Professional Documents

Culture Documents

14 - Free Trade and Protectionism

Uploaded by

alstjq1003Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

14 - Free Trade and Protectionism

Uploaded by

alstjq1003Copyright:

Available Formats

14

Revision Free trade and protectionism

Free trade: Trade that takes place between countries when there are no

barriers to trade put in place by governments or international organizations.

Protectionism: The putting into place of trade barriers by governments or

international organizations to restrict imports into a country.

Dumping: The selling by a country of large volumes of a commodity, at a

price lower than its production cost, in another country.

Tariff: A tax that is charged upon imported goods.

Subsidy: An amount of money paid by the government to a firm, per unit

ofoutput.

Quota: A physical limit on the number or value of goods that can be imported

into a country.

World Trade Organization (WTO): An international organization that

sets the rules for global trading and resolves trading disputes between its

membercountries.

Arguments for protectionism

l

To protect domestic employment this argument is not very

strong, since it is likely that the industry will continue to

decline and that protection will simply prolong the process.

To protect the economy from low-cost labour this argument

goes against the whole concept of comparative advantage.

To protect an infant (sunrise) industry developing countries,

without access to sophisticated capital markets, can use the

infant industry argument to justify protectionist policies.

To avoid the risks of over-specialization there are no real

arguments against this view. It does not promote

protectionism, it simply points out the problems that countries

may face if they specialize to a great extent.

Strategic reasons, e.g. in times of war in many cases, it is

unlikely that countries will go to war or, if they do, that they

will be completely cut off from all supplies. Then, it is likely

that the argument is being used as an excuse for protectionism.

To prevent dumping it is very difficult to prove whether or

not a foreign industry has actually been guilty of dumping, or

whether there is just a comparative advantage.

To protect product standards a valid argument, as long as the

concerns are valid.

To raise government revenue not an argument for

protectionism, but a means of raising government revenue.

To correct a balance of payments deficit this will only work

in the short run.

Arguments against protectionism

l

l

l

Protectionism may raise prices to consumers and producers of

the imports that they buy.

Protectionism leads to less choice for consumers.

Competition will diminish if foreign firms are kept out of a

country and so domestic firms may become inefficient, because

OUP: this may be reproduced for class use solely for the purchasers institute

Revision

Free trade and protectionism

they do not have an incentive to minimize costs. In addition,

innovation may be reduced for the same reason.

Protectionism distorts comparative advantage, leading to the

inefficient use of the worlds resources. Specialization is

reduced and this would reduce the potential level of the

worlds output.

For the reasons listed above, protectionism may hinder

economic growth.

Types of protectionism

The situation where free trade is taking place in a country and

there is no protectionism is shown below.

The imposition of a tariff

S (Domestic)

Pe

Pw

S (World)

D

0

Q1

Qe

Q2

Quantity of wheat (000s tons)

Price of wheat ($ per ton)

Price of wheat ($ per ton)

Free international trade

S (Domestic)

Pe

Pw+T

Pw

S (World) + tariff

a b c d e f

g

S (World)

k

D

0

Q1 Q3 Qe Q4 Q2

Quantity of wheat (000s tons)

A tariff is a tax that is charged on imported goods. In the case of a

tariff, it will shift the world supply curve upwards, since it is

placed on the foreign producers of the good and not the domestic

producers. This is shown above.

Domestic producers are able to sell more at a higher price and

domestic employment will increase. Domestic producers will pay

higher prices and consume less. The government will receive

revenue from the tariffs paid by the foreign producers. The foreign

producers end up selling less at the same price. This will affect

employment in the foreign countries.

There is a dead-weight loss of consumer surplus for domestic

consumers and there is a dead-weight loss of welfare, because

inefficient domestic producers take the place of efficient foreign

producers.

A subsidy is an amount of money paid by the government to a

firm, per unit of output. In this case, the government is giving a

subsidy to domestic producers to make them more competitive

and so the effect will be to shift the domestic supply curve

downwards by the amount of the subsidy. This is shown below.

Domestic producers are able to sell more at a higher price and

domestic employment will increase. Domestic producers will

consume the same amount at the same price. The government

will have to find the money to pay the subsidies. The foreign

producers end up selling less at the same price. This will affect

employment in the foreign countries.

OUP: this may be reproduced for class use solely for the purchasers institute

Revision

Free trade and protectionism

There is a dead-weight loss of welfare, because inefficient domestic

producers take the place of efficient foreign producers.

A quota imposed on foreign producers

S (Domestic)

S (Domestic)

+ subsidy

Pe

Pw

+ subsidy

Pw

S (World)

a

f g

b c

Price of wheat ($ per ton)

Price of wheat ($ per ton)

A subsidy for domestic producers

Q2

Q1 Q3 Qe

Quantity of wheat (000s tons)

S (Domestic)

S (Domestic)

+ Quota

Pe

PQuota

Pw

0

f

a

h

b

c d

k

e

S (World)

D

Q1 Q3 Qe Q4 Q2

Quantity of wheat (000s tons)

A quota is a physical limit on the numbers or value of goods that

can be imported into a country. For example, the EU imposes

import quotas on Chinese garlic and mushrooms. The imposition

of a quota has a peculiar effect on the free trade diagram and this

is shown above.

Domestic producers are able to sell more at a higher price and

domestic employment will increase. Domestic producers will pay

higher prices and consume less. The foreign producers end up

selling less at a higher price. This will affect employment in the

foreign countries.

There is a dead-weight loss of consumer surplus for domestic

consumers and there is a dead-weight loss of welfare, because

inefficient domestic producers take the place of efficient

foreignproducers.

Administrative barriers when goods are being imported, there

are usually administrative processes that have to be undertaken.

Thismay be known as dealing with red tape. If these processes are

lengthy and complicated, then they can act as a restriction to imports.

Health and safety standards and environmental standards

this is where various restrictions are placed upon the types of goods

that can be sold in the domestic market, or on the methods used in

the manufacture of certain goods. These regulations will apply to

imports and may restrict their entry.

Embargoes in effect, an embargo is an extreme quota. It is a

complete ban on imports and is usually put in place as a form of

political punishment. For example, the USA has a trade embargo

on products from Cuba. Complete embargoes are rare.

Nationalistic campaigns governments will sometimes run

marketing campaigns to encourage people to buy domestic goods

instead of foreign ones in order to generate more demand for

domestic goods and preserve domestic jobs.

The World Trade Organization (WTO)

The WTO is an international organization that sets the rules for

global trading and resolves disputes between its member countries.

The WTO was established in 1995 and now has 149 members.

OUP: this may be reproduced for class use solely for the purchasers institute

Revision

Free trade and protectionism

Itreplaced the General Agreement on Tariffs and Trade (GATT).

TheWTO, along with its predecessor the GATT, is largely credited

with the fact that since 1947, average world tariffs for manufactured

goods have declined from approximately 40% to 4%.

All WTO members are required to grant most favoured nation

status to one another, which means that, usually, trade

concessions granted by a WTO country to another country must

be granted to all WTO members.

The aims of the WTO are to administer WTO trade agreements, to

be a forum for trade negotiations, to handle trade disputes among

member countries, to monitor national trade policies, to provide

technical assistance and training for developing countries and to

cooperate with other international organizations.

OUP: this may be reproduced for class use solely for the purchasers institute

You might also like

- The Theory of Tariffs and QuotasDocument68 pagesThe Theory of Tariffs and QuotasAda Teaches100% (1)

- Form 1 2019 Yearly Planner For English LanguageDocument7 pagesForm 1 2019 Yearly Planner For English LanguagehazimNo ratings yet

- Assignment OF Business Corporate Law ON "Meetings Under The Provisions of The Companies Act 1956"Document20 pagesAssignment OF Business Corporate Law ON "Meetings Under The Provisions of The Companies Act 1956"Birupaksha DasNo ratings yet

- Business ResearchDocument81 pagesBusiness ResearchREMIGIUS MARIOE100% (1)

- Use of Habitats-NorskDocument12 pagesUse of Habitats-NorskmashanghNo ratings yet

- Overview of Inhalation ToxicologyDocument8 pagesOverview of Inhalation ToxicologySneha KadamNo ratings yet

- Lecture 4 (Packaging of Horticultural Crops)Document21 pagesLecture 4 (Packaging of Horticultural Crops)Ana Mae AquinoNo ratings yet

- The Use of Verb Noun Collocations in Writing StoriDocument7 pagesThe Use of Verb Noun Collocations in Writing StoriMa Minh HươngNo ratings yet

- Protecting America's Technology Industry From China Tariffs Aren't The AnswerDocument7 pagesProtecting America's Technology Industry From China Tariffs Aren't The AnswerJorge Yeshayahu Gonzales-LaraNo ratings yet

- Sample 3Document7 pagesSample 3JadeMysteryNo ratings yet

- Case Study - Dolce CafeDocument3 pagesCase Study - Dolce CafeRashid okeyoNo ratings yet

- Logic Dense NoteDocument52 pagesLogic Dense NoteGizachew MulatieNo ratings yet

- Definition of Psychiatric IllnessDocument3 pagesDefinition of Psychiatric IllnessImran ShahNo ratings yet

- SPR-0421-Working at Height - EnGDocument15 pagesSPR-0421-Working at Height - EnGTzushk47100% (1)

- Portfolio Reflection 1Document3 pagesPortfolio Reflection 1api-290638637No ratings yet

- TOK Essay - Jatin RathiDocument6 pagesTOK Essay - Jatin RathiJatin RathiNo ratings yet

- Essay On 1984Document2 pagesEssay On 1984Stefanos van Dijk0% (1)

- Unit 4 Business Feasibility StudyDocument8 pagesUnit 4 Business Feasibility StudyColdsober IreneNo ratings yet

- Business Research Benson 1Document135 pagesBusiness Research Benson 1Manuel Divine100% (1)

- Remove Class English QuestionDocument4 pagesRemove Class English QuestionSharizam Abd TalibNo ratings yet

- English Sample Marking Key 2016 PDFDocument20 pagesEnglish Sample Marking Key 2016 PDFMichael DetoniNo ratings yet

- Technology EssayDocument8 pagesTechnology EssayAdeel AhmedNo ratings yet

- Biology 111 EXAM 2 Study GuideDocument15 pagesBiology 111 EXAM 2 Study GuidecuckoofourkokoNo ratings yet

- All My SonsDocument2 pagesAll My Sonssingingman100% (1)

- Sustainable Mobility in JakartaDocument6 pagesSustainable Mobility in JakartaSeptiono Eko BawonoNo ratings yet

- Tok EssayDocument3 pagesTok EssayAaryan ChhabraNo ratings yet

- IB Psychology, Health Psychology, Learning OutcomesDocument5 pagesIB Psychology, Health Psychology, Learning OutcomesBruce BybeeNo ratings yet

- Sow Form 1Document6 pagesSow Form 1AzreeNo ratings yet

- Y Crisis Through Ambivalence in Home Fire by Kamila ShamsieDocument11 pagesY Crisis Through Ambivalence in Home Fire by Kamila Shamsieimran khalidNo ratings yet

- Cost and Benefits of Monopoly 333Document6 pagesCost and Benefits of Monopoly 333Ikram khanNo ratings yet

- Factors That Cause Depression and ItDocument9 pagesFactors That Cause Depression and ItAimee HernandezNo ratings yet

- Reaganomics SacDocument6 pagesReaganomics Sacapi-246198445No ratings yet

- International Trade System: By: Meinrad C. BautistaDocument20 pagesInternational Trade System: By: Meinrad C. BautistaRad BautistaNo ratings yet

- Cambridge International AS Level: English General Paper 8019/01 May/June 2021Document17 pagesCambridge International AS Level: English General Paper 8019/01 May/June 2021sbang.alahNo ratings yet

- History IADocument15 pagesHistory IAGowri KashyapNo ratings yet

- Poetry Analysis - Ispahan CarpetDocument2 pagesPoetry Analysis - Ispahan CarpetcarogatNo ratings yet

- Call EssayDocument6 pagesCall Essayapi-343077552No ratings yet

- Chapter 3 Research Design and ProposalDocument12 pagesChapter 3 Research Design and ProposalgeletawNo ratings yet

- ECN 138. Chapter 11Document3 pagesECN 138. Chapter 11Louren Pabria C. PanganoronNo ratings yet

- Project Report On Tariff and Non Tariff FinalDocument17 pagesProject Report On Tariff and Non Tariff FinalKomal Khatter100% (3)

- The Basics of Tariffs and Trade BarriersDocument6 pagesThe Basics of Tariffs and Trade BarriersRohit KumarNo ratings yet

- Chap 8,9Document17 pagesChap 8,9Trâm PhạmNo ratings yet

- Instruments of Trade PolicyDocument14 pagesInstruments of Trade PolicyKatrizia FauniNo ratings yet

- Various Types of Tariff Barrier and Its Impact On World Trade and Various Commercial Policies Adopted by Different Countries To Boost Their TradeDocument8 pagesVarious Types of Tariff Barrier and Its Impact On World Trade and Various Commercial Policies Adopted by Different Countries To Boost Their TradePhalguni MuthaNo ratings yet

- Zion Desamero - Module 6 Assignment #2 - Trade BarriersDocument7 pagesZion Desamero - Module 6 Assignment #2 - Trade BarriersZion EliNo ratings yet

- Assignment 4 International TradeDocument7 pagesAssignment 4 International TradeMohammad MoosaNo ratings yet

- Submitted TO: SIR M.Yousaf "International Trade Barriers AND Their Solution"Document7 pagesSubmitted TO: SIR M.Yousaf "International Trade Barriers AND Their Solution"atiqa tanveerNo ratings yet

- Team 3 ProjectDocument14 pagesTeam 3 ProjectGabriela LorenaNo ratings yet

- Lecture 2 International Trade GraphsDocument44 pagesLecture 2 International Trade GraphsL SNo ratings yet

- KTEE 308 International Economics: Lectures 5: International Trade PolicyDocument52 pagesKTEE 308 International Economics: Lectures 5: International Trade PolicyDat NgoNo ratings yet

- Microeconomics-International Trade Notes 2Document17 pagesMicroeconomics-International Trade Notes 2Khasheena RobertsNo ratings yet

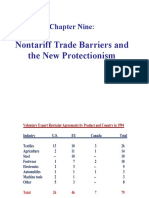

- Chapter Nine:: Nontariff Trade Barriers and The New ProtectionismDocument26 pagesChapter Nine:: Nontariff Trade Barriers and The New ProtectionismAhmad RonyNo ratings yet

- Trade Barriers 1Document35 pagesTrade Barriers 1Mahesh DesaiNo ratings yet

- Global Markets in ActionDocument20 pagesGlobal Markets in ActionbabrulhasantaponbabulNo ratings yet

- Economics NotesDocument27 pagesEconomics Notes570 BAF Drashti ShahNo ratings yet

- What Is Protectionism?Document7 pagesWhat Is Protectionism?jannerickNo ratings yet

- ASHIKADocument10 pagesASHIKAjay prakashNo ratings yet

- Chapter 9: Application: International Trade: 9.1 The Determinants of TradeDocument5 pagesChapter 9: Application: International Trade: 9.1 The Determinants of TradeFarNo ratings yet

- Microeconomics 1: Lecturer: Adam AllansonDocument25 pagesMicroeconomics 1: Lecturer: Adam AllansonVicky Ke WangNo ratings yet

- Free Trade: Start LookingDocument6 pagesFree Trade: Start LookingDarshika Singh - KumarNo ratings yet

- Chapter 16 Environmental Chemistry (Ib Option E) Summary: Air PollutionDocument7 pagesChapter 16 Environmental Chemistry (Ib Option E) Summary: Air Pollutionalstjq1003No ratings yet

- CH 18 SummaryDocument5 pagesCH 18 Summaryalstjq1003No ratings yet

- CH 15 SummaryDocument4 pagesCH 15 Summaryalstjq1003No ratings yet

- CH 17 SummaryDocument4 pagesCH 17 Summaryalstjq1003No ratings yet

- 17 - Balance of PaymentsDocument2 pages17 - Balance of Paymentsalstjq1003No ratings yet

- Revision - Exchange Rates: What Factors Shift The Demand For, and Supply Of, A Currency?Document4 pagesRevision - Exchange Rates: What Factors Shift The Demand For, and Supply Of, A Currency?Jasmine LiNo ratings yet

- 13 - TaxationDocument4 pages13 - Taxationalstjq1003No ratings yet

- 15 - Reasons For Trade, Economic Integration and Terms of TradeDocument4 pages15 - Reasons For Trade, Economic Integration and Terms of Tradealstjq1003100% (1)

- 11 - Demand-Side and Supply-Side PoliciesDocument3 pages11 - Demand-Side and Supply-Side Policiesalstjq1003No ratings yet

- 12 - National Income, Circular Flow, MultiplierDocument3 pages12 - National Income, Circular Flow, Multiplieralstjq1003No ratings yet

- 09 - UnemploymentDocument3 pages09 - Unemploymentalstjq1003No ratings yet

- EconomicsDocument3 pagesEconomicsdfantastic_KKNo ratings yet

- 10 - Inflation and DeflationDocument3 pages10 - Inflation and Deflationalstjq1003No ratings yet

- 08 - Aggregate Demand and Aggregate SupplyDocument2 pages08 - Aggregate Demand and Aggregate Supplyalstjq1003No ratings yet

- International Financial InstitutionsDocument28 pagesInternational Financial InstitutionsMainak SenNo ratings yet

- WTO - Faculty NotesDocument23 pagesWTO - Faculty Notesprashaant4uNo ratings yet

- International Journal of Research in Management & Social Science Volume1, Issue 1, July - September 2013 ISSN: 2322-0899Document130 pagesInternational Journal of Research in Management & Social Science Volume1, Issue 1, July - September 2013 ISSN: 2322-0899empyrealNo ratings yet

- Robertson, Novelli, Dale, Tikly (2007) Globalization, Education & Development - Ideas, Actors and DynamicsDocument298 pagesRobertson, Novelli, Dale, Tikly (2007) Globalization, Education & Development - Ideas, Actors and DynamicssyedamirshahNo ratings yet

- The Contemporary World SyllabusDocument10 pagesThe Contemporary World SyllabusRaul Bugtong Deleña100% (1)

- GATT ReportDocument28 pagesGATT Reportpratik3331No ratings yet

- Wto & ImfDocument15 pagesWto & ImfTHE WAYS TO YOUR DREAMNo ratings yet

- 2012 Country Commercial Guide For U.S. CoDocument132 pages2012 Country Commercial Guide For U.S. CoalexmetalsNo ratings yet

- Hill IB13e Ch07 PPT AccessibleDocument35 pagesHill IB13e Ch07 PPT AccessibleDayan DudosNo ratings yet

- Peter Magic International IP RightsDocument15 pagesPeter Magic International IP Rightskareyo47No ratings yet

- Trade Wars and Trade Talks With DataDocument57 pagesTrade Wars and Trade Talks With DataunkownNo ratings yet

- Polbrief29 Global ActorsDocument4 pagesPolbrief29 Global ActorssanjnuNo ratings yet

- International Business and Trade - Module 2Document9 pagesInternational Business and Trade - Module 2Reviewers KoNo ratings yet

- EU Common Policies-CarpDocument26 pagesEU Common Policies-CarpCristina SabrinaNo ratings yet

- How Xi Jinping Views The World - Kevin RuddDocument11 pagesHow Xi Jinping Views The World - Kevin RuddJuan Carlos SerranoNo ratings yet

- 5 Different Interpretations of Globalization According To John ScholteDocument3 pages5 Different Interpretations of Globalization According To John ScholteMaLuisa FontejonNo ratings yet

- TradeDocument3 pagesTradeSony BaniyaNo ratings yet

- Headquarters and Full Name of Different International OrganisationsDocument4 pagesHeadquarters and Full Name of Different International OrganisationsMubassher Ahmed ShoaibNo ratings yet

- International Economics 7th Edition Gerber Test BankDocument36 pagesInternational Economics 7th Edition Gerber Test Bankphillipsantosdod5is100% (21)

- International Business: Final ProjectDocument10 pagesInternational Business: Final ProjectilyasNo ratings yet

- Test Bank For Marketing 2018 19th Edition William M Pride o C Ferrell 2 Full DownloadDocument40 pagesTest Bank For Marketing 2018 19th Edition William M Pride o C Ferrell 2 Full DownloadcodysmithfknqpzosebNo ratings yet

- Radheshyam Malakar, M.A. Economics, He Has Done Recent Research On "Impact of WTO On Nepalese FSS" (Central Department of Economics), Lecturer of Economics, Kumari Multiple Campus, KathmanduDocument9 pagesRadheshyam Malakar, M.A. Economics, He Has Done Recent Research On "Impact of WTO On Nepalese FSS" (Central Department of Economics), Lecturer of Economics, Kumari Multiple Campus, Kathmanduavishek shresthaNo ratings yet

- International Trade LawDocument46 pagesInternational Trade LawAlbert RazzaqNo ratings yet

- International Business NotesDocument143 pagesInternational Business Notesdevil hNo ratings yet

- International Business TradeDocument119 pagesInternational Business TradeMarialyn Mores78% (9)

- Doctrine of Patent Exhaustion IPRDocument10 pagesDoctrine of Patent Exhaustion IPRRajah RahimNo ratings yet

- United NationDocument118 pagesUnited NationJerald CalunsagNo ratings yet

- Robbins Mgmt11 Tb03Document36 pagesRobbins Mgmt11 Tb03Abed Al Rahman KreidiehNo ratings yet

- Regional and Global StrategyDocument32 pagesRegional and Global Strategycooljani01No ratings yet

- Chapter 19Document34 pagesChapter 19chinyNo ratings yet