Professional Documents

Culture Documents

Assignment 1 - MFRD

Uploaded by

cun conOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 1 - MFRD

Uploaded by

cun conCopyright:

Available Formats

Assignment 1

Group 2:

• Minh Châu

• Đức Hoà

• Sơn Bách

• Thanh Tùng

• Đạt Khuê

• Hải Linh

(a, b) What amount of owner’s capital will the business need?

What will it do?

We start our business with a small handmade shop. Firstly, we need a place for

us to sell things which is about 5 square meters. This shop should be near some

schools or be located in entertaining area. The host usually requires at least 6

month deposit. It’s about 9 mils.

There are 6 people to join in this business so we do not have to hire anybody

else. We will distribute work equally to everyone and each of us will be paid

1.3mil per month. It’s about 7.8 mils. However, in case the business won’t get

profit during the first 3 months we should have 23.4 mils to pay salary for

employees.

We tend to pay about 10 mils for the materials and tools.

Moreover, we have to spend money for water and electricity fee. It could be

about 2.4 mils per 3 months.

In sum, we must spend about 44.8 mils to start the business. That means we

must contribute 7.5 mils per person.

(c) What category would it fall into – manufacturer, trader,

service business?

Our shop actually focus on selling goods so we are seen as trader

. However, we can be called manufacturer and service business as

well. Our goods is hand-made accessories so we have to make all

the goods by ourselves. For this reason, not only a trader, we are

also a manufacturer. Customers like something unique, different from

other and satisfy their will. Hand-made shop meets all that

requirement. Customers can give their order to us ( their expectation

of the goods for example ) and we will try our best to satisfy their

demand. That service is the advantage of hand-made shop and make

it different to other normal accessories shop. According to that, our

hand made shop can be seen also as service business. In

conclusion, our business is the combination of 3 categories:

manufacturer, traders and service business.

(d) What form of ownership would be suitable – sole trader,

partnership, limited company?

Our group intends to set up a handmade shop which is only a small business we

can manage to finance with our own capital. We ourselves buy tools and raw

material needed and make all the things to sell. Profit which is gotten from the

business will be divided fairly into each of us. It seems to consider that our

business falls into partnership form. However if there were any troubles, all of us

would have responsibility. In partnerships, owners share of capital contributions

and share of profit but they do not have any legal responsibility with the business.

It is different from the business we are involved. Although we are not one person

in quantity to run the business, we all can be considers just like one person

because we share the same work, same profit and same responsibilities. With

these reasons, we think that we fit in the sole trader form.

(e) Things to buy to get our business started:

Rent workplace: 1.5mil per month (deposit 6 months: 9mils)

Buy tools and materials: 10 mils

Staffs and employees: 1.3mil per person (7.8 mils per month)

Other fees: 0.8 mil per month.

(f) Would you need other forms of finance and, if so, what

would be the appropriate ones?

We are going to open a handmade shop with small scale with 6 people who will

contribute the capital. It is not necessary to borrow capital from banks or other

investors. With the capital of 7.5 mils per person we can manage to pay for shop

renting, salary and other fees.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Financial and Business Management - EditedDocument3 pagesFinancial and Business Management - Editedhen maryNo ratings yet

- Task3 - MFRD2Document8 pagesTask3 - MFRD2cun conNo ratings yet

- MAR Assignment 1 CoverDocument5 pagesMAR Assignment 1 Covercun conNo ratings yet

- Simon Used A Car of Company. TheDocument9 pagesSimon Used A Car of Company. Thecun conNo ratings yet

- Task 4-MFRD 2Document4 pagesTask 4-MFRD 2cun conNo ratings yet

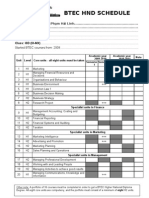

- Form Dang Ki BTEC HNDDocument1 pageForm Dang Ki BTEC HNDcun conNo ratings yet

- Principle Fukin' Full VersionDocument3 pagesPrinciple Fukin' Full Versioncun conNo ratings yet

- Slide For MFRD 2Document1 pageSlide For MFRD 2cun conNo ratings yet

- Sources of FinanceDocument2 pagesSources of Financecun conNo ratings yet

- Slide Group PresentationDocument3 pagesSlide Group Presentationcun conNo ratings yet

- MP 2 - 25 Dec 2009Document15 pagesMP 2 - 25 Dec 2009cun conNo ratings yet

- Reference (1) MFRD2Document1 pageReference (1) MFRD2cun conNo ratings yet

- Cost g1 Mfrd2Document5 pagesCost g1 Mfrd2cun conNo ratings yet

- Reference MFRD 2Document1 pageReference MFRD 2cun conNo ratings yet

- Process MappingDocument2 pagesProcess Mappingcun conNo ratings yet

- MFRD PresentationDocument15 pagesMFRD Presentationcun conNo ratings yet

- MFRD Ass 1-12 Nov 2009Document4 pagesMFRD Ass 1-12 Nov 2009cun con100% (1)

- Task 1 1a. Prepare and Implement ADocument8 pagesTask 1 1a. Prepare and Implement Acun conNo ratings yet

- MFRD 2 - 14 Dec 2009Document29 pagesMFRD 2 - 14 Dec 2009cun conNo ratings yet

- BDM2 - LinhDocument16 pagesBDM2 - Linhcun conNo ratings yet

- BDM 2 - 15 Dec 2009Document6 pagesBDM 2 - 15 Dec 2009cun conNo ratings yet

- CL A2 2009Document8 pagesCL A2 2009cun conNo ratings yet

- Table of ContentsDocument9 pagesTable of Contentscun conNo ratings yet

- BDM PresentationDocument26 pagesBDM Presentationcun conNo ratings yet

- 3c. As The CEO of The CompanyDocument1 page3c. As The CEO of The Companycun conNo ratings yet

- 1a. Compare The Various Definitions About WhatDocument2 pages1a. Compare The Various Definitions About Whatcun conNo ratings yet

- Marketing AuditDocument8 pagesMarketing Auditcun conNo ratings yet

- All The Cost - MFRD 2Document1 pageAll The Cost - MFRD 2cun conNo ratings yet

- Choose Project FDocument1 pageChoose Project Fcun conNo ratings yet

- Choose Project FDocument1 pageChoose Project Fcun conNo ratings yet

- Tinh' ARR Project A 350000 221400 128600Document1 pageTinh' ARR Project A 350000 221400 128600cun conNo ratings yet

- Igcse 0450 Business StudiesDocument91 pagesIgcse 0450 Business Studiesvincentmdala19No ratings yet

- Cambridge IGCSE ™ (9-1) : Business Studies 0986/21 October/November 2022Document22 pagesCambridge IGCSE ™ (9-1) : Business Studies 0986/21 October/November 2022YahiaNo ratings yet

- Business Enterprise Simulation Bus PlanDocument24 pagesBusiness Enterprise Simulation Bus Planchristine j.No ratings yet

- Solution Manual Business EntitiesDocument34 pagesSolution Manual Business EntitiesKiranNo ratings yet

- Profit and Loss Statement: When To Use This FormDocument5 pagesProfit and Loss Statement: When To Use This FormsureNo ratings yet

- 3rd Sem-Tato NotesDocument38 pages3rd Sem-Tato NotesNEEPANo ratings yet

- BagnetDocument32 pagesBagnetJoel Bagoyo100% (3)

- Forms of Business OrganizationDocument1 pageForms of Business OrganizationElla Simone100% (3)

- International Multidisciplinary Research JournalDocument9 pagesInternational Multidisciplinary Research Journalkahkashan khurshidNo ratings yet

- Form GST REG-06: Government of IndiaDocument3 pagesForm GST REG-06: Government of IndiaVikas JainNo ratings yet

- Capital FinancingDocument19 pagesCapital FinancingJam Maica TuboNo ratings yet

- Inland Revenue Board of Malaysia: Public Ruling No. 5/2014Document31 pagesInland Revenue Board of Malaysia: Public Ruling No. 5/2014123dddNo ratings yet

- The Procedures Are Subjected To Changes With Respect To Enclosed G.O. Gazette NotificationDocument4 pagesThe Procedures Are Subjected To Changes With Respect To Enclosed G.O. Gazette NotificationVanittharaniRamasamyNo ratings yet

- What Is A Sole Proprietorship?Document3 pagesWhat Is A Sole Proprietorship?PRANAV A Bcom IT S1No ratings yet

- Financial Accounting BasicsDocument60 pagesFinancial Accounting BasicsAhasanul ArefinNo ratings yet

- Fabm Week 2 FinalsDocument8 pagesFabm Week 2 FinalsDaniella Dela Peña100% (1)

- Lesson 1.1Document16 pagesLesson 1.1Hyunjin imtreeeNo ratings yet

- 6 OrganizingDocument58 pages6 OrganizingMalik Aixax AhmadNo ratings yet

- Chapter 3 Entrepreneurship New Ventures and Business OwnershipDocument24 pagesChapter 3 Entrepreneurship New Ventures and Business OwnershipMhmd KaramNo ratings yet

- Employer Employee PresentationDocument30 pagesEmployer Employee Presentation2307pradeepNo ratings yet

- Partnership AccountsDocument4 pagesPartnership AccountsManoj Kumar GeldaNo ratings yet

- Cooperative Mgt. - Module 1-L 1-5Document41 pagesCooperative Mgt. - Module 1-L 1-5Vince LeonesNo ratings yet

- Dwnload Full Cornerstones of Financial Accounting Canadian 1st Edition Rich Solutions Manual PDFDocument36 pagesDwnload Full Cornerstones of Financial Accounting Canadian 1st Edition Rich Solutions Manual PDFjayden77evans100% (12)

- BEM Sole Proprietor GuidelinesDocument11 pagesBEM Sole Proprietor GuidelinesSiaw Ming ChianNo ratings yet

- Introduction To Business Notes B.com Part 1Document80 pagesIntroduction To Business Notes B.com Part 1Amjad bbsulkNo ratings yet

- Reviewer in Entrep (1st Grading)Document21 pagesReviewer in Entrep (1st Grading)Raffy Ringor CondenoNo ratings yet

- TP 80 V (2017 10)Document4 pagesTP 80 V (2017 10)DiegoAhmedNo ratings yet

- THCIWRWA promotes woodcrafts and cottage industriesDocument8 pagesTHCIWRWA promotes woodcrafts and cottage industriesElmer DatuinNo ratings yet

- Reviewer AccountingDocument14 pagesReviewer Accountingveronica aban100% (1)