Professional Documents

Culture Documents

090 Form English Version

Uploaded by

RibanaMaya0 ratings0% found this document useful (0 votes)

32 views3 pages090 registration form

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document090 registration form

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views3 pages090 Form English Version

Uploaded by

RibanaMaya090 registration form

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

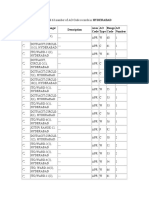

090

Fiscal registration statement /

Statement of Specifications for Non-Resident Taxpayers set

in the EU, who are registering directly

Statement type

1. Registration statement X

2. Specifications statement

Tax payer identification data

1.

2.

3.

4.

5.

Fiscal identification code

..............................................

Name / First and Last Name

..............................................

Legal Form

..............................................

Establishing date (yy/mm/dd) ..............................................

Domicile / Headquarters data

Residence country

..............................................

Full address in the country of residence ..............................................

Postal code .........................

Fax

...................................

Phone

..........................

E-mail ...................................

6. Romanian address where documents may be audited

County

District 1

Locality Bucharest

Street Mendeleev

No. 28-30

Building

Floor 2

Apt.

Postal Code 010365

Fax 021 404 3444

Phone 021 316 8075

E-mail office@soter.ro

7. Romanian address for correspondence (optional)

County

District

Locality

Street

No.

Building

Floor

Apt.

Postal Code

Fax

Phone

C. Other information on tax payer

1. Represented by empowered person

No. power of attorney

X

Date

2. Empowered person identification data

First and Last Name / Name SOTER SRL

Address:

County

District

Street Turda

No. 129

Floor 6

Apt. 220

Fax 021 404 3444

E-mail office@soter.ro

Fiscal identification code

3. Banking institution

Locality Bucharest

Entrance

5

Postal Code 011326

Phone 021 316 8075

3273781

Account IBAN number

4. Registration in another EU member state

Country

........................

Fiscal identification code

Yes

No

........................

D. Tax vector data

I. VAT

1. Registered for VAT purposes according to art. 153 parag. (4) of Fiscal Code

2. Registered for VAT purposes according to art. 153 parag. (5) of Fiscal Code

3. Estimated turnover

4. Turnover realized in previous fiscal year

5. Fiscal period

5.1. Monthly payment

5.2. Quarterly payment

5.3. Half-yearly payment no. approval from relevant tax authorities

5.4. Annual payment

no. approval from relevant tax authorities

6. Cancelation of registration for VAT purposes

6.1. As a result of ending the activity starting with date //

6.2. As a result of ending the activities

with deduction right

starting with date //

6.3. As a result of ending the 2 year period,

in case of remote sales

starting with date //

II. Social security contributions

1. Registration as payer of social security contributions in Romania

1.1. Health insurance contribution

1.2. Unemployment contribution

1.3. Labor accidents and professional diseases contribution

1.4. Social security contribution pension contribution

2. Deregistration

starting with date //

X

X

X

X

Under sanctions applied in case of forgery in public documents, I declare on my own

account that:

- I will undertake in Romania taxable operations for which I have the obligation to

pay VAT under art. 150 parag. (1) of Fiscal Code

and/or

- I will undertake operations without right of deduction, with the exception of

transport services and other auxiliary services, exempt based on art. 143 par. (1),

let. c) f), h) m), art. 144 par. (1), let. c) and art. 144 1 of Fiscal Code for which

the registration is optional.

I have enclosed the following contracts / orders:

Under sanctions applied in case of forgery in public documents, I

declare that the information provided in this statement is correct and

complete.

Name of the person making the statement

to be filled in

Signature to be filled in

Date to be filled in

Stamp to be filled in

To be filled out by the fiscal authorities

Name fiscal authority

Registration number

Date of registration

First and last name of the reviewer

Number identification card

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Activity 1Document4 pagesActivity 1LFGS Finals50% (2)

- Original For Recipient Tax Invoice: (Deepak Das)Document1 pageOriginal For Recipient Tax Invoice: (Deepak Das)Deepak DasNo ratings yet

- 18 CIR V Wander PhilippinesDocument1 page18 CIR V Wander PhilippinesMark Anthony Javellana SicadNo ratings yet

- Tax ReceiptDocument1 pageTax ReceiptCHRISNo ratings yet

- Cir V American Express International, IncDocument1 pageCir V American Express International, IncDinahNo ratings yet

- B Amazon Tax Guide 2 11 20Document10 pagesB Amazon Tax Guide 2 11 20amerikandesignsNo ratings yet

- Module 4 .1 - Schedule of Withholding TaxesDocument2 pagesModule 4 .1 - Schedule of Withholding TaxesJimbo ManalastasNo ratings yet

- 17 5402ezbkDocument64 pages17 5402ezbkPhylicia MorrisNo ratings yet

- Hunter Biden IndictmentDocument56 pagesHunter Biden IndictmentWashington ExaminerNo ratings yet

- Invoice 2223COB646 49433Document1 pageInvoice 2223COB646 49433Abhishek sharmaNo ratings yet

- Gross Taxable Income Tax DueDocument19 pagesGross Taxable Income Tax DueEdcelyn SamaniegoNo ratings yet

- FN 2 CCDocument6 pagesFN 2 CCkoosNo ratings yet

- Estate, Trust, and Heir Tax CalculationsDocument4 pagesEstate, Trust, and Heir Tax CalculationsJESTONI RAMOSNo ratings yet

- Fortress Power Dealer FormDocument3 pagesFortress Power Dealer FormJuan Esteban HenaoNo ratings yet

- Wage Slip July-2018Document1 pageWage Slip July-2018Nitesh KumarNo ratings yet

- DEBIT NOTE TITLEDocument1 pageDEBIT NOTE TITLEVinay vibhuti YadavNo ratings yet

- Adobe Scan Mar 24, 2023Document1 pageAdobe Scan Mar 24, 2023SIDDHANT KUMARNo ratings yet

- Documentary Stamp Taxes: Business and Transfer Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument3 pagesDocumentary Stamp Taxes: Business and Transfer Taxation 6Th Edition (By: Valencia & Roxas) Suggested Answersrayjoshua12No ratings yet

- Payslip 2023030Document1 pagePayslip 2023030Sivaram PopuriNo ratings yet

- Tax Invoice GeneratorDocument2 pagesTax Invoice Generatoramandeep kansalNo ratings yet

- InvocieDocument1 pageInvociepankajsabooNo ratings yet

- DTC Agreement Between China and EcuadorDocument22 pagesDTC Agreement Between China and EcuadorOECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- Salary Slip Template NewDocument1 pageSalary Slip Template NewhavinashNo ratings yet

- RMO No.34-2018Document3 pagesRMO No.34-2018kkabness101 YULNo ratings yet

- Parents Insurance PremiumDocument1 pageParents Insurance Premiumprajeesh.vijayanNo ratings yet

- Creative BillsDocument5 pagesCreative BillsTcm HaridwarNo ratings yet

- Goods & Service Tax (GST) - User DashboardDocument3 pagesGoods & Service Tax (GST) - User DashboardRAJORAJI CO.No ratings yet

- C - Tang Ho Vs CA CirDocument1 pageC - Tang Ho Vs CA Circeilo coboNo ratings yet

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return Acknowledgementaloka.rajNo ratings yet

- 53 Income Tax Ao CodesDocument4 pages53 Income Tax Ao CodesSarang PandeNo ratings yet