Professional Documents

Culture Documents

MBA Semester 1 Spring 2015 Solved Assignments - MB0041

Uploaded by

SolvedSmuAssignmentsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MBA Semester 1 Spring 2015 Solved Assignments - MB0041

Uploaded by

SolvedSmuAssignmentsCopyright:

Available Formats

Get Answers of following Questions here

Master of Business Administration- MBA Semester 1 Spring 2015

MB0041 Financial and Management Accounting

Q1. Analyze the following transaction under traditional approach

18.1.2011 Received a cheque from a customer, Sanjay at 5 p.m. Rs.20,000

19.1.2011 Paid Ramu by cheque Rs.1,50,000

20.1.2011 Paid salary Rs. 30,000

20.1.2011 Paid rent by cheque Rs. 8,000

21.1.2011 Goods withdrawn for personal use Rs. 5,000

25.1.2011 Paid an advance to suppliers of goods Rs. 1,00,000

26.1.2011 Received an advance from customers Rs. 3,00,000

31.1.2011 Paid interest on loan Rs. 5,000

31.1.2011 Paid instalment of loan Rs. 25,000

31.1.2011 Interest allowed by bank Rs. 8,000

Answer:

Sl. Accounts

Nature of

Affects

No. Involved

Account

Cash a/c

Real

Cash (cheque) is coming in

Sanjay a/c

Personal

Sanjay is the giver

Debit/

Credit

Debit

Credit

Read More

Q2. The trial balance of Nilgiris Co Ltd., as taken on 31st December, 2002 did not tally and

the difference was carried to suspense account. The following errors were detected

subsequently. a) Sales book total for November was under cast by Rs. 1200.

b) Purchase of new equipment costing Rs. 9475 has been posted to Purchases a/c.

c) Discount received Rs.1250 and discount allowed Rs. 850 in September 2002 have been

posted to wrong sides of discount account.

d) A cheque received from Mr. Longford for Rs. 1500 for goods sold to him on credit

earlier, though entered correctly in the cash book has been posted in his account as Rs.

1050.

e) Stocks worth Rs. 255 taken for use by Mr Dayananda, the Managing Director, have been

entered in sales day book.

f) While carrying forward, the total in Returns Inwards Book has been taken as Rs. 674

instead of Rs. 647.

g) An amount paid to cashier, Mr. Ramachandra, Rs. 775 as salary for the month of

November has been debited to his personal account as Rs. 757.

Pass journal entries and draw up the suspense account.

Answer: Nilgiris Co Ltd.

Date

Particulars

LF

Debit Rs.

Credit Rs.

31-12-2002 Suspense account

To Sales account

(Being under casting of sales

bookrectified)

Dr

1,200

1,200

Read More

Q3. From the given trial balance draft an Adjusted Trial Balance.

Trial Balance as on 31.03.2011

Debit balances Rs. Credit balances Rs.

Furniture and Fittings 10000 Bank Over Draft 16000

Buildings 500000 Capital Account 400000

Sales Returns 1000 Purchase Returns 4000

Bad Debts 2000 Sundry Creditors 30000

Sundry Debtors 25000 Commission 5000

Purchases 90000 Sales 235000

Advertising 20000

Cash 10000

Taxes and Insurance 5000

General Expenses 7000

Salaries 20000

TOTAL 690000 TOTAL 690000

Adjustments: 1. Charge depreciation at 10% on Buildings and Furniture and fittings. 2.

Write off further bad debts 1000 3. Taxes and Insurance prepaid 2000 4. Outstanding

salaries 5000 5. Commission received in advance1000

Answer:

Ledger accounts:

Furniture and fittings a/c

Dr.

Cr.

Particulars

Rs.

Particulars

Rs.

To bal b/d

10000 By Depreciation

1000

By bal c/d

9000

Total 10000 Total 10000

To bal b/d

9000

Read More

Q4. Compute trend ratios and comment on the financial performance of Infosys

Technologies Ltd. from the following extract of its income statements of five years.

Particulars 2010-11 2009-10 2008-09 2007-08 2006-07

Revenue 27,501 22,742 21,693 16,692 13,893

Operating Profit (PBIDT) 8,968 7,861 7,195 5,238 4,391

PAT from ordinary activities 6,835 6,218 5,988 4,659 3,856

Answer: Trend Analysis

Particulars

2010-11

2009-10

2008-09

2007-08

2006-07

Revenue

27,501

22,742

21,693

16,692

13,893

Operating Profit (PBIDT)

8,968 7,861 7,195 5,238 4,391

PAT from ordinary activities 6,835 6,218 5,988 4,659 3,856

Revenue is increasing every year from 2006-07 to 20010-11.Operatin profit has also increased.

Read More

Q5. Give the meaning of cash flow analysis and put down the objectives of cash flow

analysis. Explain the preparation of cash flow statement.

Answer: Cash flow analysis is an important tool of financial analysis. It is the process of

understanding the change in position with respect to cash in the current year and the reasons

responsible for such a change.

Read More

Q6.Write the assumptions of marginal costing. Differentiate between absorption costing

and marginal costing.

Answer: Marginal costing is based on the following assumptions:

1. Segregation of cost into fixed and variable

The whole principle of marginal costing is based on the idea that some costs vary with

production while some costs dont. Read More

Get all Assignments Answers on www.smuHelp.com

You might also like

- 35 Ipcc Accounting Practice ManualDocument218 pages35 Ipcc Accounting Practice ManualDeepal Dhameja100% (6)

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNo ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersRating: 5 out of 5 stars5/5 (5)

- Tax Invoice: Mcconnell DowellDocument1 pageTax Invoice: Mcconnell DowellAndy HeaterNo ratings yet

- Accounting Decisions Workbook Covers Financials, Costing, AnalysisDocument96 pagesAccounting Decisions Workbook Covers Financials, Costing, AnalysisSatyabrataNayak100% (1)

- Review of Ch 1 & 2 Key ConceptsDocument46 pagesReview of Ch 1 & 2 Key ConceptsBookAddict721No ratings yet

- Cash Flow StatementDocument59 pagesCash Flow StatementApple Crissa Mae Rejas100% (1)

- Assignment # 2 MBA Financial and Managerial AccountingDocument7 pagesAssignment # 2 MBA Financial and Managerial AccountingSelamawit MekonnenNo ratings yet

- Governmental and Nonprofit Accounting 11th Edition Freeman Solutions ManualDocument26 pagesGovernmental and Nonprofit Accounting 11th Edition Freeman Solutions ManualJessicaJonesemkgd100% (14)

- Get Answers of Following Questions Here: MB0041 - Financial and Management AccountingDocument3 pagesGet Answers of Following Questions Here: MB0041 - Financial and Management AccountingRajesh SinghNo ratings yet

- Solved SMU AssignmentDocument4 pagesSolved SMU AssignmentArvind KNo ratings yet

- MB0041Document3 pagesMB0041Smu DocNo ratings yet

- PDFDocument3 pagesPDFPooja RanaNo ratings yet

- MB0041 Financial and Management AccountingDocument12 pagesMB0041 Financial and Management AccountingDivyang Panchasara0% (2)

- MB0041 - Summer 2014Document3 pagesMB0041 - Summer 2014Rajesh SinghNo ratings yet

- Funds Flow AnalysisDocument20 pagesFunds Flow AnalysisRajeevAgrawalNo ratings yet

- MBA Financial Accounting Exercises SolutionsDocument17 pagesMBA Financial Accounting Exercises SolutionsRasanjaliGunasekeraNo ratings yet

- Management and Financial AcctgDocument10 pagesManagement and Financial AcctgVishnu RoyNo ratings yet

- Assignment Front Sheet: BusinessDocument13 pagesAssignment Front Sheet: BusinessHassan AsgharNo ratings yet

- SAMPLE PAPER - (Solved) : For Examination March 2017Document13 pagesSAMPLE PAPER - (Solved) : For Examination March 2017ankush yadavNo ratings yet

- ISQ EXAMINATION ACCOUNTING FOR FINANCIAL SERVICESDocument6 pagesISQ EXAMINATION ACCOUNTING FOR FINANCIAL SERVICEStysonhishamNo ratings yet

- Multiple Choice Questions: Section-IDocument6 pagesMultiple Choice Questions: Section-Isah108_pk796No ratings yet

- Sample PaperDocument28 pagesSample PaperSantanu KararNo ratings yet

- Mba025 Set1 Set2 520929319Document16 pagesMba025 Set1 Set2 520929319tejas2111No ratings yet

- IMT 57 Financial Accounting M1Document4 pagesIMT 57 Financial Accounting M1solvedcareNo ratings yet

- Pac All CAF MidtermsDocument130 pagesPac All CAF MidtermsShahid MahmudNo ratings yet

- Pac Mids With Solution 1,2,3,4,8Document67 pagesPac Mids With Solution 1,2,3,4,8Shahid MahmudNo ratings yet

- Single EntryDocument0 pagesSingle EntrylathadevaraajNo ratings yet

- MOJAKOE AK1 UTS 2010 GasalDocument10 pagesMOJAKOE AK1 UTS 2010 GasalVincenttio le CloudNo ratings yet

- 2012Document21 pages2012Mohammad Salim HossainNo ratings yet

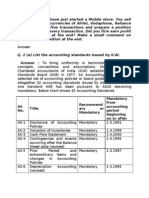

- Recommend Ary or Mandatory Mandatory From Accounting Period Beginning On or AfterDocument7 pagesRecommend Ary or Mandatory Mandatory From Accounting Period Beginning On or AfterdnbiswasNo ratings yet

- Fundamentals of Accounting Problems and SolutionsDocument7 pagesFundamentals of Accounting Problems and SolutionsashwinNo ratings yet

- Cash flow statement problemsDocument12 pagesCash flow statement problemsAnjali Mehta100% (1)

- P5 Syl2012 InterDocument12 pagesP5 Syl2012 InterVimal ShuklaNo ratings yet

- F AccountDocument39 pagesF AccountChandra Prakash SoniNo ratings yet

- Cash Flow Question Paper1Document10 pagesCash Flow Question Paper1CA Sanjeev Jarath100% (3)

- Basic Accounting QuestionnaireDocument5 pagesBasic Accounting Questionnaireangeline bulacanNo ratings yet

- Blue Print: Accounting: Class XI Weightage Difficulty Level of QuestionsDocument12 pagesBlue Print: Accounting: Class XI Weightage Difficulty Level of Questionssirsa11No ratings yet

- VEC Dept of Mgt Studies BA7106 QBDocument12 pagesVEC Dept of Mgt Studies BA7106 QBSRMBALAANo ratings yet

- Foundation Nov 2019Document138 pagesFoundation Nov 2019Ntinu joshuaNo ratings yet

- CBSE Class 11 Accountancy Sample Paper 2013 PDFDocument12 pagesCBSE Class 11 Accountancy Sample Paper 2013 PDFsivsyadav100% (1)

- T1.Tutorials 1 Introduction To Fin STMDocument4 pagesT1.Tutorials 1 Introduction To Fin STMmohammad alawadhiNo ratings yet

- Accounting For Managers MB003 QuestionDocument34 pagesAccounting For Managers MB003 QuestionAiDLo0% (1)

- ACTIVITYDocument1 pageACTIVITYjian21gamerNo ratings yet

- Term Exam 2edited Answer KeyDocument10 pagesTerm Exam 2edited Answer KeyPRINCESS HONEYLET SIGESMUNDONo ratings yet

- MBA-I Semester MB0025 - Financial & Management Accounting - 3 Credits Book ID - (B0907) Assignment Set 1 - (60 Marks)Document2 pagesMBA-I Semester MB0025 - Financial & Management Accounting - 3 Credits Book ID - (B0907) Assignment Set 1 - (60 Marks)Nigist WoldeselassieNo ratings yet

- 41Document20 pages41Rinku PatelNo ratings yet

- Intermediate Exam Question Compilation for ICWAI Syllabus 2002Document30 pagesIntermediate Exam Question Compilation for ICWAI Syllabus 2002Reshma RajNo ratings yet

- Assigment BBM Finacial AccountingDocument6 pagesAssigment BBM Finacial Accountingtripathi_indramani5185No ratings yet

- B.Com Corporate Accounting II exam questionsDocument5 pagesB.Com Corporate Accounting II exam questionsjeganrajrajNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument38 pages© The Institute of Chartered Accountants of IndiaSarah HolmesNo ratings yet

- OPTIMIZE CASH FLOWDocument10 pagesOPTIMIZE CASH FLOWAsha JyothiNo ratings yet

- Accts Class 11Document9 pagesAccts Class 11sarthak.arora281212No ratings yet

- Unsolved Paper Part IDocument107 pagesUnsolved Paper Part IAdnan KazmiNo ratings yet

- Hho9e Ch01 SMDocument101 pagesHho9e Ch01 SMWhitney NuckolsNo ratings yet

- Cash Flow Statement for ABC LtdDocument30 pagesCash Flow Statement for ABC LtdNaushad GulNo ratings yet

- Fabm 2 q3 Week 5 Module 4 Statement of Cash Flows For ReproductionDocument23 pagesFabm 2 q3 Week 5 Module 4 Statement of Cash Flows For ReproductionFranzen GabianaNo ratings yet

- Quiz#3 - SCFDocument3 pagesQuiz#3 - SCF11 ABM 2A -TORREMOCHANo ratings yet

- Wa0001Document165 pagesWa0001Rishu SinghNo ratings yet

- MB41Document5 pagesMB41Prajeesh Kumar KmNo ratings yet

- BBA106Document2 pagesBBA106SolvedSmuAssignmentsNo ratings yet

- Assignment: SPRING 2017 Bachelor of Business Administration-BBA 1 Bba107: Organizational Behaviour B1498Document2 pagesAssignment: SPRING 2017 Bachelor of Business Administration-BBA 1 Bba107: Organizational Behaviour B1498SolvedSmuAssignmentsNo ratings yet

- Meaning of Primary Data Methods of Collecting Primary Data?Document2 pagesMeaning of Primary Data Methods of Collecting Primary Data?SolvedSmuAssignmentsNo ratings yet

- BBA108Document2 pagesBBA108SolvedSmuAssignmentsNo ratings yet

- Assignment Drive SPRING 2017 Program MBA Semester I Ssubject Code & Name MBA104 Financial and Management Accounting BK Id B1624 Credit 4 Marks 60Document3 pagesAssignment Drive SPRING 2017 Program MBA Semester I Ssubject Code & Name MBA104 Financial and Management Accounting BK Id B1624 Credit 4 Marks 60SolvedSmuAssignmentsNo ratings yet

- MBA103 - Statistics For ManagementDocument1 pageMBA103 - Statistics For ManagementSolvedSmuAssignmentsNo ratings yet

- Assignment Set - 1 QuestionsDocument2 pagesAssignment Set - 1 QuestionsSolvedSmuAssignmentsNo ratings yet

- MBA106Document2 pagesMBA106SolvedSmuAssignmentsNo ratings yet

- Mba102 Business Communication deDocument1 pageMba102 Business Communication deSolvedSmuAssignmentsNo ratings yet

- BBA110Document1 pageBBA110SolvedSmuAssignmentsNo ratings yet

- Mba104 - Financial and Management AccountingDocument2 pagesMba104 - Financial and Management AccountingSolvedSmuAssignmentsNo ratings yet

- MBA103Document3 pagesMBA103SolvedSmuAssignmentsNo ratings yet

- Mba103-Statistics For Management - deDocument2 pagesMba103-Statistics For Management - deSolvedSmuAssignmentsNo ratings yet

- Mba101-Management Process and Organizational Behavior - deDocument1 pageMba101-Management Process and Organizational Behavior - deSolvedSmuAssignmentsNo ratings yet

- Q.No Questions Marks Total MarksDocument1 pageQ.No Questions Marks Total MarksSolvedSmuAssignmentsNo ratings yet

- OM0013Document2 pagesOM0013SolvedSmuAssignmentsNo ratings yet

- Mba105 Managerial Economics deDocument1 pageMba105 Managerial Economics deSolvedSmuAssignmentsNo ratings yet

- PM0011Document2 pagesPM0011SolvedSmuAssignmentsNo ratings yet

- BBA401Document2 pagesBBA401SolvedSmuAssignmentsNo ratings yet

- BBA402Document2 pagesBBA402SolvedSmuAssignmentsNo ratings yet

- MH0059Document1 pageMH0059SolvedSmuAssignmentsNo ratings yet

- MK0011Document2 pagesMK0011SolvedSmuAssignmentsNo ratings yet

- MB0051Document2 pagesMB0051SolvedSmuAssignmentsNo ratings yet

- PM0010Document2 pagesPM0010SolvedSmuAssignmentsNo ratings yet

- Q.No Questions Marks Total MarksDocument2 pagesQ.No Questions Marks Total MarksSolvedSmuAssignmentsNo ratings yet

- Q.No Questions Marks Total MarksDocument2 pagesQ.No Questions Marks Total MarksSolvedSmuAssignmentsNo ratings yet

- OM0012Document2 pagesOM0012SolvedSmuAssignmentsNo ratings yet

- OM0011Document2 pagesOM0011SolvedSmuAssignmentsNo ratings yet

- MK0013Document1 pageMK0013SolvedSmuAssignmentsNo ratings yet

- Odessa Vlasenko O.V. resume mining directorDocument4 pagesOdessa Vlasenko O.V. resume mining directorAlexandra VlasiukNo ratings yet

- Task of MidtermDocument10 pagesTask of MidtermNaurah Atika DinaNo ratings yet

- Managerial AccountingDocument6 pagesManagerial Accountingnischal subediNo ratings yet

- Financial Reporting ChangesDocument7 pagesFinancial Reporting ChangesyogeshNo ratings yet

- Group 2 - Accounting ResearchDocument111 pagesGroup 2 - Accounting ResearchEnnajieee QtNo ratings yet

- Advanced Financial Accounting Reporting Part 2Document20 pagesAdvanced Financial Accounting Reporting Part 2Jamie Rose AragonesNo ratings yet

- Amama Ira Amalia Priyono - Exercises - Introduction To Accounting (Unit 1)Document3 pagesAmama Ira Amalia Priyono - Exercises - Introduction To Accounting (Unit 1)Amama AI APNo ratings yet

- CIA Course Review-Apr - 2023Document1 pageCIA Course Review-Apr - 2023rio HENRYNo ratings yet

- Sustainability Accounting Standards Board (Sasb) : Topic Accounting Metric Category Unit of Measure Code Data ReferenceDocument1 pageSustainability Accounting Standards Board (Sasb) : Topic Accounting Metric Category Unit of Measure Code Data ReferenceGabriel CuevasNo ratings yet

- JKSC TB Nov 23Document258 pagesJKSC TB Nov 23Narayan choudharyNo ratings yet

- Week 10 - 01 - Module 22 - Property, Plant & Equipment (Part 1)Document17 pagesWeek 10 - 01 - Module 22 - Property, Plant & Equipment (Part 1)지마리No ratings yet

- Level 4 CertFM Qual SpecDocument8 pagesLevel 4 CertFM Qual SpecAlexandre SantosNo ratings yet

- MBA Resume Template Free Download PDFDocument1 pageMBA Resume Template Free Download PDFarun kNo ratings yet

- Annul Report - 2019-2020 - AppexDocument48 pagesAnnul Report - 2019-2020 - AppexRasel AshrafulNo ratings yet

- BA 118.3 (D. Salazar/R. Placido/K. Dela Cruz)Document6 pagesBA 118.3 (D. Salazar/R. Placido/K. Dela Cruz)Ian De Dios100% (1)

- Fs Squash CookiesDocument10 pagesFs Squash CookiesDanah Jane GarciaNo ratings yet

- Van Romburgh HDocument129 pagesVan Romburgh HCarmen NelNo ratings yet

- K. J. SOMAIYA COLLEGE OF SCIENCE AND COMMERCEDocument109 pagesK. J. SOMAIYA COLLEGE OF SCIENCE AND COMMERCEronNo ratings yet

- Ifrs 13 Fair Value MeasurementDocument9 pagesIfrs 13 Fair Value Measurementapi-292644739No ratings yet

- Xi Pre Final AccountsDocument7 pagesXi Pre Final AccountsDrishti ChauhanNo ratings yet

- Handouts Acctg 1Document11 pagesHandouts Acctg 1leizlNo ratings yet

- Chart of Accounts General Ledger General Ledger Page No. Page No. Assets IncomeDocument44 pagesChart of Accounts General Ledger General Ledger Page No. Page No. Assets IncomeJireh RiveraNo ratings yet

- Cash and Cash Equivalents ProblemsDocument27 pagesCash and Cash Equivalents ProblemsSalaguste Angelica MarieNo ratings yet

- Annual Report 2011: Riverview Rubber Estates 73rd AGMDocument111 pagesAnnual Report 2011: Riverview Rubber Estates 73rd AGMJames Warren0% (1)

- Bab 2. C. Soal Jawab - Latihan BudgetingDocument16 pagesBab 2. C. Soal Jawab - Latihan BudgetingM Rafi Priyambudi100% (2)

- Ali CV PDFDocument2 pagesAli CV PDFAbdelrahman ElkhollyNo ratings yet

- BKAN1013 Chapter 2Document70 pagesBKAN1013 Chapter 2Halinnie SueNo ratings yet

- Development of Financial Reporting Framework and Standard-Setting BodiesDocument3 pagesDevelopment of Financial Reporting Framework and Standard-Setting BodiesPeter BanjaoNo ratings yet