Professional Documents

Culture Documents

Venture capital method and valuation of entrepreneur's interest in staged financing

Uploaded by

Hunkar IvgenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Venture capital method and valuation of entrepreneur's interest in staged financing

Uploaded by

Hunkar IvgenCopyright:

Available Formats

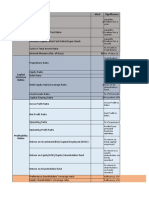

Table 13.

Panel (a)

Entrepreneur's Assumptions - Financial Model Based on Business Plan

Harvest Value Forecast

Success with Both Groups

Success with First Group

Failure

Conditional

Scenario

Round

Round

Cash Flows

Probabilities

One

Two

$35,000,000

$15,000,000

$0

40%

25%

35%

Expected Cash Flow at Harvest

Standard Deviation of Cash Flows

Investment

Burn Rate per Year

Years

Total Investment

Present Value of Unconditional Total Investment

Present Value of Expected Investment

$14,000,000

$3,750,000

$0

$21,538,462

$5,769,231

$17,750,000

$15,204,851

$27,307,692

$9,730,085

$2,000,000

1

$3,000,000

0.5

$3,500,000

$3,442,308

$2,937,500

Panel (b)

Investor's Assumptions - Financial Model Based on Business Plan

Harvest Value Forecast

Success with Both Groups

Success with First Group

Failure

Conditional

Scenario

Round

Round

Cash Flows

Probabilities

One

Two

$28,000,000

$13,500,000

$0

Expected Cash Flow at Harvest

Standard Deviation of Cash Flows

Investment

Burn Rate per Year

Years

Total Investment

Present Value of Unconditional Total Investment

Present Value of Expected Investment

$4,750,000

$4,630,391

$3,487,803

32%

20%

48%

$8,960,000

$2,700,000

$0

$17,230,769

$5,192,308

$11,660,000

$12,303,430

$22,423,077

$7,054,312

$1,800,000

1.25

$2,500,000

1

Panel (a)

Venture Capital Method (Single Round Financing)

Entrepreneur's Assumptions

3

$35,000,000

18.00%

$21,302,081

$3,442,308

16.16%

Number of years until your projected harvest date

Harvest-date value of the venture assuming success

annual hurdle rate Customary discount rates for Seed to Start-up ventures

are 50-100% per year. Discount rates are lower for more established

ventures, declining gradually to tares of 20-30% for expansion-stage

financing. The discount rate for turnaround financing is comparable to that

of a start-up.

Post-money valuation of the venture

Amount of financing required

Fraction of harvest-date equity needed to justify the financing.

Panel (b)

Venture Capital Method (Single Round Financing)

Investor's Assumptions

4

$28,000,000

40.00%

Number of years until your projected harvest date

Harvest-date value of the venture assuming success

annual hurdle rate Customary discount rates for Seed to Start-up ventures

are 50-100% per year. Discount rates are lower for more established

ventures, declining gradually to tares of 20-30% for expansion-stage

financing. The discount rate for turnaround financing is comparable to that

of a start-up.

$7,288,630

Post-money valuation of the venture

$4,360,391

Amount of financing required

59.82%

Fraction of harvest-date equity needed to justify the financing.

Table 13.4

Figure 13.1

Staged Investment Decision Model

Success

Success with

Both Groups

Failure

Success with One

Group

Fund Stage 2:

Aircraft Owners

Fund Stage 1:

Avionics OEM

Failure

Success

Abandon

Failure

Round 2

Exit

Financing:

Round 1

Table 13.5

Valuation of Unstaged Investment - Venture Capital Investor

Entrepreneur's

Assumptions

Investor's

Assumptions

1. Market and Contract Data

Annual Risk-free Rate

Annual Market Rate

Standard Deviation of Market

General Partner's Annual Fee

General Partner's Carried Interest

Correlation of Venture with Market

4.0%

10.0%

20.0%

2.5%

20.0%

0.25

4.0%

10.0%

20.0%

2.5%

20.0%

0.25

$3,442,308

3.00

$4,630,391

4.00

$17,750,000

$15,204,851

$10,257,406

$11,660,000

$12,303,430

$5,843,845

20.06%

18.85%

2. Single-Stage Investment and Timing

Total Investment Committed

Years to Harvest

3. Investor Valuation of Harvest Cash Flows

Expected Harvest Value

Standard Deviation of Harvest Cash Flows

Value of Venture at Time of Investment

4. Investor's Required Rate of Return

Annualized VC Cost of Capital

Investor Ownership Requirement

5. Ownership Requirement

Round 1 Investment

Value at Round 1

Share of Incremental Value Required

$3,442,308

$10,257,406

33.56%

$4,630,391

$5,843,845

79.24%

Valuation of Entrepreneur's Interest in Venture

6. Entrepreneur's Wealth

Entrepreneur's Wealth in Market

7. Valuation of Harvest Cash Flows

Venture (Entrepreneur's Financial Claim)

Expected Harvest Value

Standard Deviation of Venture Cash Flows

Market

Expected Harvest Value

Standard Deviation of Market Cash Flows

Portfolio

Expected Portfolio Value

Standard Deviation of Portfolio Cash Flows

Value of Entrepreneur's Portfolio

Value to Investment in Market

Value of Entrepreneur's Interest in Venture

8. Entrepreneur's Required Rate of Return

Annualized Portfolio Cost of Capital

Annualized Venture Cost of Capital

$1,700,000

$1,600,000

$11,793,235

$10,102,219

$2,421,159

$2,554,765

$2,262,700

$588,897

$2,342,560

$640,000

$14,055,935

$10,265,291

$7,065,242

$1,700,000

$5,365,242

$4,763,719

$2,784,591

$2,321,104

$1,600,000

$721,104

25.77%

30.02%

19.69%

35.36%

Table 13.6

Valuation of Staged Investment - Venture Capital Investor

Entrepreneur's

Assumptions

Investor's

Assumptions

4.0%

10.0%

20.0%

2.5%

20.0%

0.25

3.00

4.0%

10.0%

20.0%

2.5%

20.0%

0.25

4.00

Round 1 - Aircraft OEM

Burn Rate per Year

Years to Complete

$2,000,000

1.00

$1,800,000

1.25

Round 2 - Aircraft Owners

Probability of Stage 1 Success

Burn Rate per Year

Years to Complete

65%

$3,000,000

0.50

52%

$2,500,000

1.00

Round 2

Expected Harvest Value

Standard Deviation of Harvest Cash Flows

Value to Investor at Time of Investment

$27,307,692

$9,730,085

$18,481,990

$22,423,077

$7,054,312

$14,421,393

Round 1

Expected Harvest Value

Standard Deviation of Harvest Cash Flows

Value of Round 1 at Time of Investment

$17,750,000

$15,204,851

$10,257,406

$11,660,000

$12,303,430

$5,843,845

20.06%

21.55%

18.85%

17.41%

1. Market and Contract Data

Annual Risk-free Rate

Annual Market Rate

Standard Deviation of Market

General Partner's Annual Fee

General Partner's Carried Interest

Correlation of Venture with Market

Time from first investment to harvest (years)

2. Staged Investment Timing and Burn Rates

3. Valuation of Harvest Cash Flows

4. Investor's Implicit Cost of Capital at Each Round

Round 1

Round 2

Table 13.7

Valuation-based Contracting Model of Ownership Shares

Ownership Requirement

Entrepreneur's

Assumptions

Investor's

Assumptions

Investor's Round 2 Investment

Venture Value at Round 2

Incremental Equity Required

Investor's Value from Round 1

Investor's Value Required With Investing

Investor's Required Ownership after Investing

$1,500,000

$18,481,990

8.12%

$3,603,638

$5,103,638

27.61%

$2,500,000

$14,421,393

17.34%

$5,552,531

$8,052,531

55.84%

Investor's Round 1 Investment

Venture Value at Round 1

Investor's Required Ownership after Investing

$2,000,000

$10,257,406

19.50%

$2,250,000

$5,843,845

38.50%

Required Percentage Increases in Investor's Shares if New Shares are Issued

Round 2 - New Shares to Investor (percent of shares owned)

57.50%

101.95%

Table 13.8

Risk and Return of Entrepreneur's Financial Claim

Based on Entrepreneur's Projections

Ownership by Round

Round 2

Round 1

Investor Share Entrep. Share

27.61%

72.39%

19.50%

80.50%

Harvest Value Forecast

Success with OEMs

Success with Both Groups

Failure

Venture

Conditional

Cash Flows

$35,000,000

$15,000,000

$0

Scenario

Probabilities

40%

25%

35%

Entrepreneur's

Conditional

Cash Flows

$25,335,059

$10,857,883

$0

Expected Cash Flow of Entrepreneur's Claim

Standard Deviation of Entrepreneur's Claim

Probability

Weighted

Cash Flows

$10,134,024

$2,714,471

$0

$12,848,494

$11,006,166

Based on Investor's Projections

Ownership by Round

Round 2

Round 1

Investor Share Entrep. Share

55.84%

44.16%

38.50%

61.50%

Harvest Value Forecast

Success with OEMs

Success with Both Groups

Failure

Conditional

Cash Flows

$28,000,000

$13,500,000

$0

Expected Cash Flow of Entrepreneur's Claim

Standard Deviation of Entrepreneur's Claim

Scenario

Probabilities

32%

20%

48%

Entrepreneur's

Conditional

Cash Flows

$12,365,527

$5,961,951

$0

Probability

Weighted

Cash Flows

$3,956,969

$1,192,390

$0

$5,149,359

$5,433,515

Table 13.9

Valuation of Entrepreneur's Interest in Venture

Market Data and Entrepreneur's Wealth

Entrepreneur's

Assumptions

Investor's

Assumptions

Annual Risk-free Rate

Annual Market Rate

Standard Deviation of Market

Correlation of Venture with Market

Time from first investment to harvest (years)

Entrepreneur's Wealth in Market

4.0%

10.0%

20.0%

0.25

3.00

$1,700,000

4.0%

10.0%

20.0%

0.25

4.00

$1,600,000

Round 1 - Aircraft OEM

Years to Complete

1.00

1.25

Round 2 - Aircraft Owners

Years to Complete

0.50

1.00

$12,848,494

$11,006,166

$5,149,359

$5,433,515

$2,262,700

$588,897

$2,342,560

$640,000

$15,111,194

$11,167,956

$7,525,846

$1,700,000

$5,825,846

$7,491,919

$5,627,735

$2,865,420

$1,600,000

$1,265,420

Timing of Staged Investments

Valuation of Harvest Cash Flows

Venture (Entrepreneur's Financial Claim)

Expected Harvest Value

Standard Deviation of Venture Cash Flows

Market

Expected Harvest Value

Standard Deviation of Market Cash Flows

Portfolio

Expected Portfolio Value

Standard Deviation of Portfolio Cash Flows

Value of Entrepreneur's Portfolio

Value to Investment in Market

Value of Entrepreneur's Interest in Venture

You might also like

- How YOU can find Venture Capital: A story of how I did it - and so can youFrom EverandHow YOU can find Venture Capital: A story of how I did it - and so can youNo ratings yet

- Dilution Calculator Cap Table ModelDocument4 pagesDilution Calculator Cap Table ModelMichel KropfNo ratings yet

- Startup Funding and Valuation BubbleDocument10 pagesStartup Funding and Valuation BubbleAakash GuptaNo ratings yet

- Venture Capital Valuation ModelDocument4 pagesVenture Capital Valuation ModelSivakumar KrishnamurthyNo ratings yet

- Startup Financial Model TemplateDocument102 pagesStartup Financial Model TemplateAniket BardeNo ratings yet

- Pitching For Venture CapitalDocument25 pagesPitching For Venture Capitalecell_iimkNo ratings yet

- BIWS Atlassian 3 Statement Model - VFDocument8 pagesBIWS Atlassian 3 Statement Model - VFJohnny BravoNo ratings yet

- Investment Feasibility AssessmentDocument27 pagesInvestment Feasibility Assessmentad001No ratings yet

- Alibaba IPO: Prepared by - Dheeraj Vaidya, CFA, FRMDocument53 pagesAlibaba IPO: Prepared by - Dheeraj Vaidya, CFA, FRMHaysam TayyabNo ratings yet

- Venture CapitalDocument5 pagesVenture CapitalMichel KropfNo ratings yet

- If I Would Like To Protect My Downside, How Would I Structure The Investment?Document7 pagesIf I Would Like To Protect My Downside, How Would I Structure The Investment?helloNo ratings yet

- DocSend Fundraising ResearchDocument19 pagesDocSend Fundraising ResearchGimme DunlodsNo ratings yet

- Your Venture: Investment MemorandumDocument2 pagesYour Venture: Investment MemorandumThasin JaigirdarNo ratings yet

- India’s largest fund raising platform for early stage startupsDocument22 pagesIndia’s largest fund raising platform for early stage startupsabhishekNo ratings yet

- Founding Seed: Total 100% 100 100% 118 $ 95,238 Cumulative Stake Per InvestorDocument2 pagesFounding Seed: Total 100% 100 100% 118 $ 95,238 Cumulative Stake Per InvestorArturo Alejandro Rochefort RojasNo ratings yet

- Startup StrategyDocument34 pagesStartup Strategynrogers61No ratings yet

- 50folds Free Cap Table Template v1.1 BLANKDocument39 pages50folds Free Cap Table Template v1.1 BLANKPaulNo ratings yet

- Incubators PDFDocument73 pagesIncubators PDFRajesh WarrierNo ratings yet

- Startup Financial ModelDocument136 pagesStartup Financial ModelChinh Lê ĐìnhNo ratings yet

- ProjectDocument24 pagesProjectAayat R. AL KhlafNo ratings yet

- 04+AWS+Startup+Day Fundraising PDFDocument77 pages04+AWS+Startup+Day Fundraising PDFedopdxNo ratings yet

- LinkedIn's Series B Pitch To Greylock - Pitch Advice For EntrepreneursDocument49 pagesLinkedIn's Series B Pitch To Greylock - Pitch Advice For EntrepreneursfarkasdanNo ratings yet

- The Formulation of Strategy 3-Strategies For Leaders-Followers-Challengers and NichersDocument16 pagesThe Formulation of Strategy 3-Strategies For Leaders-Followers-Challengers and NichersPuneet DattaNo ratings yet

- VC valuation with future dilutionDocument7 pagesVC valuation with future dilutionKrishna SharmaNo ratings yet

- Ballerina Tech Assumptions & SummaryDocument48 pagesBallerina Tech Assumptions & Summaryapi-25978665No ratings yet

- Class 4 - Sources of FinancingDocument74 pagesClass 4 - Sources of FinancingSelina Sofie ArnelundNo ratings yet

- Startup Financial Model Template v3.0Document32 pagesStartup Financial Model Template v3.0Jordan ScottNo ratings yet

- What investors look for in early stage SaaS startups to achieve 10x growthDocument2 pagesWhat investors look for in early stage SaaS startups to achieve 10x growthRoshan D'SilvaNo ratings yet

- Anti-Dilution CalculationsDocument1 pageAnti-Dilution CalculationsHugo PereiraNo ratings yet

- Bain IVCA India Venture Capital Report 2022 1648706342Document42 pagesBain IVCA India Venture Capital Report 2022 1648706342Kiran MaadamshettiNo ratings yet

- Golduin Retail IAG Case StudyDocument23 pagesGolduin Retail IAG Case StudyNeha Butala100% (1)

- LIQUIDITY AND SOLVENCY RATIOSDocument26 pagesLIQUIDITY AND SOLVENCY RATIOSDeep KrishnaNo ratings yet

- A91 Partners JDDocument2 pagesA91 Partners JDJohn DoeNo ratings yet

- Startup Funding: Entrepreneurship and StartupsDocument95 pagesStartup Funding: Entrepreneurship and StartupsAhmed Hadad0% (1)

- Capital Budgeting Decisions: Analyzing Marge Simpson's Falafel and Pretzel Business Opportunities Using NPV and IRRDocument66 pagesCapital Budgeting Decisions: Analyzing Marge Simpson's Falafel and Pretzel Business Opportunities Using NPV and IRRKhizer Ahmed KhanNo ratings yet

- Private Equity V2 - JPMCDocument16 pagesPrivate Equity V2 - JPMCRajesh GuptaNo ratings yet

- Pitch Deck: Social Media ManagementDocument10 pagesPitch Deck: Social Media ManagementGiridhar NairNo ratings yet

- Cap TableDocument1 pageCap TabledarescribdNo ratings yet

- Raising Seed Capital: Steve Schlafman (@schlaf) RRE VenturesDocument82 pagesRaising Seed Capital: Steve Schlafman (@schlaf) RRE Venturesrezurekt100% (2)

- VC'sDocument42 pagesVC'sElchai GranotNo ratings yet

- PitchBook 2H 2014 VC Valuations and Trends ReportDocument16 pagesPitchBook 2H 2014 VC Valuations and Trends ReportsunnypankajNo ratings yet

- CB Insights Global Unicorn Club 2019Document20 pagesCB Insights Global Unicorn Club 2019Yash Joglekar0% (1)

- Financial Model Template TransactionDocument39 pagesFinancial Model Template Transactionapi-400197296No ratings yet

- Demystifying Venture Capital Economics - Part 1Document9 pagesDemystifying Venture Capital Economics - Part 1KarnYoNo ratings yet

- Discounted Cash Flow Analysis - Uber Technologies, Inc. (Unlevered DCF)Document9 pagesDiscounted Cash Flow Analysis - Uber Technologies, Inc. (Unlevered DCF)Haysam TayyabNo ratings yet

- Captable Guide Formation To ExitDocument24 pagesCaptable Guide Formation To ExitV100% (1)

- Alibaba IPO Financial Model WallstreetMojoDocument52 pagesAlibaba IPO Financial Model WallstreetMojoJulian HutabaratNo ratings yet

- StartupFunnelModel Basic v3Document8 pagesStartupFunnelModel Basic v3Anil Kumar PrasannaNo ratings yet

- Spartina Internet Business ModelDocument12 pagesSpartina Internet Business ModelKrishna Kanth KilambiNo ratings yet

- Competitor Analysis v2Document172 pagesCompetitor Analysis v2ShamsNo ratings yet

- Start Up Valuation: EntrepreneurDocument8 pagesStart Up Valuation: EntrepreneurRuchitha PrakashNo ratings yet

- Shareholder structure and financial modeling insightsDocument20 pagesShareholder structure and financial modeling insightsabdul5721No ratings yet

- GKC Projects Limited: Enterprise Valuation ReportDocument31 pagesGKC Projects Limited: Enterprise Valuation Reportcrmc999No ratings yet

- Global Unicorn Company 2019Document34 pagesGlobal Unicorn Company 2019rickyNo ratings yet

- Caanan Partners Pitch Deck GuidelinesDocument29 pagesCaanan Partners Pitch Deck GuidelinesJoe_Daniels_9307No ratings yet

- Chapter 18 20Document11 pagesChapter 18 20jessa mae zerdaNo ratings yet

- BlueBook - A Startup Valuation StoryDocument5 pagesBlueBook - A Startup Valuation StoryBlueBook100% (4)

- Financial Accounting ProblemsDocument20 pagesFinancial Accounting Problemsmobinil1No ratings yet

- Appendix B - Seed Accelerator Programme Financial ModelDocument4 pagesAppendix B - Seed Accelerator Programme Financial ModelShumba Mutumwa100% (1)

- Business Finance II: Exercise 1Document7 pagesBusiness Finance II: Exercise 1faisalNo ratings yet

- Refdate: N: Year: Month: N Year Month AmountDocument5 pagesRefdate: N: Year: Month: N Year Month AmountHunkar IvgenNo ratings yet

- Web Development Seo Monitoring Content Optimization Web Design PPT Icons GraphicsDocument4 pagesWeb Development Seo Monitoring Content Optimization Web Design PPT Icons GraphicsHunkar IvgenNo ratings yet

- Architectural Discussion Process Control Data Analysis Chart Gears PPT Icons GraphicsDocument4 pagesArchitectural Discussion Process Control Data Analysis Chart Gears PPT Icons GraphicsHunkar IvgenNo ratings yet

- Refdate: N: Year: Month: N Year Month AmountDocument5 pagesRefdate: N: Year: Month: N Year Month AmountHunkar IvgenNo ratings yet

- Architectural Discussion Process Control Data Analysis Chart Gears PPT Icons GraphicsDocument4 pagesArchitectural Discussion Process Control Data Analysis Chart Gears PPT Icons GraphicsHunkar IvgenNo ratings yet

- Architectural Discussion Process Control Data Analysis Chart Gears PPT Icons GraphicsDocument4 pagesArchitectural Discussion Process Control Data Analysis Chart Gears PPT Icons GraphicsHunkar IvgenNo ratings yet

- Governance Reporting: Management Should Not Be Left Guessing The Information Requirements of The BoardDocument26 pagesGovernance Reporting: Management Should Not Be Left Guessing The Information Requirements of The BoardHunkar IvgenNo ratings yet

- Sales & Operations PlanningDocument192 pagesSales & Operations PlanningNiraj KumarNo ratings yet

- Architectural Discussion Process Control Data Analysis Chart Gears PPT Icons GraphicsDocument4 pagesArchitectural Discussion Process Control Data Analysis Chart Gears PPT Icons GraphicsHunkar IvgenNo ratings yet

- HSBC Report 2012Document230 pagesHSBC Report 2012Hunkar IvgenNo ratings yet

- JPM Commodity Phase Shift 2011-11!22!730933Document23 pagesJPM Commodity Phase Shift 2011-11!22!730933Hunkar IvgenNo ratings yet

- Fundamental AnalysisDocument22 pagesFundamental AnalysisHunkar IvgenNo ratings yet

- Chapter Five: Planning and Performance Evaluation in Multinational EnterprisesDocument7 pagesChapter Five: Planning and Performance Evaluation in Multinational EnterprisesHunkar IvgenNo ratings yet

- Cost Accounting Formula'sDocument7 pagesCost Accounting Formula'sdigital_darwaish82% (38)

- Euroconstruct Country Report PDFDocument2 pagesEuroconstruct Country Report PDFLauraNo ratings yet

- Market IntegrationDocument12 pagesMarket IntegrationMc Evander FajutaganaNo ratings yet

- Rade Usiness Ycle: Macro Economics SybafDocument21 pagesRade Usiness Ycle: Macro Economics SybafMuthu Pathi100% (1)

- MAM-3.... Production Possibillity Curve & Opportunity Cost - 26!8!14Document99 pagesMAM-3.... Production Possibillity Curve & Opportunity Cost - 26!8!14Vijay VaghelaNo ratings yet

- Tutorial Letter 201/1/2018: Economics IADocument30 pagesTutorial Letter 201/1/2018: Economics IAZahied MukaddamNo ratings yet

- PIQ On Marketing & SalesDocument21 pagesPIQ On Marketing & SalesMathew AbrahamNo ratings yet

- LVMHDocument11 pagesLVMHLucy ChonglezNo ratings yet

- Demand Forecasting Methods Used by Fruit VendorsDocument4 pagesDemand Forecasting Methods Used by Fruit VendorsS_GoudaNo ratings yet

- Technical Analysis of The Size PremiumDocument4 pagesTechnical Analysis of The Size PremiumRamiro Gamen0% (1)

- Constraint AnalysisDocument6 pagesConstraint AnalysisIrisha AnandNo ratings yet

- Student Handbook (Revised Version)Document60 pagesStudent Handbook (Revised Version)Muhazzam MaazNo ratings yet

- Commanding Heights Episode 1 Movie WorksheetDocument3 pagesCommanding Heights Episode 1 Movie WorksheetBanana QNo ratings yet

- Parkin Econ SM CH30 GeDocument22 pagesParkin Econ SM CH30 GeMuri SetiawanNo ratings yet

- Damodaran-Estimate Terminal ValueDocument17 pagesDamodaran-Estimate Terminal ValuePATMON100% (2)

- 1.1 An Overview of International Business and GlobalizationDocument52 pages1.1 An Overview of International Business and GlobalizationFadzil YahyaNo ratings yet

- Principles of Public Expenditure: Maximum Social Advantage, Economy, Sanction, Balanced BudgetsDocument1 pagePrinciples of Public Expenditure: Maximum Social Advantage, Economy, Sanction, Balanced BudgetsNikhil Shenai100% (1)

- Economics Paper 2 w10 Ms 21Document8 pagesEconomics Paper 2 w10 Ms 21ChrisLimNo ratings yet

- Answer2 TaDocument13 pagesAnswer2 TaJohn BryanNo ratings yet

- Cost Problem SetDocument2 pagesCost Problem SetRayNo ratings yet

- Cost-Volume-Profit (CVP) Analysis: Hammad Javed Vohra, FCCADocument13 pagesCost-Volume-Profit (CVP) Analysis: Hammad Javed Vohra, FCCAUrooj MustafaNo ratings yet

- Draft National Health Research Policy, DHR, MOHFW (Nov 2021)Document50 pagesDraft National Health Research Policy, DHR, MOHFW (Nov 2021)Harish KiranNo ratings yet

- ECO3002 AssignmentsDocument6 pagesECO3002 AssignmentsanthsamNo ratings yet

- Examiners' commentary on Industrial economics examDocument23 pagesExaminers' commentary on Industrial economics examShawn MorganNo ratings yet

- Liquidity ManagementDocument57 pagesLiquidity ManagementShanmuka SreenivasNo ratings yet

- RP - CF1 - Time Value of MoneyDocument28 pagesRP - CF1 - Time Value of MoneySamyu KNo ratings yet

- Interdependence and Gains From TradeDocument5 pagesInterdependence and Gains From TradeDolphNo ratings yet

- Course 7Document36 pagesCourse 7mkinnetxNo ratings yet

- Technological Forecasting & Social Change: Bruno Brandão Fischer, Paola Rücker Schae Ffer, Nicholas S. VonortasDocument11 pagesTechnological Forecasting & Social Change: Bruno Brandão Fischer, Paola Rücker Schae Ffer, Nicholas S. VonortasAngelitaVasquezNo ratings yet

- Chopra scm6 Inppt 01r1Document37 pagesChopra scm6 Inppt 01r1ArpitPatelNo ratings yet