Professional Documents

Culture Documents

In 2013

Uploaded by

Anirudh DuttaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

In 2013

Uploaded by

Anirudh DuttaCopyright:

Available Formats

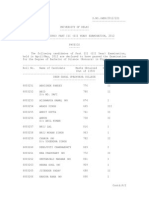

In 2013, Microsoft acquired Nokia's mobile phone business as part of an overall deal

totaling 5.44 billion (US $7.17 billion). This was is an extension of the strategic alliance

agreement dated 2011 between Nokia and Microsoft, wherein Nokia agreed to use

Microsofts Windows Phone for its main smartphone operating system. Further,

Microsoft also paid an additional 1.65 million to Nokia to license its patents. In this

document, we will discuss the strategic rationale behind the deal and what have been

the overall synergies gained by both companies.

EXPECTED SYNERGY GAINS

Nokia had been the world leader in mobile phones for a long time (48.7% market share

in 2007) until the advent of smartphones. However its inability to anticipate the rise of

smartphones saw its market share drop down to merely 3.7% by Q4, 2011. On the other

hand, Microsoft despite being a pioneer in the field of smartphones could never

successfully tap into the smartphone market. Its windows based Lumia series of

smartphones eventually lost out to Apples iPhone. Given Nokias brand equity, strong

distribution and after sales network, Microsoft feels that it can leverage them to boosts

its Windows based platform as an alternative to Android and iOS.

The official document describing Microsofts strategic rationale for deal announced with

Nokia, Microsoft states the objective to achieve 15% market share in 1.7 billion

worldwide smartphone shipments (255 million units) and achieve revenue of

approximately $45 billion ( 33.3 billion) by 2018. Microsofts acquisition of Nokias

Lumia and Asha brands of phones that represent the smartphone product portfolio of

Nokia covers price points ranging from around 140 to more than 500, excluding

taxes and subsidies. During 2012, Nokias Smart Devices unit shipped approximately 35

million smartphones with an average sale price of 155, leading to total revenue of

5.42 billion.

After acquisition, Nokias

phones will use in-sourced

Windows Mobile. Prior to

acquisition, Microsofts was

getting

royalties

gross

margin of $10 per Nokia

device running Windows OS

sold. Assuming that post

acquisition

this

cost

($10/device) will go away

since Microsoft will provide

the OS to its mobile devices

for free, cost of sales for Smart Devices will drop down by 259 million from in-sourcing

operating system for its smart devices. This will improve gross margin on Smart Devices

from 8.7% to 13.5%. If Microsoft gains traction in its smart devices business, then cost

of sales synergy because of in-sourcing operating system will increase.

The distribution networks of Microsoft and Nokia are similar with the exception that

Nokia \also caters to mobile network operators, especially in North America and Latin

America. Nokia sells through mobile network operators, distributors, independent

retailers, corporate customers and consumers. Microsoft on the other hand primarily

operates through OEMs, distributors, resellers and online. There will be synergies

through consolidation in distributor, reseller and online channels and will provide

Microsoft access to large supply chain and distribution channel assets. However, a

trade-off between realizing these synergies and costs to integrate the two complex

distribution networks exists.

Apart from these, one key asset which Nokia brings in during this acquisition is a highly

competent device engineering and development team along with more than a thousand

patents. While software development had always been Microsofts key forte, it did not

perform well in device designing. This was one of the key reasons that Microsoft

pioneer smartphones did not work well in the market. Integrating Nokias hardware R&D

and design team with its own gives Microsoft a significant competitive edge.

INTEGRATION AND RESTRCTURING

Microsoft and Nokia have very different core businesses; however there are still

products and services in both companies that have overlapping nature, functionalities

and target audience. In order to maximize the utilization rate of the complementary

assets and the mutual benefits and synergy of both companies, as well as to reduce

confusion to customers who were going to purchase the forthcoming Windows Phone

products, numerous products and services had to integrate together, for example:

Microsoft Bing Maps to adopt the rich geographical database of Nokia Maps

while Nokia Maps would leverage Microsoft Bings search engine and Microsoft

adCenter advertising platform;

Nokia would utilize Microsoft Bings search capabilities in its Windows Phone

products;

Microsoft to offer Nokia software development tools to develop software

applications on Nokia Windows Phones;

Nokia to integrate its operating billing payment arrangements in its Windows

Phone products;

Microsoft Marketplace would be the sole and only application and content stores

in Nokias Windows Phone products.

Because of the establishment of the strategic alliance, Nokia restructured the Group

Executive Board to form the Nokia Leadership Team, aiming to expedite decision

marking and improve time to-market of products and innovations. Nokia had also

restructured the product business units according to its new focused product categories,

namely Smart Devices (i.e. smartphones) and Mobile Phones (i.e. entry-level feature

phones). Both business units were headed by executive vice presidents Jo Harlow and

Mary McDowell, who reported directly to Stephen Elop, the CEO of Nokia at that time.

The Smart Devices business unit was responsible for creating the Windows Phone

portfolio together with Microsoft (Nokia Corporation February 11, 2011). At Microsoft,

Windows Phone was administered under the Entertainment and Devices Division. Joe

Belfiore, the Corporate Vice President and Manager for Windows Phone Program

Management at that time, was responsible in the high level management of the

Windows Phone products at Microsoft. He reported to Steve Ballmer, the CEO of

Microsoft.

After the acquisition, Microsoft laid off 25000 Nokia employees and reorganized to

combine Microsofts Windows and Devices groups under Terry Myerson, who had been

in charge of operating systems. Stephen Elop and Jo Harlow, both former Nokia

executives who respectively headed Microsofts Devices unit and phone business, both

left the company at the time. According to Microsoft, this restructuring would help align

goals and resources.

You might also like

- IFRS VS U.S. GAAP: The Point Form Revision Version: by Darren Degraaf, CFA, CMA, PRMDocument9 pagesIFRS VS U.S. GAAP: The Point Form Revision Version: by Darren Degraaf, CFA, CMA, PRMAnirudh DuttaNo ratings yet

- PGP I - 2014-16 - Sectionwise Email IdsDocument9 pagesPGP I - 2014-16 - Sectionwise Email IdsAnirudh DuttaNo ratings yet

- Missing in Action: Teacher and Health Worker Absence in Developing CountriesDocument31 pagesMissing in Action: Teacher and Health Worker Absence in Developing CountriesAnirudh DuttaNo ratings yet

- BSC H PH PT IIIDocument41 pagesBSC H PH PT IIIAnirudh DuttaNo ratings yet

- FDRM 1Document16 pagesFDRM 1Anirudh DuttaNo ratings yet

- Assume Call Prices Are Right in NSE Option Chain. Verify If Put Call Parity HoldsDocument6 pagesAssume Call Prices Are Right in NSE Option Chain. Verify If Put Call Parity HoldsAnirudh DuttaNo ratings yet

- Time Value of MoneyDocument22 pagesTime Value of MoneyAnirudh DuttaNo ratings yet

- Auto Pay Your Monthly Landline/broadband Bill Payment. Give Us A Standing Instruction On Your Credit Card in 3 Simple StepsDocument1 pageAuto Pay Your Monthly Landline/broadband Bill Payment. Give Us A Standing Instruction On Your Credit Card in 3 Simple StepsAnirudh DuttaNo ratings yet

- Determinants of Demand Determinants of SupplyDocument2 pagesDeterminants of Demand Determinants of SupplyAnirudh DuttaNo ratings yet

- Financial Accounting: Session No 1Document37 pagesFinancial Accounting: Session No 1Anirudh DuttaNo ratings yet

- PHL744 Problem Set III Relativity Preliminaries and Dirac Equation in 2 DimensionsDocument2 pagesPHL744 Problem Set III Relativity Preliminaries and Dirac Equation in 2 DimensionsAnirudh DuttaNo ratings yet

- Production TheoryDocument72 pagesProduction TheoryAnirudh Dutta100% (1)

- EPL202 - Quantum Mechanics and Its ApplicationsDocument1 pageEPL202 - Quantum Mechanics and Its ApplicationsAnirudh DuttaNo ratings yet

- (A) Write Down The Schroedinger Equation Is RDocument2 pages(A) Write Down The Schroedinger Equation Is RAnirudh DuttaNo ratings yet

- Basis States For An InterviewDocument3 pagesBasis States For An InterviewAnirudh DuttaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Concordia: The Lutheran Confessions - ExcerptsDocument39 pagesConcordia: The Lutheran Confessions - ExcerptsConcordia Publishing House28% (25)

- English HL P1 Nov 2019Document12 pagesEnglish HL P1 Nov 2019Khathutshelo KharivheNo ratings yet

- Newspaper OrganisationDocument20 pagesNewspaper OrganisationKcite91100% (5)

- User Manual For Inquisit's Attentional Network TaskDocument5 pagesUser Manual For Inquisit's Attentional Network TaskPiyush ParimooNo ratings yet

- Pilapil v. CADocument2 pagesPilapil v. CAIris Gallardo100% (2)

- Photo Essay (Lyka)Document2 pagesPhoto Essay (Lyka)Lyka LadonNo ratings yet

- Best Interior Architects in Kolkata PDF DownloadDocument1 pageBest Interior Architects in Kolkata PDF DownloadArsh KrishNo ratings yet

- IIT JEE Physics Preparation BooksDocument3 pagesIIT JEE Physics Preparation Booksgaurav2011999No ratings yet

- AITAS 8th Doctor SourcebookDocument192 pagesAITAS 8th Doctor SourcebookClaudio Caceres100% (13)

- Https Emedicine - Medscape.com Article 1831191-PrintDocument59 pagesHttps Emedicine - Medscape.com Article 1831191-PrintNoviatiPrayangsariNo ratings yet

- Hanumaan Bajrang Baan by JDocument104 pagesHanumaan Bajrang Baan by JAnonymous R8qkzgNo ratings yet

- Name: Nur Hashikin Binti Ramly (2019170773) Course Code: Udm713 - Decision Making Methods and Analysis Assignment Title: Need Gap AnalysisDocument2 pagesName: Nur Hashikin Binti Ramly (2019170773) Course Code: Udm713 - Decision Making Methods and Analysis Assignment Title: Need Gap AnalysisAhmad HafizNo ratings yet

- OPSS 415 Feb90Document7 pagesOPSS 415 Feb90Muhammad UmarNo ratings yet

- Describe The Forms of Agency CompensationDocument2 pagesDescribe The Forms of Agency CompensationFizza HassanNo ratings yet

- New Kanban System DesignDocument4 pagesNew Kanban System DesignJebin GeorgeNo ratings yet

- Stress Corrosion Cracking Behavior of X80 PipelineDocument13 pagesStress Corrosion Cracking Behavior of X80 Pipelineaashima sharmaNo ratings yet

- SHS StatProb Q4 W1-8 68pgsDocument68 pagesSHS StatProb Q4 W1-8 68pgsKimberly LoterteNo ratings yet

- 1b SPC PL Metomotyl 10 MG Chew Tab Final CleanDocument16 pages1b SPC PL Metomotyl 10 MG Chew Tab Final CleanPhuong Anh BuiNo ratings yet

- Green and White Zero Waste Living Education Video PresentationDocument12 pagesGreen and White Zero Waste Living Education Video PresentationNicole SarileNo ratings yet

- Thomas HobbesDocument3 pagesThomas HobbesatlizanNo ratings yet

- Imc Case - Group 3Document5 pagesImc Case - Group 3Shubham Jakhmola100% (3)

- Symptoms: Generalized Anxiety Disorder (GAD)Document3 pagesSymptoms: Generalized Anxiety Disorder (GAD)Nur WahyudiantoNo ratings yet

- Prof. Monzer KahfDocument15 pagesProf. Monzer KahfAbdulNo ratings yet

- Chemical BondingDocument7 pagesChemical BondingSanaa SamkoNo ratings yet

- Iii. The Impact of Information Technology: Successful Communication - Key Points To RememberDocument7 pagesIii. The Impact of Information Technology: Successful Communication - Key Points To Remembermariami bubuNo ratings yet

- Ulster Cycle - WikipediaDocument8 pagesUlster Cycle - WikipediazentropiaNo ratings yet

- Simple Past and Past Continuous Notes and ExercisesDocument5 pagesSimple Past and Past Continuous Notes and ExercisesConstantina KouverianosNo ratings yet

- Georgia Jean Weckler 070217Document223 pagesGeorgia Jean Weckler 070217api-290747380No ratings yet

- Java Magazine JanuaryFebruary 2013Document93 pagesJava Magazine JanuaryFebruary 2013rubensaNo ratings yet

- Educ 3 Prelim Act.1 AlidonDocument2 pagesEduc 3 Prelim Act.1 AlidonJonash AlidonNo ratings yet