Professional Documents

Culture Documents

NYSASBO Tax Cap Changes Report

Uploaded by

Matthew HamiltonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NYSASBO Tax Cap Changes Report

Uploaded by

Matthew HamiltonCopyright:

Available Formats

Chan

ngestotheN

NewYorkSttateTaxCap

p:

Wha

ataretheyan

ndwhatisthepotentialb

benefittosch

hooldistricts??

A

ANYSASBOR

ResearchNote

e

TTheNewYorkkStateAssociationofScho

oolBusinessO

Officials(NYSA

ASBO)hasad

dvocatedforaadjustmentsttotheTax

C

Capsinceitsiinceptionthatwouldbette

erbalanceth

hestatestwinnprioritiesoffprovidingtaaxreliefandiimproving

eeducationalo

outcomes.To laythegroundworkforp

potentialchanngestotheTTaxCap,that wereindeed

dactedon

tthisyearbyth

heLegislature

e,NYSASBOd

didtwoimporrtantthings.

FFirst, NYSASB

BO together with the Rocckefeller Insttitute of Govvernment held a school ffinance symp

posium in

SSeptember 20

014 entitled Balancing Educational Exxcellence witth Tax Relief that discussed how oth

her states,

n

notably Masssachusetts an

nd New Jersey, have instittuted tax capps and raised

d student ach

hievement. TThe event

w

wasattendedbystatepolicymakers,othereducationalassociatioonsandschoo

oldistrictlead

ders.

nof

SSecond,itledthedevelopm

mentofapossitionpaperb

bytheEducattionConferen

nceBoard(EC

CB),acoalition

eeducationalassociations,ttitledTaxCap

padjustmentsscanhelpschhoolsbalancestudentneed

ds,fiscalstab

bility,and

ttaxpayerconccerns[http://www.nysasbo

o.org/uploads/files/14248813093_NEW

W_ECBtaxcapFeb2015%20

0(1).pdf]

tthatwasissue

edinFebruaryy2015.Thep

paperidentified11action sNewYorkSStatecouldtaketobetterb

balance

improvementtstoeducatio

onandtaxreliefbylookinggattaxcapm

modelsfromo

otherstatesandrulesforN

New

YYorksmunicipalities.

TThe 2015 leggislative session ended with

w

two adju

ustments (seee Appendix A) to the Tax Cap that reflected

p

prioritiesofN

NYSASBOand

dthe Educatio

onConferencceBoardrelaatingtoexclu

udinglocalcaapitalexpend

dituresfor

B

BOCESinstrucctionalspace andcountinggpaymentsinlieuoftaxeesfromtaxexxemptpropertiesinthecalculation

o

oftheallowab

bletaxlevylim

mit.

ImpactofTaxxCapChangestoSchoolD

Districts

FFigure 1 show

ws data on BOCES

B

capitaal expenditures for aid yeear 201415. Five hundreed twelve co

omponent

sschooldistricttsofBOCESincurred$53 millioninaid

dableexpenseeforBOCES instructional space.Thesedistricts

rrepresent 73 percent of districts stattewide. For this expensee, they received $30 million in aid, leaving a

d

differenceofalmost$23m

millioninlocallcapitalexpenseforthiscconstruction.

by the Comm

W

Without the regulations

r

that may be promulgated

p

missioner of Tax and Finaance, we do not know

p

preciselythemannerinwh

hichtheseexxpenseswillaaffectthealloowablelevylimitoftheTaxCap.Howeever,ifwe

aanticipateap

processsimilaartothatusedforschoold

districtcapitaalexpense,w

wewouldexpectdistrictsttobeable

ttoaddtotheiirpermissible

eexclusionforlocalcapitalexpensesannamountequ

ualtototalexxpenseslessaanyaidor

ggrants receive

ed for the co

onstruction le

ess any fund balance or reeserves used

d. The $23 m

million reported by the

SStateEducatio

onDepartme

entforthe20

01415aidyearisanestim

mateofthepotentialbeneefitforNewYYorkState

sschooldistrictts.Theestimatemaybe

elowsincep

presumablythheexclusion wouldbebaasedontotal expenses

aandnotjustaidableexpense.

FFigure1.Aida

ableExpense

e,AidandLoccalCapitalExxpenseforBO

OCESInstructionalSpaces

Aidable Debtt Svc

A

and Capitaal

Outlay Expe

ense

$53,037,47

72

o Debt Svc

Aid on

and Cap

C Outlay

$30

0,086,870

Differen

nce

$22,950,602

SOURCE: NYSED State Aid

d Office data for the

201415 aid year

y

as of Julyy 8, 2015.

FFigure2show

wsrevenuesfrrompaymenttsinlieuoftaaxes(PILOTs) thatschoold

districtsreporrtedreceivinggfor2015

aand2016.Ab

bout70perce

entofNewYo

orkStatescho

ooldistrictsreeportedreceivingrevenueesfromPILOTTs.About

aathirdofscho

ooldistrictssawanincreasseinrevenue

esfromPILOTTsfrom2014to2015andalmost40percentsaw

aanincreasein

nrevenuesfro

omPILOTsfro

om2015to2

2016.Alarggenumberof schooldistrictsalsosawd

decreases

inrevenuesfrromPILOTsfrrom2014to2

2015(37perccent)andfrom

m2015to2016(21percen

nt).

W

Whileitisunknowntheexxactmanner inwhichthe CommissioneerofTaxand

dFinancewilllincorporate PILOTsin

tthequantitycchangefactorrusedtocalculatetheallo

owablelevyli mit,itisexpeectedthatsom

memeasureofgrowth

aassociated with these reve

enues will be

e used. Thus there is a ppotential ben

nefit associated with the ggrowth in

rrevenuesfrom

mPILOTswhicchtotaledapproximately$

$23millionfoor2015and$$13millionfo

or2016.

FFigure

2.

Reve

enues

fro

om

PILOTss

for

New

Yorrk

2015

Totals

T

C

Count

of districts

w

with

PILOTs or

Increase

D

Districts

with No

P

PILOTs

D

Districts

with a

d

decrease

in

P

PILOTs

T

Total

Count

PY PILOTss

Number

Percent

$343,696,687

State

School

Districts

2016

CY

Y PILOT

Ts

Growth in PILOTs

PY PILOT

Ts

CY PILO

OT

Ts

Growth in PILOTs

Numbe

er

Percent

Number

Percent

Number

Perccent

Number

Percent

Number Percent

$324,429

9,608

$336,349,618

$339,293,994

4

$23,430,418

$13,514,,391

467

69%

467

69%

221

33%

477

7

71%

474

4

70%

260

39%

209

31%

209

31%

224

33%

199

2

29%

129

9

19%

277

41%

676

100%

676

100%

247

676

37%

100%

675

10

00%

675

5

100%

139

675

21%

100%

S

SOURCE:

Office of the

t State Comptrollle

er, Tax Cap data, as of Jun

ne 1, 2015.

H

Howdoesthisshelpschooldistricts?Itaallowsthemttoincreasethheirallowableelevylimitstosupportcriticalbasic

eeducationalp

programs.Th

hecapitalexcclusiontothe

eTaxCapiseexpectedtoin

ncreasebyth

heamountoffthelocal

ccapital expenditures for BOCES

B

projeccts. The incrrease in PILO

OTs is expecteed to be refflected in thee quantity

cchange factorr which is multiplied

m

by the prior yeaar tax levy too create a p

prior year levvy that is adjjusted for

p

propertyexpaansion.The adjustedprio

oryeartaxle

evy,asthesttartingpoint fordetermin

ningtheallow

wablelevy

limit,isthenm

multipliedbytheallowable

egrowthfacttor(twoperceentorinflatio

on,whicheverisless)andtheresult

bypermissible

eexclusions,iincludinglocaalcapitalexpeenditures.Th

heimpactiseexpectedtob

begreater

issincreasedb

eespeciallyfor cashstrappe

edschooldisttrictswhichm

mayhaveexhhaustedtheirrfundbalancceandlowpeerforming

sschooldistricttswhichneed

dtoinvestmo

oreineducationalprogram

mstoraisestudentperformance.

C

Conclusion

W

Whilethelegislativeaction

niswelcomeandappearsstoreflectanninterestinm

makingtheTaaxCapwork betterfor

sschools,there

earesometrroublingaspe

ects.First,thechangesdeependontheediscretionoftheCommisssionerof

TTaxandFinan

ncetoimplem

ment.

SSecond,schoo

oldistrictsarefacedwith thepotentiaalofnoincreaaseintheTaxCapfornexxtyear.Due torecent

inflationorCPIdatareleasedbytheU

USBureauof LaborStatisttics,thetaxccapfornextyyearmayallo

owforno

ggrowthinascchooldistricttslevyoverttheprioryear.Thisisespeeciallytroublingforschoo

oldistrictswitthlimited

ffiscal capacityy and substaantial student poverty, which

w

have b een historicaally underfun

nded. Manyy of these

d

districtsareo

onlynowreco

overingfromsixyearsof GEAreductioons,threeyeearsoftaxcaaprestrictionsonlocal

rrevenues,and

dafoundationformulapro

omisedbutneverfullyfunnded.

A

Althoughthessependingad

djustmentsto

othetaxcap

pareindeedhhelpful,theaadjustmentsw

willhavelimiitedorno

p

positiveimpactifthetrend

dtowardsazeroincreaseinthetaxcappcontinues.

AppendixA

2015Le

egislativeActtion

TThesessionco

oncludedwithamendmen

ntstosection

n2023aofthheEducation Lawandsecttion3coftheGeneral

1

M

MunicipalLaw

wrelatingtottheTaxCap .

EEducationLaawsection2

2023awasaamendedto includeapossibleadju

ustmenttothedefinition

noflocal

ccapital expe

enditures to recognize school distrrict local capital expenditures for BOCES instructional

sspace,which

hareapermissibleexclu

usionfromth

heTaxCap:

T

THE COMMISSIONER OF TAXATION AND FINAN

NCE SHALL, AS APPROP

PRIATE, P

PROMULGATE RULES

A

AND REGULA

ATIONS WHICH MAY PROVIDE FOR ADJUSTMEN

NT OF CAPI

ITAL LOCAL

L EXPENDITURES TO

R

REFLECT A SCHOOL DI

ISTRICT'S

SHARE

OF

O

ADDITI

IONAL BUDG

GETED CAPI

ITAL EXPEN

NDITURES

M

MADE BY A BOARD OF COOPERATIVE

C

E EDUCATIO

ONAL SERVIC

CES.

G

GeneralMuniicipalLawsecction3cwas amendedtorecognizegrrowth(quantitychange)o

ontaxexempttland,for

w

whichthesch

hooldistrictorlocalgovern

nmentmaybe

ereceivingpaaymentsinlieeuoftaxes(P

PILOTs).

T

THE COMMISSIONER OF TAXATION AND FINANC

CE SHALL, AS APPROPRIATE,

PROMULGAT

TE RULES

Y CHANGE FACTOR WH

A

AND REGULA

ATIONS REGA

ARDING THE CALCULATI

ION OF THE

E QUANTITY

HICH MAY

A

ADJUST THE CALCULATI

ION BASED ON

O THE DEV

VELOPMENT O

ON TAX EXE

EMPT LAND.

You might also like

- NYS School District Factbook 2017Document292 pagesNYS School District Factbook 2017Jacqlene100% (2)

- 2015 2016 FPI Briefing Book 1.0Document72 pages2015 2016 FPI Briefing Book 1.0Casey SeilerNo ratings yet

- Americans For Prosperity FY 2017 Taxpayers' BudgetDocument112 pagesAmericans For Prosperity FY 2017 Taxpayers' BudgetAFPHQ_NewJerseyNo ratings yet

- 2016 Annual Report On Local Governments: ComptrollerDocument31 pages2016 Annual Report On Local Governments: ComptrollerNick ReismanNo ratings yet

- IDA Performance 2013Document24 pagesIDA Performance 2013Donald MillerNo ratings yet

- Jindal FY16 Proposed BudgetDocument48 pagesJindal FY16 Proposed BudgetRepNLandryNo ratings yet

- The Truth About Education FundingDocument2 pagesThe Truth About Education FundingKim SchmidtnerNo ratings yet

- CBC Economics of NYS EDC InitiatiesDocument2 pagesCBC Economics of NYS EDC InitiatiesbrianhoreyNo ratings yet

- State of The State 2010Document43 pagesState of The State 2010CapitolConfidentialNo ratings yet

- By The Numbers: What Government Costs in North Carolina Cities and Counties FY 2006Document45 pagesBy The Numbers: What Government Costs in North Carolina Cities and Counties FY 2006John Locke FoundationNo ratings yet

- Resolution On School Funding From WPSBADocument2 pagesResolution On School Funding From WPSBACara MatthewsNo ratings yet

- PM - Slash Seize and SellDocument11 pagesPM - Slash Seize and SellAjah HalesNo ratings yet

- The Texas Economy and School ChoiceDocument48 pagesThe Texas Economy and School ChoiceTPPFNo ratings yet

- Schools, Taxes and The New York EconomyDocument16 pagesSchools, Taxes and The New York EconomyCitizen Action of New York100% (2)

- NMTC Coalition CornerDocument3 pagesNMTC Coalition CornerReznick Group NMTC PracticeNo ratings yet

- Public FinanceDocument33 pagesPublic FinanceRebeccaDorguNo ratings yet

- Burgum BudgetDocument3 pagesBurgum BudgetRob PortNo ratings yet

- FRBSF: Economic LetterDocument5 pagesFRBSF: Economic LetterAnamaria VadanNo ratings yet

- HIM2016Q3NPDocument7 pagesHIM2016Q3NPlovehonor0519No ratings yet

- Unshackle Upstate 2014 Policy AgendaDocument8 pagesUnshackle Upstate 2014 Policy Agendarobertharding22No ratings yet

- Atlantic City Emergency Manager ReportDocument55 pagesAtlantic City Emergency Manager ReportPress of Atlantic CityNo ratings yet

- Enterprising States 2011Document135 pagesEnterprising States 2011U.S. Chamber of CommerceNo ratings yet

- International Cities NewyorkDocument6 pagesInternational Cities NewyorkDaniela StaciNo ratings yet

- Efr Vol 57 No 2 June 2019 Current Account Balance and Economic Growth in Nigeria An Empirical InvestigationDocument24 pagesEfr Vol 57 No 2 June 2019 Current Account Balance and Economic Growth in Nigeria An Empirical InvestigationNgos JeanNo ratings yet

- Joint Tax Hearing-Ron DeutschDocument18 pagesJoint Tax Hearing-Ron DeutschZacharyEJWilliamsNo ratings yet

- The Impact of The WelfareDocument24 pagesThe Impact of The WelfareKatiana ViegasNo ratings yet

- SSRN-id4433959 (1)Document7 pagesSSRN-id4433959 (1)June AlvarezNo ratings yet

- 2 0 1 2 P A: U NY: Olicy Genda NlockDocument8 pages2 0 1 2 P A: U NY: Olicy Genda NlockNick ReismanNo ratings yet

- Review of The Financial Plan of The City of New York: Report 10-2016Document36 pagesReview of The Financial Plan of The City of New York: Report 10-2016Nick ReismanNo ratings yet

- 2016 Finance Survey Report FINALDocument24 pages2016 Finance Survey Report FINALrkarlinNo ratings yet

- Acct 260 Cafr 3-15Document6 pagesAcct 260 Cafr 3-15StephanieNo ratings yet

- Maine Piglet Book 2016Document32 pagesMaine Piglet Book 2016Maine Policy InstituteNo ratings yet

- 31 Grothman DLDocument2 pages31 Grothman DLVicki McKennaNo ratings yet

- Shah Abdul Latif University Khairpur Mir's: Department: Public AdministrationDocument8 pagesShah Abdul Latif University Khairpur Mir's: Department: Public AdministrationAIJAZ ALI ABDUL LATIFNo ratings yet

- Technical Backgrounder - Million Jobs Plan (13 May 2014)Document5 pagesTechnical Backgrounder - Million Jobs Plan (13 May 2014)DavidReevelyNo ratings yet

- Rise of US Income & Wealth InequalityDocument24 pagesRise of US Income & Wealth Inequalityduttons930No ratings yet

- Keller Audit 4.5 PDFDocument25 pagesKeller Audit 4.5 PDFJason LopezNo ratings yet

- Mayor ReleaseDocument3 pagesMayor ReleaseJaime DavenportNo ratings yet

- 02008-Factsheet State LocalDocument3 pages02008-Factsheet State LocallosangelesNo ratings yet

- Distributional National Accounts: Methods and Estimates For The United StatesDocument52 pagesDistributional National Accounts: Methods and Estimates For The United StatesSrinivasaNo ratings yet

- Balanced Budget 2016 HighlightsDocument8 pagesBalanced Budget 2016 HighlightsMortgage ResourcesNo ratings yet

- Made by New Yorkers: A Plan For A Working New YorkDocument12 pagesMade by New Yorkers: A Plan For A Working New YorkPatLohmannNo ratings yet

- TreasuryDocument4 pagesTreasurylosangelesNo ratings yet

- Taxes and Budgets: Key Trends From The StatesDocument41 pagesTaxes and Budgets: Key Trends From The StatesThe Council of State GovernmentsNo ratings yet

- CPS FY16 Budget - Fact SheetDocument4 pagesCPS FY16 Budget - Fact SheetThe Daily LineNo ratings yet

- CurrentsDocument10 pagesCurrentsMassLiveNo ratings yet

- 2023 03 07 CPRAC Draft Report Executive Budget 1Document4 pages2023 03 07 CPRAC Draft Report Executive Budget 1Capitol PressroomNo ratings yet

- Comprehensive Annual Financial Report-FY2008Document132 pagesComprehensive Annual Financial Report-FY2008Navarro CollegeNo ratings yet

- Generational Accounting in The Uk: NOVEMBER2000Document28 pagesGenerational Accounting in The Uk: NOVEMBER2000Bayarmaa OdonNo ratings yet

- Pennsylvania State Budget: by Nathan Benefield Commonwealth FoundationDocument26 pagesPennsylvania State Budget: by Nathan Benefield Commonwealth FoundationCommonwealth FoundationNo ratings yet

- Literature Review On Unemployment and GDPDocument4 pagesLiterature Review On Unemployment and GDPgw1g9a3s100% (1)

- Literature Review On Revenue MobilizationDocument6 pagesLiterature Review On Revenue Mobilizationafdtvztyf100% (1)

- Fiscal Committees Taxes Kink Testimony 02.07.17 FinalDocument10 pagesFiscal Committees Taxes Kink Testimony 02.07.17 FinalMichael KinkNo ratings yet

- 2020 Budget OverviewDocument17 pages2020 Budget OverviewJohn TuringNo ratings yet

- June 2016 Financial StatusDocument10 pagesJune 2016 Financial StatusHelen BennettNo ratings yet

- Budget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018From EverandBudget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018No ratings yet

- World on the Move: Consumption Patterns in a More Equal Global EconomyFrom EverandWorld on the Move: Consumption Patterns in a More Equal Global EconomyNo ratings yet

- LAC Poverty and Labor Brief, June 2015: Working to End Poverty in Latin America and the Caribbean: Workers, Jobs, and WagesFrom EverandLAC Poverty and Labor Brief, June 2015: Working to End Poverty in Latin America and the Caribbean: Workers, Jobs, and WagesNo ratings yet

- Tax Policy and the Economy, Volume 35From EverandTax Policy and the Economy, Volume 35Robert A. MoffittNo ratings yet

- FY 18-19 Budget School Aid RunsDocument15 pagesFY 18-19 Budget School Aid RunsMatthew HamiltonNo ratings yet

- 2018-19 Executive Budget Briefing BookDocument161 pages2018-19 Executive Budget Briefing BookMatthew Hamilton100% (1)

- SNY0118 Crosstabs011618Document7 pagesSNY0118 Crosstabs011618Nick ReismanNo ratings yet

- SNY0118 Crosstabs011518Document3 pagesSNY0118 Crosstabs011518Matthew HamiltonNo ratings yet

- 11-29-17 Heastie Letter To McLaughlin Re: McLaughlin InvestigationDocument2 pages11-29-17 Heastie Letter To McLaughlin Re: McLaughlin InvestigationMatthew HamiltonNo ratings yet

- State of The State BingoDocument5 pagesState of The State BingoMatthew Hamilton100% (1)

- DiNapoli Debt Impact Study 2017Document30 pagesDiNapoli Debt Impact Study 2017Matthew HamiltonNo ratings yet

- Joint Budget Schedule 2018 Release FINALDocument1 pageJoint Budget Schedule 2018 Release FINALMatthew HamiltonNo ratings yet

- New York State Plastic Bag Task Force ReportDocument88 pagesNew York State Plastic Bag Task Force ReportMatthew Hamilton100% (1)

- IDC Leader Jeff Klein Legal Memo Re: Sexual Harassment Allegation.Document3 pagesIDC Leader Jeff Klein Legal Memo Re: Sexual Harassment Allegation.liz_benjamin6490No ratings yet

- 11-27-17 LetterDocument5 pages11-27-17 LetterNick ReismanNo ratings yet

- 6-22-17 Heastie Letter To Ethics Committee Re: McLaughlin InvestigationDocument1 page6-22-17 Heastie Letter To Ethics Committee Re: McLaughlin InvestigationMatthew HamiltonNo ratings yet

- 2018 State of The State BookDocument374 pages2018 State of The State BookMatthew HamiltonNo ratings yet

- 6-21-17 Ethics Committee Letter To Heastie Re: McLaughlin InvestigationDocument3 pages6-21-17 Ethics Committee Letter To Heastie Re: McLaughlin InvestigationMatthew HamiltonNo ratings yet

- Approval #64-66 of 2017Document3 pagesApproval #64-66 of 2017Matthew HamiltonNo ratings yet

- SNY1017 CrosstabsDocument6 pagesSNY1017 CrosstabsNick ReismanNo ratings yet

- DiNapoli Wall Street Profits Report 2017Document8 pagesDiNapoli Wall Street Profits Report 2017Matthew HamiltonNo ratings yet

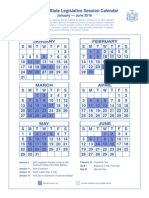

- 2016 Legislative Session CalendarDocument1 page2016 Legislative Session CalendarMatthew HamiltonNo ratings yet

- Comptroller's Fiscal Update: State Fiscal Year 2017-18 Receipts and Disbursements Through The Mid-YearDocument10 pagesComptroller's Fiscal Update: State Fiscal Year 2017-18 Receipts and Disbursements Through The Mid-YearMatthew HamiltonNo ratings yet

- Siena College October 2017 PollDocument8 pagesSiena College October 2017 PollMatthew HamiltonNo ratings yet

- USA V Pigeon 100617Document29 pagesUSA V Pigeon 100617Matthew HamiltonNo ratings yet

- OSC Municipal Water Systems ReportDocument14 pagesOSC Municipal Water Systems ReportMatthew HamiltonNo ratings yet

- DiNapoli Federal Budget ReportDocument36 pagesDiNapoli Federal Budget ReportMatthew HamiltonNo ratings yet

- Andrew Cuomo Letter To Jeff Bezos Re HQ2Document2 pagesAndrew Cuomo Letter To Jeff Bezos Re HQ2Matthew HamiltonNo ratings yet

- NYS DFS Credit Reporting Agency RegulationsDocument6 pagesNYS DFS Credit Reporting Agency RegulationsMatthew HamiltonNo ratings yet

- Faso Scaffold Law BillDocument4 pagesFaso Scaffold Law BillMatthew HamiltonNo ratings yet

- Rockefeller Instittue 106 Ideas For A Constitutional ConventionDocument17 pagesRockefeller Instittue 106 Ideas For A Constitutional ConventionMatthew HamiltonNo ratings yet

- USA v. Skelos Appellate DecisionDocument12 pagesUSA v. Skelos Appellate DecisionMatthew HamiltonNo ratings yet

- Gov. Andrew Cuomo Law Approval Message #6 - 2017Document1 pageGov. Andrew Cuomo Law Approval Message #6 - 2017Matthew HamiltonNo ratings yet

- Gov. Andrew Immigration Status Executive OrderDocument2 pagesGov. Andrew Immigration Status Executive OrderMatthew HamiltonNo ratings yet

- Accenture Faq For New JoinersDocument4 pagesAccenture Faq For New JoinersBaazinow Hack Brainbaazi Live AnswersNo ratings yet

- GI Tags Complete ListDocument17 pagesGI Tags Complete Listrameshb87No ratings yet

- Quotation For Villa Maintainance at Al RiqqaDocument2 pagesQuotation For Villa Maintainance at Al RiqqaAkosh AchuNo ratings yet

- Key plan and area statement comparison for multi-level car park (MLCPDocument1 pageKey plan and area statement comparison for multi-level car park (MLCP121715502003 BOLLEMPALLI BINDU SREE SATYANo ratings yet

- Behavioural Theory of The Firm: Presented By: Shubham Gupta Sumit MalikDocument26 pagesBehavioural Theory of The Firm: Presented By: Shubham Gupta Sumit MalikvarunymrNo ratings yet

- Vào 10 - Sở L NG Sơn 2022-2023Document5 pagesVào 10 - Sở L NG Sơn 2022-2023Lan HuongNo ratings yet

- J S S 1 Maths 1st Term E-Note 2017Document39 pagesJ S S 1 Maths 1st Term E-Note 2017preciousNo ratings yet

- Bleed Fan SelectionDocument4 pagesBleed Fan Selectionomar abdullahNo ratings yet

- Medical ParasitologyDocument33 pagesMedical ParasitologyAlexander Luie Jhames SaritaNo ratings yet

- Chapter 2 (Teacher)Document19 pagesChapter 2 (Teacher)ajakazNo ratings yet

- rfg040208 PDFDocument2,372 pagesrfg040208 PDFMr DungNo ratings yet

- ChE 4110 Process Control HW 1Document6 pagesChE 4110 Process Control HW 1MalloryNo ratings yet

- Transforming City Governments For Successful Smart CitiesDocument194 pagesTransforming City Governments For Successful Smart CitiesTri Ramdani100% (2)

- Art of Editing PDFDocument8 pagesArt of Editing PDFpremNo ratings yet

- Ratio, Proportion, and Percent: Presented By: John Darryl M. Genio Bocobo #3Document18 pagesRatio, Proportion, and Percent: Presented By: John Darryl M. Genio Bocobo #3John Darryl GenioNo ratings yet

- Bid Document Vol. II Attachment BOQDocument6 pagesBid Document Vol. II Attachment BOQHrityush ShivamNo ratings yet

- Lembar Kerja Lap Keu - Tahap 1Document4 pagesLembar Kerja Lap Keu - Tahap 1Safana AuraNo ratings yet

- A Light Sculling Training Boat PDFDocument8 pagesA Light Sculling Training Boat PDFLuis BraulinoNo ratings yet

- History of Architecture in Relation To Interior Period Styles and Furniture DesignDocument138 pagesHistory of Architecture in Relation To Interior Period Styles and Furniture DesignHan WuNo ratings yet

- Chapter 7, 8, 9Document11 pagesChapter 7, 8, 9Rubilyn IbarretaNo ratings yet

- Application Sheet: Series CW SeriesDocument2 pagesApplication Sheet: Series CW SerieskamalNo ratings yet

- Next-Generation Widebody Conversion: in Service From 2017 ONWARDSDocument6 pagesNext-Generation Widebody Conversion: in Service From 2017 ONWARDSAgusNo ratings yet

- Gas Turbine MaintenanceDocument146 pagesGas Turbine MaintenanceMamoun1969100% (8)

- CH 9 - Spontaneity, Entropy, and Free EnergyDocument65 pagesCH 9 - Spontaneity, Entropy, and Free EnergyCharbel RahmeNo ratings yet

- Grade 5 PPT English Q4 W3 Day 2Document17 pagesGrade 5 PPT English Q4 W3 Day 2Rommel MarianoNo ratings yet

- Teamcenter 10.1 Business Modeler IDE Guide PLM00071 J PDFDocument1,062 pagesTeamcenter 10.1 Business Modeler IDE Guide PLM00071 J PDFcad cad100% (1)

- Sustainability and Design EthicsDocument178 pagesSustainability and Design EthicsAbby SmithNo ratings yet

- Msme'S Premium Product Catalogue Book 2020: Craft CategoryDocument50 pagesMsme'S Premium Product Catalogue Book 2020: Craft CategoryTomikoVanNo ratings yet

- Design Proposal For North Public & Suite Areas Decorative Lighting, Solaire Quezon CityDocument42 pagesDesign Proposal For North Public & Suite Areas Decorative Lighting, Solaire Quezon CityRichard Libunao BelduaNo ratings yet

- 7.1 (149 Marks) : MarkschemeDocument51 pages7.1 (149 Marks) : MarkschemeSemwezi Enock100% (1)