Professional Documents

Culture Documents

Whyckoff Method

Uploaded by

ngocleasingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Whyckoff Method

Uploaded by

ngocleasingCopyright:

Available Formats

The Whyckoff Trading Method 1930:

A Case Study of the US Stock Market

The mechanics of the markets are so complicated that one must break

it down into some foundational guidelines that encompass the whole,

then build upon that foundation slowly and methodically until it

makes sense and becomes a high probability, low risk undertaking.

by Jerry Garner jr

The Law of Supply and Demand

1. States that when demand is

greater than supply, prices will

rise, and when supply is greater

them demand, prices will fall.

Here the analyst studies the

relationship between supply

versus demand using price &

volume over time as found on

the bar chart.

2. The Law of Cause & Effect

Postulates that in order to have

an effect will be in proportion

to the cause. This law is

seen working as the force of

accumulation or distribution

within a trading range.

3. The Law of Effort Versus Result

divergences and disharmonies

between volume and price often

presage a change in the direction

of the price trend & helpful for

indentifying accumulation verses

distribution & gauging effort.

Law of Supply and Demand

Demand refers to how much (quantity) of a product or service is desired by buyers. The quantity demanded is the amount of

a product people are willing to buy at a certain price; the relationship between price and quantity demanded is known as the

demand relationship. The analyst studies the relationship between supply vs. demand using price and volume over time.

Supply represents how much the market can offer. The quantity supplied refers to the amount of a certain good producers are

willing to supply when receiving a certain price. The correlation between price and how much of a good or service is supplied

to the market is known as the supply relationship. Price, therefore, is a reflection of supply and demand.

The Law of Demand states, the lower somethings price is, the more demand there is for it and the relationship between

demand and price is an inverse relationship. As one goes up, the other comes down. The Law of Supply states, the higher

somethings price is, the more it will be supplied and the relationship between supply and price is a direct relationship. As one

goes up, the other goes up.

Supply and demand is the basic foundation of economics However Supply and demand is the effect, not the cause. Something

happens, and supply increases or demand decreases (or both) causing price to go down, or something happens and supply

goes down or demand goes up (or both) causing price to go up. The something is the cause, and the change in supply/

demand is the effect. So, yes, price went up because of an increase in demand however, it is the cause for the change in

supply and demand that caused the price change. trading is the perception and speculation of what the change in supply and

demand will be.

Markets move off of the imbalance of supply and demand, a imbalance of supply and the market has to fall, a imbalance of

demand and the market has to rise. Accumulation from the Supply/Demand perspective is demand coming in to gradually

overcome and absorb the supply and to support the market at this price level. Distribution from the Supply/Demand

perspective is where the Supply overcomes Demand and stops the upward move and eventually begins the downward move.

Distribution refers to the elimination of a long investment or speculative position and often involves establishing a speculative

short position by professional interests in anticipation of a decline of price.

The Whyckoff Trading Method 1930:

A Case Study of the US Stock Market

Richard D. Wyckoff devised three laws that govern market dynamics.

These laws tell you how and why the markets work. The law of Supply

and Demand is the most fundamental and overriding aspect of

market dynamics. The other two laws act on and measure Supply

and Demand.

by Jerry Garner jr

The Law of Supply and Demand

1. States that when demand is

greater than supply, prices will

rise, and when supply is greater

them demand, prices will fall.

Here the analyst studies the

relationship between supply

versus demand using price &

volume over time as found on

the bar chart.

2. The Law of Cause & Effect

Postulates that in order to have

an effect will be in proportion

to the cause. This law is

seen working as the force of

accumulation or distribution

within a trading range.

3. The Law of Effort Versus Result

divergences and disharmonies

between volume and price often

presage a change in the direction

of the price trend & helpful for

indentifying accumulation verses

distribution & gauging effort.

Law of Cause & Effect

A second basic principle underlying all analytical efforts is the law of cause and effect. The idea here is that in order for there

to be an effect that shows up as a change in the price of a stock, there must first be a cause. In its most basic state, this law

seems very much the same as the law of supply and demand. In the cases of the individual trades mentioned, the cause is the

buyers desire to hold the shares, or the sellers desire to have dollars. In one case the cause is expressed in terms of demand

and in the other in terms of supply.

A cause can be stated in terms of the reason behind an individual trade. In the making of important profits in the stock

market, however, the significance of each individual trade is greatly reduced. Here the idea of a cause must be taken more

broadly, The effect realized by a cause will be in direct proportion to that cause. Consequently, to get an important move, or

effect there must be an important cause. These are not built from one trade, but rather take time, sometimes a long time, to

develop.

Generally these causes are built during an important shift in who is holding the stock. The flow of shares that is of greatest

significance is the one that occurs as shares leave the strong hands of the professional traders and go to the weaker hands of

the general public.

Every market advance begins only after the professional traders have all, or just about all, the shares they desire. Once the

move begins, it will be carried forward primarily by the increasing and emotional buying of the public. The emotion at work

here, by the way, is greed. The knowledgeable trader will go with the upward trend of the advance as long as prices continue

to move up easily.

The idea is to measure this cause and project the extent of its effect. The excesses that develop in supply and demand are not

random but are the result of key events in market action or the result of periods of preparation. This laws operation can be

seen working as the force of accumulation or distribution within a trading range that works itself out in the subsequent move

out of that trading range. This law can be seen working over a group of bars.

The Whyckoff Trading Method 1930:

A Case Study of the US Stock Market

The price of every equity moves up or down because there is an excess

of demand over supply or supply over demand, the Law of Effort vs.

Results - divergencies and disharmonies between volume and price

often presage a change in the direction of the price trend.

by Jerry Garner jr

The Law of Supply and Demand

1. States that when demand is

greater than supply, prices will

rise, and when supply is greater

them demand, prices will fall.

Here the analyst studies the

relationship between supply

versus demand using price &

volume over time as found on

the bar chart

2. The Law of Cause & Effect

Postulates that in order to have

an effect will be in proportion

to the cause. This law is

seen working as the force of

accumulation or distribution

within a trading range.

3. The Law of Effort Versus Result

divergences and disharmonies

between volume and price often

presage a change in the direction

of the price trend & helpful for

indentifying accumulation verses

distribution & gauging effort.

Law of Effort vs Result

states that the change in price of a trading vehicle is the result of an effort expressed by the level of volume & that harmony

between effort & result promotes further price movement while lack of harmony promotes a change in direction. The law of

effort (volume) verses result (price) is action, this law can be seen working on one bar.

To get a better idea of how the concept of effort versus result works and how it can help protect against disaster, consider yet

another hypothetical situation. It begins with a stock that explodes upward by six points. The volume is ten thousand shares.

The next day, there is an additional advance of four points and trading expands to twenty thousand shares. At this point,

many people are making a lot of money. This is also the type of situation that brings out an incredible amount of greed. On

the third day, the stock takes on an additional two points while the volume soars to forty-thousand shares. Then day number

four comes and this time the wonder stock only advances half a point. The volume, however, tops the hundred thousand

share level.

Is it clear what is happening in this case? Obviously, the price is moving up and the volume is expanding. That should be

a good sign and in many cases it is a good indication for the future. In this case, though, it creates a problem. As the stock

advances, the amount of each successive advance decreases. The volume on the other hand increases steadily throughout the

four days. This results in a clear case of an effort without a corresponding result. It produces a warning of potential trouble.

Anyone not already in this stock is well advised not to get in, at least not at this dangerous time. Those already holding

positions should protect themselves as best they can, or just get out. Until it can be determined why the result is lagging

behind the effort or until the situation corrects itself, there is the potential for disaster. The chart at the bottom of exhibit five

shows how this concept of effort without result might look in actual practice.

The Whyckoff Trading Method 1930:

A Case Study of the US Stock Market

Whckoff Schematics

1. Wyckoff empowers the traderanalyst with a balanced, whole

brained approach to technical

analysis decision making. The

schematics provide picture diagrams as a right-brained tool to

complement the left-brained analytical checklists furnished by the

Wyckoff three laws and nine tests.

2. One objective of the Wyckoff

method of technical analysis

is to improve market timing

when establishing a speculative

position in anticipation of a

coming move where a favorable

reward/risk ratio exists to justify

taking that position.

3. To be successful, you must be able

to anticipate and correctly judge

the direction and magnitude of

the move out of the TR.

Wyckoff Schematics Of Market Phases

Trading ranges are places where the previous move has been halted

and there is relative equilibrium between supply and demand. It is

here within the TR that campaigns of accumulation or distribution

develop in preparation for the coming bull or bear trend. It is this

force of accumulation or distribution that can be said to build a

cause that unfolds in the subsequent move.

The Whyckoff Trading Method 1930:

A Case Study of the US Stock Market

Whckoff Schematics

1. Wyckoff empowers the traderanalyst with a balanced, whole

brained approach to technical

analysis decision making. The

schematics provide picture diagrams as a right-brained tool to

complement the left-brained analytical checklists furnished by the

Wyckoff three laws and nine tests.

2. One objective of the Wyckoff

method of technical analysis

is to improve market timing

when establishing a speculative

position in anticipation of a

coming move where a favorable

reward/risk ratio exists to justify

taking that position.

3. To be successful, you must be able

to anticipate and correctly judge

the direction and magnitude of

the move out of the TR.

Trading Ranges present favorable short-term trading opportunities

with potentially very favorable reward/risk parameters.

Nevertheless, great reward comes with participation in the trend that

emerges from the Trading Range. Wyckoff offers unique guidelines by

which the trader-analyst can examine the phases within a TR.

Wyckoff Schematic Of Accumulation

visual representation of the Wyckoff market action typically found within a TR of accumulation

The Whyckoff Trading Method 1930:

A Case Study of the US Stock Market

Phases of Accumulation

1. Lines A and B define support of

the trading range, while lines C

and D define resistance.

2. Phase A: To stop a downward

trend either permanently or

temporarily.

3. Phase B: To build a cause within

the trading range for the next

effect and trend.

4. Phase C: Smart money tests

the market along the lower and/

or the upper boundaries of the

trading range. Here one observes

springs and/or jumps and

backups.

5. Phase D: Defines the line of least

resistance with the passage of the

nine buying tests.

6. Phase E: The mark up or the

upward trending phase unfolds.

Wyckoff model for accumulation is not a schematic for all the

possible variations within the anatomy of a Trading Range, it does

provide the important Wyckoff principles that are evident in an

area of accumulation. It also shows the key phases used to guide

our analysis from the beginning of the Trading Range with a selling

climax, through building a cause until the taking of a position.

Wyckoff Schematic Of Accumulation

visual representation of the Wyckoff market action typically found within a TR of accumulation

The Whyckoff Trading Method 1930:

A Case Study of the US Stock Market

Accumulation Schematic Defined

1. PS (1) preliminary support,

where substantial buying begins

to provide pronounced support

after a prolonged down-move.

Volume and the price spread widen and provide a signal that the

down move may be approaching

its end.

2. SC (2) selling climax, the point

at which widening spread and

selling pressure usually climaxes

and heavy or panicky selling by

the public is being absorbed by

larger professional interests at

prices near the bottom. At the

low, the climax helps to define the

lower level of the TR.

3. AR (3) automatic rally, where

selling pressure has been

exhausted. A wave of buying

can now easily push up prices,

which is further fuelled by short

covering.

Wyckoff Schematic Of Accumulation

visual representation of the Wyckoff market action typically found within a TR of accumulation

The Whyckoff Trading Method 1930:

A Case Study of the US Stock Market

Accumulation Schematic Defined

1. ST (4, 5, 8) secondary test, price

revisits the area of the selling climax to test the supply/demand at

these price levels. If a bottom is to

be confirmed, significant supply

should not resurface, and volume

and

2. The Creek (6) is a wavy line of

resistance drawn loosely across

rally peaks within the trading

range. There are minor lines of

resistance and a more significant

creek of supply that will have

to be crossed before the markets

journey can continue onward and

upward.

Wyckoff Schematic Of Accumulation

visual representation of the Wyckoff market action typically found within a TR of accumulation

The Whyckoff Trading Method 1930:

A Case Study of the US Stock Market

Springs or Shakeouts (7) Defined

1. Usually occur late within the

trading range and allow the

dominant players to make a

definitive test of available supply

before a markup campaign will

unfold.

2. If the amount of supply that

surfaces on a break of support is

very light (low volume), it will be

an indication that the way is clear

for a sustained advance.

3. Heavy supply here usually means

a renewed decline.

4. Moderate volume here may mean

more testing of support and a

time to proceed with caution.

5. The spring or shakeout also

serves the purpose of providing

dominant interests with

additional supply from weak

holders at low prices.

Wyckoff Schematic Of Accumulation

visual representation of the Wyckoff market action typically found within a TR of accumulation

The Whyckoff Trading Method 1930:

A Case Study of the US Stock Market

Accumulation Schematic Defined

1. Jump (9) continuing the creek

analogy, the point at which price

jumps through the resistance

line; a bullish sign if the jump is

achieved with increasing speed

and volume.

2. SOS (10, 12) sign of strength, an

advance on increasing spread and

volume, usually over some level of

resistance

3. BU/LPS (13) last point of

support, the ending point of a

reaction or pullback at which

support was met. Backing up

to an LPS means a pullback

to support that was formerly

resistance, on diminished spread

and volume after an SOS. This

is a good place to initiate long

positions or to add to profitable

ones.

Wyckoff Schematic Of Accumulation

visual representation of the Wyckoff market action typically found within a TR of accumulation

The Whyckoff Trading Method 1930:

A Case Study of the US Stock Market

Accumulation Schematic Defined

1. PS (1) Preliminary Supply is

where substantial selling begins

to provide pronounced resistance

after an up move. Volume and

spread widen and provide a signal that the up move may be approaching its end.

2. BC (2) Buying Climax is the

point at which widening spread

and the force of buying climaxes,

and heavy or urgent buying by

the public is being filled by larger

professional interests at prices

near a top.

3. AR (3) Automatic Reaction with

buying pretty much exhausted

and heavy supply continuing an

AR follows the BC. The low of this

selloff will help define the bottom

of the Trading Range (TR).

Wyckoff Schematic Of Distribution

visual representation of the Wyckoff market action typically found within a TR of accumulation

The Whyckoff Trading Method 1930:

A Case Study of the US Stock Market

Accumulation Schematic Defined

1. ST Secondary Test(s) revisit the

area of the Buying Climax to test

the demand/supply balance at

these price levels. If a top is to be

confirmed, supply will outweigh

demand and volume and spread

should be diminished as the market approaches the resistance area

of the BC.

2. SOW Sign of Weakness at point

10 will usually occur on increased

spread and volume as compared

to the rally to point 9. Supply is

showing dominance. Our first

fall on the ice holds and we get

up try to forge ahead.

3. The ice is an analogy to a wavy

line of support drawn loosely

under reaction lows of the

Trading Range. A break through

the ice will likely be followed by

attempts to get back above it.

Wyckoff Schematic Of Distribution

visual representation of the Wyckoff market action typically found within a TR of accumulation

The Whyckoff Trading Method 1930:

A Case Study of the US Stock Market

Accumulation Schematic Defined

1. UTAD UPthrust After

Distribution Similar to the Spring

and Terminal Shakeout in the

trading range of Accumulation,

a UTAD may occur in a TR or

distribution. It is more definitive

test of new demand after a

breakout above the resistance line

of the TR and usually occurs in

the latter stages of the TR.

2. If this breakout occurs on light

volume with no follow through

or on heavy volume with a

breakdown back into the center

of the trading range, then this is

more evidence that the TR was

Distribution not Accumulation.

3. This UTAD usually results in

weak holders of short positions

giving them up to more dominant

interests, and also in more

distribution to new, less informed

buyers before a decline.

An upthrust is the opposite of a spring. It is a price move above the

resistance level of a trading range that quickly reverses itself and

moves back into the trading range. An upthrust is a bull trap it

appears to signal a start of an uptrend but in reality marks the end of

the up move.

Wyckoff Schematic Of Distribution

visual representation of the Wyckoff market action typically found within a TR of accumulation

The Whyckoff Trading Method 1930:

A Case Study of the US Stock Market

Accumulation Schematic Defined

1. LPSY Last Point of Supply

after we test the ice (support)

on a SOW, a feeble rally attempt

on narrow spread shows us the

difficulty the market is having in

making a further rise. Volume

may be light or heavy, showing

weak demand or substantial

supply. It is at these LPSYs that

the last waves of distribution are

being unloaded before markdown

is to begin.

2. After a break through the ice, a

rally attempt is thwarted at the

ices surface (now resistance). The

rally meets a last wave of supply

before markdown ensues. LPSYs

are good places to initiate a short

position or to add to already

profitable ones.

3. In Phase E, the stock or

commodity leaves the TR and

supply is in control.

Within the dynamics of a Trading Range, the force of accumulation

or distribution gives us the cause and the potential opportunity for

substantial trading profits.

Wyckoff Schematic Of Distribution

visual representation of the Wyckoff market action typically found within a TR of accumulation

You might also like

- Wyckoff e BookDocument43 pagesWyckoff e BookIan Moncrieffe95% (22)

- Follow The Smart Money VSADocument10 pagesFollow The Smart Money VSADavid Gordon100% (2)

- Follow The Smart Money VSADocument10 pagesFollow The Smart Money VSADavid Gordon100% (2)

- The Hidden Strengths of Volume AnalysisDocument13 pagesThe Hidden Strengths of Volume AnalysisCryptoFX100% (8)

- Earl The Complete Volume Spread Analysis System ExplainedDocument7 pagesEarl The Complete Volume Spread Analysis System ExplainedSardar Amrik Singh MallNo ratings yet

- Wyckoff Volume Analysis Using Cumulative DeltaDocument6 pagesWyckoff Volume Analysis Using Cumulative DeltaMarcianopro183% (6)

- Wyckoff WorkbookDocument33 pagesWyckoff WorkbookSergey Khaidukov73% (11)

- Wyckoff Support Level Auction TheoryDocument65 pagesWyckoff Support Level Auction Theorymoby_rahman100% (8)

- Wyckoff Market Analysis: Charles DowDocument11 pagesWyckoff Market Analysis: Charles Dowmaulik_20_8No ratings yet

- Volume Spread Analysis ExamplesDocument55 pagesVolume Spread Analysis Examplesthinkscripter82% (11)

- Price VolumeDocument3 pagesPrice VolumeCryptoFX96% (24)

- HurstDocument7 pagesHurstngocleasing75% (4)

- Summary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthFrom EverandSummary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthNo ratings yet

- VSA High Probability TradesDocument3 pagesVSA High Probability TradesDavid Gordon100% (2)

- Test 15 SolutionsDocument31 pagesTest 15 SolutionsNguyệt LinhNo ratings yet

- Volume Spread Analysis RulesDocument3 pagesVolume Spread Analysis RulesPRASADNo ratings yet

- Wyckoff Logic LandscapeDocument1 pageWyckoff Logic LandscapeDamir Kamenjicki100% (2)

- Session 04-WTC PPT (Jan 28, 2019)Document32 pagesSession 04-WTC PPT (Jan 28, 2019)MtashuNo ratings yet

- Bible of Supply & Demand Trading for complete BeginnersFrom EverandBible of Supply & Demand Trading for complete BeginnersRating: 1 out of 5 stars1/5 (2)

- MBoxWave Wyckoff Trading SystemDocument15 pagesMBoxWave Wyckoff Trading Systemsololeos100% (5)

- Wyckoff Strategies Techniques Free ChaptersDocument8 pagesWyckoff Strategies Techniques Free ChaptersMicaela Seisas0% (1)

- He Market Bar by BarDocument49 pagesHe Market Bar by BarSalomé100% (8)

- Danny K VsaDocument8 pagesDanny K VsaLucas Perez100% (1)

- Trading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketFrom EverandTrading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketNo ratings yet

- VSA Notes on Trading With the Smart MoneyDocument1 pageVSA Notes on Trading With the Smart MoneySyed Muhammad Shahbaz100% (1)

- WykoffDocument48 pagesWykoffNavin Ratnayake100% (1)

- VSA - Cheat SheetDocument18 pagesVSA - Cheat SheetAriel Devulsky90% (20)

- Volume Spread Analysis Improved With Wyckoff 2Document3 pagesVolume Spread Analysis Improved With Wyckoff 2ngocleasing86% (7)

- Volume Spread Analysis Improved With Wyckoff 2Document3 pagesVolume Spread Analysis Improved With Wyckoff 2ngocleasing86% (7)

- Wyckoff Terms ExplainedDocument3 pagesWyckoff Terms Explainedbestnifty100% (7)

- The Wyckoff Method Session 5Document24 pagesThe Wyckoff Method Session 5Upasara Wulung100% (1)

- Chart Reading Master Classes NotesDocument15 pagesChart Reading Master Classes NotesZeeshan AhmedNo ratings yet

- The Secret Trading Strategy From The 1930s That Hedge Funders DoneDocument7 pagesThe Secret Trading Strategy From The 1930s That Hedge Funders DoneivopiskovNo ratings yet

- Just a Trade a Day: Simple Ways to Profit from Predictable Market MovesFrom EverandJust a Trade a Day: Simple Ways to Profit from Predictable Market MovesNo ratings yet

- Wisdom of Wyckoff2Document31 pagesWisdom of Wyckoff2ngocleasing100% (2)

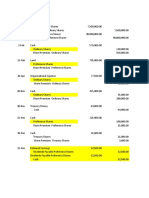

- Department A Cost Analysis and Profitability CalculationsDocument8 pagesDepartment A Cost Analysis and Profitability CalculationsRica PresbiteroNo ratings yet

- Rediscover The Lost Art of Chart Reading - Using VSA - Todd KruegerDocument5 pagesRediscover The Lost Art of Chart Reading - Using VSA - Todd KruegerRecardo AndyNo ratings yet

- Vsa Basics PDFDocument31 pagesVsa Basics PDFdiogonbig100% (1)

- Vsa Basics PDFDocument31 pagesVsa Basics PDFdiogonbig100% (1)

- The Market Makers (Review and Analysis of Spluber's Book)From EverandThe Market Makers (Review and Analysis of Spluber's Book)No ratings yet

- The Nature of Trends: Strategies and Concepts for Successful Investing and TradingFrom EverandThe Nature of Trends: Strategies and Concepts for Successful Investing and TradingNo ratings yet

- Introduction to Basic Supply & Demand Trading for BeginnersFrom EverandIntroduction to Basic Supply & Demand Trading for BeginnersRating: 1 out of 5 stars1/5 (1)

- Active Trader SSeiden 0906Document2 pagesActive Trader SSeiden 0906sn1618No ratings yet

- Evans Echoes Lectures on Wyckoff Trading MethodsDocument4 pagesEvans Echoes Lectures on Wyckoff Trading MethodsJay Sagar50% (2)

- Trade Seq ExpDocument130 pagesTrade Seq Exppowyoung100% (1)

- Wyckoff Method - Law+TestDocument6 pagesWyckoff Method - Law+Testallegre100% (3)

- VSA Official Summary Part1Document38 pagesVSA Official Summary Part1Otc Scan100% (2)

- Nature and Structure of Business EnvironmentDocument32 pagesNature and Structure of Business EnvironmentSahil Gandhi75% (4)

- Rule Based Supply and Demand Trading for BeginnersFrom EverandRule Based Supply and Demand Trading for BeginnersRating: 2.5 out of 5 stars2.5/5 (4)

- Wayne A. Thorp - Analyzing Supply & Demand Using Point & Figure ChartsDocument5 pagesWayne A. Thorp - Analyzing Supply & Demand Using Point & Figure ChartsManojKumar100% (1)

- Wyckoff Price and Market StructuresDocument2 pagesWyckoff Price and Market StructuresSeo Soon Yi100% (10)

- Wyckoff MethodDocument14 pagesWyckoff MethodAnonymous rPnAUz47Fe100% (6)

- Assignment Bsma 1a May 27Document14 pagesAssignment Bsma 1a May 27Maeca Angela Serrano100% (1)

- Wyckoff TimeDocument4 pagesWyckoff TimeACasey101100% (1)

- Supply and Demand Trading 101 for BeginnersFrom EverandSupply and Demand Trading 101 for BeginnersRating: 2.5 out of 5 stars2.5/5 (2)

- Wyckoff Lite - A Method of Tape ReadingDocument140 pagesWyckoff Lite - A Method of Tape Readingbernardo_martin_2100% (1)

- Supply and DemandDocument206 pagesSupply and DemandYagnesh Patel89% (9)

- Sentiment in the Forex Market: Indicators and Strategies To Profit from Crowd Behavior and Market ExtremesFrom EverandSentiment in the Forex Market: Indicators and Strategies To Profit from Crowd Behavior and Market ExtremesRating: 2 out of 5 stars2/5 (1)

- Introduction To Weis Waves PDFDocument7 pagesIntroduction To Weis Waves PDFlequangtruong1602No ratings yet

- Wyckoff Trading Course (WTC) : February 18Document14 pagesWyckoff Trading Course (WTC) : February 18MtashuNo ratings yet

- Using Simple Sell Rules 03 02 2013Document4 pagesUsing Simple Sell Rules 03 02 2013ngocleasing100% (3)

- Straight Line Approach, The: Understanding Supply and Demand Through TrendlinesDocument33 pagesStraight Line Approach, The: Understanding Supply and Demand Through Trendlinespjwillis100% (1)

- WyckoffDocument1 pageWyckoffRatulNo ratings yet

- Wyckoff Investment TheoryDocument2 pagesWyckoff Investment Theoryeast21west50% (6)

- Volume Spread AnalysisDocument3 pagesVolume Spread Analysisswifty4000No ratings yet

- Key IBD Chart Patterns 1.10Document1 pageKey IBD Chart Patterns 1.10ngocleasingNo ratings yet

- PatternsDocument14 pagesPatternsngocleasingNo ratings yet

- DDD Examply Stock Dec 2012Document31 pagesDDD Examply Stock Dec 2012ngocleasingNo ratings yet

- HSBC - Vietnam Economic Outlook - Lam Phi YenDocument32 pagesHSBC - Vietnam Economic Outlook - Lam Phi YenBet TranNo ratings yet

- Using Stock Checkup 9 - 12 Peter ZweigDocument7 pagesUsing Stock Checkup 9 - 12 Peter ZweigngocleasingNo ratings yet

- All 11082015Document15 pagesAll 11082015ngocleasingNo ratings yet

- NR 7 Tracker: Date Open High Low Close Day Range NR7 FlagDocument5 pagesNR 7 Tracker: Date Open High Low Close Day Range NR7 FlagngocleasingNo ratings yet

- Practical Research 1 SLHT Week 2Document9 pagesPractical Research 1 SLHT Week 2Ceyah KirstenNo ratings yet

- Unit 1 Chapters 1-2 Study Plan SolutionsDocument6 pagesUnit 1 Chapters 1-2 Study Plan SolutionskobinaNo ratings yet

- Business Plan of A Theme ParkDocument73 pagesBusiness Plan of A Theme Parkramkic1305No ratings yet

- A Study On Brand Awareness of Sanker CementsDocument14 pagesA Study On Brand Awareness of Sanker CementsREJIN TSNo ratings yet

- Adobe Scan 11 Feb 2023Document3 pagesAdobe Scan 11 Feb 2023Abhishek V BendreNo ratings yet

- IBI101Document8 pagesIBI101hongphucNo ratings yet

- Kohima Nagaland LBDocument1 pageKohima Nagaland LBIndia TreadingNo ratings yet

- Ifsc H Dfco0 or Micr: Mandate Instruction FormDocument1 pageIfsc H Dfco0 or Micr: Mandate Instruction FormurvashiNo ratings yet

- Zolo FinalDocument1 pageZolo FinalankurNo ratings yet

- Philips Lighting Price ListDocument124 pagesPhilips Lighting Price Listhalder.swapan1979No ratings yet

- Monetary Policy 1Document27 pagesMonetary Policy 1Adeola AdekunleNo ratings yet

- C-86 An Acceleration-Cyclic Corrosion Test of Coating Systems For Steel BridgesDocument6 pagesC-86 An Acceleration-Cyclic Corrosion Test of Coating Systems For Steel BridgesDhananjay ShimpiNo ratings yet

- Manroland Enhancements BookDocument32 pagesManroland Enhancements BookEmbagraf TINo ratings yet

- Copyright Law - Chapter 2 (Authorship and Ownership)Document3 pagesCopyright Law - Chapter 2 (Authorship and Ownership)Elene KNo ratings yet

- Week 3 Class/Meet Session: Discussion QuestionsDocument2 pagesWeek 3 Class/Meet Session: Discussion QuestionsForappForapp50% (2)

- Globalization: An International SystemDocument23 pagesGlobalization: An International SystemKayeden CubacobNo ratings yet

- Animal Purchase ContractDocument2 pagesAnimal Purchase ContractScribdTranslationsNo ratings yet

- Case Study BQT About Sunglass StoresDocument5 pagesCase Study BQT About Sunglass StoresztgaffNo ratings yet

- Fixed Deposits - November 22 2021Document1 pageFixed Deposits - November 22 2021Lisle Daverin BlythNo ratings yet

- Final Pre Board Plumbing Design Installation SanitationDocument19 pagesFinal Pre Board Plumbing Design Installation SanitationJahara CanutoNo ratings yet

- HELP Bachelor of Business Subject Availability. - SUBANG CAMPUSDocument3 pagesHELP Bachelor of Business Subject Availability. - SUBANG CAMPUSjingen0203No ratings yet

- Baeyens, Walter - RSI Logic, Signals & Time Frame Correlation-Đã Nén (PDF - Io) PDFDocument66 pagesBaeyens, Walter - RSI Logic, Signals & Time Frame Correlation-Đã Nén (PDF - Io) PDFthang dNo ratings yet

- Name: Venkata Naga Jagadeesh Appana Client Code: 57995415 Pan No: Bcfpa6131A Pin: 533125Document3 pagesName: Venkata Naga Jagadeesh Appana Client Code: 57995415 Pan No: Bcfpa6131A Pin: 533125sagar lovzNo ratings yet

- Solution Manual For Financial Economics Frank J Fabozzi Edwin H Neave Guofu Zhou Full DownloadDocument4 pagesSolution Manual For Financial Economics Frank J Fabozzi Edwin H Neave Guofu Zhou Full Downloadbrandonfowler12031998mgj100% (36)

- Tender NoticeDocument4 pagesTender NoticerahulsunariyaNo ratings yet

- 20210308-0043-B Lur No.: Laboratory / Radiology / Ultrasound Request FormDocument1 page20210308-0043-B Lur No.: Laboratory / Radiology / Ultrasound Request FormMarvin VerdadNo ratings yet