Professional Documents

Culture Documents

Opre6302 Operations Management Assignment #3

Uploaded by

NingFuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Opre6302 Operations Management Assignment #3

Uploaded by

NingFuCopyright:

Available Formats

OPRE6302 OPERATIONS MANAGEMENT

Assignment #3

Q (Cranberries) International Cranberry Uncooperative (ICU) is a

competitor to the National Cranberry Cooperative (NCC). At ICU,

barrels of cranberries arrive on trucks at a rate of 150 barrels per hour

and are processed continuously at a rate of 100 barrels per hour.

Trucks arrive at a uniform rate over eight hours, from 6:00 am until

2:00 pm. Assume the trucks are sufficiently small so that the delivery

of cranberries can be treated as a continuous inflow. The first truck

arrives at 6:00 am and unloads immediately, so processing begins at

6:00 am. The bins at ICU can hold up to 200 barrels of cranberries

before overflowing. If a truck arrives and the bins are full, the truck

must wait until there is room in the bins.

a. What is the maximum number of barrels of cranberries that

are waiting on the trucks at any given time?

b. At what time do the trucks stop waiting?

c. At what time do the bins become empty?

d. ICY is considering using seasonal workers in addition to their

regular workforce to help with the processing of cranberries.

When the seasonal workers are working, the processing rate

increases to 125 barrels per hour. The seasonal workers would

start working at 10:00 am and finish working when the trucks

stop waiting. At what time would ICU finish processing the

cranberries using these seasonal workers?

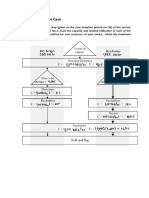

Q (Bagel Store) Consider a bagel store selling three types of bagels

that are produced according to the process flow diagram outline below.

We assume the demand is 180 bagels a day, of which there are 30

grilled veggie, 110 veggie only, and 40 cream cheese. Assume that the

workday is 10 hours long and each resource is staffed with one worker.

Moreover, we assume the following

Cut

Grilled

Stuff

Processin 3

10

g Time

[min/bage [min/bage

l]

l]

Processing times:

Veggies

Cream

Cheese

5

4

[min/bage [min/bage

l]

l]

Wrap

2

[min/bage

l]

Processing times are independent of which bagel type is processed at a

resource (for example, cutting a bagel takes the same time for a cream

cheese bagel as for a veggie bagel).

a. Where in the process is the bottleneck?

b. How many units can the process produce within on hour,

assuming the product mix has to remain constant?

Q. (Valley Forge Income Tax Advice) VF is a small accounting firm

supporting wealthy individuals in their preparation of annual income

tax statements. Every December, VF sends out a short survey to their

customers, asking for the information required for preparing the tax

statements. Based on 24 years of experience, VF categorizes their

cases into the following groups:

Group 1 (new customers, easy): 15% of cases

Group 2 (new customers, complex): 5% of cases

Group 3 (repeat customers, easy): 50% of cases

Group 4 (repeat customers, complex): 35% of cases

Here, easy versus complex refers to the complexity of the

customers earning situation.

In order to prepare the income tax statement, VF needs to complete

the following set of activities. Processing times (and even which

activities need to be carried out) depend on which group a tax

statement falls into. All of the following processing times are expressed

in minutes per income tax statement.

Group

Filing

Initial

Meeting

Preparatio

n

Writing

120

300

80

Review by

Senior

Accounta

nt

20

60

5

1

2

3

20

40

20

40

30

90

No

meeting

No

meeting

200

30

60

50

80

30

The activities are carried out by the following three persons:

Administrative support person: filing and writing.

Senior accountant (who is also the owner): initial meeting, review

by senior accountant.

Junior accountant: preparation.

Assume that all three persons work eight hours per day and 20 days a

month. For the following questions, assume the product mix as a

described above. Assume that there are 50 income tax statements

arriving each month.

a. Which of the three persons in the bottleneck?

b. What is the (implied) utilization of the senior accountant? The

junior accountant? The administrative support person?

c. You have been asked to analyze which of the four product

groups is the most profitable. Which factors would influence

the answer to this?

d. How would the process capacity of VF change if a new work

processing system would reduce the time to write the income

tax statements by 50%?

You might also like

- Guide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers: English versionFrom EverandGuide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers: English versionNo ratings yet

- Problem SetDocument8 pagesProblem SetjarjonaeNo ratings yet

- Final Exam - Module 2: Smooth Chin Device CompanyDocument16 pagesFinal Exam - Module 2: Smooth Chin Device CompanyMuhinda Fredrick0% (1)

- Exercises On Supply Process CapacityDocument2 pagesExercises On Supply Process Capacityyahska1305100% (1)

- UECM2043, UECM2093 Operations Research Tutorial 1Document5 pagesUECM2043, UECM2093 Operations Research Tutorial 1kamun00% (2)

- Assignment 2Document3 pagesAssignment 2Sodhani AnkurNo ratings yet

- Valley Forge Problem SoutionDocument5 pagesValley Forge Problem SoutionSashi Velnati0% (1)

- OPIM101 - Spring 2012 - Extra Study Problems With Solutions PDFDocument17 pagesOPIM101 - Spring 2012 - Extra Study Problems With Solutions PDFjoe91bmw100% (1)

- OM1 Practice Exam2Document5 pagesOM1 Practice Exam2nonysinghNo ratings yet

- An Intro To Operations Management QuestionsDocument2 pagesAn Intro To Operations Management Questionsjigar_30080% (3)

- Problem 1 - Operations ManagementDocument1 pageProblem 1 - Operations Managementisgigles157No ratings yet

- Chapter 3: Process and Capacity AnalysisDocument15 pagesChapter 3: Process and Capacity AnalysisAnugragha SundarNo ratings yet

- Ciceros Six Mistakes of ManDocument4 pagesCiceros Six Mistakes of ManschorleworleNo ratings yet

- Module 3 Practice QuestionsDocument3 pagesModule 3 Practice Questionswhatecer0% (1)

- Final Quiz WartonDocument13 pagesFinal Quiz WartonAleksandraMadžoski27% (11)

- Tom Opim Module 4 QuestionDocument3 pagesTom Opim Module 4 QuestionkewlharshNo ratings yet

- Chapter 10Document3 pagesChapter 10Coursera2012No ratings yet

- ..Document18 pages..keyurpatel1993No ratings yet

- Module 2 HW QuestionsDocument3 pagesModule 2 HW Questionswhatecer0% (4)

- Guesstimate The Number of COVID Testing Kits Needed by Delhi in OctoberDocument6 pagesGuesstimate The Number of COVID Testing Kits Needed by Delhi in OctobersaiNo ratings yet

- Inventory Buit Up With Time Inventory Buildup at TruckDocument3 pagesInventory Buit Up With Time Inventory Buildup at TruckdfreNo ratings yet

- Or PracticeProblems 2015Document24 pagesOr PracticeProblems 2015Hi HuNo ratings yet

- Line Balancing and Labor Productivity - Practice Questions: WS & ME (2020) 5 Semester IqtmDocument7 pagesLine Balancing and Labor Productivity - Practice Questions: WS & ME (2020) 5 Semester Iqtmsyed aliNo ratings yet

- CranberryDocument4 pagesCranberryharshkhambraNo ratings yet

- National Cranberry Case SubmissionDocument3 pagesNational Cranberry Case SubmissionHardik SemlaniNo ratings yet

- Kim Opim An Enthusiastic Student Is On Her Flight OverDocument2 pagesKim Opim An Enthusiastic Student Is On Her Flight OverAmit Pandey0% (1)

- OPIM101 - Spring 2009 - Exam 1 - SolutionsDocument12 pagesOPIM101 - Spring 2009 - Exam 1 - Solutionsjoe91bmwNo ratings yet

- SM Tutorial Sheet-2Document2 pagesSM Tutorial Sheet-2gurusodhii0% (1)

- This Study Resource Was: F (Q) Co Cu+CoDocument8 pagesThis Study Resource Was: F (Q) Co Cu+Comarvin mayaNo ratings yet

- An Introduction To Operations ManagementDocument3 pagesAn Introduction To Operations Managementjpgutierrez110% (1)

- Little Field Report 1Document2 pagesLittle Field Report 1Alibaba Lalala100% (1)

- National Cranberries CaseDocument7 pagesNational Cranberries CaseHyper Green MindNo ratings yet

- ProblemDocument3 pagesProblemPePe' Tiamo100% (1)

- The National Cranberry CooperativeDocument5 pagesThe National Cranberry CooperativeHussein BayramNo ratings yet

- WG 1 Sep7 Problem SetDocument2 pagesWG 1 Sep7 Problem SetJotham HensenNo ratings yet

- Powered by Koffee (EOQ + ROP)Document2 pagesPowered by Koffee (EOQ + ROP)Abeer SaadedineNo ratings yet

- Goal Program - ExampleDocument2 pagesGoal Program - ExampledluvjkpopNo ratings yet

- Matching Supply With Demand: An Introduction To Operations ManagementDocument1 pageMatching Supply With Demand: An Introduction To Operations Managementpiracha104502No ratings yet

- National Cranberry Cooperative 1981Document10 pagesNational Cranberry Cooperative 1981Nicole Dorado0% (1)

- Study Group - 2 NCC CaseDocument7 pagesStudy Group - 2 NCC CaseAchin ChatterjeeNo ratings yet

- Module 5 HW Questions UploadedDocument2 pagesModule 5 HW Questions Uploadedapi-1839155060% (4)

- National Cranberry Cooperative Case Answer 1Document6 pagesNational Cranberry Cooperative Case Answer 1PRITEENo ratings yet

- Chapter 5Document3 pagesChapter 5zixuan weiNo ratings yet

- Group 5 - Section C - NCCDocument16 pagesGroup 5 - Section C - NCCNitish Raj SubarnoNo ratings yet

- Three Step Process Operations ManagementDocument14 pagesThree Step Process Operations ManagementDeepthi NadimpalliNo ratings yet

- (Solved) - Save Lot Retailers The Following Table Shows Financial Data (Year... - (1 Answer) - TransDocument7 pages(Solved) - Save Lot Retailers The Following Table Shows Financial Data (Year... - (1 Answer) - Transkumar n0% (1)

- OPIM101 - Spring 2011 - Exam 1 - Solutions PDFDocument17 pagesOPIM101 - Spring 2011 - Exam 1 - Solutions PDFjoe91bmw0% (1)

- First Semester 2019 2104697 System Modeling and Analysis Homework 4 Due On November 23, 2019Document2 pagesFirst Semester 2019 2104697 System Modeling and Analysis Homework 4 Due On November 23, 2019Jiraros SoponarunratNo ratings yet

- OM WordDocument3 pagesOM WordpulakitNo ratings yet

- OM - National Cranberry - TemplateDocument3 pagesOM - National Cranberry - Templatebeta alpha gammaNo ratings yet

- Coin-Operated Coffee Vending Machine: A Project Proposal By: Pinili, Ellen Gold B. Ponce, Mary Rosechelle SDocument14 pagesCoin-Operated Coffee Vending Machine: A Project Proposal By: Pinili, Ellen Gold B. Ponce, Mary Rosechelle SPauline Ermeje GozoNo ratings yet

- Case Study M4 IslandDocument3 pagesCase Study M4 IslandKane Arvin ChingNo ratings yet

- OM Assignment 2 - Spring 2021Document5 pagesOM Assignment 2 - Spring 2021ErfanNo ratings yet

- Chapter 3 Resource PlanningDocument70 pagesChapter 3 Resource PlanningHieu TruongNo ratings yet

- Module 5 HW Questions UPLOADED PDFDocument2 pagesModule 5 HW Questions UPLOADED PDFgleisonguimaraes0% (2)

- Business Analytics ProblemDocument1 pageBusiness Analytics Problemrohit_kocharNo ratings yet

- Solutions To End of Chapter Problems 2Document2 pagesSolutions To End of Chapter Problems 2shp0719100% (1)

- Final Exam Module 2Document17 pagesFinal Exam Module 2Rodrigo Isaac17% (6)

- Solutions To End of Chapter Problems 3Document4 pagesSolutions To End of Chapter Problems 3ArunSharmaNo ratings yet

- COMM 204 HW1 25 PointsDocument2 pagesCOMM 204 HW1 25 PointsraymondNo ratings yet

- Difference Between Accounting Rules and Tax RulesDocument18 pagesDifference Between Accounting Rules and Tax RulesCezar Rishane Mae SaligueNo ratings yet

- Lesson 1 - Introduction To AccountingDocument22 pagesLesson 1 - Introduction To Accountingdelgadojudith100% (1)

- Foundations in Accountancy Ffa/Acca F: Nguyen Thi Phuong Mai (PHD, Cpa VN) Email: Maintp@Ftu - Edu.VnDocument166 pagesFoundations in Accountancy Ffa/Acca F: Nguyen Thi Phuong Mai (PHD, Cpa VN) Email: Maintp@Ftu - Edu.VnMy TranNo ratings yet

- Exercises Lesson 3 Balance Sheet: Financial AccountingDocument11 pagesExercises Lesson 3 Balance Sheet: Financial AccountingElena LuizaNo ratings yet

- Name: Date: NPM: Course:: INSTRUCTION: Determine Depreciation For Partial PeriodsDocument5 pagesName: Date: NPM: Course:: INSTRUCTION: Determine Depreciation For Partial PeriodsHernando Maulana100% (1)

- QMS ProposalDocument22 pagesQMS Proposalflawlessy2kNo ratings yet

- Instapdf - in Accounting Ratios Class 12 All Formulas 176Document18 pagesInstapdf - in Accounting Ratios Class 12 All Formulas 176Subhavi DikshitNo ratings yet

- Ebay Webdoc 649Document9 pagesEbay Webdoc 649Abdirisaq MohamudNo ratings yet

- Mid Year AcqusitionDocument4 pagesMid Year AcqusitionOmolaja IbukunNo ratings yet

- Advanced-Accounting Fischer 11e - Ch01 TBDocument18 pagesAdvanced-Accounting Fischer 11e - Ch01 TBgilli1tr100% (1)

- BADVAC2X - Accounting For Special TransactionsDocument11 pagesBADVAC2X - Accounting For Special TransactionsJack Herer100% (1)

- Six Sigma Project - Gaurav SinghDocument18 pagesSix Sigma Project - Gaurav SinghVarun GhaiNo ratings yet

- Finace in Business ReDocument20 pagesFinace in Business ReGauri SidharthNo ratings yet

- Introduction To Financial Accounting NotesDocument3 pagesIntroduction To Financial Accounting NotesRaksa HemNo ratings yet

- 6.0 Appendix: Horizontal Analysis DataDocument9 pages6.0 Appendix: Horizontal Analysis DatareemarifkhanNo ratings yet

- Professor Steve Markoff Preparation Assignment For Class #1: Fundamentals of AccountingDocument4 pagesProfessor Steve Markoff Preparation Assignment For Class #1: Fundamentals of Accountinganon_733987828No ratings yet

- Financial Accounting 2 by Valix 2012 Edition Wordp PDFDocument4 pagesFinancial Accounting 2 by Valix 2012 Edition Wordp PDFEmersonNo ratings yet

- Advanced Management AccountingDocument204 pagesAdvanced Management AccountingP TM100% (3)

- Depreciated Separately.: Property, Plant and EquipmentDocument5 pagesDepreciated Separately.: Property, Plant and EquipmentEmma Mariz GarciaNo ratings yet

- Assign 1Document5 pagesAssign 1Aubrey Camille Cabrera100% (1)

- GL SQLDocument44 pagesGL SQLBalaji Shinde100% (1)

- Uems Aac 2022Document133 pagesUems Aac 2022maswebNo ratings yet

- Other DataDocument3 pagesOther DataShadman SakibNo ratings yet

- Robert Half Salary Guide 2012Document9 pagesRobert Half Salary Guide 2012cesarthemillennialNo ratings yet

- Advanced Financial Accounting - Paper 8 CPA PDFDocument10 pagesAdvanced Financial Accounting - Paper 8 CPA PDFAhmed Suleyman100% (1)

- User Manual Asset AccountingDocument47 pagesUser Manual Asset AccountinginasapNo ratings yet

- AventDocument9 pagesAventLiigiia San YrafatsarNo ratings yet

- ACFEIC - BPKRI - SeminarOnline - Materi Pak Budi SantosoDocument36 pagesACFEIC - BPKRI - SeminarOnline - Materi Pak Budi SantosoAchmad SuryamanNo ratings yet

- Job Opportunities World Bank IUCEA African Centers of Excellence (ACE II) ProjectDocument1 pageJob Opportunities World Bank IUCEA African Centers of Excellence (ACE II) ProjectRashid BumarwaNo ratings yet

- Basic Accounting Lesson 7: Worksheet and Financial StatementsDocument33 pagesBasic Accounting Lesson 7: Worksheet and Financial StatementsGutierrez Ronalyn Y.No ratings yet