Professional Documents

Culture Documents

Schroder Australian Smaller Companies Fund: February 2013

Uploaded by

qweasd222Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Schroder Australian Smaller Companies Fund: February 2013

Uploaded by

qweasd222Copyright:

Available Formats

February 2013

Monthly Report

Schroder Australian Smaller

Companies Fund

Total return %

7

Schroder Australian Smaller Companies Fund (post-fee)

S&P/ASX Small Ordinaries Accumulation Index

Relative performance (post-fee)

1 mth

3 mths

1 yr

3.1

0.9

+2.2

12.9

8.5

+4.4

22.2

-2.4

+24.6

3 yrs p.a. 5 yrs p.a. Inception p.a.

12.6

2.6

+10.0

4.2

-3.8

+8.0

2.2

-5.9

+8.1

Please refer to www.schroders.com.au for post-tax returns

Past performance is not a reliable indicator of future performance

Inception Date: 14 Dec 2007, 5 years and 2 months.

1

Market cap

ASX 1 - 50

ASX 51 - 100

ASX 101 - 300

Non Index

Cash

Portfolio

0.0%

1.4%

67.9%

26.4%

4.2%

Benchmark

0.0%

0.0%

100.0%

Top ten holdings %

Skilled Group Ltd.

McMillan Shakespeare Ltd.

DuluxGroup Ltd.

Cash Converters International Ltd.

Technology One Ltd.

RCR Tomlinson Ltd.

Henderson Group PLC

Seven Group Holdings Ltd.

Tox Free Solutions Ltd.

Medusa Mining Ltd.

Total

Portfolio1

5.3%

4.8%

4.3%

3.8%

3.7%

3.7%

3.1%

3.1%

3.0%

2.9%

37.7%

Benchmark2

0.7%

0.9%

1.6%

0.4%

0.0%

0.3%

1.5%

1.2%

0.4%

0.8%

7.8%

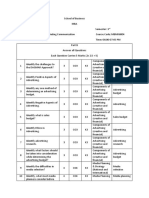

Characteristics

No. of stocks

Portfolio turnover* (1 yr)

Volatility (5yr standard deviation)

Tracking error (3yr historic)

Portfolio1

52

35.2%

17.4%

6.5%

Benchmark2

198

23.3%

Commentary

The S&P/ASX Small Ordinaries Accumulation Index rose by 0.9%, while the Schroder

Australian Smaller Companies Fund (post-fee) rose by 3.1%, outperforming by 2.2% for the

month.

Broad trends across the small cap market continued in February, with reporting season only

reinforcing two themes currently of concern to small cap investors. Firstly performance of

small caps (S&P/ASX Small Ordinaries Accumulation Index) relative to large caps

(S&P/ASX 100 Accumulation Index) continues to disappoint, with underperformance of 4.8%

in February in the context of 28.5% underperformance over the past 12 months. Secondly,

within the small cap universe, resources underperformed industrials by 11.5% during

February in the context of 54.2% underperformance over the past 12 months.

What is driving market returns?

Other than the lagging Australian small cap market weighed down by small resource stocks,

stock markets in general are continuing their upward march. Theories around what is driving

the market higher, and ten reasons (there are always ten reasons for everything) why it will

continue, often emerge at times like this. An elegant explanation of more buyers than

sellers is addressed in Martin Conlons Australian Equity commentary this month and rather

than repeat that here we look at a couple of other market myths.

Three (of the ten!) reasons investors commonly hear regarding why equity returns are likely

to continue to improve are: the economy is doing better; fund flows into equities are picking

up and stocks are attractively valued. Although we have more than some sympathy for the

last comment, it is often hard to reconcile the timing of the stocks are cheap call when

markets have already performed so well and by definition prospective returns must have

dimmed.

GDP growth and stock market return correlations

Recent analysis by Jeremy Grantham of GMO adds to the body of research that concludes

in the long run GDP growth provides little explanatory power for the returns of equity

investors. This is simply a whole economy view of what we know from our own research into

industry and company revenue growth and the implications for equity returns.

What matters for shareholders is not how fast a company, industry or economy is growing

but how much of that growth through economic or industry structure or through sustainable

competitive advantages of the company is trapped to the owners of equity. High growth and

low barriers to entry whether it is the manufacture of smart phones or the production of iron

ore will invite endless new competitors until all excess returns have been distributed

amongst the enlarged competitor set leaving shareholders to wonder where all the

opportunity went. This concept is a foundation of capitalism and until a better economic

model is discovered it will dictate equity returns in the long run far more than whether

economic growth is fast or slow.

Fund flows and stock market returns

The reason du jour for current equity market performance is the great rotation out of

bonds, into stocks. Relative value between these two asset classes may explain some of the

recent equity market performance as the more buyers than sellers condition leads prices up

to a level where marginal buyers and sellers are more balanced between the two

alternatives, however looking at the track record of equity fund flows as a predictor of returns

may have the cause and effect around the wrong way.

1 The 'Portfolio' is the Schroder Australian Smaller Companies Fund

2 Benchmark is the S&P/ASX Small Ordinaries Accumulation Index

Unless otherwise stated all figures are as at the end of February 2013

Please note numbers may not total 100 due to rounding

*Turnover = (Purchases + Sales - Cashinflows + Cashoutflows) / (Market

Value(T0)+ Market Value(T1) - Cashflows)

Analysis done by Credit Suisse looked at whether fund flows predicted market returns or

whether market returns in fact predicted fund flows. You could know something about

human nature and nothing about statistics and you would get the right answer on this one.

Although causality is hard to pick up in real time when people are financially incentivised to

believe one answer (It is difficult to get a man to understand something when his salary

depends upon his not understanding it - Upton Sinclair) the reality is that market

performance is more likely to cause fund flows (correlation of 0.35) than fund flows are likely

to cause market performance (correlation -0.09). So people follow recent performance with

real dollars no great surprise there.

Schroder Australian Smaller Companies Fund

Fund objective

Commentary Continued

To outperform the S&P/ASX Small Ordinaries Accumulation Index after

fees over the medium to long term by investing in a broad range of

smaller companies from Australia and New Zealand.

Bottom up stock valuation now you are talking

Investment style

Fund details

SCH0036AU

$48,878,109

$0.7695

December 2007

0.60%/0.60%

$50,000

Normally twice yearly - June and Dec

1.10% pa plus performance fee of

20.5% pa of net outperformance

Sector exposure versus the benchmark %

-8.0

-6.0

Energy

-4.0

-2.0

0.0

2.0

Materials

0.9

Containers & Packaging

Unfortunately the same data is not available for Australian small companies, but using

similar long term through the cycle valuation metrics as the CAPE (such as price to book or

enterprise value to sales multiples), we can observe that in an absolute sense Australian

small caps are fair value to very marginally under-valued at this time. When looked at

relative to large caps (using the S&P / ASX 100 Index as the large cap benchmark) small

caps are also marginally better value than large caps but marginal enough that we

wouldnt want to get too over confident about the accuracy of these metrics.

The good news here is that the last two years of underperformance has removed a

significant (20% relative to large caps) over valued position embedded within the Small

Ordinaries universe predominantly centred around small resource stock valuations.

Although there isnt the compellingly large discount to large caps observed twice in the last

decade (2002-03, 2008-09) there is currently no penalty for adding the diversification

benefits that small cap stocks can provide to a broader equity portfolio.

As interesting as this all may be, none of it really matters as we are not buying fund flows,

whole economies or even index relative valuations. We are buying direct shares in a

company and in return for investing our capital we obtain claims to the future cash flows of

that firm or more accurately as minority shareholders without control we realistically obtain

claims to the future dividends. Those with control (either majority shareholders or the

management and board on behalf of all shareholders) are making the higher level decision

around how much of the future cash flows are earmarked to capital investment and what is

left for distribution and so in part we are also investing in their commercial judgement.

0.0

Contributors for the month included: Skilled Group, REA Group, Cash Converters

International, Codan and McMillan Shakespeare.

-5.7

Paper & Forest Products

0.0

Industrials

4.5

Consumer Discretionary

1.9

Consumer Staples

3.7

Health Care

Detractors for the month included: Southern Cross Media Group, Tox Free Solutions,

Invocare, Medusa Mining and JB HiFi.

Outlook

-2.5

Information Technology

4.8

Telecommunication Services

2.4

Utilities

-1.0

-2.5

Capital Markets

Financials

Consumer banks

0.0

Diversified Fin Services

-0.2

Insurance

0.0

Real Estate Mgmt & Dev

Property Trusts

6.0

1.6

Construction Materials

Metals & Mining

4.0

-4.5

Chemicals

February 2013

So what does matter? Well in the context of the current arguments (GDP growth, fund flows

and valuation) we fall firmly into the camp that suggests valuation and specifically a measure

of long term valuation at the time of investment is a pretty important factor to determine

future investment returns. This is most compelling when at its most simple and analysis of

U.S stock market returns between 1881 and 2011 (Shiller) highlight that the periods of

greatest subsequent 10 year returns (average +16.1% p.a) began at Cyclically Adjusted

Price to Earnings (CAPE) ratios that averaged 10.9x. The CAPE is a P/E ratio constructed

using the average earnings over the last ten years so as not to mistake a cyclically high or

low point in earnings as a sustainable number. Unsurprisingly, the periods of the lowest 10

year market returns (average -3.3% p.a) began at an average CAPE of 23.3x. With no hint

of irony then, the U.S CAPE as at the end of February was 23.34x not exactly a screaming

buy signal if history is anything to go by but perhaps the kindest thing to be said is that in

the current financially repressed world it may be the best option.

Schroders is a bottom-up, fundamental, active growth manager of

Australian equities, with an emphasis on stocks that are able to grow

shareholder value in the long term.

APIR code

Fund size (AUD)

Redemption unit price

Fund inception date

Buy / sell spread

Minimum investment

Distribution frequency

Management costs (p.a.)

Monthly Report

-0.3

-6.4

A fresh set of financial results delivered in reporting season and large near term share price

reactions have created opportunities for the portfolio on both the buy and sell side of the

ledger. We have added some new names to the portfolio during the month that have

attractive return expectations and have been realising a number of our longer term portfolio

holdings that performed well and are no longer offering attractive return prospects.

The changes to the portfolio should result in two meaningful impacts - the long run

prospective returns of the portfolio are improving as we move into stocks with greater upside

but in the short run the portfolio exposure to momentum will decline. We expect the coming

months will provide further opportunity to continue rotating the portfolio into areas of better

risk adjusted prospective return.

David Wanis

Unless otherwise stated all figures are as at the end of February 2013

Benchmark is the S&P/ASX Small Ordinaries Accumulation Index

Contact

www.schroders.com.au

E-mail: simal@schroders.com

Schroder Investment Management Australia Limited

ABN 22 000 443 274 Australian Financial Services Licence 226473

Level 20 Angel Place, 123 Pitt Street, Sydney NSW 2000

Phone: 1300 136 471 Fax: (02) 9231 1119

Investment in the Schroder Australian Smaller Companies Fund ('the Fund') may be made on an application form in the Product Disclosure Statement dated 1 February 2011, available

from the Manager, Schroder Investment Management Australia Limited (ABN 22 000 443 274 AFSL 226473) (Schroders).

This Report is intended solely for the information of the person to whom it is provided by Schroders. It should not be relied on by any person for the purposes of making investment

decisions. Total returns are calculated using exit price to exit price, after fees and expenses, and assuming reinvestment of income. Gross returns are calculated using exit price to exit

price and are gross of fees and expenses. The repayment of capital and performance of the Fund is not guaranteed by Schroders or any company in the Schroders Group. Past

performance is not a reliable indicator of future performance. Unless otherwise stated the source for all graphs and tables contained in this report is Schroders. Opinions constitute our

judgment at the time of issue and are subject to change. This report does not contain and is not to be taken as containing any financial product advice or financial product

recommendation. For security reasons telephone calls may be recorded.

You might also like

- Schroder Wholesale Australian Equity Fund: July 2012Document2 pagesSchroder Wholesale Australian Equity Fund: July 2012qweasd222No ratings yet

- Weekly Market Recap, May 13-Main Street FinancialDocument2 pagesWeekly Market Recap, May 13-Main Street Financialasmith2499No ratings yet

- JPM Weekly MKT Recap 8-13-12Document2 pagesJPM Weekly MKT Recap 8-13-12Flat Fee PortfoliosNo ratings yet

- EdisonInsight February2013Document157 pagesEdisonInsight February2013KB7551No ratings yet

- The Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsFrom EverandThe Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsRating: 4 out of 5 stars4/5 (1)

- JPM Weekly MKT Recap 3-05-12Document2 pagesJPM Weekly MKT Recap 3-05-12Flat Fee PortfoliosNo ratings yet

- Orbe Brazil Fund - Dec2012Document7 pagesOrbe Brazil Fund - Dec2012José Enrique MorenoNo ratings yet

- Market Analysis Jan 2023Document28 pagesMarket Analysis Jan 2023tanweijun07No ratings yet

- 2012 Outlook: Australian Equity StrategyDocument36 pages2012 Outlook: Australian Equity StrategyLuke Campbell-Smith100% (1)

- JPM Weekly Commentary 12-26-11Document2 pagesJPM Weekly Commentary 12-26-11Flat Fee PortfoliosNo ratings yet

- Z-Ben Executive Briefing (March 2012)Document2 pagesZ-Ben Executive Briefing (March 2012)David QuahNo ratings yet

- The Real Returns Report, May 14 2012Document6 pagesThe Real Returns Report, May 14 2012The Real Returns ReportNo ratings yet

- JPM Weekly MKT Recap 9-24-12Document2 pagesJPM Weekly MKT Recap 9-24-12Flat Fee PortfoliosNo ratings yet

- JPM Weekly Market Recap October 10, 2011Document2 pagesJPM Weekly Market Recap October 10, 2011everest8848No ratings yet

- Weekly Market Recap-Week of May 6th-MSFDocument2 pagesWeekly Market Recap-Week of May 6th-MSFasmith2499No ratings yet

- Mason Hawkins 11q3letterDocument4 pagesMason Hawkins 11q3letterrodrigoescobarn142No ratings yet

- JPM Weekly MKT Recap 4-23-12Document2 pagesJPM Weekly MKT Recap 4-23-12Flat Fee PortfoliosNo ratings yet

- JPM Weekly MKT Recap 5-21-12Document2 pagesJPM Weekly MKT Recap 5-21-12Flat Fee PortfoliosNo ratings yet

- Spring 2014 HCA Letter FinalDocument4 pagesSpring 2014 HCA Letter FinalDivGrowthNo ratings yet

- JPM Weekly MKT Recap 10-15-12Document2 pagesJPM Weekly MKT Recap 10-15-12Flat Fee PortfoliosNo ratings yet

- Mfi 0516Document48 pagesMfi 0516StephNo ratings yet

- Weekly Trends Nov 21Document5 pagesWeekly Trends Nov 21dpbasicNo ratings yet

- File 1Document10 pagesFile 1Alberto VillalpandoNo ratings yet

- JPM Weekly MKT Recap 5-14-12Document2 pagesJPM Weekly MKT Recap 5-14-12Flat Fee PortfoliosNo ratings yet

- To: From: Christopher M. Begg, CFA - CEO, Chief Investment Officer, and Co-Founder Date: April 24, 2012 ReDocument10 pagesTo: From: Christopher M. Begg, CFA - CEO, Chief Investment Officer, and Co-Founder Date: April 24, 2012 RepolandspringsNo ratings yet

- JPM Weekly MKT Recap 10-1-12Document2 pagesJPM Weekly MKT Recap 10-1-12Flat Fee PortfoliosNo ratings yet

- Ve Weekly NewsDocument10 pagesVe Weekly NewsValuEngine.comNo ratings yet

- Research Sample - IREDocument7 pagesResearch Sample - IREIndepResearchNo ratings yet

- JPM Weekly Commentary 01-09-12Document2 pagesJPM Weekly Commentary 01-09-12Flat Fee PortfoliosNo ratings yet

- Wally Weitz Letter To ShareholdersDocument2 pagesWally Weitz Letter To ShareholdersAnonymous j5tXg7onNo ratings yet

- Other ASX Research 1Document86 pagesOther ASX Research 1asxresearchNo ratings yet

- Steven Romick September 30, 2010Document13 pagesSteven Romick September 30, 2010eric695No ratings yet

- Selector September 2004 Quarterly NewsletterDocument5 pagesSelector September 2004 Quarterly Newsletterapi-237451731No ratings yet

- JPM Weekly Commentary 01-16-12Document2 pagesJPM Weekly Commentary 01-16-12Flat Fee PortfoliosNo ratings yet

- Arlington Value 2011 Annual LetterDocument8 pagesArlington Value 2011 Annual LetterChrisNo ratings yet

- The Case For Yield Investing: SchrodersDocument6 pagesThe Case For Yield Investing: SchrodersnigeltaylorNo ratings yet

- Magnifier - October 2010Document60 pagesMagnifier - October 2010BCapital5No ratings yet

- Selector June 2013 Quarterly NewsletterDocument24 pagesSelector June 2013 Quarterly NewsletterSelectorFundNo ratings yet

- Element Global Value - 3Q13Document4 pagesElement Global Value - 3Q13FilipeNo ratings yet

- Ssga Australian Equity Market OutlookDocument2 pagesSsga Australian Equity Market Outlookapi-127423253No ratings yet

- JPM Weekly MKT Recap 10-08-12Document2 pagesJPM Weekly MKT Recap 10-08-12Flat Fee PortfoliosNo ratings yet

- JPM Weekly MKT Recap 3-19-12Document2 pagesJPM Weekly MKT Recap 3-19-12Flat Fee PortfoliosNo ratings yet

- Investing For A New World: Managing Through Low Yields and High VolatilityDocument16 pagesInvesting For A New World: Managing Through Low Yields and High VolatilityPenna111No ratings yet

- JPM Weekly MKT Recap 9-10-12Document2 pagesJPM Weekly MKT Recap 9-10-12Flat Fee PortfoliosNo ratings yet

- 2013 q2 Crescent Commentary Steve RomickDocument16 pages2013 q2 Crescent Commentary Steve RomickCanadianValueNo ratings yet

- Kerr Is Dale Quarterly Letter 12-31-11Document3 pagesKerr Is Dale Quarterly Letter 12-31-11VALUEWALK LLCNo ratings yet

- Muhlenkamp 2014 08 28Document17 pagesMuhlenkamp 2014 08 28CanadianValueNo ratings yet

- 10 Key Trends Changing Inv MGMTDocument50 pages10 Key Trends Changing Inv MGMTcaitlynharveyNo ratings yet

- PzenaCommentary Second Quarter 2013Document3 pagesPzenaCommentary Second Quarter 2013CanadianValueNo ratings yet

- PM Perspective High YieldDocument8 pagesPM Perspective High YieldMikeNo ratings yet

- John P. Hussman, PH.D.: The Future Is NowDocument6 pagesJohn P. Hussman, PH.D.: The Future Is NowdickygNo ratings yet

- Independent Equity Research: How We Do It, and Why It Matters To InvestorsDocument12 pagesIndependent Equity Research: How We Do It, and Why It Matters To InvestorsPutnam InvestmentsNo ratings yet

- Kinnaras Capital Management LLCDocument8 pagesKinnaras Capital Management LLCamit.chokshi2353No ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- Yes BankDocument12 pagesYes BankBijay AgrawalNo ratings yet

- Fixed Income Is NecessaryDocument11 pagesFixed Income Is NecessaryAkshat TulsyanNo ratings yet

- Education Brief December 2011Document4 pagesEducation Brief December 2011keatingcapitalNo ratings yet

- HEDGE FUNDS: FUNDAMENTAL VALUE AND SPECIAL SITUATIONSDocument20 pagesHEDGE FUNDS: FUNDAMENTAL VALUE AND SPECIAL SITUATIONSkill_my_kloneNo ratings yet

- Mutual Fund Category Analysis - Equity Diversified Small-Cap FundsDocument6 pagesMutual Fund Category Analysis - Equity Diversified Small-Cap FundsGauriGanNo ratings yet

- Blue Sky Overstates AUM, ReturnsDocument67 pagesBlue Sky Overstates AUM, Returnsqweasd222No ratings yet

- Officium Special Situations Fund May 2011 ReportDocument1 pageOfficium Special Situations Fund May 2011 Reportqweasd222No ratings yet

- Officium Special Situations Fund: FundsDocument1 pageOfficium Special Situations Fund: Fundsqweasd222No ratings yet

- Mosaic Special Situations FundDocument5 pagesMosaic Special Situations Fundqweasd222No ratings yet

- Officium Special Situations Fund: FundsDocument1 pageOfficium Special Situations Fund: Fundsqweasd222No ratings yet

- Friendly Dragon Template: Join Head To Neck HereDocument1 pageFriendly Dragon Template: Join Head To Neck Hereqweasd222No ratings yet

- Officium Special Situations Fund: FundsDocument1 pageOfficium Special Situations Fund: Fundsqweasd222No ratings yet

- Officium Special Situations Fund Quarterly Report ReviewDocument5 pagesOfficium Special Situations Fund Quarterly Report Reviewqweasd222No ratings yet

- Mosaic Special Situations Fund: November 2011Document1 pageMosaic Special Situations Fund: November 2011qweasd222No ratings yet

- GreenlightDocument7 pagesGreenlightZerohedge100% (1)

- David Einhorn Value Investing Congress 2005 PEG RatioDocument4 pagesDavid Einhorn Value Investing Congress 2005 PEG Ratioqweasd222No ratings yet

- 2014 Q1 Ruffer Investment ReviewDocument2 pages2014 Q1 Ruffer Investment Reviewqweasd222No ratings yet

- 3005 (29808787)Document3 pages3005 (29808787)qweasd222No ratings yet

- Greenlight Q1 15Document6 pagesGreenlight Q1 15marketfolly.com100% (2)

- Big Bets For The U.S. Cable Industry: Key Opportunities For Future Revenue GrowthDocument0 pagesBig Bets For The U.S. Cable Industry: Key Opportunities For Future Revenue Growthqweasd222No ratings yet

- LCM Logicams AR2012Document78 pagesLCM Logicams AR2012qweasd222No ratings yet

- 0113annual ReportDocument112 pages0113annual Reportqweasd222No ratings yet

- Absolute-Return-Fund 115 2657974203 PDFDocument12 pagesAbsolute-Return-Fund 115 2657974203 PDFqweasd222No ratings yet

- Secrets of SovereignDocument13 pagesSecrets of SovereignredcovetNo ratings yet

- Chopin Op 10 Etudes (Cortot Edition)Document83 pagesChopin Op 10 Etudes (Cortot Edition)qweasd22292% (13)

- Dew MarketingDocument14 pagesDew MarketingAsad MazharNo ratings yet

- Get Asset Depreciation to GL LinkDocument2 pagesGet Asset Depreciation to GL Linksrains123No ratings yet

- Project Based Learning (PBL) - 01Document26 pagesProject Based Learning (PBL) - 01ALia AtiQahNo ratings yet

- Deutsche Bank's Corporate and Investment Banking The Anshu Jain WayDocument3 pagesDeutsche Bank's Corporate and Investment Banking The Anshu Jain WaySandeep MishraNo ratings yet

- EB Sales Process PDFDocument5 pagesEB Sales Process PDFAndry YadisaputraNo ratings yet

- AmSpa Financials 150222Document59 pagesAmSpa Financials 150222Amelia SmithNo ratings yet

- Audit and Assurance June 2009 Past Paper Answers (ACCA)Document15 pagesAudit and Assurance June 2009 Past Paper Answers (ACCA)Serena JainarainNo ratings yet

- The Marketing Mix Elements - Ben Sherman Case StudyDocument12 pagesThe Marketing Mix Elements - Ben Sherman Case StudyKimberly TafaraNo ratings yet

- Consolidating Balance SheetsDocument4 pagesConsolidating Balance Sheetsangel2199No ratings yet

- ENTREP 1 Chapter 5 Opportunity SeizingDocument92 pagesENTREP 1 Chapter 5 Opportunity SeizingCristineJoyceMalubayIINo ratings yet

- Entrepreneur KKVDocument96 pagesEntrepreneur KKVAsraihan RaihanNo ratings yet

- MM MaggieDocument22 pagesMM MaggieCommerce StudentNo ratings yet

- Consumer and Business Markets: Lesson 3.4Document22 pagesConsumer and Business Markets: Lesson 3.4willsonjohndrewfNo ratings yet

- Business Case - Amy Baker Nature's CureDocument19 pagesBusiness Case - Amy Baker Nature's CurerasyidazmiNo ratings yet

- Ratio AnalysisDocument10 pagesRatio AnalysisSandesha Weerasinghe0% (1)

- Final Question Paper For CAT-2 Part B & CDocument4 pagesFinal Question Paper For CAT-2 Part B & CShailendra SrivastavaNo ratings yet

- Enterprise Performance Management - MCQDocument20 pagesEnterprise Performance Management - MCQSabina Saldanha72% (18)

- Week 5 CPA QuestionsDocument63 pagesWeek 5 CPA QuestionsIzzy BNo ratings yet

- Cost Accounting 7 & 8Document26 pagesCost Accounting 7 & 8Kyrara79% (19)

- ECON202-Quiz 6 (1) - 1Document7 pagesECON202-Quiz 6 (1) - 1Meiting XuNo ratings yet

- Questions For The Spotify Case StudyDocument2 pagesQuestions For The Spotify Case StudyAnirudh GuptaNo ratings yet

- Volatility Index CBOE (VIX)Document19 pagesVolatility Index CBOE (VIX)AVNo ratings yet

- Course Outline-Managerial Economics - FMG 27-FM1-IMG12 - Prof. Subhasis Bera and Prof. Basant K. PotnuruDocument5 pagesCourse Outline-Managerial Economics - FMG 27-FM1-IMG12 - Prof. Subhasis Bera and Prof. Basant K. PotnuruVineetNo ratings yet

- Pom14 dppt02Document28 pagesPom14 dppt02(K12HN) Nguyen Thuy LinhNo ratings yet

- Small Business Management GuideDocument79 pagesSmall Business Management GuidePrasanna Devi PalanesamyNo ratings yet

- Accounting CycleDocument4 pagesAccounting Cycleadeebaa480No ratings yet

- AP 9 Reviewer 2nd QTRDocument2 pagesAP 9 Reviewer 2nd QTRG05 - Cortiguerra, Samantha Grecel M.No ratings yet

- 51 Checklist Buy BackDocument3 pages51 Checklist Buy BackvrkesavanNo ratings yet

- AuditorDocument7 pagesAuditorEsha JavedNo ratings yet

- Fundamentals of Accounting IiDocument39 pagesFundamentals of Accounting IiMintayto TebekaNo ratings yet