drinks of 25 UP

Disclaimer:

Per Kg

Per Kg

Per Ltr

Per Ltr

Per Ltr

Per Ltr

Per Ltr

Per Ltr

Per Ltr

Prevailing rate for 2070

(Rs.)

45

80

88

210

210

220

240

55

115

Proposed rate for 2071

(Rs)

45

80

92

230

230

230

260

60

115

Per Kg

115

115

Per Ltr

50

497

50

538

Per LP Ltr

663

716

Per Ltr

464

501

per LP ltr

663

716

Per Ltr

Per LP Ltr

Per Ltr

667

785

497

719

848

538

Unit

The information contained in this document is compiled by NBSM & Associates and is exclusively for the

information of its clients and staffs. However the detail study is recommended before taking any decisions on the

matters contained herein.

Nepal Budget 2071-Tax Perspective

strength

Any other alcoholic drinks of 30 UP

strength

Any other alcoholic drinks of 40 UP

strength

Any other alcoholic drinks of 50 UP

strength

Any other alcoholic drinks of 70 UP

strength

Nicotine , Pan Masala and Gutkha

All type of Cigar

Cigarette 70 mm with filter

Cigarette 70 mm without filter

Cigarette 70-75 mm with filter

Cigarette 75-85 mm with filter

Cigarette above 85 mm with filter

Per LP Ltr

Per Ltr

per LP ltr

Per Ltr

per LP ltr

Per Ltr

per LP ltr

Per Ltr

per LP ltr

Per Gram

Per Khilli

Per Yem

Per Yem

Per Yem

Per Yem

Per Yem

663

464

663

235

392

84

168

20

67

275

9

597

272

763

977

1306

716

501

716

254

423

125

250

22

72

325

10

657

294

839

1075

1463

Custom Duty

The budget has purposed exemption on custom duty for certain infrastructure and agriculture related products, few are

highlighted below:

Exemption

Particular

For the purpose of Construction of Cable Care, On Import of cable and

Readymade Cab or steel plates used in manufacturing of cab.

Import of vehicle used for transportation of tea products by Tea

processing and production industries.

In case of import of milking machine and refrigerated van used in

transportation of meat items or, any person going for Foreign

Employment and had worked for at least one year, bring one television

set up to 32 inch.

50% exemption on import duty

100% exemption on import duty

********************

Disclaimer:

The information contained in this document is compiled by NBSM & Associates and is exclusively for the

information of its clients and staffs. However the detail study is recommended before taking any decisions on the

matters contained herein.

Nepal Budget 2071-Tax Perspective

FOR FURTHER CORRESPONDENCE:

NBSM & Associates

Chartered Accountants

Head Office

Kathmandu

6th Floor, Four Square Complex, Naxal, Kathmandu, Nepal

Phone: 977-1-4433069, Mobile: 977-9851112614,

E-mail: nil.saru@nbsm.com.np, Website: www.nbsm.com.np

Branch Offices

NBSM Consulting Pvt. Ltd,

Butwal Branch

Phone: 977-9851070442

Chitwan Contact Office

Phone: 977-9851036856

NBSM

is

the

leading Accounting

Firm in Nepal.

Headquartered in

Kathmandu,

NBSM

is

the

independent

member of GGIGeneva

Group

International.

GGI is the One of

the Largest Global

Association

of

Accountants,

Auditors,

Consultants

and

Lawyers. With its

Global

Revenue

more than 4 Billion

USD, It has been

ranked

consistently as the

Largest

Multidisciplinary

Association

of

Accountants

for

many years.

Disclaimer:

The information contained in this document is compiled by NBSM & Associates and is exclusively for the

information of its clients and staffs. However the detail study is recommended before taking any decisions on the

matters contained herein.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

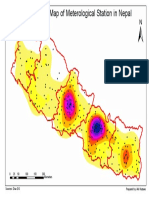

- Kernel Density Metrological Station NepalDocument1 pageKernel Density Metrological Station NepalAyanilNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Mathemeatical Model of Glider TrajectoryDocument6 pagesMathemeatical Model of Glider TrajectoryAyanilNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Activation Code HytranDocument1 pageActivation Code HytranAyanilNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Glider Report Team Anil VuDocument55 pagesGlider Report Team Anil VuAyanilNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- MM ConclusionDocument2 pagesMM ConclusionAyanilNo ratings yet

- 0 2 4 6 8 1 Kilometers: Prepared By: Anil KutuwoDocument1 page0 2 4 6 8 1 Kilometers: Prepared By: Anil KutuwoAyanilNo ratings yet

- Preliminary Design of Francis Turbine - 170927 - 1Document7 pagesPreliminary Design of Francis Turbine - 170927 - 1AyanilNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- DG Georeference LayoutDocument1 pageDG Georeference LayoutAyanilNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Legend: Seti Karnali MahakaliDocument1 pageLegend: Seti Karnali MahakaliAyanilNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Babai Surge Analysis 2016june DraftDocument7 pagesBabai Surge Analysis 2016june DraftAyanilNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- HyTran Training Hill ChartDocument31 pagesHyTran Training Hill ChartAyanilNo ratings yet

- Your Company Name: 123 Main Street Suite #321 City, State 01234Document2 pagesYour Company Name: 123 Main Street Suite #321 City, State 01234AyanilNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Long Crested Weir DesignDocument9 pagesLong Crested Weir Designbalaji_raochNo ratings yet

- What Is A Cam, r5, Dvdrip, DVDSCR, XvidDocument4 pagesWhat Is A Cam, r5, Dvdrip, DVDSCR, XvidAyanilNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Hydrology Tour III-IIDocument9 pagesHydrology Tour III-IIAyanilNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Geo Tour To Malekhu ReportDocument33 pagesGeo Tour To Malekhu ReportAyanil67% (12)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Hydraulic Design Structural Design Floor Design Detailed Drawings Solved ExampleDocument31 pagesHydraulic Design Structural Design Floor Design Detailed Drawings Solved ExampleAyanil100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Master ReportDocument42 pagesMaster ReportAyanilNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- RSC SCST Programme Briefing For Factories enDocument4 pagesRSC SCST Programme Briefing For Factories enmanikNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- QinQ Configuration PDFDocument76 pagesQinQ Configuration PDF_kochalo_100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Bhrighu Saral Paddhati - 1Document212 pagesBhrighu Saral Paddhati - 1ErrovioNo ratings yet

- Missions ETC 2020 SchemesOfWarDocument10 pagesMissions ETC 2020 SchemesOfWarDanieleBisignanoNo ratings yet

- Region 2Document75 pagesRegion 2yoyiyyiiyiyNo ratings yet

- MBA Advantage LRDocument304 pagesMBA Advantage LRAdam WittNo ratings yet

- Bernard New PersDocument12 pagesBernard New PersChandra SekarNo ratings yet

- Definition of CultureDocument14 pagesDefinition of CultureRenee Louise CoNo ratings yet

- Kuis 4Document10 pagesKuis 4Deri AntoNo ratings yet

- ERF 2019 0128 H160 Noise CertificationDocument10 pagesERF 2019 0128 H160 Noise CertificationHelimanualNo ratings yet

- Or SuperDocument2 pagesOr SuperJac BacNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Federal Election Commission Complaint Filed Against Tennessee State Sen. Brian Kelsey, OthersDocument66 pagesFederal Election Commission Complaint Filed Against Tennessee State Sen. Brian Kelsey, OthersUSA TODAY NetworkNo ratings yet

- ICT Authority Legal NoticeDocument13 pagesICT Authority Legal NoticeICT AUTHORITYNo ratings yet

- Medico Legal CaseDocument2 pagesMedico Legal CaseskcllbNo ratings yet

- Week 1Document34 pagesWeek 1Mitchie Faustino100% (1)

- Listening Test Sweeney Todd, Chapter 4: 1 C. Zwyssig-KliemDocument3 pagesListening Test Sweeney Todd, Chapter 4: 1 C. Zwyssig-KliemCarole Zwyssig-KliemNo ratings yet

- Chapter 1: Introduction Aviation Industry: Mini Project On Vistara AirlinesDocument84 pagesChapter 1: Introduction Aviation Industry: Mini Project On Vistara Airlinesselvaraj rapakaNo ratings yet

- Softwash ComparatorDocument5 pagesSoftwash ComparatorFaheem MushtaqNo ratings yet

- The Convergent Parallel DesignDocument8 pagesThe Convergent Parallel Designghina88% (8)

- Eva Braun Life With Hitler PDFDocument2 pagesEva Braun Life With Hitler PDFPamela0% (1)

- Tle9cookery q1 m7 Presentingandstoringarangeofappetizer v2Document30 pagesTle9cookery q1 m7 Presentingandstoringarangeofappetizer v2Almaira SumpinganNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Axe in Pakistan PDFDocument22 pagesAxe in Pakistan PDFAdarsh BansalNo ratings yet

- IHE ITI Suppl XDS Metadata UpdateDocument76 pagesIHE ITI Suppl XDS Metadata UpdateamNo ratings yet

- SOAL ASSEMEN PAKET A BAHASA INGGRIS NewDocument3 pagesSOAL ASSEMEN PAKET A BAHASA INGGRIS Newmtsn4 clpNo ratings yet

- Traverse AdjustmentDocument22 pagesTraverse AdjustmenthabteNo ratings yet

- Ps 202PET Manual enDocument7 pagesPs 202PET Manual enStiv KisNo ratings yet

- Citing Textual EvidenceDocument4 pagesCiting Textual EvidenceRaymondNo ratings yet

- Human Computer Interaction LECTURE 1Document19 pagesHuman Computer Interaction LECTURE 1mariya ali100% (2)

- Las Math 2 Q3 Week 1Document6 pagesLas Math 2 Q3 Week 1Honeyjo Nette100% (7)