Professional Documents

Culture Documents

Promissory Note PDF

Uploaded by

firdausOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Promissory Note PDF

Uploaded by

firdausCopyright:

Available Formats

12/18/2012

Introduction

UNIVERSITI TEKNOLOGI MARA

PROMISSORY

NOTE

When someone borrows a certain amount of

money, the borrower is required to sign a note

(thus called, a promissory note) stating that the

borrower will repay a certain sum of money at

a certain particular fixed date in the future.

MARIATHY KARIM

UiTM SARAWAK (SAMARAHAN)

FSKM(MATHEMATICS)

The main features of a promissory note are as follows.

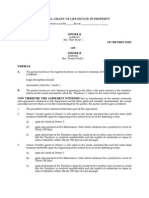

Sample of a Promissory Note

Term of the note

Bandar Jengka,

Pahang.

30 Sept. 2001

Seventy days after date I promise to pay to the order of

Maju Niaga Consulting seven thousand, and 00/100

ringgit.

Value receives with interest at 11% due.

Due 9 december 2001.

AIDa

Aida Junaidi

Maturity

date

Date of

note

Face value

Payee

Maker

FEATURES

DETAILS

MAKER

The maker (promisor or obligor) is the person that signs

the note.

PAYEE

The payee (promise or obligee) is the person to whom

payment is to be made.

DATE OF THE

NOTE

The date of the note is the date on which the note is

made.

TERM OF THE

NOTE

The term of the note is the length of time until the note is

due for payment.

FACE VALUE

The face value of the note is the amount stated on the

note.

MATURITY

VALUE

The maturity of the note is the total sum of money which

the payee will receive on the maturity date. The maturity

value of a non-interest bearing note is the face value

while the maturity value of an interest bearing note is the

face value plus any interest that is due.

The maturity date of the note is the date on which the

maturity value is due.

MATURITY

DATE

Examples

1.

In the promissory note below,

Taman Sri Gombak,

Selangor.

20 April 2007

Sixty days after date I promise to pay to the order of K.S.BUMI

Ringgit Malaysia: Two thousand and five hundred only for value

receives with interest at the rate of 11% per annum until paid.

Due 19 June 2007.

SHEILA

Sheila

a) who is the maker of the note?

b) who is the payee of the note?

Solution:

a) The maker is Sheila.

b) The payee is K.S.BUMI

Maturity Value, S = P ( 1 + rt)

= 2500 ( 1 + (0.11)*(60/360))

= RM 2545.83

Calculate the maturity value of the note.

12/18/2012

2. A promissory note dated 22 February 2005 reads

three months from date, I Promise to pay RM

1,000.00 with interest at 9% per annum. Find

a) The maturity date of the note

b) The maturity value of the note.

Solution:

3. The Maturity value of a 60-day interest bearing promissory

note is RM450. If the interest rate is 6% per annum, what

is the face value of the note?

Solution:

S =RM 450

r = 0.06

t = 60

360

S P(1 rt )

450 P(1 (0.06)*(

a) Maturity date = 22 February 2005 + 3 months

= 22 May 2005

60

))

360

450 1.01* P

P RM 445.54

b) Maturity Value, S = P ( 1 + rt)

= 1000 * ( 1 + (0.09)*(3/12))

= RM 1022.50

4.The interest on a 90-day promissory note is RM 46. If the

interest rate is 7% per annum, find the face value of the

note.

Solution:

I = RM 46

r = 0.07

t=

90

360

I Pr t

46 P *(0.07)*(

90

)

360

46

0.0175

P RM 2628.57

So, the face value is RM 445.54

Bank Discount, D

Bank Discount is such as banks and financial institutions to

deduct the interest charged IN ADVANCE for shortterm loans. This charge is also called interest in

advance.

D = Sdt

where;

D = Simple discount / bank discount

S = Maturity value

d = simple discount rate

t = time (discount period which must be stated in year)

So, the face value is RM 2628.57

Solving Mathematical Problems using Bank Discount

concept

1. Sharifah borrows an amount that the accumulated value is

RM 8000 for three months from a lender who charges a

discount rate of 5%. Find the bank discount amount.

Solution:

Bank discount is computed in much the same way as

simple interest except that it is based on the final amount

( to be paid back) or maturity value.

2. Aiman borrows an amount that the accumulated value

is RM 2000 for 40 days from a lender who charges a

discount rate of 10%. Find the bank discount amount.

Solution:

D?

S RM 8000

3

12

d 0.05

D Sdt

(8000)(0.05)(3 / 12)

RM 100

Ans: RM 22.22

12/18/2012

DISCOUNTING PROMISSORY NOTES

Promissory notes can be sold to a bank before its maturity date

if the holder is in need of cash. The processing of selling the

promissory notes is called as discounting the note.

Refer Short notes Diagram of Discounting Promissory Notes.

Proceeds ( H )

H=S-D

H = S Sdt

H = S ( 1 - dt )

where;

H =Proceeds

S = Maturity value

d = discount rate

t = discount period

Solving Mathematical Problems using

Discounting concept

1. Ah Sing, a businessman, receives a promissory note for

RM 2500 with interest at 10% per annum that is due in

80days. The note is dated 10 Mac 2012. The note is

discounted on 15 April 2012 at a bank that charges 12%

discount. Determine the

a) maturity date

b) maturity value

c) discount period

d) proceeds

e) amount discount

Solution:

Solution:

2. Ah Wong, a businessman, receives a promissory note

for RM 2000 with interest at 8% per annum that is due

in 60days. The note is dated 10 April 2012. The note is

discounted on 5 Mei 2012 at a bank that charges 12%

discount. Determine the

a) maturity date

b) maturity value

c) discount period

d) proceeds

e) amount discount

12/18/2012

SIMPLE INTEREST RATE EQUIVALENT TO

BANK DISCOUNT RATE

The interest rate and the discount rate are said to be equivalent if

the two rates give the same present value for an amount due in

future.

Find discount rate that is equivalent to the given interest

rate.

Formula:

d = __r___

1 + rt

where;

d = discount rate

r = interest rate

t = the whole period

Example:

Find Interest rate that is equivalent to the given

Discount rate.

What discount rate should a lender charge to earn an

interest rate of 12% on half years loan.

Solution:

Formula:

d = __r___

1 + rt

r = __d___

1 - dt

where;

d = discount rate

r = interest rate

t = the whole period

=

= 0.1132 100

= 11.32%

Example:

Find the equivalent interest rate for 10% discount rate

charged on 45days of discount period.

Solution:

The End of Promissory Notes

r = __d___

1 - dt

=

= 0.1013 100

= 10.13%

Please Submit Tutorial 3 (Promissory

Notes) on next class

You might also like

- SHULTZYS Bill Notice-Second Letter 27-02-2023Document2 pagesSHULTZYS Bill Notice-Second Letter 27-02-2023Michael SchulzeNo ratings yet

- 2nd LTR To LenderDocument1 page2nd LTR To LenderBob WrightNo ratings yet

- Rental Contract For Real PropertyDocument1 pageRental Contract For Real PropertySofie SofieNo ratings yet

- UNAH Student Angela Izaguirre's Statement of Interest for US Mission InternshipDocument1 pageUNAH Student Angela Izaguirre's Statement of Interest for US Mission InternshipIzaguirre KarisNo ratings yet

- Bill of Exchange Promissory NoteDocument6 pagesBill of Exchange Promissory Notesatyendrain100% (1)

- In Form Pauperis Overview and Sample FormsDocument7 pagesIn Form Pauperis Overview and Sample FormsLula SafritNo ratings yet

- Ligare "To Bind".: UK: USDocument6 pagesLigare "To Bind".: UK: USPriya Ga100% (1)

- Promissory NoteDocument10 pagesPromissory NoteIsh ChavanNo ratings yet

- Promissory NoteDocument4 pagesPromissory Noteapi-437528557No ratings yet

- Virginia Quit Claim Deed FormDocument2 pagesVirginia Quit Claim Deed FormLj PerrierNo ratings yet

- Secured Promissory Note TemplateDocument2 pagesSecured Promissory Note TemplateSteve Vachani100% (2)

- Fw8ce PDFDocument2 pagesFw8ce PDFSpiritually Gifted100% (2)

- Last Will and TestamentDocument3 pagesLast Will and TestamentLetlhogonolo Molokomme MokhuseNo ratings yet

- Transfer Assets Into A Living TrustDocument4 pagesTransfer Assets Into A Living TrustLamario StillwellNo ratings yet

- W-8BEN: Do NOT Use This Form IfDocument1 pageW-8BEN: Do NOT Use This Form IfdoyokaNo ratings yet

- The Dispatch of MerchantsDocument81 pagesThe Dispatch of MerchantsKristin Cantley SnellNo ratings yet

- Creature Loot PDF - GM BinderDocument97 pagesCreature Loot PDF - GM BinderAlec0% (1)

- What Is A BondDocument2 pagesWhat Is A BondKau MilikkuNo ratings yet

- Teaching and Learning ResourcesDocument4 pagesTeaching and Learning ResourcesTey Lee PohNo ratings yet

- Streamlined Filing Compliance Procedures For Non-Resident, Non-Filer Taxpayers QuestionnaireDocument2 pagesStreamlined Filing Compliance Procedures For Non-Resident, Non-Filer Taxpayers QuestionnaireTuan HoangNo ratings yet

- NEGOTIABLE INSTRUMENTS GUIDEDocument7 pagesNEGOTIABLE INSTRUMENTS GUIDEjustine cabanaNo ratings yet

- Asset-Backed Commercial PaperDocument4 pagesAsset-Backed Commercial PaperdescataNo ratings yet

- Certificates DepositDocument12 pagesCertificates DepositATRNo ratings yet

- Bankruptcy Intake FormDocument12 pagesBankruptcy Intake Formzack8182No ratings yet

- Issuing SecuritiesDocument6 pagesIssuing SecuritiesKomal ShujaatNo ratings yet

- Payment MethodsDocument12 pagesPayment Methodsrahul_khanna4321No ratings yet

- Beneficiary Designation: Policy InformationDocument2 pagesBeneficiary Designation: Policy Informationjaniceseto1No ratings yet

- Form W-9 and Instructions Request For Taxpayer Identification Number andDocument20 pagesForm W-9 and Instructions Request For Taxpayer Identification Number andnormlegerNo ratings yet

- Essentials of Report Writing - Application in BusinessDocument28 pagesEssentials of Report Writing - Application in BusinessMahmudur Rahman75% (4)

- Rescission of Contracts - 1Document12 pagesRescission of Contracts - 1Chudap Cell Inc.No ratings yet

- Tensile TestDocument23 pagesTensile TestHazirah Achik67% (3)

- Sebu6918 03 00 AllDocument94 pagesSebu6918 03 00 AllAhmed Moustafa100% (1)

- Promissory NoteDocument5 pagesPromissory NoteAzliana Nana100% (1)

- Form 499 R-4 Withholding ExemptionDocument2 pagesForm 499 R-4 Withholding Exemptionheidi reyesNo ratings yet

- Surety BondDocument3 pagesSurety BondRenz Dela Cruz100% (1)

- Lecture For Promissory NoteDocument9 pagesLecture For Promissory Notejas jaasNo ratings yet

- Replace lost vehicle certificate of originDocument1 pageReplace lost vehicle certificate of originFAQ MDNo ratings yet

- Accepted Offer Addendum-CounterDocument16 pagesAccepted Offer Addendum-Counterrealestate6199No ratings yet

- Contract SsDocument20 pagesContract SsMir Mahbubur RahmanNo ratings yet

- Sornson Tort Claim NoticeDocument6 pagesSornson Tort Claim NoticeStatesman JournalNo ratings yet

- Notes On Negotiable Instrument Act 1881Document6 pagesNotes On Negotiable Instrument Act 1881Pranjal SrivastavaNo ratings yet

- Letter of RevocationDocument1 pageLetter of Revocationcashman966100% (1)

- Why Sign A Power of Attorney As A DeedDocument5 pagesWhy Sign A Power of Attorney As A DeedEarl Mercado CalingacionNo ratings yet

- Glossary of Important Business TermsDocument44 pagesGlossary of Important Business TermsJkNo ratings yet

- JKSC ClassesDocument24 pagesJKSC ClassesCA Seshan KrishNo ratings yet

- Government Securities Market: Role and TradingDocument11 pagesGovernment Securities Market: Role and TradingVikasDalal100% (2)

- Sipa Workshop Remittances and Housing (Colombia)Document104 pagesSipa Workshop Remittances and Housing (Colombia)fervriveraNo ratings yet

- Instructions For Form 1066: U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnDocument6 pagesInstructions For Form 1066: U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnIRSNo ratings yet

- Private Law 2 2020 PDFDocument12 pagesPrivate Law 2 2020 PDFАнна ЛерерNo ratings yet

- Grant of Life EstateDocument2 pagesGrant of Life EstateDavid Eugene SmithNo ratings yet

- How Much Should You InvestDocument3 pagesHow Much Should You InvestKurian PunnooseNo ratings yet

- David Kotolup & Bruce Wong DBA Avenue AutoDocument5 pagesDavid Kotolup & Bruce Wong DBA Avenue AutomoorishnationNo ratings yet

- Residential Rental Application: Applicant InformationDocument3 pagesResidential Rental Application: Applicant Informationapi-115282286No ratings yet

- Mount Holyoke College travel waiver and release formDocument1 pageMount Holyoke College travel waiver and release formidkthisusernameNo ratings yet

- CASE UNCONSTITUTIONALITY THOMPSON v. SMITH 154 S.E. 579, 155 Va. 367 (VA 1930) PDFDocument29 pagesCASE UNCONSTITUTIONALITY THOMPSON v. SMITH 154 S.E. 579, 155 Va. 367 (VA 1930) PDFJo RoNo ratings yet

- US Internal Revenue Service: f1041t - 1998Document2 pagesUS Internal Revenue Service: f1041t - 1998IRSNo ratings yet

- Victory Statement Re ADTR 12-15-2011Document11 pagesVictory Statement Re ADTR 12-15-2011yancey21No ratings yet

- 12 USC 411 FRN ObligationsDocument1 page12 USC 411 FRN ObligationszicjrurtNo ratings yet

- Diploma in Islamic Banking (Dib) : S/N TopicDocument76 pagesDiploma in Islamic Banking (Dib) : S/N TopicRezaul AlamNo ratings yet

- Debt Instruments: Types, Features & AdvantagesDocument14 pagesDebt Instruments: Types, Features & AdvantagesAnubhav GoelNo ratings yet

- Security Deposit Interest LetterDocument1 pageSecurity Deposit Interest LetterJustin MassaNo ratings yet

- Promissory Note, Bill of Exchange, CheckDocument2 pagesPromissory Note, Bill of Exchange, CheckJames DecolongonNo ratings yet

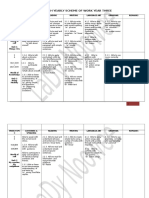

- RPT Year3 2016Document17 pagesRPT Year3 2016firdausNo ratings yet

- Reason To Stay Fit and Healthy: DAY Time EverydayDocument1 pageReason To Stay Fit and Healthy: DAY Time EverydayfirdausNo ratings yet

- SECTION A (30 Marks) A. Circle The Correct AnswersDocument5 pagesSECTION A (30 Marks) A. Circle The Correct AnswersfirdausNo ratings yet

- Yearly Scheme of Work Year 2: Week Theme Unit / Topic Learning Standard Remarks / NotesDocument20 pagesYearly Scheme of Work Year 2: Week Theme Unit / Topic Learning Standard Remarks / NotesfirdausNo ratings yet

- SECTION A (30 Marks) A. Circle The Correct AnswersDocument5 pagesSECTION A (30 Marks) A. Circle The Correct AnswersfirdausNo ratings yet

- RPT Bi Year 4 2016Document16 pagesRPT Bi Year 4 2016NOOR AZNINo ratings yet

- Year 3 Paper 2 2016Document5 pagesYear 3 Paper 2 2016firdausNo ratings yet

- Daily Lesson TempleteDocument3 pagesDaily Lesson TempleteArRahimNo ratings yet

- Bahasa Inggeris YEAR 2 2016 Section (A) Question 1-6 Choose and Fill in The Correct Sound For Each Picture. Ai Igh Ee Ar Oo OiDocument8 pagesBahasa Inggeris YEAR 2 2016 Section (A) Question 1-6 Choose and Fill in The Correct Sound For Each Picture. Ai Igh Ee Ar Oo OifirdausNo ratings yet

- Yearly Plan English Y3Document34 pagesYearly Plan English Y3Roynizan RosliNo ratings yet

- Proposal Research BaruDocument36 pagesProposal Research BarufirdausNo ratings yet

- ColoringDocument1 pageColoringfirdausNo ratings yet

- Bahasa Inggeris YEAR 2 2016 Section (A) Question 1-6 Choose and Fill in The Correct Sound For Each Picture. Ai Igh Ee Ar Oo OiDocument8 pagesBahasa Inggeris YEAR 2 2016 Section (A) Question 1-6 Choose and Fill in The Correct Sound For Each Picture. Ai Igh Ee Ar Oo OifirdausNo ratings yet

- Year 3 Paper 2 2016Document5 pagesYear 3 Paper 2 2016firdausNo ratings yet

- Bahasa Inggeris YEAR 2 2016 Section (A) Question 1-6 Choose and Fill in The Correct Sound For Each Picture. Ai Igh Ee Ar Oo OiDocument8 pagesBahasa Inggeris YEAR 2 2016 Section (A) Question 1-6 Choose and Fill in The Correct Sound For Each Picture. Ai Igh Ee Ar Oo OifirdausNo ratings yet

- SECTION A (30 Marks) A. Circle The Correct AnswersDocument5 pagesSECTION A (30 Marks) A. Circle The Correct AnswersfirdausNo ratings yet

- Sequences PDFDocument6 pagesSequences PDFfirdausNo ratings yet

- Simple Interest PDFDocument5 pagesSimple Interest PDFfirdausNo ratings yet

- Construction Internship ReportDocument8 pagesConstruction Internship ReportDreaminnNo ratings yet

- BS en 1044-1999 - Brazing Filler MetalsDocument26 pagesBS en 1044-1999 - Brazing Filler MetalsBorn ToSinNo ratings yet

- Online JournalismDocument24 pagesOnline JournalismZandra Kate NerNo ratings yet

- Uvas CaractDocument10 pagesUvas CaractgondeluNo ratings yet

- M and S Code of ConductDocument43 pagesM and S Code of ConductpeachdramaNo ratings yet

- 45 - Altivar 61 Plus Variable Speed DrivesDocument130 pages45 - Altivar 61 Plus Variable Speed Drivesabdul aziz alfiNo ratings yet

- Future War in Cities Alice Hills PDFDocument5 pagesFuture War in Cities Alice Hills PDFazardarioNo ratings yet

- 09 Lift Cylinder Drift (Bulldozer) - CheckDocument2 pages09 Lift Cylinder Drift (Bulldozer) - CheckFredy Manrique AstoNo ratings yet

- FloridaSharkman ProtocolsDocument14 pagesFloridaSharkman ProtocolsgurwaziNo ratings yet

- Liebert PEX+: High Efficiency. Modular-Type Precision Air Conditioning UnitDocument19 pagesLiebert PEX+: High Efficiency. Modular-Type Precision Air Conditioning Unitjuan guerreroNo ratings yet

- Colorimetric Determination of ManganeseDocument16 pagesColorimetric Determination of ManganeseidaayudwitasariNo ratings yet

- Ôn tập và kiểm tra học kì Tiếng anh 6 ĐÁP ÁNDocument143 pagesÔn tập và kiểm tra học kì Tiếng anh 6 ĐÁP ÁNThùy TinaNo ratings yet

- Teaching and Learning in the Multigrade ClassroomDocument18 pagesTeaching and Learning in the Multigrade ClassroomMasitah Binti TaibNo ratings yet

- A-00 IndexDocument10 pagesA-00 IndexNizarHamrouniNo ratings yet

- Sheet Metal FormingDocument13 pagesSheet Metal FormingFranklin SilvaNo ratings yet

- Case NoDocument13 pagesCase NoLaurente JessicaNo ratings yet

- Schedule For Semester III, Class of 2021Document7 pagesSchedule For Semester III, Class of 2021Jay PatelNo ratings yet

- DrainHoles - InspectionDocument14 pagesDrainHoles - Inspectionohm3011No ratings yet

- How To Retract BPS Data Back To R3 When There Is No Standard RetractorDocument3 pagesHow To Retract BPS Data Back To R3 When There Is No Standard Retractorraphavega2010No ratings yet

- A Final Project For The Course Title "Monetary Policy and Central Banking"Document11 pagesA Final Project For The Course Title "Monetary Policy and Central Banking"Elle SanchezNo ratings yet

- Introduction To Machine Learning Top-Down Approach - Towards Data ScienceDocument6 pagesIntroduction To Machine Learning Top-Down Approach - Towards Data ScienceKashaf BakaliNo ratings yet

- Lesson Plan Earth & SpaceDocument5 pagesLesson Plan Earth & SpaceSol Vega PagdangananNo ratings yet

- Base Is OkDocument84 pagesBase Is OkajaydevmalikNo ratings yet

- Bylaw 16232 High Park RezoningDocument9 pagesBylaw 16232 High Park RezoningJamie_PostNo ratings yet

- Securifire 1000-ExtractedDocument2 pagesSecurifire 1000-ExtractedWilkeey EstrellanesNo ratings yet