Professional Documents

Culture Documents

Strat Evaluation 1999

Uploaded by

Brenton BionatCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Strat Evaluation 1999

Uploaded by

Brenton BionatCopyright:

Available Formats

The Anderson School at UCLA

POL 1999-1.3

Note on Strategy Evaluation

Copyright 2000 by Richard P. Rumelt. This note was prepared by Professor Richard P. Rumelt and is

drawn from a paper originally written in 1980: "The Evaluation of Businss Strategy," in Glueck, William F.

Strategic Management and Business Policy. New York: McGraw-Hill, 1980. An abridged version of that

paper also appeared in Quinn, James Brian; Mintzberg, Henry; and Robert M. James. The Strategy Process. Englewood Cliffs, New Jersey, 1988.

Strategy can neither be formulated nor adjusted to changing circumstances without a

process of strategy evaluation. Whether performed by an individual or as part of an organizational review procedure, strategy evaluation forms an essential step in the process of guiding

an enterprise.

For many executives strategy evaluation is simply an appraisal of how well a business

performs. Has it grown? Is the profit rate normal or better? If the answers to these questions are

affirmative, it is argued that the firm's strategy must be sound. Despite its unassailable simplicity,

this line of reasoning misses the whole point of strategythat the critical factors determining the

quality of long-term results are often not directly observable or simply measured, and that by the

time strategic opportunities or threats do directly affect operating results, it may well be too late

for an effective response. Thus, strategy evaluation is an attempt to look beyond the obvious

facts regarding the short-term health of a business and appraise instead those more fundamental

factors and trends that govern success in the chosen field of endeavor.

The Challenge of Evaluation

However it is accomplished, the products of a business strategy evaluation are answers to

these three questions:

Are the objectives of the business appropriate?

Are the major policies and plans appropriate?

Do the results obtained to date confirm or refute critical assumptions on which the strategy rests?

Devising adequate answers to these questions is neither simple nor straightforward. It requires a reasonable store of situation-based knowledge and more than the usual degree of insight.

In particular, the major issues which make evaluation difficult and with which the analyst must

come to grips are these:

Each business strategy is unique. For example, one paper manufacturer might rely in its

vast timber holdings to weather almost any storm while another might place primary reliance in modern machinery and an extensive distribution system. Neither strategy is

"wrong" nor "right" in any absolute sense; both may be right or wrong for the firms in

question. Strategy evaluation must, then, rest on a type of situational logic that does not

focus on "one best way" but which can be tailored to each problem as it is faced.

Strategy is centrally concerned with the selection of goals and objectives. Many people,

including seasoned executives, find it much easier to set or try to achieve goals than to

evaluate them. In part this is a consequence of training in problem solving rather than in

Note On Strategy Evaluation

POL 1999-1.3

problem structuring. It also arises out of a tendency to confuse values, which are fundamental expressions of human personality, with objectives, which are devices for lending

coherence to action.

Formal systems of strategic review, while appealing in principal, can create explosive

conflict situations. Not only are there serious questions as to who is qualified to give an

objective evaluation, the whole idea of strategy evaluation implies management by

"much more than results" and runs counter to much of currently popular management

philosophy.

The General Principles of Strategy Evaluation

The term "strategy" has been so widely used for different purposes that it has lost any

clearly defined meaning. For our purposes a strategy is a set of objectives, policies, and plans

that, taken together, define the scope of the enterprise and its approach to survival and success.

Alternatively, we could say that the particular policies, plans, and objectives of a business express

its strategy for coping with a complex competitive environment.

One of the fundamental tenets of science is that a theory can never be proven to be absolutely true. A theory can, however, be declared absolutely false if it falls to stand up to testing.

Similarly, it is impossible to demonstrate conclusively that a particular business strategy is optimal or even to guarantee that it will work. One can, nevertheless, test it for critical flaws. Of the

many tests, which could be justifiably applied to a business strategy, most will fit within one of

these broad criteria:

Consistency: The strategy must not present mutually inconsistent goals and policies.

Consonance: The strategy must represent an adaptive response to the external environment and to the critical changes occurring within it.

Advantage: The strategy. must provide for the creation and/or maintenance of a competitive advantage in the selected area of activity.

Feasibility: The strategy must neither overtax available resources nor create unsolvable

sub problems.

A strategy that fails to meet one or more of these criteria is strongly suspect. It fails to

perform at least one of the key functions that are necessary for the survival of the business. Experience within a particular industry or other setting will permit the analyst to sharpen these criteria and add others that are appropriate to the situation at hand.

Consistency

Gross inconsistency within a strategy seems unlikely until it is realized that many strategies have not been explicitly formulated but have evolved over time in an ad hoc fashion. Even

strategies that are the result of formal procedures may easily contain compromise arrangements

between opposing power groups.

Inconsistency in strategy is not simply a flaw in logic. A key function of strategy is to

provide coherence to organizational action. A clear and explicit concept of strategy can foster a

climate of tacit coordination that is more efficient than most administrative mechanisms. Many

high-technology firms, for example, face a basic strategic choice between offering high-cost

products with high custom-engineering content and lower-cost products that are more standardized and sold at higher volume. If senior management does not enunciate a clear consistent sense

of where the corporation stands on these issues, there will be continuing conflict between sales,

design, engineering, and manufacturing people. A clear consistent strategy, by contrast, allows a

Note On Strategy Evaluation

POL 1999-1.3

sales engineer to negotiate a contract with a minimum of coordination-the trade-offs are an explicit part of the firm's posture.

Organizational conflict and interdepartmental bickering are often symptoms of a managerial disorder but may also indicate problems of strategic inconsistency. Here are some indicators

that can help sort out these two different problems:

If problems in coordination and planning continue despite changes in personnel and

tend to be issue- rather than people-based, they are probably due to inconsistencies in

strategy.

If success for one organizational department means, or is interpreted to mean, failure

for another department, either the basic objective structure is inconsistent or the organizational structure is wastefully duplicative.

If, despite attempts to delegate authority, operating problems continue to be brought

to the top for the resolution of policy issues, the basic strategy is probably inconsistent.

A final type of consistency that must be sought in strategy is between organizational objectives and the values of the management group. Inconsistency in this area is more of a problem

in strategy formulation than in the evaluation of a strategy that has already been implemented. It

can still arise, however, if the future direction of the business requires changes that conflict with

managerial values. The most frequent source of such conflict is growth. As a business expands

beyond the scale that allows an easy informal method of operation, many executives experience a

sharp sense of loss. While growth can of course be curtailed, it often will require special attention to a firm's competitive position if survival without growth is desired. The same basic issues

arise when other types of personal or social values come into conflict with existing or apparently

necessary policies: the resolution of the conflict will normally require an adjustment in the competitive strategy.

Consonance

The way in which a business relates to its environment has two aspects: the business must

both match and be adapted to its environment and it must at the same time compete with other

firms that are also trying to adapt. This dual character of the relationship between the firm and its

environment has its analog in two different aspects of strategic choice and two different methods

of strategy evaluation.

The first aspect of fit deals with the basic mission or scope of the business and the second with its special competitive position or "edge." Analysis of the first is normally done by

looking at changing economic and social conditions over time. Analysis of the second, by contrast, typically focuses on the differences across firms at a given time. We call the first the generic aspect of strategy and the second competitive strategy. Generic strategy1 deals with the

creation of social valuewith the question of whether the products and services being created are

worth more than their cost. Competitive strategy, by contrast, deals with the firm's need to capture some of the social value as profit. Exhibit 1 summarizes the differences between these concepts.

This use of the term generic strategy bears no relationship to Michael Porters later use of the same

term to mean cost leadership, differentiation, and focus strategies. See Porter, Michael, Competitive Strategy, Free Press, 1982.

Note On Strategy Evaluation

POL 1999-1.3

The notion of consonance, or matching, therefore, invites a focus on generic strategy. The role

of the evaluator in this case is to examine the basic pattern of economic relationships that

characterize the business and determine whether or not sufficient value is being created to sustain

the strategy. Most macro analysis of changing economic conditions is oriented toward the

formulation or evaluation of generic strategies. For example, a planning department forecasts

that within six years flat-panel liquid crystal displays will replace CRT-based video displays in

computers. The basic message here to makers of CRT-based video displays is that their generic

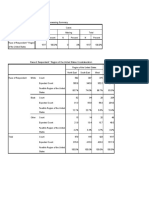

EXHIBIT 1

Generic versus Competritive Strategy

Generic Strategy

Competitive Strategy

Value Issue

Social Value

Corporate Value

Value Constraint

Customer Value > Cost

Price > Cost

Success Indicator

Sales Growth

Increased Corporate Worth

Basic Strategic Task

Adapting to Change

Innovating, impeding imitation, deterring rivals

How Strategy is Expressed

Product-market definition

Advantage, position, and policies supporting them

Basic Approach to

Analysis

Study of an industry

over time

Comparison across rivals

The basic message here to makers of CRT-based video displays is that their generic strategies are

becoming obsolete.

Note that the threat in this case is not to a particular firm, competitive position, or individual approach to the marketplace, but to the basic generic mission.

One major difficulty in evaluating consonance is that most of the critical threats to a

business are those that come from without, threatening an entire group of firms. Management,

however, is often so engrossed in competitive thinking that such threats are only recognized after

the damage has reached considerable proportions.

Another difficulty in appraising the fit between a firm's mission and the environment is

that trend analysis does not normally reveal the most critical changesthey are the result of interactions among trends. The supermarket, for example, comes into being only when home refrigeration and the widespread use of automobiles allow shoppers to buy in significantly larger

volumes. The supermarket, the automobile, and the move to suburbia together form the nexus

which gives rise to shopping centers. These, in turn, change the nature of retailing and, together

with the decline of urban centers, create new forms of enterprise, such as the suburban film theater with four screens. Thus, while gross economic or demographic trends might appear steady for

many years, there are waves of change going on at the institutional level.

Note On Strategy Evaluation

POL 1999-1.3

The key to evaluating consonance is an understanding of why the business, as it currently

stands, exists at all and how it assumed its current pattern. Once the analyst obtains a good grasp

of the basic economic foundation that supports and defines the business, it is possible to study the

consequences of key trends and changes. Without such an understanding, there is no good way of

deciding what kinds of changes are most crucial and the analyst can be quickly overwhelmed

with data.

Advantage

It is no exaggeration to say that competitive strategy is the art of creating or exploiting

those advantages that are most telling, enduring, and most difficult to duplicate.

Competitive strategy, in contrast with generic strategy, focuses on the differences among

firms rather than their common missions. The problem it addresses is not so much "how can this

function be performed" but "how can we perform it either better than, or at least instead of, our

rivals?" The chain supermarket, for example, represents a successful generic strategy. As a way

of doing business, of organizing economic transactions, it has replaced almost all the smaller

owner-managed food shops of an earlier era. Yet a potential or actual participant in the retail

food business must go beyond this generic strategy and find a way of competing in this business.

As another illustration, IBM's early success in the PC industry was genericother firms soon

copied the basic product concept. Once this happened, IBM had to try to either forge a strong

competitive strategy in this area or seek a different type of competitive arena.

Competitive advantages can normally be traced to one of three roots:

Superior skills

Superior resources

Superior position

In examining a potential advantage, the critical question is "what sustains this advantage,

keeping competitors from imitating or replicating it?" A firm's skills can be a source of advantage if they are based on its own history of learning-by-doing and if they are rooted in the coordinated behavior of many people. By contrast, skills that are based on generally understood

scientific principles, on training that can be purchased by competitors, or which can be analyzed

and replicated by others are not sources of sustained advantage.

The skills which compose advantages are usually organizational, rather than individual,

skills. They involve the adept coordination or collaboration of individual specialists and are built

through the interplay of investment, work, and learning. Unlike physical assets, skills are enhanced by their use. Skills that are not continually used and improved will atrophy.

Resources include patents, trademark rights, specialized physical assets, and the firm's

working relationships with suppliers and distribution channels. In addition, a firm's reputation

with its employees, suppliers, and customers is a resource. Resources that constitute advantages

are specialized to the firm, are built up slowly over time through the accumulated exercise of superior skills, or are obtained through being an insightful first mover, or by just plain luck. For

example, Nucor's special skills in mini-mill construction are embodied in superior physical

plants. Goldman Sachs reputation as the premier U.S. investment-banking house has been built

up over many years and is now a major resource in its own right.

A firm's position consists of the products or services it provides, the market segments it

sells to, and the degree to which it is isolated from direct competition. In general, the best positions involve supplying very uniquely valuable products to price insensitive buyers, whereas poor

positions involve being one of many firms supplying marginally valuable products to very well

informed price sensitive buyers.

Note On Strategy Evaluation

POL 1999-1.3

Positional advantage can be gained by foresight, superior skill and/or resources, or just

plain luck. Once gained, a good position is defensible. This means that it (1) returns enough

value to warrant its continued maintenance and (2) would be so costly to capture that rivals are

deterred from full-scale attacks on the core of the business. Position, it must be noted, tends to be

self-sustaining as long as the basic environmental factors that underlie it remain stable. Thus,

entrenched firms can be almost impossible to unseat, even if their raw skill levels are only average. And when a shifting environment allows position to be gained by a new entrant or innovator, the results can be spectacular.

Positional advantages are of two types: (1) first mover advantages and (2) reinforcers.

The most basic first mover advantage occurs when the minimum scale to be efficient requires a

large (sunk) investment relative to the market. Thus, the first firm to open a large discount retail

store in a rural area precludes, through its relative scale, close followers. More subtle first mover

advantages occur when standardization effects "lock-in" customers to the first-mover's product

(e.g., Lotus 123). Buyer learning and related phenomena can increase the buyer's switching costs,

protecting an incumbent's customer base from attack. Frequent flyer programs are aimed in this

direction. First movers may also gain advantages in building distribution channels, in tying up

specialized suppliers, or in gaining the attention of customers. The first product of a class to engage in mass advertising, for example, tends to impress itself more deeply in people's minds than

the second, third, or fourth. In a careful study of frequently-purchased consumer products, Urban

et al. [1986] found that (other things being equal) the first entrant will have a market share that is

n times as large as that of the nth entrant.

Reinforcers are policies or practices acting to strengthen or preserve a strong market position and which are easier to carry out because of the position. The idea that certain arrangements

of one's resources can enhance their combined effectiveness, and perhaps even put rival forces in

a state of disarray, is at the heart of the traditional notion of strategy. It is reinforcers, which provide positional advantage the strategic quality familiar to military theorists, chess players, and

diplomats.

A firm with a larger market share, due to being an early mover or to having a technological lead, can typically build a more efficient production and distribution system. Competitors

with less demand simply cannot cover the fixed costs of the larger more efficient facilities, so for

them larger facilities are not an economic choice. In this case, scale economies are a reinforcer of

market position, not the cause of market position. The firm that has a strong brand can use it as a

reinforcer in the introduction of related brands. A company that sells a specialty coating to a

broader variety of users may have better data on how to adapt the coating to special conditions

than a competitor with more limited salesproperly used, this information is a reinforcer. A famous brand will appear on TV and in films because it is famous, another reinforcer. An example

given by Porter [1985: 145], is that of Steinway and Sons, the premier U.S. maker of fine pianos.

Steinway maintains a dispersed inventory of grand pianos that approved pianists are permitted to

use for concerts at very low rental rates. The policy is less expensive for a leader than for a follower and helps maintain leadership.

The positive feedback provided by reinforcers is the source of the power of positionbased advantagesthe policies that act to enhance position may not require unusual skills; they

simply work most effectively for those who are already in the position in the first place.

While it is not true that larger businesses always have the advantages, it is true that larger

businesses will tend to operate in markets and use procedures that turn their size to advantage.

Large national consumer-products firms, for example, will normally have an advantage over

smaller regional firms in the efficient use of mass advertising, especially network TV. The larger

firm will, then, tend to deal in those products where the marginal effect of advertising is most po-

Note On Strategy Evaluation

POL 1999-1.3

tent, while the smaller firms will seek product/market positions that exploit other types of advantage.

Other position-based advantages follow from such factors as:

The ownership of special raw material sources or advantageous long-term supply

contracts

Being geographically located near key customers in a business involving significant

fixed investment and high transport costs

Being a leader in a service field that permits or requires the building of a unique experience base while serving clients

Being a full-line producer in a market with heavy trade-up phenomena

Having a wide reputation for providing a needed product or service trait reliably and

dependably

In each case, the position permits competitive policies to be adopted that can serve to reinforce the position. Whenever this type of positive-feedback phenomena is encountered, the particular policy mix that creates it will be found to be a defensible business position. The key factors that sparked industrial success stories such as IBM and Eastman Kodak were the early and

rapid domination of strong positions opened up by new technologies.

Feasibility

The final broad test of strategy is its feasibility. Can the strategy be attempted within the

physical, human, and financial resources available? The financial resources of a business are the

easiest to quantity and are normally the first limitation against which strategy is tested. It is

sometimes forgotten, however, that innovative approaches to financing expansion can both

stretch the ultimate limitations and provide a competitive advantage, even if it is only temporary.

Devices such as captive finance subsidiaries, sale-leaseback arrangements, and tying plant mortgages to long-term contracts have all been used effectively to help win key positions in suddenly

expanding industries.

The less quantifiable but actually more rigid limitation on strategic choice is that imposed

by the individual and organizational capabilities that are available.

In assessing the organization's ability to carry out a strategy, it is helpful to ask three

separate questions:

1 . Has the organization demonstrated that it possesses the problem-solving abilities and/or

special competencies required by the strategy? A strategy, as such, does not and cannot

specify in detail each action that must be carried out. Its purpose is to provide structure

to the general issue of the business' goals and approaches to coping with its environment.

It is up to the members and departments of the organization to carry out the tasks defined

by strategy. A strategy that requires tasks to be accomplished which fall outside the

realm of available or easily obtainable skill and knowledge cannot be accepted. It is either unfeasible or incomplete.

2. Has the organization demonstrated the degree of coordinative and integrative skill necessary to carry out the strategy? The key tasks required of a strategy not only require specialized skill, but often make considerable demands on the organization's ability to integrate disparate activities. A manufacturer of standard office furniture may find, for example, that its primary difficulty in entering the new market for modular office systems is

a lack of sophisticated interaction between its field sales offices and its manufacturing

plant. Firms that hope to span national boundaries with integrated worldwide systems of

Note On Strategy Evaluation

POL 1999-1.3

production and marketing may also find that organizational process, rather than functional skill per se or isolated competitive strength, becomes the weak link in the strategic

posture.

3. Does the strategy challenge and motivate key personnel and is it acceptable to those who

must lend their support? The purpose of strategy is to effectively deploy the unique and

distinctive resources of an enterprise. If key managers are unmoved by a strategy, not excited by its goals or methods, or strongly support an alternative, it fails in a major way.

The Process of Strategy Evaluation

Strategy evaluation can take place as an abstract analytic task, perhaps performed by consultants. But most often it is an integral part of an organization's processes of planning, review,

and control. In some organizations, evaluation is informal, only occasional, brief, and cursory.

Others have created elaborate systems containing formal periodic strategy review sessions. In

either case, the quality of strategy evaluation and, ultimately, the quality of corporate performance, will be determined more by the organization's capacity for self-appraisal and learning than

by the particular analytic technique employed.

In their study of organizational learning, Argyris and Schon distinguish between singleloop and double-loop learning. They argue that normal organizational learning is of the feedback-control type-deviations between expected and actual performance lead to problem solving

that brings the system back under control. They note that

[Single-loop learning] is concerned primarily with effectiveness-that is, with how best

to achieve existing 'goals and objectives and how best to keep organizational performance within the range specified by existing norms. In some cases, however, error correction requires a learning cycle in which organizational norms themselves are modified.... We call this sort of learning "double-loop." There is ... a double feedback loop

which connects the detection of error not only to strategies and assumptions for effective performance but to the very norms which define effective performance. [1978:20]

These ideas parallel those of Ashby, a cyberneticist. Ashby [1954] has argued that all

feedback systems require more than single-loop error control for stability; they also need a way of

monitoring certain critical variables and changing the system "goals" when old control methods

are no longer working.

These viewpoints help to remind us that the real strategic processes in any organization

are not found by looking at those things that happen to be labeled "strategic" or "long range."

Rather, the real components of the strategic process are, by definition, those activities which most

strongly affect the selection and modification of objectives and which influence the irreversible

commitment of important resources. They also suggest that appropriate methods of strategy

evaluation cannot be specified in abstract terms. Instead, an organization's approach to evaluation

must fit its strategic posture and work in conjunction with its methods of planning and control.

In most firms comprehensive strategy evaluation is infrequent and, if it occurs, is normally triggered by a change in leadership or financial performance. The fact that comprehensive

strategy evaluation is neither a regular event nor part of a formal system tends to be deplored by

some theorists, but there are several good reasons for this state of affairs. Most obviously, any

activity that becomes an annual procedure is bound to become more automatic. While evaluating

strategy on an annual basis might lead to some sorts of efficiencies in data collection and analysis, it would also tend to strongly channel the types of questions asked and inhibit broad-ranging

reflection.

Note On Strategy Evaluation

POL 1999-1.3

Second, a good strategy does not need constant reformulation. It is a framework for continuing problem solving, not the problem solving itself. One senior executive expressed it this

way: "If you play from strength you don't always need to be rethinking the whole plan; you can

concentrate on details. So when you see us talking about slight changes in tooling it isn't because

we forgot the big picture, its because we took care of it."

Strategy also represents a political alignment within the firm and embodies the past convictions and commitments of key executives. Comprehensive strategy evaluation is not just an

analytical exercise, it calls into question this basic pattern of commitments and policies. Most

organizations would be hurt rather than helped to have their mission's validity called into question

on a regular basis. Zero-base budgeting, for example, was an attempt to get agencies to re-justify

their existence each time a new budget is drawn up. If this were literally true, there would be little time or energy remaining for any but political activity.

Finally, there are competitive reasons for not reviewing the validity of a strategy too

freely! There are a wide range of rivalrous confrontations in which it is crucial to be able to convince others that one's position, or strategy, is fixed and unshakable. Schelling's [1963] analysis

of bargaining and conflict shows that a great deal of what is involved in negotiating is finding

ways to bind or commit oneself convincingly. This is the principle underlying the concept of deterrence and what lies behind the union leader's tactic of claiming that while he would go along

with management's desire for moderation, he cannot control the members if the less moderate

demands are not met. In business strategy, such situations occur in classic oligopoly, plantcapacity duels, new-product conflicts, and other situations in which the winner may be the party

whose policies are most credibly unswayable. Japanese electronics firms, for example, have

gained such strong reputations as low-cost committed players that their very entry into a market

has come to induce rivals to give up. If such firms had instead the reputation of continually reviewing the advisability of continuing each product, they would be much less threatening, and

thus less effective, competitors.

Given these barriers to formal periodic comprehensive strategy review, it may seem that

firms have little way of ensuring the continuing validity of their strategies. Most firms, however,

suffer no lack of measures on their performance. Deviations from expected results are the constant stimuli for management activity and problem solving. When such deviations are unusual in

size or nature, or when corrective actions become ineffective, it is often evidence of strategic

rather than operating problems. Thus, for most single-business firms, the problem of strategy

evaluation is not one of some large analytic project but of separating out of the constant flow of

information on problems and actions those pieces of evidence that point towards the need for

more fundamental change. If this strategic management job is done well, it may never be necessary to step back and call for a full evaluation of the firm's position.

What governs how well the strategic management job is done? The organization structure, the type of planning, control, and reward systems, and the managerial "climate" all have important impacts. It is worth singling out the effects of structure and objectives for further discussion.

Structure directly influences the quality of strategy management through the way it

shapes perceptions as to what tasks and issues are germane. For example, two aerospace firms

both use project-matrix organizations. But. one makes potential or current project managers responsible for the generation of new business while the other only assigns the project manager after senior executives have nailed down a contract. The first firm has a much better ability to

sense relationships and gaps between its customer's problems and its own technical ability at a

good level of detail. The second firm, by contrast, is less likely to perceive gaps at the detailed

Note On Strategy Evaluation

10

POL 1999-1.3

technical level but is more sensitive to changes in ongoing procurement programs. Thus, in each

firm, structure influences what kinds of strategic insights are facilitated.

The quality of strategic management is also strongly influenced by the kind of objectives

that are set. The issue here is not the traditional one of whether objectives should be "hard" or

"easy" but the question of what variables are made into objectives in the first place. Most management control systems have evolved out of statement of accounts and provide little, if any, help

in evaluating the strategic position of the business. If, however, management is able to devise

measures that relate directly to the firm's basis of advantage or position, a much clearer separation

of long- and short-run phenomena takes place.

Market share, at the necessary level of detail, is an excellent strategic benchmark. So are

such measures as share of industry capacity, percentage of specialty outlets carrying the product,

estimated relative cost (relative to competitors), and relative price-value relationships. Equally

important in many situations are direct measures of quality and of customer satisfaction. These

kinds of measures not only allow management to track the accomplishment of strategy, they also

permit the testing of judgments as to whether or not key assumptions are valid. It is one thing, for

example, to register a healthy increase in sales and profits and quite another to discover that it

was in, say, the adult market rather than the teen market as had been expected. The latter type of

information immediately suggests helpful adaptive actions that straight sales data do not.

Conclusions

Strategy evaluation is the appraisal of plans and the results of plans that centrally concern

or affect the basic mission of an enterprise. Its special focus is the separation between obvious

current operating results and the factors that underlie success or failure in the chosen domain of

activity. Its result is the rejection, modification, or ratification of existing strategies and plans.

It is usual to view strategy evaluation as an intellectual task-as a problem in data analysis

and interpretation that requires both imagination and intelligence. From this point of view, there

are four essential tests a strategy must pass. The strategy must (1) be internally consistent, (2)

provide for consonance between the firm and its environment, (3) be based on the gaining and

maintenance of competitive advantage, and (4) be feasible in the light of existing skills and resources. A strategy which fails one or more of these tests possesses quite serious flaws. While a

strategy that passes all four tests cannot be guaranteed to succeed, it is without question a better

starting place than one that is known to be unsound.

In most medium- to large-size firms, strategy evaluation is not a purely intellectual task.

The issues involved are too important and too closely associated with the distribution of power

and authority for either strategy formulation or evaluation to take place in an ivory tower environment. In fact, most firms rarely engage in explicit formal strategy evaluation. Rather, the

evaluation of current strategy is a continuing process and one that is difficult to separate from the

normal planning, reporting, control, and reward systems of the firm. From this point of view,

strategy evaluation is not so much an intellectual task as it is an organizational process.

As process, strategy evaluation is the outcome of activities and events that are strongly

shaped by the firm's control and reward systems, its information and planning systems, its structure, and its history and particular culture. Thus, its performance is, in practice, tied more directly

to the quality of the firm's strategic management than to any particular analytical scheme. In particular, organizing major units around the primary strategic tasks and making the extra effort required to incorporate measures of strategic success in the control system may play vital roles in

facilitating strategy evaluation within the firm.

Ultimately, a firm's ability to maintain its competitive position in a world of rivalry and

change may be best served by managers who can maintain a dual view of strategy and strategy

Note On Strategy Evaluation

11

POL 1999-1.3

evaluation-they must be willing and able to perceive the strategy within the welter of daily activity and to build and maintain structures and systems that make strategic factors the object of current activity.

References

Argyris, Chris, and Donald A. Schon. Organizational Learning: A Theory of Action Perspective.

Reading, Mass.: Addison-Wesley, 1978.

Ashby, W. Ross. Design for a Brain. London: Chapman & Hall, 1954.

Porter, Michael E. Competitive Advangage. New York: The Free Press, 1985.

Schelling, T. C. The Strategy of Conflict. Cambridge, Mass.: Harvard, 1963.

Urban, G.L.; Carter, R.; Gaskin, S.; and Z. Mucha, "Market Share Rewards to Pioneering

Brands," Management Science, 6, JUne 1986, pp. 645-659.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Spencer - First PrinciplesDocument516 pagesSpencer - First PrinciplesCelephaïs Press / Unspeakable Press (Leng)100% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Practical Intuition For SuccessDocument9 pagesPractical Intuition For SuccessMatiNo ratings yet

- Wear Debris Analysis ASHWIN THOTTUMKARA FULLDocument27 pagesWear Debris Analysis ASHWIN THOTTUMKARA FULLASHWIN THOTTUMKARA80% (5)

- Module 1 - The Nature of ChemistryDocument12 pagesModule 1 - The Nature of ChemistryElhamae Sindatoc100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Criminal Law Case DigestsDocument114 pagesCriminal Law Case DigestsZack Seifer100% (2)

- The Virus Misconception Part 1 Measles As An Example by DR Stefan LankaDocument14 pagesThe Virus Misconception Part 1 Measles As An Example by DR Stefan Lankatrixstar108087100% (2)

- Extrajudicial Settlement of EstateDocument4 pagesExtrajudicial Settlement of EstateBrenton BionatNo ratings yet

- Collection of Sum of MoneyDocument5 pagesCollection of Sum of MoneyBrenton BionatNo ratings yet

- BIOSTATISTICS McqsDocument13 pagesBIOSTATISTICS Mcqsrosaarnautovic2No ratings yet

- SWOT Data SMBDocument10 pagesSWOT Data SMBBrenton BionatNo ratings yet

- BORRADAILE 2003 - Statistics of Earth Science Data LB 6029 PDFDocument371 pagesBORRADAILE 2003 - Statistics of Earth Science Data LB 6029 PDFEduardo100% (1)

- Affidavit of Sole AdjudicationDocument1 pageAffidavit of Sole AdjudicationBrenton BionatNo ratings yet

- ContractDocument2 pagesContractBrenton BionatNo ratings yet

- UPRevised Ortega Lecture Notes IIDocument190 pagesUPRevised Ortega Lecture Notes IIRicardo Jesus GutierrezNo ratings yet

- Strat Evaluation 1999Document11 pagesStrat Evaluation 1999Brenton BionatNo ratings yet

- Oil Shock Roubini SetserDocument12 pagesOil Shock Roubini SetserBrenton BionatNo ratings yet

- List of Cases - Crim Law 1Document2 pagesList of Cases - Crim Law 1Brenton BionatNo ratings yet

- Affidavit ConsentDocument2 pagesAffidavit ConsentLynn BennettNo ratings yet

- Ateneo 2011 Criminal Law (Book 1)Document94 pagesAteneo 2011 Criminal Law (Book 1)Val Jason AlpasNo ratings yet

- Philomatheia Land Titles Case DoctrinesDocument11 pagesPhilomatheia Land Titles Case DoctrinesGeoanne Battad BeringuelaNo ratings yet

- Input Modeling For SimulationDocument48 pagesInput Modeling For Simulationロサ カルメンNo ratings yet

- Sports Stats & ProbabilitiesDocument6 pagesSports Stats & ProbabilitiesSakshya SoniNo ratings yet

- Introduction To SPSS and Epi-InfoDocument129 pagesIntroduction To SPSS and Epi-Infoamin ahmed0% (1)

- English Student Teachers' Ability to Facilitate Pair and Group InteractionDocument31 pagesEnglish Student Teachers' Ability to Facilitate Pair and Group InteractionFiza Intan NaumiNo ratings yet

- Time Series With EViews PDFDocument37 pagesTime Series With EViews PDFashishankurNo ratings yet

- Mar3613 Marketing Research HW 4Document12 pagesMar3613 Marketing Research HW 4api-620252953No ratings yet

- Mellard - Inventing Lacanian PsychoanalysisDocument33 pagesMellard - Inventing Lacanian PsychoanalysisMaximiliano Cosentino100% (1)

- Essay, Rittel and Webber (1973) Analyzed TheDocument9 pagesEssay, Rittel and Webber (1973) Analyzed Thecitra utamiNo ratings yet

- Probability and Random Processes (15B11MA301 (15B11MA301 Probability and Random Processes 15B11MA301) 15B11MA301)Document16 pagesProbability and Random Processes (15B11MA301 (15B11MA301 Probability and Random Processes 15B11MA301) 15B11MA301)Aditya gaurNo ratings yet

- Is Psychology A Science?Document4 pagesIs Psychology A Science?Travis LiladharNo ratings yet

- Multiple Linear and Non-Linear Regression in Minitab: Lawrence JeromeDocument4 pagesMultiple Linear and Non-Linear Regression in Minitab: Lawrence Jeromeanon_99054501No ratings yet

- Thirishali ReportDocument119 pagesThirishali Reportthirishali karthikNo ratings yet

- Prediksi Kelulusan Mahasiswa Menggunakan Algoritma Naive Bayes (Studi Kasus 5 PTS Di Banda Aceh)Document5 pagesPrediksi Kelulusan Mahasiswa Menggunakan Algoritma Naive Bayes (Studi Kasus 5 PTS Di Banda Aceh)Jurnal JTIK (Jurnal Teknologi Informasi dan Komunikasi)No ratings yet

- PHENOMENOLOGYDocument54 pagesPHENOMENOLOGYsrimalathiNo ratings yet

- Calibration of The High and Low Resolution Gamma-Ray SpectrometersDocument9 pagesCalibration of The High and Low Resolution Gamma-Ray SpectrometersAlejandra Ayulo CumpalliNo ratings yet

- Skittles Project 1Document7 pagesSkittles Project 1api-299868669100% (2)

- Caloocan City Schools Division Office Science Lesson PlanDocument6 pagesCaloocan City Schools Division Office Science Lesson PlanROWENA NADAONo ratings yet

- Practice Exam BHO2285 T2 2018Document4 pagesPractice Exam BHO2285 T2 2018庄敏敏No ratings yet

- Model Pembelajaran Berbasis Proyek (Project Based Learning) PDFDocument10 pagesModel Pembelajaran Berbasis Proyek (Project Based Learning) PDFmelinda herthaNo ratings yet

- Microscopy and StainingDocument3 pagesMicroscopy and StainingGio Ferson M. BautistaNo ratings yet

- Chi square test results for relationship between race and regionDocument4 pagesChi square test results for relationship between race and regionfaisalshafiq1No ratings yet

- Reduction in MFG TimeDocument6 pagesReduction in MFG TimeMehta MehulNo ratings yet

- Anova Two Way InteractionDocument7 pagesAnova Two Way InteractionJoyo MargosaeNo ratings yet