Professional Documents

Culture Documents

Chart of Accounts - Example and Explanation

Uploaded by

haradhonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chart of Accounts - Example and Explanation

Uploaded by

haradhonCopyright:

Available Formats

TOPICS

BLOG

ACCOUNTING BASICS

ABOUT

CONTACT

ANALYZING, RECORDING, AND CLASSIFYING

Chart of Accounts

Before recording transactions into the journal, we should first know what accounts to

use. This is where a chart of accounts comes in handy.

A chart of accounts is a list of all accounts used by a company in its accounting

Online resource for all

things accounting. more

SEARCH THIS SITE

system. It makes the bookkeeper's life easier.

The accounts included in the chart of accounts must be used consistently to prevent

Featured in the Blog

clerical and technical errors in the accounting system.

Accounting Certifications

Nevertheless, take note that there is no standard chart of accounts because its

contents depend upon the need of the company using it.

to Boost Your Career

Who are the Big 4

Accounting Firms?

Accounts are grouped in their respective classifications (assets, liabilities, capital,

income, and expenses) and each is given a unique account number. A coding system

is used to organize the accounts according to their classification. Here's a sample

chart of accounts for a small sole proprietorship business:

Forensic Accounting: The

Trend and More

How to Become a CPA:

What It Really Takes

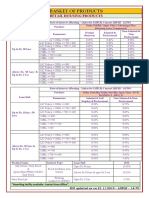

Chart of Accounts Example

Is Accounting a Good

Career Choice?

Gray Network Services

Chart of Accounts

Feedback

ASSETS

Current Assets (10000-19999)

Questions, comments and

suggestions?

10000

Cash

Contact us here.

10100

Accounts Receivable

10101

Allowance for Doubtful Accounts

10200

Notes Receivable

10300

Interest Receivable

10400

Service Supplies

Non-Current Assets (20000-29999)

20000

Leasehold Improvements

20100

Furniture and Fixtures

20101

Accumulated Depreciation Furniture and Fixtures

20200

Service Equipment

20201

Accumulated Depreciation Service Equipment

LIABILITIES (30000-39999)

30000

Accounts Payable

30100

Notes Payable

30200

Salaries Payable

30300

Rent Payable

30400

Interest Payable

30500

Unearned Revenue

30600

Loans Payable

OWNER'S EQUITY (40000-49999)

40000

Mr. Gray, Capital

40100

Mr. Gray, Drawing

INCOME (50000-59999)

50000

Service Revenue

50100

Interest Income

50200

Gain on Sale of Equipment

EXPENSE (60000-69999)

60000

Rent Expense

60100

Salaries Expense

60200

Supplies Expense

60300

Utilities Expense

60400

Interest Expense

60500

Taxes and Licenses

60600

Depreciation Expense

60700

Doubtful Accounts Expense

70000

Income Summary

Additional accounts can be added, as the need arises. For bigger companies, the

accounts may further be classified into different departments.

For example, employee salaries may have various accounts and be included in the

chart as: 60101 Salaries Expense Administration; 60102 Salaries Expense Service

Department; 60103 Salaries Expense Delivery Department; etc.

Again, take note that the chart of accounts of one company may not be suitable for

another company. It all depends upon their needs. In any case, it serves as a guide

for bookkeepers in recording business transactions.

Copyright 2014 Accountingverse.com - Your Online Resource For All Things Accounting

Terms of Use | Home | About | Contact

You might also like

- Case Study Seiko InstrumentsDocument15 pagesCase Study Seiko Instrumentsnayandumgt100% (5)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Sample Chart of AccountsDocument5 pagesSample Chart of AccountssnsdyurijjangNo ratings yet

- Basic accounting model and key concepts in 40 charactersDocument3 pagesBasic accounting model and key concepts in 40 charactersdlinds2X1No ratings yet

- Analysis and Interpretation of FS-Part 1Document2 pagesAnalysis and Interpretation of FS-Part 1Rhea RamirezNo ratings yet

- Financial Statements: By: Dr. Angeles A. de Guzman Dean, College of Business EducationDocument19 pagesFinancial Statements: By: Dr. Angeles A. de Guzman Dean, College of Business EducationJay-L TanNo ratings yet

- REVISED CHART OF ACCOUNTS AND PHILIPPINE PUBLIC SECTOR STANDARDSDocument99 pagesREVISED CHART OF ACCOUNTS AND PHILIPPINE PUBLIC SECTOR STANDARDSWilliam Kano100% (1)

- Dr. Domingo Clinic Chart of Accounts: Account Numbers Account Titles Current AssetsDocument2 pagesDr. Domingo Clinic Chart of Accounts: Account Numbers Account Titles Current AssetsmariaNo ratings yet

- Periodic and Perpetual Method Format 1Document5 pagesPeriodic and Perpetual Method Format 1Clemencia Eduria Masiba100% (1)

- Sap B1 - FinancialsDocument7 pagesSap B1 - FinancialsRhon Ryan TamondongNo ratings yet

- Accounting 10 HandoutsDocument18 pagesAccounting 10 HandoutsYssa SadjiNo ratings yet

- NC III REVIEW c2Document27 pagesNC III REVIEW c2Hannah Sophia ImperialNo ratings yet

- Accounts List Summary for CC Puno Jr ConstructionDocument4 pagesAccounts List Summary for CC Puno Jr ConstructionAndrew CatamaNo ratings yet

- OLIVO - Lesson-1-Statistics-Quiz (1)Document2 pagesOLIVO - Lesson-1-Statistics-Quiz (1)Christine Joy DañosNo ratings yet

- Cayambanan National High School: Republic of The Philippines Region 1 Division of City Schools Urdaneta CityDocument2 pagesCayambanan National High School: Republic of The Philippines Region 1 Division of City Schools Urdaneta CityJessie Rose TamayoNo ratings yet

- Lesson Plan AccSept 2018Document4 pagesLesson Plan AccSept 2018Anissa E.No ratings yet

- FAR - Module 2 - The Accounting EquationDocument5 pagesFAR - Module 2 - The Accounting EquationEva Katrina R. Lopez100% (1)

- The Accounting Cycle StepsDocument5 pagesThe Accounting Cycle StepsLayla ReksNo ratings yet

- Depreciation Accounting PPT at BEC DOMSDocument19 pagesDepreciation Accounting PPT at BEC DOMSmuudey sheikh100% (1)

- Analyzing Business TransactionsDocument13 pagesAnalyzing Business TransactionsEricJohnRoxasNo ratings yet

- Acctg Project-2Document3 pagesAcctg Project-2Jania Lopez Amiuq CampilananNo ratings yet

- Purchase Order With Unit PriceDocument1 pagePurchase Order With Unit PriceLogika KaryaNo ratings yet

- Chapter 5 Advanced Valuation Issues ModuleDocument12 pagesChapter 5 Advanced Valuation Issues ModuleJoannah maeNo ratings yet

- What Is Bank Reconciliation.Document11 pagesWhat Is Bank Reconciliation.Sabrena FennaNo ratings yet

- Special journals and voucher system for accounting transactionsDocument1 pageSpecial journals and voucher system for accounting transactionsVivienne LayronNo ratings yet

- MODULE 8 Closing and Reversing EntriesDocument5 pagesMODULE 8 Closing and Reversing EntriesChristian Cyrous AcostaNo ratings yet

- Chart of AccountsDocument4 pagesChart of AccountsAsad MuhammadNo ratings yet

- Holy Cross of Davao College: Other Campuses: Camudmud (IGACOS), Bajada (SOS Drive)Document3 pagesHoly Cross of Davao College: Other Campuses: Camudmud (IGACOS), Bajada (SOS Drive)Haries Vi Traboc Micolob100% (1)

- Chart of AccountsDocument9 pagesChart of AccountsMarius PaunNo ratings yet

- Excel Skills - Basic Accounting Template: InstructionsDocument39 pagesExcel Skills - Basic Accounting Template: InstructionsStorage BankNo ratings yet

- Accounting Perpetual & Periodic ComparisonDocument1 pageAccounting Perpetual & Periodic ComparisonAbbey LiNo ratings yet

- Proposed Disbursement ProcessDocument4 pagesProposed Disbursement ProcessmarvinceledioNo ratings yet

- MEMORANDUM Cash BoxDocument1 pageMEMORANDUM Cash BoxDharb CabahugNo ratings yet

- Accounting EquationDocument5 pagesAccounting EquationRosethel Grace GallardoNo ratings yet

- Contra AccountsDocument6 pagesContra AccountsRaviSankarNo ratings yet

- Module 2 - Double Entry Bookkeeping System and The Accounting EquationDocument9 pagesModule 2 - Double Entry Bookkeeping System and The Accounting EquationPrincess Joy CabreraNo ratings yet

- EDITED The Definition, Nature and History of AccountingDocument23 pagesEDITED The Definition, Nature and History of AccountingMaricel BagayanNo ratings yet

- Unadjusted Trial BalanceDocument4 pagesUnadjusted Trial BalanceJemma Rose BagalacsaNo ratings yet

- FABM 1 ADDITIONAL ENHANCEMENT ACTIVITIES 2 (AutoRecovered)Document2 pagesFABM 1 ADDITIONAL ENHANCEMENT ACTIVITIES 2 (AutoRecovered)JANICE CACAONo ratings yet

- Periodic inventory system purchase and sale of merchandiseDocument4 pagesPeriodic inventory system purchase and sale of merchandiseDerick FloresNo ratings yet

- Accounting Equation Powerpoint NotesDocument28 pagesAccounting Equation Powerpoint NotespsrikanthmbaNo ratings yet

- Merchandising Business Pt. 2Document18 pagesMerchandising Business Pt. 2Angelo ReyesNo ratings yet

- Credit Evaluation Process AnalysisDocument73 pagesCredit Evaluation Process AnalysisNeeRaz Kunwar100% (2)

- Chapter 1 Acctg Equation JournalizingDocument4 pagesChapter 1 Acctg Equation JournalizingNicole Marie Pontay BajadeNo ratings yet

- Accounting Cycle Journal Entries With Chart of AccountsDocument3 pagesAccounting Cycle Journal Entries With Chart of AccountsMay Rojas MortosNo ratings yet

- Chart of AccountsDocument7 pagesChart of Accountsdilip_ajjuNo ratings yet

- Class Exercise Session 1,2Document7 pagesClass Exercise Session 1,2sheheryar50% (4)

- 04 PRE-TEST OR POST-TEST Jeremy OrtegaDocument14 pages04 PRE-TEST OR POST-TEST Jeremy OrtegaJeremy OrtegaNo ratings yet

- Accounting CycleDocument7 pagesAccounting CycleJenny BernardinoNo ratings yet

- Book of Accounts Part 1. JournalDocument12 pagesBook of Accounts Part 1. JournalJace AbeNo ratings yet

- Module - Expenditure CycleDocument4 pagesModule - Expenditure CycleGANNLAUREN SIMANGANNo ratings yet

- Iyana Melgar Enterprise Chart of Account Assets Liabilities Account Name Account Name Account Code Account CodeDocument9 pagesIyana Melgar Enterprise Chart of Account Assets Liabilities Account Name Account Name Account Code Account CodeJudy Silvestre BẹnóngNo ratings yet

- 2 Rules of Debit and CreditDocument3 pages2 Rules of Debit and Creditapi-299265916No ratings yet

- Introduction to Fixed Assets in SAP Business OneDocument26 pagesIntroduction to Fixed Assets in SAP Business OnecreatorsivaNo ratings yet

- Corporate Budget Memo No. 39Document95 pagesCorporate Budget Memo No. 39mcla28No ratings yet

- Adjusting Entries Company A ExercisesDocument19 pagesAdjusting Entries Company A ExercisesRodolfo CorpuzNo ratings yet

- Business Plan Cover PageDocument3 pagesBusiness Plan Cover PageBrille Adrian FernandoNo ratings yet

- Special Journals and Voucher System GuideDocument64 pagesSpecial Journals and Voucher System GuideMCM EnterpriseNo ratings yet

- AOM On TaxesDocument4 pagesAOM On TaxesBenn DegusmanNo ratings yet

- Adjustments of Final AccountsDocument5 pagesAdjustments of Final AccountsKashif KhanNo ratings yet

- 3 Chart of AccountsDocument3 pages3 Chart of Accountsapi-299265916No ratings yet

- Dsp30 InverterDocument1 pageDsp30 InverterharadhonNo ratings yet

- 12V Absord and Flot ChargerDocument1 page12V Absord and Flot ChargerharadhonNo ratings yet

- All Differences Between Iphone 5 Models at EveryiPhone PDFDocument6 pagesAll Differences Between Iphone 5 Models at EveryiPhone PDFharadhonNo ratings yet

- SQL Comparison GuideDocument25 pagesSQL Comparison GuideharadhonNo ratings yet

- A Comparative Study of DC/AC Pure Sine Wave InvertersDocument78 pagesA Comparative Study of DC/AC Pure Sine Wave InvertersgeorgedragosNo ratings yet

- PHP Calendar Date PickerDocument29 pagesPHP Calendar Date PickerharadhonNo ratings yet

- Web Techniques - A Database-Independent API For PHPDocument2 pagesWeb Techniques - A Database-Independent API For PHPharadhonNo ratings yet

- Electrical Engineering Stack Exchange VGA cable questionDocument4 pagesElectrical Engineering Stack Exchange VGA cable questionharadhonNo ratings yet

- User Authentication With Laravel - Laravel BookDocument9 pagesUser Authentication With Laravel - Laravel BookharadhonNo ratings yet

- Gravita Corporate Presentation - 2017 PDFDocument32 pagesGravita Corporate Presentation - 2017 PDFPALRAJ100% (1)

- BASKET OF RETAIL PRODUCTS RATESDocument3 pagesBASKET OF RETAIL PRODUCTS RATESVirendra K VermaNo ratings yet

- 2008 Bar Questions and AnswersDocument15 pages2008 Bar Questions and AnswersimoymitoNo ratings yet

- 2019A QE Strategic Cost Management FinalDocument5 pages2019A QE Strategic Cost Management FinalJam Crausus100% (1)

- Tax Management-Module 1 Problems On Residential Status and Incidence On TaxDocument2 pagesTax Management-Module 1 Problems On Residential Status and Incidence On TaxdiviprabhuNo ratings yet

- Foreign Exchange Risk: Types of ExposureDocument2 pagesForeign Exchange Risk: Types of ExposurepilotNo ratings yet

- Expedicao Continua 12.1.33 Backoffice ContentsDocument122 pagesExpedicao Continua 12.1.33 Backoffice ContentsAlexandre ZennaroNo ratings yet

- Working Capital RequirementsDocument2 pagesWorking Capital RequirementsAshuwajitNo ratings yet

- Japan 2Document10,336 pagesJapan 2anon_469816957No ratings yet

- Atlas Copco and Sandvik Shank Adapter GuideDocument11 pagesAtlas Copco and Sandvik Shank Adapter GuideSubhash KediaNo ratings yet

- Jyoiti PathakDocument53 pagesJyoiti PathakNitinAgnihotriNo ratings yet

- Moats Part OneDocument9 pagesMoats Part OnerobintanwhNo ratings yet

- Cash Book: Cash Book Is A Book of Original Entry in WhichDocument10 pagesCash Book: Cash Book Is A Book of Original Entry in WhichCT SunilkumarNo ratings yet

- 321.carole Ann AinioDocument2 pages321.carole Ann AinioFlinders TrusteesNo ratings yet

- Company Law II – Fundraising Prospectus RequirementsDocument17 pagesCompany Law II – Fundraising Prospectus RequirementsAnthea LeungNo ratings yet

- Sample Ch01Document39 pagesSample Ch01wingssNo ratings yet

- About HyderabadDocument10 pagesAbout Hyderabadvs9192631770No ratings yet

- Assessing SIR Consultants on Job Satisfaction and CultureDocument2 pagesAssessing SIR Consultants on Job Satisfaction and CultureRukhsar Abbas Ali .No ratings yet

- Setting The Record Straight: Truths About Indexing: Vanguard Research January 2018Document12 pagesSetting The Record Straight: Truths About Indexing: Vanguard Research January 2018TBP_Think_TankNo ratings yet

- Company Background Jet AirwaysDocument4 pagesCompany Background Jet AirwaysPriyank AgarwalNo ratings yet

- Gap Fillers-Formation-Of-Limited-Companies PDFDocument2 pagesGap Fillers-Formation-Of-Limited-Companies PDFemonimtiazNo ratings yet

- Transfer and Transmission of SecuritiesDocument6 pagesTransfer and Transmission of Securitiesbarkha chandnaNo ratings yet

- Rahul Kumar Sharma's Profile and Contact DetailsDocument10 pagesRahul Kumar Sharma's Profile and Contact DetailsAshish AgarwalNo ratings yet

- Tax-Free Billions: Australia's Largest Companies Haven't Paid Corporate Tax in 10 Years - ABC News (Document6 pagesTax-Free Billions: Australia's Largest Companies Haven't Paid Corporate Tax in 10 Years - ABC News (Noodle Republic0% (1)

- Circularnottoissuecertaincertificates238558657Document2 pagesCircularnottoissuecertaincertificates238558657ravi kumarNo ratings yet

- An Investigation Into The Dividend Policy of Firms in East AsiaDocument53 pagesAn Investigation Into The Dividend Policy of Firms in East AsiaEvvone Ling Yee FengNo ratings yet

- 3771 Certificate of InsuranceDocument1 page3771 Certificate of InsuranceRP TripathiNo ratings yet

- Audit Committees ChecklistDocument8 pagesAudit Committees ChecklistTarryn Jacinth NaickerNo ratings yet