Professional Documents

Culture Documents

CRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDF

Uploaded by

Randora LkOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDF

Uploaded by

Randora LkCopyright:

Available Formats

FC Research

SRI LANKA

Corporate Update

Analyst: Reshan Wediwardana

SOFTLOGIC FINANCE PLC

CRL.N0000

Current Price: LKR 40.0

STRONG BUY

APR 2015

Fair Value: LKR 65.0

New Clientele, Bigger Profit

KEY DATA

Share Price (LKR)

40.00

52w High/Low (LKR)

49.0/31.0

Average Daily Volume (Shares)

37,199

Average Daily Turnover (LKR mn)

1.54

Issued Share Capital (Shares mn)

Market Capitalisation (LKR mn)

1,855

P/E 31 Mar

Net Interest Income (LKR mn)

FY13

FY14

FY15E

FY16E

FY17E

2,278

3,339

3,948

4,961

6,005

Net Profit (LKR mn)

164

166

227

457

578

EPS (LKR)

3.2

3.3

4.5

9.0

11.4

1%

37%

101%

26%

3 mths 12mths

YoY % Growth

Valuations

36%

Price Performance (%)

1 mth

CRL

-24.0%

12.7%

PER (x)

12.4x

12.3x

8.9x

4.4x

3.5x

-3.2%

-9.3%

12.8%

Major Shareholders as at 30th December 2014

PBV (x)

1.7

1.6

1.0

0.8

0.6

Dividend Yield (%)

2.8%

2.8%

3.8%

7.6%

9.7%

Softlogic Capital PLC

62.38%

NAVPS

23.7

25.8

38.8

49.3

62.5

Vanik Incorporation PLC

14.35%

Adjusted DPS (LKR)

1.1

1.1

1.5

3.1

3.9

34%

34%

34%

34%

34%

-17.2%

ASPI

LB Finance PLC

4.11%

Royal Ceramic Lanka PLC

2.78%

Associated Electrical Corporation Ltd

1.90%

Public Holdings

36.95%

50

900

48

800

46

700

44

('000)

Price

Figure 1: CRL Price Volume Graph

600

42

500

40

400

38

Dividend Payout

Softlogic Finance (CRL) as one of the fast growing finance companies in Sri

Lanka is expected to achieve a 101% earnings growth amidst changing focus

on credit disbursement portfolio to high yielding segments, lowering

impairment stemming from leases and higher purchases and increasing

presence of branch network. We expect CRL to achieve an EPS of LKR 9.0 in

FY16E leading to a PER of 4.4x and PBV of 1.0x compared to sector average of

11.2x and 1.6x respectively. FC Research expects a total return of c.58% by

FY16E, based on a target price of LKR 65.0 (+54%) and a dividend yield of 3.6%.

Changing clientele may generate 32% growth in NII in FY16E: CRL has been

changing its product mix and focus from leases and hire purchases to Micro

finance in order to capture high yielding niche market segments by developing

innovative products. Hence, we expect net interest income to grow by 32% to

LKR 2bn in FY16E attributing to high yielding loans and advances growth of 25%

to LKR 11.5bn in FY16E. Further, we maintain our conservative forecast for

leases and hire purchases growth at 17% to LKR 8bn.

300

36

34

200

32

100

30

Apr-14 Jul-14 Oct-14 Jan-15

Volume

Price

(Source: www.cse.lk)

Disclaimer on Shareholding:

First Capital Holdings does not hold positions in CRL

except for 669,642 shares in First Capital Limited.

First Capital has not taken any positions in TJL in the

3 trading days prior this report while it does not

envisage taking positions in this share for the

succeeding 7 trading days to this report.

Efficient cost management and lowering impairment may drive +101% profit

growth in FY16E: We expect CRLs to lower impairment compared to FY15 due

declined exposure in leases and hire purchase portfolio. Further, strategic

branch expansion and cost management measures are expected to improve

CRLs cost-to-core-income ratio to 63% in FY16E from 67% in FY15E.

CRL may provide a total 1-year return of 58%: CRL at LKR 40.0, trades on a FY16E

PER of 4.4x and PBV of 1.0x. The counter may also provide a DPS of LKR 1.5 for

FY15E and LKR 3.1 for FY16E, which may translate into a dividend yield of 3.8%

and 7.6% respectively. On justified book value CRL is valued at LKR 58.0 while on

8.0x FY16E average PER the company is valued at LKR 72.0. On average we

provide a target price of LKR 65.0 for CRL for a 1-Year period providing a total

return of 58% - BUY.

FC Research

New Clientele, Bigger Profit

1.0 Changing clientele may generate 32% growth in NII

in FY16E

Focus on niche-micro finance disbursement: CRL has newly instigated

focus on lending towards micro finance sector with lower risk profiles

which has enabled the company to gain higher net interest margins. The

novel micro product range which consist of group loans and cluster

financing (loans given to School Teachers, Government Servants and

etc) is expected to generate an average yield of 27% in FY16E as

opposed to 26% in FY15E. We expect CRLs new loan portfolio to achieve

a 25% growth in FY16E generating a net interest income of LKR 2bn.

Booming credit demand in focused segments: We expect credit growth

to pick up in selected segments in CRLs lending portfolio mainly from

the increasing salaries of state employees proposed by the interim

budget 2015. This may drive disbursements mainly in micro loan

segment which is currently not being touched by the commercial banks.

Lowered exposure in leases and hire purchases portfolio: CRL is

currently in a process of gradually tumbling its leases and hire purchases

portfolio due to immense competition in the sector mainly coming from

commercial banks and other large players in the industry. Though there

is a strong demand existing in the industry due to improved consumer

demand, banks and large finance companies have been capturing the

market with attractive rates.

10

Figure 3: Loans, Leases and Hire Purchases Growth QoQ

Growth QoQ

LKR Bn

Figure 2: Loans, Leases and Hire Purchases - Quarterly

9

8

70%

56%

50%

40%

30%

20%

10%

62%

60%

5%

5%

0%

4

-10%

-20%

1QFY14 2QFY14 3QFY14 4QFY14 1QFY15 2QFY15 3QFY15

Lease and hire purchase receivables

Loans and receivables

(Source: Quarterly Reports)

2QFY14

2%

7%

6%

0%

3QFY14 4QFY14 1QFY15 2QFY15 3QFY15

-12%

-6%

-15%

-19%

-30%

Lease and hire purchase receivables

Loans and receivables

(Source: Quarterly Reports)

FC Research

New Clientele, Bigger Profit

Figure 4: Leasing Rates

Figure 5: Change in Disbursement Focus

LKR 400,000 leasing for a three wheeler

which is going to mature in 4 years.

20.6%

34.1%

22.7%

20.1%

17.5%

9,258

3,677

8,344

PLC

CFIN

LFIN

COCR

CRL

6,381

9MFY14

9MFY15

Lease and hire purchase receivables

(Source: FC Research Mistry Research Survey)

Loans and receivables

(Source: Quarterly Reports)

2.0 Efficient cost management and lowering

impairment may drive +134% profit growth in FY16E

Lowering impairment in line with dip in leases and hire purchases: CRL

incurred an impairment of LKR 328mn for FY14 and LKR 365mn in

9MFY15 mainly coming from repossessed vehicles, leases and hire

purchases. With the decline in lease and hire purchase portfolio, we

expect impairment to be moderate in FY16E and FY17E. However, being

conservative, for micro finance portfolio we have taken average

impairment level being used by other peers in the sector to formulate

our valuations. (5% of total disbursement)

Figure 6: Classification of Impairment in FY14

Other

receivables, 2%

Repossessed

vehicle stock,

3%

Loans and

receivables,

29%

Lease and hire

purchase, 66%

(Source: Annual Reports)

FC Research

New Clientele, Bigger Profit

Efficient cost management may further support profitability: We

expect CRL to improve its cost to income ratio to 57% in FY16E as

opposed to 61% in FY14 mainly driven by higher net interest income

stemming from the niche market approach. Fee based income may also

support to gain higher profit growth amidst higher other operating

income.

Figure 7: Cost to Income - Annual

75%

71%

62%

61%

FY12

FY13

FY14

FY15E

57%

57%

FY16E

FY17E

(Source: Annual Reports and FC Research Estimates)

3.0 CRL may provide a total 1-year return of 72%:

P/E 31 Mar

Net Interest Income (LKR mn)

Net Profit (LKR mn)

EPS (LKR)

FY13

FY14

FY15E

FY16E

FY17E

2,278

3,339

3,948

4,961

6,005

164

166

227

457

578

3.2

3.3

4.5

9.0

11.4

YoY % Growth

Valuations

36%

1%

37%

101%

26%

PER (x)

12.4x

12.3x

8.9x

4.4x

3.5x

PBV (x)

1.7

1.6

1.0

0.8

0.6

Dividend Yield (%)

2.8%

2.8%

3.8%

7.6%

9.7%

NAVPS

23.7

25.8

38.8

49.3

62.5

1.1

1.1

1.5

3.1

3.9

34%

34%

34%

34%

34%

Adjusted DPS (LKR)

Dividend Payout

CRL at LKR 40.0, trades on a FY16E PER of 4.4x and PBV of 1.0x. The

counter may also provide a DPS of LKR 1.5 and LKR 3.4 for FY15E and

FY16E, which may translate into a dividend yield of 3.8% and 7.6%

respectively.

FC Research

New Clientele, Bigger Profit

On justified book value CRL is valued at LKR 57.6 while on 8.0x FY16E

average PER the company is valued at LKR 72.0. On average we provide

a target price of LKR 65.0 for CRL on 1 Year period providing a total

return of 58% - BUY.

3.1 Justified PBV

COE (K e)

Justified PBV based Valuation

FY16E

ROAE

20%

Rf

8%

Rm

14%

Growth

1.80

COE

18%

18%

PBV

1.2

NAVPS

49.3

Fair Value

57.6

3.2 PE Band

PE band based based Valuation

FY16E

EPS for FY16E

9.00

Average PER

8.0x

72

Fair Value

Figure 8: PE Band

PRice - LKR

Ke=Rf+ (Rm -Rf)

3%

140

120

100

80

60

40

20

Jun-09

4.0x

Jun-10

Jun-11

6.0x

Jun-12

8.0x

Jun-13

10.0x

Jun-14

12.0x

Jun-15

Jun-16

Price

(Source: www.cse.lk and FC Research Estimates)

FC Research

New Clientele, Bigger Profit

3.3 Fair value of LKR 71.0 and total return of 72%

Expected CRL price for FY16E 0

PER based target price

Justified PBV based target price

Average Fair Value

0

72

58

65

CRL price for FY16E

Return

Target Price

65

Current Price

42

Dividend FY15E

1.5

Capital Gain %

54%

Dividend Yield %

3.6%

Total Return %

58%

FC Research

New Clientele, Bigger Profit

Appendix 1 Ratio Analysis

Ratio Analysis

FY12

FY13

FY14

FY15E

FY16E

FY17E

FY18E

Capital

Equity / Assets

11.0%

9.1%

7.2%

9.6%

9.8%

10.2%

10.6%

Return on Average Equity

14.9%

14.2%

13.2%

13.8%

20.4%

20.4%

18.9%

Return on Average Assets

1.7%

1.4%

1.1%

1.2%

2.0%

2.0%

2.0%

Avg. yield on earning assets

24.9%

23.9%

27.2%

26.1%

27.3%

27.5%

27.5%

Avg. cost of funds

13.2%

14.2%

15.2%

14.1%

14.4%

14.6%

14.6%

Net Interest Spread

11.7%

9.7%

11.9%

12.0%

12.9%

12.9%

12.9%

Net Interest Margin

12.0%

9.3%

10.4%

10.4%

11.4%

11.1%

11.1%

Cost / Core-income

77%

78%

63%

67%

63%

63%

63%

Cost / Income

75%

71%

61%

61%

60%

59%

59%

Cost / Average Assets

8.4%

6.4%

5.6%

5.9%

6.1%

5.9%

5.8%

Cost / Branch (Rs.'Mn)

38.2

43.7

51.6

52.3

51.9

51.9

53.4

Earnings

Rev. / Employee (Rs.'Mn)

1.476

2.245

2.855

2.520

2.632

2.825

3.046

Asset Growth

128%

31%

38%

13%

24%

22%

20%

Deposit Growth

195%

49%

34%

30%

25%

23%

22%

54%

-38%

209%

-15%

20%

18%

10%

279%

50%

16%

137%

25%

21%

21%

79%

20%

15%

-15%

17%

17%

17%

109%

28%

15%

33%

21%

19%

19%

Loan / Deposits

176%

152%

131%

134%

130%

126%

123%

Loan / Funds

131%

182%

107%

164%

165%

167%

178%

Loan / Total Assets

82%

80%

67%

79%

77%

76%

75%

Deposit / Liabilities

52%

58%

55%

65%

66%

67%

68%

Employees

550

467

502

748

891

992

1,092

16

17

17

22

27

32

37

Asset Quality

Borrowings Growth

Loans & advances Growth

Leases & higher purchases Growth

Total Lending Growth

Liquidity

Branches

New Branches during the Year

(Source: Annual Reports and FC Research Estimates)

FC Research

New Clientele, Bigger Profit

Appendix 2 Income Statement

Income Statement

P/E 31 March

Interest Income

Interest Expense

Net Interest Income

FY12

FY13

FY14

FY15E

FY16E

FY17E

1,534

(793)

741

2,278

(1,391)

886

3,339

(2,058)

1,281

3,948

(2,377)

1,572

4,961

(2,885)

2,075

6,005

(3,578)

2,426

48

5

18

812

69

31

62

1,048

119

21

13

1,433

134

53

126

313

166

62

42

270

194

85

97

376

73

328

404

206

210

Net Operating Income

806

975

1,105

1,481

2,139

2,592

Personnel Expenses

Depreciation of Property, Plant and Equipment

Amortization of Intangible Assets

Other Operating Expenses

Total Operating Expenses

214

26

1

369

611

239

44

2

457

742

288

50

3

535

877

468

71

6

605

1,151

625

83

10

683

1,401

779

95

14

772

1,661

Operating Profit Before Value Added Tax (VAT)

195

233

228

330

737

931

Value Added Tax (VAT) on Financial Services

Profit Before Income Tax

Income Tax Expense

Profit for the Year

30

165

44

121

37

196

32

164

37

191

26

166

60

270

43

227

102

635

178

457

128

803

225

578

EPS

2.4

3.2

3.3

4.5

9.0

11.4

Fees and Commission Income

Net Trading Income

Other Operating Income

Total Operating Income

Impairment Charge / (Reversal ) for Loans and

Advances

(Source: Annual Reports and FC Research Estimates)

FC Research

New Clientele, Bigger Profit

Appendix 3 Statement of Financial Position

Statement of Financial Position

P/E 31 March

Assets

Cash and cash equivalents

Financial investments - Available for sale

Financial investments - Held for trading

Lease and hire purchase receivables

Loans and receivables

Other non financial assets

Intangible assets

Property, plant & equipment

Total Assets

FY12

FY13

FY14

FY15E

FY16E

FY17E

1,104

70

6,005

2,241

472

7

176

10,076

1,473

115

79

7,222

3,353

792

8

178

13,219

2,431

1,515

85

8,325

3,887

1,693

10

312

18,260

2,064

50

123

7,058

9,207

1,816

24

316

20,659

3,002

61

142

8,241

11,473

2,270

35

315

25,538

4,206

104

163

9,642

13,853

2,792

44

309

31,113

Liabilities

Due to banks

Derivative financial instruments

Due to customers

Other borrowed funds

Other non financial liabilities

Retirement benefit obligations

Deferred tax liabilities

Total Liabilities

1,153

4,682

2,564

481

12

75

8,968

2,653

6,957

1,581

744

14

65

12,014

1,597

11

9,313

4,888

1,073

22

47

16,950

1,627

12,107

4,159

724

22

47

18,684

1,971

15,133

4,983

877

22

47

23,034

2,350

18,614

5,860

1,046

22

47

27,938

Equity Attributable to Equity Holders of the Parent

Stated capital

Statutory reserve fund

Investment fund reserve

Retained earnings

Available for sale reserve

Total Equities

1,003

13

21

79

(8)

1,108

1,003

43

48

130

(19)

1,205

1,003

76

76

142

12

1,310

1,405

121

144

292

12

1,974

1,405

213

281

594

12

2,505

1,405

329

455

976

12

3,176

10,076

13,219

18,260

20,659

25,538

31,113

22

24

26

39

49

62

Total Liabilities and Equity

NAVPS

(Source: Annual Reports and FC Research Estimates)

FC Research

New Clientele, Bigger Profit

Appendix 4 Peer Comparison

Name

Softlogic Finance

Commercial Credit And Finance

Symbol

Price

Trailing 12

NAVPS

months

PER

PBV

CRL.N0000

39.5

4.1

29.2

9.6x

1.4x

COCR.N0000

52.7

6.2

17.0

8.5x

3.1x

People's Leasing & Finance

PLC.N0000

23.0

2.6

13.2

8.8x

1.7x

Central Finance Company

CFIN.N0000

252.9

34.3

223.7

7.4x

1.1x

LB Finance

LFIN.N0000

164.0

30.3

106.8

5.4x

1.5x

Lanka Orix Finance

LOFC.N0000

4.0

0.5

2.8

7.8x

1.4x

Commercial Credit And Finance

COCR.N0000

52.7

6.2

17.0

8.5x

3.1x

Citizens Development Business Finance

CDB.N0000

85.0

11.0

71.1

7.7x

1.2x

Commercial Leasing & Finance

CLC.N0000

4.1

0.2

1.6

19.3x

2.6x

2,200.0

189.0

2,562.7

11.6x

0.9x

1,010.5

Mercantile Investments And Finance

MERC.N0000

Alliance Finance Company

ALLI.N0000

800.0

126.2

6.3x

0.8x

The Finance Company

TFC.N0000

15.5

(12.2)

(61.6)

-1.3x

-0.3x

Senkadagala Finance

SFCL.N0000

60.0

8.2

36.8

7.3x

1.6x

Softlogic Finance

CRL.N0000

39.5

4.1

29.2

9.6x

1.4x

Vallibel Finance

VFIN.N0000

46.1

8.5

33.8

5.4x

1.4x

Singer Finance

SFIN.N0000

19.5

2.1

13.6

9.3x

1.4x

Sinhaputhra Finance

SFL.N0000

174.8

16.3

165.1

10.7x

1.1x

AMCL.N0000

22.4

10.7

57.0

2.1x

0.4x

CSF.N0000

4.4

0.3

1.2

14.4x

3.7x

People`s Merchant Finance

PMB.N0000

24.5

(1.3)

14.0

-19.2x

1.8x

Orient Finance

ORIN.N0000

12.5

0.5

7.6

22.8x

1.6x

Arpico Finance Company

ARPI.N0000

158.9

30.8

117.4

5.2x

1.4x

Asia Asset Finance

AAF.N0000

1.8

0.1

1.5

14.4x

1.2x

AMW Capital Leasing And Finance

Nation Lanka Finance

Swarnamahal Financial Services

SFS.N0000

1.9

(1.5)

(2.5)

-1.2x

-0.8x

Abans Finance

AFSL.N0000

26.1

1.6

13.9

16.3x

1.9x

Associated Motor Finance Company

AMF.N0000

437.9

52.9

132.4

8.3x

3.3x

Brac Lanka Finance

NIFL.N0000

9.3

0.2

5.7

49.6x

1.6x

Trade Finance & Investments

TFIL.N0000

27.0

3.2

15.5

8.5x

1.7x

Bimputh Finance

BLI.N0000

40.0

2.1

15.6

19.4x

2.6x

George Steuart Finance

GSF.N0000

23.1

(2.3)

11.1

-10.2x

2.1x

Multi Finance

MFL.N0000

26.3

(0.9)

12.4

-30.4x

2.1x

Chilaw Finance

CFL.N0000

24.8

1.2

15.6

20.7x

1.6x

SMB Leasing

SEMB.N0000

1.0

0.1

0.6

19.9x

1.7x

Capital Alliance Finance

CALF.N0000

14.6

0.2

8.4

80.7x

1.7x

(Source: Quarterly Reports)

10

FC Research

New Clientele, Bigger Profit

Appendix 5 Sensitivity Analysis

a. Growth Vs. Cost of Equity

Growth

57.6

Cost of Equity

1%

2%

3%

4%

5%

15%

68.3

69.8

71.5

73.5

76.0

16%

63.8

64.8

66.0

67.4

69.1

17%

59.8

60.5

61.3

62.2

63.3

18%

56.6

57.1

57.6

58.2

58.9

19%

53.2

53.4

53.6

53.9

54.3

20%

50.4

50.4

50.5

50.6

50.6

21%

47.8

47.8

47.7

47.6

47.5

11

FC Research

New Clientele, Bigger Profit

First Capital Equities (Pvt) Ltd

No.1, Lake Crescent,

Colombo 2

Sales Desk:

+94 11 2145 000

Fax:

+94 11 2145 050

HEAD OFFICE

BRANCHES

No.1, La ke Cres cent,

Matara

Negombo

Col ombo 2

No. 24, Mezza ni ne Fl oor,

No.72A, 2/1,

Sa l es Des k:

+94 11 2145 000 E.H. Coora y Bui l di ng,

Ol d Chi l a w Roa d,

Fa x:

+94 11 2145 050 Ana ga ri ka Dha rma pa l a Mw,

Negombo

Ma ta ra

Tel :

+94 41 2237 636

SALES

Tel :

+94 31 2233 299

BRANCHES

CEO

Ja l i ya Wi jera tne

+94 71 5329 602

Colombo

Negombo

Pri ya nka Anuruddha

+94 76 6910 035

Pri ya ntha Wi jes i ri

+94 76 6910 036

Ni s ha ntha Muda l i ge

+94 76 6910 041

Is uru Ja ya wa rda na

+94 76 7084 953

Matara

Anus hka Buddhi ka

+94 77 9553 613

Sumeda Ja ya wa rda na

+94 76 6910 038

Ga mi ni Hetti a ra chchi

+94 76 6910 039

Thus ha ra Abeyra tne

+94 76 6910 037

Ni s ha ni Pra s a ngi

+94 76 6910 033

Is ha nka Wi ckra ma na ya ka

+94 77 7611 200

RESEARCH

Di ma ntha Ma thew

+94 11 2145 016

Ama nda Lokuga ma ge

+94 11 2145 018

Res ha n Wedi wa rda na

+94 11 2145 017

Mi chel l e Weera s i nghe

+94 11 2145 018

FIRST CAPITAL GROUP

HEAD OFFICE

BRANCHES

No. 2, Dea l Pl a ce,

Matara

Kurunegala

Kandy

Col ombo 3

No. 24, Mezza ni ne Fl oor,

No. 6, 1s t Fl oor,

No.213-215,

Tel :

E.H. Coora y Bui l di ng,

Uni on As s ura nce Bui l di ng,

Pera deni ya Roa d,

+94 11 2576 878

Ana ga ri ka Dha rma pa l a Ma wa tha , Ra ja pi hi l l a Ma wa tha ,

Ma ta ra

Tel :

Ka ndy

Kurunega l a

+94 41 2222 988

Tel :

+94 37 2222 930

Tel :

+94 81 2236 010

Disclaimer:

Disclaimer:

This Review is prepared and issued by First Capital Equities (Pvt) Ltd. based on information in the public domain, internally developed and other sources, believed to be correct. Although all reasonable care

This

Review

prepared

andofissued

byare

First

Capital

Equities

(Pvt)

based

on information

public domain,

internally

developed

other

has

been

taken tois

ensure

the contents

the Review

accurate,

First Capital

Equities

(Pvt)Ltd.

Ltd and/or

its Directors,

employees, in

are the

not responsible

for the correctness,

usefulness,

reliabilityand

of same.

First

Capital

Equities

(Pvt) Ltd may

a Broker in the

investments

are the subject

of this

document

related to

investments

have actedof

on or

used

the information

contained in First

this document,

sources,

believed

toact

beas correct.

Although

allwhich

reasonable

care

has

beenortaken

ensureand

themay

contents

the

Review

are accurate,

Capitalor

the research or analysis on which it is based, before its publication. First Capital Equities (Pvt) Ltd and/or its principal, their respective Directors, or Employees may also have a position or be otherwise

Equities (Pvt) Ltd and/or its Directors, employees, are not responsible for the correctness, usefulness, reliability of same. First Capital Equities (Pvt)

interested in the investments referred to in this document. This is not an offer to sell or buy the investments referred to in this document. This Review may contain data which are inaccurate and unreliable. You

Ltd may

as a Broker

the investments

thehave

subject

of this

document

and

may

have acted

orCapital

usedEquities

the

hereby

waiveact

irrevocably

any rightsin

or remedies

in law or equitywhich

you haveare

or may

against First

Capital

Equities (Pvt) or

Ltd related

with respectinvestments

to the Review and

agree

to indemnify

and holdon

First

(Pvt)

Ltd and/or its

principal, their

directors and

harmless

the fullest extent

allowed

regarding

all matters

related to your use

of this

Review.Equities

No part of (Pvt)

this document

may be

information

contained

inrespective

this document,

oremployees

the research

ortoanalysis

on which

it by

is law

based,

before

its publication.

First

Capital

Ltd and/or

reproduced, distributed or published in whole or in part by any means to any other person for any purpose without prior permission.

its principal, their respective Directors, or Employees may also have a position or be otherwise interested in the investments referred to in this

document. This is not an offer to sell or buy the investments referred to in this document. This Review may contain data which are inaccurate and

unreliable. You hereby waive irrevocably any rights or remedies in law or equity you have or may have against First Capital Equities (Pvt) Ltd with

respect to the Review and agree to indemnify and hold First Capital Equities (Pvt) Ltd and/or its principal, their respective directors and

12

employees harmless to the fullest extent allowed by law regarding all matters related to your use of this Review. No part of this document may be

reproduced, distributed or published in whole or in part by any means to any other person for any purpose without prior permission.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Wei 20150904 PDFDocument18 pagesWei 20150904 PDFRandora LkNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Weekly Update 04.09.2015 PDFDocument2 pagesWeekly Update 04.09.2015 PDFRandora LkNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- ICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCDocument3 pagesICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCRandora LkNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Press 20150831ebDocument2 pagesPress 20150831ebRandora LkNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Weekly Foreign Holding & Block Trade Update: Net Buying Net SellingDocument4 pagesWeekly Foreign Holding & Block Trade Update: Net Buying Net SellingRandora LkNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Press 20150831ea PDFDocument1 pagePress 20150831ea PDFRandora LkNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- 03 September 2015 PDFDocument9 pages03 September 2015 PDFRandora LkNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Daily 01 09 2015 PDFDocument4 pagesDaily 01 09 2015 PDFRandora LkNo ratings yet

- CCPI - Press Release - August2015 PDFDocument5 pagesCCPI - Press Release - August2015 PDFRandora LkNo ratings yet

- Sri0Lanka000Re0ounting0and0auditing PDFDocument44 pagesSri0Lanka000Re0ounting0and0auditing PDFRandora LkNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Results Update For All Companies - Jun 2015 PDFDocument9 pagesResults Update For All Companies - Jun 2015 PDFRandora LkNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Results Update Sector Summary - Jun 2015 PDFDocument2 pagesResults Update Sector Summary - Jun 2015 PDFRandora LkNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

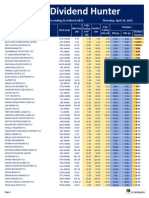

- Dividend Hunter - Apr 2015 PDFDocument7 pagesDividend Hunter - Apr 2015 PDFRandora LkNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Earnings Update March Quarter 2015 05 06 2015 PDFDocument24 pagesEarnings Update March Quarter 2015 05 06 2015 PDFRandora LkNo ratings yet

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkNo ratings yet

- Earnings & Market Returns Forecast - Jun 2015 PDFDocument4 pagesEarnings & Market Returns Forecast - Jun 2015 PDFRandora LkNo ratings yet

- Daily - 23 04 2015 PDFDocument4 pagesDaily - 23 04 2015 PDFRandora LkNo ratings yet

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Microfinance Regulatory Model PDFDocument5 pagesMicrofinance Regulatory Model PDFRandora LkNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Janashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFDocument9 pagesJanashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFRandora LkNo ratings yet

- GIH Capital Monthly - Mar 2015 PDFDocument11 pagesGIH Capital Monthly - Mar 2015 PDFRandora LkNo ratings yet

- Chevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFDocument9 pagesChevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFRandora LkNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- BRS Monthly (March 2015 Edition) PDFDocument8 pagesBRS Monthly (March 2015 Edition) PDFRandora LkNo ratings yet

- Weekly Foreign Holding & Block Trade Update - 02 04 2015 PDFDocument4 pagesWeekly Foreign Holding & Block Trade Update - 02 04 2015 PDFRandora LkNo ratings yet

- N D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Document5 pagesN D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Randora LkNo ratings yet

- The Morality of Capitalism Sri LankiaDocument32 pagesThe Morality of Capitalism Sri LankiaRandora LkNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Daily Stock Watch 08.04.2015 PDFDocument9 pagesDaily Stock Watch 08.04.2015 PDFRandora LkNo ratings yet

- Conso FS Part 2Document5 pagesConso FS Part 2moNo ratings yet

- Capital Structure Issues: V. VI. V.1 Mergers and Acquisitions Definition and DifferencesDocument26 pagesCapital Structure Issues: V. VI. V.1 Mergers and Acquisitions Definition and Differenceskelvin pogiNo ratings yet

- Daily Equity Market Report - 11.05.2022Document1 pageDaily Equity Market Report - 11.05.2022Fuaad DodooNo ratings yet

- Retail MethodDocument9 pagesRetail MethodToan Nguyen100% (1)

- Plan Your Online Business StrategyDocument9 pagesPlan Your Online Business StrategyivyNo ratings yet

- HSC SP Q.5. Answer in Brief PDFDocument4 pagesHSC SP Q.5. Answer in Brief PDFTanya SinghNo ratings yet

- MM Quiz 1.Document3 pagesMM Quiz 1.kondwani B J MandaNo ratings yet

- Problem 4B: 1. VisionDocument7 pagesProblem 4B: 1. VisionAlpha100% (1)

- Review of key capital asset pricing modelsDocument12 pagesReview of key capital asset pricing modelsdaohoa8x100% (1)

- Carrier: Delhivery: Deliver To FromDocument1 pageCarrier: Delhivery: Deliver To FromMohd ShanNo ratings yet

- RMP Everymonth Closing Activities: S.No. English Desciption Wave V SAPDocument11 pagesRMP Everymonth Closing Activities: S.No. English Desciption Wave V SAPSyed Zain Ul AbdinNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Financial Economics Study MaterialDocument13 pagesFinancial Economics Study MaterialFrancis MtamboNo ratings yet

- Assignments 24 March - March 31 2015Document2 pagesAssignments 24 March - March 31 2015Alex HuesingNo ratings yet

- Delos Santos Engineering Economy Lesson 9 10Document25 pagesDelos Santos Engineering Economy Lesson 9 10Navarro, Jherwin F.No ratings yet

- Summative Exam Principles of MarketingDocument2 pagesSummative Exam Principles of MarketingPamela Amodente100% (1)

- Week 2 ProblemsDocument4 pagesWeek 2 Problemsbjh1234517% (6)

- IAS Business Model Exam Answers 1 Section ADocument13 pagesIAS Business Model Exam Answers 1 Section AAshfa FathimaNo ratings yet

- Ceteris Paribus Is A Latin Phrase MeaningDocument14 pagesCeteris Paribus Is A Latin Phrase MeaningSheena LidasanNo ratings yet

- Branding Proposal SummaryDocument3 pagesBranding Proposal SummaryAna Ckala33% (3)

- Investment in Securities (Notes)Document5 pagesInvestment in Securities (Notes)Karla BordonesNo ratings yet

- Chapter Two The Financial System2 - Eco551Document25 pagesChapter Two The Financial System2 - Eco551Hafiz akbarNo ratings yet

- New InvoiceDocument2 pagesNew InvoiceRitesh BansalNo ratings yet

- Innovation in China's Electronic Information Industry: Management ForumDocument7 pagesInnovation in China's Electronic Information Industry: Management Forumshozaib91No ratings yet

- Unit 2.3 Market Equilibrium Study NotesDocument5 pagesUnit 2.3 Market Equilibrium Study NotesRichard XunNo ratings yet

- Consumer Behavior Unit No 1 NotesDocument6 pagesConsumer Behavior Unit No 1 NotesDrVivek SansonNo ratings yet

- Lehman Brothers Interest Rate FuturesDocument100 pagesLehman Brothers Interest Rate FuturesEric Dutaud100% (1)

- UAE Halal Cosmetics Market Opportunity AnalysisDocument3 pagesUAE Halal Cosmetics Market Opportunity AnalysisNeeraj ChawlaNo ratings yet

- Natureview Farm Case Study AnalysisDocument15 pagesNatureview Farm Case Study AnalysisSachin KamraNo ratings yet

- Media Lecture Notes: 2.1 Mass Media Vs Personal MediaDocument5 pagesMedia Lecture Notes: 2.1 Mass Media Vs Personal MediaASUPREMEANo ratings yet

- Segmentation, Targeting, & PositioningDocument51 pagesSegmentation, Targeting, & PositioningNitish SinghNo ratings yet