Professional Documents

Culture Documents

3013734

Uploaded by

GauriGanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3013734

Uploaded by

GauriGanCopyright:

Available Formats

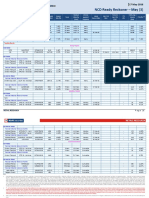

August 04 2015

NCD Ready Reckoner August (1)

RETAIL RESEARCH

Issuer

Series

HSL Scrip code

Last traded

Price (Rs)

Coupon

Rate

(%)

Tenor

Residual

Maturity

(Year)

Interest

payment

frequency

Latest

Record

Date

Call / Put

Date

Tenor to

Call / Put

(Yrs)

YTC

(%)

Daily

Avg

Volume

(Nos)

YTM (%)

**

Tax Free Bonds

AAA Rated

IIFCL

891IIFCL34E - Indivi

IIF891NBNR

1185.95

8.91%

20 Years

18.48 Yrs

Yearly

07-Jan-15

586

7.49%

PFC

892PFC33 - Indivi

PFC892B3NR

1209.95

8.92%

20 Years

18.30 Yrs

Yearly

31-Oct-14

1195

7.45%

NHAI

830NHAI27

NHA830N2NR

1146

8.30%

15 Years

11.49 Yrs

Yearly

16-Sep-14

2703

7.30%

IRFC

IRFC N1

IRF800N1NR

1102.26

8.00%

10 Years

6.56 Yrs

Yearly

29-Sep-14

800

7.26%

HUDCO

876HUDCO28 Individual

HUD876B2NR

1169.74

8.76%

15 Years

13.24 Yrs

Yearly

10-Oct-14

1545

7.53%

HUDCO

HUDCO050327

HUD820N2NR

1104.99

8.20%

15 Years

11.59 Yrs

Yearly

18-Feb-15

2328

7.26%

AA+ Rated

Taxable Bonds

Yearly Payout

AAA Rated

SBI

SBI - N3

STABANN3NR

10695

9.75%

10 Years

5.62 Yrs

Yearly

16-Mar-15

17-Mar-16

0.62 Years

3.64%

43

8.88%

SBI

SBI - N5

STABANN5NR

11088.55

9.95%

15 Years

10.62 Yrs

Yearly

16-Mar-15

17-Mar-21

5.62 Years

8.20%

318

8.84%

AA+ Rated

Residual Maturity- Below 24 months

Shriram Transport

STFC NV - Individual

SRTRANNVNR

1030

10.90%

3 Years

1.00 Yrs

Yearly

13-Mar-15

206

11.61%

Shriram Transport

STFC Y7 - Individual

SRTRANY7NR

1010.11

11.00%

3 Years

1.95 Yrs

Yearly

26-Jun-15

144

10.72%

Residual Maturity- Above 24 months

Shriram Transport

STFC NW - Individual

SRTRANNWNR

1033

11.15%

5 Years

2.99 Yrs

Yearly

13-Mar-15

149

11.37%

Shriram Transport

STFC NS - Individual

SRTRANNSNR

1043

11.40%

5 Years

2.02 Yrs

Yearly

13-Mar-15

204

11.12%

AA and AA- Rated

Residual Maturity- Below 24 months

Religare Finvest

O1C3

RFL1C3N3NR

1050

12.50%

5 Years

1.14 Yrs

Yearly

26-Mar-15

248

11.73%

Muthoot Finance

MFINNCD1F / N6

MUTFINN6NR

1115.37

12.25%

5 Years

1.12 Yrs

Yearly

30-Aug-14

1370

11.49%

Residual Maturity- Above 24 months

Blue Dart Express

BLUENCDSR1

BLUDARN1NR

10

9.30%

3 Years

2.30 Yrs

Yearly

20-Mar-15

4113

10.92%

Blue Dart Express

BLUENCDSR2

BLUDARN2NR

10

9.40%

4 Years

3.30 Yrs

Yearly

20-Mar-15

2553

10.60%

Monthly Payout

AA+ Rated

Residual Maturity- Below 24 months

None

Residual Maturity- Above 24 months

Shriram Transport

STFC NX - Individual

SRTRANNXNR

1003.15

10.63%

5 Years

2.99 Yrs

Monthly

13-Jul-15

203

11.08%

Shriram Transport

STFC YB - Individual

SRTRANYBNR

1030

10.94%

7 Years

5.95 Yrs

Monthly

13-Jul-15

113

10.80%

AA and AA- Rated

Residual Maturity- Below 24 months

Muthoot Finance

1125MFL17II - Indiv

MF1125N2NR

1009.8

12.00%

3 Years

1.51 Yrs

Monthly

17-Jul-15

400

11.90%

Muthoot Finance

1075MFL17 C - Indiv

MF1075NCNR

1006

11.50%

3 Years

1.92 Yrs

Monthly

17-Jul-15

414

11.77%

Residual Maturity- Above 24 months

India Infoline

IIHFL - N2

IIHF12N2NR

1054.36

12.00%

6 Years

4.67 Yrs

Monthly

24-Jul-15

1479

11.04%

ECL

12ECL20I

ECLFINN5NR

1069.16

12.00%

5.83 Years

4.78 Yrs

Monthly

17-Jul-15

808

10.68%

Cumulative Payout

AA+ Rated

Residual Maturity- Below 24 months

Shriram Transport

STFC NY - Individual

SRTRANNYNR

1215.2

3 Years

1.00 Yrs

Cumulative

61

12.35%

Shriram Transport

STFC YC - Individual

SRTRANYCNR

1115

3 Years

1.95 Yrs

Cumulative

54

11.08%

Residual Maturity- Above 24 months

Shriram Transport

STFC NZ - Individual

SRTRANNZNR

1225

5 Years

2.99 Yrs

Cumulative

55

11.57%

Shriram Transport

STFC YG - Individual

SRTRANYGNR

1160

7 Years

5.95 Yrs

Cumulative

72

10.88%

RETAIL RESEARCH

AA and AA- Rated

Residual Maturity- Below 24 months

Muthoot Finance

MFINNCD2D

MUTFIN2DNR

1615

5.50 Years

1.96 Yrs

Cumulative

297

11.57%

1170.15

6 Years

4.67 Yrs

Cumulative

113

12.18%

1570

5.50 Years

2.21 Yrs

Cumulative

218

11.61%

Residual Maturity- Above 24 months

India Infoline

IIHFL - N3

IIHF00N3NR

Muthoot Finance

0MFL17

MF000017NR

Note:

Credit Rating (as per latest data): For STFC NCDs CARE AA+ / Crisil AA (Stable). For TATA Cap NCDs CARE AA+ / ICRA LAA+. For L&T Fin NCDs CARE AA+ / ICRA LAA+. For SBI Bonds CARE AAA / AAA/ Stable by CRISIL. For

IndiaInfoline NCDs issued on Aug 2011 and Sep 2012 - CARE AA-' by CARE & ICRA AA- by ICRA. For IndiaInfoline NCDs issued on Sep 2013 - CARE AA[Double A] by CARE & BWR AA (Outlook:Stable)' by Brickwork. For

SHRIRAMCITI NCDs - Crisil AA-/Stable Care AA'. For Muthoot NCDs - CRISIL AA-/Stable by CRISIL and [ICRA] AA-(stable) by ICRA. For Manappuram NCDs A+/Negative by CRISIL. For Religare Finvest NCDs - [ICRA] AA

(Stable) from ICRA Ltd. &[CARE] AA- from CARE. For NHAI NCDs - CRISIL AAA/Stable by CRISIL CARE AAA by CARE and "Fitch AAA (ind) with Stable Outlook by FITCH. For PFC NCDs - "CRISIL AAA/Stable by CRISIL and ICRA

AAA by ICRA. For IRFC - CRISIL AAA/Stable by CRISIL, [ICRA] AAA by ICRA and CARE AAA by CARE ". For HUDCO - CARE AA+ from CARE and Fitch AA+ (ind) from Fitch. For REC - CRISIL AAA/Stableby CRISIL,CARE AAA by

CARE, Fitch AAA (ind)by FITCH and [ICRA] AAA by ICRA. For Tata Capital Financial Service Ltd - AA+/Stable from ICRA Limited and CARE AA from CARE. For IIFCL, ICRA AAA/Stable by ICRA,BWR AAA by Brickworks and

CARE AAA by CARE. For NHB, CRISIL AAA/Stable and CARE AAA". For Ennore Port, BWR AA+ (SO), CRISIL AA-/Stable and CARE AA-. For Dredging Corporation of India, BWR AA+ (SO) and CARE AA. For Jawaharlal Nehru Port

Trust, CRISIL AAA/Stable, "BWR AAA". For NHPC, [ICRA] AAA by ICRA IND AAA by India Rating & Research Private Limited and CARE AAA by CARE. For NTPC, CRISIL AAA from CRISIL and ICRA AAA from ICRA. For ECL - CARE

AA by CARE and BWR AA by Brickwork. For SREI "CARE AA- (Double A Minus) by CARE and BWR AA (BWR Double A) by BRICKWORK. For IIFHL: CRISIL AA-/Stable by CRISIL and CARE AA- [CARE AA Minus] by CARE. For Blue dart

Express, AA by ICRA. For IFCI, AA- by BRICKWORK, A+ by CARE & LA by ICRA.

** - In Tax Free Bonds, to avail ( or retain) the 25bps additional in the coupon rate, Investors should be aware that the total investment in the aggregate face value of Bonds held by the Bondholders in all the Series of Bonds,

allotted under the relevant Tranche Issue shall be clubbed and taken together and that should be up to Rs. 10 Lakhs. This can be explained in the following way. In the Year 2013-14, the issuers such as IRFC, HUDCO, IIFCL, etc

came out with more than one tranches offering 10 Years, 15 Years or 20 Years maturing bonds. In any Tranche, to avail the additional 25bps in the coupon rate by retailers, the investment in any series or all the series of

bonds (usually 3 series like 10 Years, 15 Years or 20 Years) should not be more than Rs. 10 lakhs. That means that the investor can hold a maximum of Rs. 10 Lakhs across all series of Bonds in one tranche/issue if he wants to

avail of the benefit of extra 25 bps interest. If the investment in any series or all the series of one issue or tranche exceeds Rs. 10 lakhs, then the investor will lose out the benefit of additional 25 bps in the coupon rate.

As mentioned, the series named 'NHPC - Individual', 'REC - Individual', 'HUDCO - Individual' and 'NTPC - Individual' are available only for Retail investors. To avail of 25 bps higher coupon rates, retailers have to hold the bonds for

the face value amount of not more than Rs. 10 lakh as on record dates as shown in the above point.

YTM is yield to maturity - Annualized yield that would be realized on a bond if the bond is held until the maturity date. Yield to call (YTC) is the annualized rate of return that an investor would earn if he bought a callable bond at

its current market price and held until the call is first exercisable by the issuer.

Religare, PFC, REC, DCI, Ennore Port, IIFCL NCDs are listed only on BSE, while the rest are listed on NSE and (in some cases - Muthoot finance, IIFL, HUDCO and some series of Shriram Citi, Muthoot Fin, Religare Fin, IFCI, NTPC &

Blue Dart Express) also on BSE. In case where the NCD are listed on both the exchanges, the price on the exchange where it is traded more (average daily volumes) is considered.

FV of NCDs in all cases is Rs.1000, except Rs.10, 000 for SBI, Rs.1, 00,000 for TATA Cap N1 and Rs. 200 for STFC N1 and STFC N2. For NHB, the FV of Series NHBTF2023 is Rs 10,000, while the FV for Series N1,N2,N3,N4,N5,N6 is Rs

5000. FV of Blue Dart is Rs 10, FV of NTPC(Taxable) is Rs 12.50.

Last traded date means date of last trade (not beyond the previous month). Further freak trades are not considered for YTM calculations. While short listing the top picks, enough weightage is given to frequency of trade and

average volumes. Unexpected cut in credit rating could result in bond prices going down and resultant MTM loss.

The series mentioned as individual in taxable NCDs of Shriram Transport, Muthhot Finance and Shriram Citi are eligible for retail investments (and higher coupon) irrespective of investment amount. The only criterion for higher

interest is that the holder should be an individual as on the record date.

RETAIL RESEARCH Tel: (022) 3075 3400 Fax: (022) 2496 5066 Corporate Office

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East),

Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022) 2496 5066 Website: www.hdfcsec.com Email: hdfcsecretailresearch@hdfcsec.com

Disclaimer: This document has been prepared by HDFC Securities Limited and is meant for sole use by the recipient and not for circulation. This document is not to

be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information

contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from

time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other

services for, any company mentioned in this document. This report is intended for non-Institutional Clients

This report has been prepared by the Retail Research team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other

parameters mentioned in this document may or may not match or may be contrary with those of the other Research teams (Institutional, PCG) of HDFC Securities Ltd.

RETAIL RESEARCH

You might also like

- 3013618Document2 pages3013618GauriGanNo ratings yet

- ReportDocument3 pagesReportshobhaNo ratings yet

- ReportDocument3 pagesReportumaganNo ratings yet

- ReportDocument3 pagesReportumaganNo ratings yet

- ReportDocument3 pagesReportumaganNo ratings yet

- ReportDocument3 pagesReportumaganNo ratings yet

- Report PDFDocument2 pagesReport PDFGauriGanNo ratings yet

- ReportDocument2 pagesReportumaganNo ratings yet

- ReportDocument1 pageReportarun_algoNo ratings yet

- ReportDocument1 pageReportumaganNo ratings yet

- ReportDocument1 pageReportshobhaNo ratings yet

- Top NCD Picks - April (4) : Retail ResearchDocument1 pageTop NCD Picks - April (4) : Retail Researcharun_algoNo ratings yet

- HDFC Top NCD PicksDocument1 pageHDFC Top NCD Picksvivekrajbhilai5850No ratings yet

- Nhai NCD Note - 27122011Document7 pagesNhai NCD Note - 27122011Akchat JainNo ratings yet

- Shriram Transport Financ NCDDocument2 pagesShriram Transport Financ NCDRajib LayekNo ratings yet

- ReportDocument10 pagesReportumaganNo ratings yet

- T V Sundram Iyengar-R-16022018Document7 pagesT V Sundram Iyengar-R-16022018AGN YaNo ratings yet

- SAME Deutz-Fahr India Private Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument7 pagesSAME Deutz-Fahr India Private Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionABHISHEK BHAGATNo ratings yet

- NCD Option Wise DetailsDocument11 pagesNCD Option Wise DetailsMohit NatuNo ratings yet

- Indiabulls Commercial Credit LTD: Stock Price & Q4 Results of Indiabulls Commercial Credit Limited - HDFC SecuritiesDocument7 pagesIndiabulls Commercial Credit LTD: Stock Price & Q4 Results of Indiabulls Commercial Credit Limited - HDFC SecuritiesHDFC SecuritiesNo ratings yet

- Indiabulls Housing Finance LTD - Product Note: Retail ResearchDocument5 pagesIndiabulls Housing Finance LTD - Product Note: Retail ResearchumaganNo ratings yet

- Caiib Risk Manage Mod CDDocument95 pagesCaiib Risk Manage Mod CDMusahib ChaudhariNo ratings yet

- R.S. Brothers Retail - R-06122017Document7 pagesR.S. Brothers Retail - R-06122017srv 99No ratings yet

- Zuwachs Advisory Investments PlansDocument13 pagesZuwachs Advisory Investments Plansketanagarwal143No ratings yet

- IREDA Tax Free Bonds-Tranche-I: About The IssuerDocument4 pagesIREDA Tax Free Bonds-Tranche-I: About The IssuerKashmira RNo ratings yet

- Investment Analysis & Portfolio MGTDocument104 pagesInvestment Analysis & Portfolio MGTkhusbuNo ratings yet

- Fmi Individual Probelem Set 7: Chapter 3 - Valuing BondsDocument5 pagesFmi Individual Probelem Set 7: Chapter 3 - Valuing BondsMuskan ValbaniNo ratings yet

- DHFL Non-Convertible Debentures 2018: Group 2Document8 pagesDHFL Non-Convertible Debentures 2018: Group 2subham paulNo ratings yet

- Module1-Investments & Risk & DerivativesDocument169 pagesModule1-Investments & Risk & DerivativesLMT indiaNo ratings yet

- Script Code: 531179 ISIN: INE109C01017 Symbol: ARMANFIN Series: EQDocument42 pagesScript Code: 531179 ISIN: INE109C01017 Symbol: ARMANFIN Series: EQvermaanuradha823No ratings yet

- 18542final Old Sugg Paper Nov09 2Document14 pages18542final Old Sugg Paper Nov09 2Atish SahooNo ratings yet

- Triveni TurbineDocument6 pagesTriveni TurbinevikasNo ratings yet

- Magnolia Martinique - R - 03082017Document7 pagesMagnolia Martinique - R - 03082017Bhavin SagarNo ratings yet

- TREASURYDocument90 pagesTREASURYPankaj FarliaNo ratings yet

- Nelcast Limited: Long-Term Rating Re-Affirmed and Outlook Revised To Negative Short-Term Rating Downgraded To (ICRA) A1 Summary of Rating ActionDocument7 pagesNelcast Limited: Long-Term Rating Re-Affirmed and Outlook Revised To Negative Short-Term Rating Downgraded To (ICRA) A1 Summary of Rating ActionPuneet367No ratings yet

- L&T Tax Saver Fund Application FormDocument32 pagesL&T Tax Saver Fund Application FormPrajna CapitalNo ratings yet

- ABT Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument6 pagesABT Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionWilliam Veloz DiazNo ratings yet

- 04-Jan-2019 25-Jan-2019: Mahindra & Mahindra Financial Services LimitedDocument3 pages04-Jan-2019 25-Jan-2019: Mahindra & Mahindra Financial Services Limitedkishore13No ratings yet

- RL Steel Jan 2017 ICRADocument6 pagesRL Steel Jan 2017 ICRAPuneet367No ratings yet

- Market Lacking Clear Direction, Wait For A Breakout: Sensex (39452) / Nifty (11823)Document3 pagesMarket Lacking Clear Direction, Wait For A Breakout: Sensex (39452) / Nifty (11823)Hardik ShahNo ratings yet

- Iiisl NCD RRDocument1 pageIiisl NCD RRManish SippyNo ratings yet

- Head and Shoulders Broken: Punter's CallDocument5 pagesHead and Shoulders Broken: Punter's CallRajasekhar Reddy AnekalluNo ratings yet

- BeyondMarket Issue 114Document52 pagesBeyondMarket Issue 114ektapatelbmsNo ratings yet

- Solairedirect Energy India Private LimitedDocument6 pagesSolairedirect Energy India Private LimitedAfzal AneesNo ratings yet

- Daily Derivatives: December 23, 2016Document3 pagesDaily Derivatives: December 23, 2016choni singhNo ratings yet

- Ace Designers-R-05042018 PDFDocument7 pagesAce Designers-R-05042018 PDFkachadaNo ratings yet

- Rating Rationale - KirloskarDocument4 pagesRating Rationale - KirloskarDeepti JajooNo ratings yet

- Muthoot Finance LimitedDocument11 pagesMuthoot Finance LimitedKhasimvali ShaikNo ratings yet

- Factsheet August 2012 V10Document13 pagesFactsheet August 2012 V10Roshni BhatiaNo ratings yet

- AXIS Mutual FundDocument68 pagesAXIS Mutual Fundallsbri600No ratings yet

- Analyst ReportDocument9 pagesAnalyst ReportPriyaSharmaNo ratings yet

- Range Bound Markets With A Positive Bias Seen Today: Top Nifty GainersDocument5 pagesRange Bound Markets With A Positive Bias Seen Today: Top Nifty GainersDynamic LevelsNo ratings yet

- Ace Designers Limited: Summary of Rated InstrumentsDocument7 pagesAce Designers Limited: Summary of Rated InstrumentskachadaNo ratings yet

- Commercial Property Webinar (March 12, 2022) (Final)Document19 pagesCommercial Property Webinar (March 12, 2022) (Final)Sanskar SurekaNo ratings yet

- Mechemco - R-30102017 PDFDocument7 pagesMechemco - R-30102017 PDFflytorahulNo ratings yet

- Final Sa AssgmntDocument13 pagesFinal Sa Assgmntsaurabhtayal88No ratings yet

- VIP OnepagerDocument2 pagesVIP Onepagerkarthik.vNo ratings yet

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- DrekkanasDocument59 pagesDrekkanasHemlata GuptaNo ratings yet

- Book - 1914 - A Day in The Moon - Abbe Th. MoreuxDocument232 pagesBook - 1914 - A Day in The Moon - Abbe Th. MoreuxGauriGanNo ratings yet

- Book 2010 Abd Al-Rehman Al Sufi The Fixed Stars ThesisDocument405 pagesBook 2010 Abd Al-Rehman Al Sufi The Fixed Stars ThesisGauriGan100% (2)

- ReportDocument5 pagesReportjaimaaganNo ratings yet

- HSL PCG "Currency Daily": June 22, 2016Document6 pagesHSL PCG "Currency Daily": June 22, 2016GauriGanNo ratings yet

- HSL PCG "Currency Daily": June 21, 2016Document6 pagesHSL PCG "Currency Daily": June 21, 2016GauriGanNo ratings yet

- Retail Research: Indian Currency MarketDocument3 pagesRetail Research: Indian Currency MarketGauriGanNo ratings yet

- Bharat Wire Ropes Limited: Retail ResearchDocument3 pagesBharat Wire Ropes Limited: Retail ResearchshobhaNo ratings yet

- Mentum Stocks: Positional Technical PickDocument2 pagesMentum Stocks: Positional Technical PickGauriGanNo ratings yet

- ReportDocument3 pagesReportGauriGanNo ratings yet

- ReportDocument3 pagesReportGauriGanNo ratings yet

- IPO Snapshot V-Mart Retail LTD (VMRL) January 31, 2013Document3 pagesIPO Snapshot V-Mart Retail LTD (VMRL) January 31, 2013GauriGanNo ratings yet

- ReportDocument3 pagesReportGauriGanNo ratings yet

- ReportDocument8 pagesReportGauriGanNo ratings yet

- Pennar Engineered Building System Limited - IPO Snapshot: Retail ResearchDocument3 pagesPennar Engineered Building System Limited - IPO Snapshot: Retail ResearchGauriGanNo ratings yet

- Report PDFDocument2 pagesReport PDFGauriGanNo ratings yet

- S.P. Apparels LTD: Retail ResearchDocument3 pagesS.P. Apparels LTD: Retail ResearchGauriGanNo ratings yet

- Wave 59Document5 pagesWave 59GauriGanNo ratings yet

- Jyotish KP The Times Horary Astrology PrabhakarDocument186 pagesJyotish KP The Times Horary Astrology PrabhakarRozhannaa100% (5)

- Monthly Strategy Report - September 2015: Month Gone byDocument10 pagesMonthly Strategy Report - September 2015: Month Gone byGauriGanNo ratings yet

- Daily Technical Snapshot: October 15, 2015Document3 pagesDaily Technical Snapshot: October 15, 2015GauriGanNo ratings yet

- NFO Note: HDFC Retirement Savings FundDocument7 pagesNFO Note: HDFC Retirement Savings FundGauriGanNo ratings yet

- Daily Technical Snapshot: September 03, 2015Document3 pagesDaily Technical Snapshot: September 03, 2015GauriGanNo ratings yet

- Technical Pick: Weekly ChartDocument2 pagesTechnical Pick: Weekly ChartGauriGanNo ratings yet

- 3014199Document2 pages3014199GauriGanNo ratings yet

- Nifty Technical Levels: September 02, 2015Document1 pageNifty Technical Levels: September 02, 2015GauriGanNo ratings yet

- Technical Stock PickDocument3 pagesTechnical Stock PickGauriGanNo ratings yet

- Sector Momentum Stock Pick: GHCL LTDDocument2 pagesSector Momentum Stock Pick: GHCL LTDGauriGanNo ratings yet

- Nifty Technical Levels: September 02, 2015Document1 pageNifty Technical Levels: September 02, 2015GauriGanNo ratings yet

- 3002439Document11 pages3002439GauriGanNo ratings yet

- Algorithmic Trading Directory - 2009 EditionDocument104 pagesAlgorithmic Trading Directory - 2009 Editionmotiwig6302100% (2)

- HKEX Listing RulesDocument1,038 pagesHKEX Listing Rulesjennifertong82No ratings yet

- List of TransactionsDocument4 pagesList of TransactionsRahul Kumar100% (2)

- Why Are Financial Institutions Special?: True / False QuestionsDocument23 pagesWhy Are Financial Institutions Special?: True / False Questionslatifa hnNo ratings yet

- Tutorials Math BankDocument13 pagesTutorials Math BankryzaxNo ratings yet

- Who's Who in Korean Film Industry - Producers and InvestorsDocument114 pagesWho's Who in Korean Film Industry - Producers and InvestorsthedstermanNo ratings yet

- Basic Accounting EquationDocument7 pagesBasic Accounting EquationLuisa MirandaNo ratings yet

- Ipca LaboratoriesDocument22 pagesIpca LaboratoriesAbhishekAgrawalNo ratings yet

- Manitou MRT Easy (EN)Document28 pagesManitou MRT Easy (EN)Manitou100% (1)

- Basics of Micro FinanceDocument3 pagesBasics of Micro FinanceHiral PatelNo ratings yet

- Michael Burry Write Ups From 2000Document27 pagesMichael Burry Write Ups From 2000Patrick LangstromNo ratings yet

- 3017 Tutorial 7 SolutionsDocument3 pages3017 Tutorial 7 SolutionsNguyễn HảiNo ratings yet

- Service - Journal-TB - Dr. Who ClinicDocument11 pagesService - Journal-TB - Dr. Who ClinicJasmine Acta67% (3)

- Bachelor of Commerce Guide - 2016 Edition PDFDocument58 pagesBachelor of Commerce Guide - 2016 Edition PDFcaitlinNo ratings yet

- Functional Information SystemDocument8 pagesFunctional Information SystemHimanshu RaikwarNo ratings yet

- Lotusxbt Trading ModelDocument8 pagesLotusxbt Trading ModelNassim Alami MessaoudiNo ratings yet

- Business Simulation Indivitual Report Quasain AliDocument7 pagesBusiness Simulation Indivitual Report Quasain AliSyed Quasain Ali NaqviNo ratings yet

- New Venture Development Process-TruefanDocument34 pagesNew Venture Development Process-Truefanpowerhanks50% (2)

- Investment Memo: NVSTRDocument8 pagesInvestment Memo: NVSTRAnthony Bellafiore100% (3)

- Mock 1Document10 pagesMock 1Manan SharmaNo ratings yet

- 07-Combining Rsi With RsiDocument5 pages07-Combining Rsi With Rsimajasan75% (4)

- Banking and Allied Laws - Atty IgnacioDocument23 pagesBanking and Allied Laws - Atty IgnacioAngela B. Lumabas0% (1)

- Corporate Scholarship GuideDocument17 pagesCorporate Scholarship GuideAsisclo CastanedaNo ratings yet

- Mco 03 Block 02 1559781031Document112 pagesMco 03 Block 02 1559781031arushichananaNo ratings yet

- Bbclocalradio MyersDocument21 pagesBbclocalradio MyersTarca AndreiNo ratings yet

- SOURCES OF BUSINESS FINANCE (Compatibility Mode) PDFDocument30 pagesSOURCES OF BUSINESS FINANCE (Compatibility Mode) PDFAmeya PatilNo ratings yet

- PDF BloombergDocument2 pagesPDF BloombergfahdlyNo ratings yet

- Final Fmi Banking BaselDocument37 pagesFinal Fmi Banking BaselRohan ShahNo ratings yet

- Marketing PhilosophiesDocument45 pagesMarketing Philosophieszakirno19248No ratings yet

- Burberry Annual Report 2015-16Document188 pagesBurberry Annual Report 2015-16Siddharth Shekhar100% (1)