Professional Documents

Culture Documents

Benefits and Limitation of BCG

Uploaded by

FreddyChandraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Benefits and Limitation of BCG

Uploaded by

FreddyChandraCopyright:

Available Formats

Benefits of BCG-Matrix

Organizations that are very large such that they require setting up business units

usually face the test of the allocation of resources among those business units. The

BCG matrix was developed by Boston Consulting Group for the management of

various business units. Using the BCG opens an organization to several benefits such

as :

1. SimplifiesManagement

The BCG is an effective management tool and it offers a good framework for

resource allocation among various units. This enables the managers to

compare several business units whenever they want. It simplifies many

business factors through showing employees the market share as well as

growth rate and how to use them to create new strategies.

2. PopularMatrix

Even though BCG matrix may be among the oldest matrices ever formulated,

it is also the most common and best known matrix taught all over the world.

There are forums on the internet where individuals share their ideas on the

best methods of using BCG matrix because of its popularity. This means that

those looking to use it will never lack assistance and support. The BCG still

remains a quick and beneficial guide for resource allocation and ensuring

better profits.

3. BetterDecisionMaking

The BCG allows for the making of comparisons so as to measure the growth

and development rate of a company against the average growth rate in that

specific industry. In addition, this particular matrix is also enjoyable to use,

encouraging better decision making. Large organizations that are normally in

need of effective decision making can benefit a lot from using BCG matrix,

especially

those

seeking

better

resource

management.

Nevertheless, the BCG model only takes into account two dimensions, which

are growth rate and market share. This might tempt the management to focus

on a certain product or divest prematurely.

Limitations of the BCG-Matrix:

It neglects the effects of synergies between business units.

High market share is not the only success factor.

Market growth is not the only indicator for attractiveness of a market.

Sometimes Dogs can earn even more cash as Cash Cows.

The problems of getting data on the market share and market growth.

There is no clear definition of what constitutes a market.

A high market share does not necessarily lead to profitability all the time.

The model uses only two dimensions market share and growth rate. This

may tempt management to emphasize a particular product, or todivest

prematurely.

A business with a low market share can be profitable too.

The model neglects small competitors that have fast growing market shares.

You might also like

- Financial Reporting and AnalysisDocument34 pagesFinancial Reporting and AnalysisNatasha AzzariennaNo ratings yet

- Chap 1 Basis of Malaysian Income Tax 2022Document7 pagesChap 1 Basis of Malaysian Income Tax 2022Jasne OczyNo ratings yet

- Option Strategies and Profit DiagramsDocument30 pagesOption Strategies and Profit DiagramsmodikiritNo ratings yet

- Cost AccountingDocument6 pagesCost AccountingDorianne BorgNo ratings yet

- BCG Matrix & GE - McKinsey Matrix - CI-wikiDocument10 pagesBCG Matrix & GE - McKinsey Matrix - CI-wikiNamrita Gupta0% (1)

- MC Donald CSRDocument13 pagesMC Donald CSRVivian WanNo ratings yet

- Chapter1 - Operations and ProductivityDocument34 pagesChapter1 - Operations and ProductivityrafthaNo ratings yet

- Bpmn3023 - Strategic Audit Report - Group 6Document52 pagesBpmn3023 - Strategic Audit Report - Group 6Nadzirah SalahuddinNo ratings yet

- An Analysis of Case 16-59 From Managerial Accounting by Hilton 8th EditionDocument7 pagesAn Analysis of Case 16-59 From Managerial Accounting by Hilton 8th EditionTyrelle CastilloNo ratings yet

- Activity Evaluation Form: "Where Children Come First"Document1 pageActivity Evaluation Form: "Where Children Come First"TuTitNo ratings yet

- Strategic Management Chapter 2 SummaryDocument2 pagesStrategic Management Chapter 2 Summarysutan fanandi100% (1)

- BPI Mission VisionDocument6 pagesBPI Mission VisionJanNo ratings yet

- Chapter 1 - Review of Accounting ProcessDocument13 pagesChapter 1 - Review of Accounting ProcessJam100% (1)

- Q4 Music 6 Module 2Document15 pagesQ4 Music 6 Module 2Dan Paolo AlbintoNo ratings yet

- ACC2054 Tutorial 4Document3 pagesACC2054 Tutorial 4Euvan KumarNo ratings yet

- Davis Case StudyDocument4 pagesDavis Case StudyMuhammad Abid100% (1)

- 10 Capital RationingDocument7 pages10 Capital Rationingramkishan8267% (3)

- TOPIC 7 Vote Book Accounting Latest PDFDocument45 pagesTOPIC 7 Vote Book Accounting Latest PDFIRENE WARIARANo ratings yet

- Digi TelecommuicationDocument3 pagesDigi Telecommuicationriddan100% (1)

- Income TaxationDocument32 pagesIncome Taxationblackphoenix303No ratings yet

- Common Size Analys3esDocument5 pagesCommon Size Analys3esSaw Mee LowNo ratings yet

- Benefits of Accounting StandardsDocument2 pagesBenefits of Accounting Standardsmanikkin bagasNo ratings yet

- OligopolyDocument32 pagesOligopolyAnj SelardaNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and Errors: MFRS 108Document9 pagesAccounting Policies, Changes in Accounting Estimates and Errors: MFRS 108Nurul AsmidaNo ratings yet

- Interest Rates and Their Role in FinanceDocument17 pagesInterest Rates and Their Role in FinanceClyden Jaile RamirezNo ratings yet

- Lecture Tutorial - P, CL and CA (A)Document3 pagesLecture Tutorial - P, CL and CA (A)yym cindyy100% (1)

- Read The Following Excerpt From A Complaint Filed by TheDocument1 pageRead The Following Excerpt From A Complaint Filed by TheLet's Talk With Hassan0% (1)

- Ifm Assignment ProposalDocument26 pagesIfm Assignment ProposalAtiqahNo ratings yet

- CFAS - Quiz 4Document5 pagesCFAS - Quiz 4Sanyln AclaNo ratings yet

- EBF 2054 Capital BudgetingDocument48 pagesEBF 2054 Capital BudgetingizzatiNo ratings yet

- Lecture 6 - Process & Capacity DesignDocument22 pagesLecture 6 - Process & Capacity DesignMehr Nawaz0% (1)

- Universiti Teknologi Mara Common Test 1 Answer Scheme: Confidential AC/OCT2018/FAR320Document5 pagesUniversiti Teknologi Mara Common Test 1 Answer Scheme: Confidential AC/OCT2018/FAR320iqbalhakim123No ratings yet

- Tega Payment SystemDocument8 pagesTega Payment Systemzarfarie aron67% (3)

- Internal Control Cases: Bern Fly Rod CompanyDocument2 pagesInternal Control Cases: Bern Fly Rod CompanyTrixie Jane Bautista LeymaNo ratings yet

- External Factor Evaluation Matrix (Efe)Document14 pagesExternal Factor Evaluation Matrix (Efe)Christian CagasNo ratings yet

- International Business Module 1Document22 pagesInternational Business Module 1Ajesh Mukundan P0% (1)

- Chapter 3 - Agriculture AllowancesDocument3 pagesChapter 3 - Agriculture AllowancesNURKHAIRUNNISA100% (2)

- Major Research Project On "Impact of Availability Bias, Overconfidence Bias, Low Aversion Bias On Investment Decision Making"Document32 pagesMajor Research Project On "Impact of Availability Bias, Overconfidence Bias, Low Aversion Bias On Investment Decision Making"shaurya bandil100% (2)

- MGT 657 Strategic Management Case Study Daibochi and ShoemakerDocument7 pagesMGT 657 Strategic Management Case Study Daibochi and ShoemakerNur HazwaniNo ratings yet

- Appeal Tax Procedure (Malaysia)Document2 pagesAppeal Tax Procedure (Malaysia)Zati TyNo ratings yet

- Analyse The Positive Features and Limitations of The Quantitative Strategic Planning MatrixDocument6 pagesAnalyse The Positive Features and Limitations of The Quantitative Strategic Planning MatrixBobby M.No ratings yet

- Approaches To EthicsDocument5 pagesApproaches To EthicsErine GainsmNo ratings yet

- Equivalent Annual AnnuityDocument10 pagesEquivalent Annual Annuitymohsin_ali07428097No ratings yet

- BWFF5013 Individual Assignment (10%)Document2 pagesBWFF5013 Individual Assignment (10%)fitriNo ratings yet

- Audit Planning AssignmentDocument8 pagesAudit Planning AssignmentYunisaraNo ratings yet

- Answers Chapter 1Document43 pagesAnswers Chapter 1Maricel Inoc FallerNo ratings yet

- GROUP 7 - Mission and Vision of SHEIN and ZARADocument1 pageGROUP 7 - Mission and Vision of SHEIN and ZARABea PalentinosNo ratings yet

- MINI-CASE 3 Intangible Assets AnswerDocument5 pagesMINI-CASE 3 Intangible Assets Answeryu choongNo ratings yet

- Project Report - Management Accounting 2Document5 pagesProject Report - Management Accounting 2Anindyadeep PalNo ratings yet

- Revision Chapter 1-4, Hogwart IncDocument5 pagesRevision Chapter 1-4, Hogwart IncNUR AINA BINTI AB AZIZ NUR AINA BINTI AB AZIZNo ratings yet

- Corporate Social Responsibility - PetronasDocument3 pagesCorporate Social Responsibility - Petronashapi_child100% (2)

- 7 P'S of Telecom IndustryDocument23 pages7 P'S of Telecom IndustryYogesh Jain0% (1)

- CH 9 RahmaDocument2 pagesCH 9 RahmaSajakul SornNo ratings yet

- Test1 MKT 646 Nov 2014Document5 pagesTest1 MKT 646 Nov 2014delisyaaamilyNo ratings yet

- Steve Albrecht Service TriangleDocument3 pagesSteve Albrecht Service Trianglejared soNo ratings yet

- Credit Risk Issue in Partnership Contract The Case of MusyarakahDocument28 pagesCredit Risk Issue in Partnership Contract The Case of MusyarakahhisyamstarkNo ratings yet

- TAX 467 Topic 4 Capital Allowance - AgricultureDocument11 pagesTAX 467 Topic 4 Capital Allowance - AgricultureAnis RoslanNo ratings yet

- Far410 Chapter 2 Conceptual Framework EditedDocument60 pagesFar410 Chapter 2 Conceptual Framework EditedWAN AMIRUL MUHAIMIN WAN ZUKAMALNo ratings yet

- Strategic Management IntroductionDocument4 pagesStrategic Management Introductionkim che100% (1)

- What Is BGC Matrix?: Advantages of BCG Matrix AreDocument1 pageWhat Is BGC Matrix?: Advantages of BCG Matrix AreMarieJoiaNo ratings yet

- BCG Matrix Research PaperDocument6 pagesBCG Matrix Research Paperwclochxgf100% (1)

- Marketing: Assignment 03Document4 pagesMarketing: Assignment 03Meeral FatemahNo ratings yet

- IMC - BisleriDocument8 pagesIMC - BisleriVineetaNo ratings yet

- ISO - 21.060.10 - Bolts, Screws, Studs (List of Codes)Document9 pagesISO - 21.060.10 - Bolts, Screws, Studs (List of Codes)duraisingh.me6602No ratings yet

- ARC-232, Material Construction 2Document4 pagesARC-232, Material Construction 2danishali1090No ratings yet

- The International Poker RulesDocument2 pagesThe International Poker RulesOutontheBubbleNo ratings yet

- Homework 1Document8 pagesHomework 1Yooncheul JeungNo ratings yet

- Audi R8 Advert Analysis by Masum Ahmed 10PDocument2 pagesAudi R8 Advert Analysis by Masum Ahmed 10PMasum95No ratings yet

- DxDiag Copy MSIDocument45 pagesDxDiag Copy MSITạ Anh TuấnNo ratings yet

- Ideal Gas Law Lesson Plan FinalDocument5 pagesIdeal Gas Law Lesson Plan FinalLonel SisonNo ratings yet

- AstmDocument5 pagesAstmyanurarzaqaNo ratings yet

- Suspend and Resume Calls: Exit PlugDocument4 pagesSuspend and Resume Calls: Exit PlugrajuNo ratings yet

- Research Paper On Air QualityDocument4 pagesResearch Paper On Air Qualityluwahudujos3100% (1)

- Linear Dynamic Analysis of Free-Piston Stirling Engines OnDocument21 pagesLinear Dynamic Analysis of Free-Piston Stirling Engines OnCh Sameer AhmedNo ratings yet

- Britannia Volume 12 Issue 1981 (Doi 10.2307/526240) Michael P. Speidel - Princeps As A Title For 'Ad Hoc' CommandersDocument8 pagesBritannia Volume 12 Issue 1981 (Doi 10.2307/526240) Michael P. Speidel - Princeps As A Title For 'Ad Hoc' CommandersSteftyraNo ratings yet

- Geotechnical Aspects of Open Stope Design at BHP Cannington: G C StreetonDocument7 pagesGeotechnical Aspects of Open Stope Design at BHP Cannington: G C StreetonJuan PerezNo ratings yet

- Pest of Field Crops and Management PracticalDocument44 pagesPest of Field Crops and Management PracticalNirmala RameshNo ratings yet

- TRICARE Behavioral Health Care ServicesDocument4 pagesTRICARE Behavioral Health Care ServicesMatthew X. HauserNo ratings yet

- Intervensi Terapi Pada Sepsis PDFDocument28 pagesIntervensi Terapi Pada Sepsis PDFifan zulfantriNo ratings yet

- Assignment Csi104Document11 pagesAssignment Csi104Minh Lê KhảiNo ratings yet

- Powerwin EngDocument24 pagesPowerwin Engbillwillis66No ratings yet

- UntitledDocument13 pagesUntitledTestNo ratings yet

- HandsoutDocument3 pagesHandsoutloraine mandapNo ratings yet

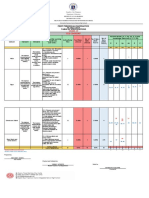

- Revised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10Document6 pagesRevised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10May Ann GuintoNo ratings yet

- Public Access - The GauntletDocument1 pagePublic Access - The GauntletTesting0% (2)

- Fmicb 10 02876Document11 pagesFmicb 10 02876Angeles SuarezNo ratings yet

- ArcGIS Shapefile Files Types & ExtensionsDocument4 pagesArcGIS Shapefile Files Types & ExtensionsdanangNo ratings yet

- Morse Potential CurveDocument9 pagesMorse Potential Curvejagabandhu_patraNo ratings yet

- P. E. and Health ReportDocument20 pagesP. E. and Health ReportLESSLY ABRENCILLONo ratings yet

- 3M 309 MSDSDocument6 pages3M 309 MSDSLe Tan HoaNo ratings yet