Professional Documents

Culture Documents

Lect 1 Notes

Uploaded by

Muhammad KashifCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lect 1 Notes

Uploaded by

Muhammad KashifCopyright:

Available Formats

Hanke, Wichern and Reitsch,

//\\

//\\

Business Forecasting,

\I7l \I7l O)('HAPTER

7th ed, 2001

\\ /l\\ //\\ //\\

7/\I7l \I/' \7'

Introduction

to

Forecosting

Tni, Uoot is concerned with methods used to predict the uncertain future in an effort

to help the managersof a businessmake better decisions.Such efforts involve the study

of historical data and the manipulation of thesedata to searchfor patterns that can be

effectively extended into the future.

In this text,we regularly remind readersthat soundjudgment must be used along with

numerical resultsif good forecastingis to result.The casesat the end of text chaptersemphasizethis point, and there are discussionsof this matter in this chapter and in the concluding chapter of the text.The example in this chapter emphasizesthis point as well.

Historyof Forecosling

Many of the forecastingtechniquesused today and discussedin this book were developed in the nineteenthcentury;regressionanalysisproceduresare an example.By contrast, some of the topicsin this book were developedand have receivedattention only

recently.The Box-Jenkins procedures and neural networks fall into this category.

With the development of more sophisticatedforecastingtechniqueg along with the

advent of computers,especiallythe proliferation of the small,personal computer and associatedsoftware,forecastinghas receivedmore and more attention. Every managernow

has the ability to utilize very sophisticateddata analysistechniques for forecasting purposes,and an understandingof these techniquesis now essentialfor businessmanagers

For this same reason,consumersof forecasts(managers)must be alert to the improper

use of forecastingtechniquesbecauseinaccurate forecastscan lead to poor decisions

New techniquesfor forecastingcontinue to be developedas managementconcern

with the forecasting processcontinues to grow.A particular focus of this attention is on

the errors that are an inherent part of any forecastingprocedure.Predictionsas to future outcomes rarely are preciselyon the mark; the forecastercan only endeavor to

make the inevitable errors as small as possible.

Need for Forecosting

In view of the inherent inaccuraciesin the process,why is forecastingnecessary?The answer is that all organizationsoperate in an atmosphere of uncertainty and that, in spite

of this fact, decisionsmust be made that affect the future of the organization.Educated

guessesabout the future are more valuable to organization managersthan are uneducated guesses.

This book discussesvarious ways of making forecaststhat rely on logical

methodsof manipulatingthe data that have been generatedby historicalevents.

cHAPTER 1 Introduction Io Forecasting

This is not to say that intuitive forecastingis bad. On the contrary,the "gut" feelings of personswho manage organizationsoften provide the only forecastsavailable.

This text discussesforecastingtechniquesthat can be used to supplementthe common

senseand management ability of decision makers;judgmental elements in the forecastingprocessare discussedin Chapter 10.It is our view that decisionmakers are better off understanding both quantitative and qualitative forecasting techniques and

using them wisely than they are if forced to plan for the future without the benefit of

valuable supplemental information.

The role of judgmental forecasting has changed in recent years.Before the advent

of modern forecastingtechniquesand the power of the computer,the manager'sjudgment was the only forecasting tool available. There is now evidence according to

Makridakis (1986) that forecastsusing judgment only are not as accurateas those involving the judicious application of quantitative techniques:

Humans possessunique knowledge and inside information not available to

quantitative methods.Surprisingly,however, empirical studies and laboratory

experiments have shown that their forecastsare not more accurate than those

of quantitative methods.Humans tend to be optimistic and underestimate future uncertainty. In addition, the cost of forecasting with judgmental methods

is often considerably higher than when quantitative methods are used.l

It is our belief that the most effective forecaster is able to formulate a skillful mix

of quantitative forecasting techniques and good judgment and to avoid the extremes

of total reliance on either. At the one extreme we find the executive who, through ignorance and fear of quantitative techniques and computers, relies solely on intuition

and feel. At the other extreme is the forecasterskilled in the latest sophisticateddata

manipulation techniques who is unable or unwilling to relate the forecasting processto

the needs of the organization and its decision makers.We view the quantitative forecasting techniques discussedin most of this book to be only the starting point in the effective forecasting of outcomes important to the organization:Analysis, judgment,

common sense,and businessexperiencemust be brought to bear at the point at which

these important techniques have generated their results.

Since the world in which organizationsoperate has always been changing,forecasts

However, recent years have brought about increasedrehave always been necessary.

liance on methods that involve sophisticateddata manipulation techniques.New technology and new disciplineshave sprung up overnight;governmentactivity at all levels

has intensified;competitionin many areashas become more keen;international trade

has steppedup in almost all industries;socialhelp and serviceagencieshave been created and have grown; and the Internet has become an important source of data and

decision-making information. These factors have combined to create an organizational

climate that is more complex,more fast-paced,and more competitive than ever before.

Organizations that cannot react quickly to changing conditions and cannot foresee the

future with any degree of accuracyare doomed to extinction'

Computers,along with the quantitative techniquesthey make possible,have become more than a conveniencefor modern organizations;theyhave become essential.

The complexitiesjust discussedgenerate tremendous amounts of data and an overwhelming need to extract useful information. The modern tools of forecasting,along

with the capabilitiesof the computer,have becomeindispensablefor organizationsoperating in the modern world.

p.17.

M-mauti, (1986),

CHAPTER I

Introduction to Forecasting 3

Who needs forecasts?Almost every organizalion,large and small, private and public, uses forecastingeither explicitly or implicitly, becausealmost every organization

must plan to meet the conditions of the future for which it has imperfect knowledge.

In addition, the need for forecastscuts acrossall functional lines as well as all types of

organizations.Forecastsare needed in finance,marketing, personnel,and production

areas,in government and profit-seekingorganizations,in small social clubs,and in national political parties.Considerthe following questionsthat suggestthe need for some

forecastingprocedures:

. If we increaseour advertisingbudget by 70"h, how will salesbe affected?

o What revenue might the state government expect over the next two-year period?

r How many units might we sell in an effort to recover our fixed investment in production equipment?

r What factors can we identify that will help explain the variability in monthly unit

sales?

o What is a year-by-yearprediction for the total loan balanceof our bank over the

next 10 years?

. Will there be a recession?If so,when will it begin, how severewill it be, and when

will it end?

Typesof Forecosts

When organizationmanagersare faced with the need to make decisionsin an atmosphere of uncertainty, what types of forecasts are available to them? Forecasting proceduresmight first be classifiedas long term or short term. Long-term forecastsare

necessaryto set the general course of an organization for the long run; thus, they become the particular focus of top management.Short-term forecastsare used to design

immediate strategiesand are used by middle managementand first-line management

to meet the needs of the immediate future.

Forecastsmight also be classifiedin terms of their position on a micro-macro continuum, that is, on the extent to which they involve small details versus large summary

values.For example, a plant manager might be interested in forecasting the number of

workers neededfor the next severalmonths (a micro forecast),whereasthe federal government is forecasting the total number of people employed in the entire country (a

macro forecast).Again, different levels of management in an organization tend to focus

on different levels of the micro-macro continuum.Top management would be interested in forecasting the sales of the entire company, for example, whereas individual

salespersonswould be much more interested in forecasting their own salesvolumes.

Forecastingprocedurescan also be classifiedaccordingto whether they tend to be

more quantitative or qualitative.At one extreme,a purely qualitative technique is one

requiring no overt manipulation of data.Only the "judgment" of the forecasteris used.

Even here,of course,the forecaster's"judgment" is actually a result of the mental manipulation of past historical data.At the other extreme,purely quantitative techniques

need no input of judgment; they are mechanicalproceduresthat produce quantitative

results.Some quantitativeproceduresrequire a much more sophisticatedmanipulation

of data than do others,of course.This book emphasizesthe quantitative forecasting

techniquesbecausea broader understandingof thesevery useful proceduresis needed

in the effective managementof modern organizations.However, we emphasizeagain

that judgment and common sensemust be used along with mechanicaland data manipulative procedures.Only in this way can intelligent forecastingtake place.

CHAPTER I

Introduction to Forecasting

Mocroeconomic

Forecosting

We usually think of forecasting in terms of predicting important variables for an individual company or perhaps for one component of a company.Monthly company sales,

unit salesfor one of a company'sstores,and absenthours per employee per month in

a factory are examples.

By contrast, there is growing interest in forecasting important variables for the entire economy of a country.Much work has been done in evaluatingmethods for doing

this kind of overall economic forecasting,called macroeconomic forecasting.Examples

of interest to the federal government of the United States are unemployment rate,

grossdomestic product, and the prime interest rate.Economic policy is based,in part,

on projections of important economic indicatorssuch as the three just mentioned.For

this reason,there is great interest in improving forecastingmethods that focus on overall measuresof a country's economic performance.

One of the chief difficulties in developing accurate forecasts of overall economic

activity is an unexpected and significant shift in a key economic factor. Among such

factors are significant changesin oil prices, inflation surges,and broad policy changes

by a country's government that affect the global economy.

The possibility of such significant shifts in the economic scene has raised a key

question in macroeconomic forecasting: Should the forecasts generated by the forecasting model be modified using the forecaster'sjudgment? Current work on forecasting methodology often involves this question.

Much work, both theoretical and practical, continues on the subject of macroeconomic forecasting.An issueof the International Journal of Forecastingis devoted to this

subject(Vol.6, No.3, October 1990).Consideringthe importanceof accurateeconomic

forecasting to economic policy formulation in this country and others, continuing attention to this kind of forecasting can be expected in the future.

Choosingo ForecosfingMethod

The preceding discussionsuggestsseveral factors to be considered in choosing a forecasting method. The level of detail must be considered.Are forecastsof specific details

needed (a micro forecast)? Or is the future status of some overall or summary factor

needed (a macro forecast)? Is the forecast needed for some point in the near future (a

short-term forecast) or for a point in the distant future (a long-term forecast)?And to

what extent are qualitative fiudgment) and quantitative (data manipulative) methods

appropriate?

The overriding consideration in choosing a forecasting method is that the results

must facilitate the decision-making processof the organizatioh's managers.The essential requirement,then, is not that the forecastingmethod involve a complicatedmathematical processor that it be the latest sophisticatedmethod. Rather, the method

chosen should produce a forecast that is accurate,timely, and understood by management so that the forecast can help produce better decisions.Also, the use of the forecasting procedure must produce a benefit that is in excessof the cost associatedwith

its use.

Forecosting

Steps

All formal forecasting procedures involve extending the experiences of the past into

the uncertain future. Thus, they involve the assumption that the conditions that generated past data are indistinguishable from the conditions of the future except for those

CHAPTER 1. Introduction to Forecasting 5

variables explicitly recognizedby the forecastingmodel. If one is forecastingjob performance ratings of employees using only the company entrance examination score as

a predictor,for example,it is being assumedthat each person'sjob performancerating

is related only to the entranceexaminationscore.To the extent that this assumptionof

indistinguishablepast and future is not totally met, inaccurateforecastsresult unless

they are modified by the judgment of the forecaster.

The recognition that forecastingtechniquesoperate on the data generatedby historical events leads to the identification of the following five steps in the forecasting

process:

1.

2.

3.

4.

5.

Data collection

Data reduction or condensation

Model building and evaluation

Model extrapolation (the actual forecast)

Forecastevaluation

Step 1, data collection,suggeststhe importanceof getting the proper data and making sure they are correct.This step is often the most challenging part of the entire forecasting process and the most difficult to monitor since subsequent steps can be

performed on data whether relevant to the problem at hand or not. Collection and

quality control problems usually abound wheneverit becomesnecessaryto obtain pertinent data in an organization.

Step 2, data reduction or condensation,is often necessarysince it is possible to

have too much data in the forecasting processas well as too little. Some data may not

be relevant to the problem and may reduce forecasting accuracy.Other data may be

appropriate but only in certain historical periods.For example, in forecasting the sales

of small cars one may wish to use only car salesdata since the oil embargo of the 1970s

rather than data over the past 50 years.

Step 3, model building and evaluation,involves fitting the collected data into a forecasting model that is appropriate in terms of minimizing the forecasting error. The simpler the model, the better it is in terms of gaining acceptanceof the forecasting process

by managerswho must make the firm's decisions.Often a balance must be struck between a sophisticatedforecastingapproach that offers slightly more accuracyand a simple approach that is easily understood and gains the support of-and, hence,is actively

used by-the company's decision makers.Obviously,judgment is involved in this selection process.Since this book discussesnumerous forecasting models and their applicability, it is our hope that the reader's ability to exercisegood judgment in the choice and

use of appropriate forecastingmodels will increaseafter studying'this material.

Step 4, model extrapolation, consistsof the actual model forecasts that are generated once the appropriate data have been collected and possibly reduced and an appropriate forecasting model has been chosen.Often forecasting for recent periods in

which the actual historical values are known is used to check the accuracy of the

process.The forecasting errors are then observed and summarized in some way. This

procedure is discussedin Step 5.

Step 5, forecast evaluation,involves comparing forecast values with actual historical

values.In this process,a few of the most recent data values are often held back from the

data set being analyzed.After the forecasting model is completed, forecasts are made

for these periods and compared with the known historical values.Some forecastingprocedures sum the absolute values of the errors and may report this sum, or divide it by

the number of forecastattempts to produce the averageforecast error. Other procedures

produce the sum of squared errors,which is then compared with similar figures from alternative forecastingmethods.Some procedures also track and report the magnitude of

CHAPTER 1. Introduction to Forecasting

the error terms over the forecastingperiod. Examination of error patterns often leads

the analyst to a modification of the forecastingprocedure.Specific methods of measuring forecastingerrors are discussednear the end of Chapter 3.

Process

Monogingthe Forecosting

The discussionin this chapter servesto underline our belief that management ability

and common sensemust be involved in the forecasting process.The forecaster should

be thought of as an advisor to the manager rather than as the monitor of an automatic

decision-making device.Unfortunately, the latter is sometimes the case in practice, especially with the aura of the computer. Again, quantitative techniques in the forecasting process must be seen as what they really are, namely, tools to be used by the

manager in arriving at better decisions.According to Makridakis (1986),

The usefulnessand utility of forecasting can be improved if management

adopts a more realistic attitude. Forecasting should not be viewed as a substitute for prophecy but rather as the best way of identifying and extrapolating

establishedpatterns or relationships in order to forecast.If such an attitude

is accepted,forecasting errors must be considered inevitable and the circumstancesthat cause them investigated.2

Given that, several key questions should always be raised if management of the

forecasting processis to be properly conducted.

.

.

o

o

e

o

.

o

.

Why is a forecast needed?

Who will use the forecast, and what are their specific requirements?

What level of detail or aggregationis required, and what is the proper time horizon?

What data are available, and will the data be sufficient to generate the needed

forecast?

What will the forecast cost?

How accurate can we expect the forecast to be?

Will the forecast be made in time to help the decision-making process?

Does the forecaster clearly understand how the forecast will be used in the

organization?

Is a feedback processavailable to evaluate the forecast after it is made and to adjust the forecasting processaccordingly?

Pockoges

ComputerForecosling

The developmentthat has had the greatestimpact on forecastingin the past several

yearsis that of computersoftwarepackagesspecificallydesignedto deal directly with

variousforecastingmethods.Two typesof computerpackagesare of interestto foretime seriesanalysis,and

casters:(1) statisticalpackagesthat includeregressionanalysis,

and (2) forecastingpackagesthat are

other techniquesusedfrequentlyby forecasters;

specificallydesignedfor forecastingapplications.

Hundredsof statisticaland forecastingpackageshave been developedfor both

mainframesand microcomputers(or personalcomputers,frequently referred to as

techniquesare

PCs).Managerswith PCson their desksand knowledgeof forecasting

managers

are

taking advanModern

their

forecasts.

no longer dependenton staff for

46F+::

CHAPTER 1 Introduction to Forecasting 7

tage of the easeand availability of sophisticatedforecastingmethods afforded by personal computers.

Becauseof the rapid turnover in available forecastingsoftware,it would not be

wise in a text such as this to detail and discussthe dedicatedforecastingpackagesavailable as this text is written. Softwareauthorsare constantlystrivingto improve the number of techniquesavailableon their programs and their easeof use and interpretation.

Forecastersmust constantlybe alert to new software developmentsand, without constantly jumping from one package to another, realize that software improvements are

inevitable. They should be in a position to take advantage of such improvements.

In spite of this caveat,it remainsessentialto use computer software packagesfor

many forecastingapplicationsbecauseof the extensivecalculationsinvolved. For this

reasonwe have chosentwo typical computer programs to illustrate many of the techniques in this text: Minitab 13 and Excel 2000.You will find screensfor theseprograms

throughout the text. Keep in mind that any programs you use will have the samebasic

calculations programmed into them, even though the input and output screenswill not

be identical.

A listing of forecasting packageswas published in The Forum, The Joint Newsletter of the International Association of BusinessForecastingand the International Institute of Forecasters.Vol. 9. No. 3. Fall 1996.

Forecosling

Exomple

Discussionsin this chapter emphasizethat forecastingrequires a great deal of judgment along with a mathematicalmanipulation of collected data.The following example shows the kind of thinking that often precedes a forecasting effort in a real firm.

Notice that the data valuesthat will produce useful forecasts,even if they exist,are not

apparent at the beginning of the processand may not have been identified. In other

words,the initial efforts may turn out to be uselessto management.The computer results of the forecasting effort using the identified variables are not shown here as they

involve topicsthat are describedthroughout this text. However,look for the techniques

describedin later chaptersto be applied to thesedata. Example 1.1 will be resolvedin

Chapter 11. For the moment, we hope that this example underlines the scope of the

forecasting effort that real managersface.

E x o m p l el . l

AlomegaFoodStoresis a retail food providerwith2"/storesin a midwesternstate.The company

engages

in variouskindsof advertisingand,until recently,hasneverstudiedthe effectits advertisingdollarshaveon sales,althoughsomedatahad beencollectedfor threeyears.

The executivesat Alomega decidedto begin trackingtheir advertisingefforts alongwith

the salesvolumesfor eachmonth.Their hope wasthat after severalmonthsthe collecteddata

could be examinedto possiblyrevealany relationshipsthat would help in future advertising

expenditures.

Theaccountingdepartmentbeganextendingits historicalrecordsby recordingthe salesvolume for eachmonth alongwith the advertisingdollarsfor both newspaperads and TV spots.

They alsorecordedboth thesevalueslaggedone and two months.This wasdone becausesome

peopleon the executivecommitteethoughtthat salesmight lag advertisingexpendituresrather

than respondin the month the adsappeared.

It wasalsobelievedthat salesexperienced

a seasonal

effect.For thisreasona dummyor categoricalvariablewasusedto indicateeachmonth.Managementalsowonderedaboutany trend

in salesvolume.

Finally,it wasbelievedthat Alomega'sadvertisingdollarsmight havean effecton its major

competitors'advertisingbudgetsthe followingmonth.For eachfollowingmonth it wasdecided

that competitors'

advertising

couldbe classified

aslittle (1),a moderateamount(2),or a great

amount(3).

cHAPTER 1 Intro duction to Fo recasting

After a few months of data collection and analysis of past records,the accounting department completed a data array for 48 months using the following variables.

.

.

.

r

e

.

.

.

.

.

.

Salesdollars

Newspaper advertising dollars

TV advertising dollars

Month code where January = 1, February = 2, through December = 12

A seriesof 11 dummy variables to indicate month

Newspaper advertising lagged one month

Newspaper advertising lagged two months

TV advertising lagged one month

TV advertising lagged two months

Month number from 1 to 48

Code 1,2, or 3 to indicate competitors' advertising efforts the following month

Alomega management, especially Julie Ruth, the company president, now wants to learn

anything it can from the data it has collected.In addition to learning about the effects of advertising on salesvolumes and competitors' advertising,Julie wonders about any trend and seasonal

effeJts on sales.However, the company's production manager,JacksonTilson, does not share her

enthusiasm.At the end of the forecasting planning meeting, he makes the following statement:

"I've been trying to keep my mouth shut during this meeting, but this is really too much. I think

we're wasting alot of people's time with all this data collection and fooling around with computers. All you have to do is talk with our people on the floor and with the grocery store manug"rs to understand what's going on. I've seen this happen around here before, and here we go

alain. Some of you people need to turn off your computers, get out of your fancy offices, and

talk with a few real peoPle."

Summory

The purpose of a forecast is to reduce the range of uncertainty within which manage-

two primary rules to which the

ment judgmentsmust be made.This purposesuggests

process

adhere:

must

forecasting

1. The forecastmustbe technicallycorrectand produceforecastsaccurateenoughto

meet the firm's needs.

2. T\e forecastingprocedureand its resultsmust be effectivelypresentedto managementso that the forecastsare utilized in the decision-makingprocessto the

basis.

mustalsobe justifiedon a cost-benefit

firm's advantage;results

The latter considerationis often misunderstoodand can be frustratingto profesYet if forecastsare to be usedto the firm's benefit,thosewho have

sionalforecasters.

authoritymustutilizethem.Thisraisesthe questionof whatmight

the decision-making

and sometimesmajor expenditures

Substantial

be calledthe "politics"of forecasting.

view of the course

and resourceallocationswithin the firm often reston management's

of future events.As the movementof resourcesand power within an organizationis

it is not surprisingto

often basedon the perceiveddirectionof the future (forecasts),

process.This

forecasting

find a certain amount of political intrigue surroundingthe

considerationunderlinesthe importanceof the secondprimaryrule:The forecastsgeneratedwithin the firm must be understoodand appreciatedby its decisionmakersso

that they are usedby the managementof the firm.

variousforecastingmodelsand procedures.

The remainderof this book discusses

appears,includingan introductionto correconcepts

statistical

basic

First,a review of

One chapteris then devotedto methodsof collecting

analysis.

lation and regression

data and exploringdata setsfor underlyingpatterns.Many specificforecastingmethods are detailedin the chaptersthat follow,and the final two text chaptersare devoted

processasit relatesto the decisionmakersof the firm.

to the forecasting

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Manufacturing Egg Trays from Waste PaperDocument17 pagesManufacturing Egg Trays from Waste Paperravibarora86% (7)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Marco OH Lighting-Business Plan PDFDocument43 pagesMarco OH Lighting-Business Plan PDFsjcoolgeniusNo ratings yet

- Answers About HubSpotDocument1 pageAnswers About HubSpotPrasetyaNo ratings yet

- Volume 1 Drafting Design and Presentation StandardsDocument328 pagesVolume 1 Drafting Design and Presentation StandardsAntonio Herrera PérezNo ratings yet

- WRAP Lewin Fwp01-11Document45 pagesWRAP Lewin Fwp01-11Muhammad KashifNo ratings yet

- B RAST.0000028186.44328.3fDocument32 pagesB RAST.0000028186.44328.3fMuhammad KashifNo ratings yet

- Av Average ValueDocument3 pagesAv Average ValuechatuusumitavaNo ratings yet

- EViews IllustratedDocument441 pagesEViews IllustratedAlfredo Candia Barriga100% (3)

- Asif Research Paper1Document19 pagesAsif Research Paper1Muhammad KashifNo ratings yet

- Reasons For Negative Interest Rates in JapanDocument4 pagesReasons For Negative Interest Rates in JapanMuhammad KashifNo ratings yet

- Chapter 23 BootstrappingDocument25 pagesChapter 23 BootstrappingMuhammad KashifNo ratings yet

- GMM in Asset PricingDocument4 pagesGMM in Asset PricingMuhammad KashifNo ratings yet

- Solutions Manual CCDocument2 pagesSolutions Manual CCMuhammad KashifNo ratings yet

- Chapter 22 - Elements of Hierarchical Regression ModelsDocument21 pagesChapter 22 - Elements of Hierarchical Regression ModelsMuhammad KashifNo ratings yet

- Downside Risk Premium of Approximately 6% per AnnumDocument49 pagesDownside Risk Premium of Approximately 6% per AnnumMuhammad KashifNo ratings yet

- Constant Expected ReturnDocument49 pagesConstant Expected ReturnbeckybaikNo ratings yet

- Media 214383 enDocument36 pagesMedia 214383 enMuhammad KashifNo ratings yet

- Distributions HandbookDocument202 pagesDistributions HandbookMubangaNo ratings yet

- Return CalculationsDocument35 pagesReturn CalculationsJohn DoeNo ratings yet

- Econometric SDocument387 pagesEconometric SMuhammad KashifNo ratings yet

- Conditional Asset Pricing With Higher Moments: Volker ZiemannDocument50 pagesConditional Asset Pricing With Higher Moments: Volker ZiemannMuhammad KashifNo ratings yet

- Using Matlab in Mutual Funds EvaluationDocument16 pagesUsing Matlab in Mutual Funds EvaluationMuhammad KashifNo ratings yet

- 1 s2.0 S2212567112000585 MainDocument8 pages1 s2.0 S2212567112000585 MainMuhammad KashifNo ratings yet

- 1 s2.0 S037842661300455X MainDocument18 pages1 s2.0 S037842661300455X MainMuhammad KashifNo ratings yet

- Lecture Fr1PDDocument63 pagesLecture Fr1PDMuhammad KashifNo ratings yet

- Ecm AllDocument266 pagesEcm AllMuhammad KashifNo ratings yet

- 1 s2.0 S0927539813000789 MainDocument19 pages1 s2.0 S0927539813000789 MainMuhammad KashifNo ratings yet

- Chapter 1 IntroductionDocument3 pagesChapter 1 IntroductionAlexandra CherciuNo ratings yet

- Using Matlab in Mutual Funds EvaluationDocument16 pagesUsing Matlab in Mutual Funds EvaluationMuhammad KashifNo ratings yet

- Understanding CPP An Accelerated IntroductionDocument63 pagesUnderstanding CPP An Accelerated IntroductionMuhammad KashifNo ratings yet

- Money and Financial Markets: PD Dr. M. Pasche Friedrich Schiller University JenaDocument65 pagesMoney and Financial Markets: PD Dr. M. Pasche Friedrich Schiller University JenaMuhammad KashifNo ratings yet

- 1 s2.0 S2212567112000585 MainDocument8 pages1 s2.0 S2212567112000585 MainMuhammad KashifNo ratings yet

- A Cookbook of MathematicsDocument116 pagesA Cookbook of MathematicsMohsin Ali Sheikh100% (1)

- Holux M-1000C Bluetooth GPS Logger Manual GuideDocument22 pagesHolux M-1000C Bluetooth GPS Logger Manual Guidenabiloo2003No ratings yet

- # 6030 PEN OIL: Grade: Industrial Grade Heavy Duty Penetrating OilDocument3 pages# 6030 PEN OIL: Grade: Industrial Grade Heavy Duty Penetrating OilPrakash KumarNo ratings yet

- Fundamentals 2014Document959 pagesFundamentals 2014Angelo Vittorio VettorazziNo ratings yet

- Admin Interview Questions and Answers - Robert HalfDocument2 pagesAdmin Interview Questions and Answers - Robert HalfWaqqas AhmadNo ratings yet

- FlowCon General InstructionDocument4 pagesFlowCon General InstructionGabriel Arriagada UsachNo ratings yet

- Smart Payment MeterDocument2 pagesSmart Payment MeterJesus Castro OrozcoNo ratings yet

- IG 55 CalculationDocument11 pagesIG 55 CalculationNoridhamNo ratings yet

- College Report of Optical Burst SwitchingDocument21 pagesCollege Report of Optical Burst Switchingimcoolsha999No ratings yet

- Vijay Kumar Gupta (OILER)Document1 pageVijay Kumar Gupta (OILER)VIJAY GUPTANo ratings yet

- Duotone GuideDocument1 pageDuotone Guideapi-648378651No ratings yet

- Powerful Cooling and Easy Installation For Really Large SpacesDocument4 pagesPowerful Cooling and Easy Installation For Really Large Spacesalkaf08No ratings yet

- Updated After 11th BoS Course Curriculum - B.tech CSEDocument120 pagesUpdated After 11th BoS Course Curriculum - B.tech CSEAnonymous 9etQKwWNo ratings yet

- Player Alex's SEO-Optimized Character Sheet for Antero VipunenDocument2 pagesPlayer Alex's SEO-Optimized Character Sheet for Antero VipunenAlex AntiaNo ratings yet

- Geometric Design of Highways for EngineersDocument39 pagesGeometric Design of Highways for EngineersZeleke TaimuNo ratings yet

- TN 46Document23 pagesTN 46Khalil AhmadNo ratings yet

- Advances in Remediation-eBookDocument88 pagesAdvances in Remediation-eBookalinerlfNo ratings yet

- Design Rules CMOS Transistor LayoutDocument7 pagesDesign Rules CMOS Transistor LayoututpalwxyzNo ratings yet

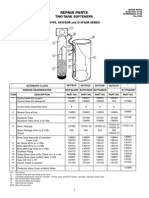

- Star S07FS32DR Water Softener Repair PartsDocument1 pageStar S07FS32DR Water Softener Repair PartsBillNo ratings yet

- 1893 Shadow RunDocument6 pages1893 Shadow RungibbamonNo ratings yet

- CHEST Workout Structure and Training Log PREVIEWDocument3 pagesCHEST Workout Structure and Training Log PREVIEWgaurav singhNo ratings yet

- Friday Night FightsDocument8 pagesFriday Night Fightsapi-629904068No ratings yet

- Selection ToolsDocument13 pagesSelection ToolsDominador Gaduyon DadalNo ratings yet

- Phase Locked LoopDocument4 pagesPhase Locked LoopsagarduttaNo ratings yet

- 0.9PF PW 380v 3phase HF UPS10-120kvaDocument8 pages0.9PF PW 380v 3phase HF UPS10-120kvaArmandinho CaveroNo ratings yet

- V 2172 0020 0031 - Rev - 6 (3458748) PDFDocument262 pagesV 2172 0020 0031 - Rev - 6 (3458748) PDFLG Milton LuisNo ratings yet

- Assessment of Groundwater Quality Using GIS - A Case Study of The Churu District of RajasthanDocument9 pagesAssessment of Groundwater Quality Using GIS - A Case Study of The Churu District of RajasthanSivaShankarNo ratings yet