Professional Documents

Culture Documents

Reverse Charge 01-04-2015

Uploaded by

Rohit SharmaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reverse Charge 01-04-2015

Uploaded by

Rohit SharmaCopyright:

Available Formats

V

V

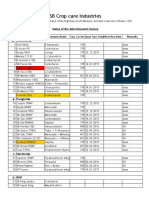

Reverse and Partial Reverse Mechanism Chart from 01.04.2015

Reverse Mechanism and Partial Reverse Mechanism in Service Tax was First Introduced Vide

Principal Notification No. 30/2012-Service Tax Dated- 20th June, 2012 and subsequently

been amended vide Corrigendum Notification [F. No.334/1/2012 -TRU], dated 29-6-2012,

Notification No. 45/2012-Service Tax, dated 7th August, 2012 , Notification No. 10/2014Service Tax Dated- 11th July, 2014 and Notification No.7/2015-Service Tax, Dated- 1st

March, 2015.

After Considering all these Notifications We have Compiled The Reverse and Partial

Reverse Mechanism Chart as Applicable from 01.04.2015Reverse and Partial Reverse Mechanism Chart with effect from 01.04.2015 and The extent

of service tax payable thereon by the person who provides the service and any other person

liable for paying service tax for the taxable services

Table

Sl.

Description of a service

No.

(1) (2)

in respect of services provided or agreed to

1 be provided by an insurance agent to any

person carrying on insurance business

in respect of services provided or agreed to

be provided by a recovery agent to a

1A banking company or a financial institution

or a non-banking financial company

(Effective from 01.04.2015)

in respect of services provided or agreed to

1B. be provided by a mutual fund agent or

distributor, to a mutual fund or asset

management company (Effective from

01.04.2015)

in respect of service provided or agreed to

be provided by a selling or marketing agent

1C.

of lottery tickets to a lottery distributor or

selling agent

vmvsr@rediffmail.com

Percentage of

service tax

payable by the

person

providing

service

(3)

Percentage of

service tax payable

by any person liable

for paying service

tax other than the

service provider

(4)

Nil

100%

Nil

100%

Nil

100%

Nil

100%

9390221100

http://vmvsraoco.icai.org.in/

in respect of services provided or agreed to

be provided by a goods transport agency in

respect of transportation of goods by road

to Company, Partnership Firm, Registered

2

Factory, Registered Society, co-operative

society, AOP, LLP, Person Registered

Under Central Excise Act, 1944 including

Excise Dealers

in respect of services provided or agreed to

3 be provided by way of sponsorship to

anybody corporate or partnership firm

in respect of services provided or agreed to

4 be provided by an arbitral tribunal to any

Business entity

in respect of services provided or agreed to

be provided by individual advocate or a

5

firm of advocates by way of legal services

to any Business entity

in respect of services provided or agreed to

be provided by a director of a company or

5A

a body corporate to the said company or

the body corporate

in respect of services provided or agreed to

be provided by Government or local

authority excluding,- (1) renting of

6 immovable property, and (2) services

specified in sub-clauses (i), (ii) and (iii) of

clause (a) of section 66D of the Finance

Act,1994 to any Business Entity

(a) in respect of services provided or

agreed to be provided by way of renting of

a motor vehicle designed to carry

passengers on abated value to any person

who is not engaged in the similar line of

business by individual, HUF, firm or AOP

7 to Body Corporate

(b) in respect of services provided or

agreed to be provided by way of renting of

a motor vehicle designed to carry

passengers on non abated value to any

person who is not engaged in the similar

vmvsr@rediffmail.com

Nil

100%

Nil

100%

Nil

100%

Nil

100%

Nil

100%

Nil

100%

Nil

100%

50%

50%

9390221100

http://vmvsraoco.icai.org.in/

line of business by individual, HUF, firm

or AOP to Body Corporate

in respect of services provided or agreed to

be provided by way of supply of

8. manpower for any purpose or security

Nil

services by individual, HUF, firm or AOP

to Body Corporate

in respect of services provided or agreed to

be provided in service portion in execution

9.

50%

of works contract by individual, HUF, firm

or AOP to Body Corporate

in respect of any taxable services provided

or agreed to be provided by any person

10 who is located in a non-taxable territory

Nil

and received by any person located in the

taxable territory

in respect of any service provided or

agreed to be provided by a person

involving an aggregator in any manner to

11.

any Business Entity

Nil

100%

50%

100%

100%

(Effective from 01.03.2015)

Explanation-I. The person who pays or is liable to pay freight for the transportation of goods

by road in goods carriage, located in the taxable territory shall be treated as the person who

receives the service for the purpose of this notification.

Explanation-II. In works contract services, where both service provider and service recipient is

the persons liable to pay tax, the service recipient has the option of choosing the valuation

method as per choice, independent of valuation method adopted by the provider of service.

Explanation-III. Hitherto, support services provided by a Government/Local authority to any

business entity was subject to 100% reverse charge. The scope of reverse charge has now been

extended in case of all services provided by the Government/Local authority to such business

entities. The exclusion from reverse charge on renting of immovable property and some specified

services of Sec. 66D of the Act shall continue.

vmvsr@rediffmail.com

9390221100

http://vmvsraoco.icai.org.in/

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Vertical Cutoff WallsDocument18 pagesVertical Cutoff WallsMark LaiNo ratings yet

- Star Wars Galactic Connexionstm Galactic Beckett Star Wars Story Connexions CallingDocument4 pagesStar Wars Galactic Connexionstm Galactic Beckett Star Wars Story Connexions CallingJuan TorresNo ratings yet

- Retail Operations ManualDocument44 pagesRetail Operations ManualKamran Siddiqui100% (2)

- Activity Based Costing TestbanksDocument18 pagesActivity Based Costing TestbanksCharlene MinaNo ratings yet

- Combining Wavelet and Kalman Filters For Financial Time Series PredictionDocument17 pagesCombining Wavelet and Kalman Filters For Financial Time Series PredictionLuis OliveiraNo ratings yet

- Rate If Iodine and PropanoneDocument3 pagesRate If Iodine and Propanoneshareef1No ratings yet

- Internship Report PDFDocument71 pagesInternship Report PDFNafiz FahimNo ratings yet

- Certificate of Attendance: Yosapat NashulahDocument2 pagesCertificate of Attendance: Yosapat NashulahStrata WebNo ratings yet

- Alto Hotel Melbourne GreenDocument2 pagesAlto Hotel Melbourne GreenShubham GuptaNo ratings yet

- Genie PDFDocument277 pagesGenie PDFOscar ItzolNo ratings yet

- E-Waste: Name: Nishant.V.Naik Class: F.Y.Btech (Civil) Div: VII SR - No: 18 Roll No: A050136Document11 pagesE-Waste: Name: Nishant.V.Naik Class: F.Y.Btech (Civil) Div: VII SR - No: 18 Roll No: A050136Nishant NaikNo ratings yet

- Mini Project A-9-1Document12 pagesMini Project A-9-1santhoshrao19No ratings yet

- Skilled Worker Overseas FAQs - Manitoba Immigration and Economic OpportunitiesDocument2 pagesSkilled Worker Overseas FAQs - Manitoba Immigration and Economic OpportunitieswesamNo ratings yet

- 2012 Conference NewsfgfghsfghsfghDocument3 pages2012 Conference NewsfgfghsfghsfghabdNo ratings yet

- Manual TV Hyundai HYLED3239iNTMDocument40 pagesManual TV Hyundai HYLED3239iNTMReinaldo TorresNo ratings yet

- Purposive Communication Preliminary DiscussionDocument2 pagesPurposive Communication Preliminary DiscussionJohn Mark100% (1)

- GSE v. Dow - AppendixDocument192 pagesGSE v. Dow - AppendixEquality Case FilesNo ratings yet

- Jordan CVDocument2 pagesJordan CVJordan Ryan SomnerNo ratings yet

- 1 s2.0 S2238785423001345 MainDocument10 pages1 s2.0 S2238785423001345 MainHamada Shoukry MohammedNo ratings yet

- IELTS Material Writing 1Document112 pagesIELTS Material Writing 1Lê hoàng anhNo ratings yet

- Teal Motor Co. Vs CFIDocument6 pagesTeal Motor Co. Vs CFIJL A H-DimaculanganNo ratings yet

- State Farm Claims: PO Box 52250 Phoenix AZ 85072-2250Document2 pagesState Farm Claims: PO Box 52250 Phoenix AZ 85072-2250georgia ann polley-yatesNo ratings yet

- Paper 4 Material Management Question BankDocument3 pagesPaper 4 Material Management Question BankDr. Rakshit Solanki100% (2)

- Chapter 3 Depreciation - Sum of The Years Digit MethodPart 4Document8 pagesChapter 3 Depreciation - Sum of The Years Digit MethodPart 4Tor GineNo ratings yet

- Studies - Number and Algebra P1Document45 pagesStudies - Number and Algebra P1nathan.kimNo ratings yet

- Analysis of MMDR Amendment ActDocument5 pagesAnalysis of MMDR Amendment ActArunabh BhattacharyaNo ratings yet

- Southern California International Gateway Final Environmental Impact ReportDocument40 pagesSouthern California International Gateway Final Environmental Impact ReportLong Beach PostNo ratings yet

- Characteristics of Trochoids and Their Application To Determining Gear Teeth Fillet ShapesDocument14 pagesCharacteristics of Trochoids and Their Application To Determining Gear Teeth Fillet ShapesJohn FelemegkasNo ratings yet

- Products ListDocument11 pagesProducts ListPorag AhmedNo ratings yet

- OMM 618 Final PaperDocument14 pagesOMM 618 Final PaperTerri Mumma100% (1)