Professional Documents

Culture Documents

SCAM Detection in Credit Card Application

Uploaded by

Integrated Intelligent ResearchCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SCAM Detection in Credit Card Application

Uploaded by

Integrated Intelligent ResearchCopyright:

Available Formats

Volume: 03, June 2014, Pages: 355-360

International Journal of Data Mining Techniques and Applications

ISSN: 2278-2419

SCAM Detection in Credit Card Application

M.Sanjeeevkumar1,A.Kamakshi2

1

Student, Department of CSE, Jayam College of Engineering & Technology, Dharmapuri-636813,

Tamilnadu, India

2

Asst. Professor, Department of CSE, Jayam College of Engineering & Technology,

Dharmapuri-636813, Tamilnadu, India

Email: sanjeevkumarmecse@gmail.com , dhivya.kamakshi@gmail.com

Abstract

Identity crime is well known, prevalent, and costly, and credit application scam is a specific case of

identity crime. The existing no data mining recognition system of business rules and scorecards and

known scam matching have confines. To address these confines and combat identity crime in real time,

this paper proposes a new multilayered discovery system complemented with two additional layers:

communal detection (CD) and spike detection (SD). CD finds real social relationships to reduce the

suspicion score, and is tamper unaffected to synthetic social relationships. It is the whitelist-oriented

methodology on a fixed set of attributes. SD finds spikes in false to increase the suspicion score, and is

probe-unaffected for elements. It is the attribute-oriented approach on a variable-size set of elements.

Together, CD and SD can detect more types of attacks, better account for changing legal activities, and

remove the redundant elements. Experiments were carried out on CD and SD with several million real

credit applications. Results on the data support the suggestion that successful credit application scam

patterns are sudden and exhibit sharp spikes in false. Although this research is specific to credit

application scam recognition, the concept of flexibility, together with adaptively and quality data

discussed in the paper, are general to the model, implementation, and evaluation of all recognition

systems.

Keywords Data mining-based scam detection, security, data stream mining, anomaly detection.

I. INTRODUCTION

Identity Scam Detection is the process of

detecting the scam that uses a false identity for

obtaining goods or services. This paper detects

the application scam that arises in the credit card

industry. This paper increases the effectiveness

of the existing system. This paper aims at

identifying application scam by achieving

flexibility by adding data mining-based layers.

This paper makes use of these powerful layers to

identify the identity scam named application

scam. This paper consists mainly of two parts

i.e. identifying scam lent application and

comparing the performance of these data mining

based layers.

Credit-card-based purchases categorized into

two types: 1) physical card and 2) virtual card.

In a physical-card based purchase, the card

defender presents his card physically to a

merchant for making payment. To carry out

Integrated Intelligent Research (IIR)

scam lent transactions in this purchase, an

attacker has to steal the credit card. If the card

defender does not realize the loss of card, it can

lead to a plentiful financial loss to the credit card

company. In the second purchase, only some

important information about the card (card

number, expiration date, secure code) is

mandatory to make the payment. Such

purchases are customarily done on the Internet

or over the telephone. To commit scam in these

types of purchases, a scamster simply needs to

know the card details. Most of the time, the

genuine card defender is not aware that someone

else has seen or stolen his card information. The

only way to detect this scam is to analyze the

spending patterns on every card and to figure out

any inconsistency with respect to the "usual"

spending patterns. Scam detection based on the

analysis of existing purchase data of the card

defender is a promising way to reduce the rate of

successful credit card scams. This paper is the

355

Volume: 03, June 2014, Pages: 355-360

International Journal of Data Mining Techniques and Applications

ISSN: 2278-2419

continuity of existing model. Application scam

is when someone applies for a credit card with

false information. For detect application scam,

the solution is to implement a scam system that

allows identifying suspicious applications. For

detect application scam, two different situations

have to be distinguished: when applications

come from the same individual with the same

details, the so-called duplicates, and when

applications come from different individuals

with similar details, the so called identity fakes.

In most banks, to be eligible for a credit card,

applicants need to complete an application form.

This application form is mandatory except for

social fields. The information mandatory

includes identification information, location

information, contact information, confidential

information and additional information.

Recurrent information available would be for

identification purposes, such as the full name

and the date of birth. The applicant would

inform the bank about his/her location details:

the address, the postal code, the city and the

country.

requires the applicant to provide sufficient

point-weighted identity documents face-to-face.

They must hang together to at tiniest 100 points,

where a passport is worth 70 points.

Another business rule is to contact (or

investigate) the applicant over the telephone or

Internet. The above two business rules are

exceedingly effective, but human resource

intensive.

For rely less on human resources, common

business rule is to match an application's

identity number, address, or phone number

against exterior databases. That was convenient,

but the public telephone and address handbooks,

semi-public voters' register, and credit history

data can have data quality misgivings of

accuracy, completeness, and timeliness.

Another existing defence knew scam

matching. Here, known scams are complete

applications that were confirmed to have the

intent to descam and usually periodically

recorded into a blacklist. Afterward, the current

applications are matched against the blacklist.

The bank would also ask for contact details,

such as e-mail address, land-line and mobile

phone numbers. Confidential information will be

the password. In addition, the gender will be

given. All those characteristics may use while

searching for duplicates.

That has the benefit and clarity of hindsight

because patterns often reiteration themselves.

However, there are two main problems in using

known scams. First, they are untimely due to

long time delays, in days or months, for scam to

reveal itself, and be chronicled and recorded.

As in identity scam, credit application scam has

reached a critical mass of fakes who are

exceedingly experienced, organized, and

high-tech. Their visible patterns can be different

for each other and constantly change. They are

relentless, due to the high financial rewards, and

the risk and endeavor involved are minimal.

Based on anecdotal reflections of experienced

credit application investigators, fakes can use

software automation to manipulate particular

values within the application and increase

frequency of successful values.

Drawbacks of an Existing System

II. EXISTING SYSTEM

There are non data mining layers of defence

to protect against credit application scam, each

with its unique strengths and weaknesses. The

first existing defence made up of business rules

and scorecards.

In Australia, one business rule is the

hundred-point physical identity check test which

Integrated Intelligent Research (IIR)

For rely less on human resources, common

business rule is to match an application's

identity n umber, address, or phone number

against exterior databases.

Not Efficient process for crime detection.

Security level is low.

Not Cost Effective.

III. PROPOSED SYSTEM

If The main fact-based of this research is to

realize flexibility by adding two new, real time,

data mining-based layers to complement the two

existing non data mining layers discussed in the

paper.

The main contribution of this paper is the

demonstration of flexibility, with adaptively and

quality data in real-time data mining-based

discovery algorithms. The first new layer is

Communal Detection (CD): the white

356

Volume: 03, June 2014, Pages: 355-360

International Journal of Data Mining Techniques and Applications

ISSN: 2278-2419

list-oriented approach on a fixed set of

attributes. To complement and strength CD.

The second new layer is Spike Detection

(SD): the attribute-oriented approach on a

variable-size set of attributes. The second

involvement is the significant extension of

knowledge in credit application scam detection

because publications in this area are rare.

The last involvement is the recommendation

of credit application scam detection as one of the

many solutions to identity lawbreaking. Being at

the first stage of the credit life cycle, credit

application scam detection also prevents some

credit transactional scam, gives an overview of

related work in credit application scam detection

and other domains.

Before the testing and interpretation of CD

and SD results, final Section considers the legal

and ethical responsibility of handling

application data and describes the data,

evaluation measures, and experimental design.

Advantages of Proposed System:

Accuracy

Find scam applications very closely and

accuracy.

IV. SYSTEM ARCHITECTURE

A system architecture or systems architecture is

the conceptual model that defines the structure,

behavior, and more views of a system. It serves a

model to describe/analyze a system.

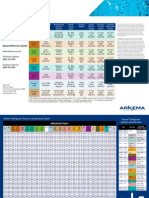

Fig 3.2.System Architecture for Checking

Efficiency of the System

V. MODULE DESCRIPTION

a. Multi-attribute link.

b. Communal relationship.

c. White list creation.

d. Spike detection.

e. Identifying scam lent application &

evaluation

Measures.

f. Performance of cd-sd.

Multi-attribute Link

This module is used to find the multi attribute

link between current application and

applications in the data set. For calculating this

multi attribute link, string similarity measure

Jaro-Winkler used.

Input / Output of the Module:

Input: Name, Surname, Address, State, Driving

License, Passport_ID, Organization Name

(string), DOB, Date received-date, Postcode,

Home Number (integer).

Output: Multi attribute link

Steps:

1. Set the initial values to string similarity

threshold, attribute threshold and number of

link types

2. Get the inputs from user

Calculate single attribute match between the

current application and applications in data

set by comparing its attributes. Computing

similarity measure does it. The match is set

to 1 if it exceeds string similarity threshold,

otherwise set to 0

Fig 3.1.System Architecture for Creating White

List.

Integrated Intelligent Research (IIR)

For string similarity

Jaro-Winkler method.

measure,

use

357

Volume: 03, June 2014, Pages: 355-360

International Journal of Data Mining Techniques and Applications

ISSN: 2278-2419

Jaro distance (dj):

Sk = Ek * (1/N) * Wk

dj = (1/3) (m/s1 + m/s2 + (m - t) / m)

Sk - single link score

m - Number of matching characters

Ek - single attribute match

t - Half the number of transpositions

N - Number of attributes

s1 - length of string1

Wk - weight of the zth link type

s2 - length of string2

Jaro-Winkler distance (dw):

If link type is not available for the match in

white list,

dw = dj + (p (1- dj)/10)

Sk = Ek * (1/N)

p - Length of common prefix

2. Calculate Single link average previous score

by

taking ratio of suspicion

score and number of links

Calculate multi-attribute link by comparing

all the attributes between current application

and applications in dataset, so that it yields multi

attribute link such as 00111110, 11111110 and

so.

A. Communal Relationship

This module is used to find the communal

relationship between the incoming application

and the applications in dataset. The communal

relationships such as Twins, Brothers, Spouse,

Neighbors, House mates, Office mates,

Duplicates can found.

Input / Output of the Module:

Input: Multi-attribute link

Output: Communal Relationship

Module Description

Steps:

1. Get the multi-attribute link

2. Based on the multi attribute link, find the

communal relationship as Twins/Brothers/..Etc

B. White List Creation

Input / Output of the Module

Input: Multi attribute link - integer

Output: White list

Module Description

Steps:

1. Calculate Single link score by comparing

Multi attribute link against sorted link type in

the white list to calculate single link score.

If link type is available for the match in white

list,

Integrated Intelligent Research (IIR)

SSk

Bk = --------

Ok

Bk - Single link average previous score

SSk - suspicion score

Ok - Number of out links

3. Calculate suspicion score using link score

and its previous score

SSk= SK + Bk

4. Then update the white list.

C. Spike Detection

Input / Output of the Module

Input: Current application, string similarity

threshold, exponential smoothing factor

integer

Output: Suspicion score, Attribute weight integer

Module Description

Steps:

1. If there is a match between applications,

calculate single attribute match as in multi

attribute link module

In case of non match,

Ek

St = -------------------

St - single step scaled count

Ek - single attribute match

K - Number of values

2. Calculate every current applications score as

follows

358

Volume: 03, June 2014, Pages: 355-360

International Journal of Data Mining Techniques and Applications

ISSN: 2278-2419

Ck = St * Wk

Ck - Current application score

Wk - attribute weight

3. SD attributes selection: Select the attributes

for the Spike Detection suspicion Score

4. CD attribute weights change: Change the

attribute weight

Ck New attribute weight = -------------Wk in white list

D.

Identifying Scam lent Application &

Evaluation Measures

Input / Output of the Module

Input: Suspicion score, exact positive, exact

Negative - integer

Output: Scam lent application

Precision, Recall, F measure - integer

Module Description

Steps:

1. Get the suspicion score from spike detection

2. Find the higher suspicion score

3. Return the application as scam lent

application which have higher suspicion score

4. Calculate precision, recall and F-measure

E. Performance Of CD-SD

Input / Output of the Module

Input: Precision, recall measures of CD-SD and

Naive Bayesian, SVM

Output: Performance of CD-SD

Module Description

Steps:

1. Get the precision, recall measures for

CD-SD and other data

2. Get the precision, recall measures for

CD-SD and other data mining techniques

3. Compare the measures among them

4. Show how much CD-SD is efficient than

others

Integrated Intelligent Research (IIR)

VI. CONCLUSION

The implementation of Communal Detection

algorithm is practical because this algorithm

designed for use to complement the existing

detection system. The algorithm can search with

a larger moving window number of link types in

the white list, and a number of attributes.

Communal Detection updated after every period;

it is not a true evaluation as the fakes do not get

a chance to react and change their strategy in

response to Communal Detection as would

occur if they deployed in real life.

The main focus of this paper is Identity Scam

Detection in Credit card application. It has

documented the development and evaluation in

the data mining layers of defense for a real-time

credit application scam detection system. It

produces some few concepts which increase the

detection system's effectiveness. These concepts

are adaptive, which accounts for changing scam

and legal behavior and quality data, which deals

real-time removal of data errors. Finally, the last

contribution is the recommendation of credit

application scam detection is one of the many

solutions to identity scam.

VII. FUTURE ENHANCEMENT

Comparison of the incoming application with

the applications in the moving window of the

data set for generating links for attributes

consumes lot of time when the window size is

large. Parallelizing the code to run on multicore

architectures would drastically reduce the

execution time of the paper.

REFERENCES

1. Anthony Brabazon, Jane Cahill, Peter Keenan

& Daniel Walsh, Identifying Online Credit

Card Fraud using Artificial Immune Systems,

IEEE 2010.

2. Brause.R, Langsdorf.T, Hepp.M: Credit

Card Fraud Detection by Adaptive Neural

Data Mining, J.W.Goethe- University, Comp.

Sc. Dep., Report 7/99, Frankfurt, Germany

(1999).

3. Chao-Tung Yang, Tzu-Chieh Chang,

Hsien-Yi Wang, William C.C.Chu, Chih-Hung

Chang, Performance comparison with open

MP parallelization for multi-core systems,

Ninth IEEE International Symposium on

Parallel and Distributed Processing with

Applications, IEEE, 2011.

359

Volume: 03, June 2014, Pages: 355-360

International Journal of Data Mining Techniques and Applications

ISSN: 2278-2419

4. Clifton Phua, Kate Smith, Vincent Lee &

Ross Gayler, Resilient Identity Crime

Detection, IEEE Transactions on Knowledge &

Data Engineering, IEEE Transactions On

Knowledge and Data Engineering, March 2012.

5. Clifton Phua, Kate Smith, & Ross Gayler,

Resilient Identity Crime Detection,IEEE

Transactions on Knowledge & Data

Engineering,

IEEE Transactions On

Knowledge And Data Engineering, March

2012,Vol.24,No.3,pp 533-546

6. Ghosh.S, Reilly.D.L: Credit Card Fraud

Detection with a Neural-Network; Proc. 27th

Annual Hawaii Int. Conf. on System Science,

IEEE Comp. Soc. Press, Vol.3, pp.621-630

(1994).

7. Hamdi.M, Mine Isik, Ekram Duman, Tugba

Cevik, Improving a credit card fraud detection

system using Genetic algorithm, International

Conference on Networking and Information

Technology, IEEE 2010.

8. John Talburt and Chia-Chu Chiang,

Attributed Identity Resolution for Fraud

Detection and Prevention, IEEE 2009.

9. Linda Delamaire, Hussein Abdou, John

Pointon, Credit card fraud and detection

techniques: A review, Banks and Bank Systems,

2009.

10. Mikhail

Bilenko,

Raymond

Mooney, Adaptive Name Matching in

Information Integration IEEE Intelligent

systems, IEEE 2003.

11. Neville.J,

Simsek.O,

Jensen.D,

Komoroske.J, Palmer.K, and Goldberg.H,

Using Relational Knowledge Discovery to

Prevent Securities Fraud, Proc. 11th ACM

SIGKDD Intl Conf. Knowledge Discovery in

Data Mining (KDD 05), 2005.

12. Smith.L.A, Bull.J.M, Obdrzalek.J, A

parallel Java Grande benchmark suite,

ACM/IEEE Conference, 2001.

13. Sherly K.K, Nedunchezhian, Boat

adaptive credit card fraud detection system,

IEEE 2010.

14. Sahin.Y and Duman.E, Detecting Credit

Card Fraud by Artificial Neural Network and

Logistic Regression, IEEE 2011.

15. Tatsuya Minegishi, Ayahiko Niimi,

Proposal of Credit Card Fraudulent Use

Detection by Online-type Decision Tree

Construction and Verification of Generality,

International Journal for Information Security

Integrated Intelligent Research (IIR)

Research (IJISR),December 2011, Vol-1, Issue

4.

16. William Yancey.E, An Adaptive String

Comparator for Record Linkage, research

report series, U.S. Bureau of the Census, 2004.

17. Wen-Fang YU, Na Wang, Research on

Credit Card Fraud Detection Model Based on

Distance Sum, International Joint Conference

on Artificial Intelligence, 2009, pp 353-356.

18. Wong.W, Moore. A, Cooper.G, and

Wagner.M, Bayesian Network Anomaly

Pattern Detection for Detecting Disease

Outbreaks, Proc. 20th Intl Conf. Machine

Learning (ICML 03), pp. 808- 815, 2003.

360

You might also like

- A Review On Role of Software-Defined Networking (SDN) in Cloud InfrastructureDocument6 pagesA Review On Role of Software-Defined Networking (SDN) in Cloud InfrastructureIntegrated Intelligent ResearchNo ratings yet

- Investigating Performance and Quality in Electronic Industry Via Data Mining TechniquesDocument5 pagesInvestigating Performance and Quality in Electronic Industry Via Data Mining TechniquesIntegrated Intelligent ResearchNo ratings yet

- A Survey On The Simulation Models and Results of Routing Protocols in Mobile Ad-Hoc NetworksDocument6 pagesA Survey On The Simulation Models and Results of Routing Protocols in Mobile Ad-Hoc NetworksIntegrated Intelligent ResearchNo ratings yet

- Slow Intelligence Based Learner Centric Information Discovery SystemDocument3 pagesSlow Intelligence Based Learner Centric Information Discovery SystemIntegrated Intelligent ResearchNo ratings yet

- Prediction of Tumor in Classifying Mammogram Images by K-Means, J48 and CART AlgorithmsDocument6 pagesPrediction of Tumor in Classifying Mammogram Images by K-Means, J48 and CART AlgorithmsIntegrated Intelligent ResearchNo ratings yet

- Three Phase Five Level Diode Clamped Inverter Controlled by Atmel MicrocontrollerDocument5 pagesThree Phase Five Level Diode Clamped Inverter Controlled by Atmel MicrocontrollerIntegrated Intelligent ResearchNo ratings yet

- Applying Clustering Techniques For Efficient Text Mining in Twitter DataDocument4 pagesApplying Clustering Techniques For Efficient Text Mining in Twitter DataIntegrated Intelligent ResearchNo ratings yet

- A New Arithmetic Encoding Algorithm Approach For Text ClusteringDocument4 pagesA New Arithmetic Encoding Algorithm Approach For Text ClusteringIntegrated Intelligent ResearchNo ratings yet

- Effective Approaches of Classification Algorithms For Text Mining ApplicationsDocument5 pagesEffective Approaches of Classification Algorithms For Text Mining ApplicationsIntegrated Intelligent ResearchNo ratings yet

- A New Computer Oriented Technique To Solve Sum of Ratios Non-Linear Fractional Programming ProblemsDocument1 pageA New Computer Oriented Technique To Solve Sum of Ratios Non-Linear Fractional Programming ProblemsIntegrated Intelligent ResearchNo ratings yet

- Impact of Stress On Software Engineers Knowledge Sharing and Creativity (A Pakistani Perspective)Document5 pagesImpact of Stress On Software Engineers Knowledge Sharing and Creativity (A Pakistani Perspective)Integrated Intelligent ResearchNo ratings yet

- Classification of Retinal Images For Diabetic Retinopathy at Non-Proliferative Stage Using ANFISDocument6 pagesClassification of Retinal Images For Diabetic Retinopathy at Non-Proliferative Stage Using ANFISIntegrated Intelligent ResearchNo ratings yet

- A Study For The Discovery of Web Usage Patterns Using Soft Computing Based Data Clustering TechniquesDocument7 pagesA Study For The Discovery of Web Usage Patterns Using Soft Computing Based Data Clustering TechniquesIntegrated Intelligent ResearchNo ratings yet

- Associative Analysis of Software Development Phase DependencyDocument9 pagesAssociative Analysis of Software Development Phase DependencyIntegrated Intelligent ResearchNo ratings yet

- RobustClustering Algorithm Based On Complete LinkApplied To Selection Ofbio - Basis Foramino Acid Sequence AnalysisDocument10 pagesRobustClustering Algorithm Based On Complete LinkApplied To Selection Ofbio - Basis Foramino Acid Sequence AnalysisIntegrated Intelligent ResearchNo ratings yet

- A Study For The Discovery of Web Usage Patterns Using Soft Computing Based Data Clustering TechniquesDocument7 pagesA Study For The Discovery of Web Usage Patterns Using Soft Computing Based Data Clustering TechniquesIntegrated Intelligent ResearchNo ratings yet

- A Survey On Analyzing and Processing Data Faster Based On Balanced Partitioning - IIR - IJDMTA - V4 - I2 - 006Document4 pagesA Survey On Analyzing and Processing Data Faster Based On Balanced Partitioning - IIR - IJDMTA - V4 - I2 - 006Integrated Intelligent ResearchNo ratings yet

- A Study For The Discovery of Web Usage Patterns Using Soft Computing Based Data Clustering TechniquesDocument14 pagesA Study For The Discovery of Web Usage Patterns Using Soft Computing Based Data Clustering TechniquesIntegrated Intelligent ResearchNo ratings yet

- A Framework To Discover Association Rules Using Frequent Pattern MiningDocument6 pagesA Framework To Discover Association Rules Using Frequent Pattern MiningIntegrated Intelligent ResearchNo ratings yet

- A Framework To Discover Association Rules Using Frequent Pattern MiningDocument6 pagesA Framework To Discover Association Rules Using Frequent Pattern MiningIntegrated Intelligent ResearchNo ratings yet

- A Framework To Discover Association Rules Using Frequent Pattern MiningDocument6 pagesA Framework To Discover Association Rules Using Frequent Pattern MiningIntegrated Intelligent ResearchNo ratings yet

- Multidimensional Suppression For KAnonymity in Public Dataset Using See5Document5 pagesMultidimensional Suppression For KAnonymity in Public Dataset Using See5Integrated Intelligent ResearchNo ratings yet

- Agricultural Data Mining - Exploratory and Predictive Model For Finding Agricultural Product PatternsDocument8 pagesAgricultural Data Mining - Exploratory and Predictive Model For Finding Agricultural Product PatternsIntegrated Intelligent ResearchNo ratings yet

- A Review Paper On Outlier Detection Using Two-Phase SVM Classifiers With Cross Training Approach For Multi - Disease DiagnosisDocument7 pagesA Review Paper On Outlier Detection Using Two-Phase SVM Classifiers With Cross Training Approach For Multi - Disease DiagnosisIntegrated Intelligent ResearchNo ratings yet

- Significance of Similarity Measures in Textual Knowledge MiningDocument4 pagesSignificance of Similarity Measures in Textual Knowledge MiningIntegrated Intelligent ResearchNo ratings yet

- Paper13 PDFDocument8 pagesPaper13 PDFIntegrated Intelligent ResearchNo ratings yet

- Paper13 PDFDocument8 pagesPaper13 PDFIntegrated Intelligent ResearchNo ratings yet

- A Comparative Analysis On Credit Card Fraud Techniques Using Data MiningDocument3 pagesA Comparative Analysis On Credit Card Fraud Techniques Using Data MiningIntegrated Intelligent ResearchNo ratings yet

- Paper13 PDFDocument8 pagesPaper13 PDFIntegrated Intelligent ResearchNo ratings yet

- Paper11 PDFDocument5 pagesPaper11 PDFIntegrated Intelligent ResearchNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Lec No.6 Solvent ExtractionDocument13 pagesLec No.6 Solvent Extractionrejie magnayeNo ratings yet

- AXM Tianhe Core ModuleDocument8 pagesAXM Tianhe Core ModuleFaust YngveNo ratings yet

- Caixa Eletrica Ec120Document262 pagesCaixa Eletrica Ec120Carlyson SilvaNo ratings yet

- Smartlay™ Pipeline Flooding Prevention System: Service Data SheetDocument2 pagesSmartlay™ Pipeline Flooding Prevention System: Service Data Sheetnagid_428463849No ratings yet

- Exercise Problem # 1: 7.5 KG/S 300 K 100 Kpa 50 0.5 0.9 450 M/SDocument4 pagesExercise Problem # 1: 7.5 KG/S 300 K 100 Kpa 50 0.5 0.9 450 M/SSyed YousufuddinNo ratings yet

- B9.question Bank PQ&MDocument2 pagesB9.question Bank PQ&MBatva MayurNo ratings yet

- TV4KSDocument1 pageTV4KSthedamnedNo ratings yet

- AFX Tuning Manual REV 06Document15 pagesAFX Tuning Manual REV 06Derek KloogNo ratings yet

- Retrofitting With Forane Quickrefguide FinalDocument2 pagesRetrofitting With Forane Quickrefguide FinalCoolSolutions ElSalvadorNo ratings yet

- MINI End Mills Cutting DataDocument15 pagesMINI End Mills Cutting DataGábor BíróNo ratings yet

- Service Manual Type MCGG Overcurrent Relays For Phase and Earth FaultsDocument32 pagesService Manual Type MCGG Overcurrent Relays For Phase and Earth FaultsEmmanuel Entzana HdzNo ratings yet

- Service Manual: PN-2474B-A PN-2475D-A PN-2475F-A PN-2475F-BDocument12 pagesService Manual: PN-2474B-A PN-2475D-A PN-2475F-A PN-2475F-BMahmoud ElrefaeyNo ratings yet

- R1200GS Torque Values: FT-LB Values in REDDocument11 pagesR1200GS Torque Values: FT-LB Values in REDFebri Maulana100% (1)

- Cyrustek ES51966 (Appa 505)Document25 pagesCyrustek ES51966 (Appa 505)budi0251No ratings yet

- M-STripes Usage in Dudhwa Tiger ReserveDocument12 pagesM-STripes Usage in Dudhwa Tiger ReservePrakhar MisraNo ratings yet

- Folleto Estabilizadores Rolls-RoyceDocument6 pagesFolleto Estabilizadores Rolls-RoyceManuel Castelló NavarroNo ratings yet

- ReadmeDocument2 pagesReadmeJesus MorenoNo ratings yet

- TroubleshootingDocument54 pagesTroubleshootingbrenda zelaya venturaNo ratings yet

- Engineering Thermodynamics ProblemsDocument16 pagesEngineering Thermodynamics ProblemsMahantesh ChulakiNo ratings yet

- Certificate of Calibration: Customer InformationDocument2 pagesCertificate of Calibration: Customer InformationSazzath HossainNo ratings yet

- Problem-Set HumidificationDocument1 pageProblem-Set Humidificationari_blackroseNo ratings yet

- S200 2CSC400002D0211Document1,168 pagesS200 2CSC400002D0211Santiago Avaltroni50% (2)

- Internship Report on Reactive Dyes ManufacturingDocument39 pagesInternship Report on Reactive Dyes Manufacturingpawar vishalNo ratings yet

- C4 - Mixing, Fresh Properties, Casting, Demoulding and CuringDocument26 pagesC4 - Mixing, Fresh Properties, Casting, Demoulding and CuringTAN PANG ZORNo ratings yet

- Surveying Work Method StatementDocument5 pagesSurveying Work Method StatementKelvin TanNo ratings yet

- Intertanko Dry Dock ChecklistDocument14 pagesIntertanko Dry Dock Checklistsandeepkumar2311No ratings yet

- Structural TheoryDocument9 pagesStructural TheoryVincent ParagasNo ratings yet

- Ariel Tagapan DLP - Task SheetDocument3 pagesAriel Tagapan DLP - Task SheetArthur CapawingNo ratings yet

- Console Cherokee Sport 97 XJ Over ConsoleDocument8 pagesConsole Cherokee Sport 97 XJ Over ConsoleFrancisco KappsNo ratings yet