Professional Documents

Culture Documents

Cost Accounting-Job Order Costing1 (Q)

Uploaded by

Vanessa HaliliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Accounting-Job Order Costing1 (Q)

Uploaded by

Vanessa HaliliCopyright:

Available Formats

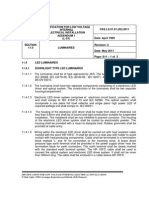

COST ACCOUNTING &COST CONCEPTS

Job Order Costing

Counting more, counting less

I. Hurley Company uses job-order costing. Data are as follows:

Totals

---------Materials

$2,050,000

Direct labor $2,250,000

Jobs Sold

---------$1,500,000

$1,650,000

Jobs in

Ending WIP

---------$200,000

$160,000

Jobs in Ending

Finished Goods

-------------$350,000

$440,000

Hurley applies overhead to jobs at $0.60 per direct labor dollar. Total

overhead cost incurred was $1,460,000. There were no beginning

inventories.

1.

What is cost of goods sold using normal costing?

2.

Find the ending inventory of work in process using normal costing.

3.

Find the amount of overhead (overapplied underapplied) and circle

the correct direction.

4.

Hurley treats overapplied or underapplied overhead as an

adjustment to cost of goods sold. Compute total cost of goods

sold.

II.

Acme Company uses job-order costing. Data related to August are as

follows:

Material cost

Direct labor cost

Machine hours

Job A

-----$3,900

$4,000

400

Job B

-----$4,700

$7,000

700

Job C

-----$5,400

$4,000

500

Acme applies overhead to jobs at $10.00 per machine hour. Total overhead

cost incurred in August was $16,700. There were no beginning inventories.

Job A was incomplete at the end of August, Job B was sold for $34,000, and

Job C was in finished goods inventory. Selling and administrative expenses

were $3,500.

5.

Compute the ending inventory of work in process.

6.

Compute the ending inventory of finished goods.

7.

Overhead was (overapplied underapplied) by?

direction.

8.

Compute the normal cost of goods sold.

9.

Prepare an income statement showing underapplied or overapplied

overhead as an adjustment to normal cost of sales.

Circle the correct

III. Beloit Company uses job-order costing. Data related to September

are as follows:

Material cost

Job A

-----$4,400

Job B

-----$3,400

Cost Accounting and Cost Concepts- Job Order Costing Quiz

Job C

-----$4,200

Page 1

COST ACCOUNTING &COST CONCEPTS

Job Order Costing

Counting more, counting less

Direct labor cost

$3,000

$6,000

$2,000

Beloit uses actual costing to apply overhead to jobs based on direct labor

cost. Total overhead cost incurred in September was $14,300. There were no

beginning inventories. Job A was incomplete at the end of September, Job B

was sold for $22,000, and Job C was in finished goods inventory. Selling

and administrative expenses were $3,800.

10.

Compute the ending inventory of work in process.

11.

Compute the ending inventory of finished goods.

Overhead was (overapplied underapplied) by?

correct direction.

12.

Circle the

Compute cost of goods sold.

13.

Prepare an income statement showing underapplied or

overapplied overhead as an adjustment to cost of sales.

14.

IV.

Perry Company uses a job order costing system and has the

following information for the first week of June:

1. Direct labor and direct materials used:

Job No.

498

506

507

508

509

511

512

Total

Direct

Material

$1,500

960

415

345

652

308

835

$5,015

Direct Labor

Hours

116

16

18

42

24

10

30

256

2. The direct labor wage rate is $4 per hour.

3. The overhead rate is $5 per direct labor hour.

4. Actual overhead costs for the week, $1,480.

5. Jobs completed: Nos. 498, 506, and 509.

6. The factory had no work in process at the beginning of

the week.

Required:

a. Prepare a summary that will show the total cost assigned

to each job.

b. Compute the amount of overhead over- or underapplied

during the week.

c. Calculate the cost of the work in process at the end of

the week.

Cost Accounting and Cost Concepts- Job Order Costing Quiz

Page 2

You might also like

- Hyde Greek PreviewDocument73 pagesHyde Greek PreviewVanessa HaliliNo ratings yet

- Vanessa P. Halili: Kelly AndersonDocument1 pageVanessa P. Halili: Kelly AndersonVanessa HaliliNo ratings yet

- Sheryl LDocument2 pagesSheryl LVanessa HaliliNo ratings yet

- Edited MarketingDocument13 pagesEdited MarketingVanessa HaliliNo ratings yet

- Stocks, Sauces and SoupsDocument15 pagesStocks, Sauces and SoupsVanessa Halili100% (2)

- Tomato Sauce Recipe IngredientsDocument1 pageTomato Sauce Recipe IngredientsVanessa HaliliNo ratings yet

- English 2 Chapter 5Document2 pagesEnglish 2 Chapter 5Vanessa HaliliNo ratings yet

- Sol Ass3Document3 pagesSol Ass3Vanessa HaliliNo ratings yet

- Chapter 4-Differential AnalysisDocument16 pagesChapter 4-Differential AnalysisVanessa HaliliNo ratings yet

- LawDocument31 pagesLawVanessa HaliliNo ratings yet

- Market Survey QuestionnaireDocument1 pageMarket Survey QuestionnaireVanessa HaliliNo ratings yet

- CHapter 3Document32 pagesCHapter 3Vanessa HaliliNo ratings yet

- Chapter 4-Differential Analysis (Q)Document10 pagesChapter 4-Differential Analysis (Q)Vanessa HaliliNo ratings yet

- ApprovalDocument13 pagesApprovalVanessa HaliliNo ratings yet

- Huánlǐ - : RequitalDocument7 pagesHuánlǐ - : RequitalVanessa HaliliNo ratings yet

- Cost Accounting - Chapter 12Document7 pagesCost Accounting - Chapter 12xxxxxxxxx33% (3)

- Call Center Industry: AOL Member Services Philippines, Inc. (America On-Line)Document2 pagesCall Center Industry: AOL Member Services Philippines, Inc. (America On-Line)Vanessa HaliliNo ratings yet

- Chapter 4-Differential AnalysisDocument16 pagesChapter 4-Differential AnalysisVanessa HaliliNo ratings yet

- 20 Winter 2014 - FinalDocument21 pages20 Winter 2014 - FinalVanessa HaliliNo ratings yet

- FinanceSolutions Manual of FMDocument170 pagesFinanceSolutions Manual of FMRahman Ullah Khan100% (2)

- Chapter 3Document29 pagesChapter 3Vanessa HaliliNo ratings yet

- Preliminary Examination MC (Q)Document9 pagesPreliminary Examination MC (Q)Vanessa HaliliNo ratings yet

- Fifo Method of Process CostingDocument17 pagesFifo Method of Process CostingPrateek DubeyNo ratings yet

- Cost Accounting Answer Chapter 2 PDFDocument5 pagesCost Accounting Answer Chapter 2 PDFangel cruz0% (1)

- Activity-Based Costing and Management Systems Chapter ReviewDocument63 pagesActivity-Based Costing and Management Systems Chapter ReviewVanessa HaliliNo ratings yet

- Project in Marketing 1: (SWOT Analysis)Document2 pagesProject in Marketing 1: (SWOT Analysis)Vanessa HaliliNo ratings yet

- Ch08 Teamwork and Team PerformanceDocument40 pagesCh08 Teamwork and Team PerformanceThezenwayNo ratings yet

- Preliminary Examination MC (Q)Document9 pagesPreliminary Examination MC (Q)Vanessa HaliliNo ratings yet

- Management 2Document2 pagesManagement 2Vanessa HaliliNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Case Analysis of CriminologyDocument12 pagesCase Analysis of CriminologyinderpreetNo ratings yet

- Njhs Application EssayDocument4 pagesNjhs Application Essaycjawrknbf100% (2)

- Picco Tac 1095 N Hydrocarbon ResinDocument2 pagesPicco Tac 1095 N Hydrocarbon ResindevanandamqaNo ratings yet

- Solwezi General Mental Health TeamDocument35 pagesSolwezi General Mental Health TeamHumphreyNo ratings yet

- Introduction To The Philosophy of The Human Person Quarter I - Module 2Document26 pagesIntroduction To The Philosophy of The Human Person Quarter I - Module 2Katrina TulaliNo ratings yet

- Open MPDocument30 pagesOpen MPmacngocthanNo ratings yet

- Vernacular Architecture: Bhunga Houses, GujaratDocument12 pagesVernacular Architecture: Bhunga Houses, GujaratArjun GuptaNo ratings yet

- Chapter 1 - The Empirical Beginnings and Basic Contents of Educational PsychologyDocument9 pagesChapter 1 - The Empirical Beginnings and Basic Contents of Educational PsychologyJoshua Almuete71% (7)

- Tipolo WH Gantt ChartDocument15 pagesTipolo WH Gantt ChartMayeterisk RNo ratings yet

- TR-Pharmacy Services NC IIIDocument135 pagesTR-Pharmacy Services NC IIIAljon Fortaleza Balanag100% (2)

- Appraisal Sample PDFDocument22 pagesAppraisal Sample PDFkiruthikaNo ratings yet

- Gatk Pipeline Presentation: From Fastq Data To High Confident VariantsDocument8 pagesGatk Pipeline Presentation: From Fastq Data To High Confident VariantsSampreeth ReddyNo ratings yet

- The Ideal Structure of ZZ (Alwis)Document8 pagesThe Ideal Structure of ZZ (Alwis)yacp16761No ratings yet

- PEB Requirment by ClientDocument4 pagesPEB Requirment by ClientViraj ModiNo ratings yet

- Mega Goal 4Document52 pagesMega Goal 4mahgoubkamel0% (1)

- 4WE10 New Series Directional Valves NG10Document9 pages4WE10 New Series Directional Valves NG10Paulo ArrudaNo ratings yet

- Mathematics Specimen Papers and Mark Schemes UG013054Document102 pagesMathematics Specimen Papers and Mark Schemes UG013054minnie murphy86% (7)

- Timoshenko Beam TheoryDocument8 pagesTimoshenko Beam Theoryksheikh777No ratings yet

- JKR Specs L-S1 Addendum No 1 LED Luminaires - May 2011Document3 pagesJKR Specs L-S1 Addendum No 1 LED Luminaires - May 2011Leong KmNo ratings yet

- Basic Concepts of Citrix XenAppDocument13 pagesBasic Concepts of Citrix XenAppAvinash KumarNo ratings yet

- Questions 32 - 34: Sunny English MqaDocument9 pagesQuestions 32 - 34: Sunny English MqaHạnh NguyễnNo ratings yet

- Rock ClimbingDocument11 pagesRock ClimbingDaria TurdalievaNo ratings yet

- Pub - Perspectives On Global Cultures Issues in Cultural PDFDocument190 pagesPub - Perspectives On Global Cultures Issues in Cultural PDFCherlyn Jane Ventura TuliaoNo ratings yet

- EJC H2 Math P1 With Solution PDFDocument23 pagesEJC H2 Math P1 With Solution PDFKipp SohNo ratings yet

- AWS S3 Interview QuestionsDocument4 pagesAWS S3 Interview QuestionsHarsha KasireddyNo ratings yet

- System Software Module 3: Machine-Dependent Assembler FeaturesDocument28 pagesSystem Software Module 3: Machine-Dependent Assembler Featuresvidhya_bineeshNo ratings yet

- How To Use Hyper-V Snapshot Revert, Apply, and Delete OptionsDocument15 pagesHow To Use Hyper-V Snapshot Revert, Apply, and Delete OptionsKaran MishraNo ratings yet

- DionWIred Black FridayDocument13 pagesDionWIred Black FridayAmon SimelaneNo ratings yet

- Flight Instructor Patter Ex17Document1 pageFlight Instructor Patter Ex17s ramanNo ratings yet

- Otis Brochure Gen2life 191001-BELGIUM SmallDocument20 pagesOtis Brochure Gen2life 191001-BELGIUM SmallveersainikNo ratings yet