Professional Documents

Culture Documents

Sibar Funds Flow State

Uploaded by

Anonymous 22GBLsme1Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sibar Funds Flow State

Uploaded by

Anonymous 22GBLsme1Copyright:

Available Formats

A Study on Funds Flow Analysis

1.1 INTRODUCTION

Finance is one the basic foundations of all kinds of economic activities. It is

the master key, which provides access to all the sources for being employed in

manufacturing. Hence it is rightly said that finance is lifeblood of any enterprise,

besides being the scarcest elements, it is also the most indispensable requirement.

Without finance neither any business can be started nor successfully run. Provision of

sufficient funds at the required time is the key to success of concern. As matter of fact

finance may be said to be the circulatory system of economic body, making possible

the needed co-operation among many units of the activity.

FINANCIAL MANAGEMENT:

Financial management emerged as a distinct field of study at the turn of this

Century. Many eminent persons defined it in the following ways.

DEFINITIONS:

According to GUTHMANN AND DOUGHAL: Business finance can broadly

be defined as the activity concerned with planning, rising, controlling and

administering of funds used in the business.

According to BONNEVILE AND DEWEY: Financing consists in the rising,

providing and managing of all the money, capital or funds of any kind to be used in

connection with the business.

According to Prof. EZRA SOLOMAN: Financial management is concerned

with the efficient use of any important economic resource, namely capital funds.

BES Group of Institutions (GVIC)Angallu

A Study on Funds Flow Analysis

FINANCIAL FUNCTIONS:

The finance functions of raising funds, investing them in assets and

distributing returns earned from assets to shareholders are respectively known as

financing, investment and dividend decisions. While performing these functions, a

firm attempts to balance cash inflows and outflows. This is called as liquidity

decision.

The finance functions can be divided into four broad categories.

1. Investment or long-term asset mix decision

2. Financing or capital mix decision

3. Dividend or profit allocation decision

4. Liquidity or short-term asset mix decision

INVESTMENT DECISION:

Investment or capital budgeting involves the decisions of allocation of cash or

commitment of funds to long-term assets, which would yield benefits in future. It

involves measurement of future profitability, which involves risk, because of

uncertain future. Investment proposal should therefore be evaluated in terms of both

expected return and risk. Other major aspect of investment decision is the

measurement of standard or hurdle rate against which the expected return of new

investment can be compared.

FINANCING DECISIONS:

Financing decision is the second important function to be performed by the fir.

Broadly, he must decide when, where, and how to acquire funds to meet the firms

investment needs. He has to determine the proportion of debt and equity. This mix of

debt and equity is known as the firms capital structure. The financial manager must

strive to obtain the least financing mix or the optimum capital structure where the

market value of share is maximized.

BES Group of Institutions (GVIC)Angallu

A Study on Funds Flow Analysis

DIVIDEND DECISIONS:

It is the third major financial decision. The financial manager decides whether

the firm should distribute all profits, or return them, or distribute a portion and return

the balance. The optimum dividend policy should be determined where is maximizes

the markets value of the share.

LIQUIDITY DECISIONS:

Current assets management, which affects firms liquidity, is yet another

finance function in addition to the management of long-term assets. Current assets

should be managed effectively safeguarding the firm against the dangers of liquidity

and insolvency.

Investment in current assets affects the profitability, liquidity, and risk. A

conflict exists between profitability and liquidity while managing current assets. If the

firm doesnt invest sufficient funds in current assets it may. Become illiquid. But it

could loose profitability, as idle CA would not earn anything. Thus a proper takeoff

must be achieved between profitability and liquidity. In order to ensure that neither

insufficient nor unnecessary funds are invested in current assets.

BES Group of Institutions (GVIC)Angallu

A Study on Funds Flow Analysis

GOALS OF FINANCIAL MANAGEMENT:

Maximize the value of the firm to its equity shareholders. This means that

the Goals of the firm should be to maximize the market value of its

equity shares (Which represent the value of the firm to its equity

shareholders)

Maximization of profit.

Maximization of earnings per share.

Maximization of return on equity (defined as equity earnings/net worth).

Maintenance of liquid assets in the firm.

Ensuring maximum operational efficiency through planning,

directing and Controlling of the utilization of the funds i.e., through the

effective employment of funds.

Enforcing financial discipline in the use of financial resources

through the coordination of the operation of the various divisions in the

organization.

Building up of adequate reserves for financing growth and

expansion.

Ensuring a fair return to the shareholders on their investment.

BES Group of Institutions (GVIC)Angallu

A Study on Funds Flow Analysis

1.2 INDUSTRY PROFILE

The present automobiles are most sophisticate combining luxury, safety

economy in utilizing the energy resource with great speed and least environment.

Pollution

using various field of science likes aerodynamics, mechanical expertise

and electrical engineering. Every day improvement in the existing models holding the

price line in reasonable range involving high become necessity.

Present day

consumer satisfaction involves great skill in marketing, advertising and positioning

the product line whim and Cashion advances with increased performance and reduce

size. Business minded people started selling them top the society.

The automotive components and ancillary industry I Indian has made big

strides in last couple of year following of the phased manufacturing programmer for

his main product. With the launching of a major modernization scheme by the

manufactures, substantial progress has been made towards indigenization of the auto

components and spare parts.

AUTOMOBILE

2 WHEELER

3 WHEELER

I.C.V.

MOTORCYCLE

SCOOTERS

BES Group of Institutions (GVIC)Angallu

PASSENGER

VEHICLE

M.C.V.

SCOOTERETTES

COMMERCIAL

VEHICLE

H.C.V.

MOPEDS

A Study on Funds Flow Analysis

COMMERCIAL

TATA MOTORS, ASHOK LEYLAND, SWARAJ

VEHICLES

MAZDA,MAHINDRA & MAHINDRA ,FORCE MOTORS,

PASSENGER

EICHER MOTORS

TATA MOTORS, MARUTI UDYOG, HONDA MOTORS, TOYATA,

VEHICLE

SKODA, MAHINDRA & MAHINDRA, DAIMLER CHRYSLER,

TWO WHEELER

HINDUSTAN MOTORS

HERO HONDA, BAJAJ AUTO, HONDA MOTORS, TVS

THREE WHEELER

MOTORS, YAMAHA , KINETIC MOTORS

BAJAJ AUTO, PIAGGIO INDIA

RAW MATERIALS

Most of the raw materials to manufacture cylinder blocks are available from

Hyderabad, Chennai and Calcutta. The following are some of the raw materials used

for the production:

Aluminum Alloy

Caustic Soda

Shell Sand

LDO oil

Chromic Acid

Diamond Honing sticks

Nickel Carbonate

1.3 COMPANY PROFILE

M/S SIBAR AUTOPARTS Ltd. Was originally incorporated as private limited

company by name M/s SIBAR AUTOPARTS (PVT) Limited in the year 1983,

located at industrial estate, TIRUPATHI.

BES Group of Institutions (GVIC)Angallu

It was converted into public limited

6

A Study on Funds Flow Analysis

company in the year 1994. The company is presently engaged in manufacturing and

marketing of aluminum hard chrome plated cylinder kits mainly for the two wheelers

up to engine capacity 150cc.

The company had started o aluminum foundry with a small capital of Rs.3.00

lacks to manufacture aluminum alloy casting. The castings were supplied to reputed

establishments viz., TVS, SHKNEY PARIS ROHME LTD etc. In the year 1987, the

company expanded its activity to achieve the original conceived idea of

manufacturing aluminum hard chrome plated cylinders blocks for two wheelers

applications. The entire technology development was started by in-house R&D skills

and in the course of time the technology was developed with the in-house R&Ds

network, the quality of the product was found very good land it was accepted in the

European market immediately. The company was reached about 272 lacks worth of

exports and the company also received MERIT AWARD FRO EXPORT

PROMOTION COUNCIL for EXCELLENCE in exports during the year 1994-95

and in the same year the company had come out with a public issue and it was over

subscribed by 18 times which only shows the companys credibility among the

investors. The company has become public since then and company started

developing

the

cylinders

for

domestic

ORIGINAL

EQUOPMENT

(OE)

manufactories. In the process the company has developed various modals of Asias

biggest two wheeler manufacture like M/S BAJAJ AUTO Ltd, M/S HERO MOTORS

Ltd, and M/S ENFIELD INDIA Ltd, etc. from a turnover of approximately Rs.190

lacks in the year 1993-94 the company achieved Rs.843 lacks turnover in the year

1996-97. Besides serving these OEMS in India, the company is still in the over seas

market with a very good network. The technology developed by the company is

UNIQUE.

BES Group of Institutions (GVIC)Angallu

A Study on Funds Flow Analysis

1.4 PRODUCT PROFILE

In India automobile engine cylinders are predominantly of cast iron or of

aluminum with cast iron sleeves whereas world wide there is a growing shift to

aluminum allay cylinders and engine blocks.

Aluminum cylinders with hard chrome plating reduce engine weight

significantly. Also the wear and tear the piston bore is reduced drastically because

cylinders have about 900 Vickers hardness, consequently giving better mileage and

fuel efficiency.

Unlike aluminum with cast iron sleeves hard chrome plated aluminum

cylinders are of uniform material and provides excellent heat dissipation. Further

very close clearance is possible between bore and piston for optimal engine power out

put without fear of seizure at higher temperature. Aluminum chrome plated cylinders

also consume less oil than cast iron cylinders and hence are less polluting and cheaper

to maintain.

PROMOTERS:

The founder of this company is Mr. P.V.NARAYANA who is now as vice

chairman and managing director. He completed his company diploma in Mechanical

Engineering and completed his Training tool and Die making from NTTF, Dharwada.

After attaining 8 years of experience in reputed companies like M/s Suvega Moped

Ltd, M/s HERO Megistic Ltd, And And etc and setup this unit.

Now this company is also supported with to young men who are the sons of

vice chairman and managing director. Mr.Madhu Pratap, now as the directorTechnical completed his graduation in Mechanical Engineering, and Post graduation

in Industrial.

Engineering and Management. Mr.Ravichandra, now as Executive director,

completed his graduation in chemical Engineering.

BES Group of Institutions (GVIC)Angallu

A Study on Funds Flow Analysis

TECHNOLOGY:

The company started hard-chrome plating technology with in house research

and development efforts. The company also developed NI-SI plating. In 1998 the

company had entered technical collaboration with Italian company to refine its

technology. Ours is the first company in India to this technology.

MANUFACTURING PROCESS:

The manufacturing process broadly consists of shell molding, die casting

machining heat treatment, chrome platting, inspecting, packing and dispatch. The

sand shell core and first made using shell core shooting machine, having a capacity of

making 500nos. Modules/shift. The shells are then housed in the dies. Aluminum

LM-13 grade alloy, melted in bate-out titling furnace, are then transferred to an

electrical holding furnace, where the melt is and treated with necessary chemicals.

The molten metal held in the holding furnace for around 4 hrs is cast is then used for

making casting by using permanent would gravity dies or low pressure die- casting.

After atmospheric cooling (times 3 hours) the casting is sawed. Fettling of the

casting is then done to remove the flashes. The casting is then heat treated in a pit

furnace (temp 510 c for 3 hours) quenched in the water (temp 60 c ) and aged for 2

hours in oven at 200 c _250 c for stabilization of the micro structural properties of the

casting. The rough casting is then machine and made ready for hard chrome platting.

The casting is then degreased using tri-chloreothylene and then chromo- plated. The

hard chrome plated cylinder are further machine is sophisticated machine and tested

with measuring instruments. These operations are very critical and having very close

tolerance those are subsequently sent to AC room plated kit there in Ac room and

bore measurement is recorded are a temperature of 20c.

BES Group of Institutions (GVIC)Angallu

A Study on Funds Flow Analysis

ADVANTAGES OF SIBER ALUMINUM HARD CHROME

CYLINDERS:

1.

The life of the aluminum cylinder block is much longer than conventional

cast iron cylinder blocks. This is due to higher hardness in aluminum

cylinder block because the bore is plated with hard chrome/nickel. Since

the hardness much higher, the wear pattern of the bore is also much less.

2.

Since the aluminum is a light metal, the fuel efficiency is also better.

3.

Since both piton and cylinder block are of the same material, the

expansion is uniform, with will be an added advantage.

4.

Since the bore is finished with nickel, the ratio if oil is use may also be

comparatively less. This helps to maintain very low emission.

5.

Since the wear pattern of the cylinder bore is very less, the cost of

maintains is very negligible.

6.

Better eye-appeal.

7.

There is no need to see bore up to 60,000 kms.

8.

Replacing rings easy at nominal cost.

9.

60% reduction in engine weight.

10.

More economical.

11.

None to beat price.

12.

Ready availability of spares with leading two wheeler dealer through our

distributor.

CUSTOMER:

Automotive item O.E.M Customer for casting:

1.

M/S greaves cotton ltd-RANIPET.

2.

M/S Greaves cotton ltd- AURANGABAD.

3.

M/S Same Deutz- FAHRINDIA (P) LTD RANIPET

4.

ALKRAFT THERMOTECHNOLOGIES PVT.LTD. CHENNAI (Is 90012000 certified unit)

BES Group of Institutions (GVIC)Angallu

10

A Study on Funds Flow Analysis

Auto Motive Item O.E.M (INDIA) Customer For Cylinder Blocks:

1.

M/S BAJAJ AUTO LTD. PUNE.

2.

M/S HERO MOTORS LTD- GAZIABAD.

Auto Motive Item O.E.M (Exports) Customer for Cylinder Blocks:

1.

M/S Electrolux, Meculloch- TALIANA, ITALY,

2.

We have replacement market in EUROPE and we supply to ITALY,

NETHERLANDS, and DENMARK etc.

Electrical Transmission Line Item and other are casting Customer:

1.

M/S GR power switches Gear Limited HYDERABED. (ISI 9001 certified

unit)

2.

M/S KLEMMEN engineering corporation CHENNAI.

3.

M/S SEIMENS LIMITED (Hyderabad works) Hyderabad (under process)

ACHIEVEMENTS

The Company always maintained status of single source supplier with

all its customers.

Its customers by serving then quality products

delivery scheduled without interception of their production.

The company was success full in giving satisfied results of VRDE

(Vehicle Research Development Estate) for their simulation air crafts

engines both hard chrome and NI-SI PLATING.

The company also satisfied NAL (National aeronautical Ltd)

Bangalore by giving them NI-SI plating on propeller shaft ring.

The company was awarded Merit of Excellence in Exports from

Promotion Council in India.The company has been awarded ISO

9001-2000 quality management system (Under clause 7 permissible

exclusion: 7.3).

BES Group of Institutions (GVIC)Angallu

11

A Study on Funds Flow Analysis

2. REVIEW OF LITERATURE

ANALYSIS OF FUNDS FLOW STATEMENT

The statement of changes in financial position, prepared to determine only the

sources and uses of working capital between dates of two balance sheets, is known as

the funds flow statement. Working capital is defined as the difference. Between

current assets and current liabilities. Working capital determines the liquidity position

of the firm.

The balance sheet presents a snapshot picture of the financial position at a given

point of the financial position at a given point of time and the income statement shows

a summary of revenues and expenses during the accounting period. The funds flow

statement, also referred to as the statement of changes in financial position or the

statement of changes in financial position or the statement of sources and uses of

funds.

Funds flow analysis provides insight into the movement of funds and helps in

understanding the changes in the structure of assets, liabilities and owners equity.

Funds-Flow statement is a widely used tool in the hands of financial executives for

analyzing the financial performance of a concern. Good concerns always prepare such

statement along with the balance sheet At the end of the year. This statement shows

how the activities of a business have been used during a particular period. The

statement of sources and application of funds serves the purpose.

FUNDS FLOW STATEMENT

INTRODUCTION

The basic financial statements i.e., the Balance Sheet and Profit & Loss A/c or

income statement of business reveals the net effect of various transactions on

operational and financial position of the company. The balance sheet gives a summary

of the assets and liabilities of an undertaking at a particular point of time.

There are many transactions that take place in an undertaking and which do

not operate Profit and Loss A/c. Thus another statement has to be prepared to show

the change in Assets and Liabilities from the end of one period of time to the end of

another period of time. The statement is called a statement of changes in financial

position or a Funds Flow statement.

BES Group of Institutions (GVIC)Angallu

12

A Study on Funds Flow Analysis

The funds flow statement is a statement which shown the movement of funds

and is a report of financial operations of business undertaking. In simple words it is a

statement of source and application of funds.

Definition of funds flow statement:

The funds flow statement is not a statement of financial position but it is

instead a report on financial operations, changes flows or movements during the

period. - S.C. Kuchhal

The funds flow statement describes the sources from which additional

funds were derived and the uses to which these were put.- R.N. Anthony

A statement of sources and Applications of funds is a Technical

device designed to analyze the changes in the financial condition of a business

between two dates.-R.A. Foulk

It is a statement which highlights the underlying financial

movements and explains the changes of working capital from one point of time to

another. Bierman

MEANING & CONCEPT OF FLOW OF FUNDS

The term flow means movement & includes both "inflow' & 'outflow'. The term

flow of funds means transfer of economic values from one asset of equity to another.

Flow of funds is said to have taken place when any transaction makes changes in

amount of funds available before happening of transactions. If the effect of transaction

results in increase of funds. It is called a "source of funds" and it is results in decrease

of funds, it is known as an application of funds

RULES

The flow of funds occurs when a transaction changes on one hand a noncurrent A/c and on the other a current A/c and Vice-versa. According to working

capita concept of funds the term "Flow o Funds" return to movement of funds in

working capital.

If any transaction results in increase in working capital. It is said to be a

"source" or "inflow of funds" and if it results in decrease of working capital, it is said

to be "application" or "out flow of funds".

BES Group of Institutions (GVIC)Angallu

13

A Study on Funds Flow Analysis

BES Group of Institutions (GVIC)Angallu

14

A Study on Funds Flow Analysis

CURRENT ASSETS

Current Assets are those assets, which in the ordinary course of business can

be or will be converted into cash within a short period of normally one accounting

year.

CURRENT LIABILITIES

Current liabilities are those liabilities which are intended to be paid in ordinary

course of business with in short period of normally one accounting year out of the

current assets or the income of the business.

DIFFERENCES

BETWEEN

CURRENT

LIABILITIES

&

CURRENT ASSETS

CURRENT LIABILITIES

1. Bills Payable

2. Sundry Creditors

3. Accrued O/s Expenses

4. Dividends Payable

5. Bank Overdraft

6. Short term loans, advances &

deposits

7. Provision for taxation

8. Proposed Dividend

BES Group of Institutions (GVIC)Angallu

CURRENT ASSETS

1. Cash in Hand

2. Cash at Bank

3. Bills Receivable

4. Sundry Debtors or A/cs receivable

5. Short term loans & advances

6. Short term investment

7. Inventories or stock

8. Prepaid Expenses

9. Accrued incomes.

15

A Study on Funds Flow Analysis

DIFFERENCE BETWWEN FUNDS FLOW STATEMENT &

CASH FLOWSTATEMENT

BASIS OF

FUNDS FLOW STATEMENT

CASH FLOW STATMENT

DIFFERENCE

1. Basis of concept

It is based on a wider concept of funds,

It is based on a narrower

2. Basis of Accounting

i.e., working capital.

It is based on accrual basis of

concept of funds, i.e., cash.

It is based on cash basis of

3. Schedule on

accounting

Schedule of changes in working capital

accounting.

No such Schedule of changes

changes in Working

is prepared to show the changes in

in working

capital

4. Method of

current assets and current liabilities.

Capital is prepared.

Funds flow statement reveals the It is prepared by classifying

preparing

sources and applications of funds. The all Cash inflows and outflows

net difference between sources and in

terror

applications of funds represent net investing

increase or decrease in working capital.

of

operating,

are

financing

activities. The net different

represents time net

Increase or Decrease in Cash

5. Basis of usefulness.

and cash equivalents.

It is useful in planning intermediate and It is more useful for shortlong term financing.

term

analysis

and

planning of the business

PROCEDURE FOR PREPARING A FUNDS FLOW STATEMENT

Funds flow Statement is a method by which we study changes in financial

position of business enterprise between beginning & ending financial statement dates.

BES Group of Institutions (GVIC)Angallu

16

cash

A Study on Funds Flow Analysis

Hence the funds flow statement is prepared by comparing two balance sheets and any

of such other information derived from the Accounts as may be needed

The preparation of funds flow statement consists of two parts.

A. Statement or schedule of changes in working capital.

B. Statement of sources & application of fund.

A.) STATEMENT OR SCHEDULE OF CHANGES IN W.C.

Working Capital means the excess of current assets over current liabilities.

Statement of changes in working capital is prepared to show the changes in

working capital between two balance sheet dates.

This statement is prepared with help of current assets and current liabilities derived

from two balance sheets

Working capital = Current Assets - Current Liabilities

An increase in current assets increases W.C.

A decrease in current assets decreases W.C.

An increase in current liabilities decreased W.C.

A decrease in current liabilities increases W.C.

As a separate activity & discipline it is of recent origin. It was a branch of

economics till 1890. Today financial management is recognized as the most important

branch of business administration.

Financial management may be defined as the part of management, which is

concerned mainly with raising funds in the most economic and suitable manner, using

these funds as possible planning future operations, and controlling current

performance and future development through financial accounting, cost accounting,

budgeting statistics and other means. It guides investment where opportunity is the

greatest production relatively uniform yard strikes judging most of the firms

operations and projects and is continually necessary for survival and attracting of new

capital.

According to Howard and Upyon, financial management involves the application

of general management principles to a particular operation.

BES Group of Institutions (GVIC)Angallu

17

A Study on Funds Flow Analysis

N.G.Wright says finance management is intimately itself woven into the fabric

of the management itself. Its central role is concerned with the some objectives as

these of the management which the way in which the resources of the business are

employed and how the business is finance. He divides financial management into

three main areas.

1. Decision on the structures,

2. Allocation of available funds to specific uses,

3. Analysis and appraised of problems.

Financial management includes planning of finance, cash budgets and sources

of finance. EZRA Solomon and John Piglet insists that financial management must

attend to investment decision because if these decision that affects in a large measure

the future of a firm major financial management is an operational function it is

involved with financial planning, forecasting and providing of finance as well as the

formation of financial policies.

Hunt William and Donald Son have called financial management as Resources

Management because in a large Organization, the finance managers are the members

of planning, organization, performing and controlling the financial affairs of the

enterprise. The financial management is of great importance in the present day

corporate world. It is the science of money, which permits the authorities to go

further.

BES Group of Institutions (GVIC)Angallu

18

A Study on Funds Flow Analysis

STATEMENT OF SCHEDULE OF CHANGES IN WORKING

CAPITAL

Particular

Current Assets:

Previous

Current

Year

Year

Amount

Amount

Effect on Working Capital

Increase

Amount

Decrease

Amount

(A)

Stock

xx

xx

xx

Debtors

xx

xx

xx

Cash

xx

xx

xx

Bank

xx

xx

xx

Bills receivable

xx

xx

xx

xxx

xxx

xx

xx

xx

xx

xx

xx

xx

xx

xx

xx

xxx

xxx

xx

xx

xxx

xxx

xxx

xx

Xxx

Prepaid expenses

Total(a)

Current Liabilities:

(B)

Creditors

Bills payable

Outstanding expenses

Total(b)

Working Capital(A-B)

Increase/decrease in

working

capital

Total

(B) STATEMENT OF SOURCES & APPLICATION OF FUNDS

BES Group of Institutions (GVIC)Angallu

19

A Study on Funds Flow Analysis

Funds flow statement is a statement, which indicates various sources from

which funds (W.C.) have been obtained during a certain period and uses or

applications to which these funds have been put during that period. Generally this

statement is prepared in two formats.

Statement of sources and application of funds:1. Funds from operations: It is an internal source of funds. Funds from

operations are to be calculated as per the method stated above.

2. Funds from long term loans:

Long term loans such as debentures,

borrowings from financial institutions will increase the working capital and

therefore, there will be inflow of funds. However, if the debentures have been

issued in consideration of some fixed assets, there will be no inflow of funds.

3. Sale of fixed assets: Sale of land, buildings, and long term investments will

result in generation of funds.

4. Funds from increase in share of capital: Issue of shares for cash or for any

other current asset or in discharge of a current liability is another source of

funds.

5. Decrease in working capital: Decrease in working capital is the result of

decrease in current asset or increase in current liabilities. In both the cases

inflow of funds takes place.

PROFORMA OF FUNDS FLOW STATEMENT

BES Group of Institutions (GVIC)Angallu

20

A Study on Funds Flow Analysis

Sources

Rs.

Applications

Rs.

Funds from operations

Xx

Funds lost in operations

Xx

Issue of share capital

Xx

Redemption of preference share

Xx

Issue of Debentures

Xx

Capital

Xx

Raising of long term loans

Xx

Redemption of debentures

Xx

Sale of non current (fixed) assets

Xx

Repayment of long term loan

Xx

Non-trading receipts such as

dividends

Xx

Purchase of long term

investments

Xx

Scale of long term investments

Xx

Non-trading payments

Xx

Net decrease in working capital

Xx

Payment of Dividends

Xx

Xx

Payment of Tax

Xx

Xx

Net increase in working capital

Xx

Xxx

Xxx

IMPORTANCE OF FUNDS FLOW STATEMENT:

BES Group of Institutions (GVIC)Angallu

21

A Study on Funds Flow Analysis

A funds statement is an essential tool for the financial analysis and primary

importance to the financial management. Nowadays, it is being widely used by the

financial analysts, credit granting institutions and financial managers. The basic

purpose of a funds flow statement is to reveal the changes in the working capital on

the two balance sheet dates. It is also describes the sources from which additional

working capital has been financed and the uses to which working capital has been

applied. Such a statement is particularly useful in assessing the growth of the firm, its

resulting financial needs and in determining the best way of financing these needs. By

making use of projected funds flow statements, the management can come to know

the adequacy or inadequacy of working capital evening advance. One can plan the

intermediate and long-term financing of the firm, repayment of long term debts,

expansion of the business, allocation of resources, etc. The significance or importance

of funds flow statement can be well followed from its various uses given below:

It helps in the analysis of financial operation:

The financial statements reveal the net effect of various transactions on the

operational and financial position of a concern. The balance sheet gives a static view

of the resources of a business and the uses to which these resources have been put at a

certain point of time. But it does not disclose the causes for changes in the assets and

liabilities between two different points of time. The funds flow statements explains

causes for such changes and also the effect of these changes on the liquidity position

of the company. Sometimes a concern may operate profitability and yet its cash

position may become more and worse. The funds flow statement gives a clear answer

to such a situation explaining what has happened to the profit of the firm.

It throws light on many perplexing questions of general interest:

BES Group of Institutions (GVIC)Angallu

22

A Study on Funds Flow Analysis

Which otherwise may be difficult to be answered. Such as:

a) Why were the net current assets lesser in spite of higher profits and

vice versa?

b) Why more dividends could not be declared in spite of available profits?

c) How was it possible to distribute more dividends than the present earnings?

d) What happened to the net profit? Where did they go?

e) What happened to the proceeds of sale of fixed assets or issue of shares,

debentures, etc.?

f) What are the sources of repayment of debt?

g) How was the increase in working capital financed and how will it be financed

to future?

IT HELPS

IN THE

FORMULATION

OF A REALISTIC

DIVIDEND POLICY:

Sometimes a firm has sufficient profits available for distribution as dividend

but yet it may not be advisable to distribute dividend for lack of liquid or cash

resources. In such cases, a funds flow statement helps in the formation of a realistic

dividend policy.

IT HELPS IN THE PROPER ALLOCATION OF RESOURCES:

The resources of a Spares are always limited and it wants to make the best use

of these resources. A projected funds flow statement constructed for the future helps

in making managerial decisions. The firm can plan the deployment of its resources

and allocate them among various applications.

IT ACTS AS A FUTURE GUIDE:

A projected funds flow statement also acts as a guide for future to the

management. The management can come to know the various problems it is going to

face in near future for want of funds. The firms future needs of funds can be projected

well in advance and also the turning of these needs. The firm can arrange to finance

these needs more effectively and avoid future problems.

IT HELPS IN APPRAISING THE USE OF WORKING CAPITAL:

BES Group of Institutions (GVIC)Angallu

23

A Study on Funds Flow Analysis

A funds flow statement helps in explaining how efficiently the management has

used its working capital and also suggest ways to improve working capital position of

the firm.

IT HELPS KNOWING THE OVERALL CREDITWORTHINESS

OF A FIRM:

The financial institutions and banks such as state financial institutions. Industrial

Development Corporation, industrial finance corporation of India, industrial

development bank of India, etc. all ask for funds flow statement constructed for a

number of years before granting loans to know the creditworthiness and paying

capacity of the firm. Hence, a firm seeking financial assistance from these institutions

has no alternative but to prepare funds flow statements.

BES Group of Institutions (GVIC)Angallu

24

A Study on Funds Flow Analysis

3.1 RESEARCH METHODOLOGY

Methodology is a systematic process of collecting information in order to

analyze and verifies a phenomenon. The collection of data is two principle sources.

They are discussed as

I. Primary Data

II. Secondary Data

PRIMARY DATA:

The primary data needed for the study is gathered through interview with

concerned officers and staff, either individually or collectively, sum of the information

has been verified or supplemented with personal observation conducting personal

interviews with concerned officers of finance department of SIBAR AUTOPARTS

LTD.,

SECONDARY DATA:

The secondary data needed for the study was collected from published sources

such as, pamphlets of annual reports, returns and internal records, reference from

Advance management text books and journal management.

BES Group of Institutions (GVIC)Angallu

25

A Study on Funds Flow Analysis

3.2 OBJECTIVES OF THE STUDY

To identify the sources and application of funds a study on Funds Flow

Statements at SIBAR AUTOPARTS LTD.,

To analyze the trend of net working capital that is being maintained by the firm

for period of 5 years.

To know and analyze the financial position of the SIBAR AUTOPARTS LTD.,

To know and analyze the Liquidity position of the SIBAR AUTOPARTS LTD.,

BES Group of Institutions (GVIC)Angallu

26

A Study on Funds Flow Analysis

3.3 SCOPE OF THE STUDY

In this study the financial performance of the spares under the study is done

from the angles Calculating funds from operation, maintaining of working

capital, sources and applications of the funds.

Financial analysis consists of funds flow analysis. To know funds flow from

one to one, as the time available is very limited and study is continued to over

all financial condition of a firm.

The study to know working capital increase or decrease, funds from operation,

source and application of funds

BES Group of Institutions (GVIC)Angallu

27

A Study on Funds Flow Analysis

3.4 LIMITATIONS OF THE STUDY

The present reported is based on the secondary data provided by the SIBAR

AUTOPARTS LTD.,

The source of the study is limited to 5 years from 2009-10 to 2013-14.

The analysis is based on the annual reports.

The liquidity position of Spares is very low.

BES Group of Institutions (GVIC)Angallu

28

A Study on Funds Flow Analysis

4. DATA ANALYSIS & INTERPRETATION

1. WORKING CAPITAL RATIO:

Effective working capital management depends on the systematic management

of the components of working capital .i.e., inventory, debtors, cash etc.

Working

capital ratio is the tool of the working capital management. It reflects the ability of

the Spares to pay the current obligations .

It calculated as

Working capital ratio = current assets/current liabilities

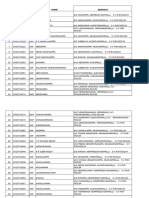

TABLE: 4.1

CURREN

C

YEAR

2009-10

2010-11

2011-12

2012-13

2013-14

CURRENT ASSETS

8,167.50

10,725.94

9,427.74

24,288.00

36,866

CURRENT

WORKING

LIABILITIES

3,509.59

3,922.4

5,388.52

22479.86

19,445.18

CAPITAL RATIO

2.32

2.73

1.74

1.08

1.89

Factors:

YEAR

2009-10

2010-11

2011-12

2012-13

2013-14

2.32

2.73

1.74

1.08

1.89

working capital

ratio

BES Group of Institutions (GVIC)Angallu

29

A Study on Funds Flow Analysis

CHART: 4.1

INTERPRETATION:

The working capital ratio it was gradually increased the years 2009-10 is ,

2.32, 2.73 and it was in the year 2010-11 is very fall down as 1.74 In 2011-2012 it

was 1.08 . It and it was increase a little bit in 2012-13, 1.89 it indicates working

capital is not maintaining proper management in the year 2014. It is decrease to the

working capital ratio.

2. CASH RATIO:

BES Group of Institutions (GVIC)Angallu

30

A Study on Funds Flow Analysis

Cash is the most liquid asset. A financial analyst may examine cash ratio and

its Equivalent to current liabilities. Trade investment or marketable securities are

Equivalent of cash. The standard ratio is 0.5:1or 50:100(%).

RATIO= (Cash+ Marketable Securities)/Current Liabilities

TABLE: 4.2

YEAR

CASH

CURRENT LAIBILITIES

CASH RATIO

2009-10

1290.71

3509.59

0.36

2010-11

1383.35

3922.48

0.35

2011-12

12012.16

14506.15

0.83

2012-13

4,773.47

22479.86

0.21

2013-14

21,081.89

19,445.18

1.08

FACTORS:

YEAR

2009-10

2010-11

2011-12

2012-13

2013-14

Cash ratio

0.36

0.35

0.83

0.21

1.08

BES Group of Institutions (GVIC)Angallu

31

A Study on Funds Flow Analysis

CHART: 4.2

INTERPRETATION:

The standard cash ratio is 0.5. It represents the satisfactory level in the years

2009-10 to 2013-14 the cash ratio is 0.36, 0.35, 0.83, 0.21 and 1.08 however it has

heavily increased to 1.08 in the year 2012 the ratio 1.08. It represents Spares is

maintaining standard level of cash in the Spares

3. QUICK RATIO (or) ACID TEST RATIO:

BES Group of Institutions (GVIC)Angallu

32

A Study on Funds Flow Analysis

It establishes the relationship between quick or liquid, Assets and liabilities.

An asset is a Liquid if it can be converted into cash immediately. Inventories are

considered to be less liquid. The quick ratio is found out by dividing quick assets by

current liabilities. A quick ratio of 1to1 is considered to represent a satisfactory

current financial condition.

Quick Ratio= (Current Assets-Inventories) / Current Liabilities

TABLE: 4.3

YEAR

CURRENT

QUICK

QUICK RATIO

LIABLITIES

ASSETS

2009-10

5664.30

3509.59

1.61

2010-11

7611.37

3922.48

1.94

2011-12

23365.09

14506.15

1.61

2012-13

18216.65

25214.04

0.72

2013-14

32487.57

24366.35

1.33

FACTOR:

YEAR

2009-10

2010-11

2011-12

2012-13

2013-14

Quick ratio

1.61

1.94

1.61

0.72

1.33

BES Group of Institutions (GVIC)Angallu

33

A Study on Funds Flow Analysis

CHART: 4.3

INTERPRETATION:

The standard ratio of current ratio is 2:1. The higher the current ratio the grater

the margin of safety. In the year 2009-2010. Current ratio is 2.32 and 2010-11, 2.73

from 2011. The current ratio is gradually increased. In 2014 the current ratio is 1.51

lower than the safety margin.

4. INVENTORY TURNOVER RATIO (or) STOCK TURNOVER

RATIO:

BES Group of Institutions (GVIC)Angallu

34

A Study on Funds Flow Analysis

Inventory turnover ratio is a measure of liquidity. It indicates the speed at

which the inventory is sold out. A high turnover ratio indicates that the inventory is

out Fast and a low turnover ratio show a sale of inventory. This ratio indicates the

efficiency of the firm in selling its products.

Stock turnover ratio=Cost of goods sold / average investment

The high stock turnover ratio is indicating of good inventory management.

TABLE: 4.4

COST OF GOODS

AVG

INVENTORY

SOLD

INVENTORY

TURNOVER RATIO

2009-10

27153.59

2392.56

11.34

2010-11

29725.95

2808.88

10.58

2011-12

36172.58

3430.26

10.54

2012-13

46374.89

6071.35

7.63

2013-14

40613.42

4378.43

9.27

YEAR

FACTORS:

YEAR

Inventory turnover

2009-10

2010-11

2011-12

2012-13

2013-14

ratio

11.34

10.58

10.54

7.63

9.27

BES Group of Institutions (GVIC)Angallu

35

A Study on Funds Flow Analysis

CHART: 4.4

INTERPRETATION:

A high stock turnover indicated that the stocks are fast moving and get

converted into sales very quickly .the year 2009-10 to 2014. The company inventory

turnover ratio is 11.34, 10.58, 10.54, 7.63 and 9.27 respectively. Overall five years the

ratio is increased.

STATEMENT OF THE CHANGES IN FINANCIAL POSITION OF SIBAR

AUTOPARTS LTD., WORKING CAPITAL BASIS IN THE YEAR

2009-2010

STATEMENT OF CHANGE IN WORKING CAPITAL 2009-2010

BES Group of Institutions (GVIC)Angallu

36

A Study on Funds Flow Analysis

Change In Working

Particulars

2009

2010

A) current assets:a) Inventories

B) Sundry Debtors

C) Cash & Bank Balance

E) Loans and Advances

Total Current Assets

2503.2

2467.39

1290.71

1906.2

8167.5

3114.57

943.79

1383.35

5284.23

10725.94

B) Current Liabilities:A) Liabilities

B) Provision

Total Current Liabilities

3381.69

127.9

3509.59

3758.62

163.86

3922.48

Working Capital

(A-B)

Increase in Working Capital

TOTAL

4657.91

2145.55

6803.46

6803.46

Capital

Increase

Decrease

6803.46

611.37

1523.6

92.64

3378.03

376.93

35.96

4082.04

2145.55

4082.04

INTERPRETATION:

From the above table it is observed that the networking capital of the Spares

shows increased i.e. Lakhs 2145.55.

FUNDS FLOW STATEMENT

Sources

Rs

Issue unsecured loans

101.14 Increase in work in progress

Decrease in miscellaneous expenses

Applications

Rs

149.2

102 Purchase of investment

166.03

Sale of fixed assets

2093.49 Payment secured loans

2100.96

Funds from operations

2265.11

2145.55

4561.74

BES Group of Institutions (GVIC)Angallu

Increase in working capital

4561.74

37

A Study on Funds Flow Analysis

INTERPRETATION:

From the above table it is observed that the Funds flow of the Spares shows fund

i.e. from operation is Lakhs 2265.11.

STATEMENT OF THE CHANGES IN FINANCIAL POSITION OF SIBAR

AUTOPARTS LTD.,WORKING CAPITAL BASIS IN THE YEAR 2010-2011

STATEMENT OF CHANGE IN WORKING CAPITAL 2010-2011

Change in working

Particulars

2010

2011

capital

Increase

A) current assets:a) inventories

b) sundry debtors

3114.57

943.79

BES Group of Institutions (GVIC)Angallu

3971.01

2531

Decrease

856.44

1587.21

38

A Study on Funds Flow Analysis

c) cash & bank balance

e) loans and advances

Total current assets

1383.35

5284.23

10725.94

12012.16

8821.93

27336.1

B) current liabilities:a) liabilities

b) provision

Total current liabilities

3758.62

163.86

3922.48

13132.52

1373.63

14506.15

6803.46

6026.49

12829.95

12829.95

12829.95

working capital

(A-B)

Increase in working capital

TOTAL

10628.81

3537.7

9373.9

1209.77

6026.49

16610.16

16610.16

INTERPRETATION

From the above table it is observed that the networking capital of the Spares

shows increased i.e. Lakhs 6026.49.

FUNDS FLOW STATEMENT

Sources

Issue unsecured loans

Decrease in miscellaneous expenses

Rs

Applications

Rs

2417.93 Increase in work in progress

19957.4

67.1 Purchase of fixed assets

28163.9

Sale of investment

26672.5 Payment secured loans

11161.6

Reserve and surplus

16148.5

6026.49

Funds from operations

25662.8 Deferred tax liabilities

5659.36

70968.9

70968.9

BES Group of Institutions (GVIC)Angallu

Increase in working capital

39

A Study on Funds Flow Analysis

INTERPRETATION:

From the above table it is observed that the Funds flow of the Spares shows fund

i.e. from operation is Lakhs 25662.8.

STATEMENT OF THE CHANGES IN FINANCIAL POSITION OF SIBAR

AUTOPARTS LTD.,WORKING CAPITAL BASIS IN THE YEAR 2011-2012

STATEMENT OF CHANGE IN WORKING CAPITAL 2011-2012

Change in working

Particulars

A) Current Assets:A) Inventories

B) Sundry Debtors

C) Cash & Bank Balance

E) Loans and Advances

Total Current Assets

2011

2012

3971.01

2531

12012.16

8821.93

27336.1

6071.35

2640.09

4773.47

10803.09

24288

BES Group of Institutions (GVIC)Angallu

capital

Increase

Decrease

2100.34

109.09

7238.69

1981.16

40

A Study on Funds Flow Analysis

B) Current Liabilities:A) Liabilities

B) Provision

Total current liabilities

Working Capital

(A-B)

Decrease in Working Capital

TOTAL

13132.52

1373.63

14506.15

22479.86

2734.18

25214.04

12829.95

-926.04

13755.99

13755.99

12829.95

17946.58

12829.95

9347.34

1360.55

17946.58

INTERPRETATION:

From the above table it is observed that the networking capital of the Spares

shows decreased i.e. Lakhs 13755.9

FUNDS FLOW STATEMENT

Sources

Rs

Applications

Issue unsecured loans

2319.45 Increase in work in progress

Issue secured loans

6173.86 Deferred tax liabilities

Sale of fixed assets

4646.01

Reserve and surplus

19772.72

Sale of investment

Decrease in working capital

Rs

51100.89

518.2

4951.06

13755.99

51619.09

BES Group of Institutions (GVIC)Angallu

51619.09

41

A Study on Funds Flow Analysis

INTERPRETATION:

From the above table it is observed that the Funds flow of the Spares shows

sources and applications are same.

STATEMENT OF THE CHANGES IN FINANCIAL POSITION OF SIBAR

AUTOPARTS LTD.WORKING CAPITAL BASIS IN THE YEAR 2012-2013

STATEMENT OF CHANGE IN WORKING CAPITAL 2012-2013

Change in working

Particulars

A) current assets:a) Inventories

b) Sundry Debtors

c) Cash & Bank Balance

e) Loans and Advances

Total Current Assets

2012

2013

6071.35

2640.09

4773.47

10803.09

24288

4378.43

3922.79

21081.89

7482.89

36866

BES Group of Institutions (GVIC)Angallu

capital

Increase

Decrease

1692.92

1282.7

16308.42

3320.2

42

A Study on Funds Flow Analysis

B) Current Liabilities:a) Liabilities

b) Provision

Total Current Liabilities

Working Capital

(A-B)

Increase in Working Capital

TOTAL

22479.86

2734.18

25214.04

19445.18

4921.17

24366.35

-926.04

13425.69

12499.65

12499.65

12499.65

3034.68

2186.99

13425.69

20625.8

20625.8

INTERPRETATION:

From the above table it is observed that the networking capital of the Spares

shows increased i.e. Lakhs 13425.69.

FUNDS FLOW STATEMENT

Sources

Issue unsecured loans

Rs

Applications

1645.37 Increase in work in progress

Rs

29942.71

issue secured loans

32848.64 Deferred tax liabilities

781.16

sale of fixed assets

4355.69 purchase of investment

11664.09

Reserve and surplus

16963.95 Increase in working capital

13425.69

55813.65

55813.65

INTERPRETATION:

From the above table it is observed that the Funds flow of the Spares shows

sources and applications are same.

BES Group of Institutions (GVIC)Angallu

43

A Study on Funds Flow Analysis

STATEMENT OF THE CHANGES IN FINANCIAL POSITION OF SIBAR

AUTOPARTS LTD., WORKING CAPITAL BASIS IN THE YEAR 2013-2014

STATEMENT OF CHANGE IN WORKING CAPITAL 2013-2014

Change in working

Particulars

2013

2014

A) Current Assets:a) Inventories

b) Sundry Debtors

c) Cash & Bank Balance

e) Loans and Advances

Total Current Assets

9071.35

3640.09

4773.47

10803.09

34288

6378.43

4922.79

21081.89

7482.89

26866

B) Current Liabilities:a) Liabilities

b) Provision

Total Current Liabilities

44479.86

4734.18

28214.04

19445.18

8921.17

44366.35

BES Group of Institutions (GVIC)Angallu

capital

Increase

Decrease

2692.62

1282.7

15308.42

3220.2

32034.18

2586.45

44

A Study on Funds Flow Analysis

Working Capital

(A-B)

Increase in Working Capital

TOTAL

-926.04

16422.67

15499.63

15499.63

15499.63

16422.67

25625.2

25625.2

INTERPRETATION:

From the above table it is observed that the networking capital of the Spares

shows increased i.e. Lakhs 16422.67.

FUNDS FLOW STATEMENT

Sources

Issue unsecured loans

Rs

Applications

2563.24 Increase in Work in Progress

Rs

4725.05

Issue Secured Loans

58123.25 Deferred Tax Liabilities

5523.33

Sale of Fixed Assets

8563.56 Purchase of Investment

5813.05

Reserve and Surplus

8756.45 Increase in Working Capital

78006.50

16422.67

78006.50

INTERPRETATION:

From the above table it is observed that the Funds flow of the Spares shows

sources and applications are same.

BES Group of Institutions (GVIC)Angallu

45

A Study on Funds Flow Analysis

5.1 FINDINGS

The networking capital of the Spares shows increased in 2009-10 i.e. Lakhs

2145.55. Funds flow of the Spares shows fund i.e. from operation is Lakhs

2265.11.

The networking capital of the Spares shows increased in 2010-11 i.e. Lakhs

6026.49. Funds flow of the Spares shows fund i.e. from operation is Lakhs

25662.8.

The networking capital of the Spares shows decreased in 2011-12 i.e. Lakhs

13755.99. Funds flow of the Spares shows sources and applications are

same.

The networking capital of the Spares shows increased in 2012-13 i.e. Lakhs

13425.69. Funds flow of the Spares shows sources and applications are

same.

The working capital ratio it was gradually increased the years 2009-10 is ,

2.32, 2.73 and it was in the year 2010-11 is very fall down as 1.74 In 20112012

it was 1.08 . It and it was increase a little bit in 2012-13, 1.89 it

indicates working capital is not maintaining proper management in the year

2013. It is decrease to the working capital ratio.

BES Group of Institutions (GVIC)Angallu

46

A Study on Funds Flow Analysis

The higher working capital turnover ratio indicated the better management of

working capital in the years 2009-10 to 2014 the ratio is 8.5 and 5.9, 11.7,

14.8, 9.6 respectively. In the year 2013 working capital turnover will be

decreased that is 9.6over. Previous year will not refer the better management

of working capital of the firm. All the five years better management of

working capital of the Spares.

5.2 SUGGESTIONS

The Spares should have maintained working capital turnover without

fluctuations for better management of working capital.

The Spares must have maintained the cash ratio for better circulation of money

for in the Spares for the management of working capital.

The Spares maintains standard level of current ratio 0.5. So the Spares should

have maintained above standard level of current ratio for better management of

working capital.

The Spares should have increase stock turnover for the moving of stock in to

sales very immediately for the better management of working capital.

For the relations to creditors, it helps to. The Spares is ability to efficient in the

management of credit

The Spares must have maintained debtors turn over

ratios for the better liquidity fast the debtors are converted into cash in year. It

leads to higher the turnover ratio and lower the collection period.

The financial year 2012 to 2013 can increase the sources.

BES Group of Institutions (GVIC)Angallu

47

A Study on Funds Flow Analysis

5.3 CONCLUSION

The Spares being mostly depends on working capital facilities it is

maintaining very good relationship with their banks and their working capital

management is balanced.

The Spares is performing exceptionally well due to up wising in the Global

market followed by the domestic market it is up coming on with good and innovative

ideas and believe in improving all the area of its operations. The Spares has a good

quality position and does not delay commitment in case of but its creditors and

debtors.

Finally I conclude that the performance of the Spares is satisfactory there was

increasing the activities.

BES Group of Institutions (GVIC)Angallu

48

A Study on Funds Flow Analysis

ANNEXURES

PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31ST MAR, 2009-2010

Rs in lakhs

Particulars

2010

2009

Income

Sales (Gross)

47,306.18

40,166.84

7,616.56

7,284.19

39,689.62

32,882.65

457.41

412.55

40,147.03

33,295.20

3,288.27

1,574.49

29,552.25

28,359.17

Depreciation

2,859.77

2,839.05

Interest and other finance charges

2,234.88

2,333.38

Less : Excise Duty

Sales (Net)

Other Income

Expenditure

Purchase of finished goods for resale

Manufacturing and other expenses

(Increase)/Decrease in stocks of work-inprocess

a and finished goods

BES Group of Institutions (GVIC)Angallu

86.54

49

A Study on Funds Flow Analysis

37,690.57

35,192.63

2,456.46

(1,897.43)

--

--

65.00

--

2,265.11

(2,104.92)

(16,609.18)

(14,504.26)

14,344.07

16,609.18

Profit / (Loss) for the year

Povision for Tax

Current Tax

Fringe Benefit Tax

Profit / (Loss) for the year

Debit balance brought forward from previous

year

Debit balance carried to balance sheet

BALANCE SHEET AS ON 31ST MAR, 2009-2010

Rs in lakhs

Particulars

1. Sources of Funds :

Share Capital

2010

2009

42,796.14

42,796.14

21,901.93

21,901.93

64,698.07

64,698.07

Secured Loans / Funds

1,533.07

17,431.03

Unsecured Funds

9,868.55

9,767.41

25,198.68

27,198.44

89,896.69

91,896.51

Goss Block

54,205.96

53,550.07

(-) Dep.

22,537.12

19,787.74

Net Block

Capital work in progress

31,668.84

289.62

33,762.33

140.42

31,958.46

33,902.75

Reserve & Surplus

Loans Funds :

Total

2 . Application of Funds :

Fixed Assets

BES Group of Institutions (GVIC)Angallu

50

A Study on Funds Flow Analysis

Investments

Current assets, loans & advances :

36,723.60

36,557.57

3,114.57

2,503.20

934.79

2,467.39

Cash & Bank Balances

1,383.35

1,290.71

Loans & Advances

5,284.23

1,906.20

10,725.94

8,167.50

3,758.62

3,38169

289.62

127.90

3,922.48

6,803.46

3,509.59

4,657.91

67.10

169.10

14,344.07

16,609.18

89,896.69

91,896.51

Inventories

Sundry Debtors

Current Liabilities & Provisions :

Current Liabilities

Provisions

Net Current Assets

Miscellaneous Expenditure

Profit and Loss Account

Total

PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31ST MAR, 2010-2011

Rs. in lakhs

Particulars

2011

2010

Income

Sale of manufactured goods

1,16,900.24

47,905.48

17,521.32

6,388.76

99,378.92

41,516.72

2,404.44

1,832.29

432.61

1,01,211.21

44,353.77

36,172.58

16,825.32

Personnel cost

3,604.81

1,777.200

Other expenses

25,119.28

9,234.53

Depreciation

5,204.23

2,200.41

Amortisation of goodwill

1,7,99.20

--

Less : Excise Duty

Sale of traded goods

Other Income

Expenditure

Cost of goods sold

BES Group of Institutions (GVIC)Angallu

51

A Study on Funds Flow Analysis

Interest and other finance cost

950.93

871.49

72,851.03

30,908.95

Profit before tax

28,360.18

13,444.82

Provision for tax

6,542.84

982.00

- Current tax

(982.00)

- MAT credit of earlier years

(713.59)

115.83

28.00

5,339.36

18,057.74

12,434.82

(1,909.25)

(14,344.07)

16,148.49

(1,909.25)

- fringe benefit tax

- deferred tax charge

Profit for the year

Debit balance in Profit and Loss account

b brought forward

Balance in Profit & Loss account carried

forward

BALANCE SHEET AS ON 31st MAR, 2010-2011

Particulars

2011

2010

1. Sources of Funds :

Share Capital

42,796.14

42,796.14

Reserve & Surplus

38,050.42

21,901.93

80846.56

64,698.07

4,168.45

6,760.49

12,286.48

8,943.65

5,659.63

---------

22,114.29

15,704.14

1,02,960.85

80402.21

Gross Block

89,683.71

53,811.03

(-) Dep.

29,850,93

24,043.25

Net Block

59,832.78

29,767.78

320,247.06

3,453.60

80,079.84

33,221.38

Loans Funds :

Secured Loans / Funds

Unsecured Funds

Deferred tax liability

Total

2. Application of Funds :

Fixed Assets

Capital work in progress

BES Group of Institutions (GVIC)Angallu

52

A Study on Funds Flow Analysis

Investments

10,051.06

42,083.62

Inventories

3971.01

2889.51

Sundry Debtors

2531.00

1866.11

12012.16

1576.48

8821.93

27336.1

3442.81

9774.91

131132.52

6020.09

1373.63

14506.18

12,829.95

566.86

6586.95

3,187.96

-----------

1,909.25

1,02,960.85

80402.21

Current assets, loans & advances :

Cash & Bank Balances

Loans & Advances

Current Liabilities & Provisions :

Current Liabilities

Provisions

Net Current Assets

Profit and Loss Account

Total

PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31ST MAR, 2011-2012

Particulars

2012

2011

Income

Sale of manufactured goods

Less : Excise Duty

Sale of traded goods

Other Income

137,728.95

1,16,900.24

20,207.11

17,521.32

117,521.84

99,378.92

1,807.18

1,832.29

1,19,329.02

1,01,211.21

46,374.89

36,172.58

Personnel cost

4,030.09

3,604.81

Other expenses

29,017.00

25,119.28

Depreciation

5,377.68

5,204.23

Amortization of goodwill

1,7,99.20

1,799.20

534.19

950.93

Expenditure

Cost of goods sold

Interest and other finance cost

BES Group of Institutions (GVIC)Angallu

53

A Study on Funds Flow Analysis

87,133.05

72,851.03

Profit before tax

32,195.97

28,360.18

Provision for tax

12,881.45

6,542.84

- Current tax

(982.00)

- MAT credit of earlier years

(713.59)

60.00

115.83

518.20

5,339.36

19,772.72

18,057.74

(16,148.49)

(1,909.25)

(35,921.21)

(16,148.49)

- fringe benefit tax

- deferred tax charge

Profit for the year

Debit balance in Profit and Loss

account brought forward

Balance in Profit & Loss account carried

forward

BALANCE SHEET AS ON 31stMAR, 2011-2012

Rs. In lakhs

Particulars

1. Sources of Funds :

Share Capital

2012

2011

42,796.14

42,796.14

Reserve & Surplus

57,823.14

38,050.42

100,619.28

80846.56

Secured Loans / Funds

10,342.31

4,168.45

Unsecured Funds

14,605.93

12,286.48

5,141.16

5,659.63

15,704.14

22,114.29

1,30,708.68

1,02,960.85

Gross Block

91,539.87

89,683.71

(-) Dep.

36,353.10

29,850,93

Net Block

Capital work in progress

55,186.77

71,347.95

59,832.78

320,247.06

126,534.72

80,079.84

Loans Funds :

Deferred tax liability

Total

2. Application of Funds :

Fixed Assets

BES Group of Institutions (GVIC)Angallu

54

A Study on Funds Flow Analysis

Investments

Current assets, loans & advances :

5,100.00

10,051.06

Inventories

6,071.35

3971.01

Sundry Debtors

2,640.09

2531.00

Cash & Bank Balances

4,773.47

12012.16

10,803.09

8821.93

24,288.00

27336.1

22,479.86

13132.52

2,734.18

1373.63

25,214.04

926.04

14506.18

12,829.95

-----------

----------

1,30,708.68

1,02,960.85

Loans & Advances

Current Liabilities & Provisions :

Current Liabilities

Provisions

Net Current Assets

Profit and Loss Account

Total

PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31ST DEC, 2012-2013

Rs. in lakh

Particulars

2013

2012

Income

Sale of manufactured goods

Less : Excise Duty

Sale of traded goods

Other Income

1,20,946.74

137,728.95

12,218.19

20,207.11

1,08,728.55

117,521.84

796.30

1,807.18

1,09,524.85

1,19,329.02

40,613.42

46,374.89

Personnel cost

4,427.88

4,030.09

Other expenses

29,052.66

29,017.00

Depreciation

5,488.32

5,377.68

Amortization of goodwill

1,799.20

1,799.20

Expenditure

Cost of goods sold

BES Group of Institutions (GVIC)Angallu

55

A Study on Funds Flow Analysis

Interest and other finance cost

424.13

534.19

81,805.61

87,135.02

Profit before tax

27,719.24

32,195.97

Provision for tax

11,520.00

12,879.48

- Current tax

- MAT credit of earlier years

16.45

60.00

(781.16)

518.20

16,963.95

19,772.72

35,921.21

(16,148.49)

52,885.16

(35,921.21)

- fringe benefit tax

- deferred tax charge

Profit for the year

Debit balance in Profit and Loss account

brought forward

Balance in Profit & Loss account carried

forward

BALANCE SHEET AS ON 31st DEC, 2012-2013

Rs. in lakhs

Particulars

1. Sources of Funds :

Share Capital

2013

2012

42,796.14

42,796.14

Reserve & Surplus

74,787.09

57,823.14

117,619.28

100,619.28

Secured Loans / Funds

43,190.95

10,342.31

Unsecured Funds

16,251.30

14,605.93

4,360.00

5,141.16

181,385.48

1,30,708.68

Gross Block

94,463.86

91,539.87

(-) Dep.

43,632.78

36,353.10

50,831.08

101,290.66

55,186.77

71,347.95

152,121.74

126,534.72

16,764.09

5,100.00

Loans Funds :

Deferred tax liability

Total

2. Application of Funds :

Fixed Assets

Net Block

Capital work in progress

Investments

BES Group of Institutions (GVIC)Angallu

56

A Study on Funds Flow Analysis

Current assets, loans & advances :

Inventories

4,378.43

6,071.35

Sundry Debtors

3,922.79

2,640.09

21,081.89

4,773.47

7,482.89

10,803.09

36,866.00

24,288.00

19,445.18

22,479.86

4,921.17

2,734.18

24,366.35

12,499.65

25,214.04

926.04

181,385.48

1,30,708.68

Cash & Bank Balances

Loans & Advances

Current Liabilities & Provisions :

Current Liabilities

Provisions

Net Current Assets

Total

PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31ST DEC, 2013-2014

Rs. In lakh

Particulars

2014

2013

Income

Sale of manufactured goods

116,737.13

1,20,946.74

Less : Excise Duty

15,059.29

101,677.84

12,218.19

1,08,728.55

1,955.93

796.30

103,633.77

1,09,524.85

45,948.33

40,613.42

Personnel cost

4,765.94

4,427.88

Other expenses

34,007.69

29,052.66

Depreciation

8,610.36

5,488.32

Amortization of goodwill

1,799.20

1,799.20

Sale of traded goods

Other Income

Expenditure

Cost of goods sold

BES Group of Institutions (GVIC)Angallu

57

A Study on Funds Flow Analysis

Interest and other finance cost

3,439.37

424.13

98,570.89

81,805.61

5,062.88 27,719.24

Profit before tax

Provision for tax

- Current tax

1,031.00

11,520.00

3,000.00

16.45

(1,031.00)

(781.16)

2,062.88

16,963.95

52,885.16

54,948.04

35,921.21

- MAT credit of earlier years

- fringe benefit tax

- deferred tax charge

Profit for the year

Debit balance in Profit and Loss account

brought forward

Balance in Profit & Loss account carried

forward

52,885.16

BALANCE SHEET AS ON 31st DEC, 2013-2014

Rs. in lakhs

Particulars

1. Sources of Funds :

Share Capital

2014

2013

42,796.14

42,796.14

76,849.97

74,787.09

119,646.11

117,583.23

Secured Loans / Funds

42,501.93

43,190.95

Unsecured Funds

18,534.91

16,251.30

7,360.00

4,360.00

Total

2. Application of Funds :

Fixed Assets

188,042.95

181,385.48

Gross Block

193,075.65

94,463.86

53,870.09

43,632.78

139,205.56

44,859.34

50,831.08

101,290.66

184,064.90

152,121.74

Reserve & Surplus

Loans Funds :

Deferred tax liability

(-) Dep.

Net Block

Capital work in progress

BES Group of Institutions (GVIC)Angallu

58

A Study on Funds Flow Analysis

Investments

Current assets, loans & advances :

6850.27

16,764.09

Inventories

9061.61

4,378.43

Sundry Debtors

4123.75

3,922.79

Cash & Bank Balances

4550.46

21,081.89

11,510.12

7,482.89

29,245.94

36,866.00

Current Liabilities

29522.36

19,445.18

Provisions

2,595.80

4,921.17

32,118.16

(2,872.22)

24,366.35

12,499.65

188,042.95

181,385.48

Loans & Advances

Current Liabilities & Provisions :

Net Current Assets

Total

BES Group of Institutions (GVIC)Angallu

59

A Study on Funds Flow Analysis

BIBLIOGRAPHY

1. Author

I.M.PANDEY

Title of the book

Financial Management

Publisher

Vikas Publishing House Pvt. Pvt.Ltd..,

Edition

Ninth Edition.

2. Author

M.Y. Khan & P.K. Jain

Title of the book

Financial Management

Publisher

Tata Mc. Graw Hill Publishing Co.Pvt.Ltd..,

Edition

Third Edition.

3. Author

Prasanna Chandra

Title of the book

Financial Management

Publisher

Tata Mc. Graw Hill Publishing Co.Pvt.Ltd..,

Edition

Fifth Edition.

WEBSITES:

www.sibarautopartsltd.com

www.wikipedia.com

BES Group of Institutions (GVIC)Angallu

60

A Study on Funds Flow Analysis

SYNOPSIS

INTRODUCTION

Finance is one the basic foundations of all kinds of economic activities. It is

the master key, which provides access to all the sources for being employed in

manufacturing. Hence it is rightly said that finance is lifeblood of any enterprise,

besides being the scarcest elements, it is also the most indispensable requirement.

Without finance neither any business can be started nor successfully run. Provision of

sufficient funds at the required time is the key to success of concern. As matter of fact

finance may be said to be the circulatory system of economic body, making possible

the needed co-operation among many units of the activity.

INDUSTRY PROFILE

The present automobiles are most sophisticate combining luxury, safety

economy in utilizing the energy resource with great speed and least environment.

Pollution

using various field of science likes aerodynamics, mechanical expertise

and electrical engineering. Every day improvement in the existing models holding the

price line in reasonable range involving high become necessity.

Present day

consumer satisfaction involves great skill in marketing, advertising and positioning

the product line whim and Cashion advances with increased performance and reduce

size. Business minded people started selling them top the society.

COMPANY PROFILE

M/S SIBAR AUTOPARTS Ltd. Was originally incorporated as private limited

company by name M/s SIBAR AUTOPARTS (PVT) Limited in the year 1983,

located at industrial estate, TIRUPATHI.

It was converted into public limited

company in the year 1994. The company is presently engaged in manufacturing and

marketing of aluminum hard chrome plated cylinder kits mainly for the two wheelers

up to engine capacity 150cc.

BES Group of Institutions (GVIC)Angallu

61

A Study on Funds Flow Analysis

RESEARCH METHODOLOGY

Methodology is a systematic process of collecting information in order to

analyze and verifies a phenomenon. The collection of data is two principle sources.

They are discussed as

III. Primary Data

IV. Secondary Data

PRIMARY DATA:

The primary data needed for the study is gathered through interview with

concerned officers and staff, either individually or collectively, sum of the information

has been verified or supplemented with personal observation conducting personal

interviews with concerned officers of finance department of SIBAR AUTOPARTS

LTD.,

SECONDARY DATA:

The secondary data needed for the study was collected from published sources

such as, pamphlets of annual reports, returns and internal records, reference from

Advance management text books and journal management.

OBJECTIVES OF THE STUDY

To identify the sources and application of funds a study on Funds Flow

Statements at SIBAR AUTOPARTS LTD.,

To analyze the trend of net working capital that is being maintained by the firm

for period of 5 years.