Professional Documents

Culture Documents

Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax Return

Uploaded by

Sarah KuldipOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax Return

Uploaded by

Sarah KuldipCopyright:

Available Formats

Certain Cash Contributions for Typhoon Haiyan Relief Efforts

in the Philippines Can Be Deducted on Your 2013 Tax Return

A new law allows you to choose to deduct certain charitable contributions

of money on your 2013 tax return instead of your 2014 return. The

contributions must have been made after March 25, 2014, and before April

15, 2014, for the relief of victims in the Republic of the Philippines affected

by the November 8, 2013, typhoon. Contributions of money include

contributions made by cash, check, money order, credit card, charge card,

debit card, or via cell phone.

The new law was enacted after the 2013 forms, instructions, and

publications had already been printed. When preparing your 2013 tax

return, you may complete the forms as if these contributions were made on

December 31, 2013, instead of in 2014. To deduct your charitable

contributions, you must itemize deductions on Schedule A (Form 1040) or

Schedule A (Form 1040NR).

The contribution must be made to a qualified organization and meet all

other requirements for charitable contribution deductions. However, if you

made the contribution by phone or text message, a telephone bill showing

the name of the donee organization, the date of the contribution, and the

amount of the contribution will satisfy the recordkeeping requirement.

Therefore, for example, if you made a $10 charitable contribution by text

message that was charged to your telephone or wireless account, a bill

from your telecommunications company containing this information

satisfies the recordkeeping requirement.

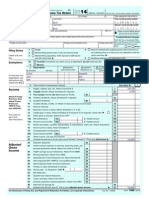

Form

1040

2013

(99)

Department of the TreasuryInternal Revenue Service

U.S. Individual Income Tax Return

For the year Jan. 1Dec. 31, 2013, or other tax year beginning

OMB No. 1545-0074

, 2013, ending

IRS Use OnlyDo not write or staple in this space.

See separate instructions.

, 20

Your social security number

Last name

Your first name and initial

Magdalena

Schmitz

294

Apt. no.

Home address (number and street). If you have a P.O. box, see instructions.

623 S Liberty Road

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions).

Foreign country name

Check only one

box.

Exemptions

6a

b

Income

Attach Form(s)

W-2 here. Also

attach Forms

W-2G and

1099-R if tax

was withheld.

If you did not

get a W-2,

see instructions.

Adjusted

Gross

Income

childs name here.

Qualifying widow(er) with dependent child

Yourself. If someone can claim you as a dependent, do not check box 6a .

Spouse

.

Dependents:

(1) First name

(2) Dependents

social security number

Last name

Alyssa Schmitz

Tyler Schmitz

Connor Schmitz

d

Head of household (with qualifying person). (See instructions.) If

the qualifying person is a child but not your dependent, enter this

Married filing separately. Enter spouses SSN above

and full name here.

If more than four

dependents, see

instructions and

check here

Single

Married filing jointly (even if only one had income)

2

3

824

824

824

(4) if child under age 17

qualifying for child tax credit

(see instructions)

(3) Dependents

relationship to you

84 8456

34 9584

56 2984

Total number of exemptions claimed

Make sure the SSN(s) above

and on line 6c are correct.

Check here if you, or your spouse if filing

jointly, want $3 to go to this fund. Checking

Foreign postal code

a box below will not change your tax or

refund.

You

Spouse

Foreign province/state/county

2845

Presidential Election Campaign

Bedford, Pennsylvania 15522

Filing Status

83

Spouses social security number

Last name

If a joint return, spouses first name and initial

Boxes checked

on 6a and 6b

No. of children

on 6c who:

lived with you

1

3

did not live with

you due to divorce

or separation

(see instructions)

Daughter

Son

Son

Dependents on 6c

not entered above

.

8b

. .

8a

9a

10

11

Qualified dividends . . . . . . . . . . .

9b

Taxable refunds, credits, or offsets of state and local income taxes

Alimony received . . . . . . . . . . . . . . .

.

.

.

.

.

.

.

.

.

.

.

.

10

11

325 00

12

13

14

Business income or (loss). Attach Schedule C or C-EZ . . . . . . . . .

Capital gain or (loss). Attach Schedule D if required. If not required, check here

Other gains or (losses). Attach Form 4797 . . . . . . . . . . . . .

12

13

14

4,820 00

15a

16a

17

IRA distributions .

15a

b Taxable amount

. . .

Pensions and annuities 16a

b Taxable amount

. . .

Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E

15b

16b

17

18

19

20a

Farm income or (loss). Attach Schedule F .

Unemployment compensation . . . .

Social security benefits 20a

18

19

20b

21

22

Other income. List type and amount

Combine the amounts in the far right column for lines 7 through 21. This is your total income

23

Educator expenses

24

Certain business expenses of reservists, performing artists, and

fee-basis government officials. Attach Form 2106 or 2106-EZ

25

Health savings account deduction. Attach Form 8889

24

25

26

27

28

Moving expenses. Attach Form 3903 . . . . . .

Deductible part of self-employment tax. Attach Schedule SE .

Self-employed SEP, SIMPLE, and qualified plans

. .

26

27

28

29

30

31a

Self-employed health insurance deduction

Penalty on early withdrawal of savings . .

.

.

.

.

.

.

.

.

32

33

34

Alimony paid b Recipients SSN

IRA deduction . . . . . . .

Student loan interest deduction . .

Tuition and fees. Attach Form 8917 .

29

30

31a

.

.

.

.

.

.

.

.

.

.

.

.

32

33

34

35

36

37

Domestic production activities deduction. Attach Form 8903

35

Add lines 23 through 35 . . . . . . . . . . . . .

Subtract line 36 from line 22. This is your adjusted gross income

Wages, salaries, tips, etc. Attach Form(s) W-2

8a

b

9a

Taxable interest. Attach Schedule B if required .

Tax-exempt interest. Do not include on line 8a .

Ordinary dividends. Attach Schedule B if required

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Add numbers on

lines above

50,885 00

3,510 00

3,800 00

. . . . . .

. . . . . .

b Taxable amount

.

.

.

.

.

.

.

.

.

21

22

59,540 00

23

3,200 00

340 52

4,000 00

.

.

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions.

.

.

.

.

.

.

.

.

36

37

Cat. No. 11320B

7,540 52

51,999 48

Form 1040 (2013)

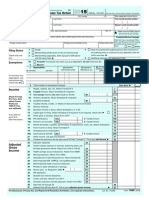

Page 2

Form 1040 (2013)

Tax and

Credits

Standard

Deduction

for

People who

check any

box on line

39a or 39b or

who can be

claimed as a

dependent,

see

instructions.

All others:

Single or

Married filing

separately,

$6,100

Married filing

jointly or

Qualifying

widow(er),

$12,200

Head of

household,

$8,950

Other

Taxes

38

Amount from line 37 (adjusted gross income)

39a

Check

if:

If you have a

qualifying

child, attach

Schedule EIC.

Sign

Here

Paid

Preparer

Use Only

You were born before January 2, 1949,

Spouse was born before January 2, 1949,

Blind.

Blind.

42

43

Exemptions. If line 38 is $150,000 or less, multiply $3,900 by the number on line 6d. Otherwise, see instructions

Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter -0- . .

Form 4972 c

Tax (see instructions). Check if any from: a

Form(s) 8814 b

44

45

46

Alternative minimum tax (see instructions). Attach Form 6251 .

Add lines 44 and 45 . . . . . . . . . . . . . .

.

.

.

.

.

.

.

.

.

.

.

.

47

48

Foreign tax credit. Attach Form 1116 if required .

49

50

51

52

53

54

55

Residential energy credits. Attach Form 5695 . . . .

52

3800 b

8801 c

Other credits from Form: a

53

Add lines 47 through 53. These are your total credits . . . . .

Subtract line 54 from line 46. If line 54 is more than line 46, enter -0-

56

57

Self-employment tax. Attach Schedule SE . . . .

Unreported social security and Medicare tax from Form:

58

59a

b

Additional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 if required

Household employment taxes from Schedule H

Credit for child and dependent care expenses. Attach Form 2441

600 00

Education credits from Form 8863, line 19 . . . . .

Retirement savings contributions credit. Attach Form 8880

Child tax credit. Attach Schedule 8812, if required . . .

49

50

51

2,000 00

. . . .

a

4137

.

.

.

.

.

.

.

b

.

.

.

.

.

.

. .

8919

.

.

.

.

First-time homebuyer credit repayment. Attach Form 5405 if required . . . .

Form 8959 b

Form 8960 c

Instructions; enter code(s)

Taxes from: a

Add lines 55 through 60. This is your total tax

Federal income tax withheld from Forms W-2 and 1099 . .

2013 estimated tax payments and amount applied from 2012 return

64a

b

Earned income credit (EIC) . . . . . .

Nontaxable combat pay election

64b

Additional child tax credit. Attach Schedule 8812 .

American opportunity credit from Form 8863, line 8 .

Reserved . . . . . . . . . . . . .

Amount paid with request for extension to file . .

.

.

.

.

.

.

.

.

.

40

41

42

13,620

38,379

15,600

22,779

2,524

43

44

45

46

00

48

00

48

42

2,524 42

2,600 00

0

681 04

55

56

57

58

59a

59b

60

61

681 04

1,100 00

62

63

64a

65

66

67

68

. . . .

69

Credit for federal tax on fuels. Attach Form 4136 . . . .

70

Credits from Form: a

2439 b

Reserved c

8885 d

71

Add lines 62, 63, 64a, and 65 through 71. These are your total payments .

Excess social security and tier 1 RRTA tax withheld

73

If line 72 is more than line 61, subtract line 61 from line 72. This is the amount you overpaid

74a

b

d

Amount of line 73 you want refunded to you. If Form 8888 is attached, check here .

c Type:

Routing number

Checking

Savings

Account number

Amount of line 73 you want applied to your 2014 estimated tax 75

Amount you owe. Subtract line 72 from line 61. For details on how to pay, see instructions

75

76

51,999 48

54

62

63

65

66

.

.

.

.

47

48

38

Total boxes

checked 39a

39b

77

77

Estimated tax penalty (see instructions) . . . . . . .

Do you want to allow another person to discuss this return with the IRS (see instructions)?

Designees

name

Phone

no.

72

73

1,100 00

418 96

418 96

74a

76

Yes. Complete below.

No

Personal identification

number (PIN)

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief,

they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your signature

Date

Your occupation

Daytime phone number

Spouses signature. If a joint return, both must sign.

Date

Spouses occupation

If the IRS sent you an Identity Protection

PIN, enter it

here (see inst.)

PTIN

Check

if

self-employed

Joint return? See

instructions.

Keep a copy for

your records.

.

.

Third Party

Designee

Itemized deductions (from Schedule A) or your standard deduction (see left margin)

Subtract line 40 from line 38

. . . . . . . . . . . . . . . . .

Direct deposit?

See

instructions.

Amount

You Owe

40

41

67

68

69

70

71

72

Refund

If your spouse itemizes on a separate return or you were a dual-status alien, check here

60

61

Payments

Print/Type preparers name

Preparers signature

Date

Sarah Kuldip

Firms name

Firms address

Death & Taxes

123 Mulberry Lane, Bedford, PA 15522

Firm's EIN

Phone no.

xx-xxxxxxx

456-838-2937

Form 1040 (2013)

You might also like

- F 1040Document2 pagesF 1040Kevin RowanNo ratings yet

- f1040 PDFDocument3 pagesf1040 PDFjc75aNo ratings yet

- F 1040Document2 pagesF 1040Sue BosleyNo ratings yet

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax Returnapi-173610472No ratings yet

- Week 2 Form 1040Document2 pagesWeek 2 Form 1040Linda100% (2)

- TaxDocument9 pagesTaxKuan ChenNo ratings yet

- NATH f1040Document2 pagesNATH f1040Spencer NathNo ratings yet

- Schauer 2013 Tax ReturnDocument3 pagesSchauer 2013 Tax ReturnDetroit Free Press0% (1)

- Income Tax Fundamentals Chapter 4 Comprehensive Problem 1Document2 pagesIncome Tax Fundamentals Chapter 4 Comprehensive Problem 1AU Sharma0% (1)

- Example Tax ReturnDocument6 pagesExample Tax Returnapi-252304176No ratings yet

- FTF1301242185129Document3 pagesFTF1301242185129Donna SchatzNo ratings yet

- Form 1040Document2 pagesForm 1040Jessi100% (6)

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax ReturnHamzah B ShakeelNo ratings yet

- FTF1327867575806Document3 pagesFTF1327867575806erzahler0% (1)

- FTF1302745105156Document5 pagesFTF13027451051562sly4youNo ratings yet

- Alice Tax FormDocument6 pagesAlice Tax FormShrey MangalNo ratings yet

- Chapter 10 MERGEDDocument10 pagesChapter 10 MERGEDola69% (13)

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax Returnapi-310622354No ratings yet

- f1040 Draft 2015Document3 pagesf1040 Draft 2015Anonymous IpryXQAKZNo ratings yet

- Form 1040Document2 pagesForm 1040karthu48No ratings yet

- U.S. Nonresident Alien Income Tax Return: Please Print or TypeDocument5 pagesU.S. Nonresident Alien Income Tax Return: Please Print or TypepdizypdizyNo ratings yet

- Jeff Bell 2012 Tax ReturnDocument71 pagesJeff Bell 2012 Tax ReturnRaylene_No ratings yet

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax ReturnadrianaNo ratings yet

- Ivan Incisor CH 2 Tax Return - For - FilingDocument4 pagesIvan Incisor CH 2 Tax Return - For - FilingShakilaMissz-KyutieJenkins100% (1)

- Ivan Incisor CH 3 2014 Tax Return - For - FilingDocument6 pagesIvan Incisor CH 3 2014 Tax Return - For - FilingShakilaMissz-KyutieJenkinsNo ratings yet

- Chapter 4 For FilingDocument9 pagesChapter 4 For Filinglagurr100% (1)

- U.S. Individual Income Tax ReturnDocument3 pagesU.S. Individual Income Tax Returnyupper2014No ratings yet

- F1040sa 2013Document2 pagesF1040sa 2013Sarah KuldipNo ratings yet

- Form 1040Document3 pagesForm 1040Peng JinNo ratings yet

- 2015 TaxReturn GregAbbottDocument14 pages2015 TaxReturn GregAbbottDana ThompsonNo ratings yet

- Tax Return ProjectDocument62 pagesTax Return ProjectGiovaniPerez100% (1)

- Santos Return PDFDocument14 pagesSantos Return PDFMark Long75% (4)

- 2014 Federal 1040 (Esther)Document2 pages2014 Federal 1040 (Esther)Abdirahman Abdullahi Omar43% (7)

- Chapter 12 TR Assignment Kelsey EwellDocument22 pagesChapter 12 TR Assignment Kelsey Ewellapi-272863459No ratings yet

- U.S. Individual Income Tax Return 1040A: Filing StatusDocument3 pagesU.S. Individual Income Tax Return 1040A: Filing StatusYosbanyNo ratings yet

- Zuckerman2015 Tax ReturnDocument3 pagesZuckerman2015 Tax ReturnAnonymous 2zbzrvNo ratings yet

- 1040x2 PDFDocument2 pages1040x2 PDFolddiggerNo ratings yet

- Joint Astronomy Centre - Birthday Stars - FinalDocument2 pagesJoint Astronomy Centre - Birthday Stars - Finalhail2pigdumNo ratings yet

- TaxReturn PDFDocument7 pagesTaxReturn PDFChristine WillisNo ratings yet

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocument2 pagesAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesKel TranNo ratings yet

- U.S. Individual Income Tax Return: John Public 0 0 0 0 0 0 0 0 0 Jane Public 0 0 0 0 0 0 0 0 1Document2 pagesU.S. Individual Income Tax Return: John Public 0 0 0 0 0 0 0 0 0 Jane Public 0 0 0 0 0 0 0 0 1Renee Leon100% (1)

- Tax Return ScribdDocument5 pagesTax Return ScribdYvonne TanNo ratings yet

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDocument6 pagesCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnStephanie YatesNo ratings yet

- F 1040 SaDocument2 pagesF 1040 Saljens09No ratings yet

- U.S. Individual Income Tax Return: See Separate InstructionsDocument4 pagesU.S. Individual Income Tax Return: See Separate InstructionsNewsTeam20100% (1)

- Child and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Document2 pagesChild and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Sarah KuldipNo ratings yet

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDocument6 pagesCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax Returnapi-252942620No ratings yet

- 2012 Biden Complete Return PDFDocument31 pages2012 Biden Complete Return PDFTyler DeiesoNo ratings yet

- Taxes Are FunDocument2 pagesTaxes Are Funlfoirirjrkjbghghg999No ratings yet

- Complete Return President Obama 2012 PDFDocument38 pagesComplete Return President Obama 2012 PDFTyler DeiesoNo ratings yet

- F 1040 SaDocument1 pageF 1040 SaPrekelNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- J.K. Lasser's 1001 Deductions and Tax Breaks 2024: Your Complete Guide to Everything DeductibleFrom EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2024: Your Complete Guide to Everything DeductibleNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Your Income Tax 2024, Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNo ratings yet

- J.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnNo ratings yet

- J.K. Lasser's 1001 Deductions and Tax Breaks 2023: Your Complete Guide to Everything DeductibleFrom EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2023: Your Complete Guide to Everything DeductibleNo ratings yet

- Assurance Through A Phrase Such As "We Are Not Aware of Any Material Modifications"Document2 pagesAssurance Through A Phrase Such As "We Are Not Aware of Any Material Modifications"Sarah KuldipNo ratings yet

- Tuition and Fees Deduction: Before You BeginDocument4 pagesTuition and Fees Deduction: Before You BeginSarah Kuldip100% (1)

- Answer: 10 Out of 10 PointsDocument4 pagesAnswer: 10 Out of 10 PointsSarah KuldipNo ratings yet

- Answer: 10 Out of 10 PointsDocument4 pagesAnswer: 10 Out of 10 PointsSarah KuldipNo ratings yet

- Child and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Document2 pagesChild and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Sarah KuldipNo ratings yet

- Self-Employment Tax: May I Use Short Schedule SE or Must I Use Long Schedule SE?Document2 pagesSelf-Employment Tax: May I Use Short Schedule SE or Must I Use Long Schedule SE?Sarah KuldipNo ratings yet

- Moving Expenses: Before You BeginDocument4 pagesMoving Expenses: Before You BeginSarah KuldipNo ratings yet

- Interest and Ordinary DividendsDocument2 pagesInterest and Ordinary DividendsSarah KuldipNo ratings yet

- F1040sa 2013Document2 pagesF1040sa 2013Sarah KuldipNo ratings yet

- Tax InvoiceDocument3 pagesTax InvoicerangersuhaibNo ratings yet

- Shashank GuptaDocument2 pagesShashank GuptaThe Cultural CommitteeNo ratings yet

- Form IL-W-4: Employee's Illinois Withholding Allowance Certificate and InstructionsDocument2 pagesForm IL-W-4: Employee's Illinois Withholding Allowance Certificate and InstructionsMorning32No ratings yet

- Hyundai Motor India LTDDocument5 pagesHyundai Motor India LTDgurujmNo ratings yet

- Net Infotech System NIS/G/21-22/0340 31-Jul-21: Tax InvoiceDocument1 pageNet Infotech System NIS/G/21-22/0340 31-Jul-21: Tax InvoicehhNo ratings yet

- Str. Poieni Nr. 1 Wernersholmvegen 5 5232 Paradis NORWAY: Seatrans Crewing A/S Constanta Filip, Dumitru IulianDocument1 pageStr. Poieni Nr. 1 Wernersholmvegen 5 5232 Paradis NORWAY: Seatrans Crewing A/S Constanta Filip, Dumitru Iuliandumitru68No ratings yet

- CourseheroDocument3 pagesCourseheronumber oneNo ratings yet

- Kendriya Vidyalaya: Bulandshahar: Near Numaise Ground, Bulandshahar (U.P.) - 203001Document10 pagesKendriya Vidyalaya: Bulandshahar: Near Numaise Ground, Bulandshahar (U.P.) - 203001Nihit SandNo ratings yet

- Pertemuan 12 Chapter 19 KiesoDocument90 pagesPertemuan 12 Chapter 19 KiesoJordan SiahaanNo ratings yet

- Certain Government Payments 1099G: Claimant: Daniel Young Claimant ID: 0003011053Document1 pageCertain Government Payments 1099G: Claimant: Daniel Young Claimant ID: 0003011053Daniel YoungNo ratings yet

- 2022 Property Tax BillDocument1 page2022 Property Tax BillDjibzlaeNo ratings yet

- Dfi 306 Public FinanceDocument134 pagesDfi 306 Public FinanceElizabeth MulukiNo ratings yet

- AEC - 12 - Q1 - 0402 - PS - Minimum Wages and Taxes Concerns of Filipino EntrepreneursDocument88 pagesAEC - 12 - Q1 - 0402 - PS - Minimum Wages and Taxes Concerns of Filipino EntrepreneursJust TinNo ratings yet

- TBT CH1Document10 pagesTBT CH1darkNo ratings yet

- Mail To LornaDocument27 pagesMail To Lornaapi-3740993No ratings yet

- Income Taxation Sample QuestionsDocument3 pagesIncome Taxation Sample QuestionsIrdo Kwan33% (3)

- Rate of Depreciation in Case of WDV (1-nth Root of Residual Value) /cost (Cost-Sv) /lifeDocument3 pagesRate of Depreciation in Case of WDV (1-nth Root of Residual Value) /cost (Cost-Sv) /lifeAnishaSapra100% (1)

- Partisan Politics and Public Finance: Changes in Public Spending in The Industrialized Democracies, 1955-1989Document21 pagesPartisan Politics and Public Finance: Changes in Public Spending in The Industrialized Democracies, 1955-1989SumardiNo ratings yet

- Public Finance PolyDocument65 pagesPublic Finance PolyNeelabh KumarNo ratings yet

- Vijayawada Municipal Corporation: OriginalDocument4 pagesVijayawada Municipal Corporation: Originallakshmiteja105_18319No ratings yet

- Cloudways Ltd. 52 Springvale, Pope Pius XII Street, Mosta, Malta VAT#: MT20765109Document2 pagesCloudways Ltd. 52 Springvale, Pope Pius XII Street, Mosta, Malta VAT#: MT20765109MD NasimNo ratings yet

- DoccDocument1 pageDoccsonalikaNo ratings yet

- GST Practitioners PerspectiveDocument359 pagesGST Practitioners PerspectiveAbhishek ShuklaNo ratings yet

- 納稅義務人 Taxpayer: 2020 Individual Income Tax Return Of The Republic Of ChinaDocument2 pages納稅義務人 Taxpayer: 2020 Individual Income Tax Return Of The Republic Of China妮妮No ratings yet

- GST APL-01 Goenka BrothersDocument15 pagesGST APL-01 Goenka BrothersUtkarsh KhandelwalNo ratings yet

- Atal Pension Yojana Subscriber FormDocument1 pageAtal Pension Yojana Subscriber FormTarsem SoniNo ratings yet

- Corporate Tax in Dubai and UAEDocument5 pagesCorporate Tax in Dubai and UAEcharlielucaslieNo ratings yet

- Business Economics SEM-IV Question Bank Regular Examination PDFDocument13 pagesBusiness Economics SEM-IV Question Bank Regular Examination PDFSudhir NaikNo ratings yet

- 82310BIR Form 1700Document20 pages82310BIR Form 1700Georgia HolstNo ratings yet

- Pa-Note Nalang Pag May Babaguhin Kayong SagotDocument26 pagesPa-Note Nalang Pag May Babaguhin Kayong SagotErika Mae LegaspiNo ratings yet