Professional Documents

Culture Documents

Tds Challan

Uploaded by

ajad babuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tds Challan

Uploaded by

ajad babuCopyright:

Available Formats

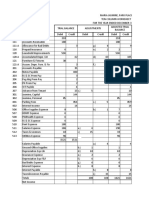

T.D.S.

/TCS TAX CHALLAN

* Important : Please see notes

Single C

overleaf before filling up the

challan

the ZAO

CHALLAN NO./

Tax Applicable (Tick One)*

ITNS

TAX DEDUCTED/COLLECTED AT SOURCE FROM

281

(0020) COMPANY

(0021) NON-COMPANY

DEDUCTEES

DEDUCTEES

Tax Deduction Account No. (T.A.N.)

Full Name

Complete Address with City & State

Tel. No.

Pin

Type of Payment

Code *

(Tick One)

(Please see overleaf)

TDS/TCS Payable (200)

TDS/TCS Regular Assessment (Raised by I.T. Deptt.)

FOR USE IN REC

-

(400)

Amount (in Rs. Only)

DETAILS OF PAYMENTS

Income Tax

Surcharge

SPACE FOR B

Education Cess

Interest

Penalty

Total

Total (in words)

CRORES

LACS

THOUSANDS

HUNDREDS

TENS

Paid in Cash/Debit to A/c /Cheque No.

UNITS

Dated

Drawn on

(Name of the Bank and Branch)

Date:

Signature of person making payment

Rs.

Taxpayers Counterfoil (To be filled up by tax payer)

SPACE FOR B

PAN

Received from

(Name)

Cash/ Debit to A/c /Cheque No.

For Rs.

Rs. (in words)

Drawn on

(Name of the Bank and Branch)

Company/Non-Company Deductees

on account of Tax Deducted at Source (TDS)/Tax Collected at Source (TCS) from____(Fill up Code)

for the Assessment Year

(Strike out whichever is not applicable)

-

Rs.

Single Copy (to be sent to

the ZAO)

Assessment Year

-

Pin

USE IN RECEIVING BANK

M

PACE FOR BANK SEAL

PACE FOR BANK SEAL

T.D.S./TCS TAX CHALLAN

* Important : Please see notes

Single

overleaf before filling up the

challan

the ZA

CHALLAN NO./

Tax Applicable (Tick One)*

ITNS

TAX DEDUCTED/COLLECTED AT SOURCE FROM

281

(0020) COMPANY

DEDUCTEES

(0021) NON-COMPANY

DEDUCTEES

Tax Deduction Account No. (T.A.N.)

J P R R

0 7 1 0 8D

Full Name

R A N G

C R E A T I

O N S

Complete Address with City & State

Tel. No.

1-

Pin

Type of Payment

9 4I

Code *

(Tick One)

TDS/TCS Payable (200)

TDS/TCS Regular Assessment (Raised by I.T. Deptt.)

FOR USE IN RE

-

(400)

Amount (in Rs. Only)

DETAILS OF PAYMENTS

Income Tax

Surcharge

Education Cess

Interest

Penalty

SPACE FOR

Total

Total (in words)

CRORES

LACS

THOUSANDS

HUNDREDS

TENS

Paid in Cash/Debit to A/c /Cheque No.

Dated

Drawn on

UNITS

06.05.2014

BANK OF BARODA, NEHRU PLACE

(Name of the Bank and Branch)

06.05.2014

Date:

Signature of person making payment

P

Rs.

Taxpayers Counterfoil (To be filled up by tax payer)

R

0

7

1

0

8D

TAN

Received from

RANG CREATIONS

Cash/ Debit to A/c /Cheque No.

For Rs.

SPACE FOR

Rs. (in words)

Drawn on

BANK OF BARODA, NEHRU PLACE

(Name of the Bank and Branch)

Company/Non-Company Deductees

on account of Tax Deducted at Source (TDS)/Tax Collected at Source (TCS) from_ __94I _(Fill up Code)

for the Assessment Year

(Strike out whichever is not applicable)

1

6

2

0

15

Rs.

Single Copy (to be sent to

the ZAO)

Assessment Year

5 -

Pin

USE IN RECEIVING BANK

-

PACE FOR BANK SEAL

PACE FOR BANK SEAL

T.D.S./TCS TAX CHALLAN

* Important : Please see notes

Single

overleaf before filling up the

challan

the ZA

CHALLAN NO./

Tax Applicable (Tick One)*

ITNS

TAX DEDUCTED/COLLECTED AT SOURCE FROM

281

(0020) COMPANY

DEDUCTEES

(0021) NON-COMPANY

DEDUCTEES

Tax Deduction Account No. (T.A.N.)

J P R R

0 7 1 0 8D

Full Name

R A N G

C R E A T I

O N S

Complete Address with City & State

Tel. No.

1-

Pin

Type of Payment

9 4C

Code *

(Tick One)

TDS/TCS Payable (200)

TDS/TCS Regular Assessment (Raised by I.T. Deptt.)

FOR USE IN RE

-

(400)

Amount (in Rs. Only)

DETAILS OF PAYMENTS

Income Tax

Surcharge

Education Cess

Interest

Penalty

SPACE FOR

Total

Total (in words)

CRORES

LACS

THOUSANDS

HUNDREDS

TENS

Paid in Cash/Debit to A/c /Cheque No.

Dated

Drawn on

UNITS

06.05.2014

BANK OF BARODA, NEHRU PLACE

(Name of the Bank and Branch)

06.05.2014

Date:

Signature of person making payment

P

Rs.

Taxpayers Counterfoil (To be filled up by tax payer)

R

0

7

1

0

8D

TAN

Received from

RANG CREATIONS

Cash/ Debit to A/c /Cheque No.

For Rs.

SPACE FOR

Rs. (in words)

Drawn on

BANK OF BARODA, NEHRU PLACE

(Name of the Bank and Branch)

Company/Non-Company Deductees

on account of Tax Deducted at Source (TDS)/Tax Collected at Source (TCS) from___94C _(Fill up Code)

for the Assessment Year

(Strike out whichever is not applicable)

1

6

2

0

15

Rs.

Single Copy (to be sent to

the ZAO)

Assessment Year

5 -

Pin

USE IN RECEIVING BANK

-

PACE FOR BANK SEAL

PACE FOR BANK SEAL

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Working Capital ManagementDocument98 pagesWorking Capital ManagementGanesh PatashalaNo ratings yet

- Consolidated Financial StatementDocument36 pagesConsolidated Financial StatementArt KingNo ratings yet

- State Audit Code of The Philippines (P.D. 1445)Document37 pagesState Audit Code of The Philippines (P.D. 1445)Monique del Rosario100% (3)

- p176 Maria JasmineDocument9 pagesp176 Maria JasmineIsaiah Valencia100% (1)

- Midterm Bisek Chapter 2Document4 pagesMidterm Bisek Chapter 2FiqriNo ratings yet

- GST VS VatDocument62 pagesGST VS VatMohit AgarwalNo ratings yet

- Contrarian Investment ExtrapolationDocument11 pagesContrarian Investment ExtrapolationB.C. MoonNo ratings yet

- Policy Proposal On Caregiving: Child Care, Early Education, and After School CareDocument5 pagesPolicy Proposal On Caregiving: Child Care, Early Education, and After School CareNga TranNo ratings yet

- JBE Accounting Case AnalysisDocument8 pagesJBE Accounting Case AnalysisTaufan PutraNo ratings yet

- Tanzania Revenue Authority: Institute of Tax Administration PGDT ExecutivesDocument33 pagesTanzania Revenue Authority: Institute of Tax Administration PGDT ExecutivesMoud KhalfaniNo ratings yet

- DRL and Beta Pharma Whole DealDocument19 pagesDRL and Beta Pharma Whole DealManish PatelNo ratings yet

- 2281 w05 QP 1Document12 pages2281 w05 QP 1mstudy123456No ratings yet

- Accountacy With CA Q.P.Document3 pagesAccountacy With CA Q.P.riyaskalpettaNo ratings yet

- DocxDocument10 pagesDocxAiziel OrenseNo ratings yet

- REN AND SHINO PartnershipDocument23 pagesREN AND SHINO PartnershipDaneca Gallardo100% (1)

- BenefitsDocument2 pagesBenefitsmontenegroloveNo ratings yet

- Westchester Overtime Costs MillionsDocument2 pagesWestchester Overtime Costs MillionsGerald McKinstryNo ratings yet

- MSME Customer - Sales DocumentationDocument14 pagesMSME Customer - Sales DocumentationkathirNo ratings yet

- NLG - Annual Report 2016Document48 pagesNLG - Annual Report 2016Kiva DangNo ratings yet

- SA4 Pension&Other Employee BenefitsDocument6 pagesSA4 Pension&Other Employee BenefitsVignesh SrinivasanNo ratings yet

- Horizontal and Vertical Ratio AnalysisDocument21 pagesHorizontal and Vertical Ratio AnalysismrnttdpnchngNo ratings yet

- UFAS2Document4 pagesUFAS2Romylen De GuzmanNo ratings yet

- Study+guide 16-19Document39 pagesStudy+guide 16-19bakerbjNo ratings yet

- Fsa AnswersDocument22 pagesFsa AnswersManan GuptaNo ratings yet

- Detailed Project Report For Biscuit Manufacturing Plant: Naganu Foods Pvt. LTDDocument21 pagesDetailed Project Report For Biscuit Manufacturing Plant: Naganu Foods Pvt. LTDGavin MathewNo ratings yet

- Business Analysis FarmeximDocument22 pagesBusiness Analysis FarmeximFlorina-Maria SavuNo ratings yet

- Computerized AccountingDocument14 pagesComputerized Accountinglayyah2013No ratings yet

- 10 TAX Tips: For Real Estate ProfessionalsDocument14 pages10 TAX Tips: For Real Estate ProfessionalsnnauthooNo ratings yet

- Public Utility Entity Is Not Allowed To Use The Pfrs For Smes in The Philippines)Document6 pagesPublic Utility Entity Is Not Allowed To Use The Pfrs For Smes in The Philippines)Glen JavellanaNo ratings yet

- BudgetingDocument11 pagesBudgetingWinnie Ann Daquil LomosadNo ratings yet