Professional Documents

Culture Documents

Montreal Municipal Taxes 2010

Uploaded by

Montreal Gazette0 ratings0% found this document useful (0 votes)

2K views1 pageWhat residents of Montreal and its suburbs will be paying in municipal taxes for 2010.

Original Title

Montreal municipal taxes 2010

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentWhat residents of Montreal and its suburbs will be paying in municipal taxes for 2010.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2K views1 pageMontreal Municipal Taxes 2010

Uploaded by

Montreal GazetteWhat residents of Montreal and its suburbs will be paying in municipal taxes for 2010.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

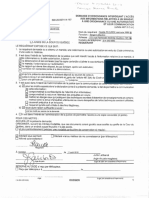

MUNICIPAL TAXES 2010

What people are paying Only two

Assessed value 2010 tax Average municipalities

of average increase on tax bill asked to provide

Municipality single-family average home in 2010 tax data for this

home (%) chart were unable

Westmount $1.02 million 8.23 $11,022 to do so: Hudson

and Ste. Anne de

Hampstead $784,600 6.4 $10,593 Bellevue.

Town of Mount Royal $667,173 5.9 $6,694

Senneville $620,363 5.6 $5,501

Montreal West $431,658 8.39 $7,010

St. Lambert $427,597 4.0 $4,950

Baie d’Urfé $422,300 8.5 $3,628

Côte St. Luc $412,700 4.9 $5,385

Beaconsfield $381,425 4.63 $4,672

Kirkland $343,494 8.18 $3,915

Candiac $322,975 2.4 $2,486

Boucherville $304,120 3.4 $2,737

St. Bruno $286,066 4.38 $2,618

Blainville $284,000 6.0 $2,465

Dollard des Ormeaux $280,000 5.8 $3,120

Montreal $278,000 5.3 $3,063

Dorval $264,380 3.79 $2,798

Pointe Claire $258,107 6.97 $3,209

Laval $255,700 1.7 $2,503

Brossard $250,600 1.3 $2,239

Pincourt $225,688 2.48 $2,523

Longueuil $212,000 5.2 $2,130

Châteauguay $188,700 6.8 $2,700

Mirabel $180,000 2.9 $1,260

Montreal East $158,403 4.14 $1,667

NOTES:

1: The figures for average tax bill in 2010 exclude school taxes. The figures include amounts for general

property taxes, as well as for water, garbage and all other municipal charges that are billed separately. Not

included are amounts for swimming pools or local improvement taxes, as these are not broadly applicable.

2: The figures for assessed value of average single-family homes are taken from municipal valuation rolls.

Some municipal rolls are newer than others; in general, the newer the roll, the more closely its assessments

reflect current market values. The assessments for municipalities on Montreal Island are taken from the

2007-10 valuation rolls, which are based on transaction prices in June 2005. The next Montreal Island valuation

roll is expected to see assessments rise by 15 to 30 per cent, to reflect current property values. Most off-island

municipalities have newer valuation rolls than Montreal. Pincourt’s roll, new this year, shows assessments for

single-family homes up 15.9 per cent from 2007; Blainville’s new roll shows a corresponding rise of 19.5 per cent.

Andy Dodge & Associates of Westmount says the average Westmount home is now worth $1.3 million, up

eight per cent in the past year. That’s 30 per cent more than in June 2005, when the assessed value of $1.02

million was determined.

3. The $3,063 figure provided by the city of Montreal for average 2010 tax bill does not include borough

surtaxes. Seven of 19 boroughs in the city have these surtaxes. They can run as high as $200 a year and

are highest in Pierrefonds-Roxboro, Montreal North, Lachine and LaSalle.

4. In Senneville, 20 per cent of residents get their water from their own wells and don’t pay the city’s annual $255 flat tax

for water. The $5,501 figure published in the tax chart for Senneville’s average tax bill includes the $255 charge. The $3,209 figure

for Pointe Claire is the sum of the average $3,028 property-tax bill for 2010 and the average residential water bill for 2009. The average

Pointe Claire homeowner paid $181 for water last year, based on metered consumption, according to Mayor Bill McMurchie. The $10,593 for

Hampstead’s average tax bill does not include water charges. Hampstead was unable to provide a figure for its average residential water bill.

SOURCE: 2010 MUNICIPAL BUDGETS

THE GAZETTE

You might also like

- B.florida Producto Kilos: Cliente Factura Valor Kilo Total Neto Florida 48232 LOMITO 5 $2,350 $11,750Document6 pagesB.florida Producto Kilos: Cliente Factura Valor Kilo Total Neto Florida 48232 LOMITO 5 $2,350 $11,750PalomajimNo ratings yet

- Agent 360: Public RecordsDocument3 pagesAgent 360: Public RecordsCarlos CruzNo ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- Tax Year 2020 StatisticsDocument127 pagesTax Year 2020 StatisticsAdam HarringtonNo ratings yet

- College Station Impact Fee Collection RatesDocument8 pagesCollege Station Impact Fee Collection RatesKBTXNo ratings yet

- 2024 Truth in Taxation PresentationDocument19 pages2024 Truth in Taxation PresentationinforumdocsNo ratings yet

- Boyce A BudgetDocument4 pagesBoyce A Budgetapi-513816841No ratings yet

- Salesperson Ellis Barrow HammondDocument7 pagesSalesperson Ellis Barrow HammondRohan Chatterjee100% (1)

- SOBO Sept 6, 2017 AgendaDocument11 pagesSOBO Sept 6, 2017 AgendaOaklandCBDsNo ratings yet

- News Water Rwsarates2010Document1 pageNews Water Rwsarates2010readthehookNo ratings yet

- Brentwood MH & RV ParkDocument14 pagesBrentwood MH & RV ParkNiranjan REDDY.KNo ratings yet

- Cash Flow Duplexes - Real Estate Investment - Kansas CityDocument21 pagesCash Flow Duplexes - Real Estate Investment - Kansas CityNorada Real Estate Investments100% (5)

- 806 McDougal - Tax RollDocument2 pages806 McDougal - Tax RollDavid CallawayNo ratings yet

- Final LEEF Ranking Short 3-23-11 - REVISEDDocument2 pagesFinal LEEF Ranking Short 3-23-11 - REVISEDeperkins721No ratings yet

- CpasimCourier Round 0Document14 pagesCpasimCourier Round 0AjitNo ratings yet

- Guri-BABMGT517 - Operational Performance Report Template-Task 4Document2 pagesGuri-BABMGT517 - Operational Performance Report Template-Task 4Kumar Creative ContentsNo ratings yet

- Dept. of Ed. Federal Student Aid PorfolioDocument1 pageDept. of Ed. Federal Student Aid PorfolioCampus ReformNo ratings yet

- Bellingham Crossroads Economics 9-23-22Document7 pagesBellingham Crossroads Economics 9-23-22deresensNo ratings yet

- Task 1: Prepare Budgets Part 1 A (Refer To Spreadsheet) Profit BudgetDocument15 pagesTask 1: Prepare Budgets Part 1 A (Refer To Spreadsheet) Profit BudgetUurka LucyNo ratings yet

- Tax Assessor's Office: Property DetailDocument2 pagesTax Assessor's Office: Property Detailluke elbertNo ratings yet

- September 2009 Forecast of Alameda Point Revenues and ExpensesDocument1 pageSeptember 2009 Forecast of Alameda Point Revenues and ExpensesAction Alameda NewsNo ratings yet

- Synergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023Document10 pagesSynergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023brook emenikeNo ratings yet

- 2021 Illustrative Property Assessment Examples - PFC2020-1014Document3 pages2021 Illustrative Property Assessment Examples - PFC2020-1014Darren KrauseNo ratings yet

- Mayor Chokwe Antar Lumumba's FY19 Budget PresentationDocument25 pagesMayor Chokwe Antar Lumumba's FY19 Budget Presentationthe kingfishNo ratings yet

- 2022 Crop ReportDocument12 pages2022 Crop ReportLakeCoNewsNo ratings yet

- T0Wn Warrant: Commonwealth of MassachusettsDocument10 pagesT0Wn Warrant: Commonwealth of MassachusettsZachary DeLucaNo ratings yet

- ApnicbugDocument4 pagesApnicbugHiko KikoNo ratings yet

- Home Buy Vs Rent Complex 2019 UpdateDocument6 pagesHome Buy Vs Rent Complex 2019 UpdateOthman Alaoui Mdaghri BenNo ratings yet

- 10yr Capital Works Program 2012 21Document8 pages10yr Capital Works Program 2012 21Joe BidenNo ratings yet

- Resource Sheet - RevDocument13 pagesResource Sheet - RevTatiana RodriguezNo ratings yet

- 2021 Budget in Brief Executive SummaryDocument2 pages2021 Budget in Brief Executive SummaryScott AtkinsonNo ratings yet

- Round: 0 Dec. 31, 2016: Selected Financial StatisticsDocument13 pagesRound: 0 Dec. 31, 2016: Selected Financial StatisticsHimanshu KriplaniNo ratings yet

- Westport Homes Sales Report January 2011Document2 pagesWestport Homes Sales Report January 2011HigginsGroupRENo ratings yet

- SOBO Jan 9, 2018 Agenda PacketDocument19 pagesSOBO Jan 9, 2018 Agenda PacketOaklandCBDsNo ratings yet

- Greater Vancouver Dec 2010Document7 pagesGreater Vancouver Dec 2010urbaniak_bcNo ratings yet

- Figure out buy vs rent with IRRDocument6 pagesFigure out buy vs rent with IRRLogan WilsonNo ratings yet

- Nassau County Legislator TaxesDocument1 pageNassau County Legislator TaxesNewsdayNo ratings yet

- Matt Castello Monthly Annual Cash InflowsDocument1 pageMatt Castello Monthly Annual Cash InflowsMatt CastelloNo ratings yet

- Ohio Rock Salt SettlementsDocument32 pagesOhio Rock Salt SettlementsChristiana FordNo ratings yet

- State of New Jersey: SENATE, No. 3732Document6 pagesState of New Jersey: SENATE, No. 3732Alexis TarraziNo ratings yet

- Campbell SubsidiesDocument2 pagesCampbell SubsidiesRob PortNo ratings yet

- Municipal Budgeting 101Document50 pagesMunicipal Budgeting 101David DillnerNo ratings yet

- Tablas Caso Examen HHCDocument12 pagesTablas Caso Examen HHCCristian MuñozNo ratings yet

- Only Enter Data Into The Green CellsDocument34 pagesOnly Enter Data Into The Green CellsEthan StoneNo ratings yet

- FY 2012 Budget PresentationDocument37 pagesFY 2012 Budget PresentationDavid DillnerNo ratings yet

- 21 Tax RatesDocument1 page21 Tax Ratesrdaigle566No ratings yet

- 2022PGP257 - Rent or Buy - Arpit Agarwal - Arpit AgarwalDocument11 pages2022PGP257 - Rent or Buy - Arpit Agarwal - Arpit AgarwalShrey RanaNo ratings yet

- 2008 Domestic Water SurveyDocument1 page2008 Domestic Water SurveyCaroline Nordahl BrosioNo ratings yet

- 2011-2012 County ExpendituresDocument55 pages2011-2012 County ExpendituresMichael ToddNo ratings yet

- Cma-27-1 Douro Place-West Perth-Wa 6005Document16 pagesCma-27-1 Douro Place-West Perth-Wa 6005sapphireNo ratings yet

- Excel JobsDocument12 pagesExcel Jobsapi-250762002No ratings yet

- 3042 Austin Pale Ave, North Las Vegas, 89081 RentalDocument4 pages3042 Austin Pale Ave, North Las Vegas, 89081 RentalLarry RobertsNo ratings yet

- Downshifting Costs 05-12-09Document2 pagesDownshifting Costs 05-12-09Grant BosseNo ratings yet

- Houston County Budget PresentationDocument7 pagesHouston County Budget PresentationJohn S KeppyNo ratings yet

- Second Stub-1Document1 pageSecond Stub-1alihassan459001No ratings yet

- Cash Flow TemplateDocument11 pagesCash Flow TemplateNOR AIMAN AZIM NOR AZLISHAMNo ratings yet

- Finances 2021 - Brian & Annalicia W - CompsDocument5 pagesFinances 2021 - Brian & Annalicia W - CompsRobert JohnsonNo ratings yet

- NYC Hidden AccountsDocument3 pagesNYC Hidden AccountsAzi PaybarahNo ratings yet

- Marc Tanguay: A Meaningful But Insufficient ReversalDocument2 pagesMarc Tanguay: A Meaningful But Insufficient ReversalCTV MontrealNo ratings yet

- BUSRC Open Letter On Tuition IncreasesDocument5 pagesBUSRC Open Letter On Tuition IncreasesMontreal GazetteNo ratings yet

- Habs 2019-20 TV Schedule For Quebec, Eastern Ontario and Atlantic CanadaDocument2 pagesHabs 2019-20 TV Schedule For Quebec, Eastern Ontario and Atlantic CanadaMontreal GazetteNo ratings yet

- Amor Ftouhi Criminal ComplaintDocument6 pagesAmor Ftouhi Criminal Complainttom clearyNo ratings yet

- Bibeau Affidavit Aug. 16 2016Document50 pagesBibeau Affidavit Aug. 16 2016Montreal GazetteNo ratings yet

- Amor Ftouhi Criminal ComplaintDocument6 pagesAmor Ftouhi Criminal Complainttom clearyNo ratings yet

- Bibeau Affidavit Aug. 11 2016Document42 pagesBibeau Affidavit Aug. 11 2016Montreal GazetteNo ratings yet

- The Liberal Playbook (2022)Document102 pagesThe Liberal Playbook (2022)Montreal GazetteNo ratings yet

- COVID-19 Potential ScenariosDocument7 pagesCOVID-19 Potential ScenariosMontreal GazetteNo ratings yet

- Habs 2019-20 TV Schedule For Western Canada and OntarioDocument2 pagesHabs 2019-20 TV Schedule For Western Canada and OntarioMontreal GazetteNo ratings yet

- Vision of The Service Offering of RSSS de L'ouest de MontréalDocument48 pagesVision of The Service Offering of RSSS de L'ouest de MontréalMontreal GazetteNo ratings yet

- Code White RecruitingDocument1 pageCode White RecruitingMontreal GazetteNo ratings yet

- The Gazette - April 28, 1967 - Page 1Document1 pageThe Gazette - April 28, 1967 - Page 1Montreal Gazette100% (1)

- Amor Ftouhi Criminal ComplaintDocument6 pagesAmor Ftouhi Criminal Complainttom clearyNo ratings yet

- Montreal Gazette, Oct. 12, 1966Document1 pageMontreal Gazette, Oct. 12, 1966Montreal GazetteNo ratings yet

- The Gazette - April 28, 1967 - Page 3Document1 pageThe Gazette - April 28, 1967 - Page 3Montreal GazetteNo ratings yet

- Montreal Gazette, Oct. 10, 1966Document2 pagesMontreal Gazette, Oct. 10, 1966Montreal GazetteNo ratings yet

- The Gazette - April 28, 1967 - Page 2Document1 pageThe Gazette - April 28, 1967 - Page 2Montreal GazetteNo ratings yet

- Quake Cottage QC 9.5: The UltimateDocument1 pageQuake Cottage QC 9.5: The UltimateMontreal GazetteNo ratings yet

- Sussex Weekly Advertiser Or, Lewes Journal Dec. 30, 1799 Page 4Document1 pageSussex Weekly Advertiser Or, Lewes Journal Dec. 30, 1799 Page 4Montreal GazetteNo ratings yet

- Montreal Gazette 1799, Page 4Document1 pageMontreal Gazette 1799, Page 4Montreal GazetteNo ratings yet

- Sussex Weekly Advertiser Or, Lewes Journal Dec. 30, 1799 Page 3Document1 pageSussex Weekly Advertiser Or, Lewes Journal Dec. 30, 1799 Page 3Montreal GazetteNo ratings yet

- Montreal Gazette 1799, Page 1Document1 pageMontreal Gazette 1799, Page 1Montreal GazetteNo ratings yet

- Sussex Weekly Advertiser Or, Lewes Journal Dec. 30, 1799 Page 2Document1 pageSussex Weekly Advertiser Or, Lewes Journal Dec. 30, 1799 Page 2Montreal GazetteNo ratings yet

- Montreal Gazette 1799, Page 3Document1 pageMontreal Gazette 1799, Page 3Montreal GazetteNo ratings yet

- Lettre Consortium Santé MontréalDocument4 pagesLettre Consortium Santé MontréalAnonymous e3OFiZNo ratings yet

- Sussex Weekly Advertiser Or, Lewes Journal Dec. 30, 1799 Page 1Document1 pageSussex Weekly Advertiser Or, Lewes Journal Dec. 30, 1799 Page 1Montreal Gazette0% (1)

- Montreal Gazette 1799, Page 2Document1 pageMontreal Gazette 1799, Page 2Montreal Gazette100% (1)

- Montreal Gazette: July 16, 1976Document38 pagesMontreal Gazette: July 16, 1976Montreal GazetteNo ratings yet

- NYC Montreal Amicus On Horse-Drawn Carriage MoratoriumDocument9 pagesNYC Montreal Amicus On Horse-Drawn Carriage MoratoriumMontreal GazetteNo ratings yet

- For Each of The Following SituationsDocument2 pagesFor Each of The Following Situationslo jaNo ratings yet

- Acc802 Tut Topc 7 QuestionsDocument3 pagesAcc802 Tut Topc 7 Questionssanjeet kumarNo ratings yet

- M.Nor Abdul Razak - EditDocument8 pagesM.Nor Abdul Razak - EditWredha KusumaNo ratings yet

- Answer For T3 FMRDocument4 pagesAnswer For T3 FMRYehHunTeeNo ratings yet

- The Decision-Making Process of Fiscal Policy in Viet NamDocument21 pagesThe Decision-Making Process of Fiscal Policy in Viet NamADBI EventsNo ratings yet

- Presentation On Inflation: Presented By: Darwin Balabbo ManaguelodDocument13 pagesPresentation On Inflation: Presented By: Darwin Balabbo ManaguelodJulius MacaballugNo ratings yet

- Case Study 2 - Alex SharpeDocument3 pagesCase Study 2 - Alex SharpeNell Mizuno100% (3)

- Islamic Economics PDFDocument214 pagesIslamic Economics PDFDzaky Ahmad NaufalNo ratings yet

- Unit 3Document54 pagesUnit 3MumbaiNo ratings yet

- A Sum of Money Allocated For A Particular Purpose A Summary ofDocument12 pagesA Sum of Money Allocated For A Particular Purpose A Summary ofsaneshonlineNo ratings yet

- Global Strategy: Yield Curve, Markets and StrategyDocument12 pagesGlobal Strategy: Yield Curve, Markets and StrategySiphoKhosaNo ratings yet

- CasesDocument3 pagesCasesouzheshiNo ratings yet

- Managerial Accounting II Case Study Analysis Harsh ElectricalsDocument7 pagesManagerial Accounting II Case Study Analysis Harsh ElectricalsSiddharth GargNo ratings yet

- Integrated Accounting SystemsDocument15 pagesIntegrated Accounting SystemsSanjeev JayaratnaNo ratings yet

- NICEHoldingsInvestorsRelations 2020 3Q ENGDocument31 pagesNICEHoldingsInvestorsRelations 2020 3Q ENGSimonasNo ratings yet

- Journal LedgerDocument50 pagesJournal LedgerShevina Maghari shsnohsNo ratings yet

- Chapter 5 Core Banking SystemsDocument73 pagesChapter 5 Core Banking SystemsbiswajitNo ratings yet

- PGDMSM 2022 Prospectus PDFDocument24 pagesPGDMSM 2022 Prospectus PDFAkash SherryNo ratings yet

- National Cooperative Insurance Society NigeriaDocument2 pagesNational Cooperative Insurance Society NigeriaChristopher Azuka100% (2)

- Hewlett PackardDocument31 pagesHewlett PackardAamir Awan0% (2)

- CVP Relationship Kelompok 3Document42 pagesCVP Relationship Kelompok 3Enrico Jovian S SNo ratings yet

- Ken Calhoun - Time and Sales. The Tale of The TapeDocument4 pagesKen Calhoun - Time and Sales. The Tale of The TapeMarius Lungu100% (4)

- Premier FactsheetDocument2 pagesPremier FactsheetMaurizio CerosioNo ratings yet

- Valuing Rent-Controlled Residential PropertiesDocument14 pagesValuing Rent-Controlled Residential PropertiesiugjkacNo ratings yet

- BIR Form 2306 Certificate of Final Tax Withheld At SourceDocument14 pagesBIR Form 2306 Certificate of Final Tax Withheld At SourceBrianSantiagoNo ratings yet

- Income Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)Document2 pagesIncome Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)pankaj goyalNo ratings yet

- Chapter 1 5Document100 pagesChapter 1 5Bijaya DhakalNo ratings yet

- Introduction To Valuation: The Time Value of Money: Chapter OrganizationDocument58 pagesIntroduction To Valuation: The Time Value of Money: Chapter OrganizationAshar Ahmad FastNuNo ratings yet

- BBFA2303 Sample Exam QuestionDocument11 pagesBBFA2303 Sample Exam QuestionAnnieNo ratings yet

- Finance Project For McomDocument40 pagesFinance Project For McomSangeeta Rachkonda100% (1)