Professional Documents

Culture Documents

Capitol Update 12

Uploaded by

Terri BonoffCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capitol Update 12

Uploaded by

Terri BonoffCopyright:

Available Formats

Capitol Update 12 2015

As we approach the Legislative Recess, committee time is where most efforts are spent with members having to get

their policy bills heard before second deadline kicks in. This deadline marks the transition for the Legislature to

change the focus from Policy to Finance. When we come back from break, Finance bills will dominate the

conversation and the budget will be the focus. We were given a preview this week when both the House and the

Senate released their budget targets approximately how much money each body intends to invest in particular

areas of the budget. The Senate numbers were not known when I recorded the video so this is newly released.

As stated in this weeks video, I believe in a balanced approach. In my ideal world, we would put 1/3 away in the

reserves (our savings), make targeted tax reductions (relief for "Pass Through" entities and the commercial property

tax) and make strategic investments in other areas of the budget, with a focus on Education initiatives. This is a onetime surplus and we cannot count on it moving forward. You can find a comparison of the targets here.

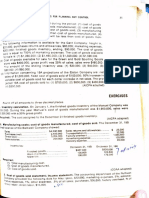

Governor Recommendations:

Before we get into the targets released by the House and Senate, its important to take a look at where the Governor

stands. Following the February Forecast, Governor Dayton released a supplemental budget. In it, he outlined his

thoughts for how to use the surplus. Highlights include additional spending of nearly $700 million in E-12 investments,

$288 million in Higher Education increases and $137 million for the Tax Committee. Governor Dayton also proposed

$341 million for Health and Human Services and $82.8 million for Environment and Energy. The Governor approached

the surplus as an opportunity to invest in priorities yet my preference is to set aside some as both savings and tax

relief.

House Targets:

On Tuesday, the House leadership released a spreadsheet that outlined their targets. They decided to place the

greatest emphasis on tax reductions - over $2 billion. This comes at the expense of greater investments in Education,

both E-12 and Higher Education, to which they dedicate $150 million and $50 million, respectively. While not

insignificant figures, they fall far short of the Governors recommendations and may not make the kind of impact our

children deserve. To give you an idea of the scope, in the E-12 budget a $173 million investment equates to a 1%

increase in the basic formula not even enough to pay for school districts inflationary increases, let alone make any

investments in early childhood scholarships. In addition, the House chooses to reduce spending in several budget

areas, including Environment and Natural Resources, Economic Job Growth, State Government and Veterans Affairs,

Capital Investment and Health and Human Services (which received a reduction of over $1 billion). I appreciate the

importance of tax reductions, but believe that the approach outlined in this budget does not maximize the

opportunity to stabilize our economic future and change the course in areas of great concern; i.e. achievement gap

and higher ed affordability.

Senate Targets:

The Senate leadership released our targets and we find ourselves positioned somewhere in between the House and

the Governor. We too propose to provide tax relief. While the figure isnt as high as the Houses proposed $2 billion,

this proposal dedicates nearly $500 million to this effort. We make significant investments in E-12 and Higher

Education, but do not go nearly as high as the Governor. I appreciate this approach and believe that it allows us to

invest in critical areas where change is needed. One other point of emphasis for the Senate is to put a large amount

of the surplus money into the reserves. As we learned the hard way over the last seven years, we cannot count on

year after year of strong economic growth; we will have tough years ahead. When we do, its important that we have

money to fall back on.

Overall, I am most comfortable with the Senates approach. I believe it balances much needed relief for businesses

and families, while not neglecting the fact that we do have a surplus and can afford strategic investments. The

conversation is just beginning and we are still two months away from a final product. Let me know what you think

about the proposals.

Easter/Passover Recess:

As mentioned above, the Legislature is going on recess for a

week. For those of you that observe Easter or Passover, I hope

you are able to celebrate with your friends and family and wish

you the very best.

Senator Bonoff and Senator Latz hear from the National Council on Jewish Women

You might also like

- Governor Maggie Hassan's 2015 Budget AddressDocument16 pagesGovernor Maggie Hassan's 2015 Budget AddressRebecca LavoieNo ratings yet

- Samuel-659766347-Java Paragon Hotel and Residence-HOTEL - STANDALONEDocument3 pagesSamuel-659766347-Java Paragon Hotel and Residence-HOTEL - STANDALONEsamuel chenNo ratings yet

- Capitol Update 8 - 2015Document2 pagesCapitol Update 8 - 2015Terri BonoffNo ratings yet

- Capitol Update 12Document4 pagesCapitol Update 12Terri BonoffNo ratings yet

- A Bipartisan Path Forward To Securing America's Future: Questions and AnswersDocument5 pagesA Bipartisan Path Forward To Securing America's Future: Questions and AnswersPeggy W SatterfieldNo ratings yet

- HON2Document9 pagesHON2Political AlertNo ratings yet

- 2011 Facts&figuresDocument2 pages2011 Facts&figuresSandra WhalenNo ratings yet

- The Annapolis Report: A Review of The 2012 Legislative Session and Special SessionsDocument14 pagesThe Annapolis Report: A Review of The 2012 Legislative Session and Special SessionsmarknewgentNo ratings yet

- LAO May ReviseDocument40 pagesLAO May ReviseJbrownie HeimesNo ratings yet

- Key Aspects of The 2012 Democratic BudgetDocument3 pagesKey Aspects of The 2012 Democratic Budgeteniedowski4960No ratings yet

- Budget Update April 2007Document6 pagesBudget Update April 2007Committee For a Responsible Federal BudgetNo ratings yet

- 2013 4 16 Week in ReviewDocument2 pages2013 4 16 Week in Reviewapi-215003736No ratings yet

- Budget Deficit ThesisDocument5 pagesBudget Deficit ThesisErica Thompson100% (1)

- BiennialBudgetPresentation Monday121613Document12 pagesBiennialBudgetPresentation Monday121613normanomtNo ratings yet

- Petri Fall 2010 NewsletterDocument4 pagesPetri Fall 2010 NewsletterPAHouseGOPNo ratings yet

- The Texas Budget: An UpdateDocument14 pagesThe Texas Budget: An UpdateJason RobertsNo ratings yet

- Capitol Update 11Document2 pagesCapitol Update 11Terri BonoffNo ratings yet

- Budget OverviewDocument3 pagesBudget OverviewSteve CouncilNo ratings yet

- Senate Hearing, 110TH Congress - Financial Services and General Government Appropriations For Fiscal Year 2008Document45 pagesSenate Hearing, 110TH Congress - Financial Services and General Government Appropriations For Fiscal Year 2008Scribd Government DocsNo ratings yet

- Budget Primer 2012Document8 pagesBudget Primer 2012bee5834No ratings yet

- MessageDocument2 pagesMessageapi-19777944No ratings yet

- 2014 Post-Session ReviewDocument6 pages2014 Post-Session ReviewSenator Melissa Halvorson WiklundNo ratings yet

- 2016 17 Enacted Budget Report PDFDocument74 pages2016 17 Enacted Budget Report PDFNick ReismanNo ratings yet

- Best/Worst of 2010: South Carolina Policy CouncilDocument47 pagesBest/Worst of 2010: South Carolina Policy CouncilSteve CouncilNo ratings yet

- Enate Update: S J T S M WDocument7 pagesEnate Update: S J T S M WSenator Jerry TillmanNo ratings yet

- Supporting Maine's Economic GrowthDocument28 pagesSupporting Maine's Economic Growthstephen_mistler2763No ratings yet

- Pa Environment Digest Oct. 9, 2017Document58 pagesPa Environment Digest Oct. 9, 2017www.PaEnvironmentDigest.comNo ratings yet

- 3.03 TemplateDocument3 pages3.03 TemplateDestiny LittleNo ratings yet

- Departments of Labor, Health and Human Services, and Education, and Related Agencies Appropriations For Fiscal Year 2012Document77 pagesDepartments of Labor, Health and Human Services, and Education, and Related Agencies Appropriations For Fiscal Year 2012Scribd Government DocsNo ratings yet

- Dear Friends,: Coffee and ConversationDocument4 pagesDear Friends,: Coffee and ConversationPAHouseGOPNo ratings yet

- Testimony Robert Doar, Commissioner, NYC Human Resource Administration, May 18, 2010.Document8 pagesTestimony Robert Doar, Commissioner, NYC Human Resource Administration, May 18, 2010.Rick ThomaNo ratings yet

- An Independent BudgetDocument6 pagesAn Independent BudgetDavid WelchNo ratings yet

- Nunavut Finance Minister 2017-18 Budget AddressDocument14 pagesNunavut Finance Minister 2017-18 Budget AddressNunatsiaqNewsNo ratings yet

- Senate Hearing, 112TH Congress - Transportation and Housing and Urban Development, and Related Agencies Appropriations For Fiscal Year 2013Document159 pagesSenate Hearing, 112TH Congress - Transportation and Housing and Urban Development, and Related Agencies Appropriations For Fiscal Year 2013Scribd Government DocsNo ratings yet

- Capitol Update 2Document2 pagesCapitol Update 2Terri BonoffNo ratings yet

- March Update 2013Document2 pagesMarch Update 2013Holly BrattNo ratings yet

- Legislative Update 4.12.13Document1 pageLegislative Update 4.12.13Dave ThompsonNo ratings yet

- DR Janet Yellen Senate Finance Committee QFRs 01 21 2021Document114 pagesDR Janet Yellen Senate Finance Committee QFRs 01 21 2021ForkLogNo ratings yet

- Burgum BudgetDocument3 pagesBurgum BudgetRob PortNo ratings yet

- Tatement of Dministration OlicyDocument7 pagesTatement of Dministration OlicylosangelesNo ratings yet

- Budget FAIL Plan Awaiting Gov. Quinn's Signature Grows Spending, DebtDocument5 pagesBudget FAIL Plan Awaiting Gov. Quinn's Signature Grows Spending, DebtIllinois PolicyNo ratings yet

- John Liu Budget TestimonyDocument4 pagesJohn Liu Budget TestimonyCeleste KatzNo ratings yet

- Budget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018From EverandBudget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018No ratings yet

- Bill Shorten's 2015 Budget ReplyDocument21 pagesBill Shorten's 2015 Budget ReplyStephanie AndersonNo ratings yet

- Treasurer Minister For FinanceDocument12 pagesTreasurer Minister For FinancePolitical AlertNo ratings yet

- Gregoire's 2013-2015 Budget ProposalDocument5 pagesGregoire's 2013-2015 Budget ProposalMatt DriscollNo ratings yet

- Platforms and Campaign Updates From The Canadian Building Trades UnionsDocument4 pagesPlatforms and Campaign Updates From The Canadian Building Trades UnionsIWDCWesternCanadaNo ratings yet

- 2015 Pa. Budget Proposal by Tom WolfDocument967 pages2015 Pa. Budget Proposal by Tom WolfPennLiveNo ratings yet

- DOCUMENT: Gov. Dannel P. Malloy Connecticut Budget Fact Sheet (2/3/16)Document6 pagesDOCUMENT: Gov. Dannel P. Malloy Connecticut Budget Fact Sheet (2/3/16)NorwichBulletin.comNo ratings yet

- Whitebook 2012 FINALDocument209 pagesWhitebook 2012 FINALticklemestalinNo ratings yet

- Rep. Gail Lavielle End of Session ReportDocument2 pagesRep. Gail Lavielle End of Session ReportConnecticut House RepublicansNo ratings yet

- Budget of The United States GovernmentDocument7 pagesBudget of The United States GovernmentTina Brown MundyNo ratings yet

- 2019 State of The County SpeechDocument16 pages2019 State of The County SpeechelizabethNo ratings yet

- Hon. J.B. Hockey: Minister For Finance Acting Assistant TreasurerDocument15 pagesHon. J.B. Hockey: Minister For Finance Acting Assistant TreasurerPolitical AlertNo ratings yet

- Capitol Update 15Document4 pagesCapitol Update 15Terri BonoffNo ratings yet

- PM - Slash Seize and SellDocument11 pagesPM - Slash Seize and SellAjah HalesNo ratings yet

- 2.20.2013 Budget Points For UnderstandingDocument3 pages2.20.2013 Budget Points For UnderstandingKen KnickerbockerNo ratings yet

- Budget Speech, June 6, 2011Document7 pagesBudget Speech, June 6, 2011CBCPoliticsNo ratings yet

- Presidents Budget FY05Document9 pagesPresidents Budget FY05Committee For a Responsible Federal BudgetNo ratings yet

- Capitol Update 4Document2 pagesCapitol Update 4Terri BonoffNo ratings yet

- Capitol Update - Special SessionDocument5 pagesCapitol Update - Special SessionTerri BonoffNo ratings yet

- Capitol Update 5Document2 pagesCapitol Update 5Terri BonoffNo ratings yet

- Capitol Update 3Document1 pageCapitol Update 3Terri BonoffNo ratings yet

- Joint Letter To Legislative AuditorDocument1 pageJoint Letter To Legislative AuditorTerri BonoffNo ratings yet

- Capitol Update 1Document1 pageCapitol Update 1Terri BonoffNo ratings yet

- Capitol Update 2Document1 pageCapitol Update 2Terri BonoffNo ratings yet

- Omnibus Agriculture Bill: Program - $8,500,000 For FY2016 and $8,500,000 For FY2017. This Appropriation FundsDocument26 pagesOmnibus Agriculture Bill: Program - $8,500,000 For FY2016 and $8,500,000 For FY2017. This Appropriation FundsTerri BonoffNo ratings yet

- Capitol Update 16Document2 pagesCapitol Update 16Terri BonoffNo ratings yet

- Capitol Update 17Document2 pagesCapitol Update 17Terri BonoffNo ratings yet

- Capitol Update 18Document2 pagesCapitol Update 18Terri BonoffNo ratings yet

- Capitol Update 18Document2 pagesCapitol Update 18Terri BonoffNo ratings yet

- Capitol Update 15Document4 pagesCapitol Update 15Terri BonoffNo ratings yet

- Lynne ThomasDocument2 pagesLynne ThomasTerri BonoffNo ratings yet

- Capitol Update 13Document2 pagesCapitol Update 13Terri BonoffNo ratings yet

- Senate TargetsDocument1 pageSenate TargetsTerri BonoffNo ratings yet

- Higher Education OmnibusDocument40 pagesHigher Education OmnibusTerri BonoffNo ratings yet

- Capitol Update 14Document2 pagesCapitol Update 14Terri BonoffNo ratings yet

- Higher Education OmnibusDocument40 pagesHigher Education OmnibusTerri BonoffNo ratings yet

- Legislative TargetsDocument1 pageLegislative TargetsTerri BonoffNo ratings yet

- Capitol Update 11Document2 pagesCapitol Update 11Terri BonoffNo ratings yet

- Senate TargetsDocument1 pageSenate TargetsTerri BonoffNo ratings yet

- House TargetsDocument1 pageHouse TargetsTerri BonoffNo ratings yet

- Capitol Update 9Document2 pagesCapitol Update 9Terri BonoffNo ratings yet

- Capitol Update 7 - 2015Document2 pagesCapitol Update 7 - 2015Terri BonoffNo ratings yet

- Capitol Update 10 - 2015Document2 pagesCapitol Update 10 - 2015Terri BonoffNo ratings yet

- Capitol Update 6 - 2015Document2 pagesCapitol Update 6 - 2015Terri BonoffNo ratings yet

- Capitol Update 5 - 2015Document2 pagesCapitol Update 5 - 2015Terri BonoffNo ratings yet

- Security Bank v. CADocument3 pagesSecurity Bank v. CASiobhan Robin100% (1)

- Goldman Sachs Risk Management: November 17 2010 Presented By: Ken Forsyth Jeremy Poon Jamie MacdonaldDocument109 pagesGoldman Sachs Risk Management: November 17 2010 Presented By: Ken Forsyth Jeremy Poon Jamie MacdonaldPol BernardinoNo ratings yet

- All Weeks GlobalDocument70 pagesAll Weeks GlobalGalaxy S5No ratings yet

- Trump Presidency 33 - May 5th, 2018 To May 14th, 2018Document513 pagesTrump Presidency 33 - May 5th, 2018 To May 14th, 2018FW040100% (1)

- 04 CPM Procurement ManagementDocument75 pages04 CPM Procurement ManagementGORKEM KARAKOSENo ratings yet

- Spicer: Dana Heavy Tandem Drive AxlesDocument34 pagesSpicer: Dana Heavy Tandem Drive AxlesPatrick Jara SánchezNo ratings yet

- Portrayal of Women in Outdoor Advertising.Document33 pagesPortrayal of Women in Outdoor Advertising.Ali ChaganiNo ratings yet

- Free Pattern Easy Animal CoasterDocument4 pagesFree Pattern Easy Animal CoasterAdrielly Otto100% (2)

- TCDocument29 pagesTCDanny NationalNo ratings yet

- September 21 Sales Digests PDFDocument23 pagesSeptember 21 Sales Digests PDFAnonymous bOG2cv3KNo ratings yet

- Borromeo v. DescallarDocument2 pagesBorromeo v. Descallarbenjo2001No ratings yet

- PI Manpower Vs NLRCDocument9 pagesPI Manpower Vs NLRCKornessa ParasNo ratings yet

- Delhi To BareliDocument3 pagesDelhi To BareliSanjeev SinghNo ratings yet

- International FinanceDocument24 pagesInternational FinanceAtasi SinghaniaNo ratings yet

- Sahih Bukhari Aur Imam Bukhari Ahnaf Ki Nazar MeinDocument96 pagesSahih Bukhari Aur Imam Bukhari Ahnaf Ki Nazar MeinIslamic Reserch Center (IRC)No ratings yet

- Ed2 Project Eklavya ApplicationForm August 2020Document23 pagesEd2 Project Eklavya ApplicationForm August 2020Shourya GargNo ratings yet

- Motion To Vacate Summary Eviction OrderDocument3 pagesMotion To Vacate Summary Eviction OrderAlly MakambaNo ratings yet

- CarusoComplaint Redacted PDFDocument20 pagesCarusoComplaint Redacted PDFHudson Valley Reporter- PutnamNo ratings yet

- Company: ManufacturingDocument8 pagesCompany: Manufacturingzain khalidNo ratings yet

- Revision Guide For AMD Athlon 64 and AMD Opteron Processors: Publication # Revision: Issue DateDocument85 pagesRevision Guide For AMD Athlon 64 and AMD Opteron Processors: Publication # Revision: Issue DateSajith Ranjeewa SenevirathneNo ratings yet

- Questions and Every Right Explained in Simple Words in A Dialect or Language Known To The Person Under InvestigationDocument2 pagesQuestions and Every Right Explained in Simple Words in A Dialect or Language Known To The Person Under InvestigationMark MlsNo ratings yet

- Motion For Bill of ParticularsDocument3 pagesMotion For Bill of ParticularsPaulo Villarin67% (3)

- Causing Death by NegligenceDocument6 pagesCausing Death by NegligenceVanisha WadhwaNo ratings yet

- MechanicalDocument609 pagesMechanicalMohammed100% (1)

- Bonsato Vs CA DigestDocument3 pagesBonsato Vs CA DigestFrances Ann Marie GumapacNo ratings yet

- Dansart Security Force v. BagoyDocument4 pagesDansart Security Force v. BagoyAyo LapidNo ratings yet

- Arcelor MittalDocument4 pagesArcelor Mittalnispo100% (1)

- Clutario v. CADocument2 pagesClutario v. CAKrisha Marie CarlosNo ratings yet

- Valeriano v. Employees Compensation CommissionDocument2 pagesValeriano v. Employees Compensation CommissionSherry Jane GaspayNo ratings yet