Professional Documents

Culture Documents

7 9

Uploaded by

Alwidg WidgOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7 9

Uploaded by

Alwidg WidgCopyright:

Available Formats

Investments- theo-7-9

Study online at quizlet.com/_2qs0s

1.

1. The Capital Asset Pricing Model:

a. has serious flaws because of its complexity.

b. measures relevant risk of a security and shows the

relationship between

risk and expected return.

c. was developed by Markowitz in the 1930s.

d. discounts almost all of the Markowitz portfolio

theory.: b. measures relevant risk of a security and shows the

relationship between

risk and expected return.

2.

8.

4. The Markowitz model assumes most investors are:

a. risk averse.

b. risk neutral.

c. risk seekers.

d. risk moderators.: a. risk averse.

9.

4. The most familiar distribution is the normal

distribution which is:

a. upward sloping.

b. downward sloping.

c. linear.

d. bell-shaped.: d. bell-shaped.

10.

3. Probability distributions:

a. are always discrete.

b. are always continuous.

c. can be either discrete or continuous.

d. are inverse to interest rates.: c. can be either discrete or

continuous.

5. Portfolio weights are found by:

a. dividing standard deviation by expected value.

b. calculating the percentage each asset is to the total

portfolio value.

c. calculating the return of each asset to total portfolio

return.

d. dividing expected value by the standard deviation: b.

calculating the percentage each asset is to the total portfolio

value.

11.

5. The _______ is typically taken to be the risk-free rate.

a. savings account

b. certificate of deposit

c. Treasury bill

d. Treasury bond: Treasury bill

2. Which of the following is not one of the assumptions of

the CMT?

a. All investors have the same one-period time horizon.

b. There are no personal income taxes.

c. There is no interest rate charged on borrowing.

d. There are no transaction costs.: There is no interest rate

charged on borrowing.

6.

a. Liquidity of positions.

b. Investor preferences are based only on expected

return and risk.

c. Low transactions costs.

d. A single investment period.: d. A single investment

period.

2. Under the Markowitz model, investors:

a. are assumed to be risk-seekers.

b. are not allowed to use leverage.

c. are assumed to be institutional investors.

d. all of the above.: b. are not allowed to use leverage.

5.

portfolio theory?

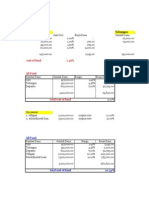

2. Given the following probability distribution, calculate

the expected return of security XYZ.

Security XYZ's

Potential return Probability

20% 0.3

30% 0.2 -40% 0.1 50% 0.1 10% 0.3

a. 16 percent

b. 22 percent

c. 25 percent d. 18 percent: a. 16 percent Solution:

b. 22 percent E(R) = Ripri

c. 25 percent = (20)(0.3) + (30)(0.2) + (- 40)(0.1) + (50)(0.1) +

d. 18 percent = (10)(0.3) = 22 percent

4.

3. Which of the following is not one of the assumptions of

1. The expected value is the:

a. inverse of the standard deviation

b. correlation between a security's risk and return.

c. weighted average of all possible outcomes.

d. same as the discrete probability distribution.: c.

weighted average of all possible outcomes.

3.

7.

12.

5. The optimal portfolio for a risk-averse investor:

a. cannot be determined.

b. occurs at the point of tangency between the highest

indifference curve and the highest expected return.

c. occurs at the point of tangency between the highest

indifference curve and the efficient set of portfolios.

d. occurs at the point of tangency between the highest

expected return and lowest risk efficient portfolios.: c.

occurs at the point of tangency between the highest indifference

curve and the efficient set of portfolios.

13.

14.

6. Which of the following is true regarding the expected

20.

efficient frontier are likely to be chosen by

a. It is a weighted average only for stock portfolios.

b. It can only be positive.

c. It can never be above the highest individual return.

d. All of the above are true.: c. It can never be above the

highest individual return.

a. aggressive investors.

b. conservative investors.

c. risk-averse investors.

d. defensive investors.: a. aggressive investors.

21.

7. A portfolio which lies below the efficient frontier is

a. optimal.

b. unattainable.

c. dominant.

d. dominated.: d. dominated.

16.

a. Security B's return should also increase by 10

percent.

b. Security B's return should decrease by 10 percent.

c. Security B's return should be zero.

d. Security B's return is impossible to determine from

the above information.: d. Security B's return is impossible to

determine from the above information.

7. Company specific risk is also known as:

a. market risk.

b. systematic risk.

c. non-diversifiable risk.

d. idiosyncratic risk.: d. idiosyncratic risk.

22.

a. A portfolio with securities all having positive

correlation with each other.

b. A portfolio with securities all having zero correlation

with each other.

c. A portfolio with securities all having negative

correlation with each other.

d. A portfolio with securities all having skewed

correlation with each other.: a. A portfolio with securities all

having positive correlation with each other.

8. The optimal portfolio is the efficient portfolio with the

8. Which of the following statements regarding the

correlation coefficient is not true?

a. It is a statistical measure.

b. It measure the relationship between two securities'

returns.

c. It determines the causes of the relationship between

two securities' returns.

d. All of the above are true.: c. It determines the causes of the

relationship between two securities' returns.

18.

23.

9. The range of the correlation coefficient is from:

13. When returns are perfectly positively correlated, the

risk of the portfolio is:

a. 0 to +1.0

b. 0 to +2.0

c. -1.0 to 0

d. -1.0 to +1.0: d. -1.0 to +1.0

a. zero.

b. the weighted average of the individual securities risk.

c. equal to the correlation coefficient between the

securities.

d. infinite.: b. the weighted average of the individual securities

risk.

10. How many pieces of data does the single-index model

require for a universe of 500 securities?

a. 1002

b. 1502

c. 500

d. 502: Solution: Number = 3n + 2

12. The _________ is a plot of __________.

a. CML . . . individual stocks and efficient portfolios

b. CML . . . both efficient and inefficient portfolios, only

c. SML . . . individual securities and efficient portfolios

d. SML . . . individual securities, inefficient portfolios,

and efficient

portfolios.: SML . . . individual securities and efficient

portfolios

24.

19.

11. Which of the following portfolios has the least

reduction of risk?

a. lowest risk.

b. highest risk.

c. highest utility.

d. least investment.: c. highest utility.

17.

10. Security A and Security B have a correlation

coefficient of 0. If Security A's return is expected to

increase by 10 percent,

described as

15.

10. Portfolios lying on the upper right portion of the

return of a portfolio?

25.

14. Portfolio risk is best measured by the:

a. expected value..

b. portfolio beta.

c. weighted average of individual risk.

d. standard deviation.: d. standard deviation.

26.

14. The relevant risk for a well-diversified portfolio is:

32.

a. interest rate risk.

b. inflation risk.

c. business risk.

d. market risk.: d. market risk.

27.

14. The single-index model implies that stocks covary

a. nondiversifiable risk.

b. market risk.

c. random risk.

d. company-specific risk.: d. company-specific risk.

33.

together only because

of their common:

a. currency.

b. relationship to each other.

c. relationship to the market.

d. desire to make a profit.: c. relationship to the market.

28.

a. positive.

b. negative.

c. zero.

d. impossible to determine.: a. positive.

34.

35.

a. a hostile takeover

b. a rise in inflation

c. a fall in GDP

d. a panic on Wall Street: a. a hostile takeover

applications of:

30.

31.

36.

37.

a. foreign stocks have higher risks than U.S. stocks on

average.

b. foreign stocks tend to fall more in declining markets

than U.S. stocks.

c. foreign stocks have high correlation with U.S. stocks.

d. foreign stocks have higher transaction costs, on

average, than U.S. stocks.: c. foreign stocks have high

correlation with U.S. stocks.

20. The major problem with the Markowitz model is its:

a. lack of accuracy.

b. predictability flaws.

c. complexity.

d. inability to handle large number of inputs.: c.

complexity.

17. A major argument against international

diversification is that:

20. The arbitrage pricing theory (APT) and the CAPM

both assume all except

which of the following?

a. Investors have homogeneous beliefs.

b. Investors are risk-averse utility maximizers.

c. Borrowing and lending can be done at the rate RF.

d. Markets are perfect.: Borrowing and lending can be done

at the rate RF.

16. Markowitz's main contribution to portfolio theory is:

a. that risk is the same for each type of financial asset.

b. that risk is a function of credit, liquidity and market

factors.

c. risk is not quantifiable.

d. insight about the relative importance of variances

and covariances in determining portfolio risk.: d. insight

about the relative importance of variances and covariances in

determining portfolio risk.

19. Which of the following would not be considered a

source of systematic risk?

16. Asset allocation is one of the most widely used

a. the Capital Asset Pricing Model.

b. random diversification.

c. passive portfolio approach.

d. the modern portfolio theory.: d. the modern portfolio

theory.

19. A less restrictive form of the Single Index Model is

the:

a. Risk-free Model.

b. CAPM.

c. CML.

d. Market Model.: d. Market Model.

actual return and expected return given a particular

market index is referred to as the:

29.

18. When the covariance is positive, the correlation will

be:

15. With the Single-index model, the difference between

a. parameter.

b. unique part.

c. error term.

d. beta.: c. error term.

18. Nonsystematic risk is also known as:

38.

23. The APT is based on the:

a. law of averages.

b. law of attraction.

c. law of accelerating return.

d. law of one price.: law of one price.

39.

According to Markowitz, an efficient portfolio is one

that has the

a. largest expected return for the smallest level of risk.

b. largest expected return and zero risk.

c. largest expected return for a given level of risk.

d. smallest level of risk.: c. largest expected return for a given

level of risk.

40.

According to Markowitz, rational investors will seek

47.

efficient portfolios because these portfolios are optimal

based on:

risk taken by an investor if the two securities are

a. perfectly positively correlated with each other.

b. perfectly independent of each other.

c. perfectly negatively correlated with each other.

d. of the same category, e.g. blue chips.: a. perfectly

positively correlated with each other.

a. expected return.

b. risk.

c. expected return and risk.

d. transactions costs.: c. expected return and risk.

41.

The arbitrage pricing theory (APT)

a. considers only one factor and is a narrower model

than the CAPM.

b. considers more factors than the CAPM and is a

broader model.

c. is useful only for well-diversified portfolios of

common stock.

d. is easy to practice because the factors are readily

observable.: considers more factors than the CAPM and is a

broader model.

42.

48.

49.

because it contains all securities weighted by their

A change in the correlation coefficient of the returns of

50.

a. both the expected return and the risk of the portfolio.

b. only the expected return of the portfolio.

c. only the risk level of the portfolio.

d. neither the expected return nor the risk level of the

portfolio.: c. only the risk level of the portfolio.

the efficient frontier.

45.

46.

51.

a. supply; demand

b. control; non-control

c. company-related; industry-related

d. micro; macro: d. micro; macro

52.

The SML can be used to analyze the relationship between

risk and

required return for

a. all assets.

b. inefficient portfolios.

c. only efficient portfolios.

d. only individual securities.: all assets.

Market risk is best measured by the:

a. alpha

b. beta

c. standard deviation

d. coefficient of variation: b. beta

The single index model divides a security's return into

_______ and ________ parts.

If markets are truly efficient and in equilibrium

a. all securities would lie on the SML.

b. any security that plots below the SML would be

considered undervalued.

c. any security that lies above the SML would be

considered overvalued.

d. no security would lie on the SML..: all securities would

lie on the SML.

Select the INCORRECT statement regarding the CML.

a. The CML is an equilibrium relationship for efficient

portfolios and

individual securities.

b. The CML represents the risk-return tradeoff in

equilibrium for efficient

portfolios.

c. The intercept of the CML is the reward per unit of

time available to

investors for deferring consumption.

d. Standard deviation is the measure of risk which

determines a portfolio's

equilibrium return.: The CML is an equilibrium relationship

for efficient portfolios and

individual securities.

Choose the portfolio from the following set that is not on

a. A: expected return of 10 percent ; standard deviation

of 8 percent.

b. B: expected return of 18 percent; standard deviation

of 13 percent

c. C: expected return of 38 percent; standard deviation

of 38 percent.

d. D: expected return of 15 percent; standard deviation

of 14 percent.: d. D: expected return of 15 percent; standard

deviation of 14 percent.

Select the correct statement regarding the market

portfolio. It:

a. is readily and precisely observable.

b. is a risky portfolio.

c. is the lowest point of tangency between the risk-free

rate and the efficient

frontier.

d. should be composed of stocks or bonds.: b. is a risky

portfolio.

two securities in a portfolio causes a change in

44.

Securities with betas less than l should have:

a. expected returns higher than the market.

b. required returns higher than the market return.

c. required returns lower than the market return.

d. no systematic risk.: required returns lower than the market

return.

market values.: because it contains all securities weighted by

their market values.

43.

Owning two securities instead of one will not reduce the

53.

Treasury bill: because it contains all securities weighted by

their market values.

54.

Which of the following is an assumption of the CMT?

a. Single investors can affect the market by their buying and selling

decisions.

b. There is no inflation.

c. Investors prefer capital gains over dividends.

d. Different investors have different probability distributions..: There is no inflation.

55.

Which of the following is not true regarding the Markowitz theory?

a. Markowitz portfolio theory is considered a three-parameter model.

b. Under the Markowitz model, no portfolio on the efficient frontier dominates any other portfolio on the efficient

frontier.

c. The Markowitz model is cumbersome to work with due to the large variance-covariance matrix needed for a set of

stocks.

d. All of the above are true.: a. Markowitz portfolio theory is considered a three-parameter model.

56.

Which of the following is the correct calculation for the required rate of

return under the CAPM?

a. beta (market risk premium)

b. beta + market risk premium

c. risk-free rate + risk premium

d. risk-free rate(market risk premium): risk-free rate + risk premium

57.

Which of the following might be used as a factor in an APT factor model?

a. The risk-free rate

b. Expected inflation

c. Unanticipated deviations from expected inflation

d. Loss by fire at a company's manufacturing plant: Unanticipated deviations from expected inflation

58.

Which of the following regarding investors and the CMT is true?

a. Investors recognize that all the assumptions of the CMT are unrealistic.

b. Investors recognize that all of the CMT assumptions are not unrealistic.

c. Investors are not aware of the assumptions of the CMT model.

d. Investors recognize the CMT is useless for individual investors.: Investors recognize that all of the CMT assumptions are not

unrealistic.

59.

Which of the following statements regarding portfolio risk and number of stocks is generally true?

a. Adding more stocks increases risk.

b. Adding more stocks decreases risk but does not eliminate it.

c. Adding more stocks has no effect on risk.

d. Adding more stocks increases only systematic risk.: b. Adding more stocks decreases risk but does not eliminate it.

You might also like

- Launch of Space Rocket PowerPoint Templates WidescreenDocument3 pagesLaunch of Space Rocket PowerPoint Templates WidescreenAlwidg WidgNo ratings yet

- City Buildings Silhouettes Colors Google Slides PresentationDocument37 pagesCity Buildings Silhouettes Colors Google Slides PresentationditriNo ratings yet

- City Buildings Silhouettes Colors Google Slides PresentationDocument37 pagesCity Buildings Silhouettes Colors Google Slides PresentationditriNo ratings yet

- Chap009 Test Bank (1) SolutionDocument16 pagesChap009 Test Bank (1) Solutionbaskarbaju1No ratings yet

- Kuis ParalelDocument4 pagesKuis ParalelAlwidg WidgNo ratings yet

- Raumanen by Marianne KatoppoDocument3 pagesRaumanen by Marianne KatoppoAlwidg WidgNo ratings yet

- IHRSADocument4 pagesIHRSAAlwidg WidgNo ratings yet

- LirikDocument5 pagesLirikAlwidg WidgNo ratings yet

- Loan AnalysisDocument16 pagesLoan AnalysisJulie TanNo ratings yet

- IHRSADocument4 pagesIHRSAAlwidg WidgNo ratings yet

- RW7 e CH 23Document9 pagesRW7 e CH 23Alwidg WidgNo ratings yet

- Research Methods For Business by UMA SEKARAN 6th Edition Test BankDocument3 pagesResearch Methods For Business by UMA SEKARAN 6th Edition Test BankSaniya1488% (8)

- Analyzing Receivables Impairment and FactoringDocument2 pagesAnalyzing Receivables Impairment and FactoringAlwidg WidgNo ratings yet

- PE2 1 (Edit)Document5 pagesPE2 1 (Edit)Alwidg WidgNo ratings yet

- Solution Quiz PararelDocument5 pagesSolution Quiz PararelFarah Fauziah HilmanNo ratings yet

- Pajak Internasional Seminar PerpajakanDocument35 pagesPajak Internasional Seminar PerpajakanAlwidg WidgNo ratings yet

- Pararel Quiz Intermediate Accounting 11Document3 pagesPararel Quiz Intermediate Accounting 11Krisna PangestuNo ratings yet

- Manage petty cash and bank reconciliation reportsDocument2 pagesManage petty cash and bank reconciliation reportsAlwidg WidgNo ratings yet

- 9.17 Task Performance Time (Min) Task Must Follow Task Listed Below A B C D E F G H IDocument1 page9.17 Task Performance Time (Min) Task Must Follow Task Listed Below A B C D E F G H IAlwidg WidgNo ratings yet

- Akili Essay Competition GuidelinesDocument2 pagesAkili Essay Competition GuidelinesAlwidg WidgNo ratings yet

- Cost of Fund Giro TabunganDocument13 pagesCost of Fund Giro TabunganAlwidg WidgNo ratings yet

- Business Ownerships 2011Document1 pageBusiness Ownerships 2011Alwidg WidgNo ratings yet

- Without Financial Institution S Without Financial MarketDocument2 pagesWithout Financial Institution S Without Financial MarketAlwidg WidgNo ratings yet

- Choosing the Right Database: A Comparison of MySQL and OracleDocument14 pagesChoosing the Right Database: A Comparison of MySQL and OraclezainposeNo ratings yet

- IPM Bonds CH17 CH18Document2 pagesIPM Bonds CH17 CH18Alwidg WidgNo ratings yet

- MotivationequitytheoryDocument29 pagesMotivationequitytheoryAlwidg WidgNo ratings yet

- 9.17 Task Performance Time (Min) Task Must Follow Task Listed Below A B C D E F G H IDocument1 page9.17 Task Performance Time (Min) Task Must Follow Task Listed Below A B C D E F G H IAlwidg WidgNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Lao Gi Vs CADocument2 pagesLao Gi Vs CARichel DeanNo ratings yet

- Eunoia Fit 'n Slim - Slimming Coffee (Meal Plan)Document2 pagesEunoia Fit 'n Slim - Slimming Coffee (Meal Plan)jbkmw4hmvmNo ratings yet

- Lesson Plan For Clothes Fashion TeenagersDocument4 pagesLesson Plan For Clothes Fashion Teenagerschitini170774No ratings yet

- Unified Field Theory - WikipediaDocument24 pagesUnified Field Theory - WikipediaSaw MyatNo ratings yet

- Medical Missionary and The Final Crisis MainDocument256 pagesMedical Missionary and The Final Crisis MainHarold Wong100% (2)

- NafsDocument3 pagesNafsMabub_sddqNo ratings yet

- Sa Tally Education BrochureDocument6 pagesSa Tally Education BrochurePoojaMittalNo ratings yet

- NSCC Great Expectations 09Document6 pagesNSCC Great Expectations 09HDTT_09101199No ratings yet

- Moor defines computer ethics and its importanceDocument2 pagesMoor defines computer ethics and its importanceNadia MalikNo ratings yet

- OAU004301 UMG8900 Data Configuration and Routine Maintenance R003 ISSUE2!0!20050622Document56 pagesOAU004301 UMG8900 Data Configuration and Routine Maintenance R003 ISSUE2!0!20050622firas1976No ratings yet

- Week 5 AssignmentDocument2 pagesWeek 5 AssignmentNGUYEN HAINo ratings yet

- TSR 9278 - DLR1 - OtherlandsDocument106 pagesTSR 9278 - DLR1 - OtherlandsDiego RB100% (5)

- Exl - Exterior Lighting System PDFDocument336 pagesExl - Exterior Lighting System PDFAxxNo ratings yet

- Designing Organizational Structure: Specialization and CoordinationDocument30 pagesDesigning Organizational Structure: Specialization and CoordinationUtkuNo ratings yet

- Yoga Poses For Back Pain ReliefDocument11 pagesYoga Poses For Back Pain Reliefshiv yoga100% (2)

- Analogy and LogicDocument2 pagesAnalogy and LogicCOMELEC CARNo ratings yet

- Workshop 3-6: RCS of A Cube: Introduction To ANSYS HFSSDocument11 pagesWorkshop 3-6: RCS of A Cube: Introduction To ANSYS HFSSRicardo MichelinNo ratings yet

- SESSION 8 - Anti-Malaria DrugsDocument48 pagesSESSION 8 - Anti-Malaria DrugsYassboy MsdNo ratings yet

- Chapter L: Background of The Study As Technology Continues To Develop, Mobile Devices Have BecomeDocument9 pagesChapter L: Background of The Study As Technology Continues To Develop, Mobile Devices Have Becomeferlyn dumapeNo ratings yet

- Barriers To Tourism PlanningDocument4 pagesBarriers To Tourism PlanningApril GonzalezNo ratings yet

- ArgalaDocument4 pagesArgalaTushar Kumar BhowmikNo ratings yet

- Stylistics: The Routledge Handbook of Stylistics Edited by Michael BurkeDocument56 pagesStylistics: The Routledge Handbook of Stylistics Edited by Michael BurkeAmmara FarhanNo ratings yet

- Beginners Guide To Sketching Chapter 06Document30 pagesBeginners Guide To Sketching Chapter 06renzo alfaroNo ratings yet

- The 4th Secret of The One Minute ManagerDocument147 pagesThe 4th Secret of The One Minute ManagerReyes CristobalNo ratings yet

- Literary Criticism ExamDocument1 pageLiterary Criticism ExamSusan MigueNo ratings yet

- Fundamentals of Surveying by S.K. RoyDocument613 pagesFundamentals of Surveying by S.K. RoyChalamaiah Vadlamudi100% (1)

- Destined To ReignDocument7 pagesDestined To ReignMichael B. BolotaoloNo ratings yet

- Business Statistics: Methods For Describing Sets of DataDocument103 pagesBusiness Statistics: Methods For Describing Sets of DataDrake AdamNo ratings yet

- School Memo Reada A ThonDocument6 pagesSchool Memo Reada A ThonJanine EspinedaNo ratings yet

- Aquinas' EthicsDocument33 pagesAquinas' EthicsRBCD INDUSTRIAL SUPPLY100% (1)