Professional Documents

Culture Documents

March 2015 Market Update

Uploaded by

Dan DunlapCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

March 2015 Market Update

Uploaded by

Dan DunlapCopyright:

Available Formats

THE

NANTUCKET REAL ESTATE REPORT

March 2015

At A Glance...

In like a lion, out like a lion at least that is what we

experienced on Nantucket in March - where both weather and

real estate activity never stopped roaring. Even with wind, rain,

snow and fog slowing island life to a fast crawl, buyers still

seemed to ?ind their way to the island spending a record-breaking

$64 million on real estate.

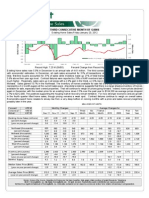

Dollar Volume & Number Of Transactions

(For Same 3-Month Period Ending March 31)

129

99

92

86

$212M $187M

$201M

$118M

$107M

2011

93

2012

2013

2014

Properties Sold

2015

$ Volume

10.1% decline in sales and

26.4% reduction in dollar volume (vs. same 90 day period last year).

Number Of Residen5al Proper5es Sold Last Month

0

>

$4M

$3.5 - $4M

2

$2

-

$2.5M

0

$1.5

-

$2M

$ - $1.5M

$750K - $1M

< $750K

$3 - $3.5M

$2.5 - $3M

With two fewer transactions than in March 2014, last months

dollar volume ?inished $14.75M higher (29.3%) than last year.

And while average sale prices increased a whopping 135.2% over

a year ago, with the $27M commercial sale included, average

prices were still 6.2% higher with it excluded. In addition, average

residential property prices increased an encouraging 14.7% over

last year ($1.69M versus $1.47M).

Dollar volume for the last 90 days was 11.8% lower than last year

with 6 fewer transactions (-6.1%). This places Q1 2015 tied for

third place in the number of properties sold and third in total

dollar volume when compared to the last ?ive 1st Quarters.

Even without the $27M commercial sale last month, March

2015 would have been better than average with over $38

million in sales. While maybe not as good as 2014, March 2015

will still be known for being the 2nd busiest March since 2010.

YTD Dollar Volume & Number Of Properties Sold

57% of sales were under $1M

$174M

$187M

$94M

$74M

$72M

103

92

78

62

59

Number of Sales

15

20

14

20

13

20

12

20

Marchs residential closings and accepted offers

were at their lowest level in 4 years even with more

price reductions than seen in last 2 years.

11

Accepted Offers

20

Price Reductions

Number of Closings

$ Volume

March 2015 Ac,vity Compared to March 2014 Ac,vity

Land

Commercial

MulJ-Family

Condos & Co-op

Single-Family

Total Sales

2015

2014

%

Of

Change

From

Last

Year

Number

Sold $

Volume

Sold

Number

Sold $

Volume

Sold

Number

$

Volume

Sold

13

$9,435,000

4

$5,280,000

225.0%

78.7%

4

$30,600,000

3

$5,544,999

33.3%

451.8%

1

$785,000

1

$500,000

0.0%

57.0%

1

$500,000

3

$1,472,499

-66.7%

-66.0%

13

$24,028,809

23

$37,745,065

-43.5%

-36.3%

32

$65,348,809

34

$50,542,563

29.3%

-5.9%

Data

Source:

LINK

Nantucket,

Nantucket

Lis5ng

Service

Residential Sales:

Dollar Volume & Number Of Properties Sold In March

Number

& Volume Of Properties Sold Last Month By Type

$51M

Number of Sales

15

32

20

14

34

20

20

$17M

25

13

31

20

27

12

$31M

20

31

$34M

11

$39M

10

Marchs $1,687,587 average sale price was 36.4% less than

February 2015s average of $2,656,026 but 14.7% higher than

the $1,471,021 average seen last March.

$65M

20

Last months 15 residential sales were signi?icantly lower than

the 27 sales seen in March 2014 (-44.4%) with the resulting

dollar volume declining more than $14.4M (-36.3%) from a year

ago. Unlike the 1 sale over $4M last March, there were 3 sales

over the $4M mark last month.

$ Volume

Bottom-line:

The

more

things

change

the

more

they

stay

the

same

-

or

so

it

may

seem

when

it

comes

to

Nantucket

real

estate.

Land

Multi-Family

Single-Family

Land Sales:

Commercial

Condos & Co-op

Marchs 13 land sales were 9 transactions (225%) ahead of last

years 4 sales yet yielded only $4.15M more in dollar volume

(14.7.%). Not surprisingly, last months $726K average sale

price was $594K lower (-45%) than last year with the average

parcel size considerably smaller - .75 acres (.38 acres if you

exclude the 5 acre Girl Scout tract) versus 1.42 acres in 2014.

The 54 land parcels currently on-market represent about an 8-

month supply of inventory (based on last 6 months activity).

Commercial

Sales:

Four

commercially

zoned

properties

sold

last

month,

two

of

which

also

had

living

quarters.

Nine

commercial

properties

remain

on-market

-

4

of

which

are

in

the

core

commercial

district.

The

$27M

paid

for

6

Sun

Island

Road

was

the

highest

amount

paid

for

one

commercial

property

in

Nantucket

history.

Availability:

There

were

283

properties

(223

residential)

on-market

at

month-end

versus

265

listings

(216

residential)

at

the

end

of

February

and

283

(229

residential)

at

the

end

of

March

2014.

Of

the

46

properties

brought

to

market

in

March,

19

(39.6%)

were

previously

listed

with

an

average

time

on-market

of

573

days.

Average

days

on-market

for

current

listings

is

311

days

or

241

days

if

the

12

on-market

more

than

3

years

are

excluded.

A year ago there were 283 properties on-

market and at the end of March 2015

there were still 283 properties listed for

sale - thats after 508 properties (and over

$1 billion) changed hands this past year.

Of the 508 sales, 381 (75%) of them,

totaling more than $799 million (79.5%)

in dollar volume, were facilitated through

a real estate ?irm. Sale prices for these

properties averaged 89.9% of original

asking price and 93% of ?inal asking price.

During this same time period in

2013-2014, the 511 properties sold

totaled almost $847 million in dollar

volume. Of these sales, real estate ?irms

were involved in 403 of them (78.9%)

totaling $693 million (81.9%) in dollar

volume. Sale prices for these properties

averaged 87.1% of original asking price

and 91.3% of ?inal asking price.

While last months numbers wouldnt be

as impressive without the $27 million

dollar commercial sale, there is still solid

improvement in the marketplace with

plenty of inventory to choose from at

prices that are becoming more realistic.

Dan Dunlap, Broker & Market Analyst

10 South Beach Street | Nantucket, MA 02554 | 508.325.5800 | leerealestate.com

Properties Sold In March 2015

(excluding foreclosures)

Residential Properties

Selling Price

% of Final

Asking

Price**

% of

Original

Price**

Price

per sq. ft

(living area)

Lot size

(sq. ft.)

Days On

Market

Living Area

Sq. Ft.

Beds

Baths

6 Jackson Street # 2

$500,000

84.7%

80.0%

958

Condo

509

522

35 Miacomet Avenue

$576,976

112.9%

112.9%

$343.44

8,276

25

1,680

2.5

48A Skyline Drive

$590,000

94.4%

94.4%

$347.88

80,150

1,696

88 Surfside Road

$600,000

N/A*

N/A*

$388.60

16,553

N/A*

1,544

353 Madaket Road

$603,500

83.9%

71.0%

$446.38

54,886

551

1,352

16 Cato Lane

$785,000

98.7%

98.7%

$333.76

6,830

61

2,352

2.5

58 Pleasant Street

$850,000

95.0%

95.0%

$481.04

5,227

248

1,767

18 Sesapana Road

$975,000

83.0%

75.3%

$382.80

32,914

159

2,547

3 Rosaly Lane

$1,133,333

N/A*

N/A*

$536.36

10,019

N/A*

2,113

40 Long Pond Drive

$1,485,000

99.3%

99.3%

$742.50

20,473

98

2,000

71 Lovers Lane

$2,215,000

113.6%

113.6%

$709.03

14,985

3,124

3.5

56 West Chester Street

$2,400,000

90.6%

87.3%

$1,123.07

17,860

172

2,137

34 Pocomo Road

$4,100,000

87.3%

87.3%

$890.53

126,324

106

4,604

5.5

15 North Liberty Street

$4,100,000

93.2%

93.2%

$1,023.21

5,009

110

4,007

4.5

$4,400,000

88.1%

88.1%

$1,261.11

15,246

157

3,489

4.5

94.2%

93.2%

92.0%

93.2%

$664.50

$536.36

29,625

15,899

170

110

2,329

2,113

4

4

3

3

2 Franklin Street

Total Residential Sales

$25,313,809

Average:

Median Of All Residential Sales:

Commercial Properties

$1,687,587

$975,000

Selling Price

% of Final

Asking

Price**

% of

Original

Price**

Price

per sq. ft

(living area)

2 Bartlett Road

$1,100,000

100.0%

100.0%

23,522

130 Old South Road

$1,250,000

125.6%

104.2%

51 Nobadeer Farm Road

$1,250,000

125.6%

104.2%

$27,000,000

N/A*

N/A*

6 Sun Island Road

Total Commercial Sales

Lot size

(sq. ft.)

Days On

Market

Living Area

Sq. Ft.

Beds

Baths

$46.76

119

1540

60,984

$20.50

881

2176

6,534

$191.31

881

504

74,052

$364.61

N/A*

97645

627

881

25,466

1,858

2

2

1

1

$30,600,000

Average:

Median Of All Residential Sales:

$7,650,000

$1,250,000

N/A* - Not Sold Through A Real Estate Firm

117.1%

125.6%

102.8% $41,273.10

104.2% $42,253.20

156

119

** Excludes Properties Not Sold Through A Real Estate Firm

Properties Sold In March 2015

(excluding foreclosures)

Land Parcels

Selling Price

% of Final

Asking

Price**

% of

Original

Price**

Lot size

(sq. ft.)

Price per

sq. ft.

Days On

Market

20 Tomahawk Road

$260,000

N/A*

N/A*

4,792

$54.26

13B Greglen Avenue

$300,000

N/A*

N/A*

11,273

$26.61

13A Greglen Avenue

$300,000

N/A*

N/A*

11,273

$26.61

11B Greglen Avenue

$300,000

N/A*

N/A*

11,273

$26.61

10 Trotters Lane

$405,000

95.3%

95.3%

10,006

$40.48

2

26

6 Marble Way (Portion) Lot 2

$570,000

95.8%

95.8%

15,246

$37.39

42 Union Street Lot A

$600,000

N/A*

N/A*

2,875

$208.70

19 & 21 Tomahawk Road

$625,000

N/A*

N/A*

15,682

$39.86

42 Union Street Lot B

$750,000

N/A*

N/A*

2,875

$260.87

55 Dukes Road

$800,000

N/A*

N/A*

38,947

$20.54

57 Dukes Road

$800,000

N/A*

N/A*

30,405

$26.31

45 Polpis Road

$1,750,000

N/A*

N/A*

226,512

$7.73

4 Old Westmoor Farm Road

Total Land Sales

$1,975,000

$9,435,000

80.6%

80.6%

44,431

$44.45

135

$725,769

$600,000

90.6%

95.3%

90.6%

95.3%

32,738

11,273

$63.11

$37.39

54

26

Average:

Median Of All Land Sales:

N/A* - Not Sold Through A Real Estate Firm

** Excludes Properties Not Sold Through A Real Estate Firm

You might also like

- June 2015 Market UpdateDocument4 pagesJune 2015 Market UpdateDan DunlapNo ratings yet

- April 2015 Market UpdateDocument4 pagesApril 2015 Market UpdateDan DunlapNo ratings yet

- May 2015 Market UpdateDocument4 pagesMay 2015 Market UpdateDan DunlapNo ratings yet

- January 2015 Market UpdateDocument4 pagesJanuary 2015 Market UpdateDan DunlapNo ratings yet

- December 2014 Market UpdateDocument3 pagesDecember 2014 Market UpdateDan DunlapNo ratings yet

- November 2013 Market UpdateDocument0 pagesNovember 2013 Market UpdateDan DunlapNo ratings yet

- Nantucket Real Estate Report: April Showers Did Indeed Bring FlowersDocument3 pagesNantucket Real Estate Report: April Showers Did Indeed Bring FlowersDan DunlapNo ratings yet

- Real Estate: Sales Las Vegas Market April 2014Document6 pagesReal Estate: Sales Las Vegas Market April 2014Gideon JoffeNo ratings yet

- March 2014 Nantucket Real Estate UpdateDocument3 pagesMarch 2014 Nantucket Real Estate UpdateDan DunlapNo ratings yet

- Nantucket Real Estate Report: June Weddings Were Not The Only ReasonDocument4 pagesNantucket Real Estate Report: June Weddings Were Not The Only ReasonDan DunlapNo ratings yet

- Victoria Solidly in A Seller'S MarketDocument2 pagesVictoria Solidly in A Seller'S MarketKevin WhiteNo ratings yet

- Victoria Market Shows Modest GainsDocument2 pagesVictoria Market Shows Modest GainsKevin WhiteNo ratings yet

- ArielPA MFMIR: NYC Dec 2011Document16 pagesArielPA MFMIR: NYC Dec 2011Ariel Property AdvisorsNo ratings yet

- Housing Market Report Aug 2013 SalesDocument6 pagesHousing Market Report Aug 2013 SalesGideon JoffeNo ratings yet

- ArielPA MFMIR: NYC Nov 2011Document16 pagesArielPA MFMIR: NYC Nov 2011Ariel Property AdvisorsNo ratings yet

- Market Remains in Balanced TerritoryDocument2 pagesMarket Remains in Balanced TerritoryKevin WhiteNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2016 December 4Document6 pagesCoreLogic Weekly Market Update Week Ending 2016 December 4Australian Property ForumNo ratings yet

- August 2014 Nantucket Real Estate UpdateDocument3 pagesAugust 2014 Nantucket Real Estate UpdateDan DunlapNo ratings yet

- Monterey Real Estate Sales Market Report For December 2015Document4 pagesMonterey Real Estate Sales Market Report For December 2015Nicole TruszkowskiNo ratings yet

- Monterey Homes Market Action Report Real Estate Sales For November 2014Document4 pagesMonterey Homes Market Action Report Real Estate Sales For November 2014Nicole TruszkowskiNo ratings yet

- Monterey Homes Market Action Report Real Estate Sales For October 2014Document4 pagesMonterey Homes Market Action Report Real Estate Sales For October 2014Nicole TruszkowskiNo ratings yet

- PortlandmetroareaDocument7 pagesPortlandmetroareaapi-306032424No ratings yet

- TRNDGX PressRelease Aug2011Document2 pagesTRNDGX PressRelease Aug2011deedrileyNo ratings yet

- Pacific Grove Real Estate Sales Market Report For December 2015Document4 pagesPacific Grove Real Estate Sales Market Report For December 2015Nicole TruszkowskiNo ratings yet

- Weekend Market Summary Week Ending 2015 June 7Document4 pagesWeekend Market Summary Week Ending 2015 June 7Australian Property ForumNo ratings yet

- Pacific Grove Real Estate Sales Market Report For May 2015Document4 pagesPacific Grove Real Estate Sales Market Report For May 2015Nicole TruszkowskiNo ratings yet

- Trendgraphix Monthly Real Estate Report, March 2011Document4 pagesTrendgraphix Monthly Real Estate Report, March 2011Jim HamiltonNo ratings yet

- Weekly Market Update Week Ending 2016 May 29Document5 pagesWeekly Market Update Week Ending 2016 May 29Australian Property ForumNo ratings yet

- REMAX National Housing Report 2012Document2 pagesREMAX National Housing Report 2012Jay ClearyNo ratings yet

- January Existing Home SalesDocument1 pageJanuary Existing Home SalesJessica Kister-LombardoNo ratings yet

- Calgary Regional Housing Market StatisticsDocument28 pagesCalgary Regional Housing Market StatisticsCTV CalgaryNo ratings yet

- Monterey Homes Market Action Report Real Estate Sales For August 2013Document3 pagesMonterey Homes Market Action Report Real Estate Sales For August 2013Nicole TruszkowskiNo ratings yet

- Big Sur Coast Homes Market Action Report Real Estate Sales For October 2014Document4 pagesBig Sur Coast Homes Market Action Report Real Estate Sales For October 2014Nicole TruszkowskiNo ratings yet

- Carmel Valley Homes Market Action Report Real Estate Sales For February 2015Document4 pagesCarmel Valley Homes Market Action Report Real Estate Sales For February 2015Nicole TruszkowskiNo ratings yet

- REMAX National Housing Report - July 2012 FinalDocument2 pagesREMAX National Housing Report - July 2012 FinalSheila Newton TeamNo ratings yet

- Monterey Homes Market Action Report Real Estate Sales For February 2015Document4 pagesMonterey Homes Market Action Report Real Estate Sales For February 2015Nicole TruszkowskiNo ratings yet

- Weekend Market Summary Week Ending 2015 June 14Document4 pagesWeekend Market Summary Week Ending 2015 June 14Australian Property ForumNo ratings yet

- Central Okanagan January 2016 The Start of A New Year: Macdonald Realty KelownaDocument1 pageCentral Okanagan January 2016 The Start of A New Year: Macdonald Realty Kelownaapi-305341413No ratings yet

- Central Okanagan First Quarter 2016: Macdonald Realty KelownaDocument1 pageCentral Okanagan First Quarter 2016: Macdonald Realty Kelownaapi-305341413No ratings yet

- Central Okanagan First Quarter 2016: Macdonald Realty KelownaDocument1 pageCentral Okanagan First Quarter 2016: Macdonald Realty Kelownaapi-305341413No ratings yet

- Weekend Market Summary Week Ending 2014 April 6Document3 pagesWeekend Market Summary Week Ending 2014 April 6Australian Property ForumNo ratings yet

- Carmel-by-the-Sea Homes Market Action Report Real Estate Sales For February 2015Document4 pagesCarmel-by-the-Sea Homes Market Action Report Real Estate Sales For February 2015Nicole TruszkowskiNo ratings yet

- Weekly Market Update Week Ending 2015 NovemberDocument5 pagesWeekly Market Update Week Ending 2015 NovemberAustralian Property ForumNo ratings yet

- Carmel-by-the-Sea Homes Market Action Report Real Estate Sales For November 2014Document4 pagesCarmel-by-the-Sea Homes Market Action Report Real Estate Sales For November 2014Nicole TruszkowskiNo ratings yet

- Manhattan Beach Real Estate Market Conditions - May 2015Document15 pagesManhattan Beach Real Estate Market Conditions - May 2015Mother & Son South Bay Real Estate AgentsNo ratings yet

- Monterey Homes Market Action Report Real Estate Sales For December 2014Document4 pagesMonterey Homes Market Action Report Real Estate Sales For December 2014Nicole TruszkowskiNo ratings yet

- Carmel Highlands Real Estate Sales Market Report For October 2015Document4 pagesCarmel Highlands Real Estate Sales Market Report For October 2015Nicole TruszkowskiNo ratings yet

- Central Okanagan February 2016 The End of Winter: Macdonald Realty KelownaDocument1 pageCentral Okanagan February 2016 The End of Winter: Macdonald Realty Kelownaapi-305341413No ratings yet

- Monterey Real Estate Sales Market Report For October 2015Document4 pagesMonterey Real Estate Sales Market Report For October 2015Nicole TruszkowskiNo ratings yet

- 2018 01 15 News Release RLDocument26 pages2018 01 15 News Release RLapi-125614979No ratings yet

- December 2014 West Hartford Market ReportDocument4 pagesDecember 2014 West Hartford Market ReportSean PageNo ratings yet

- Compass PDFDocument17 pagesCompass PDFAnonymous Feglbx5No ratings yet

- Salinas Monterey Highway Real Estate Sales Market Report For April 2015Document4 pagesSalinas Monterey Highway Real Estate Sales Market Report For April 2015Nicole TruszkowskiNo ratings yet

- Weekly Market Update Week Ending 2016 March 20Document5 pagesWeekly Market Update Week Ending 2016 March 20Australian Property ForumNo ratings yet

- RE/MAX Professionals Metropolitan Denver Real Estate Statistics As of August, 2011Document14 pagesRE/MAX Professionals Metropolitan Denver Real Estate Statistics As of August, 2011Michael KozlowskiNo ratings yet

- CREB - November 2011 Calgary Real Estate StatisticsDocument10 pagesCREB - November 2011 Calgary Real Estate StatisticsMike FotiouNo ratings yet

- Calgary Real Estate November 2011 Monthly Housing StatisticsDocument19 pagesCalgary Real Estate November 2011 Monthly Housing StatisticsCrystal TostNo ratings yet

- Ontario Tax Sale Property Buyer's GuideFrom EverandOntario Tax Sale Property Buyer's GuideRating: 3 out of 5 stars3/5 (1)

- Unlock Your Guide to Profitable Home Sales: Sell your home for Top and Fast DollarFrom EverandUnlock Your Guide to Profitable Home Sales: Sell your home for Top and Fast DollarNo ratings yet

- Buy and Hold is Still Dead (Again): The Case for Active Portfolio Management in Dangerous MarketsFrom EverandBuy and Hold is Still Dead (Again): The Case for Active Portfolio Management in Dangerous MarketsNo ratings yet

- Nantucket Real Estate Update - October, 2014Document4 pagesNantucket Real Estate Update - October, 2014Dan DunlapNo ratings yet

- Nantucket Properties Selling For More Than $5 MillionDocument6 pagesNantucket Properties Selling For More Than $5 MillionDan DunlapNo ratings yet

- Nantucket Real Estate Newsletter - July 2014Document3 pagesNantucket Real Estate Newsletter - July 2014Dan Dunlap100% (1)

- December 2014 Market UpdateDocument3 pagesDecember 2014 Market UpdateDan DunlapNo ratings yet

- Nantucket Real Estate Market Update - November 2014Document3 pagesNantucket Real Estate Market Update - November 2014Dan DunlapNo ratings yet

- August 2014 Nantucket Real Estate UpdateDocument3 pagesAugust 2014 Nantucket Real Estate UpdateDan DunlapNo ratings yet

- Nantucket Real Estate Market Update - September 2014Document4 pagesNantucket Real Estate Market Update - September 2014Dan DunlapNo ratings yet

- 1st Quarter 2014 Real Estate Activity On NantucketDocument1 page1st Quarter 2014 Real Estate Activity On NantucketDan DunlapNo ratings yet

- Traffic Statistics For The Steamship Authority Between Hyannis and Nantucket For The First Half of 2014Document1 pageTraffic Statistics For The Steamship Authority Between Hyannis and Nantucket For The First Half of 2014Dan DunlapNo ratings yet

- 31 Main Street, Sconset, MA Now Available...Document4 pages31 Main Street, Sconset, MA Now Available...Dan DunlapNo ratings yet

- Waterfront Vs Waterviews On NantucketDocument3 pagesWaterfront Vs Waterviews On NantucketDan DunlapNo ratings yet

- Nantucket Real Estate Market Update - May 2014Document4 pagesNantucket Real Estate Market Update - May 2014Dan DunlapNo ratings yet

- Nantucket Real Estate Report: June Weddings Were Not The Only ReasonDocument4 pagesNantucket Real Estate Report: June Weddings Were Not The Only ReasonDan DunlapNo ratings yet

- Nantucket Real Estate Report: April Showers Did Indeed Bring FlowersDocument3 pagesNantucket Real Estate Report: April Showers Did Indeed Bring FlowersDan DunlapNo ratings yet

- March 2014 Nantucket Real Estate UpdateDocument3 pagesMarch 2014 Nantucket Real Estate UpdateDan DunlapNo ratings yet

- Nantucket Real Estate Market Update - January 2014Document3 pagesNantucket Real Estate Market Update - January 2014Dan DunlapNo ratings yet

- Shortage of Real Estate Listings On NantucketDocument7 pagesShortage of Real Estate Listings On NantucketDan DunlapNo ratings yet

- November 2013 Market UpdateDocument0 pagesNovember 2013 Market UpdateDan DunlapNo ratings yet

- 1st Quarter 2014 Real Estate Activity On NantucketDocument1 page1st Quarter 2014 Real Estate Activity On NantucketDan DunlapNo ratings yet

- Nantucket Real Estate Market Update - December 2013Document0 pagesNantucket Real Estate Market Update - December 2013Dan DunlapNo ratings yet

- Nantucket Real Estate Report: Spectacular SeptemberDocument0 pagesNantucket Real Estate Report: Spectacular SeptemberDan DunlapNo ratings yet

- Nantucket Real Estate Update - February 2014Document3 pagesNantucket Real Estate Update - February 2014Dan DunlapNo ratings yet

- October 2013 Nantucket Real Estate Market Update PDFDocument4 pagesOctober 2013 Nantucket Real Estate Market Update PDFDan DunlapNo ratings yet

- Real Estate Activity On Nantucket in 2013 PDFDocument1 pageReal Estate Activity On Nantucket in 2013 PDFDan DunlapNo ratings yet

- Test Bank For Fundamental Financial Accounting Concepts 10th by EdmondsDocument18 pagesTest Bank For Fundamental Financial Accounting Concepts 10th by Edmondsooezoapunitory.xkgyo4100% (47)

- SolBridge Application 2012Document14 pagesSolBridge Application 2012Corissa WandmacherNo ratings yet

- Letter From Attorneys General To 3MDocument5 pagesLetter From Attorneys General To 3MHonolulu Star-AdvertiserNo ratings yet

- Certification Presently EnrolledDocument15 pagesCertification Presently EnrolledMaymay AuauNo ratings yet

- Tutorial 1 Discussion Document - Batch 03Document4 pagesTutorial 1 Discussion Document - Batch 03Anindya CostaNo ratings yet

- What Is A Problem?: Method + Answer SolutionDocument17 pagesWhat Is A Problem?: Method + Answer SolutionShailaMae VillegasNo ratings yet

- Desana Texts and ContextsDocument601 pagesDesana Texts and ContextsdavidizanagiNo ratings yet

- Equilibruim of Forces and How Three Forces Meet at A PointDocument32 pagesEquilibruim of Forces and How Three Forces Meet at A PointSherif Yehia Al MaraghyNo ratings yet

- LEARNING ACTIVITY Sheet Math 7 q3 M 1Document4 pagesLEARNING ACTIVITY Sheet Math 7 q3 M 1Mariel PastoleroNo ratings yet

- !!!Логос - конференц10.12.21 копіяDocument141 pages!!!Логос - конференц10.12.21 копіяНаталія БондарNo ratings yet

- Correlation Degree Serpentinization of Source Rock To Laterite Nickel Value The Saprolite Zone in PB 5, Konawe Regency, Southeast SulawesiDocument8 pagesCorrelation Degree Serpentinization of Source Rock To Laterite Nickel Value The Saprolite Zone in PB 5, Konawe Regency, Southeast SulawesimuqfiNo ratings yet

- eHMI tool download and install guideDocument19 pageseHMI tool download and install guideNam Vũ0% (1)

- Objective Mech II - IES 2009 Question PaperDocument28 pagesObjective Mech II - IES 2009 Question Paperaditya_kumar_meNo ratings yet

- 202112fuji ViDocument2 pages202112fuji ViAnh CaoNo ratings yet

- Draft SemestralWorK Aircraft2Document7 pagesDraft SemestralWorK Aircraft2Filip SkultetyNo ratings yet

- Alignment of Railway Track Nptel PDFDocument18 pagesAlignment of Railway Track Nptel PDFAshutosh MauryaNo ratings yet

- UD150L-40E Ope M501-E053GDocument164 pagesUD150L-40E Ope M501-E053GMahmoud Mady100% (3)

- Composite Structures: A. Grimaldi, A. Sollo, M. Guida, F. MaruloDocument15 pagesComposite Structures: A. Grimaldi, A. Sollo, M. Guida, F. MaruloSharan KharthikNo ratings yet

- PeopleSoft Security TablesDocument8 pagesPeopleSoft Security TablesChhavibhasinNo ratings yet

- List of Reactive Chemicals - Guardian Environmental TechnologiesDocument69 pagesList of Reactive Chemicals - Guardian Environmental TechnologiesGuardian Environmental TechnologiesNo ratings yet

- SDS OU1060 IPeptideDocument6 pagesSDS OU1060 IPeptideSaowalak PhonseeNo ratings yet

- Navistar O & M ManualDocument56 pagesNavistar O & M ManualMushtaq Hasan95% (20)

- 7 Aleksandar VladimirovDocument6 pages7 Aleksandar VladimirovDante FilhoNo ratings yet

- Factors of Active Citizenship EducationDocument2 pagesFactors of Active Citizenship EducationmauïNo ratings yet

- Gapped SentencesDocument8 pagesGapped SentencesKianujillaNo ratings yet

- Pemaknaan School Well-Being Pada Siswa SMP: Indigenous ResearchDocument16 pagesPemaknaan School Well-Being Pada Siswa SMP: Indigenous ResearchAri HendriawanNo ratings yet

- CBT For BDDDocument13 pagesCBT For BDDGregg Williams100% (5)

- Done - NSTP 2 SyllabusDocument9 pagesDone - NSTP 2 SyllabusJoseph MazoNo ratings yet

- STS Prelim ExamDocument2 pagesSTS Prelim ExamMychie Lynne MayugaNo ratings yet

- Reading Comprehension Exercise, May 3rdDocument3 pagesReading Comprehension Exercise, May 3rdPalupi Salwa BerliantiNo ratings yet