Professional Documents

Culture Documents

Introduction To Cost Accounting

Uploaded by

Hunson AbadeerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction To Cost Accounting

Uploaded by

Hunson AbadeerCopyright:

Available Formats

COST ACCOUNTING by Raiborn and Kinney

CHAPTER 1: Introduction to Cost Accounting

Chapter Summary

1. Accounting

provides

information

to

external

parties

(stockholders, creditors, and

various regulatory bodies) for

investment

and

credit

decisions.

helps estimate the cost of

products

produced

and

services provided by the

organization.

provides information useful

to the internal managers who

are responsible for planning,

controlling, decision making,

and evaluating performance.

2. The

purpose

of

financial,

management, and cost accounting

are that

financial

accounting

is

designed to meet external

information needs and to

comply

with

generally

accepted

accounting

principles.

management

accounting

attempts to satisfy internal

users information needs.

cost accounting creates an

overlap between financial

accounting and management

accounting

by

providing

product costing information

for financial statements and

quantitative, disaggregated,

cost-based information that

managers need to perform

their responsibilities.

3. The organizational mission and

strategy are important to cost

accountants because they help

establish

appropriate

measures

of

accomplishment.

develop,

implement,

and

monitor

the

necessary

information systems.

4. The common corporate strategies

are

cost leadership, which refers

to maintaining a competitive

edge

by

undercutting

competitor prices.

product differentiation, which

refers to offering (generally

at a premium price) superior

quality products or more

unique

services

than

competitors

5. The value chain is a set of valueadding functions or processes that

converts inputs into products and

services for company customers,

and

organizations

add

value

through the value chain functions

of

research and development

product design

supply

production

marketing

distribution

customer service

6. A balanced scorecard

is a four perspective measure

of critical goals and targets

needed

to

operationalize

strategy.

looks at the success factors

for learning and growth,

internal business, customer

satisfaction, and stockholder

value.

COST ACCOUNTING by Raiborn and Kinney

CHAPTER 1: Introduction to Cost Accounting

includes

financial

and

nonfinancial, internal and

external,

long-term

and

short-term, and lead and lag

indicators.

7. The organizational structure

is composed of people,

resources other than people,

and commitments that are

acquired

and

arranged

relative to authority and

responsibility

to

achieve

organizational

mission,

strategy, and goals.

is used by cost accountants

to

understand

how

information is communicated

between

managers

and

departments as well as the

authority and responsibility

of each manager.

has line personnel who seek

to achieve the organizational

mission and strategy through

balanced scorecard targets.

has staff personnel, such as

cost accountants, who seek

to advise and assist line

personnel.

8. Some sources for professional

ethics include the

IMAs Code of Ethics that

refers

to

issues

of

competence, confidentiality,

integrity, and objectivity.

Sarbanes-Oxley

Act

that

requires corporate CEOs and

CFOs to sign off on the

accuracy of financial reports.

False

Claims

Act

that

provides for whistle-blowing

protection.

Foreign Corrupt Practices Act

that

prohibits

U.S.

corporations from offering or

giving bribes to foreign

officials to influence those

individuals to help, obtain, or

retain business.

9. Generally accepted cost accounting

standards

do not exist for companies

that are not engaged in

contracts with the federal

government; however, the

statements on management

accounting and management

accounting guidelines are

well-researched suggestions

related

to

management

accounting practices.

are prepared by the Cost

Accounting Standards Board

for companies engaged in

federal

government

cost/bidding contracts.

You might also like

- Assignment On Diesel Engine OverhaulingDocument19 pagesAssignment On Diesel Engine OverhaulingRuwan Susantha100% (3)

- Reviewer 3, Fundamentals of Accounting 2Document21 pagesReviewer 3, Fundamentals of Accounting 2Hunson Abadeer67% (3)

- Reviewer 2, Fundamentals of Accounting 2Document22 pagesReviewer 2, Fundamentals of Accounting 2Hunson Abadeer100% (2)

- Reviewer 1, Fundamentals of Accounting 2Document13 pagesReviewer 1, Fundamentals of Accounting 2Hunson Abadeer76% (17)

- Footnote To YouthDocument6 pagesFootnote To YouthHunson Abadeer0% (1)

- Distinguish Opinion From TruthDocument12 pagesDistinguish Opinion From TruthMAR ANTERO R. CENIZA100% (2)

- Nanking StoreDocument9 pagesNanking StoreHunson Abadeer100% (2)

- CFASDocument61 pagesCFASPrinces Jamela G. AgraNo ratings yet

- Estate Tax Test BankDocument38 pagesEstate Tax Test BankMario LuigiNo ratings yet

- Xerox 6030 PDFDocument663 pagesXerox 6030 PDFРумен ИвановNo ratings yet

- Capillary Puncture Equipment and Procedures: Topic 7Document39 pagesCapillary Puncture Equipment and Procedures: Topic 7Angelica Camille B. AbaoNo ratings yet

- "Magnificence" by Estrella D. AlfonDocument3 pages"Magnificence" by Estrella D. Alfonruby soho83% (12)

- 20764C ENU Companion PDFDocument192 pages20764C ENU Companion PDFAllan InurretaNo ratings yet

- O The Beat 1 - TBDocument164 pagesO The Beat 1 - TBJulliana SantosNo ratings yet

- PFRS 10 13Document2 pagesPFRS 10 13Patrick RiveraNo ratings yet

- 6organizational Innovations:total Quality Management Just-In-Time Production SystemDocument10 pages6organizational Innovations:total Quality Management Just-In-Time Production SystemAryan LeeNo ratings yet

- BA 114.1 Module2 Cash Exercise 3Document3 pagesBA 114.1 Module2 Cash Exercise 3Kurt Orfanel100% (1)

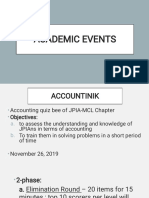

- JPIA-MCL Academic-EventsDocument17 pagesJPIA-MCL Academic-EventsJana BercasioNo ratings yet

- Conceptual Framework and Accounting StandardsDocument4 pagesConceptual Framework and Accounting StandardsKrestyl Ann GabaldaNo ratings yet

- Lecture Note - Receivables Sy 2014-2015Document10 pagesLecture Note - Receivables Sy 2014-2015LeneNo ratings yet

- Chap7 Notes Intermediate Accounting KiesoDocument8 pagesChap7 Notes Intermediate Accounting Kiesoangelbear2577100% (1)

- Ch010.Lam2e TBDocument25 pagesCh010.Lam2e TBTnananaNo ratings yet

- CFAS Graded Recitation CompleteDocument14 pagesCFAS Graded Recitation CompleteJONATHAN LANCE JOBLENo ratings yet

- Chapter 2Document34 pagesChapter 2Ahmed DapoorNo ratings yet

- Vol 2. SampleDocument23 pagesVol 2. SamplevishnuvermaNo ratings yet

- Job Costing Finished Goods InventoryDocument46 pagesJob Costing Finished Goods InventoryNavindra JaggernauthNo ratings yet

- Invest in Equity SecuritiesDocument3 pagesInvest in Equity SecuritiesGIRLNo ratings yet

- FINANCIAL FORECAST GUIDEDocument16 pagesFINANCIAL FORECAST GUIDEMariann Jane GanNo ratings yet

- Mixed PDFDocument8 pagesMixed PDFChris Tian FlorendoNo ratings yet

- Lease Accounting Multiple Choice QuestionsDocument5 pagesLease Accounting Multiple Choice QuestionsDarrelNo ratings yet

- As 12 - Full Notes For Accounting For Government GrantDocument6 pagesAs 12 - Full Notes For Accounting For Government GrantShrey KunjNo ratings yet

- Module 2 Bank Reconciliation Proof of CashDocument2 pagesModule 2 Bank Reconciliation Proof of CashziNo ratings yet

- Lyceum-Northwestern University: L-NU AA-23-02-01-18Document8 pagesLyceum-Northwestern University: L-NU AA-23-02-01-18Amie Jane MirandaNo ratings yet

- Merchandise Inventory For A Personal Computer Would IncludeDocument1 pageMerchandise Inventory For A Personal Computer Would Includejahnhannalei marticioNo ratings yet

- rev-mat-2-IA Print PDFDocument31 pagesrev-mat-2-IA Print PDFAyaka FujiharaNo ratings yet

- Topacio Rizza C. Activity 6-1Document12 pagesTopacio Rizza C. Activity 6-1santosashleymay7No ratings yet

- Factors Affecting Currency Exchange RatesDocument2 pagesFactors Affecting Currency Exchange RatesEmmanuelle RojasNo ratings yet

- Cash Flow and Financial PlanningDocument48 pagesCash Flow and Financial PlanningIsmadth2918388100% (1)

- CFAS MODULE and AssDocument87 pagesCFAS MODULE and AsshellokittysaranghaeNo ratings yet

- Borrowing Cost DrillDocument2 pagesBorrowing Cost DrillJasmin Rabon0% (1)

- Fin Man ReviewerDocument5 pagesFin Man ReviewerJea BalagtasNo ratings yet

- Problems 3 PRELIM TASK FINALDocument4 pagesProblems 3 PRELIM TASK FINALJohn Francis RosasNo ratings yet

- 7 Pricing DecisionsDocument14 pages7 Pricing DecisionsZenCamandangNo ratings yet

- Chapter 2Document12 pagesChapter 2Cassandra KarolinaNo ratings yet

- Document 4 PDFDocument1 pageDocument 4 PDFMiljane PerdizoNo ratings yet

- Pas 21-The Effects of Changes in Foreign Exchange RatesDocument3 pagesPas 21-The Effects of Changes in Foreign Exchange RatesAryan LeeNo ratings yet

- PART I: True or False: Management Accounting Quiz 1 BsmaDocument4 pagesPART I: True or False: Management Accounting Quiz 1 BsmaAngelyn SamandeNo ratings yet

- ESTIMATING DOUBTFUL ACCOUNTSDocument15 pagesESTIMATING DOUBTFUL ACCOUNTSMARY GRACE VARGASNo ratings yet

- Mostafa Fouda98Document9 pagesMostafa Fouda98deepak1818No ratings yet

- Income Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Document4 pagesIncome Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Nhel AlvaroNo ratings yet

- Lesson 3 Sales Budget and Schedule of Expected Cash CollectionDocument18 pagesLesson 3 Sales Budget and Schedule of Expected Cash CollectionZybel RosalesNo ratings yet

- JPIA CA5101 MerchxManuf Reviewer PDFDocument7 pagesJPIA CA5101 MerchxManuf Reviewer PDFmei angelaNo ratings yet

- Strategic Cost Management PDFDocument10 pagesStrategic Cost Management PDFMohamad RifkyNo ratings yet

- FS Mapping FLE02-1Document29 pagesFS Mapping FLE02-1Lenielyn UbaldoNo ratings yet

- Assignment 7 1Document1 pageAssignment 7 1Eilen Joyce BisnarNo ratings yet

- Capital Budgeting: Decision Criteria: True-FalseDocument40 pagesCapital Budgeting: Decision Criteria: True-Falsedavid80dcnNo ratings yet

- Setting Standard Costs-Ideal and Practical StandardsDocument2 pagesSetting Standard Costs-Ideal and Practical StandardsAmmar Ul ArfeenNo ratings yet

- Why Is Economics Central To An Understanding of The Problems of DevelopmentDocument1 pageWhy Is Economics Central To An Understanding of The Problems of DevelopmentMaureen LeonidaNo ratings yet

- The Nature of Managerial Economics Economics EssayDocument86 pagesThe Nature of Managerial Economics Economics EssayCoke Aidenry SaludoNo ratings yet

- Standard Costing and Variance Analysis: This Accounting Materials Are Brought To You byDocument16 pagesStandard Costing and Variance Analysis: This Accounting Materials Are Brought To You byChristian Bartolome LagmayNo ratings yet

- Ch15 Capital Structure and Leverage-1Document44 pagesCh15 Capital Structure and Leverage-1Fizza AwanNo ratings yet

- ISA 265 Summary: Communicating Deficiencies in Internal Control To Those Charged With Governance and ManagementDocument2 pagesISA 265 Summary: Communicating Deficiencies in Internal Control To Those Charged With Governance and ManagementtruthNo ratings yet

- SM 31 Study Guide and Reading Materials Preliminary PeriodDocument33 pagesSM 31 Study Guide and Reading Materials Preliminary PeriodRuth MohametanoNo ratings yet

- Intermediate Accounting - Petty Cash Journal EntriesDocument2 pagesIntermediate Accounting - Petty Cash Journal EntriesSean Lester S. NombradoNo ratings yet

- Curriculum For BSADocument4 pagesCurriculum For BSAYeppeuddaNo ratings yet

- Chapter 12 Strategy Balanced Scorecard A PDFDocument52 pagesChapter 12 Strategy Balanced Scorecard A PDFShing Ho TamNo ratings yet

- Long Quiz Investments Class IJ (5:30-7:30 TWFS)Document5 pagesLong Quiz Investments Class IJ (5:30-7:30 TWFS)Jolina AynganNo ratings yet

- Accounting 4 Module 1 3Document3 pagesAccounting 4 Module 1 3Micaela EncinasNo ratings yet

- Chapter 1 - Intro To Cost AccountingDocument2 pagesChapter 1 - Intro To Cost AccountingShana VillamorNo ratings yet

- Draft APDocument6 pagesDraft APhchi7171No ratings yet

- NAAADocument3 pagesNAAAMonica AlauraNo ratings yet

- ICT Collaboration Tools For Virtual Teams in Terms of The SECI ModelDocument22 pagesICT Collaboration Tools For Virtual Teams in Terms of The SECI ModelHunson AbadeerNo ratings yet

- The Effect of Digitalization in The Workplace On Employee Performance Mediated by Employee AttachmentDocument16 pagesThe Effect of Digitalization in The Workplace On Employee Performance Mediated by Employee AttachmentHunson AbadeerNo ratings yet

- SPCOverview MFGDocument44 pagesSPCOverview MFGtuyen_bnNo ratings yet

- Exec Brief Network InventoriesDocument20 pagesExec Brief Network InventoriesHunson AbadeerNo ratings yet

- Statistical Quality ControlDocument3 pagesStatistical Quality ControlHunson Abadeer100% (1)

- Portents by Jessica ZafraDocument8 pagesPortents by Jessica ZafraMclin Jhon Marave MabalotNo ratings yet

- The FenceDocument4 pagesThe FenceHunson AbadeerNo ratings yet

- Cost Terminology and Cost BehaviorsDocument8 pagesCost Terminology and Cost BehaviorsHunson Abadeer100% (2)

- My Father Goes To CourtDocument2 pagesMy Father Goes To CourtNilo Palsic CampoNo ratings yet

- Project MethodDocument6 pagesProject MethodMtr Jonathan Uribe CarvajalNo ratings yet

- PGW Spring SuitDocument14 pagesPGW Spring Suitapi-3700386No ratings yet

- Geppetto's Wish Comes True: Pinocchio Becomes a Real BoyDocument1 pageGeppetto's Wish Comes True: Pinocchio Becomes a Real BoyDonzNo ratings yet

- GelSight - Measurement of Surface RoughnessDocument5 pagesGelSight - Measurement of Surface RoughnessXto PeregrinNo ratings yet

- Balancing The Cybersecurity BattlefieldDocument4 pagesBalancing The Cybersecurity BattlefieldLilminowNo ratings yet

- Netscaler 10 With Citrix Triscale™ Technology: Download This SlideDocument40 pagesNetscaler 10 With Citrix Triscale™ Technology: Download This SlidePhong TrầnNo ratings yet

- Di Bella Et Al 2004Document13 pagesDi Bella Et Al 2004Emilio Patané SpataroNo ratings yet

- Fiber006 SorDocument1 pageFiber006 SormbuitragoNo ratings yet

- Present Tense Review for Motorcycle RepairDocument2 pagesPresent Tense Review for Motorcycle RepairFaheemuddin Veterans50% (2)

- Shamanhood and Mythology: Archaic Techniques of Ecstasy and Current Techniques of ResearchDocument22 pagesShamanhood and Mythology: Archaic Techniques of Ecstasy and Current Techniques of ResearchDunja Chrysina ChrysargyreaNo ratings yet

- Toan Bo Cac Bai Ktra E11CBDocument13 pagesToan Bo Cac Bai Ktra E11CBNguyễn Thị Huyền Phương0% (1)

- Community-Acquired Pneumoniaandhospital-Acquiredpneumonia: Charles W. Lanks,, Ali I. Musani,, David W. HsiaDocument15 pagesCommunity-Acquired Pneumoniaandhospital-Acquiredpneumonia: Charles W. Lanks,, Ali I. Musani,, David W. HsiaMajo EscobarNo ratings yet

- Chong Co Thai Restaurant LocationsDocument19 pagesChong Co Thai Restaurant LocationsrajragavendraNo ratings yet

- GEY 102-Introduction To Geology 1-Lecture Slides - Prof. M.E. NtonDocument44 pagesGEY 102-Introduction To Geology 1-Lecture Slides - Prof. M.E. Ntonabuabdmuqseet2001No ratings yet

- Butterfly Court SpreadsDocument24 pagesButterfly Court SpreadsAbigaïl EnderlandNo ratings yet

- SAP FICO Asset Accounting 1Document3 pagesSAP FICO Asset Accounting 1Ananthakumar ANo ratings yet

- 2012 C R I M I N A L L A W 1 Reviewer Wordpresscom 5a237cee1723dd6eef7c227dDocument15 pages2012 C R I M I N A L L A W 1 Reviewer Wordpresscom 5a237cee1723dd6eef7c227dSan PedroNo ratings yet

- Cept To Cept Company PVT LTDDocument17 pagesCept To Cept Company PVT LTDRatnil ShrivastavaNo ratings yet

- LESSON 1 Definition and Functions of ManagementDocument2 pagesLESSON 1 Definition and Functions of ManagementJia SorianoNo ratings yet

- Guide Number 5 My City: You Will Learn To: Describe A Place Tell Where You in The CityDocument7 pagesGuide Number 5 My City: You Will Learn To: Describe A Place Tell Where You in The CityLUIS CUELLARNo ratings yet

- At HomeDocument16 pagesAt HomesamoorewritesNo ratings yet

- Impact of Technology On Future JobsDocument29 pagesImpact of Technology On Future Jobsmehrunnisa99No ratings yet

- Data Structures Assignment 2: (Backtracking Using Stack)Document4 pagesData Structures Assignment 2: (Backtracking Using Stack)Sai CharanNo ratings yet