Professional Documents

Culture Documents

BRS Monthly (March 2015 Edition) PDF

Uploaded by

Randora LkOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BRS Monthly (March 2015 Edition) PDF

Uploaded by

Randora LkCopyright:

Available Formats

March 2015

BRS Monthly Market Report

BRS Monthly Market Report

Monthly Market Summary

Market Performance

Political woes affected market sentiment during the month of March, resulting in

both indices plummeting significantly. The ASPI came down by a staggering 480.95

points MoM while the S&P SL20 index dipped 263.45 points MoM.

The ASPI declined below 7,000 while the S&P SL20 index declined below the 4,000

mark during the month. The market capitalization fell below three trillion after

reaching it for the first time in September 2014.

The bourse moved on a slow pace throughout the month with most investors adopting a cautious approach. Activity was limited during the month with total volumes

contracting by 30% MoM to 652mn. Retail participation remained low throughout

the month. However, some interest was evident on low valued counters in the likes

of FLCH, SIRA, CIFL and PAP. FLCH contributed to ~9% of total volume for the month.

Exhibit 1: Monthly Market Snapshot

Closing

Opening

Change %

ASPI

6,820.34

7,301.29

6.60

S&P

SL 20

3,852.43

4,115.88

6.40

Exhibit 2: Monthly Index Performance

S&P SL20

ASPI

7,700

ASPI

4,300

S&P SL20

7,600

The market posted a turnover of LKR 17.27bn during the month with the highest

contribution coming from big wig JKH with a contribution of ~22%. The stock dipped

below the LKR 200 mark to LKR 196.20 towards the end of the month, albeit was

quick to recover. SEYB (N & X) collectively contributed ~14% of market turnover

aided by negotiated deals on the stock. Overall interest was evident on JKH and the

banking sector, albeit on thin volumes.

4,225

7,500

4,150

7,400

7,300

4,075

7,200

4,000

7,100

3,925

7,000

3,850

6,900

The construction and engineering sector declined by 22% MoM influenced by the

dip in price of AEL by LKR 8.00, which closed at LKR 19.20.

6,700

2-Mar-15

Foreigners were active for most part of the month, however a slowdown in activity

was witnessed at the end of March. Foreigners contributed ~31% to turnover and

~13% to volumes during the month. Foreigners were net buyers for the month

amounting to LKR 1.4bn. Average daily turnover for the month amounted to LKR

822mn (-42.2%) from a previous LKR 1.42bn.

Exhibit 4: Monthly Statistical Summary

Mkt.Turnover (LKR)

No. Trading Days

Avg. Daily Turnover (LKR)

17,271,652,394

21

822,459,638

3,775

6,800

3,700

7-Mar-15

11,961,372,352

Domestic Sales (LKR)

13,359,414,469

Foreign Purchases - (LKR)

5,310,280,044

Foreign Sales - (LKR)

3,912,237,927

Op.Index

Vol of turnover

% Vol of foreign turnover to vol of total turnover

Total No. of Trades

Market cap . - (LKR)(opening)

Market cap . - (LKR)(closing)

1,398,042,117

652,305,812

12.94%

100,581

22-Mar-15

27-Mar-15

Cl.Index

Chg %

Banks, Fin. & Ins.

18,982.14

17,735.31

-6.6%

Bev, Food & Tobacco

22,637.75

21,581.15

-4.7%

Chemicals & Phar.

7,367.99

6,880.29

-6.6%

Const. & Eng.

3,396.32

2,655.68

-21.8%

Diversified

1,928.77

1,790.48

-7.2%

Footwear & Textiles

1,005.57

998.34

-0.7%

-7.4%

Healthcare

IT

Inv. Trusts

Land & Prop.

Manufacturing

862.82

799.07

3,431.12

3,281.60

-4.4%

76.67

68.76

-10.3%

20,289.81

18,985.25

-6.4%

741.40

661.15

-10.8%

-5.2%

4,280.90

4,058.60

18,129.93

16,690.78

-7.9%

121,942.68

112,842.18

-7.5%

Plantations

814.76

757.03

-7.1%

Power & Energy

173.22

159.98

-7.6%

Services

27,101.48

26,150.98

-3.5%

Stores & Supplies

26,888.28

23,645.30

-12.1%

207.17

186.55

-10.0%

17,243.32

15,909.18

-7.7%

Motors

Net Foreign Inflow/(Outflow) (LKR)

17-Mar-15

Exhibit 3: Sector Indices

Hotels & Travels

Domestic Purchases (LKR)

12-Mar-15

Oil Palms

3,094,618,736,859

Telecommunications

2,891,168,282,342

Trading

Page 1

March 2015

BRS Monthly Market Report

Key Macroeconomic Indicators

TB Rates (as at 27.03.2015)

91 days

%

6.60

Commercial Bank

Lending Rate (AWPR) - monthly (02.04.2015)

%

6.90

182 days

6.70

Deposit Rate (AWDR) - monthly (31.03.2015)

5.83

364 days

6.80

SLIBOR (as at 31.03.2015)

Overnight

(%)

6.62

7 Days

6.87

1 Month

7.13

3 Months

7.31

6 Months

7.63

12 Months

7.94

Inflation Rate

March

Daily Money Market Rates (31.03.2015)

Market Repo Rate

Max

Min

WAR

Call Market Rate

Max

Min

WAR

%

7.50

6.15

6.40

6.70

6.55

6.64

February

Exchange Rates (27.02.2015)

Colombo Consumer Price Index

(CCPI) - 2006/07 = 100

178.1

178.9

Year on Year Change

0.1

0.6

Annual Average Change

2.5

2.9

Exhibit 5: Inflation

LKR

USD

134.73

GBP

200.03

EUR

146.65

JPY

1.13

Exhibit 6: Exchange Rate Movements

Index Number

(Base: 2006/07=100)

LKR

250

186

LKR./USD

184

230

182

210

LKR./Euro

LKR./BP

180

190

178

176

170

174

150

172

130

170

168

Headline

110

Core

166

90

164

Mar-13

Mar-14

May-14

Jul-14

Sep-14

Nov-14

Jan-15

May-13

Jul-13

Sep-13

Nov-13

Jan-14

Mar-14

May-14

Jul-14

Sep-14

Nov-14

Jan-15

Mar-15

Mar-15

Inflation, as measured by the CCPI decreased from 0.6% to 0.1% on

a YoY basis during the month of March. Annual average inflation

further declined to 2.5% in March from 2.9% in February. Core

inflation posted a decline in annual average change to 3.0% while

on a YoY basis core inflation increased to 1.4% from 0.8% a month

ago. The decline was due to the moderation of certain essential

food prices during the month. The decline in fuel and gas prices

also had a positive impact on the non food category during the

month.

Source: CBSL

Source: CBSL

Page 2

March 2015

BRS Monthly Market Report

Key Macroeconomic Indicators

Exhibit 7: Tourist Arrivals

No.

Tourist Arrivals 2012 to Date

200,000

180,000

2012

2013

2014

2015

160,000

140,000

120,000

100,000

80,000

60,000

40,000

20,000

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Arrivals in March increased 18% YoY to 157,051, while the first quarter of 2015 depicted a overall growth of 13.6% to 478,838 arrivals. Latin America, Caribbean and Western Europe recorded the highest number of arrivals amounting to 57, 094 posting a 27.4%

growth YoY. UK and Germany were the highest contributors to this segment. South Asia was the second largest contributor of

34,343 arrivals topped by the arrivals from India amounting to 21,838. Arrivals from China (Including Hong kong and Macau) continued to grow steadily posting a YoY growth of 81.5% to 13,975 arrivals.

Source: SLTDA

Exhibit 8: Monthly Foreign Flows - CSE

900

700

500

300

Inflow

100

31-Mar

30-Mar

27-Mar

26-Mar

25-Mar

24-Mar

23-Mar

20-Mar

19-Mar

18-Mar

17-Mar

16-Mar

13-Mar

12-Mar

11-Mar

10-Mar

9-Mar

6-Mar

4-Mar

3-Mar

-100

2-Mar

Outflow

-300

-500

Source: CSE

Page 3

March 2015

BRS Monthly Market Report

Commodity Market Write-up

Exhibit 9: Crude Oil

Exhibit 10: Copper

USD/barrel

USD/MT

125

WTI

115

8750

BRENT

105

8250

95

7750

85

7250

75

6750

65

6250

55

5750

45

35

5250

Mar-13

Sep-13

Mar-14

Sep-14

Mar-15

Mar-13 Jun-13 Sep-13 Dec-13 Mar-14 Jun-14 Sep-14 Dec-14 Mar-15

Source: US Energy Information Administration, Reuters

Source: London Metal Exchange, www.metalbulletin.com, Indonesian Mining Association

Oil prices plummeted further in the month of March with Brent

prices falling 13% MoM to USD 53.69/bbl and WTI dropping 4%

MoM to USD 47.72/bbl. The drop was mainly due to six world

powers entering into negotiations with Iran for a nuclear deal

that could bring more of its oil to the market with the ease of

sanctions on Iran.

Copper prices were on a downward trend in the recent months

with declining property prices in China, the worlds largest copper consumer. However, the MoM surge in March by 3.9% to

USD 5,925.45/MT is due to supply shortages caused by disruptions to mining output in Chile, Indonesia and Australia.

Exhibit 11: Rubber

Exhibit 12: Tea

LKR/kg

High

LKR

Medium

Low

AVG.

550.00

635

TPC 1X

Skim

RSS 2

555

500.00

475

450.00

395

400.00

315

350.00

235

300.00

155

75

Mar-13

250.00

Sep-13

Mar-14

Sep-14

Mar-15

Mar-13

Jun-13

Sep-13

Dec-13

Mar-14

Jun-14

Sep-14

Dec-14

Mar-15

Source: Rubber Traders Association, indexmundi

Source: Sri Lanka Tea Board, forbes and walker

Rubber prices further weakened during the month of March

hitting its lowest since 2009. TPC 1X declined 2.0% MoM to LKR

245/kg, Skim rubber plummeted 9.0% MoM to LKR 101.00/kg

and RSS 2 dropped 13.1% MoM to LKR 225.00/kg. The drop in

price was a result of the over supply in top producing countries

leading to imports in to Sri Lanka while the decline in oil prices

led to the reduction in price for synthetic rubber. Rubber production decreased by 24.4% during the month.

Average tea price dipped marginally by 0.6% MoM to LKR

415.64/kg during the month of March. High and medium grown

tea prices dipped 1.9% and 1.1% MoM to LKR 404.54/kg and

LKR 386.26/kg respectively. Low grown tea prices showed some

resilience during the month appreciating 1.9% MoM to LKR

426.30/kg. During the month tea production marginally declined by 0.6% MoM.

Page 4

March 2015

BRS Monthly Market Report

Exhibit 13: BRS Stocks In Focus

MPS

MTD

YTD

Historical

Trailing

Forecasted

Forward

DPS

Dividend

NAV

PBV

(LKR)

change %

Change %

EPS (LKR)

PER (x)

EPS (LKR)

PER (x)

(LKR)

Yield (%)

(LKR)

(x)

Banks, Finance & Insurance

CFIN

250.10

-7.37%

0.04%

31.38

7.97

31.11*

8.04

3.00

1.20%

223.74

1.12

CINS

1,691.70

1.91%

22.69%

96.46

17.54

N/A

N/A

16.00

0.95%

671.02

2.52

CINS(X)

625.00

4.17%

13.64%

96.46

6.48

N/A

N/A

16.00

2.56%

671.02

0.93

COMB

165.40

-7.34%

-3.27%

13.01

12.71

N/A

N/A

6.50

3.93%

70.90

2.33

COMB(X)

131.20

-5.68%

4.88%

13.01

10.08

N/A

N/A

6.50

4.95%

70.90

1.85

DFCC

202.80

-9.46%

-7.40%

11.89

17.06

9.96*

20.36

5.00

2.47%

181.14

1.12

HASU

85.00

-4.49%

1.80%

8.35

10.18

N/A

N/A

3.75

4.41%

48.28

1.76

HNB

222.00

-5.25%

13.90%

24.50

9.06

N/A

N/A

8.50

3.83%

168.67

1.32

HNB(X)

165.00

-8.89%

7.91%

24.50

6.73

N/A

N/A

8.50

5.15%

168.67

0.98

NTB

100.10

-5.03%

3.20%

11.00

9.10

N/A

N/A

2.10

2.10%

60.25

1.66

NDB

248.00

-4.62%

-0.80%

16.04

15.46

N/A

N/A

10.00

4.03%

148.85

1.67

SAMP

252.10

-5.93%

6.69%

31.35

8.04

28.99

8.70

11.00

4.36%

205.53

1.23

SEYB

100.00

1.73%

5.26%

9.21

10.86

N/A

16.39

2.50

2.50%

73.04

1.37

SEYB(X)

63.40

-0.78%

10.26%

9.21

6.88

N/A

10.39

2.50

3.94%

73.04

0.87

JINS

22.50

#N/A

-3.02%

2.92

7.71

2.44

9.22

1.00

4.44%

14.34

1.57

CTC

999.50

-8.40%

-5.72%

46.01

21.72

N/A

39.50

3.95%

20.81

48.03

DIST

240.50

0.21%

14.52%

20.68

11.63

18.36

13.10

3.00

1.25%

201.35

1.19

NEST

2,295.00

-0.93%

9.03%

61.51

37.31

N/A

N/A

60.00

2.61%

77.20

29.73

CIC

76.00

-7.88%

-10.59%

(0.73)

N/M

4.40

17.27

0.00%

71.00

1.07

CIC(X)

57.60

-12.86%

-13.25%

(0.73)

N/M

4.40

13.09

0.00%

71.00

0.81

165.50

-10.54%

-14.25%

12.89

12.84

2.25

73.56

4.00

2.42%

152.65

1.08

CARS

366.40

-11.71%

-14.87%

19.05

19.23

16.89*

21.69

2.00

0.55%

236.79

1.55

HAYL

300.00

-11.76%

-11.74%

24.11

12.44

30.12*

9.96

5.00

1.67%

334.37

0.90

HHL

73.70

-7.53%

-0.81%

3.34

22.07

3.15*

23.40

0.75

1.02%

28.69

2.57

JKH

199.40

-2.59%

-20.24%

12.07

16.52

13.87

14.38

3.50

1.76%

132.21

1.51

SPEN

99.50

-5.33%

-3.86%

9.04

11.01

7.21*

13.80

2.00

2.01%

82.57

1.21

SUN

48.00

-11.93%

-11.11%

4.47

10.74

4.70

10.21

0.95

1.98%

38.35

1.25

Beverage, Food & Tobacco

Chemicals & Pharmaceuticals

Construction & Engineering

DOCK

Diversified

1. Please note that the historical EPS represents the EPS reported for the last financial year, adjusted for non-recurring items, share splits, bonuses and share consolidations.

2. * Annualized EPS

3. ** Companies who have paid both cash and scrip dividends, during the last FY. However, DPS here only represents cash dividend

4. DPS figures represent per share dividend paid during the last FY and are adjusted for splits , bonus issues and share repurchases.

Page 5

March 2015

BRS Monthly Market Report

Exhibit 13: BRS Stocks In Focus

MPS

MTD

YTD

Historical

Trailing

Forecasted

Forward

DPS

Dividend

NAV

PBV

(LKR)

change %

Change %

EPS (LKR)

PER (x)

EPS (LKR)

PER (x)

(LKR)

Yield (%)

(LKR)

(x)

Healthcare

CHL

113.90

3.55%

-2.98%

6.98

16.32

7.85*

14.51

2.00

1.76%

83.89

1.36

75.10

-6.13%

-6.13%

6.98

10.76

7.85*

9.57

2.00

2.66%

83.89

0.90

AHPL

63.00

-7.35%

-7.08%

5.39

11.69

3.88

16.24

4.00

6.35%

49.23

1.28

AHUN

67.00

-14.10%

-14.65%

6.91

9.70

7.60

8.82

1.00

1.49%

45.45

1.47

CONN

71.50

-10.63%

-15.88%

7.83

9.13

8.60

8.31

4.50

6.29%

57.03

1.25

EDEN

21.00

-20.75%

-18.29%

4.16

N/M

N/A

N/A

0.00%

44.94

0.47

KHL

14.30

-13.33%

-15.88%

1.08

N/M

1.34

10.67

0.30

2.10%

12.50

1.14

PALM

45.90

-18.04%

-42.63%

(17.08)

N/M

0.00%

153.78

0.30

SHOT

28.00

-11.95%

-14.63%

0.12

233.33

N/A

N/A

0.00%

17.84

1.57

STAF

56.90

1.07%

3.08%

1.53

37.19

3.59

15.85

1.50

2.64%

37.50

1.52

ACL

76.00

-6.52%

-0.52%

7.40

10.27

6.36*

11.95

1.00

1.32%

104.48

0.73

KCAB

80.00

-4.19%

-10.51%

9.83

8.14

8.80*

9.09

1.50

1.88%

110.21

0.73

LLUB

392.90

-3.94%

-1.68%

21.10

18.62

24.08

16.32

15.00

3.82%

49.57

7.93

LWL

95.80

-3.23%

-1.54%

10.65

9.00

15.59

6.14

2.50

2.61%

113.03

0.85

TJL

24.10

-2.82%

16.99%

1.76

13.69

1.89

12.75

1.30

5.39%

10.27

2.35

RCL

111.00

-6.64%

-5.05%

9.71

11.43

16.94

6.55

1.00

0.90%

103.43

1.07

TKYO

54.90

-8.50%

-15.41%

6.90

7.96

6.90

7.96

1.00

1.82%

28.92

1.90

TKYO(X)

37.40

-13.02%

-20.26%

6.90

5.42

6.90

5.42

1.00

2.67%

28.92

1.29

DIAL

10.40

-13.33%

-21.80%

0.76

13.68

N/A

N/A

0.29

2.79%

5.50

1.89

SLTL

45.50

-6.19%

-8.82%

3.32

13.70

N/A

N/A

0.85

1.87%

35.40

1.29

CHL(X)

Hotels & Travels

Manufacturing

Telecommunications

Plantations

AGAL

27.90

9.41%

2.95%

(9.15)

N/M

N/A

N/A

0.00%

39.82

0.70

KGAL

85.80

-4.67%

-8.72%

13.84

6.20

8.78*

9.77

1.50

1.75%

143.93

0.60

KOTA

24.70

-16.27%

-21.84%

(7.51)

(3.29)

(15.60)*

N/M

0.00%

64.88

0.38

KVAL

71.90

-1.37%

-2.84%

1.47

48.91

N/A

N/A

0.00%

79.55

0.90

MAL

3.70

-15.91%

-17.78%

0.39

9.49

N/A

N/A

0.00%

72.81

0.29

WATA

20.00

0.00%

6.38%

2.10

9.52

2.31*

8.66

0.50

2.50%

18.10

1.10

TPL

35.10

-5.65%

6.36%

7.51

4.67

N/A

N/A

0.00%

67.60

0.52

LIOC

40.30

-11.23%

-32.83%

9.04

4.46

7.37*

5.47

1.50

3.72%

36.03

1.12

HPWR

18.90

4.42%

4.42%

(2.07)

(9.13)

N/A

N/A

0.75

3.97%

19.44

0.97

Power & Energy

1. Please note that the historical EPS represents the EPS reported for the last financial year, adjusted for non-recurring items, share splits, bonuses and share consolidations.

2. * Annualized EPS

3. ** Companies who have paid both cash and scrip dividends, during the last FY. However, DPS here only represents cash dividend

4. DPS figures represent per share dividend paid during the last FY and are adjusted for splits , bonus issues and share repurchases.

Page 6

March 2015

BRS Monthly Market Report

Announcements - Dividends

Company

CODE

Mercantile Investments & Finance PLC

Regnis (Lanka) PLC

DPS (LKR)

Final/ Interim

XD

PD

MERC

17.00

Interim

11.03.2015

19.03.2015

REG

7.00

Final

12.03.2015

19.03.2015

Singer Sri Lanka PLC

SINS

2.50

Final

12.03.2015

19.03.2015

Colombo Dockyard PLC

DOCK

3.00

First & final

12.03.2015

23.03.2015

Sierra Cables PLC

SIRA

0.20

Interim

12.03.2015

23.03.2015

Asiri Hospitals PLC

ASIR

0.50

Interim

18.03.2015

27.03.2015

Asiri Surgical Hospital PLC

AMSL

0.40

Interim

18.03.2015

25.03.2015

Trans Asia Hotels PLC

TRAN

1.50

Interim

18.03.2015

27.03.2015

Sanasa Development Bank PLC

SDB

2.50

Interim

Sanasa Development Bank PLC

SDB

1 for 15.08 shares

Scrip dividend

Lanka Aluminium Industries PLC

LALU

1.50

Interim

19.03.2015

30.03.2015

Overseas Realty (Ceylon) PLC

OSEA

0.50

Interim

07.03.2015

15.05.2015

Asian Hotels & Properties PLC

Subject to approval

Subject to approval

AHPL

1.00

Interim

20.03.2015

31.03.2015

CINS (N & X)

20.00

Final

23.04.2015

05.05.2015

Ceylon Investment PLC

CINV

2.50

Interim

30.03.2015

08.04.2015

Alumex PLC

ALUM

0.42

Interim

02.04.2015

16.04.2015

Ceylinco Insurance PLC

Announcements - Scrip Dividends

Company

Si nha pu th ra Fi na nce PLC

Proportion

XD

1 i nto 10 ordi na ry a n d pre fe re nce

s h a re s

Subje ct to a p prova l

Announcements - Rights Issue

Company

Overseas Rea lty (Ceyl on) PLC

Proportion

Issue Price (LKR)

XR

1 for 19

33.00

Subject to approval

Page 7

March 2015

BRS Monthly Market Report

Contact Us

Institutional Sales

Research

Voice

E- Mail

Nikita

5260204

nikita@bartleetreligare.com

angelo@bartleetreligare.com

Nusrath

5260210

nusrath@bartleetreligare.com

5220213

sujeewa@bartleetreligare.com

Jennita

5260207

jennita@bartleetreligare.com

Yadhavan

5220215

yadhavan@bartleetreligare.com

Thilini

5260208

thilini@bartleetreligare.com

Ahmadeen

5220218

ahamadeen@bartleetreligare.com

Rakshila

5260206

rakshila@bartleetreligare.com

Sonali

5260211

sonali@bartleetreligare.com

Voice

E- Mail

Murali

5220201/212

murali@bartleetreligare.com

Angelo

5220207/214

Sujeewa

Retail Sales

Voice

E- Mail

Vajira

5220217

vajira@bartleetreligare.com

Yusri

5220224

ymm@bartleetreligare.com

Dhanushka

5220222

dhanushka@bartleetreligare.com

Muditha

5220226

muditha@bartleetreligare.com

Business Development

Asitha

5220209

asitha@bartleetreligare.com

Dilusha

5220219

dilusha@bartleetreligare.com

Hiral

5220275

hiral@bartleetreligare.com

Iresh

5220274

iresh@bartleetreligare.com

Waruna

5220277

dewaraja@bartleetreligare.com

Suren Dayarathne

Voice

E- Mail

5220216

suren@bartleetreligare.com

Visit us at

www.bartleetreligare.com

Branches

Voice

E- Mail

Bandarawela

575675083

572225537

indrajith@bartleetreligare.com

Batticalo

655679525

Dehiwala

115238064

Galle

915633512

Jaffna

212221800

212220145

215671115

mohan@bartleetreligare.com

Kandy

815622779

815622781

812203710

dayananda@bartleetreligare.com

Kiribathgoda

115238065

112916711

Matara

415410005

415410006

Negombo

315677838

10

Panadura

382239610

11

Polonnaruwa

275678995

mahesh@bartleetreligare.com

12

Vauniya

245679544

mohan@bartleetreligare.com

13

Wellawatta

115633733

upul@bartleetreligare.com

gireesan@bartleetreligare.com

112737325

suren@bartleetreligare.com

milindu@bartleetreligare.com

heshan@bartleetreligare.com

412232985

412234926

thilina@bartleetreligare.com

samith@bartleetreligare.com

385678617

duminda@bartleetreligare.com

DISCLAIMER: In compiling this report, Bartleet Religare Securities (Pvt) Ltd has made every endeavour to ensure its accuracy but cannot hold ourselves responsible for any errors that may be found herein. We further disclaim all responsibility for any loss or damage which may be suffered by any person relying upon such

information or any options, conclusions or recommendations herein whether that loss or damage is caused by any fault or negligence in the part of Bartleet

Religare Securities (Pvt) Limited.

Page 8

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 2018 International Swimming Pool and Spa CodeDocument104 pages2018 International Swimming Pool and Spa CodeEngFaisal Alrai100% (3)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- BTL - 5000 SWT - Service Manual PDFDocument158 pagesBTL - 5000 SWT - Service Manual PDFNuno Freitas BastosNo ratings yet

- Inclusions in Gross IncomeDocument2 pagesInclusions in Gross Incomeloonie tunesNo ratings yet

- New Python Basics AssignmentDocument5 pagesNew Python Basics AssignmentRAHUL SONI0% (1)

- 03 September 2015 PDFDocument9 pages03 September 2015 PDFRandora LkNo ratings yet

- Wei 20150904 PDFDocument18 pagesWei 20150904 PDFRandora LkNo ratings yet

- Weekly Foreign Holding & Block Trade Update: Net Buying Net SellingDocument4 pagesWeekly Foreign Holding & Block Trade Update: Net Buying Net SellingRandora LkNo ratings yet

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkNo ratings yet

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkNo ratings yet

- Weekly Update 04.09.2015 PDFDocument2 pagesWeekly Update 04.09.2015 PDFRandora LkNo ratings yet

- Results Update Sector Summary - Jun 2015 PDFDocument2 pagesResults Update Sector Summary - Jun 2015 PDFRandora LkNo ratings yet

- Sri0Lanka000Re0ounting0and0auditing PDFDocument44 pagesSri0Lanka000Re0ounting0and0auditing PDFRandora LkNo ratings yet

- Daily 01 09 2015 PDFDocument4 pagesDaily 01 09 2015 PDFRandora LkNo ratings yet

- Press 20150831ebDocument2 pagesPress 20150831ebRandora LkNo ratings yet

- CCPI - Press Release - August2015 PDFDocument5 pagesCCPI - Press Release - August2015 PDFRandora LkNo ratings yet

- N D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Document5 pagesN D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Randora LkNo ratings yet

- ICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCDocument3 pagesICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCRandora LkNo ratings yet

- Press 20150831ea PDFDocument1 pagePress 20150831ea PDFRandora LkNo ratings yet

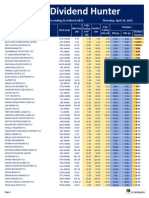

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkNo ratings yet

- Earnings & Market Returns Forecast - Jun 2015 PDFDocument4 pagesEarnings & Market Returns Forecast - Jun 2015 PDFRandora LkNo ratings yet

- Results Update For All Companies - Jun 2015 PDFDocument9 pagesResults Update For All Companies - Jun 2015 PDFRandora LkNo ratings yet

- Daily - 23 04 2015 PDFDocument4 pagesDaily - 23 04 2015 PDFRandora LkNo ratings yet

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkNo ratings yet

- Dividend Hunter - Apr 2015 PDFDocument7 pagesDividend Hunter - Apr 2015 PDFRandora LkNo ratings yet

- Janashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFDocument9 pagesJanashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFRandora LkNo ratings yet

- Chevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFDocument9 pagesChevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFRandora LkNo ratings yet

- CRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFDocument12 pagesCRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFRandora LkNo ratings yet

- Earnings Update March Quarter 2015 05 06 2015 PDFDocument24 pagesEarnings Update March Quarter 2015 05 06 2015 PDFRandora LkNo ratings yet

- Microfinance Regulatory Model PDFDocument5 pagesMicrofinance Regulatory Model PDFRandora LkNo ratings yet

- GIH Capital Monthly - Mar 2015 PDFDocument11 pagesGIH Capital Monthly - Mar 2015 PDFRandora LkNo ratings yet

- The Morality of Capitalism Sri LankiaDocument32 pagesThe Morality of Capitalism Sri LankiaRandora LkNo ratings yet

- Weekly Foreign Holding & Block Trade Update - 02 04 2015 PDFDocument4 pagesWeekly Foreign Holding & Block Trade Update - 02 04 2015 PDFRandora LkNo ratings yet

- Daily Stock Watch 08.04.2015 PDFDocument9 pagesDaily Stock Watch 08.04.2015 PDFRandora LkNo ratings yet

- Anzsco SearchDocument6 pagesAnzsco SearchytytNo ratings yet

- BCSS Sec Unit 1 Listening and Speaking SkillsDocument16 pagesBCSS Sec Unit 1 Listening and Speaking Skillsjiny benNo ratings yet

- Catalyst 4500 SeriesDocument1,230 pagesCatalyst 4500 SeriesnvleninkumarNo ratings yet

- Dbe Bes100 ZZ XXXX YyyDocument3 pagesDbe Bes100 ZZ XXXX Yyyjavierdb2012No ratings yet

- Filtomat M300Document4 pagesFiltomat M300Sasa Jadrovski100% (1)

- Lab 08: SR Flip Flop FundamentalsDocument6 pagesLab 08: SR Flip Flop Fundamentalsjitu123456789No ratings yet

- Put Them Into A Big Bowl. Serve The Salad in Small Bowls. Squeeze Some Lemon Juice. Cut The Fruits Into Small Pieces. Wash The Fruits. Mix The FruitsDocument2 pagesPut Them Into A Big Bowl. Serve The Salad in Small Bowls. Squeeze Some Lemon Juice. Cut The Fruits Into Small Pieces. Wash The Fruits. Mix The FruitsNithya SweetieNo ratings yet

- User Manual - Wellwash ACDocument99 pagesUser Manual - Wellwash ACAlexandrNo ratings yet

- D-Dimer DZ179A Parameters On The Beckman AU680 Rev. ADocument1 pageD-Dimer DZ179A Parameters On The Beckman AU680 Rev. AAlberto MarcosNo ratings yet

- Gulf Case Study SolnDocument9 pagesGulf Case Study SolnHarsh SNo ratings yet

- 20171025141013chapter-3 Chi-Square-Test PDFDocument28 pages20171025141013chapter-3 Chi-Square-Test PDFNajwa WawaNo ratings yet

- Segmentation of Qarshi Industries Private Limited PakistanDocument6 pagesSegmentation of Qarshi Industries Private Limited PakistanReader100% (1)

- Applications of Remote Sensing and Gis For UrbanDocument47 pagesApplications of Remote Sensing and Gis For UrbanKashan Ali KhanNo ratings yet

- CFA L1 Ethics Questions and AnswersDocument94 pagesCFA L1 Ethics Questions and AnswersMaulik PatelNo ratings yet

- Comparativa Microplex F40 Printronix P8220 enDocument1 pageComparativa Microplex F40 Printronix P8220 enangel ricaNo ratings yet

- English Examination 1-Bdsi-XiDocument1 pageEnglish Examination 1-Bdsi-XiHarsuni Winarti100% (1)

- Stadium and Club Tours - Senior Tour GuideDocument4 pagesStadium and Club Tours - Senior Tour GuidebizmbuuNo ratings yet

- Digital Economy 1Document11 pagesDigital Economy 1Khizer SikanderNo ratings yet

- Local, Local Toll and Long Distance CallingDocument2 pagesLocal, Local Toll and Long Distance CallingRobert K Medina-LoughmanNo ratings yet

- ASM NetworkingDocument36 pagesASM NetworkingQuan TranNo ratings yet

- Topics For Oral PresentationDocument6 pagesTopics For Oral PresentationMohd HyqalNo ratings yet

- Iot Practical 1Document15 pagesIot Practical 1A26Harsh KalokheNo ratings yet

- 04 10 ALINT DatasheetDocument2 pages04 10 ALINT DatasheetJoakim LangletNo ratings yet

- Computerised Project Management PDFDocument11 pagesComputerised Project Management PDFsrishti deoli50% (2)

- The Accreditation Committee Cityland Development CorporationDocument5 pagesThe Accreditation Committee Cityland Development Corporationthe apprenticeNo ratings yet