Professional Documents

Culture Documents

Jeter AA 4e SolutionsManual Ch16

Uploaded by

Dian Ayu PermatasariOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jeter AA 4e SolutionsManual Ch16

Uploaded by

Dian Ayu PermatasariCopyright:

Available Formats

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.

com

CHAPTER 16

ANSWERS TO QUESTIONS

1. Realization gains or losses are allocated to partners in their profit and loss ratio because the changes

in asset values are the result of risk assumed by the partnership. Also, because it may be difficult to

separate gains and losses that result from liquidation from the under- or over-statement in book

values that result from accounting policies followed in prior years.

2. The final cash distribution is based on capital balances, not on profit and loss ratios, since the

capital balance represents the partners' "residual claims" to the assets remaining after settlement of

partnership obligations.

3. Because the UPA order of payment ranks partnership obligations to a partner ahead of asset

distributions to a partner for capital investments, a debit balance in a partner's capital account will

create problems when that partner has an outstanding loan balance. Other partners will have a

claim against this partner for the amount of his/her debit balance which is considered to be an asset

of the partnership by the UPA. If the partner with a debit balance settles his/her obligation with the

partnership, there is no problem. However, if he/she can't settle, the other partners must absorb the

deficit as a loss, even though the partner with the debit balance had received cash for his/her

outstanding loan balance. To avoid this inequity, the courts have recognized the right of the

partnership to offset the loan balance against the debit capital balance.

4. Maintaining separate accounts for outstanding loan and capital accounts recognizes the legal

distinction between the two. This would be important if the liquidation is carried on over an

extended period, since the UPA provides that a partner is entitled to accrued interest on the loan

balance.

5. When the equity interest of one partner is inadequate to absorb realization losses several alternative

outcomes are possible. If the partner is personally solvent, he may pay the partnership for the

amount he is liable. If he/she is personally insolvent then the other partners must absorb his/her

debit balance in their respective profit and loss ratio. If the other partners are unsure of what the

partner with the debit balance will do, but still wish to distribute cash, they can assume the worst

(absorbing their share of the debit balance) to determine what amount of cash can be safely

distributed.

6. Cash should not be distributed to any partner until all liquidation losses are recognized in the

accounts or are provided for in determining a safe cash payment.

7. The classification of assets into personal and partnership categories in recognition of the rights of

both partnership creditors and creditors of the individual partners is referred to as "marshalling of

assets."

8. To the extent that personal creditors do not recover from personal assets they can seek recovery

from those partnerships assets still available after partnership obligations have been met. This

recovery, however, is limited to the extent that the partner involved has a credit interest in

partnership assets.

16 - 1

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

9. Because in an installment liquidation the amount of cash to be received from the unsold assets and

the resulting gain or loss is unknown, the partners should view each cash distribution as if it were

the final distribution.

10. The three assumptions upon which a safe cash distribution is determined are (1) any loan balances

to partners are offset against their capital accounts, (2) the remaining noncash assets will not

generate any more cash, and (3) any partner with a deficit capital balance will not settle his/her

obligation to the partnership. In other words, assume the worst.

The safe cash balance is computed as the difference between the current capital balances and the

balance required to maintain the above assumptions.

11. Unexpected costs are added to the book value of noncash assets. When the potential loss on the

noncash assets is allocated in the determination of a safe payment, these costs are also included.

12. The objective of the procedure is to bring the balance of the partners' capital accounts into the

agreed profit and loss ratio as soon as possible so that no one partner is placed in a better position

than any other partner.

13. The "loss absorption potential" is determined by dividing the partners' net capital balances by their

respective profit ratio. This determines the maximum amount of loss each partner can absorb.

14. The Uniform Partnership Act provides that the liabilities of the partnership shall rank in order of

payment as follows:

(1) Those owing to creditors other than partners,

(2) Those owing to partners other than for capital and profits,

(3) Those owing to partners in respect of capital,

(4) Those owing to partners in respect of profits.

Business Ethics Solution

Business ethics solutions are merely suggestions of points to address. The objective is to raise the

students' awareness of the topics, and to invite discussion. In most cases, there is clear room for

disagreement or conflicting viewpoints.

1) Partnership laws grant each partner the right to information about the firms business. This

allows each partner to monitor the firms activities. Given the circumstances of the case, it

would be your duty to inspect any questionable transaction. Furthermore, you should ask the

partner to explain the reason for increasing the cost by $10,000. This would give you the

opportunity to raise the concern regarding the presence of the previously undetected rock. If the

additional charge is not based on fact, the cost should be removed.

2) In the present scenario, it appears that the partner might be experiencing personal financial

pressures. However, the firms reputation and future implications of the action must be

considered for the benefit of the partnership. Your loyalty to your partner does not alter these

responsibilities. You may wish to find other, more constructive ways to offer assistance to your

partner in meeting his personal obligations, and surviving what may be a difficult time in his

life. However, ignoring the situation is dishonest to the client and is likely to result in more

serious long-term consequences.

Reference: http://www.lrc.ky.gov/KRS/362-01/403.PDF

16 - 2

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

ANSWERS TO EXERCISES

Exercise 16-1

Part A

Capital balances

Loan balances

Net interest

Potential loss - $50,000

Potential loss - $5,000

Cash distribution

Part B

(30%)

Cook

$(30,000)

_______

(30,000)

15,000

(15,000)

3,000

$(12,000)

(50%)

Parks

$(10,000)

(10,000)

(20,000)

25,000

5,000

(5,000)

$ -0-

Liabilities

Cash

25,000

Cook, Capital

Argo, Capital

Cash

12,000

3,000

Cash

Cook, Capital ($35,000 0.30)

Parks, Capital ($35,000 0 50)

Argo, Capital ($35,000 0.20)

Other Assets

15,000

10,500

17,500

7,000

Parks, Loan

Parks, Capital

10,000

25,000

15,000

50,000

10,000

Parks, Capital ($10,000 - $17,500 + $10,000)

Cook, Capital

Argo, Capital

Cash

16 - 3

2,500

7,500

5,000

15,000

(20%)

Argo

$(15,000)

______

(15,000)

10,000

(5,000)

2,000

$(3,000)

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Exercise 16-2

Part A

Account balances

Sale of assets

Payment to creditors

Cash distribution

Cash

$70,000

270,000

340,000

(98,000)

242,000

(242,000)

$ -0-

Noncash

Assets

Liabilities

$260,000

$(98,000)

(260,000) _______

0

(98,000)

_______

98,000

0

_______

_______

$ -0$ -0-

Part B 1. Cash

John

$(90,000)

(3,000)

(93,000)

_______

(93,000)

93,000

$ -0-

270,000

Other Assets

John, Capital

Jake, Capital

Joe, Capital

260,000

3,000

4,000

3,000

2. Liabilities

Cash

98,000

3. John, Capital

Jake, Capital

Joe, Capital

Cash

93,000

82,000

67,000

Exercise 16-3

Capital balances

Estimated loss on sale of assets ($45,000)

Allocate debit balance

Estimated cash payment

98,000

242,000

(1/3)

Doug

$(55,000)

15,000

(40,000)

11,500

$(28,500)

(1/3)

Dave

$(50,000)

15,000

(35,000)

11,500

$(23,500)

16 - 4

(1/3)

Dan

$8,000

15,000

23,000

(23,000)

$ -0-

Capital Balances

Jake

$(78,000)

(4,000)

(82,000)

_______

(82,000)

82,000

$ -0-

Joe

$(64,000)

(3,000)

(67,000)

_______

(67,000)

67,000

$ -0-

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Exercise 16-4

Capital balances

Drawing account

Loans

Operating loss

Liquidation loss

Allocate debit balance

Cash distribution

(1/5)

Amos

$(49,000)

10,000

4,200

2,400

(32,400)

733

$(31,667)

(2/5)

Boone

$(18,000)

15,000

(8,000)

8,400

4,800

2,200

(2,200)

$0

(2/5)

Childs

$(10,000)

20,000

(25,000)

8,400

4,800

(1,800)

1,467

$(333)

The first $40,000 is paid to satisfy the claims of creditors.

Exercise 16-5

Account balances

Sale of inventory, collect accounts receivable - allocate loss

Payment to creditors

Payment to partners (Schedule 1)

Cash

$10,000

38,000

48,000

(18,000)

30,000

(30,000)

$

0

Noncash

Assets

$130,000

(43,000)

87,000

87,000

_______

$87,000

Schedule 1

Capital balances

Allocation of potential loss

Allocation of deficit

Safe Payment

Brink

Davis

Olsen

$(43,000)

$(25,000)

$(49,000)

34,800

34,800

17,400

(8,200)

9,800

(31,600)

6,533

(9,800)

3,267

$(1,667) $ - 0 $(28,333)

16 - 5

Liabilities

$(18,000)

_______

(18,000)

18,000

0

_______

$

0

Capital Balances

Brink

Davis

Olsen

40%

40%

20%

$(45,000) $(27,000) $(50,000)

2,000

2,000

1,000

(43,000) (25,000) (49,000)

_______ _______ _______

(43,000) (25,000) (49,000)

1,667

28,333

$(41,333) $(25,000) $(20,667)

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Exercise 16-6

Part A

Balances

Sale of other assets and allocation of loss

Cash

$15,000

30,000

45,000

Noncash

Assets

$110,000

(110,000)

0

Liabilities

$(42,000)

0

(42,000)

Allocate Zack's debit balance

45,000

14,286

59,286

(42,000)

17,286

(17,286)

$0

Investment by Tom

Payment to creditors

Payment to Pete

(42,000)

(42,000)

42,000

0

Capital Balances

Pete

Tom

Zack

40%

30%

30%

$(55,000) $(14,000) $(14,000)

32,000

24,000

24,000

(23,000)

10,000

10,000

5,714

4,286

(10,000)

(17,286)

14,286

0

(14,286)

(17,286)

0

0

(17,286)

17,286

$0

$0

$0

Pete receives $17,286.

Tom makes an additional investment of $14,286.

Zack receives zero and cannot make an investment in the partnership because he is personally insolvent.

Part B

Personal

Assets

$55,000

30,000

30,000

Pete

Tom

Zack

Exercise 16-7

1. c

2. c

3. a

4. d

5. d

Personal

Liabilities

$80,000

10,000

50,000

Exercise 16-8

1. c; X =

2. b

3. d

4. c

5. d

($690,000 + X); X = $230,000

16 - 6

Excess

(Deficiency)

$(25,000)

20,000

(20,000)

0

$0

Distribution from

Partnership

$17,286

-----

0

$0

Total Payable

to Creditors

$72,286

10,000

30,000

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Exercise 16-9

Part A The partnership creditors will receive payment before any distributions are made to the partners. The creditors can seek recovery

from Q and S's personal assets after their personal creditors have been paid from their personal assets.

Part B The personal creditors have first claim to the personal assets. If they have not fully recovered the amount owed, they have a right

to partnership assets after partnership creditors to the extent the partner has a credit interest in the partnership.

Part C

Cash

Balances

Investment by Q

Payment of Liabilities

Allocation of T's deficit

Investment by S

Payment to partners

Liabilities

$(2,000)

_______

(2,000)

2,000

0

______

0

0

2,000

2,000

(2,000)

0

______

0

7,000

(7,000) ______

$

0

$

0 $

Q

$(500)

(2,000)

(2,500)

______

(2,500)

2,000

(500)

500

0

Part D & E

R

T

Personal Assets

$8,000

6,000

Partnership Distribution

$6,500

---

16 - 7

Total

$14,500

6,000

Capital Balance

R

S

T

$(7,500)

$6,000

$4,000

______

______ ______

(7,500)

6,000

4,000

______

______ ______

(7,500)

6,000

4,000

1,000

1,000

(4,000)

(6,500)

7,000

0

(7,000)

6,500

______ ______

$

0

$

0

$

0

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Exercise 16-10

Part A Net capital interest

Profit-loss ratio

Loss absorption potential

Order of cash distribution

Matt

Allen

Dave

$54,000

0.45

$120,000

1

$30,000

0.30

100,000

2

$18,000

0.25

$72,000

3

Loss Absorption Potential

Matt

Allen

Dave

0.45

0.30

0.25

$120,000 $100,000 $72,000

Profit-loss ratio

Loss absorption potential

Net capital interest

Distribution to Matt to reduce loss potential to Allen's

Balance after distribution

Distribution to Matt and Allen to reduce loss potential to Dave's

20,000

100,000

28,000

$72,000

______

100,000

28,000

$72,000

Remainder of assets distributed

Cash Distribution Plan

Order of Cash Distribution

1. First

$18,000

2. Next

$9,000

3. Next

$21,000

4. Remainder

Liabilities

100%

Part B

First $9,000 available to partner

Next $21,000

Total

Matt

45

Allen

30

Dave

25

100%

60%

45%

40%

30%

25%

Matt

$9,000

12,600

21,600

Allen

Dave

$8,400

$8,400

Matt, Loan

Matt, Capital

Allen, Capital

Cash

_______

$ -0-

10,000

11,600

8,400

30,000

16 - 8

______

72,000

______

$72,000

Assets Distribution

Matt

Allen

Dave

0.45

0.30

0.25

$54,000

9,000

45,000

12,600

$32,400

0.45

$30,000 $18,000

______ ______

30,000 18,000

8,400 ______

$21,600 $18,000

0.30

0.25

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

ANSWERS TO PROBLEMS

Problem 16-1

Part A - 1

DISCOUNT PARTNERSHIP

Schedule of Partnership Liquidation

January 14, 2008

Explanation

Balances before realization

Sales of noncash assets

Balances

Payment of liabilities

Balances

Allocation of Hardin's debit balance

Balances

Distribution of cash to partners

Balances

Cash

$25,000

60,000

85,000

Other Assets Liabilities

$120,000 $(40,000)

(120,000)

0

(40,000) __________

45,000

0

______

(40,000)

Capital Balances

Dawson

Feeney

Hardin

$(31,000) $(65,000) $(9,000)

18,000

(13,000)

18,000

9,000

40,000 ________ ________ ________

0

(13,000)

(41,000)

9,000

______ __________

45,000

0

______

0

3,857

(9,143)

(45,000) __________

$

0

$

0

______

$

0

9,143

$

0

16 - 9

24,000

(41,000)

5,143

(35,857)

(9,000)

0

35,857 ________

$

0

$

0

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Problem 16-1 (continued)

DISCOUNT PARTNERSHIP

Schedule of Partnership Liquidation

January 14, 2008

Part A - 2

Explanation

Balances before realization

Sales of noncash assets

Balances

Payment of liabilities

Balances

Cash investment by Hardin

Balances

Distribution of cash to partners

Balances

Cash Other Assets

$25,000

$120,000

60,000

85,000

(120,000)

0

(40,000)

45,000

9,000

54,000

(54,000)

$0

16 - 10

$0

Capital Balances

Liabilities

Dawson

Feeney

Hardin

$(40,000) $(31,000) $(65,000) $(9,000)

(40,000)

18,000

(13,000)

24,000

(41,000)

18,000

9,000

40,000

0

(13,000)

(41,000)

9,000

(13,000)

(41,000)

(9,000)

0

$0

13,000

$0

41,000

$0

$0

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Problem 16-1 (continued)

Part A 3

Explanation

Balances before realization

Sales of noncash assets

Balances

Payment of liabilities

Balances

Cash investment by Hardin

Balances

Allocation of Hardin's deficit

Balances

Distribution of cash to partners

Balances

Part B

DISCOUNT PARTNERSHIP

Schedule of Partnership Liquidation

January 14, 2008

Capital Balances

Cash Other Assets Liabilities

Dawson

Feeney

Hardin

$25,000

$120,000 $(40,000) $(31,000) $(65,000) $(9,000)

50,000

75,000

(120,000)

0

(40,000)

21,000

(10,000)

28,000

(37,000)

21,000

12,000

(40,000)

35,000

40,000

0

(10,000)

(37,000)

12,000

8,000

43,000

(10,000)

(37,000)

2,286

(34,714)

(4,000)

0

34,714

$0

$0

43,000

(43,000)

$0

$0

$0

8,286

$0

60,000

18,000

24,000

18,000

Liabilities

Cash

40,000

120,000

40,000

9,000

Hardin, Capital

Dawson, Capital

Feeney, Capital

Cash

1,714

(8,286)

Cash

Dawson, Capital

Feeney, Capital

Hardin, Capital

Other Assets

Cash

(8,000)

4,000

9,000

13,000

41,000

54,000

16 - 11

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Problem 16-2

Balances

Sale of asset and allocation of gain

Payment to creditors

Payment to partners (Schedule 1)

Sale of assets and allocation of gain

Payment to partners (Schedule 2)

Sale of assets and allocation of loss

Payment to partners

Sale of asset and allocation of loss

Payment to partners

Cash

$5,000

16,000

21,000

(20,000)

1,000

(1,000)

0

12,000

12,000

(12,000)

0

10,000

10,000

(10,000)

0

2,000

2,000

(2,000)

$0

Other

Assets

Liabilities

$60,000

$(20,000)

(12,000)

--48,000

(20,000)

--20,000

48,000

0

----48,000

0

(10,000)

--38,000

0

----38,000

0

(20,000)

--18,000

0

----18,000

0

(18,000)

--0

0

----$0

$0

Capital & Loan Balances

Nelson

Parker

Rice

0.40

0.30

$(20,000)

$(12,000) $(13,000)

(1,600)

(1,200) (1,200)

(21,600)

(13,200) (14,200)

------(21,600)

(13,200) (14,200)

1,000

--(20,600)

(13,200) (14,200)

(800)

(600)

(600)

(21,400)

(13,800) (14,800)

6,200

2,400

3,400

(15,200)

(11,400) (11,400)

4,000

3,000

3,000

(11,200)

(8,400) (8,400)

4,000

3,000

3,000

(7,200)

(5,400) (5,400)

6,400

4,800

4,800

(800)

(600)

(600)

800

600

600

$0

$0

$0

Schedules to Compute Safe Payments

Schedule 1

Capital Balance

Allocation of potential loss ($48,000)

Allocation of deficit balance

Safe payment

Nelson

$(21,600)

19,200

(2,400)

1,400

$(1,000)

Parker

$(13,200)

14,400

1,200

(1,200)

$0

Rice

$(14,200)

14,400

200

(200)

$0

Nelson

$(21,400)

15,200

$(6,200)

Parker

$(13,800)

11,400

$(2,400)

Rice

$(14,800)

11,400

$(3,400)

Schedule 2

Capital Balance

Allocation of potential loss ($38,000)

Safe payment

16 - 12

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Problem 16-3

Beginning Balances

3/15 asset sale

3/16 A/R sale

3/16 pay creditors

3/18 cash distribution (Schedule 1)

3/19 adjustment to fair value

3/19 withdrawal by Murphey

3/21 sale allocate loss

3/25 assign lease

3/25 cash distribution (Schedule 2)

4/1 adjustment to fair value

4/1 withdrawal by Hamm

4/5 sale and allocate loss

4/6 investment by Hamm

4/6 final distribution

Cash

$10,000

80,000

90,000

26,000

116,000

(110,000)

6,000

(5,000)

1,000

--1,000

--1,000

30,000

31,000

12,000

43,000

(43,000)

0

--0

--0

4,000

4,000

2,000

6,000

(6,000)

$0

Other

Assets

Liabilities

$218,000

$(110,000)

(90,000)

--128,000

(110,000)

(30,000)

--98,000

(110,000)

--110,000

98,000

0

----98,000

0

3,000

--101,000

0

(13,000)

--88,000

0

(50,000)

--38,000

0

----38,000

0

----38,000

0

(2,000)

--36,000

0

(8,000)

--28,000

0

(28,000)

--0

0

----0

0

----$0

$0

16 - 13

Capital & Loan Balances

Hann

Murphey

Ryan

0.50

0.30

0.20

$(50,000)

$(42,000) $(26,000)

5,000

3,000

2,000

(45,000)

(39,000) (24,000)

2,000

1,200

800

(43,000)

(37,800) (23,200)

------(43,000)

(37,800) (23,200)

--4,200

800

(43,000)

(33,600) (22,400)

(1,500)

(900)

(600)

(44,500)

(34,500) (23,000)

--13,000

--(44,500)

(21,500) (23,000)

10,000

6,000

4,000

(34,500)

(15,500) (19,000)

(6,000)

(3,600) (2,400)

(40,500)

(19,100) (21,400)

21,500

7,700

13,800

(19,000)

(11,400) (7,600)

1,000

600

400

(18,000)

(10,800) (7,200)

8,000

----(10,000)

(10,800) (7,200)

12,000

7,200

4,800

2,000

(3,600) (2,400)

(2,000)

----0

(3,600) (2,400)

--3,600

2,400

$0

$0

$0

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Problem 16-3 (continued)

Schedules to Compute Safe Payments

Schedule 1

Capital balances

Allocation of potential loss ($99,000)

Allocation of deficit balance

Safe cash payment

Hann

0.50

$(43,000)

49,500

6,500

(6,500)

$0

Murphey

0.30

$(37,800)

29,700

(8,100)

3,900

$(4,200)

Ryan

0.20

$(23,200)

19,800

(3,400)

2,600

$(800)

Schedule 2

Capital balance

Allocation of potential loss ($38,000)

Safe cash distribution

Problem 16-4

Part A Balances before realization

Sale of assets

Hann

Murphey

$(40,500)

$(19,100)

19,000

11,400

$(21,500)

$(7,700)

Ryan

$(21,400)

7,600

$(13,800)

MARY, PAULA, AND RAY

Schedule of Partnership Liquidation

Cash

$10,000

20,000

30,000

Other

Assets

Liabilities

$100,000

$(40,000)

(100,000)

0

(40,000)

0

(40,000)

Mary

0.40

$(50,000)

32,000

(18,000)

8,000

(10,000)

(40,000)

40,000

$0

(10,000)

10,000

$0

Allocate Ray's debit balance

Investment by Paula

Distribution of cash

30,000

20,000

50,000

(50,000)

$0

$0

Paula

0.30

$(10,000)

24,000

14,000

6,000

20,000

(20,000)

0

Mary will receive $10,000.

Paula must invest $20,000.

Ray is personally insolvent and cannot make an investment in the partnership to eliminate the deficit balance.

16 - 14

$0

Ray

0.30

$(10,000)

24,000

14,000

(14,000)

0

0

$0

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Problem 16-4 (continued)

Part B

Payments to Personal Creditors

Personal

$50,000

10,000

30,000

Mary

Paula

Ray

Partnership

Distribution

$10,000

0

0

Total

$60,000

10,000

30,000

Problem 16-5

Part A Capital and loan balances

Profit and loss ratio

Loss absorption potential

Order of cash distribution

Profit and loss rates

Loss absorption potential

Net capital interest

Reduce loss absorption potential of Baker

Reduce loss absorption potential of

-Baker

-Weak

Baker

$55,000

.40

$137,500

1

Strong

$45,000

.40

$112,500

3

Weak

$24,000

.20

$120,000

2

Loss Absorption Potential

Baker

Strong

Weak

.40

.40

.20

$137,500

$112,500

$120,000

17,500

120,000

112,500

120,000

Weak

.20

$45,000

$24,000

45,000

24,000

$45,000

0.40

1,500

$22,500

0.20

3,000

$112,500

7,500

$112,500

Remainder

$17,000

7,000

4,500

Cash Distribution

Strong

.40

$55,000

7,000

48,000

7,500

$112,500

First

Next

Next

Remainder

Baker

.40

Creditors

100%

$45,000

0.40

Cash Distribution

Baker

Strong

Weak

100%

67%

40%

33%

20%

16 - 15

40%

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Problem 16-5 (continued)

To Creditors

To Baker

To Baker and Weak

Remainder -Profit and Loss Ratio

Part B

July

Account balances

Collection of accounts receivable

Sale of inventory

Paid liquidation expenses

Cash distribution (Schedule 1)

Account balances (end of July)

August

Paid liquidation expenses

Gain on equipment

Withdrawal on equipment

Cash distribution (Schedule 2)

Account balances (end of August)

September

Sale of equipment

Paid liquidation expense

Balances

Cash distribution

Total

$17,000

7,000

4,500

77,500

$106,000

Creditors

$17,000

Cash Distribution

Baker

Strong

Weak

$7,000

3,000

$1,500

31,000

$41,000

$17,000

$31,000

$31,000

15,500

$17,000

Accounts

Plant and Accounts

Baker

Strong

Weak

Cash Receivable Inventory Equipment

Payable

0.40

0.40

0.20

$6,000

$22,000 $14,000

$99,000 $(17,000) $(55,000) $(45,000) $(24,000)

16,500

(22,000)

2,200

2,200

1,100

10,000

(14,000)

1,600

1,600

800

(1,000)

400

400

200

(23,500)

17,000

6,500

8,000

0

0

99,000

0 (44,300) (40,800) (21,900)

(1,500)

600

(2,400)

600

(2,400)

3,750

(42,350)

250

(42,350)

(12,800)

0

0

$0

8,000

400

(33,950)

33,950

$0

8,000

400

(33,950)

33,950

$0

4,000

200

(8,600)

8,600

$0

6,000

(10,000)

(4,000)

2,500

75,000

(1,000)

76,500

(76,500)

$0

95,000

(95,000)

0

0

$0

16 - 16

0

0

$0

0

0

$0

300

(1,200)

10,000

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Problem 16-5 (continued)

Schedule 1

Total

Creditors

$17,000

$17,000

6,500_______

$23,500

$17,000

First $17,000

Up to $7,000

0.4

Baker

0.4

Strong

0.2

Weak

$6,500

$6,500

Schedule 2

Capital balances

Potential loss of $95,000 plus

Cash retained 97,500 0.4 =

97,500 0.4 =

97,500 0.2 =

$(46,100)

39,000

______

_______

(7,100)

(3,600)

3,350

_______

$(3,750)

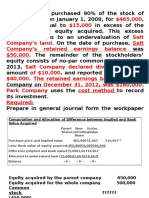

Capital balances, 1/1/2008

Add: Investments

Net income allocation*

Totals

Less: Withdrawals

Capital balances, 12/31/2008

$60,000

$60,000

$60,000

Malone

$

0

140,000

21,000

161,000

30,000

$131,000

($140,000/$400,000)

($160,000/$400,000)

($100,000/$400,000)

Part B Malone, Capital

Malone, Drawing

Patton

$

0

160,000

24,000

184,000

0

$184,000

Spencer

$

0

100,000

15,000

115,000

0

$115,000

$21,000

24,000

15,000

$60,000

30,000

30,000

Income Summary

Malone, Capital

Patton, Capital

Spencer, Capital

60,000

21,000

24,000

15,000

16 - 17

19,500

6,700

(6,700)

3,350 _______

$(250)

$0

MALONE, PATTON, AND SPENCER

Statement of Changes in Partners' Capital

For the Year Ended December 31, 2008

Part A

* Malone

Patton

Spencer

Total

$(12,800)

39,000

Allocate Weak's potential deficit

1/2

1/2

Problem 16-6

$(42,600)

Total

$

0

400,000

60,000

460,000

30,000

$430,000

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Problem 16-6 (continued)

Part C On next page

Part D Cash

Malone, Capital

Patton, Capital

Spencer, Capital

Accounts Receivable

Inventory

Furniture and Fixtures

243,000

36,400

41,600

26,000

Accounts Payable

Cash

74,000

Patton, Capital

Mortgage Payable

Land

Building

120,000

145,000

129,000

188,000

30,000

74,000

85,000

180,000

Malone, Capital

Patton, Capital

Spencer, Capital

Cash

94,600

22,400

89,000

206,000

16 - 18

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Problem 16-6 (continued)

Part C

MALONE, PATTON, AND SPENCER

Schedule of Partnership Liquidation

January 2, 2009

Explanation

Capital Balances

Malone

Patton

Spencer

Other Assets Liabilities

35%_

40%_

25%_

$612,000 $(219,000) $(131,000) $(184,000) $(115,000)

Balances before realization

Cash

$37,000

Sales of noncash assets

Balances

243,000

280,000

(347,000)

265,000

________

(219,000)

36,400

(94,600)

41,600

(142,400)

26,000

(89,000)

Payment of accounts payable

Balances

(74,000)

206,000

__________

265,000

74,000

(145,000)

________

(94,600)

________

(142,400)

________

(89,000)

Distribution of land, bldg., and assumption of mortgage

Balances

________

206,000

(265,000)

0

145,000

0

________

(94,600)

120,000

(22,400)

________

(89,000)

Distribution to partners

Balances

(206,000)

$0

__________

$0

________

$0

94,600

$0

22,400

$0

89,000

$0

Accounts Receivable

Inventory

Furniture/Fixtures

Total

Sales Price

$ 92,000

141,000

10,000

$243,000

Book Value

$129,000

188,000

30,000

$347,000

16 - 19

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Problem 16-7

Part A Valuation Adjustment

Accumulated Depreciation

Office Equipment

Allowance for Uncollectibles

Jan, Loan

2,700

12,600

14,200

900

200

Jan, Loan

Jan, Capital

6,600

Jan, Capital

Sue, Capital

Valuation Adjustment

1,350

1,350

6,600

2,700

Part B Jan, Capital ($29,400 + $6,600 - $1,350)

Sue, Capital ($28,000 $1,350)

Capital Stock (400 $100)

Additional Paid-in Capital

Proof

Cash

Accounts receivable

Allowance for uncollectibles

Prepaid insurance

Office equipment

Total stockholders' equity

34,650

26,650

40,000

21,300

$15,000

32,400

(2,900)

800

16,000

$61,300

16 - 20

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Problem 16-8

Part A 1. Starnes, Capital

Cash

Partners 1-9, Capital ($50,000 90/95)

Partner 10, Capital ($50,000 5/95)

Cash

125,000

75,000

47,368

2,632

150,000

Norwood, Capital ($2,500,000 5%)

Partners 1-9, Capital ($25,000 90/95)

Partner 10, Capital ($25,000 5/95)

125,000

23,684

1,316

2. Because Alan is now a partner in the partnership, it is more difficult to determine the

exact amount of his compensation because he will be taxed on his "share of partnership

earnings" reported to him on his Schedule K-1 from BSM. While this share of earnings

will most likely bear a relationship to the draws taken by Alan, it will undoubtedly be

more or less than $216,000 ($18,000

12). Alan must also consider the following

additional expenses which correspond to his increased compensation and status as a

partner:

(a)

Increased individual income tax to correspond to his increased earnings.

(b)

Self-employment tax. As an employee this was withheld from wages at a rate of

7.65% (2002 rate; with a ceilings of $84.900 for 6.2% of the tax). Now that Alan is

a partner, he must pay these taxes himself at a rate of 15.3% with the same ceiling,

and with an offsetting deduction for 50% of the self-employment tax. This

additional tax must be remitted with Alan's individual income tax return.

(c)

Alan has invested $150,000 in the partnership. If he borrowed the funds to join, he

must make interest and principal payments on the debt. The amount of required

annual payments depends of course on the interest rate and term of the loan. If he

used his own funds (say from a mutual fund earning 10%) for the investment, he has

traded the earning power of the funds for earnings from the partnership. He has

given up $15,000 in income from the former investment.

3. Alan should be concerned about the true value of a 5% interest in the partnership since

Mr. Starns was paid $75,000 for his 5% interest while within the same time frame, Alan is

expected to pay $150,000 for an equivalent interest. There may be mitigating

circumstances (e.g. Mr. Starns contributes little to the firm, Alan lacks sufficient ability to

bring in new clients), but Alan has a clear signal of a discrepancy which should prompt

him to ask questions before investing in the partnership.

16 - 21

To download more slides, ebook, solutions and test bank, visit http://downloadslide.blogspot.com

Problem 16-8 (continued)

Part B 1. This matter is sometimes addressed in employment contracts. Some professional firms

require employees to agree not to actively recruit clients upon their departure from the

firm. Barring such a specific agreement or firm precedent (and profession-related

guidelines), Alan and Mary must determine the basis on which they can rely to call a

BSM client "their client". This may involve such issues as whether Alan or Mary were

involved in bringing the client to BSM originally, or it may involve the extent to which

the BSM clients were served by the firm as opposed to exclusively by Alan or Mary.

Further, if the client's interests are better served by BSM as a larger firm or by Alan and

Mary in a smaller firm, that should enter the decision made by the departing employees.

2. It may be difficult to block actions by Alan and Mary if a written agreement is not in

existence. Clearly, the BSM partners can enlighten clients to any benefits of remaining a

BSM client.

Part C 1. Current Net income

Partners 1-9, Capital ($25,000 90%)

Partners 10-11, Capital ($25,000 10%)

Cash

25,000

22,500

2,500

8,000,000

Accounts Receivable

8,000,000

Liabilities - Outside

Starns, Loan

Cash

7,490,000

10,000

7,500,000

Partners 1-9, Capital ($3,750 90/95)

Partner 10, Capital ($3,750 5/95)

Starns, Capital ($125,000 - $130,000 + $1,250 = $3,750)

3,553

197

3,750

Partners 1-9, Capital ($2,395,000 90/95)

2,268,947

Partner 10, Capital ($2,395,000 5/95)

126,053

Cash

2,395,000

($2,025,000 - $130,000 + $8,000,000 - $7,500,000 = $2,395,000)

2. Yes. The debit balance in the Starns capital account is considered a partnership asset.

Judicial precedent exists to allow offset of the liability by the debit capital account

balance. The net payment to the partner with the debit capital account leaves both the

partnership and partner's obligations fully paid without "endangering" the capital of other

partners.

16 - 22

You might also like

- Southeast Shoe Distributor 2006Document12 pagesSoutheast Shoe Distributor 2006Benny SuhendraNo ratings yet

- 4.1 Enron The Control Environment RatanDocument3 pages4.1 Enron The Control Environment RatanNurul Islam 18352216600% (1)

- Case 3.1 EnglishDocument10 pagesCase 3.1 EnglishIbnu Zaqi FirdausNo ratings yet

- BAB 4 Analyzing Investing Activities 220916 PDFDocument15 pagesBAB 4 Analyzing Investing Activities 220916 PDFHaniedar NadifaNo ratings yet

- Accounting Theory Chapter 4Document18 pagesAccounting Theory Chapter 4gabiNo ratings yet

- Chapter 11Document10 pagesChapter 11HusainiBachtiarNo ratings yet

- Introduction to Farm Management DecisionsDocument90 pagesIntroduction to Farm Management DecisionsSwapnil AshtankarNo ratings yet

- Business Finance ExamDocument5 pagesBusiness Finance Examlope pecayo80% (5)

- p8-1 Tugas GSLCDocument3 pagesp8-1 Tugas GSLCelaine aureliaNo ratings yet

- 8 (Terbaru) CHANGES in OWNERSHIP INTEREST - Advanced Accounting, 5th EditionDocument29 pages8 (Terbaru) CHANGES in OWNERSHIP INTEREST - Advanced Accounting, 5th EditionParamithaNo ratings yet

- Chapter 6 (Installment Sales)Document3 pagesChapter 6 (Installment Sales)Jean100% (1)

- Audit Report AnalysisDocument9 pagesAudit Report AnalysisRey Aurel TayagNo ratings yet

- MINI CASE - CH 14Document2 pagesMINI CASE - CH 14Dedi JayadiNo ratings yet

- Chap 016Document63 pagesChap 016Morisa Septiani100% (2)

- Improving Expenditure Cycle EfficiencyDocument21 pagesImproving Expenditure Cycle EfficiencyJuan Rafael FernandezNo ratings yet

- Case 6.2Document5 pagesCase 6.2Azhar KanedyNo ratings yet

- CHPT 12 Derivatives and Foreign Currency: Concepts and Common TransactionsDocument9 pagesCHPT 12 Derivatives and Foreign Currency: Concepts and Common TransactionsKamran ShafiNo ratings yet

- Statistical Sampling QuestionDocument4 pagesStatistical Sampling QuestionNad Adenan100% (1)

- Chapter 1 Oakdale Inc.Document15 pagesChapter 1 Oakdale Inc.Ronald Flores100% (1)

- Chapter 2Document26 pagesChapter 2IstikharohNo ratings yet

- Auditing CH 22Document9 pagesAuditing CH 22saruyaNo ratings yet

- Chapter 13 - Overview of A Group AuditDocument48 pagesChapter 13 - Overview of A Group AuditGarini Putri ParamesthiNo ratings yet

- The Concept of Cost Attach Is The Theory Based On The Assumption That The Value in Any CommodityDocument1 pageThe Concept of Cost Attach Is The Theory Based On The Assumption That The Value in Any CommodityAlexius Julio BrianNo ratings yet

- CH 01Document7 pagesCH 01Justin J-Five Anderson100% (3)

- CH 12.palepuDocument15 pagesCH 12.palepumclaren685100% (1)

- Important Note To InstructorsDocument21 pagesImportant Note To InstructorsHassan KhaledNo ratings yet

- Chapter 14Document30 pagesChapter 14Tumpal Sagala100% (1)

- SOAL LATIHAN MK - AKL - FC TransactionsDocument4 pagesSOAL LATIHAN MK - AKL - FC Transactionscaca natalia100% (1)

- Resolve Contract Disputes with Original ContractDocument27 pagesResolve Contract Disputes with Original ContractMhmd HabboshNo ratings yet

- Intercompany Inventory Transactions: Mcgraw-Hill/IrwinDocument123 pagesIntercompany Inventory Transactions: Mcgraw-Hill/IrwinsresaNo ratings yet

- On January 1 2014 Paxton Company Purchased A 70 InterestDocument1 pageOn January 1 2014 Paxton Company Purchased A 70 InterestMuhammad ShahidNo ratings yet

- Solution Manual For Advanced Accounting 11th Edition by Beams 3 PDF FreeDocument14 pagesSolution Manual For Advanced Accounting 11th Edition by Beams 3 PDF Freeluxion bot100% (1)

- Audit CH 19 Completing The AuditDocument19 pagesAudit CH 19 Completing The AuditAnji GoyNo ratings yet

- Overview of Financial Statement AnalysisDocument25 pagesOverview of Financial Statement Analysisxxcocxine100% (1)

- Chapter 20 - MenbiDocument41 pagesChapter 20 - MenbiMayadianaSugondo100% (1)

- CH 11 PDFDocument33 pagesCH 11 PDFRizal SyaifuddinNo ratings yet

- Intercompany Inventory and Land Profits: Solutions Manual, Chapter 6Document40 pagesIntercompany Inventory and Land Profits: Solutions Manual, Chapter 6HelloWorldNowNo ratings yet

- Chapter 1 SolutionsDocument6 pagesChapter 1 SolutionsBoy PakpahanNo ratings yet

- Intercompany Inventory TransactionsDocument3 pagesIntercompany Inventory TransactionsMeysi SoviaNo ratings yet

- AP - Liabilities - Without AnswersDocument2 pagesAP - Liabilities - Without AnswersstillwinmsNo ratings yet

- TUGAS SIA1 EY Kelompok 6Document54 pagesTUGAS SIA1 EY Kelompok 6Marcell ArifinNo ratings yet

- ACL 9 Tutorial 3: Aging Accounts Receivable, Joining Data Files, and Identifying Unmatched RecordsDocument6 pagesACL 9 Tutorial 3: Aging Accounts Receivable, Joining Data Files, and Identifying Unmatched RecordsFiyo DarmawanNo ratings yet

- Chapter 7 - The FASB ' S Conceptual FrameworkDocument29 pagesChapter 7 - The FASB ' S Conceptual FrameworkelizabethNo ratings yet

- Audit Chapter SolutionsDocument3 pagesAudit Chapter SolutionsJana WrightNo ratings yet

- Rais12 SM ch13Document32 pagesRais12 SM ch13Edwin MayNo ratings yet

- Appendix B Solutions to Self-Test ProblemsDocument30 pagesAppendix B Solutions to Self-Test ProblemsjuanggamaNo ratings yet

- Chap 008Document61 pagesChap 008nhildebrNo ratings yet

- Chapter 4Document25 pagesChapter 4Anonymous XOv12G67% (3)

- Download More Slides, Ebook, Solutions and Test BankDocument17 pagesDownload More Slides, Ebook, Solutions and Test BankIndra Pramana50% (2)

- Audit ProgramDocument4 pagesAudit ProgramJoey BeringuelaNo ratings yet

- Behavioral Research in Management Accounting The Past, Present, and FutureDocument24 pagesBehavioral Research in Management Accounting The Past, Present, and FutureBabelHardyNo ratings yet

- 18-32 (Objectives 18-2, 18-3, 18-4, 18-6)Document8 pages18-32 (Objectives 18-2, 18-3, 18-4, 18-6)image4all100% (1)

- Importing Exporting Journal Entries FX RatesDocument2 pagesImporting Exporting Journal Entries FX RatesSandra SholehahNo ratings yet

- Financial Reporting Error CorrectionDocument14 pagesFinancial Reporting Error CorrectionSel AtenionNo ratings yet

- Partnership Liquidation and Termination ProcessDocument34 pagesPartnership Liquidation and Termination ProcessclevereuphemismNo ratings yet

- Chapter 03, Modern Advanced Accounting-Review Q & ExrDocument35 pagesChapter 03, Modern Advanced Accounting-Review Q & Exrrlg481483% (12)

- Liquidating Partnerships and Distributing CashDocument54 pagesLiquidating Partnerships and Distributing Cashthriu86% (7)

- Fischer11e Chap14 FinalDocument32 pagesFischer11e Chap14 Finalstr8dop30% (1)

- Partnerships: Termination and Liquidation: Chapter OutlineDocument51 pagesPartnerships: Termination and Liquidation: Chapter OutlineJordan Young100% (1)

- Fischer11e SMChap14 FinalDocument38 pagesFischer11e SMChap14 Finalgilli1trNo ratings yet

- Lesson 5 Accounting For Partnership Liquidation - Lump SumDocument13 pagesLesson 5 Accounting For Partnership Liquidation - Lump SumKenneth NinalgaNo ratings yet

- Chap 015Document44 pagesChap 015Ashley Lynn100% (1)

- Dissolution QuizDocument2 pagesDissolution QuizveriNo ratings yet

- MPF753+Finance+T3+2015 W5-1slideDocument40 pagesMPF753+Finance+T3+2015 W5-1slideAnkurNo ratings yet

- FINAL SLIDE - Financial Distress Among UNIMAS StudentsDocument48 pagesFINAL SLIDE - Financial Distress Among UNIMAS StudentsChristinus NgNo ratings yet

- Invoice DocumentDocument1 pageInvoice DocumentAman SharmaNo ratings yet

- Financial Markets and Institutions PowerPoint SlidesDocument24 pagesFinancial Markets and Institutions PowerPoint Slideshappy aminNo ratings yet

- GSC SelfPrint TicketDocument1 pageGSC SelfPrint Ticketrizal.rahmanNo ratings yet

- Understanding Working Capital Needs and Financing OptionsDocument66 pagesUnderstanding Working Capital Needs and Financing OptionsAamit KumarNo ratings yet

- What is a continuing guaranteeDocument9 pagesWhat is a continuing guaranteeSuchitra SureshNo ratings yet

- Gift Case InvestigationsDocument17 pagesGift Case InvestigationsFaheemAhmadNo ratings yet

- Responsibility of DDOs PDFDocument64 pagesResponsibility of DDOs PDFRanga Nayak PaltyaNo ratings yet

- Inventory ManagementDocument3 pagesInventory Managementrayjoshua12No ratings yet

- Master SiomaiDocument18 pagesMaster SiomaiShierdy Lynn E. NorialNo ratings yet

- Discounted Cash Flow Valuation Concept Questions and ExercisesDocument3 pagesDiscounted Cash Flow Valuation Concept Questions and ExercisesAnh TramNo ratings yet

- Business Cae - Cameron LNGDocument12 pagesBusiness Cae - Cameron LNGDavidNo ratings yet

- United States Court of Appeals, Third CircuitDocument13 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- The CQF Careers Guide 2023Document45 pagesThe CQF Careers Guide 2023ashaik1No ratings yet

- Accounting Organizations and SocietyDocument24 pagesAccounting Organizations and SocietyJuni TambunanNo ratings yet

- 2 Philippine Financial SystemDocument11 pages2 Philippine Financial SystemSTELLA MARIE BAUGBOGNo ratings yet

- Closing OperationsDocument88 pagesClosing OperationsNavyaKmNo ratings yet

- Key Technical Questions For Finance InterviewsDocument27 pagesKey Technical Questions For Finance InterviewsSeb SNo ratings yet

- Statement of Account: State Bank of IndiaDocument10 pagesStatement of Account: State Bank of IndiaPriya ShindeNo ratings yet

- Ceiling Legend: Shop DrawingDocument1 pageCeiling Legend: Shop DrawingHelmi Achmad FauziNo ratings yet

- Banking Legal and Regulatory Aspects Janbi Model QuestionsDocument8 pagesBanking Legal and Regulatory Aspects Janbi Model QuestionsKhanal PremNo ratings yet

- Company AnalysisDocument19 pagesCompany AnalysisPashaJONo ratings yet

- The Determinants of Venture Capital: Research PaperDocument12 pagesThe Determinants of Venture Capital: Research PaperSehar SajjadNo ratings yet

- Bank Management Financial Services Rose 9th Edition Solutions ManualDocument23 pagesBank Management Financial Services Rose 9th Edition Solutions Manualkevahuynh4vn8d100% (27)

- The Truth About MoneyDocument21 pagesThe Truth About MoneyTaha MirNo ratings yet

- Tax Invoice: de Guzman Randy Sison 64 PUNGGOL WALK #03-31 SINGAPORE 828782 Account No: 3924232952Document2 pagesTax Invoice: de Guzman Randy Sison 64 PUNGGOL WALK #03-31 SINGAPORE 828782 Account No: 3924232952Randy GusmanNo ratings yet