Professional Documents

Culture Documents

50 Cent Bankruptcy

Uploaded by

FortuneCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

50 Cent Bankruptcy

Uploaded by

FortuneCopyright:

Available Formats

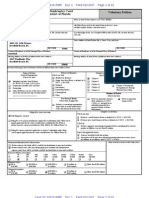

Case 15-21233

Doc 1

Filed 07/13/15

Document

B1 (Official Form 1)(04/13)

Entered 07/13/15 09:39:38

Page 1 of 5

United States Bankruptcy Court

Desc Main

Voluntary Petition

District of Connecticut

}

b

k

1

{

F

o

r

m

.

V

l

u

n

t

a

y

P

e

i

Name of Joint Debtor (Spouse) (Last, First, Middle):

Name of Debtor (if individual, enter Last, First, Middle):

Jackson, Curtis James III

All Other Names used by the Debtor in the last 8 years

(include married, maiden, and trade names):

All Other Names used by the Joint Debtor in the last 8 years

(include married, maiden, and trade names):

Last four digits of Soc. Sec. or Individual-Taxpayer I.D. (ITIN)/Complete EIN

Last four digits of Soc. Sec. or Individual-Taxpayer I.D. (ITIN) No./Complete EIN

(if more than one, state all)

(if more than one, state all)

xxx-xx-0616

Street Address of Joint Debtor (No. and Street, City, and State):

Street Address of Debtor (No. and Street, City, and State):

50 Poplar Hill Drive

Farmington, CT

ZIP Code

ZIP Code

06032

County of Residence or of the Principal Place of Business:

County of Residence or of the Principal Place of Business:

Hartford

Mailing Address of Joint Debtor (if different from street address):

Mailing Address of Debtor (if different from street address):

ZIP Code

ZIP Code

Location of Principal Assets of Business Debtor

(if different from street address above):

Type of Debtor

Nature of Business

(Form of Organization) (Check one box)

(Check one box)

Individual (includes Joint Debtors)

Chapter of Bankruptcy Code Under Which

the Petition is Filed (Check one box)

Health Care Business

Single Asset Real Estate as defined

in 11 U.S.C. 101 (51B)

Railroad

Stockbroker

Commodity Broker

Clearing Bank

Other

See Exhibit D on page 2 of this form.

Corporation (includes LLC and LLP)

Partnership

Other (If debtor is not one of the above entities,

check this box and state type of entity below.)

Chapter 15 Debtors

Tax-Exempt Entity

Country of debtor's center of main interests:

(Check box, if applicable)

Debtor is a tax-exempt organization

under Title 26 of the United States

Code (the Internal Revenue Code).

Each country in which a foreign proceeding

by, regarding, or against debtor is pending:

Filing Fee (Check one box)

Full Filing Fee attached

Filing Fee to be paid in installments (applicable to individuals only). Must

attach signed application for the court's consideration certifying that the

debtor is unable to pay fee except in installments. Rule 1006(b). See Official

Form 3A.

Filing Fee waiver requested (applicable to chapter 7 individuals only). Must

attach signed application for the court's consideration. See Official Form 3B.

Chapter 7

Chapter 9

Chapter 11

Chapter 12

Chapter 13

(Check one box)

Debts are primarily consumer debts,

defined in 11 U.S.C. 101(8) as

"incurred by an individual primarily for

a personal, family, or household purpose."

Check all applicable boxes:

A plan is being filed with this petition.

Acceptances of the plan were solicited prepetition from one or more classes of creditors,

in accordance with 11 U.S.C. 1126(b).

THIS SPACE IS FOR COURT USE ONLY

100199

200999

1,0005,000

5,00110,000

10,00125,000

25,00150,000

50,001100,000

OVER

100,000

$100,001 to

$500,000

$500,001

to $1

million

$1,000,001

to $10

million

$10,000,001

to $50

million

$50,000,001

to $100

million

$100,000,001 $500,000,001 More than

to $500

to $1 billion $1 billion

million

$100,001 to

$500,000

$500,001

to $1

million

$1,000,001

to $10

million

$10,000,001

to $50

million

$50,000,001

to $100

million

$100,000,001 $500,000,001 More than

to $500

to $1 billion $1 billion

million

Estimated Assets

$0 to

$50,000

$50,001 to

$100,000

Estimated Liabilities

$0 to

$50,000

$50,001 to

$100,000

Debts are primarily

business debts.

Chapter 11 Debtors

Check one box:

Debtor is a small business debtor as defined in 11 U.S.C. 101(51D).

Debtor is not a small business debtor as defined in 11 U.S.C. 101(51D).

Check if:

Debtors aggregate noncontingent liquidated debts (excluding debts owed to insiders or affiliates)

are less than $2,490,925 (amount subject to adjustment on 4/01/16 and every three years thereafter).

Estimated Number of Creditors

5099

Chapter 15 Petition for Recognition

of a Foreign Nonmain Proceeding

Nature of Debts

Statistical/Administrative Information

Debtor estimates that funds will be available for distribution to unsecured creditors.

Debtor estimates that, after any exempt property is excluded and administrative expenses paid,

there will be no funds available for distribution to unsecured creditors.

149

Chapter 15 Petition for Recognition

of a Foreign Main Proceeding

Case 15-21233

Doc 1

B1 (Official Form 1)(04/13)

Filed 07/13/15

Document

Entered 07/13/15 09:39:38

Page 2 of 5

Desc Main

Page 2

Name of Debtor(s):

Jackson, Curtis James III

Voluntary Petition

(This page must be completed and filed in every case)

Location

Where Filed: - None -

All Prior Bankruptcy Cases Filed Within Last 8 Years (If more than two, attach additional sheet)

Case Number:

Date Filed:

Location

Where Filed:

Case Number:

Date Filed:

Pending Bankruptcy Case Filed by any Spouse, Partner, or Affiliate of this Debtor (If more than one, attach additional sheet)

Name of Debtor:

Case Number:

Date Filed:

- None District:

Relationship:

Judge:

Exhibit B

Exhibit A

(To be completed if debtor is an individual whose debts are primarily consumer debts.)

(To be completed if debtor is required to file periodic reports (e.g.,

forms 10K and 10Q) with the Securities and Exchange Commission

pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

and is requesting relief under chapter 11.)

I, the attorney for the petitioner named in the foregoing petition, declare that I

have informed the petitioner that [he or she] may proceed under chapter 7, 11,

12, or 13 of title 11, United States Code, and have explained the relief available

under each such chapter. I further certify that I delivered to the debtor the notice

required by 11 U.S.C. 342(b).

Exhibit A is attached and made a part of this petition.

/s/ James Berman

Signature of Attorney for Debtor(s)

July 13, 2015

(Date)

James Berman ct06027

Exhibit C

Does the debtor own or have possession of any property that poses or is alleged to pose a threat of imminent and identifiable harm to public health or safety?

Yes, and Exhibit C is attached and made a part of this petition.

No.

Exhibit D

(To be completed by every individual debtor. If a joint petition is filed, each spouse must complete and attach a separate Exhibit D.)

Exhibit D completed and signed by the debtor is attached and made a part of this petition.

If this is a joint petition:

Exhibit D also completed and signed by the joint debtor is attached and made a part of this petition.

Information Regarding the Debtor - Venue

(Check any applicable box)

Debtor has been domiciled or has had a residence, principal place of business, or principal assets in this District for 180

days immediately preceding the date of this petition or for a longer part of such 180 days than in any other District.

There is a bankruptcy case concerning debtor's affiliate, general partner, or partnership pending in this District.

Debtor is a debtor in a foreign proceeding and has its principal place of business or principal assets in the United States in

this District, or has no principal place of business or assets in the United States but is a defendant in an action or

proceeding [in a federal or state court] in this District, or the interests of the parties will be served in regard to the relief

sought in this District.

Certification by a Debtor Who Resides as a Tenant of Residential Property

(Check all applicable boxes)

Landlord has a judgment against the debtor for possession of debtor's residence. (If box checked, complete the following.)

(Name of landlord that obtained judgment)

(Address of landlord)

Debtor claims that under applicable nonbankruptcy law, there are circumstances under which the debtor would be permitted to cure

the entire monetary default that gave rise to the judgment for possession, after the judgment for possession was entered, and

Debtor has included with this petition the deposit with the court of any rent that would become due during the 30-day period

after the filing of the petition.

Debtor certifies that he/she has served the Landlord with this certification. (11 U.S.C. 362(l)).

Case 15-21233

Doc 1

B1 (Official Form 1)(04/13)

Filed 07/13/15

Document

Entered 07/13/15 09:39:38

Page 3 of 5

Desc Main

Page 3

Name of Debtor(s):

Jackson, Curtis James III

Voluntary Petition

(This page must be completed and filed in every case)

Signatures

Signature(s) of Debtor(s) (Individual/Joint)

Signature of a Foreign Representative

I declare under penalty of perjury that the information provided in this

petition is true and correct.

[If petitioner is an individual whose debts are primarily consumer debts and

has chosen to file under chapter 7] I am aware that I may proceed under

chapter 7, 11, 12, or 13 of title 11, United States Code, understand the relief

available under each such chapter, and choose to proceed under chapter 7.

[If no attorney represents me and no bankruptcy petition preparer signs the

petition] I have obtained and read the notice required by 11 U.S.C. 342(b).

I declare under penalty of perjury that the information provided in this petition

is true and correct, that I am the foreign representative of a debtor in a foreign

proceeding, and that I am authorized to file this petition.

(Check only one box.)

I request relief in accordance with chapter 15 of title 11. United States Code.

Certified copies of the documents required by 11 U.S.C. 1515 are attached.

Pursuant to 11 U.S.C. 1511, I request relief in accordance with the chapter

of title 11 specified in this petition. A certified copy of the order granting

recognition of the foreign main proceeding is attached.

I request relief in accordance with the chapter of title 11, United States Code,

specified in this petition.

/s/ Curtis James Jackson, III

Signature of Debtor Curtis James Jackson, III

X

Signature of Foreign Representative

Printed Name of Foreign Representative

Signature of Joint Debtor

Date

Telephone Number (If not represented by attorney)

Signature of Non-Attorney Bankruptcy Petition Preparer

July 13, 2015

Date

I declare under penalty of perjury that: (1) I am a bankruptcy petition

preparer as defined in 11 U.S.C. 110; (2) I prepared this document for

compensation and have provided the debtor with a copy of this document

and the notices and information required under 11 U.S.C. 110(b),

110(h), and 342(b); and, (3) if rules or guidelines have been promulgated

pursuant to 11 U.S.C. 110(h) setting a maximum fee for services

chargeable by bankruptcy petition preparers, I have given the debtor notice

of the maximum amount before preparing any document for filing for a

debtor or accepting any fee from the debtor, as required in that section.

Official Form 19 is attached.

Signature of Attorney*

/s/ James Berman

Signature of Attorney for Debtor(s)

James Berman ct06027

Printed Name of Attorney for Debtor(s)

Zeisler & Zeisler, P.C.

Firm Name

10 Middle Street, 15th Floor

P.O. Box 1220

Bridgeport, CT 06604

Printed Name and title, if any, of Bankruptcy Petition Preparer

Social-Security number (If the bankrutpcy petition preparer is not

an individual, state the Social Security number of the officer,

principal, responsible person or partner of the bankruptcy petition

preparer.)(Required by 11 U.S.C. 110.)

Address

(203) 368-4234 Fax: (203) 367-9678

Telephone Number

July 13, 2015

Date

*In a case in which 707(b)(4)(D) applies, this signature also constitutes a

certification that the attorney has no knowledge after an inquiry that the

information in the schedules is incorrect.

Signature of Debtor (Corporation/Partnership)

I declare under penalty of perjury that the information provided in this

petition is true and correct, and that I have been authorized to file this petition

on behalf of the debtor.

The debtor requests relief in accordance with the chapter of title 11, United

States Code, specified in this petition.

Address

X

Date

Signature of bankruptcy petition preparer or officer, principal, responsible

person,or partner whose Social Security number is provided above.

Names and Social-Security numbers of all other individuals who prepared or

assisted in preparing this document unless the bankruptcy petition preparer is

not an individual:

X

Signature of Authorized Individual

Printed Name of Authorized Individual

Title of Authorized Individual

Date

If more than one person prepared this document, attach additional sheets

conforming to the appropriate official form for each person.

A bankruptcy petition preparers failure to comply with the provisions of

title 11 and the Federal Rules of Bankruptcy Procedure may result in

fines or imprisonment or both. 11 U.S.C. 110; 18 U.S.C. 156.

Case 15-21233

Doc 1

Filed 07/13/15

Document

Entered 07/13/15 09:39:38

Page 4 of 5

Desc Main

B 1D (Official Form 1, Exhibit D) (12/09)

United States Bankruptcy Court

District of Connecticut

In re

Curtis James Jackson, III

Debtor(s)

Case No.

Chapter

11

EXHIBIT D - INDIVIDUAL DEBTOR'S STATEMENT OF COMPLIANCE WITH

CREDIT COUNSELING REQUIREMENT

Warning: You must be able to check truthfully one of the five statements regarding credit

counseling listed below. If you cannot do so, you are not eligible to file a bankruptcy case, and the court

can dismiss any case you do file. If that happens, you will lose whatever filing fee you paid, and your

creditors will be able to resume collection activities against you. If your case is dismissed and you file

another bankruptcy case later, you may be required to pay a second filing fee and you may have to take

extra steps to stop creditors' collection activities.

Every individual debtor must file this Exhibit D. If a joint petition is filed, each spouse must complete

and file a separate Exhibit D. Check one of the five statements below and attach any documents as directed.

1. Within the 180 days before the filing of my bankruptcy case, I received a briefing from a credit

counseling agency approved by the United States trustee or bankruptcy administrator that outlined the

opportunities for available credit counseling and assisted me in performing a related budget analysis, and I have

a certificate from the agency describing the services provided to me. Attach a copy of the certificate and a copy

of any debt repayment plan developed through the agency.

2. Within the 180 days before the filing of my bankruptcy case, I received a briefing from a credit

counseling agency approved by the United States trustee or bankruptcy administrator that outlined the

opportunities for available credit counseling and assisted me in performing a related budget analysis, but I do

not have a certificate from the agency describing the services provided to me. You must file a copy of a

certificate from the agency describing the services provided to you and a copy of any debt repayment plan

developed through the agency no later than 14 days after your bankruptcy case is filed.

3. I certify that I requested credit counseling services from an approved agency but was unable to

obtain the services during the seven days from the time I made my request, and the following exigent

circumstances merit a temporary waiver of the credit counseling requirement so I can file my bankruptcy case

now. [Summarize exigent circumstances here.]

If your certification is satisfactory to the court, you must still obtain the credit counseling briefing

within the first 30 days after you file your bankruptcy petition and promptly file a certificate from the

agency that provided the counseling, together with a copy of any debt management plan developed

through the agency. Failure to fulfill these requirements may result in dismissal of your case. Any

extension of the 30-day deadline can be granted only for cause and is limited to a maximum of 15 days.

Your case may also be dismissed if the court is not satisfied with your reasons for filing your bankruptcy

case without first receiving a credit counseling briefing.

4. I am not required to receive a credit counseling briefing because of: [Check the applicable

statement.] [Must be accompanied by a motion for determination by the court.]

Software Copyright (c) 1996-2014 Best Case, LLC - www.bestcase.com

Best Case Bankruptcy

Case 15-21233

Doc 1

Filed 07/13/15

Document

Entered 07/13/15 09:39:38

Page 5 of 5

Desc Main

B 1D (Official Form 1, Exhibit D) (12/09) - Cont.

Page 2

Incapacity. (Defined in 11 U.S.C. 109(h)(4) as impaired by reason of mental illness or mental

deficiency so as to be incapable of realizing and making rational decisions with respect to financial

responsibilities.);

Disability. (Defined in 11 U.S.C. 109(h)(4) as physically impaired to the extent of being

unable, after reasonable effort, to participate in a credit counseling briefing in person, by telephone, or

through the Internet.);

Active military duty in a military combat zone.

5. The United States trustee or bankruptcy administrator has determined that the credit counseling

requirement of 11 U.S.C. 109(h) does not apply in this district.

I certify under penalty of perjury that the information provided above is true and correct.

Signature of Debtor:

Date:

Software Copyright (c) 1996-2014 Best Case, LLC - www.bestcase.com

/s/ Curtis James Jackson, III

Curtis James Jackson, III

July 13, 2015

Best Case Bankruptcy

You might also like

- Bankruptcy Law OutlineDocument30 pagesBankruptcy Law Outlinelcahern100% (2)

- Gregory Owens Chapter 7 Bankruptcy PetitionDocument39 pagesGregory Owens Chapter 7 Bankruptcy Petitiondavid_lat100% (1)

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- Defendant's Eviction Trial BriefDocument49 pagesDefendant's Eviction Trial Briefsaldanna100% (5)

- Agent Script Debt Settlement 15th MarchDocument8 pagesAgent Script Debt Settlement 15th MarchMildred LuceroNo ratings yet

- A Guide to District Court Civil Forms in the State of HawaiiFrom EverandA Guide to District Court Civil Forms in the State of HawaiiNo ratings yet

- James T. Turner Bankruptcy FilingDocument70 pagesJames T. Turner Bankruptcy Filingsavannahnow.comNo ratings yet

- Rita Gail Edwards Student Loan DischargeDocument15 pagesRita Gail Edwards Student Loan DischargeRob Wile100% (1)

- Simple Guide for Drafting of Civil Suits in IndiaFrom EverandSimple Guide for Drafting of Civil Suits in IndiaRating: 4.5 out of 5 stars4.5/5 (4)

- Preliminary Title ReportDocument24 pagesPreliminary Title Reportpournima mohiteNo ratings yet

- Bain Capital LP LetterDocument1 pageBain Capital LP LetterFortune100% (1)

- Chapter 13 Bankruptcy in the Western District of TennesseeFrom EverandChapter 13 Bankruptcy in the Western District of TennesseeNo ratings yet

- LumpSum Project GuidelinesDocument48 pagesLumpSum Project GuidelinesAiswarya RajeevNo ratings yet

- Eugenia Lichauco Et Al., Plaintiffs and Appellants, vs. Faustino Lichauco, Defendant and AppellantDocument3 pagesEugenia Lichauco Et Al., Plaintiffs and Appellants, vs. Faustino Lichauco, Defendant and AppellantLorjyll Shyne Luberanes TomarongNo ratings yet

- 50cent PetitionDocument5 pages50cent PetitionAdamNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of FloridaDocument31 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of FloridaMy-Acts Of-SeditionNo ratings yet

- Clark TurnerDocument13 pagesClark TurnerdaggerpressNo ratings yet

- Trick Daddy's Bankruptcy PetitionDocument36 pagesTrick Daddy's Bankruptcy PetitionJohn BringardnerNo ratings yet

- Sapphire Road BankruptcyDocument33 pagesSapphire Road BankruptcyTod RobbersonNo ratings yet

- Spectrum Analyitcal Bankruptcy ApplicationDocument8 pagesSpectrum Analyitcal Bankruptcy ApplicationJim KinneyNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNo ratings yet

- Glisson Bankruptcy 4-6-2012 Show - TempDocument44 pagesGlisson Bankruptcy 4-6-2012 Show - Temp4profit1No ratings yet

- John Altorelli Bankruptcy PetitionDocument9 pagesJohn Altorelli Bankruptcy Petitiondavid_latNo ratings yet

- Zane First Bankruptcy FilingDocument39 pagesZane First Bankruptcy FilingWashingtonian MagazineNo ratings yet

- Earthclassmailshow TempDocument78 pagesEarthclassmailshow TempJohn CookNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of FloridaDocument59 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of Floridamarie_beaudette1272No ratings yet

- Mason Bankruptcy PetitionDocument195 pagesMason Bankruptcy PetitionLansingStateJournalNo ratings yet

- Natalie Khawam Voluntary Chapter 7 Bankruptcy PetitionDocument53 pagesNatalie Khawam Voluntary Chapter 7 Bankruptcy PetitionStaci ZaretskyNo ratings yet

- Clark Turner LLCDocument23 pagesClark Turner LLCdaggerpressNo ratings yet

- MMA's Bankruptcy PetitionDocument94 pagesMMA's Bankruptcy PetitionWilliam Wolfe-WylieNo ratings yet

- Full Details SugarmanDocument40 pagesFull Details SugarmanBecket AdamsNo ratings yet

- Bankruptcy PetitionDocument16 pagesBankruptcy PetitionEmily Amelia HeilNo ratings yet

- Earl Gaudio & Son PetitionDocument11 pagesEarl Gaudio & Son PetitionChapter 11 DocketsNo ratings yet

- Young BK Petition TXSDDocument8 pagesYoung BK Petition TXSDslappy00No ratings yet

- Court DocumentsDocument64 pagesCourt DocumentsAnonymous DeZm0ZLptONo ratings yet

- DMX PetitionDocument23 pagesDMX PetitionMarie Beaudette GlatsteinNo ratings yet

- Dahl's Bankruptcy PetitionDocument116 pagesDahl's Bankruptcy PetitiondmronlineNo ratings yet

- Terri Williams BankruptcyDocument59 pagesTerri Williams BankruptcyThe Greenville Guardian100% (1)

- 10000019287Document165 pages10000019287Chapter 11 DocketsNo ratings yet

- Dahl's FilingDocument116 pagesDahl's FilingwhohdNo ratings yet

- Michigan Brewing Company Bankruptcy FilingDocument171 pagesMichigan Brewing Company Bankruptcy FilingLansingStateJournalNo ratings yet

- Bankruptcy Filing For Business Interface (See Page 15 For Labor Dept. Claim)Document31 pagesBankruptcy Filing For Business Interface (See Page 15 For Labor Dept. Claim)WAMU885newsNo ratings yet

- Circle Family Healthcare Network Voluntary PetitionDocument108 pagesCircle Family Healthcare Network Voluntary PetitionEllyn FortinoNo ratings yet

- James R. Rosendall Jr.'s Bankruptcy Filing.Document50 pagesJames R. Rosendall Jr.'s Bankruptcy Filing.rob_snell_1No ratings yet

- Palomar Hangar, LLC Chapter 11 Bankruptcy - MacalusoDocument10 pagesPalomar Hangar, LLC Chapter 11 Bankruptcy - MacalusoSpoiledMomNo ratings yet

- Braswell BankruptcyDocument58 pagesBraswell BankruptcyMatt DixonNo ratings yet

- Jimmy Taylor Sr. Bankruptcy PetitionDocument51 pagesJimmy Taylor Sr. Bankruptcy PetitionsrdielNo ratings yet

- Far East Energy Corporation - Bankruptcy Petition 15-35970 Doc 1 Filed 10 Nov 15Document15 pagesFar East Energy Corporation - Bankruptcy Petition 15-35970 Doc 1 Filed 10 Nov 15scion.scionNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of New York AmendedDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of New York AmendedChapter 11 DocketsNo ratings yet

- Steven F Meldahl Bankruptcy PetitionDocument13 pagesSteven F Meldahl Bankruptcy PetitionCamdenCanaryNo ratings yet

- Illuzzi Chap 7 BankruptcyDocument46 pagesIlluzzi Chap 7 BankruptcyAlan BedenkoNo ratings yet

- Michael Kasparian Chapter 11 PetitionDocument41 pagesMichael Kasparian Chapter 11 Petitionmariner12No ratings yet

- United States Bankruptcy Court Voluntary Petition: Central District of California - Santa AnaDocument12 pagesUnited States Bankruptcy Court Voluntary Petition: Central District of California - Santa AnaChapter 11 DocketsNo ratings yet

- Arcapita Bank Chapter 11 PetitionDocument32 pagesArcapita Bank Chapter 11 PetitionDealBook100% (1)

- Northern District of Georgia - Atlanta Division: Voluntary Petition United States Bankruptcy CourtDocument5 pagesNorthern District of Georgia - Atlanta Division: Voluntary Petition United States Bankruptcy CourtRichard Donald JonesNo ratings yet

- Marlene Davis Bankruptcy FilingDocument51 pagesMarlene Davis Bankruptcy Filingacsamaha100% (1)

- Transdel First Day PetitionsDocument122 pagesTransdel First Day PetitionsjaxxstrawNo ratings yet

- Andrei Leon Gill SR Bankruptcy Petition 185 McCarrons BLVD PO Box 11683 06-05-2012Document71 pagesAndrei Leon Gill SR Bankruptcy Petition 185 McCarrons BLVD PO Box 11683 06-05-2012CamdenCanaryNo ratings yet

- Sunset Junction Festival Bankruptcy FilingDocument105 pagesSunset Junction Festival Bankruptcy FilingTheEastsiderNo ratings yet

- 001 NYC Opera PetitionDocument10 pages001 NYC Opera Petitionahawkins8223No ratings yet

- Outwrite Bookstore and Coffeehouse Files For Chapter 7 BankruptcyDocument112 pagesOutwrite Bookstore and Coffeehouse Files For Chapter 7 BankruptcyThe GA VoiceNo ratings yet

- 10000021291Document490 pages10000021291Chapter 11 DocketsNo ratings yet

- Bankruptcy Filing of "Sister Wife" Christine Allred Brown 3/2010Document5 pagesBankruptcy Filing of "Sister Wife" Christine Allred Brown 3/2010borninbrooklynNo ratings yet

- 05014834923Document41 pages05014834923My-Acts Of-SeditionNo ratings yet

- GingrichDocument16 pagesGingrichmarie_beaudette1272No ratings yet

- Hargreaves Ch. 11 Bankruptcy FilingDocument24 pagesHargreaves Ch. 11 Bankruptcy FilingNick HalterNo ratings yet

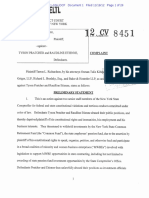

- Relativity SuitDocument56 pagesRelativity SuitFortune100% (1)

- Cals TrsDocument6 pagesCals TrsFortuneNo ratings yet

- Omega Advisors Inc. Letter To Investors 9.21.16Document5 pagesOmega Advisors Inc. Letter To Investors 9.21.16Fortune100% (1)

- Washington State Investment Board Portfolio Overview by Strategy December 31, 2015Document7 pagesWashington State Investment Board Portfolio Overview by Strategy December 31, 2015FortuneNo ratings yet

- Foia q1 2016 OperfDocument7 pagesFoia q1 2016 OperfFortuneNo ratings yet

- Omega Advisors Inc. Letter To Investors 9.21.16Document5 pagesOmega Advisors Inc. Letter To Investors 9.21.16Fortune100% (1)

- Pe Irr 06 30 15Document4 pagesPe Irr 06 30 15Fortune100% (1)

- PrimDocument6 pagesPrimFortuneNo ratings yet

- Square FilingDocument21 pagesSquare FilingFortuneNo ratings yet

- SEC Servergy SuitDocument26 pagesSEC Servergy SuitFortuneNo ratings yet

- Cals TrsDocument6 pagesCals TrsFortuneNo ratings yet

- Lisa Lee CVC ComplaintDocument23 pagesLisa Lee CVC ComplaintFortune100% (1)

- Utimco ActiveDocument20 pagesUtimco ActiveFortune100% (4)

- Caspersen Andrew ComplaintDocument14 pagesCaspersen Andrew ComplaintFortuneNo ratings yet

- Don Blankenship IndictmentDocument43 pagesDon Blankenship IndictmentFortuneNo ratings yet

- Ab 2833Document4 pagesAb 2833FortuneNo ratings yet

- Tarrus Richardson ComplaintDocument26 pagesTarrus Richardson ComplaintFortuneNo ratings yet

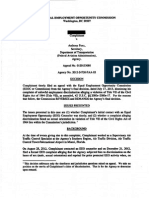

- EEOC Decision Sexual Orientation Title VIIDocument17 pagesEEOC Decision Sexual Orientation Title VIIFortuneNo ratings yet

- Gilt Groupe FilingDocument25 pagesGilt Groupe FilingFortuneNo ratings yet

- UberDocument33 pagesUberTechCrunch67% (3)

- SEC Order On KKRDocument12 pagesSEC Order On KKRFortuneNo ratings yet

- Herington v. Milwaukee Bucks ComplaintDocument20 pagesHerington v. Milwaukee Bucks ComplaintFortuneNo ratings yet

- Fanduel v. SchneidermanDocument17 pagesFanduel v. SchneidermanFortuneNo ratings yet

- LC RFI PreambleDocument7 pagesLC RFI PreambleFortuneNo ratings yet

- LC RFI PreambleDocument7 pagesLC RFI PreambleFortuneNo ratings yet

- University of Texas Investment Management Company Private Investments Fund Performance (Active Relationships)Document18 pagesUniversity of Texas Investment Management Company Private Investments Fund Performance (Active Relationships)FortuneNo ratings yet

- Yair V MattesDocument19 pagesYair V MattesFortuneNo ratings yet

- EEOC v. UPS 071515Document16 pagesEEOC v. UPS 071515Fortune100% (1)

- companiesRegActivities2010 2011Document42 pagescompaniesRegActivities2010 2011BrendaNo ratings yet

- SRS Liquidation Meeting AgendaDocument4 pagesSRS Liquidation Meeting AgendaManoj100% (1)

- CASINOTESDocument13 pagesCASINOTESEnric AlcaideNo ratings yet

- Worldcom ScandalDocument5 pagesWorldcom ScandalJia Faye GiaNo ratings yet

- Report on Bankruptcy Laws Advisory GroupDocument54 pagesReport on Bankruptcy Laws Advisory GroupZeenat MasoodiNo ratings yet

- Jeremy J. Cobb, Esq. ResumeDocument11 pagesJeremy J. Cobb, Esq. ResumeJeremy J. Cobb, Esq.No ratings yet

- Restitution of ServerPronto AssetsDocument16 pagesRestitution of ServerPronto Assetsjaybobby007No ratings yet

- Dave Waite - Bankruptcy Proceedings in BarbadosDocument4 pagesDave Waite - Bankruptcy Proceedings in BarbadosClaudine BaileyNo ratings yet

- 2017 08 02 18 44 39 STD PG3 - Revised - 18.8.15 - 107 1 - 107 - 107Document86 pages2017 08 02 18 44 39 STD PG3 - Revised - 18.8.15 - 107 1 - 107 - 107Kamruz zamanNo ratings yet

- Financial Institutional Act 2004Document101 pagesFinancial Institutional Act 2004Chicharito HernandezNo ratings yet

- Roll No. ..................................... : New SyllabusDocument8 pagesRoll No. ..................................... : New SyllabusManojNo ratings yet

- Kevin Stevensen North MinneapolisDocument7 pagesKevin Stevensen North MinneapolisCamdenCanaryNo ratings yet

- Engleski Jezik IV-Profile 3 - Priprema Za Kolokvijum 1Document109 pagesEngleski Jezik IV-Profile 3 - Priprema Za Kolokvijum 1jovana kovacevicNo ratings yet

- Latham Watkins Second Lien LoansDocument56 pagesLatham Watkins Second Lien Loanspvalka1No ratings yet

- Sewell 110613 WebDocument40 pagesSewell 110613 WebtodaysshopperNo ratings yet

- The Recovery of Debts Due To Banks and Financial Institutions ACT, 1993Document21 pagesThe Recovery of Debts Due To Banks and Financial Institutions ACT, 1993jagankilariNo ratings yet

- April 2021 MagazineDocument143 pagesApril 2021 MagazineVarun JainNo ratings yet

- Problem Set 4Document2 pagesProblem Set 4Haseeb RazaNo ratings yet

- Alphatec Final V2Document25 pagesAlphatec Final V2Zhou Yuan ZhanNo ratings yet

- Bidding Document For Compita Security+Document105 pagesBidding Document For Compita Security+EyuNo ratings yet

- RFBT 04 03 Law On Obligation For Discussion Part TwoDocument15 pagesRFBT 04 03 Law On Obligation For Discussion Part TwoStephanieNo ratings yet

- Su v. Mega International Commercial BankDocument9 pagesSu v. Mega International Commercial BankPriorSmartNo ratings yet

- Dr. Ram Manohar Lohia National Law UniversityDocument13 pagesDr. Ram Manohar Lohia National Law UniversityAbhi BloggerNo ratings yet