Professional Documents

Culture Documents

Economic Growth

Uploaded by

Apollon PheboCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Economic Growth

Uploaded by

Apollon PheboCopyright:

Available Formats

Quantity of Guns Produced

Economic growth

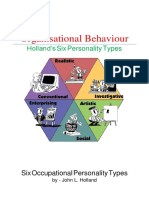

GDP real growth rates, 19901998 and 19902006, in selected

countries.

Quantity of Butter Produced

Economic growth caused the production-possibility frontier to

shift outward.

adjusted terms to eliminate the distorting eect of

ination on the price of goods produced. Measurement

of economic growth uses national income accounting.[3]

Since economic growth is measured as the annual percent change of gross domestic product (GDP), it has all

the advantages and drawbacks of that measure.

Rate of change of Gross domestic product, world and OECD,

since 1961.

Economic growth is the increase in the market value

of the goods and services produced by an economy over

time. It is conventionally measured as the percent rate of

increase in real gross domestic product, or real GDP.[1]

Of more importance is the growth of the ratio of GDP

to population (GDP per capita, which is also called

per capita income). An increase in growth caused by

more ecient use of inputs is referred to as intensive

growth. GDP growth caused only by increases in inputs

such as capital, population or territory is called extensive

growth.[2]

1 Measuring economic growth

Main article: Gross domestic product

Economic growth is generally calculated from data on

GDP and population provided by countries statistical

agencies, although independent scholarly estimates are

also available.

In economics, economic growth or economic growth

theory typically refers to growth of potential output,

i.e., production at "full employment". As an area of

study, economic growth is generally distinguished from

development economics. The former is primarily the study

of how countries can advance their economies. The latter

is the study of the economic development process particularly in low-income countries.

2 Importance of long-run growth

Over long periods of time, even small rates of growth,

such as a 2% annual increase, have large eects. For example, the United Kingdom experienced a 1.97% average annual increase in its ination-adjusted GDP between

1830 and 2008.[4] In 1830, the GDP was 41,373 million

Growth is usually calculated in real terms i.e., ination- pounds. It grew to 1,330,088 million pounds by 2008. A

1

growth rate that averaged 1.97% over 178 years resulted

in a 32-fold increase in GDP by 2008.

The large impact of a relatively small growth rate over a

long period of time is due to the power of exponential

growth. The rule of 72, a mathematical result, states that

if something grows at the rate of x% per year, then its

level will double every 72/x years. For example, a growth

rate of 2.5% per annum leads to a doubling of the GDP

within 28.8 years, whilst a growth rate of 8% per year

leads to a doubling of GDP within 9 years. Thus, a small

dierence in economic growth rates between countries

can result in very dierent standards of living for their

populations if this small dierence continues for many

years.

2.1

Quality of life

Happiness has been shown to increase with a higher GDP

per capita, at least up to a level of $15,000 per person.[5]

Economic growth has the indirect potential to alleviate

poverty, as a result of a simultaneous increase in employment opportunities and increased labour productivity.[6]

A study by researchers at the Overseas Development Institute (ODI) of 24 countries that experienced growth

found that in 18 cases, poverty was alleviated.[6] However, employment is no guarantee of escaping poverty;

the International Labour Organization (ILO) estimates

that as many as 40% of workers are poor, not earning

enough to keep their families above the $2 a day poverty

line.[6] For instance, in India most of the chronically poor

are wage earners in formal employment, because their

jobs are insecure and low paid and oer no chance to

accumulate wealth to avoid risks; other countries found

bigger benets from focusing more on productivity improvement than on low-skilled work.[6]

Increases in employment without increases in productivity lead to a rise in the number of working poor, which

is why some experts are now promoting the creation of

quality and not quantity in labour market policies.[6]

This approach does highlight how higher productivity has

helped reduce poverty in East Asia, but the negative impact is beginning to show.[6] In Vietnam, for example,

employment growth has slowed while productivity growth

has continued.[6] Furthermore, productivity increases do

not always lead to increased wages, as can be seen in the

United States, where the gap between productivity and

wages has been rising since the 1980s.[6] The ODI study

showed that other sectors were just as important in reducing unemployment, as manufacturing.[6] The services

sector is most eective at translating productivity growth

into employment growth. Agriculture provides a safety

net for jobs and an economic buer when other sectors

are struggling.[6] This study suggests a more nuanced understanding of economic growth and quality of life and

poverty alleviation.

FACTORS AFFECTING ECONOMIC GROWTH

3 Factors

growth

aecting

economic

3.1 Political institutions, property rights,

and rule of law

See also: Great Divergence Property rights, Great

Divergence Eciency of markets and state intervention and Great Divergence State prohibition of new

technology

In economics and economic history, the transition to

capitalism from earlier economic systems was enabled by

the adoption of government policies that facilitated commerce and gave individuals more personal and economic

freedom. These included new laws favorable to the establishment of business, including contract law, the abolishment of anti-usury laws and laws providing for the protection of private property.[7][8] When property rights are

less certain, transaction costs can increase, hindering economic development. Enforcement of contractual rights

is necessary for economic development because it determines the rate and direction of investments. When the

rule of law is absent or weak, the enforcement of property rights depends on threats of violence, which causes

bias against new rms because they can not demonstrate

reliability to their customers.[9]

3.2 Productivity

Increases in labor productivity(ratio of value output to labor input) have historically been the most

important source of real per capita economic

growth.[10][11][12][13][14] (Note:

There are various

measures of productivity. The term used here applies

to a broad measure of productivity. By contrast, Total

factor productivity (TFP) measures the change in output

not attributable to capital and labor. Many of the cited

references use TFP. Increases in productivity lower the

real cost of goods. Over the 20th century the real price

of many goods fell by over 90%.[15]

3.2.1 Historical sources of productivity growth

Main article: Productivity (economic history)

Economic growth has traditionally been attributed

to the accumulation of human and physical capital,

and increased productivity arising from technological

innovation.[16]

Before industrialization, technological progress resulted

in an increase in population, which was kept in check

by food supply and other resources, which acted to limit

per capita income, a condition known as the Malthusian

3.3

Capital

trap.[17][18] The rapid economic growth that occurred during the Industrial Revolution was remarkable because it

was in excess of population growth, providing an escape

from the Malthusian trap.[19] Countries that industrialized

eventually saw their population growth slow down, a phenomenon known as the demographic transition.

Increases in productivity are the major factor responsible for per capita economic growth this has been especially evident since the mid-19th century. Most of the

economic growth in the 20th century was due to reduced

inputs of labor, materials, energy, and land per unit of

economic output (less input per widget). The balance of

growth has come from using more inputs overall because

of the growth in output (more widgets or alternately more Productivity lowered the cost of most items in terms of work time

value added), including new kinds of goods and services required to purchase. Real food prices fell due to improvements

(innovations).[20]

in transportation and trade, mechanized agriculture, fertilizers,

scientic farming and the Green Revolution.

During the Industrial Revolution, mechanization began

to replace hand methods in manufacturing, and new processes streamlined production of chemicals, iron, steel,

mand for entirely new goods and services, such as teleand other products.[21] Machine tools made the economiphones, radio, television, automobiles, and household apcal production of metal parts possible, so that parts could

pliances, air conditioning, and commercial aviation (after

[22]

be interchangeable. See: Interchangeable parts.

1950), creating enough new demand to stabilize the work

During the Second Industrial Revolution, a major fac- week.[29] The building of highway infrastructures also

tor of productivity growth was the substitution of inan- contributed to post World War II growth, as did capital

imate power for human and animal labor. Also there investments in manufacturing and chemical industries.[30]

was a great increase power as steam powered electricity The post World War II economy also beneted from the

generation and internal combustion supplanted limited discovery of vast amounts of oil around the world, parwind and water power.[21] Since that replacement, the ticularly in the Middle East. By John W. Kendricks estigreat expansion of total power was driven by contin- mate, three-quarters of increase in U.S. per capita GDP

uous improvements in energy conversion eciency.[23] from 1889 to 1957 was due to increased productivity.[14]

Other major historical sources of productivity were

Economic growth in in the United States slowed down afautomation, transportation infrastructures (canals, railter 1973.[31] In contrast growth in Asia has been strong

[24][25]

roads, and highways),

new materials (steel) and

since then, starting with Japan and spreading to Kopower, which includes steam and internal combustion

rea, China, the Indian subcontinent and other parts of

engines and electricity. Other productivity improveAsia. In 1957 South Korea had a lower per capita GDP

ments included mechanized agriculture and scientic

than Ghana,[32] and by 2008 it was 17 times as high as

agriculture including chemical fertilizers and livestock

Ghanas.[33] The Japanese economic growth has slackand poultry management, and the Green Revolution.

ened considerably since the late 1980s.

Interchangeable parts made with machine tools powered

by electric motors evolved into mass production, which is Productivity in the United States grew at an increasing rate throughout the 19th century and was most

universally used today.[22]

rapid in the early to middle decades of the 20th

Great sources of productivity improvement in the late

century.[34][35][36][37][38] US productivity growth spiked

19th century were railroads, steam ships, horse-pulled

towards the end of the century in 19962004, due to

reapers and combine harvesters, and steam-powered

an acceleration in the rate of technological innovation

factories.[26][27] The invention of processes for makknown as Moores law.[39][40][41][42] After 2004 U.S. proing cheap steel were important for many forms of

ductivity growth returned to the low levels of 1972-96.[39]

mechanization and transportation. By the late 19th century both prices and weekly work hours fell because less

labor, materials, and energy were required to produce

and transport goods. However, real wages rose, allow- 3.3 Capital

ing workers to improve their diet, buy consumer goods

Capital in economics ordinarily refers to physical capiand aord better housing.[26]

tal, which consists of structures and equipment used in

Mass production of the 1920s created overproduction,

business (machinery, factory equipment, computers and

which was arguably one of several causes of the Great

oce equipment, construction equipment, business veDepression of the 1930s.[28] Following the Great Depreshicles, etc.).[3] Up to a point the amount of capital per

sion, economic growth resumed, aided in part by deworker is an important determinant of economic output.

FACTORS AFFECTING ECONOMIC GROWTH

Capital is subject to diminishing returns because of the A 1999 review in the Journal of Economic Literature

amount that can be eectively invested and because of states high inequality lowers growth, perhaps because

the growing burden of depreciation.

it increases social and political instability.[47] A 1992

In the development of economic theory the distribution World Bank report published in the Journal of Developof income was considered to be between labor and the ment Economics said that inequality is negatively, and

robustly, correlated with growth. This result is not highly

owners of land and capital.[43]

dependent upon assumptions about either the form of

the growth regression or the measure of inequality.[48]

NYU economist William Baumol found that substan3.4 New products and services

tial inequality does not stimulate growth because poverty

[49]

Economists Dierk

Another major cause of economic growth is the introduc- reduces labor force productivity.

Herzer

and

Sebastian

Vollmer

found

that increased intion of new products and services and the improvement of

come

inequality

reduces

economic

growth,

but growth itexisting products. New products create demand, which is

[50]

self

increases

income

inequality.

necessary to oset the decline in employment that occurs

through labor saving technology.[40][44]

3.5

Growth phases and sector shares

Economic growth in the U.S. and other developed countries went through phases that aected growth through

changes in the labor force participation rate and the relative sizes of economic sectors. The transition from an

agricultural economy to manufacturing increased the size

of the high output per hour, high productivity growth

manufacturing sector while reducing the size of the lower

output per hour, lower productivity growth agricultural

sector. Eventually high productivity growth in manufacturing reduced the sector size as prices fell and employment shrank relative to other sectors.[45][46] The service

and government sectors, where output per hour and productivity growth is very low, saw increases in share of the

economy and employment.[10]

3.5.1

Business cycle

For more details on this topic, see Business cycle.

Berg and Ostry of the International Monetary Fund found that of

the factors aecting the duration of growth spells (not the rate of

growth) in developed and developing countries, income equality

is more benecial than trade openness, sound political institutions, or foreign investment.[51][52]

According to International Monetary Fund economists,

inequality in wealth and income is negatively correlated

with the duration of economic growth spells (not the rate

of growth).[51] High levels of inequality prevent not just

economic prosperity, but also the quality of a countrys

institutions and high levels of education.[53]

According to economists David Castells-Quintana and

Vicente Royuela, increasing inequality harms economic

growth.[54] High and persistent unemployment, in which

inequality increases, has a negative eect on subsequent

long-run economic growth.[54] Unemployment can harm

growth not only because it is a waste of resources, but

also because it generates redistributive pressures and subsequent distortions, drives people to poverty, constrains

liquidity limiting labor mobility, and erodes self-esteem

promoting social dislocation, unrest and conict.[54] Policies aiming at controlling unemployment and in particular at reducing its inequality-associated eects support

economic growth.[54]

Economists distinguish between short-run economic

changes in production and long-run economic growth.

Short-run variation in economic growth is termed the

business cycle. The business cycle is made up of booms

and drops in production that occur over a period of

months or years. Generally, economists attribute the

ups and downs in the business cycle to uctuations in

aggregate demand. In contrast, economic growth is concerned with the long-run trend in production due to structural causes such as technological growth and factor accumulation. The business cycle moves up and down, creating uctuations around the long-run trend in economic Economist Joseph Stiglitz presented evidence in 2009

that both global inequality and inequality within coungrowth.

tries prevent growth by limiting aggregate demand.[55]

Economist Branko Milanovic, wrote in 2001 that, The

3.6 Income equality

view that income inequality harms growth or that improved equality can help sustain growth has become

For more details on this topic, see Economic inequality. more widely held in recent years. ... The main reason

for this shift is the increasing importance of human capi-

3.7

Demographic changes

tal in development. When physical capital mattered most,

savings and investments were key. Then it was important

to have a large contingent of rich people who could save

a greater proportion of their income than the poor and invest it in physical capital. But now that human capital is

scarcer than machines, widespread education has become

the secret to growth.[56]

5

3.6.1 Equitable growth

Main article: Inclusive growth

While acknowledging the central role economic growth

can potentially play in human development, poverty reduction and the achievement of the Millennium Development Goals, it is becoming widely understood amongst

the development community that special eorts must

be made to ensure poorer sections of society are able

to participate in economic growth.[65][66][67] The eect

of economic growth on poverty reduction - the growth

elasticity of poverty - can depend on the existing level

of inequality.[68][69] For instance, with low inequality a

country with a growth rate of 2% per head and 40%

of its population living in poverty, can halve poverty in

ten years, but a country with high inequality would take

nearly 60 years to achieve the same reduction.[70][71] In

the words of the Secretary General of the United Nations

Ban Ki-Moon: While economic growth is necessary, it

is not sucient for progress on reducing poverty.[65]

In 1993, Galor and Zeira showed that inequality in the

presence of credit market imperfections has a long lasting detrimental eect on human capital formation and

economic development.[57] A 1996 study by Perotti examined the channels through which inequality may aect

economic growth. He showed that, in accordance with

the credit market imperfection approach, inequality is associated with lower level of human capital formation (education, experience, and apprenticeship) and higher level

of fertility, and thereby lower levels of growth. He found

that inequality is associated with higher levels of redistributive taxation, which is associated with lower levels

of growth from reductions in private savings and investment. Perotti concluded that, more equal societies have

lower fertility rates and higher rates of investment in education. Both are reected in higher rates of growth. Also,

very unequal societies tend to be politically and socially 3.7 Demographic changes

unstable, which is reected in lower rates of investment

Demographic factors may inuence growth by changand therefore growth.[58]

ing the employment to population ratio and the labor

Research by Harvard economist Robert Barro, found that

force participation rate.[10] Industrialization creates a

there is little overall relation between income inequaldemographic transition in which birth rates decline and

ity and rates of growth and investment. According to

the average age of the population increases.

work by Barro in 1999 and 2000, high levels of inequality reduce growth in relatively poor countries but encour- Women with fewer children and better access market emage growth in richer countries.[59][60] A study of Swedish ployment tend to join the labor force in higher percentcounties between 1960 and 2000 found a positive im- ages. There is a reduced demand for child labor and

pact of inequality on growth with lead times of ve years children spend more years in school. The increase in

or less, but no correlation after ten years.[61] Studies of the percentage of women in the labor force in the U.S.

larger data sets have found no correlations for any xed contributed to economic growth, as did the entrance of

[10]

lead time,[62] and a negative impact on the duration of the baby boomers into the work force. See: Spending

[51]

wave

growth.

Some theories developed in the 1970s established possible avenues through which inequality may have a positive

eect on economic development.[51][52] According to a

1955 review, savings by the wealthy, if these increase

with inequality, were thought to oset reduced consumer demand.[63] A 2013 report on Nigeria suggests that

growth has risen with increased income inequality.[64]

Some theories popular from the 1950s to 2011 incorrectly

stated that inequality had a positive eect on economic

development.[51][52] Analyses based on comparing yearly

equality gures to yearly growth rates were misleading

because it takes several years for eects to manifest as

changes to economic growth.[62] IMF economists found

a strong association between lower levels of inequality in

developing countries and sustained periods of economic

growth. Developing countries with high inequality have

succeeded in initiating growth at high rates for a few

years but longer growth spells are robustly associated

with more equality in the income distribution.[52]

4 Negative eects

A number of arguments have been raised against economic growth.[72]

4.1 Resource depletion

See also: Energy returned on energy invested

Many earlier predictions of resource depletion, such as

Thomas Malthus' 1798 predictions about approaching

famines in Europe, The Population Bomb (1968),[73][74]

and the SimonEhrlich wager (1980) [75] have not materialized. Diminished production of most resources has

not occurred so far, one reason being that advancements

in technology and science have allowed some previously

unavailable resources to be produced.[75] In some cases,

substitution of more abundant materials, such as plastics

for cast metals, lowered growth of usage for some metals.

In the case of the limited resource of land, famine was relieved rstly by the revolution in transportation caused by

railroads and steam ships, and later by the Green Revolution and chemical fertilizers, especially the Haber process

for ammonia synthesis.[76][77]

Production (10 9 bbls/yr)

14

10

8

6

4

cumulative

production

90x10 9 bbls

is creating a scenario where we could see a systemic collapse of our planets natural resources.[79][80]

Concerns about possible negative eects of growth on

the environment and society led some to advocate lower

levels of growth. This led to the ideas of uneconomic

growth and de-growth and Green parties that argue that

economies are part of a global society and global ecology,

and cannot outstrip their natural growth without damaging those.

Those more optimistic about the environmental impacts

of growth believe that, though localized environmental

eects may occur, large-scale ecological eects are minor. The argument, as stated by commentator Julian Lincoln Simon, states that if these global-scale ecological effects exist, human ingenuity will nd ways to adapt to

them.[81]

proven reserves

250x10 9 bbls

12

NEGATIVE EFFECTS

Future discoveries

910x10 9 bbls

2

0

1850

1900

1950

2000

2050

2100

2150

2200

Year

M. King Hubbert's prediction of world petroleum production

rates. Virtually all economic sectors rely heavily on petroleum.

In the case of minerals, lower grades of mineral resources

are being extracted, requiring higher inputs of capital and

energy for both extraction and processing.[78] An example

is natural gas from shale and other low permeability rock,

which can be developed with much higher inputs of energy, capital, and materials than conventional gas in previous decades. Another example is oshore oil and gas,

which has exponentially increasing cost as water depth

increases.

4.2

Environmental impact

4.2.1 Implications of global warming

see Economics of global warming

Up to the present there are close correlations of economic

growth with carbon dioxide emissions across nations, although there is also a considerable divergence in carbon

intensity (carbon emissions per GDP).[82] Globally, Tim

Garrett observes that the emissions rate is directly related

to the historical accumulation of economic wealth.[83]

The Stern Review notes that the prediction that, Under business as usual, global emissions will be sucient

to propel greenhouse gas concentrations to over 550ppm

CO2 by 2050 and over 650700ppm by the end of this

century is robust to a wide range of changes in model

assumptions. The scientic consensus is that planetary

ecosystem functioning without incurring dangerous risks

requires stabilization at 450550 ppm.[84]

As a consequence, growth-oriented environmental

economists propose massive government intervention

See also: The Limits to Growth

Critics such as the Club of Rome argue that a narrow into switching sources of energy production, favouring

wind, solar, hydroelectric, and nuclear. This would

largely conne use of fossil fuels to either domestic

cooking needs (such as for kerosene burners) or where

carbon capture and storage technology can be costeective and reliable.[85] The Stern Review, published

by the United Kingdom Government in 2006, concluded

that an investment of 1% of GDP (later changed to

2%) would be sucient to avoid the worst eects of

climate change, and that failure to do so could risk

climate-related costs equal to 20% of GDP. Because

carbon capture and storage is as yet widely unproven,

and its long term eectiveness (such as in containing

carbon dioxide 'leaks) unknown, and because of current

costs of alternative fuels, these policy responses largely

rest on faith of technological change.

Forest in Indonesia being cut for palm oil plantation.

On the other hand, British conservative politician and

journalist Nigel Lawson claimed that people in a hundred

view of economic growth, combined with globalization, years time would be seven times as well o as we are to-

6.3

Endogenous growth theory

day, therefore it is not reasonable to impose sacrices on workers remains constant and economic growth ceases.

the much poorer present generation.[86]

This point is called a steady state.

Physical constraints on growth

Some physical scientists like Al Bartlett regard continuous economic growth as unsustainable.[87][88] Several factors may constrain economic growth - for example: nite,

peaked, or depleted resources.

In 1972, the The Limits to Growth study modeled limitations to innite growth; originally ridiculed,[73][74][89]

these models have been validated and updated.[90][91][92]

Some Malthusians, such as William R. Catton, Jr., author

of the 1980 book Overshoot, express skepticism of the

idea that various technological advancements will make

previously inaccessible or lower-grade resources more

available. Such advances and increases in eciency, they

suggest, merely accelerate the drawing down of nite

resources. Catton refers to the contemporary increases

in rates of resource extraction as, "...stealing ravenously

from the future.[93]

6

6.1

Theories and models

Classical growth theory

The model also notes that countries can overcome this

steady state and continue growing by using new technology. In the long run, output per capita depends on the

rate of saving, but the rate of output growth is independent of the saving rate. The process by which countries

continue growing despite the diminishing returns is exogenous and represents the creation of new technology

that allows production with fewer resources. Technology

improves, the steady state level of capital increases, and

the country invests and grows. One important prediction

of the model, mostly borne out by the data, is that of conditional convergence; the idea that poor countries will

grow faster and catch up with rich countries as long as

they have similar saving rates and technology.

A major shortcoming of the approach is that it does not

explain the sources of technological change.

6.3 Endogenous growth theory

Main article: Endogenous growth theory

Growth theory advanced again with theories of economist

Paul Romer and Robert Lucas, Jr. in the late 1980s and

early 1990s.

Unsatised with the assumption of exogenous technological progress in the Solow-Swan model, economists

worked to endogenize technology in the 1980s.

They developed the endogenous growth theory that

includes a mathematical explanation of technological

advancement.[98][99] This model also incorporated a new

concept of human capital, the skills and knowledge that

make workers productive. Unlike physical capital, human capital has increasing rates of return. Research

done in this area has focused on what increases human

capital (e.g. education) or technological change (e.g.

innovation).[100]

In classical (Ricardian) economics, the theory of production and the theory of growth are based on the theory or

law of variable proportions, whereby increasing either of

the factors of production (labor or capital), while holding

the other constant and assuming no technological change,

will increase output, but at a diminishing rate that eventually will approach zero. These concepts have their origins in Thomas Malthuss theorizing about agriculture.

Malthuss examples included the number of seeds harvested relative to the number of seeds planted (capital)

on a plot of land and the size of the harvest from a plot

of land versus the number of workers employed.[94] See:

Diminishing returns

6.4 Unied growth theory

Criticisms of classical growth theory are that technology,

the most important factor in economic growth, is held Unied growth theory was developed by Oded Galor

and his co-authors to address the inability of endogenous

constant and that economies of scale are ignored.[95]

growth theory to explain key empirical regularities in the

growth processes of individual economies and the world

economy as a whole. Endogenous growth theory was sat6.2 Solow-Swan model

ised with accounting for empirical regularities in the

Robert Solow[96] and Trevor Swan[97] developed what growth process of developed economies over the last huneventually became the main model used in growth eco- dred years. As a consequence, it was not able to explain

nomics in the 1950s. This model assumes that there are the qualitatively dierent empirical regularities that chardiminishing returns to capital and labor. Capital accumu- acterized the growth process over longer time horizons in

lates out of saving but its level per worker decreases due both developed and less developed economies. Unied

to depreciation and population growth. As a result of di- growth theories are endogenous growth theories that are

minishing returns to capital economies eventually reach consistent with the entire process of development, and

a point where, absent technological progress, capital per in particular the transition from the epoch of Malthusian

THEORIES AND MODELS

stagnation that had characterized most of the process of colonizers) that are not properly placed regarding the gedevelopment to the contemporary era of sustained eco- ographical locations of dierent ethnic groups, creating

nomic growth.[101]

internal disputes and conicts that hinder development.

In another example, societies that emerged in colonies

without solid native populations established better prop6.5 The big push

erty rights and incentives for long-term investment than

those where native populations were large.[106]

One popular theory in the 1940s was the Big Push, which

suggested that countries needed to jump from one stage of

development to another through a virtuous cycle, in which

large investments in infrastructure and education coupled with private investments would move the economy 6.8 Human capital and growth

to a more productive stage, breaking free from economic

paradigms appropriate to a lower productivity stage.[102] One ubiquitous element of both theoretical and empirThe idea was revived and formulated rigorously, in the ical analyses of economic growth is the role of human

late 1980s by Kevin Murphy, Andrei Schleifer and Robert capital. The skills of the population enter into both neoVishny.[103]

classical and endogenous growth models.[107] The most

commonly used measure of human capital is the level of

school attainment in a country, building upon the data de6.6 Schumpeterian growth

velopment of Robert Barro and Jong-Wha Lee.[108] This

measure of human capital, however, requires the strong

Schumpeterian growth is an economic theory named af- assumption that what is learned in a year of schooling is

ter the 20th-century Austrian economist Joseph Schum- the same across all countries. It also presumes that hupeter. The approach explains growth as a consequence man capital is only developed in formal schooling, conof innovation and a process of creative destruction that trary to the extensive evidence that families, neighborcaptures the dual nature of technological progress: in hoods, peers, and health also contribute to the developterms of creation, entrepreneurs introduce new products ment of human capital. To measure human capital more

or processes in the hope that they will enjoy temporary accurately, Eric Hanushek and Dennis Kimko introduced

monopoly-like prots as they capture markets. In doing measures of mathematics and science skills from internaso, they make old technologies or products obsolete. This tional assessments into growth analysis.[109] They found

can be seen as an annulment of previous technologies, that quality of human capital was very signicantly rewhich makes them obsolete, and "...destroys the rents lated to economic growth. This approach has been exgenerated by previous innovations. (Aghion 855)[104] A tended by a variety of authors, and the evidence indicates

major model that illustrates Schumpeterian growth is the that economic growth is very closely related to the cogniAghion-Howitt model.[105]

tive skills of the population.[110]

6.7

Institutions and growth

According to Acemolu, Simon Johnson and James

Robinson, the positive correlation between high income

and cold climate is a by-product of history. Europeans

adopted very dierent colonization policies in dierent

colonies, with dierent associated institutions. In places

where these colonizers faced high mortality rates (e.g.,

due to the presence of tropical diseases), they could not

settle permanently, and they were thus more likely to establish extractive institutions, which persisted after independence; in places where they could settle permanently

(e.g. those with temperate climates), they established institutions with this objective in mind and modeled them

after those in their European homelands. In these 'neoEuropes better institutions in turn produced better development outcomes. Thus, although other economists

focus on the identity or type of legal system of the colonizers to explain institutions, these authors look at the

environmental conditions in the colonies to explain institutions. For instance, former colonies have inherited corrupt governments and geo-political boundaries (set by the

6.9 Energy consumption and eciency

theories

For more details on Energy eciency, see Productivity

improving technologies (historical) Energy eciency.

Energy economic theories emphasize the role of energy

consumption and energy eciency as important historical causes of economic growth. Increases in energy efciency were a portion of the increase in Total factor

productivity.[14] Some of the most technologically important innovations in history involved increases in energy eciency. These include the great improvements

in eciency of conversion of heat to work, the reuse of

heat, the reduction in friction and the transmission of

power, especially through electrication.[111][112] Electricity consumption and economic growth are strongly

correlated.[113] Per capita electric consumption correlates almost perfectly with economic development.[114]

See also

Degrowth

Export-oriented industrialization

Growth accounting

List of countries by real GDP growth rate

References

[1] Statistics on the Growth of the Global Gross Domestic

Product (GDP) from 2003 to 2013, IMF, October 2012.

[2] Bjork, Gordon J. (1999). The Way It Worked and Why It

Wont: Structural Change and the Slowdown of U.S. Economic Growth. Westport, CT; London: Praeger. pp. 2,

67. ISBN 0-275-96532-5.

[3] Bjork 1999, pp. 251

[4] Lawrence H. Ocer, What Was the U.K. GDP

Then?" MeasuringWorth, 2011.

URL:http://www.

measuringworth.com/ukgdp/

[5] In Pursuit of Happiness Research. Is It Reliable? What

Does It Imply for Policy? The Cato institute. April 11,

2007

[6] Claire Melamed, Renate Hartwig and Ursula Grant 2011.

Jobs, growth and poverty: what do we know, what don't

we know, what should we know? London: Overseas Development Institute

[7] Hunt, E. K.; Lautzenheiser, Mark (2014). History of Economic Thought: A Critical Perspective. PHI Learning.

ISBN 978-0765625991.

[8] Landes, David. S. (1969). The Unbound Prometheus:

Technological Change and Industrial Development in

Western Europe from 1750 to the Present. Cambridge,

New York: Press Syndicate of the University of Cambridge. pp. 818. ISBN 0-521-09418-6.

[9] Li, Rita Yi Man, and Li, Yi Lut (2013) The relationship

between law and economic growth: A paradox in China

Cities, Asian Social Science, 9(9): 19-30.

[10] Bjork 1999

[11] Roubini, Nouriel; Backus, David (1961). Lectures in

Macroeconomics"<Chapter 4. Productivity and Growth>

[12] Wang, Ping (2014). Growth Accounting (PDF). p. 2.

[15] Rosenberg, Nathan (1982). Inside the Black Box: Technology and Economics. Cambridge, New York: Cambridge University Press. p. 258. ISBN 0-521-273676<Attributed to Simon Kuznets>

[16] Lucas, R. E. 1988. "On the mechanics of economic development, Journal of monetary economics, 22(1), 342.

[17] Galor, Oded (2005). From Stagnation to Growth: Unied Growth Theory. Handbook of Economic Growth 1.

Elsevier. pp. 171293.

[18] Clark, Gregory (2007). A Farewell to Alms: A Brief Economic History of the World. Princeton University Press.

ISBN 978-0-691-12135-2Part I: The Malthusian Trap

[19] Clark 2007, pp. Part 2: The Industrial Revolution

[20] Kendrick, J. W. 1961 "Productivity trends in the United

States, Princeton University Press

[21] Landes, David. S. (1969). The Unbound Prometheus:

Technological Change and Industrial Development in

Western Europe from 1750 to the Present. Cambridge,

New York: Press Syndicate of the University of Cambridge. ISBN 0-521-09418-6.

[22] Hounshell, David A. (1984), From the American System to Mass Production, 1800-1932: The Development of

Manufacturing Technology in the United States, Baltimore,

Maryland: Johns Hopkins University Press, ISBN 978-08018-2975-8, LCCN 83016269

[23] Ayres, Robert U.; Warr, Benjamin (2004). Accounting

for Growth: The Role of Physical Work (PDF).

[24] Grubler, Arnulf (1990). The Rise and Fall of Infrastructures (PDF).

[25] Taylor, George Rogers. The Transportation Revolution,

18151860. ISBN 978-0873321013.

[26] Wells, David A. (1890). Recent Economic Changes and

Their Eect on Production and Distribution of Wealth and

Well-Being of Society. New York: D. Appleton and Co.

ISBN 0543724743.

[27] Atack, Jeremy; Passell, Peter (1994). A New Economic

View of American History. New York: W.W. Norton and

Co. ISBN 0-393-96315-2.

[28] Beaudreau, Bernard C. (1996). Mass Production, the Stock

Market Crash and the Great Depression. New York, Lincoln, Shanghi: Authors Choice Press.

[13] Corry, Dan; Valero, Anna; Van Reenen, John (Nov 2011).

UK Economic Performance Since 1997 (PDF)<" The

UKs high GDP per capita growth was driven by strong

growth in productivity (GDP per hour), which was second

only to the US .">

[29] Moore, Stephen; Simon, Julian (December 15, 1999).

The Greatest Century That Ever Was: 25 Miraculous

Trends of the last 100 Years, The Cato Institute: Policy

Analysis, No. 364 (PDF).Diusion curves for various

innovations start at Fig. 14

[14] Kendrick, John W. (1961). Productivity Trends in

the United States (PDF). Princeton University Press for

NBER. p. 3.

[30] Field, Alexander J. (2011). A Great Leap Forward: 1930s

Depression and U.S. Economic Growth. New Haven, London: Yale University Press. ISBN 978-0-300-15109-1.

10

[31] St. Louis Federal Reserve Real GDP per capita in

the U.S. rose from $17,747 in 1960 to $26,281 in

1973 for a growth rate of 3.07%/yr. Calculation:

(26,281/17,747)^(1/13). From 1973 to 2007 the growth

rate was 1.089%. Calculation: (49,571/26,281)^(1/34)

From 2000 to 2011 average annual growth was 0.64%.

REFERENCES

[44] Ayres, Robert (1989). Technological Transformations

and Long Waves (PDF). p. 9<Attributed to Mensch who

described new products as demand creating.>

[45] Manufacturings Declining Share of GDP is a Global

Phenomenon, and Its Something to Celebrate. U.S.

Chamber of Commerce Foundation.

[32] Leading article: Africa has to spend carefully. The Independent. July 13, 2006.

[46] All Employees: Manufacturing.

[33] Data refer to the year 2008. $26,341 GDP for Korea,

$1513 for Ghana. World Economic Outlook Database

October 2008. International Monetary Fund.

[47] Temple, J (1999).

The New Growth Evidence

(PDF). Journal of Economic Literature 37 (1): 112156.

doi:10.1257/jel.37.1.112.

[34] Kendrick, John (1991). U.S. Productivity Performance

in Perspective, Business Economics, October 1, 1991.

doi:10.2307/23485828.

[48] Clarke, G (1995). More evidence on income distribution

and growth (PDF). Journal of Development Economics

47: 403427. doi:10.1016/0304-3878(94)00069-o.

[35] Field, Alezander J. (2007). U.S. Economic Growth in

the Gilded Age, Journal of Macroeconomics 31 (PDF).

pp. 173190.

[49] Baumol, William J. (2007). On income distribution and

growth (PDF). Journal of Policy Modeling 29: 545548.

[36] Field, Alexander (2004). Technological Change and

Economic Growth the Interwar Years and the 1990s.

[50] Herzer, Dierk; Vollmer, Sebastian (2013). Rising top

incomes do not raise the tide. Journal of Policy Modeling

35 (4): 504519. doi:10.1016/j.jpolmod.2013.02.011.

[37] Gordon, Robert J. (2000). Interpreting the One Big

Wave in U.S. Long Term Productivity Growth, National

Bureau of Economic Research Working paper 7752.

[51] Berg, Andrew G.; Ostry, Jonathan D. (2011). Equality

and Eciency. Finance and Development (International

Monetary Fund) 48 (3). Retrieved July 13, 2014.

[38] Abramovitz, Moses; David, Paul A. (2000). Two Centuries of American Macroeconomic Growth From Exploitation of Resource Abundance to Knowledge-Driven Development (PDF). Stanford University. pp. 245 (pdf p=28

9).

[52] Andrew Berg and Jonathan Ostry. (2011) Inequality and

Unsustainable Growth: Two Sides of the Same Coin IMF

Sta Discussion Note No. SDN/11/08 (International Monetary Fund)

[39] Gordon, Robert J. (Spring 2013). U.S. Productivity

Growth: The Slowdown Has Returned After a Temporary Revival (PDF). International Productivity Monitor,

Centre for the Study of Living Standards 25: 1319. Retrieved 2014-07-19. The U.S. economy achieved a growth

rate of labour productivity of 2.48 per cent per year for 81

years, followed by 24 years of 1.32 per cent, then a temporary recovery back to 2.48 per cent per cent, and a nal

slowdown to 1.35 per cent. The similarity of the growth

rates in 1891-1972 with 1996-2004, and of 1972-96 with

1996-2011 is quite remarkable.

[40] Dale W. Jorgenson, Mun S. Ho and Jon D. Samuels

(2014). Long-term Estimates of U.S. Productivity and

Growth (PDF). World KLEMS Conference. Retrieved

2014-05-27.

[41] Dale W. Jorgenson, Mun S. Ho, and Kevin J. Stiroh

(2008). A Retrospective Look at the U.S. Productivity

Growth Resurgence. Journal of Economic Perspectives.

Retrieved 2014-05-15.

[42] Bruce T. Grimm, Brent R. Moulton, and David B.

Wasshausen (2002). Information Processing Equipment

and Software in the National Accounts (PDF). U.S. Department of Commerce Bureau of Economic Analysis.

Retrieved 2014-05-15.

[43] Hunt, E. K.; Lautzenheiser, Mark (2014). History of Economic Thought: A Critical Perspective. PHI Learning.

ISBN 978-0765625991.

[53] Easterly, W (2007). Inequality does cause underdevelopment: Insights from a new instrument (PDF).

Journal of Development Economics 84 (2): 755776.

doi:10.1016/j.jdeveco.2006.11.002.

[54] Castells-Quintana, David; Royuela, Vicente (2012).

Unemployment and long-run economic growth: The role

of income inequality and urbanisation (PDF). Investigaciones Regionales 12 (24): 153173. Retrieved 17 October 2013.

[55] Stiglitz, J (2009). The global crisis, social protection and

jobs (PDF). International Labour Review 148 (12).

[56] More or Less| Branko Milanovic| Finance & Development|

September 2011| Vol. 48, No. 3

[57] Galor, Oded and Joseph Zeira, 1993, Income Distribution and Macroeconomics, Review of Economic Studies,

60(1), 3552.

[58] Perotti, R (1996). Growth, income distribution and

democracy: what do the data say?" (PDF). Journal of Economic Growth 1 (2): 149187. doi:10.1007/bf00138861.

[59] Barro (1999)

[60] Inequality and Growth in a Panel of Countries.

[61] Ruth-Aida Nahum (2 February 2005). Income Inequality and Growth: a Panel Study of Swedish Counties 19602000.

11

[62] Banerjee, Abhijit V.;

Duo, Esther (2003).

Inequality And Growth:

What Can The Data

Say?". Journal of Economic Growth 8 (3): 26799.

doi:10.1023/A:1026205114860. Retrieved September

25, 2012.

[63] Kaldor, Nicoals, 1955, Alternative Theories of Distribution, Review of Economic Studies, 23(2), 83100.

[64] Muhammad Dandume Yusuf (2 February 2013).

Corruption, Inequality of Income and economic Growth

in Nigeria.

[65] Claire Melamed, Kate Higgins and Andy Sumner (2010)

Economic growth and the MDGs Overseas Development

Institute

[66] Anand, Rahul et al. (17 August 2013). Inclusive growth

revisited: Measurement and evolution. VoxEU.org (Centre for Economic Policy Research). Retrieved 13 January

2015.

[67] Anand, Rahul et al. (May 2013). Inclusive Growth:

Measurement and Determinants (PDF). IMF Working

Paper (WP/13/135). Asia Pacic Department: International Monetary Fund. Retrieved 13 January 2015.

[68] Ranieri, Rafael; Ramos, Raquel Almeida (March 2013).

Inclusive Growth: Building up a Concept (PDF). Working Paper 104. Brazil: International Policy Centre for Inclusive Growth. ISSN 1812-108X. Retrieved 13 January

2015.

[69] Bourguignon, Francois, Growth Elasticity of Poverty Reduction: Explaining Heterogeneity across Countries and

Time Periods in Inequality and Growth, Ch. 1.

[70] Ravallion, M. (2007) Inequality is bad for the poor in S.

Jenkins and J. Micklewright, (eds.) Inequality and Poverty

Re-examined, Oxford University Press, Oxford.

[71] Elena Ianchovichina and Susanna Lundstrom, 2009.

Inclusive growth analytics: Framework and application,

Policy Research Working Paper Series 4851, The World

Bank.

[72] Case, K.E., and Fair, R.C. 2006. Principles of Macroeconomics. Prentice Hall. ISBN 0-13-222645-6, ISBN 9780-13-222645-5.

[73] Chapter 17: Growth and Productivity-The Long-Run

Possibilities. Oswego.edu. 1999-06-10. Retrieved

2010-12-22.

[74] Bailey, Ronald (2004-02-04). Science and Public Policy

- Reason Magazine. Reason.com. Retrieved 2010-1222.

[75] Regis, Ed. The Doomslayer. Wired.

[76] Wells, David A. (1891). Recent Economic Changes and

Their Eect on Production and Distribution of Wealth and

Well-Being of Society. New York: D. Appleton and Co.

ISBN 0-543-72474-3.Opening line of the Preface.

[77] Smil, Vaclav (2004). Enriching the Earth: Fritz Haber,

Carl Bosch, and the Transformation of World Food Production. MIT Press. ISBN 0-262-69313-5.

[78] Hall, Charles A.S.; Cleveland, Cutler J.; Kaufmann,

Robert (1992). Energy and Resource Quality: The ecology of the Economic Process. Niwot, Colorado: University

Press of Colorado.

[79] Donella H. Meadows, Jorgen Randers, Dennis L. Meadows. Limits to Growth: The 30-Year Update. White

River Junction, Vermont : Chelsea Green, 2004.

[80] Allan Schnaiberg. The Environment: From Surpus to

Scarcity. New York: Oxford University Press.

[81] The Ultimate Resource, Julian Simon, 1981

[82] Stern Review, Part III Stabilization. Table 7.1 p. 168

[83] Garrett, T. J. (2009). Are there basic physical constraints

on future anthropogenic emissions of carbon dioxide?".

Climatic Change 104 (34): 437. doi:10.1007/s10584009-9717-9.

[84] Stern Review Economics of Climate Change. Part III Stabilization p.183

[85] Jaccard, M. 2005 Sustainable Fossil Fuels. Cambridge

University Press.

[86] Examination of Witnesses (Questions 3239)". 16 May

2007. Retrieved 2007-11-29.

[87] Bartlett, Albert Allen (2013). Arithmetic, Population and Energy - a talk by Al Bartlett. albartlett.org.

Retrieved 2014-07-22. You cannot sustain population

growth and / or growth in the rates of consumption of resources.

[88] Murphy, Tom (2011-07-12). Galactic-Scale Energy.

Do the Math. Retrieved 2014-07-22. continued growth

in energy use becomes physically impossible within conceivable timeframes ... all economic growth must similarly end.

[89]

[90] Turner, Graham. A Comparison of the Limits of Growth

with Thirty Years of Reality. CSIRO Working Paper Series, (2010). Available at: http://www.csiro.au/files/files/

plje.pdf

[91] Hall, C. & Day, J. Revisiting the Limits to Growth After

Peak Oil American Scientist 2009; 97: 230-238.

[92] Meadows, D H; Randers (2004). Limits to Growth: The

30-Year Update. Chelsea Green Publishing. ISBN 978-1931498-58-6.

[93] Overshoot by William Catton, p. 3 [1980]

[94] Bjork 1999, pp. 297,8

[95] Bjork 1999, pp. 298

[96] Robert M. Solow (1956), A Contribution to the Theory

of Economic Growth, Quarterly Journal of Economics,

70(1), p p. 6594.

[97] Swan, Trevor W. (1956). Economic Growth and Capital Accumulation'". Economic Record 32: 33461.

doi:10.1111/j.1475-4932.1956.tb00434.x.

12

9 FURTHER READING

[98] D. Romer, 1986

[99]

[100]

[101]

[102]

[103]

[104]

[111] Landes, David. S. (1969). The Unbound Prometheus:

Technological Change and Industrial Development in

Lucas, 1988

Western Europe from 1750 to the Present. Cambridge,

New York: Press Syndicate of the University of CamElhanah Helpman, The Mystery of Economic Growth,

bridge. pp. 289, 293. ISBN 0-521-09418-6.

Harvard University Press, 2004.

[112] Devine, Jr., Warren D. (1983). From Shafts to Wires:

Historical Perspective on Electrication, Journal of EcoGalor O., 2005, From Stagnation to Growth: Unied

nomic History, Vol. 43, Issue 2 (PDF). p. 355.

Growth Theory. Handbook of Economic Growth, Elsevier

[113] Committee on Electricity in Economic Growth Energy Engineering Board Commission on Engineering and

Paul Rosenstein-Rodan

Technical Systems National Research Council (1986).

Electricity in Economic Growth. Washington, DC: National Academy Press. pp. 16, 40. ISBN 0-309-036771<Available as free .pdf download>

Quote from Philippe Aghion, 2002, Schumpeterian

Growth Theory and the Dynamics of Income Inequality,

[114] Paepke, C. Owen (1992). The Evolution of Progress: The

Econometrica, 70(3), 855882.

End of Economic Growth and the Beginning of Human

Also see Wendy Carlin and David Soskice, 2006,

Transformation. New York, Toronto: Random House. p.

Macroeconomics: Imperfections, Institutions & Policies,

109. ISBN 0-679-41582-3.

specically chapter 14.

[105] Philippe Aghion and Peter Howitt, 1992, A Model

of Growth Through Creative Destruction, Econometrica,

60(2), 323351.

Philippe Aghion, 2002, Schumpeterian Growth Theory

and the Dynamics of Income Inequality, Econometrica,

70(3), 855882.

[106] Daron Acemolu, Simon Johnson and James A.

Robinson.The Colonial Origins of Comparative Development: An Empirical Investigation. American Economic

Review 91(5): 1369401. 2001.

[107] Mankiw, N. Gregory, David Romer, and David Weil.

1992. A contribution to the empirics of economic

growth. Quarterly Journal of Economics 107, no. 2

(May): 407437

Sala-i-Martin, Xavier, Gernot Doppelhofer, and Ronald

I. Miller. 2004. Determinants of long-term growth: A

Bayesian Averaging of Classical Estimates (BACE) approach. American Economic Review 94, no. 4 (September): 813835.

LudRomer, Paul. 1990. Human capital and growth:

Theory and evidence. Carnegie-Rochester Conference

Series on Public Policy 32: 251286.

[108] Barro, Robert J., and Jong-Wha Lee. 2001. International data on educational attainment: Updates and implications. Oxford Economic Papers 53, no. 3 (July): 541

563.

[109] Hanushek, Eric A., and Dennis D. Kimko. 2000.

Schooling, labor force quality, and the growth of nations. American Economic Review 90, no. 5 (December):

11841208

[110] Hanushek, Eric A., and Ludger Woessmann. 2008.

The role of cognitive skills in economic development.

Journal of Economic Literature 46, no. 3 (September):

607668 .

Hanushek, Eric A., and Ludger Woessmann. 2011.

How much do educational outcomes matter in OECD

countries?" Economic Policy, 26, no. 67: 427491.

9 Further reading

Argyrous, G., Forstater, M and Mongiovi, G. (eds.)

(2004) Growth, Distribution, And Eective Demand:

Essays in Honor of Edward J. Nell. New York: M.E.

Sharpe.

Barro, Robert J. (1997) Determinants of Economic

Growth: A Cross-Country Empirical Study. MIT

Press: Cambridge, MA.

Galor, O. (2005) From Stagnation to Growth: Unied Growth Theory. Handbook of Economic

Growth, Elsevier.

Grier, Kevin (2008). Empirics of Economic Growth.

The Concise Encyclopedia of Economics (2nd ed.).

Library of Economics and Liberty. ISBN 9780865976658. OCLC 237794267.

Halevi, Joseph; Laibman, David and Nell, Edward

J. (eds.) (1992) Beyond the Steady State: Essays in

the Revival of Growth Theory, edited with, London,

UK:

Hueting, Roe (2011) The future of the Environmentally sustainable national income. kologisches

Wirtschaften, 4/2011, 30-35

Jones, Charles I. (2002) Introduction to Economic

Growth 2nd ed. W. W. Norton & Company: New

York, N.Y.

Kirzner, Israel.

trepreneurship

(1973) Competition and En-

Lucas, Robert E., Jr. (2003) The Industrial Revolution: Past and Future, Federal Reserve Bank of

Minneapolis, Annual Report online edition

10.2

Data

Mises, Ludwig E. (1949) Human Action 1998

reprint by the Mises Institute

13

Research and Degrowth network Academic association dedicated to research, awareness raising, and

events organization around the topic of degrowth.

Paepke, C. Owen. The Evolution of Progress: The

End of Economic Growth and the Beginning of Human Transformation. New York, Toronto: Random 10.2 Data

House. ISBN 0-679-41582-3.

Angus Maddisons Historical Dataseries Series for

Puthenkalam, John Joseph, Integrating Freedom,

almost all countries on GDP, Population and GDP

Democracy and Human Rights into Theories of

per capita from the year 0 up to 2003

Economic Growth, Manila, 1998.

OECD Economic growth statistics

Romer, Paul M. (2008). Economic Growth. The

Concise Encyclopedia of Economics (2nd ed.).

multinational data sets easy to use data set showing

Library of Economics and Liberty. ISBN 978gdp, per capita and population, by country and re0865976658. OCLC 237794267.

gion, 1970 to 2008. Updated regularly.

Schumpeter, Jospeph A. (1912) The Theory of Economic Development 1982 reprint, Transaction Publishers

Vladimir N. Pokrovskii (2011) Econodynamics. The

Theory of Social Production, Springer, Berlin.

Weil, David N. (2008) Economic Growth 2nd ed.

Addison Wesley.

10

10.1

External links

Articles and lectures

Economic growth. Encyclopdia Britannic.

2007.

Encyclopdia Britannica Online.

17

November 2007.

Beyond Classical and Keynesian Macroeconomic

Policy. Paul Romer's plain-English explanation of

endogenous growth theory.

Does Economic Growth increase Living Standards?

CEPR Economics Seminar Series Two seminars on

the importance of growth with economists Dean

Baker and Mark Weisbrot

On global economic history by Jan Luiten van Zanden. Explores the idea of the inevitability of the Industrial Revolution.

The Economist Has No Clothes essay by Robert

Nadeau in Scientic American on the basic assumptions behind current economic theory

World Growth Institute. An organization dedicated

to helping the developing world realize its full potential via economic growth.

Economics for Everyone- Evaluating Economic

Growth

Understanding the world today Multiple reports on

economic growth

14

11

11

11.1

TEXT AND IMAGE SOURCES, CONTRIBUTORS, AND LICENSES

Text and image sources, contributors, and licenses

Text

Economic growth Source: http://en.wikipedia.org/wiki/Economic_growth?oldid=665667560 Contributors: Mav, Tarquin, Youssefsan,

Enchanter, SimonP, Quasar~enwiki, Edward, Michael Hardy, Modster, Kku, Gabbe, Extro, Notheruser, Kingturtle, Mydogategodshat,

Charles Matthews, Viz, Dysprosia, Wik, Tpbradbury, Philopp, Fvw, Pakaran, Phil Boswell, Robbot, Korath, Geordieandy, Meelar, SpellBott, Alan Liefting, David Gerard, Stirling Newberry, Nikodemos, Everyking, Andris, Guanaco, Khalid hassani, Jackol, Bobblewik,

Wmahan, Andycjp, Jdevine, Beland, Phil Sandifer, The Land, Gsociology, Sam Hocevar, Klemen Kocjancic, Discospinster, Mani1,

Stereotek, Bender235, Jensbn, Mwanner, RoyBoy, Cretog8, Per Olofsson, BrokenSegue, Giraedata, Jerryseinfeld, Nk, Rajah, AppleJuggler, Alansohn, Andy L, John Quiggin, Martinship, DreamGuy, Sciurin, Guo, Dennis Bratland, Ultramarine, Oleg Alexandrov, Bobrayner,

Woohookitty, Bluemoose, DL5MDA, Driftwoodzebulin, Sapin~enwiki, ArchCarrier~enwiki, Rjwilmsi, Bob A, Yamamoto Ichiro, Naraht,

RobertG, Old Moonraker, LAk loho, RexNL, DaGizza, Volunteer Marek, Bgwhite, Clinton Boys, Wjfox2005, Shaggyjacobs, YurikBot, Wavelength, RobotE, Hairy Dude, RussBot, Polluxian, Gaius Cornelius, Morphh, Afelton, NawlinWiki, Fabhcn, Grafen, Voyevoda,

Mhartl, Thiseye, Daniel Mietchen, Odddmonster, Lajiri, PhilipO, Farmanesh, Obey, Aaron Schulz, M3taphysical, Fenrith, CLW, Lapafrax,

Maunus, Leptictidium, Closedmouth, Arthur Rubin, Spliy, Martinku, AndrewWTaylor, Erik Sandberg, SmackBot, YellowMonkey, Ramneek, Alex1011, Lawrencekhoo, Jagged 85, Gunnar.Kaestle, Yamaguchi , Gilliam, Hmains, GwydionM, Chris the speller, Bluebot, Deli

nk, Dlohcierekims sock, DHN-bot~enwiki, Chendy, Can't sleep, clown will eat me, Brimba, Lazar Taxon, Makemi, Nakon, John D. Croft,

Dacoutts, RandomP, Skinnyweed, Clicketyclack, Ozhiker, Lapaz, Copeland.James.H, Luisinui, JHunterJ, Smith609, Makyen, SQGibbon,

San Saba, SandyGeorgia, AdultSwim, J Brassy, Nikka-EN, Paul Nollen, Phuzion, Keith-264, Levineps, Iridescent, Tamino, Joseph Solis in

Australia, JoeBot, JHP, RekishiEJ, HongQiGong, Madla~enwiki, Elharo, Colignatus, Trevor.tombe, CRGreathouse, Sven945, Van helsing,

Aherunar, Vision Thing, DSachan, Dgw, Thomasmeeks, Pfhenshaw, Requestion, Goatchurch, Kraky, Piccolo Modicatore Laborioso,

Richhoncho, Thijs!bot, Epbr123, Cimbalom, Doc richard, Nalvage, Marek69, Jackftwist, AntiVandalBot, Gregalton, Fayenatic london,

Shein, Alphachimpbot, Mrs smartygirl, AniRaptor2001, Barek, MER-C, Sheitan, Mgbjimmy, RainbowCrane, PhilKnight, Bongwarrior,

VoABot II, Sarahj2107, Brusegadi, Catgut, Awinkle, JaGa, LonghornJohnny, Pikitfense, Gun Powder Ma, Barak1, STBot, Marenco, Earthdenizen, Fconaway, J.delanoy, Rfalcon27, Rlsheehan, LChimienti, Mattnad, Ricky setiawan~enwiki, NagamasaAzai, Clerks, Andyohio,

Aformalevent, Colchicum, Collinpark, Cometstyles, Brahmastra, Scott Illini, Wikipeterproject, DASonnenfeld, Idioma-bot, Funandtrvl,

28bytes, VolkovBot, Marekzp, Wmcg, Countermereology, Larklight, Lamro, Phmoreno, SchumiChamp, Farcaster, MaCRoEco, GirasoleDE, StAnselm, Springbreak04, Financeeditor, Malcolmxl5, Flyer22, Emilfarb, Xahm2307, Martinangel, Keynes13, Fuller.brandon,

OKBot, Belligero, Msrasnw, Capitalismojo, Rinconsoleao, Educationeciency, Mr. Granger, ClueBot, LAX, Mild Bill Hiccup, Tkeu,

Alexhopkins, Niceguyedc, Studentteacher1, Dwrcan, Sun Creator, AZatBot~enwiki, Redthoreau, SchreiberBike, Whaleiouse, Nem1yan,

Aprock, Thingg, Versus22, Johnuniq, SF007, Attaboy, Ramisses, Nathan Johnson, Jytdog, Zencv, WikHead, Lookatim, Kelseywslee, Addbot, Yakiv Gluck, Some jerk on the Internet, Yoenit, Oericgo, DougsTech, Nathan zuckerman, Asfreeas, MrOllie, Download, LaaknorBot,

Casperdc, Favonian, West.andrew.g, Tassedethe, HansIsaksson, Lightbot, Teles, Ettrig, Legobot, Luckas-bot, Yobot, JohnnyCalifornia,

Acromaniac, Gongshow, Marshall Williams2, AnomieBOT, NathanoNL, Jim1138, Vextration, OpenFuture, Dave94703, Elostirion, Materialscientist, Markofmathias, ArthurBot, LilHelpa, Xqbot, S h i v a (Visnu), Cureden, Capricorn42, Tomdo08, J JMesserly, Srich32977,

Fotisaros, Econo67a, Alexandru Stanoi, Ignoranteconomist, Smallman12q, Shadowjams, Mcstubble, FrescoBot, Tobby72, Afab, Ong

saluri, Rd232 public, Atlantia, Citation bot 1, Shoxie, Economics Research, A8UDI, Madliner, Jandalhandler, Hunarian, LilyKitty, Rbyteisbst, Schmelzerm, Fernanr, Minimac, DARTH SIDIOUS 2, OopsTardyAgain, RjwilmsiBot, HanAre, Cdjwells, Mconover14, Elium2,

EmausBot, John of Reading, Orphan Wiki, Dewritech, GoingBatty, Lbagman, Active Banana, RememberingLife, Unsyncategoremata,

Cogiati, Traxs7, Mar4d, Abletu, Gsarwa, Donner60, Stikemanforum, 12igon6, Financestudent, Fritz.grobbelaar, Grampion76, Foxxygrandpa, DASHBotAV, Danielfc.mx, Islamrezk2013, Locomotive999, ClueBot NG, Cwmhiraeth, Somedierentstu, Satellizer, Snotbot,

Frietjes, Widr, CasualVisitor, Helpful Pixie Bot, Gloriadai, Strike Eagle, BG19bot, Google Guruprasad, Iselilja, Karim errouaki, Mark

Arsten, H0339637, Citingsources, CitationCleanerBot, Rrronny, Polmandc, Matador78, PietervanderZouwen, Achowat, Stephen wilhelm,

EcoChap, CeraBot, BattyBot, Pratyya Ghosh, The Illusive Man, John M. DiNucci, Panga, Sae Harshberger, Chow, Hmainsbot1, Mogism, Wikignome1213, Viewmont Viking, Dechrwr, SFK2, Mathematician314, Cupco, Chris97531, Gsurgey, Reatlas, Neo Poz, EllenCT,

Globalizr, StapelChips, Hugo LM, Inaaaa, MrScorch6200, BigZ12, Jonasbarka, Estaling, JaconaFrere, Monkbot, Wallaby65, Red WI,

Lukeyhano, Trackteur, Research83, Etherington1993, Sy9045, Apenuta, Jodielavery, Jbitz743, KasparBot, Th3ASh0rtninja, Asimova and

Anonymous: 538

11.2

Images

File:Berg_Ostry_2011_Chart_4.gif Source: http://upload.wikimedia.org/wikipedia/commons/4/41/Berg_Ostry_2011_Chart_4.gif License: Public domain Contributors: Equality and Eciency Finance and Development, September 2011, Vol. 48, No. 3 Original artist:

Andrew G. Berg and Jonathan D. Ostry, International Monetary Fund

File:Cost_of_chicken_in_time_worked.jpg Source:

time_worked.jpg License: CC BY 3.0 Contributors:

http://upload.wikimedia.org/wikipedia/commons/7/72/Cost_of_chicken_in_

Transferred from en.wikipedia by SreeBot Original artist: Phmoreno at en.wikipedia

File:Forest_of_Bangka_Island.jpg Source: http://upload.wikimedia.org/wikipedia/commons/4/4c/Forest_of_Bangka_Island.jpg License: CC BY-SA 3.0 Contributors: Own work Original artist: Taman Renyah

File:Gdp_accumulated_change.png Source: http://upload.wikimedia.org/wikipedia/commons/4/45/Gdp_accumulated_change.png License: CC-BY-SA-3.0 Contributors: WP EN. Source of the gures : IMF World Economic Database, Gross domestic product, constant

prices, annual percent change Original artist: en:User:Ultramarine

File:Hubbert_peak_oil_plot.svg Source: http://upload.wikimedia.org/wikipedia/commons/8/8f/Hubbert_peak_oil_plot.svg License:

CC BY 2.5 Contributors: Transferred from en.wikipedia; transfered to Commons by User:Pline using CommonsHelper. Original artist:

Original uploader was Hankwang at en.wikipedia

File:PPF_expansion.svg Source: http://upload.wikimedia.org/wikipedia/commons/e/ef/PPF_expansion.svg License: CC-BY-SA-3.0

Contributors:

Production_Possibilities_Frontier_Curve.svg Original artist: Production_Possibilities_Frontier_Curve.svg: User:Everlong

11.3

Content license

15

File:Unbalanced_scales.svg Source: http://upload.wikimedia.org/wikipedia/commons/f/fe/Unbalanced_scales.svg License: Public domain Contributors: ? Original artist: ?

File:WeltBIPWorldgroupOECDengl.PNG

Source:

http://upload.wikimedia.org/wikipedia/commons/4/45/

WeltBIPWorldgroupOECDengl.PNG License: CC BY-SA 3.0 Contributors: Own work Original artist: Alex1011

11.3

Content license

Creative Commons Attribution-Share Alike 3.0

You might also like

- Basic Macroeconomic ConceptsDocument3 pagesBasic Macroeconomic ConceptsAlexanderNo ratings yet

- Monetary PolicyDocument31 pagesMonetary Policyapi-3748231100% (1)

- Does Monetary Policy Influence EconomicDocument12 pagesDoes Monetary Policy Influence Economicixora indah tinovaNo ratings yet

- Economic GrowthDocument28 pagesEconomic GrowthGrachel Gabrielle EnriquezNo ratings yet

- Macro Lecture ch16 Fiscal and Monetary PolicyDocument33 pagesMacro Lecture ch16 Fiscal and Monetary PolicyKatherine Sauer100% (1)

- Economic Growth and DevelopmentDocument1 pageEconomic Growth and DevelopmentJESSICA100% (5)

- 1 Advanced Microeconomic Theory 3rd Ed. JEHLE RENYDocument673 pages1 Advanced Microeconomic Theory 3rd Ed. JEHLE RENYKushal DNo ratings yet

- Inflation and Economic Growth in MalaysiaDocument20 pagesInflation and Economic Growth in MalaysiaNurulSyahidaHassanNo ratings yet

- Macroeconomic Theory and PolicyDocument320 pagesMacroeconomic Theory and Policymriley@gmail.com100% (17)

- The Simple Multiplier ModelDocument9 pagesThe Simple Multiplier ModelInderpreet Singh SainiNo ratings yet

- Monetary Policy of PakistanDocument25 pagesMonetary Policy of PakistanAli JumaniNo ratings yet

- Development EconomicsDocument11 pagesDevelopment EconomicsNikki Jean HonaNo ratings yet

- Introduction of Economic SystemDocument11 pagesIntroduction of Economic SystemPruthviraj Rathore100% (1)

- Rostow ModelDocument4 pagesRostow ModeltubenaweambroseNo ratings yet

- Theories of Economic Development and GrowthDocument5 pagesTheories of Economic Development and GrowthFatima Erica I. Datumanguda100% (1)

- The New Theory of Economic Growth: Endogenous Growth ModelDocument4 pagesThe New Theory of Economic Growth: Endogenous Growth ModelinventionjournalsNo ratings yet

- Difference Between Economic Development and Economic GrowthDocument22 pagesDifference Between Economic Development and Economic GrowthPaaforiNo ratings yet

- Macroeconomic Theories of Inflation PDFDocument4 pagesMacroeconomic Theories of Inflation PDFBushra Nauman100% (1)

- Intermediate Macro Economics - Assignment 1 PDFDocument12 pagesIntermediate Macro Economics - Assignment 1 PDFTriple HNo ratings yet

- Public Choice and The Political Process - CHAPTER 5Document13 pagesPublic Choice and The Political Process - CHAPTER 5Armand RoblesNo ratings yet

- Solow ModelDocument12 pagesSolow ModelManuGuptaNo ratings yet

- Economic Development Vs Economic GrowthDocument2 pagesEconomic Development Vs Economic GrowthLeslee Ruth CanonoyNo ratings yet

- Monetarists Vs Rational E, PresentationDocument34 pagesMonetarists Vs Rational E, PresentationTinotenda Dube100% (2)

- Phyllis Deane - The Evolution of Economic Ideas (Livro) PDFDocument253 pagesPhyllis Deane - The Evolution of Economic Ideas (Livro) PDFpkandradeNo ratings yet

- Economics of Welfare Lecture NotesDocument54 pagesEconomics of Welfare Lecture NotesAbhi Bhardwaj100% (1)

- Exam Prep for:: Introduction to Game Theory in Business and EconomicsFrom EverandExam Prep for:: Introduction to Game Theory in Business and EconomicsNo ratings yet

- Foreign Aid and Its Impact On Income Inequality Muhammad ShafiullahDocument15 pagesForeign Aid and Its Impact On Income Inequality Muhammad ShafiullahAdnan KabirNo ratings yet

- Gravity Model For SpainDocument35 pagesGravity Model For SpainMarco TagliabueNo ratings yet

- Fiscal PolicyDocument23 pagesFiscal Policyapi-376184490% (10)

- International Economics ExplainedDocument82 pagesInternational Economics ExplainedS. Shanmugasundaram100% (1)

- Chapter 1 Introducing Economic DevelopmentDocument17 pagesChapter 1 Introducing Economic DevelopmentRuthchell Ciriaco100% (1)

- Role of Moenetary and Fiscal Policies in Economic DevelopmentDocument16 pagesRole of Moenetary and Fiscal Policies in Economic Developmentprof_akvchary85% (13)

- Market Failure & Role of RegulationDocument38 pagesMarket Failure & Role of Regulationanand agrawalNo ratings yet

- Differences Between Economic Growth and Economic DevelopmentDocument7 pagesDifferences Between Economic Growth and Economic DevelopmentGizem ÖzçelikNo ratings yet

- Umer Mid EcoDocument4 pagesUmer Mid EcoMalik NoraizNo ratings yet

- Muhammad Danish Dar (9182024) (BBA-4C Evening) (Assignment 2)Document8 pagesMuhammad Danish Dar (9182024) (BBA-4C Evening) (Assignment 2)Danish DarNo ratings yet

- Chapter 18 Economic GrowthDocument50 pagesChapter 18 Economic GrowthJemimah Rejoice LuangoNo ratings yet

- CH28 - EconomicsDocument20 pagesCH28 - EconomicsrojascollegeemailNo ratings yet

- EconomicsDocument40 pagesEconomicsUmesh KumarNo ratings yet

- Long-Run Economic Growth: Sources and Policies: Chapter Summary and Learning ObjectivesDocument25 pagesLong-Run Economic Growth: Sources and Policies: Chapter Summary and Learning Objectivesvivianguo23No ratings yet

- Economic Function of Government - Presentation Transcript: Business-To-Government (B2G) Is A Derivative ofDocument20 pagesEconomic Function of Government - Presentation Transcript: Business-To-Government (B2G) Is A Derivative ofaditibrijptlNo ratings yet

- Macro Economics (Fwa Lina Fenny)Document12 pagesMacro Economics (Fwa Lina Fenny)LinaNo ratings yet

- Chapter 29Document26 pagesChapter 29ENG ZI QINGNo ratings yet

- Economic Growth and DevelopmentDocument16 pagesEconomic Growth and DevelopmentShahrukhKhanNo ratings yet

- Economic GrowthDocument8 pagesEconomic Growthhilary bassaraghNo ratings yet

- Economic GrowthDocument12 pagesEconomic GrowthBoubakar AtmaneNo ratings yet

- The Growth Theories: Prepared By: Mary Jane Araos Erlyn Garcia Mary Grace Latorre Trisha Anne OlivaDocument60 pagesThe Growth Theories: Prepared By: Mary Jane Araos Erlyn Garcia Mary Grace Latorre Trisha Anne OlivaJennifer Dela RosaNo ratings yet

- Household Responsibility System. The System Can Be Divided Into 3Document4 pagesHousehold Responsibility System. The System Can Be Divided Into 3Fong Kah YanNo ratings yet

- Unit IDocument10 pagesUnit Ithanigaivelu4No ratings yet

- Industrialization Entails A Transformation in Humankind and Explains The Differences inDocument14 pagesIndustrialization Entails A Transformation in Humankind and Explains The Differences inhabtamuNo ratings yet

- How the Industrial Revolution Shaped Modern StatesDocument35 pagesHow the Industrial Revolution Shaped Modern States18038 ARUNJEET SINGHNo ratings yet

- The Impact of Environmental Pollution To Economic GrowthDocument20 pagesThe Impact of Environmental Pollution To Economic GrowthDrogNo ratings yet

- Economic Growth & Development StructureDocument33 pagesEconomic Growth & Development Structuremusinguzi francisNo ratings yet

- Chapter-IV Structural Change in Indian EconomyDocument40 pagesChapter-IV Structural Change in Indian Economybindeshwari vermaNo ratings yet

- BE NotesDocument9 pagesBE Notesroshantwenty10No ratings yet

- Economics 19e ch1 and CH 19 NotesDocument7 pagesEconomics 19e ch1 and CH 19 NotesUntzzerNo ratings yet

- Topic2 GlobalizationDocument20 pagesTopic2 GlobalizationVikram7181No ratings yet

- ECONOMIC DEVELOPMENT AND GROWTHDocument5 pagesECONOMIC DEVELOPMENT AND GROWTHHammad AhmadNo ratings yet

- Eco AssignmentDocument3 pagesEco AssignmentSaad KhanNo ratings yet

- BeeswaxDocument7 pagesBeeswaxApollon PheboNo ratings yet

- BeekeepingDocument17 pagesBeekeepingApollon Phebo0% (1)

- Lorenz CurveDocument5 pagesLorenz CurveApollon PheboNo ratings yet

- PovertyDocument25 pagesPovertyApollon Phebo100% (1)

- InflationDocument16 pagesInflationApollon PheboNo ratings yet

- Burkina Faso: A Brief HistoryDocument18 pagesBurkina Faso: A Brief HistoryApollon PheboNo ratings yet

- Papua New GuineaDocument20 pagesPapua New GuineaApollon Phebo100% (1)

- List of Countries by GDP (PPP)Document24 pagesList of Countries by GDP (PPP)Apollon PheboNo ratings yet

- Agricultural Labor Conceptual ClarityDocument49 pagesAgricultural Labor Conceptual Clarityammu arellaNo ratings yet

- U.S. Individual Income Tax Return: (See Instructions.)Document2 pagesU.S. Individual Income Tax Return: (See Instructions.)Daniel RamirezNo ratings yet

- Lecture 1 and 2 SlidesDocument23 pagesLecture 1 and 2 SlidesKINZA ASHRAFNo ratings yet

- Minsola vs. New CityDocument12 pagesMinsola vs. New CityruelNo ratings yet

- NAR Casino ResearchDocument21 pagesNAR Casino ResearchMassLiveNo ratings yet

- Chapter One: The History of I/O PsychologyDocument17 pagesChapter One: The History of I/O PsychologySherif ShamsNo ratings yet