Professional Documents

Culture Documents

Cao 6-2014

Uploaded by

attyGez0 ratings0% found this document useful (0 votes)

516 views3 pagesCAO 6-2014

Original Title

CAO 6-2014

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCAO 6-2014

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

516 views3 pagesCao 6-2014

Uploaded by

attyGezCAO 6-2014

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

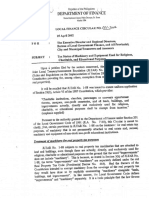

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE,

BUREAU OF CUSTOMS

MANILA 1099

CUSTOMS ADMINISTRATIVE ORDER

NO_ OG _-2014

SUBJECT: Guidelines on the Imposition of Surcharge under Section 2503 of the Tariff

and Customs Code, as amended)

1. Repealing Clause

Customs Administrative Order 01-2014, Sections 2-6 are repealed and replaced by this

‘Customs Administrative Order.

2. Amount of Surcharge

The Collector of Customs shall impose the surcharge in Section 2503 of the TCCP in

accordance with the following:

a. For Misclassification.

‘Where the percentage difference in misclassification is ten per cent (10%) or more

the amount of surcharge shall be as follows:

i, When the percentage difference is ten per cent (10%) or more but not

exceeding twenty per cent (20%), a one time surcharge of the difference in

customs duty shall be imposed.

ii, When the percentage difference exceeds twenty per cent (20%) a two

times surcharge of the difference in customs duty shall be imposed.

b. For Undervaluation, Misdeclaration in Weight, Measurement or Quantity

‘When the percentage difference in undervaluation/misdeclaration in weight,

measurement or quantity is ten per cent (10%) or more, but not exceeding thirty

per cent (30%), a surcharge of two times of the difference in customs duty shall be

imposed.

An undervaluation, misdeclaration in weight, measurement or quantity of more

than thirty percent (30%) between the value, weight, measurement or quantity

declared in the entry, and the actual value, weight, measurement or quantity shall

constitute a prima facie evidence of fraud penalized through seizure proceedings

under Section 2530 of the TCP."

CAO 6- 204 P-2

3. Determination of Percentage Difference in Undervaluation, Misclassification and

Misdeclaration

For purposes of determining the amount of surcharge due to undervaluation,

isclassification and misdeclaration, the computation of the percentage difference shall

be in accordance with following:

a. Undervaluation

The percentage difference in undervaluation shall be determined using this formula:

duty using valuation as found — duty using valuation as declared

duty using valuation as found

b. Misclassification

The percentage difference in misclassification shall be determined using this

formula:

duty using classification as found — duty using classification as declared

duty using classification as found

. Misdeclaration in weight, measurement or quantity

‘The percentage difference in misdeclaration shall be determined using this formula:

uy sing weight measurement or quantity a5 found ~ uty sing weight measurement or quany a deca

duty sing weight mesnurementor quantity 35 ound

4, Mandatory Imposition of Surcharge

Imposition of surcharge under Section 2503, TCCP is mandatory except in following,

cases:

a. For Misclassitic

When the entered tariff classification is based on an advance tariff classification

ruling issued by the Tariff Commission pursuant to its authority under Section 1313-a

of the TCCP which had not been reversed by the Secretary of Finance as of the time

of the entry of such tariff classification, but which is subsequently reversed by the

Secretary of Finance at any time between the time the tariff classification was entered

but before final liquidation of the import.

b, For Errors, under certain circumstances

When the undervaluation, misclassification, and misdeclaration in entry described

under Section 2503 of the TCP is:

CAO 6-204 p-3

i. Discovered before any payments are made on the entry; and

ii, The result of either of the followin,

a. Manifest clerical error made in an invoice or entry

'b, Error in return of weight, measure, or gauge, duly certified to under

penalties of falsification or perjury by the surveyor or examini

official (When there are such officials at the port)

¢. An error in the distribution of charges on invoices not involving any

‘question of law, certified to under penalties of falsification or perjury

by the surveyor or examining official

5. Surcharges Not Subject to Compromise

‘The imposition of surcharge under Section 2503 of the TCCP, as amended, may not be

subject of compromise under Section 2316 of the TCCP. Surcharge properly imposed

cannot be waived. Good faith on the part of the importer is not a valid defense.

6. Effectivity

This Order shall take effect immediately upon publication in a newspaper of general

circulation or Official Gazette and three (3) copies deposited to the UP Law Center.

(WL Ea

John P. Sevilla Cesar VW’ Purisima

Commissioner Secretary of Finance

@ sivian

snot 024077

ocr?

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- DOF Local Finance Circular No 001-2002Document4 pagesDOF Local Finance Circular No 001-2002attyGezNo ratings yet

- ASEAN Trade in Goods Agreement (ATIGA)Document6 pagesASEAN Trade in Goods Agreement (ATIGA)attyGez100% (2)

- Rigor v. RosalesDocument6 pagesRigor v. RosalesattyGezNo ratings yet

- Transglobe International, Inc.,V. Court of AppealsDocument6 pagesTransglobe International, Inc.,V. Court of AppealsattyGezNo ratings yet

- RMO No. 8-2017Document5 pagesRMO No. 8-2017attyGezNo ratings yet

- Taxation Law 2006Document4 pagesTaxation Law 2006attyGezNo ratings yet

- People v. ChuaDocument6 pagesPeople v. ChuaattyGezNo ratings yet

- Civil Law Bar Question 2014Document8 pagesCivil Law Bar Question 2014Raziel BocitaNo ratings yet

- Datuman v. First CosmopolitanDocument11 pagesDatuman v. First CosmopolitanattyGezNo ratings yet

- People v. PanisDocument3 pagesPeople v. PanisattyGezNo ratings yet

- Yap v. ThenamarisDocument8 pagesYap v. ThenamarisattyGezNo ratings yet

- Trans Action v. DOLEDocument6 pagesTrans Action v. DOLEattyGezNo ratings yet

- Republic v. Principalia ManagementDocument8 pagesRepublic v. Principalia ManagementattyGezNo ratings yet

- People v. GalloDocument14 pagesPeople v. GalloattyGezNo ratings yet

- Special Leave Benefits DOLE - AmendedDocument5 pagesSpecial Leave Benefits DOLE - Amendederks1219No ratings yet

- DO 143-15 Guidelines Governing Exemption of Establishments From Setting Ip Workplace Lactation StationsDocument8 pagesDO 143-15 Guidelines Governing Exemption of Establishments From Setting Ip Workplace Lactation StationsKirk BejasaNo ratings yet

- Cao 4-2004Document21 pagesCao 4-2004Philip Harold Tolentino100% (4)

- Tanada Vs TuveraDocument5 pagesTanada Vs TuveraSharon Padaoan RuedasNo ratings yet

- 2014 Bar Commercial Law PDFDocument14 pages2014 Bar Commercial Law PDFMarco Angelo BalleserNo ratings yet

- Procedure Anti-Dumping Duty 20 Nov. 2014Document4 pagesProcedure Anti-Dumping Duty 20 Nov. 2014attyGezNo ratings yet

- People v. ChuaDocument6 pagesPeople v. ChuaattyGezNo ratings yet

- Civil Law Bar Question 2014Document8 pagesCivil Law Bar Question 2014Raziel BocitaNo ratings yet

- 03 - Sulo NG Bayan vs. Araneta PDFDocument5 pages03 - Sulo NG Bayan vs. Araneta PDFattyGezNo ratings yet

- Manila International Airport Authority Vs CA - 495 SCRA 591Document62 pagesManila International Airport Authority Vs CA - 495 SCRA 591westernwound82No ratings yet

- Concept BuildersDocument4 pagesConcept Buildersherbs22221473No ratings yet

- 05 - Luxuria Homes vs. CADocument7 pages05 - Luxuria Homes vs. CAattyGezNo ratings yet

- 04 - Bataan Shipyard vs. PCGG PDFDocument50 pages04 - Bataan Shipyard vs. PCGG PDFattyGezNo ratings yet

- 02 - Magsaysay-Labrador vs. CA PDFDocument4 pages02 - Magsaysay-Labrador vs. CA PDFattyGezNo ratings yet