Professional Documents

Culture Documents

The Standard - Business Daily Stocks Review (May 5, 2015)

Uploaded by

Manila Standard TodayCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

The Standard - Business Daily Stocks Review (May 5, 2015)

Uploaded by

Manila Standard TodayCopyright:

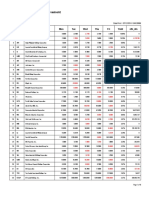

MST Business Daily Stocks Review

Tuesday, May 5, 2015

52 Weeks Previous

High Low STOCKS

Close

High Low

Close

7.88

75.3

124.4

104

63

2.49

4.2

18.48

31.6

9.5

2.95

890

99.4

30.5

94.95

137

361.2

59

174.8

1700

127.9

2.5

66

84.6

84.5

45.8

1.97

2.03

12.02

23.55

6.3

1.75

625

78

18.02

76.5

95

276

45

107.6

1200

66

AG Finance

8

Asia United Bank

70.85

Banco de Oro Unibank Inc. 110.40

Bank of PI

103.00

China Bank

45.65

BDO Leasing & Fin. INc. 2.50

Bright Kindle Resources 2.02

COL Financial

15.02

Eastwest Bank

22.25

Filipino Fund Inc.

7.50

I-Remit Inc.

1.66

Manulife Fin. Corp.

770.00

Metrobank

92.9

PB Bank

18.38

Phil. National Bank

77.25

Phil. Savings Bank

94.9

PSE Inc.

319

RCBC `A

44.75

Security Bank

167

Sun Life Financial

1385.00

Union Bank

66.00

FINANCIAL

8.01

8

70.9

70

113.00 110.40

103.70 102.40

46.15

45.5

2.50

2.50

2.05

2.04

15.4

15

22.3

22.1

7.40

7.40

1.66

1.66

792.00 770.00

94.25

93

18.38

18.20

77.00

76.50

94

94

320

315

45

44.8

169.5

166.1

1420.00 1410.00

66.70

66.00

INDUSTRIAL

43.75

43.3

1.65

1.59

1.09

1.03

2.09

2.07

11.38

11.3

19.5

19.28

132

132

28.05

26.9

63.5

63

2.66

2.4

1.86

1.77

13.36

12.96

20.900 20.45

11.50

11.42

8.40

8.29

10.20

10.06

1.86

1.8

15.5

14.5

28.85

28.15

94.6

93.5

15.14

14.30

14.00

14.00

6.29

6.11

212.00 208.60

10.3

10.1

35.00

35.00

2.77

2.7

2.51

2.51

52.00

47.20

24.65

24.1

28

27.1

7.900

7.650

263.80 262.60

4.37

4.19

9.85

9.65

11.60

11.38

4.04

3.90

2.38

2.32

2.52

2.37

5.14

5.06

1.98

1.92

6.01

6

200

195.9

4.46

4.15

1.77

1.72

0.169

0.165

1.37

1.37

2.58

2.20

222.6

219

4.5

4.5

0.76

0.67

1.35

1.35

HOLDING FIRMS

0.470

0.470

57.60

57.30

25.80

25.50

1.28

1.28

7.00

6.88

1.55

1.55

0.315

0.285

0.31

0.29

801

796

8.25

8.1

15.18

15.04

3.79

3.05

4.45

4.30

0.285

0.280

1318

1285

6.40

6.20

74.20

72.45

6

5

8.94

8.79

0.74

0.7

15.14

14.7

0.66

0.66

4.59

4.54

5.2

5.1

1.220

1.130

68.00

67.15

2.96

2.95

925.00 910.00

1.24

1.17

263.80 263.00

99.50

98.00

0.3800 0.3750

0.2450 0.2250

0.315

0.305

PROPERTY

8.900

8.720

10.48

9.46

0.76

0.74

1.310

1.310

0.265

0.265

40.65

39.50

4.19

4.15

5.25

5.13

0.91

0.89

1.22

1.22

1.07

1.06

0.156

0.154

Net Foreign

Change Volume

Trade/Buying

8

70.9

112.50

102.90

46

2.50

2.04

15.38

22.15

7.40

1.66

792.00

93.65

18.20

76.90

94

319

45

167.1

1420.00

66.50

0.00

0.07

1.90

-0.10

0.77

0.00

0.99

2.40

-0.45

-1.33

0.00

2.86

0.81

-0.98

-0.45

-0.95

0.00

0.56

0.06

2.53

0.76

182,300

42,910

4,454,270

567,110

51,800

1,000

53,000

9,000

96,200

12,600

2,000

1,910

4,145,510

24,100

10,330

20,020

1,200

261,100

127,220

1,620

17,750

43.65

1.64

1.08

2.09

11.38

19.44

132

27.85

63

2.43

1.86

13.16

20.600

11.48

8.37

10.20

1.8

15.18

28.75

94.6

14.30

14.00

6.17

211.00

10.2

35.00

2.7

2.51

52.00

24.65

27.55

7.770

263.60

4.27

9.80

11.60

4.00

2.33

2.4

5.10

1.92

6

196

4.15

1.72

0.166

1.37

2.24

220.8

4.5

0.72

1.35

0.81

-0.61

0.93

0.48

0.18

2.21

-12.00

-0.18

0.00

-6.18

1.64

1.39

1.23

-0.17

1.95

1.39

-4.26

-1.43

2.68

1.50

1.42

0.00

-0.48

1.93

-0.78

-3.45

0.00

0.00

0.10

0.61

-1.61

-0.38

0.38

1.91

0.00

0.17

0.00

-1.27

0.00

-0.39

0.52

-6.25

0.05

-8.59

-2.82

-0.60

5.38

3.23

0.82

0.00

7.46

0.00

2,332,600

34,000

1,350,000

845,000

1,600

329,200

10

103,200

58,950

10,730,000

436,000

52,700

1,594,300

424,000

20,608,000

622,800

46,000

70,600

3,196,600

584,390

78,800

11,000

119,400

672,480

572,900

100

26,000

3,000

90

1,399,100

251,500

1,611,300

128,510

1,103,000

796,900

43,700

97,000

831,000

628,000

279,500

51,000

14,100

5,040

60,000

1,234,000

950,000

13,000

31,971,000

2,302,510

127,000

7,422,000

247,000

0.470

57.30

25.65

1.28

7.00

1.55

0.305

0.31

801

8.2

15.08

3.79

4.30

0.280

1315

6.39

74.00

5

8.9

0.71

15

0.66

4.54

5.1

1.130

67.40

2.96

925.00

1.24

263.40

98.50

0.3750

0.2400

0.315

0.00

0.53

0.79

0.00

0.00

-0.64

7.02

5.17

0.63

0.12

0.27

-0.26

-1.83

-3.45

3.30

3.06

2.07

-5.66

1.37

-5.33

2.46

4.76

0.22

1.80

-4.24

-0.81

0.00

1.98

5.98

-15.03

-1.01

0.00

0.00

5.00

60,000

3,634,650

13,107,000

20,000

41,300

1,000

35,390,000

3,320,000

461,080

940,800

4,896,900

18,000

129,000

320,000

259,005

346,700

2,907,270

6,200

4,035,400

2,075,000

8,037,700

29,000

32,298,000

77,000

15,956,000

173,940

10,000

243,650

3,000

800

1,080

3,240,000

1,020,000

430,000

8.850

10.48

0.75

1.310

0.265

40.45

4.17

5.23

0.9

1.22

1.07

0.156

-0.56

-0.19

-5.06

-3.68

3.92

1.13

-0.48

0.58

0.00

0.00

2.88

0.65

515,000

2,000

3,128,000

34,000

30,000

7,730,100

6,061,000

29,000

2,081,000

3,000

257,000

2,620,000

1,128,485.50

-61,776,206.00

-4,104,617.00

-809,355.00

994,460.00

-99,589,592.00

52 Weeks Previous

High Low STOCKS

Close

High Low

Close

0.98

1.09

0.305

2.25

1.87

1.8

5.73

0.180

0.470

0.72

8.54

31.8

2.29

3.6

20.6

1.02

7.56

1.96

8.59

0.445

0.85

0.188

1.4

1.42

1.19

4.13

0.090

0.325

0.39

2.57

21.35

1.64

3.08

15.08

0.69

3.38

1

5.69

Cyber Bay Corp.

Empire East Land

Ever Gotesco

Global-Estate

Filinvest Land,Inc.

Interport `A

Megaworld

MRC Allied Ind.

Phil. Estates Corp.

Phil. Realty `A

Primex Corp.

Robinsons Land `B

Rockwell

Shang Properties Inc.

SM Prime Holdings

Sta. Lucia Land Inc.

Starmalls

Suntrust Home Dev. Inc.

Vista Land & Lifescapes

Net Foreign

Change Volume

Trade/Buying

0.475

0.860

0.192

1.37

1.88

1.41

5.36

0.122

0.3300

0.5100

7

29.90

1.76

3.30

19.00

0.78

7

0.990

7.490

0.480

0.465

0.465

0.870

0.860

0.860

0.190

0.180

0.183

1.42

1.36

1.38

1.95

1.86

1.94

1.44

1.40

1.40

5.47

5.37

5.42

0.125

0.120

0.122

0.3400 0.3300

0.3400

0.5100 0.5000

0.5000

7.02

7.01

7.01

30.00

29.30

29.35

1.77

1.76

1.76

3.30

3.21

3.30

19.90

19.20

19.90

0.78

0.76

0.76

7

6.48

7

1.030

1.000

1.000

7.640

7.470

7.520

SERVICES

10.5

1.97 2GO Group

6.36

6.53

6.34

6.5

66

32.5 ABS-CBN

61.5

62.25

61.3

62.2

1.44

1

Acesite Hotel

1.06

1.15

1.03

1.03

1.09

0.6

APC Group, Inc.

0.680

0.690

0.680

0.680

12.46

10

Asian Terminals Inc.

14

13.54

13.54

13.54

15.82

9.61 Bloomberry

11.68

11.88

11.68

11.70

0.1460 0.0770 Boulevard Holdings

0.1000

0.1030 0.1010

0.1020

4.61

2.95 Calata Corp.

4.8

4.99

4.82

4.9

99.1

46.55 Cebu Air Inc. (5J)

85.3

87.1

86

87

12.3

10.14 Centro Esc. Univ.

10.36

10

10

10

9

5.88 DFNN Inc.

7.00

7.18

7.12

7.18

4

2.58 Easy Call Common

3.12

4.20

3.14

3.30

1700

830 FEUI

932

999.5

946

946

2090

1600 Globe Telecom

2182

2222

2182

2212

8.41

5.95 GMA Network Inc.

6.30

6.32

6.27

6.27

33

30

Grand Plaza Hotel

44.90

59.00

38.00

45.90

1.97

1.36 Harbor Star

1.46

1.44

1.41

1.43

119.5

105 I.C.T.S.I.

111

111.5

110

111

7

3.01 Imperial Res. `A

6.61

6.61

6.55

6.55

12.5

8.72 IPeople Inc. `A

12.38

12.4

11.52

12.4

0.017

0.012 IP E-Game Ventures Inc. 0.013

0.014

0.013

0.014

0.8200 0.036 Island Info

0.238

0.238

0.232

0.232

2.2800 1.200 ISM Communications

1.2600

1.2600 1.2500

1.2500

5.93

2.34 Jackstones

2.6

2.6

2.6

2.6

12.28

6.5

Leisure & Resorts

9.60

9.65

9.51

9.55

2.85

1.69 Liberty Telecom

2.05

2.04

1.99

2.04

2.2

1.1

Lorenzo Shipping

1.29

1.27

1.26

1.26

3.2

2

Macroasia Corp.

2.14

2.19

2.14

2.19

5.9

1.05 Manila Broadcasting

20.25

30.35

30.35

30.35

1.97

0.490 Manila Bulletin

0.680

0.670

0.670

0.670

2.46

1.8

Manila Jockey

2

2.05

2

2.05

15.2

8.7

Melco Crown

9.08

9.15

9.05

9.05

0.62

0.34 MG Holdings

0.360

0.370

0.355

0.370

1.040

0.37 NOW Corp.

0.440

0.435

0.435

0.435

22.8

14.54 Pacific Online Sys. Corp. 18.38

18.44

18.42

18.44

6.41

3

PAL Holdings Inc.

4.70

5.10

4.70

5.10

4

2.28 Paxys Inc.

3

2.99

2.8

2.99

110.2

79

Phil. Seven Corp.

116.00

145.00 117.00

139.00

14

4.39 Philweb.Com Inc.

14.72

14.74

14.58

14.74

3486

2726 PLDT Common

2840.00

2892.00 2842.00

2884.00

0.710

0.380 PremiereHorizon

0.610

0.620

0.610

0.610

2.28

0.32 Premium Leisure

1.680

1.700

1.650

1.660

48.5

31.45 Puregold

39.20

41.10

39.35

40.30

90.1

60.55 Robinsons RTL

86.10

87.00

85.90

85.90

11.6

7.59 SSI Group

10.40

10.76

10.34

10.72

0.87

0.63 STI Holdings

0.67

0.67

0.66

0.66

2.95

1.71 Transpacific Broadcast 1.96

1.96

1.73

1.96

10.2

6.45 Travellers

6.8

6.8

6.66

6.8

0.490

0.305 Waterfront Phils.

0.340

0.345

0.330

0.340

1.6

1.04 Yehey

1.360

1.310

1.300

1.300

MINING & OIL

0.0098 0.0043 Abra Mining

0.0054

0.0054 0.0053

0.0053

5.45

1.72 Apex `A

2.65

2.65

2.60

2.60

17.24

8.65 Atlas Cons. `A

8.00

8.09

8.00

8.00

25

9.43 Atok-Big Wedge `A

15.42

15.48

14.50

15.00

0.330

0.236 Basic Energy Corp.

0.255

0.265

0.265

0.265

12.7

6.5

Benguet Corp `A

6.7000

6.7200 6.7000

6.7000

12.8

6.98 Benguet Corp `B

6.8000

6.8100 6.8000

6.8000

1.2

0.61 Century Peak Metals Hldgs 1.02

1.07

1.02

1.04

1.73

0.78 Coal Asia

0.89

0.9

0.89

0.9

10.98

5.99 Dizon

7.88

7.95

7.68

7.68

4.2

1.08 Ferronickel

1.85

1.9

1.86

1.87

0.48

0.330 Geograce Res. Phil. Inc. 0.350

0.360

0.345

0.350

0.455

0.2130 Lepanto `A

0.233

0.233

0.230

0.233

0.475

0.2160 Lepanto `B

0.234

0.240

0.235

0.235

0.023

0.014 Manila Mining `A

0.0140

0.0140 0.0140

0.0140

0.026

0.014 Manila Mining `B

0.0150

0.0150 0.0140

0.0150

8.2

3.660 Marcventures Hldgs., Inc. 4.26

4.25

4.18

4.2

49.2

20.2 Nickelasia

23.3

24.5

23.65

24.2

4.27

2.11 Nihao Mineral Resources 3.81

3.88

3.81

3.83

1.030

0.365 Omico

0.7200

0.7100 0.7100

0.7100

3.06

1.54 Oriental Peninsula Res. 2.200

2.270

2.200

2.200

0.020

0.012 Oriental Pet. `A

0.0120

0.0130 0.0120

0.0130

0.021

0.013 Oriental Pet. `B

0.0130

0.0140 0.0140

0.0140

7.67

5.4

Petroenergy Res. Corp. 4.58

4.58

4.48

4.50

12.88

7.26 Philex `A

7.17

7.29

7.15

7.15

10.42

2.27 PhilexPetroleum

1.77

1.78

1.66

1.67

0.040

0.015 Philodrill Corp. `A

0.015

0.016

0.015

0.016

420

115.9 Semirara Corp.

163.80

165.50 164.00

164.50

9

3.67 TA Petroleum

4.21

6.31

4.28

5.7

0.016

0.0100 United Paragon

0.0100

0.0100 0.0100

0.0100

PREFERRED

70

33

ABS-CBN Holdings Corp. 62.5

65

62.5

65

553

490 Ayala Corp. Pref `B1

520

515

515

515

525

500 Ayala Corp. Pref B2

522

525

525

525

118

101 First Gen F

121

122

122

122

120

101.5 First Gen G

119

120

120

120

8.21

5.88 GMA Holdings Inc.

5.97

6.2

6.2

6.2

12.28

6.5

Leisure and Resort

1.09

1.09

1.09

1.09

111

101 MWIDE PREF

115.9

108.1

108.1

108.1

1060

997 PCOR-Preferred A

1150

1080

1066

1066

PCOR-Preferred B

1095

1095

1095

1095

1047

1011 PF Pref 2

1045

1045

1045

1045

76.9

74.2 SMC Preferred A

76.2

76.1

76

76.1

84.8

75

SMC Preferred C

85

85

83.05

85

WARRANTS & BONDS

6.98

0.8900 LR Warrant

4.280

4.360

4.210

4.300

SME

10.96

2.4

Double Dragon

9

9.23

9

9.2

15

3.5

Makati Fin. Corp.

7.99

8.44

6.1

8

88

13.5 IRipple E-Business Intl 77.4

75.95

73.5

75.9

12.88

5.95 Xurpas

9.2

9.45

9.2

9.3

EXCHANGE TRADED FUNDS

130.7

105.6 First Metro ETF

127.1

128.9

127.5

128.9

-2.11

0.00

-4.69

0.73

3.19

-0.71

1.12

0.00

3.03

-1.96

0.14

-1.84

0.00

0.00

4.74

-2.56

0.00

1.01

0.40

2,570,000

43,000

2,140,000

6,457,000

24,430,000

1,156,000

35,891,200

4,030,000

1,320,000

294,000

219,000

2,229,900

341,000

157,000

24,580,800

24,000

1,900

35,000

3,570,500

9,300.00

2.20

1.14

-2.83

0.00

-3.29

0.17

2.00

2.08

1.99

-3.47

2.57

5.77

1.50

1.37

-0.48

2.23

-2.05

0.00

-0.91

0.16

7.69

-2.52

-0.79

0.00

-0.52

-0.49

-2.33

2.34

49.88

-1.47

2.50

-0.33

2.78

-1.14

0.33

8.51

-0.33

19.83

0.14

1.55

0.00

-1.19

2.81

-0.23

3.08

-1.49

0.00

0.00

0.00

-4.41

98,900

30,960

484,000

446,000

500

15,325,300

5,610,000

1,641,000

874,110

51,500

5,200

140,000

1,340

26,065

176,500

21,200

95,000

908,580

1,000

102,600

1,300,000

5,350,000

128,000

20,000

460,000

10,000

29,000

2,000

5,700

77,000

52,000

2,847,400

60,000

12,000

3,000

458,000

38,000

940

136,700

111,160

1,442,000

10,811,000

4,842,900

1,677,620

6,742,600

1,454,000

20,000

2,403,400

760,000

64,000

-1.85

-1.89

0.00

-2.72

3.92

0.00

0.00

1.96

1.12

-2.54

1.08

0.00

0.00

0.43

0.00

0.00

-1.41

3.86

0.52

-1.39

0.00

8.33

7.69

-1.75

-0.28

-5.65

6.67

0.43

35.39

0.00

370,000,000 -58,300.00

152,000

241,000

29,100

80,000

7,000

3,000

528,000

-10,200.00

111,000

11,400

11,568,000 7,595,040.00

2,560,000

1,480,000

90,000

170,700,000

13,500,000 -28,000.00

299,000

8,037,800 41,436,810.00

833,000

58,150.00

318,000

512,000

-475,780.00

4,800,000

200,000

121,000

258,600

229,120.00

2,051,000 55,100.00

46,300,000

539,450

14,672,786.00

7,735,000 -269,950.00

12,500,000

4.00

-0.96

0.57

0.83

0.84

3.85

0.00

-6.73

-7.30

0.00

0.00

-0.13

0.00

313,930

500

7,600

1,000

3,800

300

102,000

170

600

540

2,665

22,400

128,560

10,695,846.50

0.47

491,000

-364,580.00

2.22

0.13

-1.94

1.09

1,648,100

22,000

1,140

1,057,800

-614,890.00

-3,780.00

11,392.50

4,143,024.00

1.42

6,790

36,600.00

-5,982,490.00

1,145,730.00

-26,050,492.00

-22,936,315.00

268,908,408.00

MST

47

35.6

5

1.6

1.66

1.04

2.36

1.41

15.3

7.92

20.6

14.6

125

62.5

32

10.08

65.8

29.15

4.57

1.04

23.35

10.72

21.6

8.44

12.98

9.79

9.13

5.43

12.34

9.54

2.89

1.06

17

8.61

31.8

18.06

109

67.9

20.75

14

15.3

13.24

9.4

3.12

241

168

12.5

8.65

79

34.1

3.95

2.3

4

1.63

45.45

16

33.9

24.4

90

16.2

13.98

7.62

292.4

250.2

5.25

3.87

13.04

9

14.5

9.94

7.03

3.03

3.4

2.22

4.5

1

6.68

4.72

7.86

1.65

8.1

6

253

201.6

5.5

4.1

3.28

1.67

0.315

0.122

2.5

1.02

2.68

2.01

226.6

143.4

5.5

4.28

1.3

0.670

2.17

1.39

Aboitiz Power Corp.

43.3

Agrinurture Inc.

1.65

Alliance Tuna Intl Inc.

1.07

Alsons Cons.

2.08

Asiabest Group

11.36

Century Food

19.02

Chemphil

150

Cirtek Holdings (Chips) 27.9

Concepcion

63

Crown Asia

2.59

Da Vinci Capital

1.83

Del Monte

12.98

DNL Industries Inc.

20.350

Emperador

11.50

Energy Devt. Corp. (EDC) 8.21

EEI

10.06

Euro-Med Lab

1.88

Federal Res. Inv. Group 15.4

First Gen Corp.

28

First Holdings A

93.2

Ginebra San Miguel Inc. 14.10

Holcim Philippines Inc. 14.00

Integ. Micro-Electronics 6.2

Jollibee Foods Corp.

207.00

Lafarge Rep

10.28

Liberty Flour

36.25

LMG Chemicals

2.7

Mabuhay Vinyl

2.51

Macay Holdings

51.95

Manila Water Co. Inc.

24.5

Maxs Group

28

Megawide

7.800

Mla. Elect. Co `A

262.60

Pepsi-Cola Products Phil. 4.19

Petron Corporation

9.80

Phinma Corporation

11.58

Phoenix Petroleum Phils. 4.00

Phoenix Semiconductor 2.36

Pryce Corp. `A

2.4

RFM Corporation

5.12

Roxas and Co.

1.91

Roxas Holdings

6.4

San MiguelPure Foods `B 195.9

SPC Power Corp.

4.54

Splash Corporation

1.77

Swift Foods, Inc.

0.167

TKC Steel Corp.

1.30

Trans-Asia Oil

2.17

Universal Robina

219

Victorias Milling

4.5

Vitarich Corp.

0.67

Vulcan Indl.

1.35

0.7

59.2

31.85

2.16

7.39

2.27

3.4

3.35

800

11.06

84

3.68

5.14

0.66

1380

6.68

72.6

8.9

9.25

0.9

18.9

0.73

5.53

6.55

0.84

87

3.5

934

2.2

390

156

0.710

0.435

0.510

0.45

48.1

20.85

1.6

6.62

1.210

1.4

1.6

600

7.390

14.18

1.15

4.25

0.144

818

5.3

46.6

4.96

4.43

0.59

12

0.580

4.22

4.5

0.450

66.7

1.5

709.5

1.13

170

85.2

0.200

0.173

0.310

Abacus Cons. `A

0.470

Aboitiz Equity

57.00

Alliance Global Inc.

25.45

Anglo Holdings A

1.28

Anscor `A

7.00

Asia Amalgamated A

1.56

ATN Holdings A

0.285

ATN Holdings B

0.29

Ayala Corp `A

796

Cosco Capital

8.19

DMCI Holdings

15.04

F&J Prince B

3.8

Filinvest Dev. Corp.

4.38

Forum Pacific

0.290

GT Capital

1273

House of Inv.

6.20

JG Summit Holdings

72.50

Jolliville Holdings

5.3

Lopez Holdings Corp.

8.78

Lodestar Invt. Holdg.Corp. 0.75

LT Group

14.64

Mabuhay Holdings `A

0.63

Metro Pacific Inv. Corp. 4.53

Minerales Industrias Corp. 5.01

Prime Orion

1.180

San Miguel Corp `A

67.95

Seafront `A

2.96

SM Investments Inc.

907.00

Solid Group Inc.

1.17

Transgrid

310.00

Top Frontier

99.50

Unioil Res. & Hldgs

0.3750

Wellex Industries

0.2400

Zeus Holdings

0.300

10.5

26.95

1.99

2.07

0.375

40

6.15

5.4

1.54

1.97

1.48

0.201

6.01

12

0.91

1.29

0.192

29.1

4.1

4.96

0.89

1.1

0.97

0.083

8990 HLDG

8.900

Anchor Land Holdings Inc. 10.50

A. Brown Co., Inc.

0.79

Araneta Prop `A

1.360

Arthaland Corp.

0.255

Ayala Land `B

40.00

Belle Corp. `A

4.19

Cebu Holdings

5.2

Century Property

0.9

City & Land Dev.

1.22

Cityland Dev. `A

1.04

Crown Equities Inc.

0.155

Trading Summary

FINANCIAL

INDUSTRIAL

HOLDING FIRMS

PROPERTY

SERVICES

MINING & OIL

GRAND TOTAL

SHARES

10,083,616

96,496,793

134,687,662

135,764,946

68,390,691

655,828,817

1,103,988,357

-91,557.50

19,080.00

288,100.00

9,110,312.00

1,022,400.00

-11,097,535.00

-15,900.00

0.00

-1,024,706.00

-418,500.00

214,735.00

55,990.00

-18,000.00

-3,071,890.00

-2,988,728.00

90,173,197.00

2,127,720.00

38,220.00

5,299,980.00

21,452,924.50

151,200.00

46,704,882.00

-595,078.00

-24,300.00

735.00

-6,570,955.00

-27,100.00

-11,025,849.00

7,896,786.00

227,150.00

2,307,559.00

71,020.00

42,120.00

-11,950.00

833,846.00

-488,204.00

41,040.00

-33,200.00

450,240.00

75,434,404.00

468,000.00

904,940.00

-14,891,615.50

-48,933,480.00

-14,090.00

338,500.00

210,618,520.00

533,474.00

-5,053,456.00

-79,916,895.00

658,607.00

33,919,881.50

26,532,263.00

12,993,016.00

-33,236,290.00

-62,640.00

-3,645,380.00

-47,614,735.00

-985.00

456,594.00

15,720.00

-7,950.00

-34,305,160.00

17,633,100.00

140,689.00

-1,345,470.00

-13,880.00

T op G ainers

VALUE

998,148,978.89

1,362,978,794.804

2,389,370,731.309

1,206,588,880.58

1,298,173,221.65

371,073,230.765

7,652,449,505.399

STOCKS

FINANCIAL

1,804.21 (up) 12.16

INDUSTRIAL

12,524.01 (UP) 131.81

HOLDING FIRMS

7,062.62 (UP) 98.95

PROPERTY

3,230.10 (UP) 55.37

SERVICES

2,156.89 (UP) 20.90

MINING & OIL

15,198.62 (UP) 155.80

PSEI

7,919.21 (UP) 102.77

All Shares Index

4,552.23 (UP) 54.84

Gainers: 113 Losers:78; Unchanged: 46; Total: 237

-23,130,258.00

-38,770.00

-241,858.00

-48,400.00

-25,849,325.00

7,000.00

38,560.00

-11,320,200.00

56,899,914.00

2,947,868.00

-11,364,265.00

43,020.00

-56,000.00

26,720.00

151,774.00

13,474,250.00

-666,540.00

-4,440,580.00

1,813,922.00

10,161,340.00

-617,230.00

-17,440.00

-619,090.00

T op L osers

Close

(P)

Change

(%)

STOCKS

Close

(P)

Change

(%)

Manila Broadcasting

30.35

49.88

Transgrid

263.40

-15.03

TA Petroleum

5.7

35.39

Chemphil

132

-12.00

Phil. Seven Corp.

139.00

19.83

SPC Power Corp.

4.15

-8.59

PAL Holdings Inc.

5.10

8.51

PCOR-Preferred A

1066

-7.30

Oriental Pet. `A'

0.0130

8.33

MWIDE PREF

108.1

-6.73

Oriental Pet. `B'

0.0140

7.69

Roxas Holdings

-6.25

IP E-Game Ventures Inc.

0.014

7.69

Crown Asia

2.43

-6.18

Vitarich Corp.

0.72

7.46

Jolliville Holdings

-5.66

ATN Holdings A

0.305

7.02

PhilexPetroleum

1.67

-5.65

Philodrill Corp. `A'

0.016

6.67

Lodestar Invt. Holdg.Corp.

0.71

-5.33

You might also like

- The Standard - Business Daily Stocks Review (May 6, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 29, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 30, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 30, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 20, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 10, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 10, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 18, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 20, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 20, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 25, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 25, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 2, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 2, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 4, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 13, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 13, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 26, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 26, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 20, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 20, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 11, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 28, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 28, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 24, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 24, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 25, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 25, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 11, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 11, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 29, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 29, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 26, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 26, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 23, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 23, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 12, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (August 12, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 6, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 18, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 18, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 23, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (June 23, 2013)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 2, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 8, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (January 8, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 19, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (November 19, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 12, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 12, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 12, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (November 12, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (September 2, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (September 2, 2013)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 17, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 17, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 7, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 7, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 02, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 02, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 9, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 9, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 10, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (July 10, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 11, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 11, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 26, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 26, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 31, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 31, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 22, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 22, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 14, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 14, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 18, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 18, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (January 6, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 1, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 1, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 11, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (January 11, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 1, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (October 1, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 19, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (January 19, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 9, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 9, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 8, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 29, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 23, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 23, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 2, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 5, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 5, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 15, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanNo ratings yet

- The Standard - Business Daily Stocks Review (May 20, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 18, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 15, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 3, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (July 3, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 12, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 12, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stock Review (May 08, 2015)Document1 pageManila Standard Today - Business Daily Stock Review (May 08, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 11, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Document1 pageManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayNo ratings yet

- Top Philippine Stocks by Company NameDocument8 pagesTop Philippine Stocks by Company NameRamon EstarezNo ratings yet

- ContactsDocument6 pagesContactslerry ruallo0% (1)

- Order Students CasesDocument6 pagesOrder Students CasesgianelleNo ratings yet

- Former Siomai Vendor Jovit Baldivino Is Pilipinas Got TalentDocument1 pageFormer Siomai Vendor Jovit Baldivino Is Pilipinas Got Talentjoserizal666No ratings yet

- 33F Tower One, Ayala Triangle, Ayala Avenue Makati City, 1226 PhilippinesDocument4 pages33F Tower One, Ayala Triangle, Ayala Avenue Makati City, 1226 PhilippinesSherri BonquinNo ratings yet

- Doris Susan VennDocument1 pageDoris Susan VennJogie AradaNo ratings yet

- BDO Unibank General InformationDocument2 pagesBDO Unibank General InformationLolNo ratings yet

- Blue Chip Companies For The Year 2014Document2 pagesBlue Chip Companies For The Year 2014Nadine SantiagoNo ratings yet

- Meat Importer Valid PDFDocument32 pagesMeat Importer Valid PDFOlen Dael LontocNo ratings yet

- List of Accredited Banks Account Officers - June 2023Document1 pageList of Accredited Banks Account Officers - June 2023Nicole AtuanNo ratings yet

- The Philippine Stock Exchange, Inc Daily Quotations Report February 11, 2016Document8 pagesThe Philippine Stock Exchange, Inc Daily Quotations Report February 11, 2016Paul JonesNo ratings yet

- SQL CC 10092020 Hpi Data TableDocument314 pagesSQL CC 10092020 Hpi Data TableRodel DerlaNo ratings yet

- RLFI BPI Endorsement SY 2023 2024 For Scholars With NamesDocument8 pagesRLFI BPI Endorsement SY 2023 2024 For Scholars With NamesYOW BiatchNo ratings yet

- Loadcentral Product CodesDocument7 pagesLoadcentral Product CodesAnnie HinloNo ratings yet

- John Robinson L. Gokongwei, JR.: JG Summit HoldingsDocument3 pagesJohn Robinson L. Gokongwei, JR.: JG Summit HoldingsJohn Eric De Guzman100% (1)

- PESONet Participants PDFDocument1 pagePESONet Participants PDFmaydzNo ratings yet

- Bacolod Amusement Places Entertainment PlacesDocument511 pagesBacolod Amusement Places Entertainment PlacesCrisant Dema-alaNo ratings yet

- SMART and GLOBE NUMBERS PHILIPPINESDocument2 pagesSMART and GLOBE NUMBERS PHILIPPINESMaiko IchijoNo ratings yet

- 10 Succesful Pilipino Entrepreneur: 1. Socorro C. Ramos National Book Store, IncDocument3 pages10 Succesful Pilipino Entrepreneur: 1. Socorro C. Ramos National Book Store, IncNolan NolanNo ratings yet

- WEEKLY REPORT - Price Movement: Sym Name Mon Tue Wed Thu Fri NFB - Nfs Yield NosDocument8 pagesWEEKLY REPORT - Price Movement: Sym Name Mon Tue Wed Thu Fri NFB - Nfs Yield Nosανατολή και πετύχετεNo ratings yet

- Dev Phil 1Document102 pagesDev Phil 1EyegateNo ratings yet

- I. GENERAL PROVISIONS (Article 1156 To 1162)Document6 pagesI. GENERAL PROVISIONS (Article 1156 To 1162)George JR. E. SilandoteNo ratings yet

- BDO Philheath BranchesDocument6 pagesBDO Philheath BranchesMichelle Bernice B GarciaNo ratings yet

- Negotiable Instruments Law: Case Syllabus in (Prof. A.E. Tayag) Jan. 2020Document3 pagesNegotiable Instruments Law: Case Syllabus in (Prof. A.E. Tayag) Jan. 2020Robinson MojicaNo ratings yet

- Prefix # Mobile Prefix # Mobile: 932 Sun Cellular 933 Sun Cellular 934 Sun CellularDocument1 pagePrefix # Mobile Prefix # Mobile: 932 Sun Cellular 933 Sun Cellular 934 Sun CellularHaia CawiaNo ratings yet

- NTC Decision On ABS-CBN FrequenciesDocument8 pagesNTC Decision On ABS-CBN FrequenciesRapplerNo ratings yet

- Cases For Civil Law Review (Torts and Damages)Document3 pagesCases For Civil Law Review (Torts and Damages)ervingabralagbonNo ratings yet

- Philippine Stock Exchange: OIC-Head, Disclosure DepartmentDocument8 pagesPhilippine Stock Exchange: OIC-Head, Disclosure DepartmentBrian SeeNo ratings yet

- Top 10 Philippine Retailers: SM, Robinsons, Ayala Lead the PackDocument1 pageTop 10 Philippine Retailers: SM, Robinsons, Ayala Lead the PackDonnaChuaquico100% (4)

- STOCKS Listed CompaniesDocument6 pagesSTOCKS Listed CompaniesgheecelmarkNo ratings yet