Professional Documents

Culture Documents

How Practical Are Raghuram Rajan's Radical Ideas - Business Today

Uploaded by

Abhishek SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How Practical Are Raghuram Rajan's Radical Ideas - Business Today

Uploaded by

Abhishek SinghCopyright:

Available Formats

3/9/14

How practical are Raghuram Rajan's radical ideas? : Business Today

Close

How practical are Raghuram Rajan's radical

ideas?

Anand Adhikari

March 4, 2014

If we are to achieve results never accomplished before, we must expect to employ methods

never before attempted," said the 16th century author and statesman Sir Francis Bacon.

Raghuram Rajan, the 23rd Governor of the Reserve Bank of India (RBI), may well have

been inspired by Bacon. RBI under Rajan is talking of a radically new approach to achieving

financial inclusion and creating a financial infrastructure for the new millennium.

In his five months at the RBI's Mumbai headquarters, the central bank has come up with

ideas that were never considered before. Consider, for example, the move to have bank

accounts for all citizens by 2016. Or the initiative to raise over $5 billion in September,

without having a sovereign bond issue, to combat the rupee depreciation. This was achieved

through a swap facility to attract NRI funds. The masterstroke was Rajans decision to go

after black money and fake currency by simply withdrawing currency issued before 2005.

Many of the existing banking practices and regulations were given shape several decades

ago. The RBI Act itself was drafted in the pre-Independence era, Winds of change have been

blowing globally for some time and the RBI needs to respond to them. The emergence of

electronic payments is transforming a poverty-stricken continent like Africa. "The

technological revolution bodes well for India. It can leverage payment technologies to bring

about financial inclusion," says Raj Jain, Chairman and Managing Director at RS Software

(India) Ltd, a technology company.

businesstoday.intoday.in/storyprint/203626

1/6

3/9/14

How practical are Raghuram Rajan's radical ideas? : Business Today

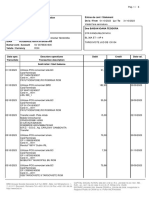

Click here to Enlarge

Financial Inclusion

Today, 60 per cent of Indias population does not have a bank account. In addition, about 90

per cent of small businesses have no links with formal lending institutions. Efforts to achieve

financial inclusion have failed to deliver adequate results. Rajan sounded out his Indian

Institute of Management (IIM) Ahmedabad classmate Nachiket Mor, now a member of the

RBIs central board within days of taking over, for ways to cover small businesses and low

income households. By January, the Mor committee had come up with the concept of

"payment banks" with initial capital of Rs 50 crore, one-tenth of what a full-service bank

requires. These banks could be set up by existing banks as subsidiaries or by consumer

goods dealers and mobile phone companies, non-banking finance companies (NBFCs) and

the post office system. Payment banks will only accept deposits and not do any lending.

But some question the need to create another structure in addition to the existing banking

network. "The infrastructure of mobile phone outlets and kirana stores already exists," says

Mor. This obviates the need to set up more new branches and payment banks can begin

offering basic banking services on getting a licence, he adds. Mor has also recommended

allowing NBFCs to set up wholesale banks which will accept wholesale deposits (not retail)

and engage in lending activity too. Mor reasons that the best incentive for financial inclusion

is to create competitive pressure in the system.

The second important

recommendation of the Mor

committee is to have bank accounts

for all by 2016 by linking them to the

Aadhaar numbers of citizens. But

not many are convinced. They say

the larger issue is of simultaneously

strengthening the banking

infrastructure and raising standards

of living. "Financial inclusion

definitely cannot mean just the

...Not everybody needs credit and not everyone who asks for

opening of a bank account. It also

credit should get it: Nachiket Mor, Central Board Member, RBI

cannot be done only by the banks.

Photo: Rachit Goswami

You have to have financial viability,

telecommunications, power, water, roads and then banks can follow," said Aditya Puri,

Managing Director of HDFC Bank at a recent Indian Bank Association function.

Two of the Mor committee members - Shikha Sharma, Managing Director and CEO, Axis

Bank, and S.S. Mundra, Chairman, Bank of Baroda - have stressed the need for providing

the complete bouquet of financial services which wont be achieved through payment banks.

"But not everybody needs credit and not everyone who asks for credit should get it. Credit

has to be given much more carefully," says Mor.

Rajan is yet to take a call on the Mor committee report.

Monetary Policy Reforms

On his very first day, Rajan also talked about a new approach to formulating monetary policy.

Rajan picked Deputy Governor Urjit Patel to take a look at what more needed to be done to

strengthen the monetary policy framework. The Patel committees report talks of inflation

targeting as the sole objective of the monetary policy and has insisted on using the

businesstoday.intoday.in/storyprint/203626

2/6

3/9/14

How practical are Raghuram Rajan's radical ideas? : Business Today

consumer price index (CPI) instead of the wholesale price index (WPI) for determining

interest rates. The CPI itself is a very new series with no long history. The share of food

component is very high in the CPI, almost half, which limits the impact of the monetary policy

on the index, say analysts.

"There is nothing wrong, theoretically or

conceptually, in using CPI as a nominal

anchor, but I dont think it will work as

monetary policy cannot influence any

significant component of the CPI," says

Madan Sabnavis, Chief Economist at Care

Ltd. In the third quarter review of the

monetary policy in January, Rajan has

made a reference to CPI, which shows he

obviously sees merit in using it as an

inflation anchor. Patel committee has also

suggested forming a five-member monetary

policy committee (MPC) to decide policy

action.

These two radical ideas are in direct conflict

with the recommendations of the

government-appointed Srikrishna panel on

Financial Sector Legislative Reforms.

Srikrishna report, submitted a year ago, has

clearly spelt out the governments role in

Financial inclusion definitely cannot mean just the

giving quantitative monitorable objectives to

opening of a bank account: Aditya Puri, MD, HDFC

RBI for monetary policy formulation. The

Bank Photo: Nishikant Gamre

mandate of the RBI spelt out in the Act is to

support growth, financial stability (of the banking system) and price (inflation) stability. "The

objective that the RBI must pursue would be defined by a central government and could

potentially change over the years," added the Srikrishna report.

businesstoday.intoday.in/storyprint/203626

3/6

3/9/14

How practical are Raghuram Rajan's radical ideas? : Business Today

The composition of the MPC suggested by the Patel committee - with RBI Governor as

Chairman, a deputy governor, executive director and two external members - is also in

contrast to the Srikrishna committee recommendations. Srikrishna has suggested a sevenmember MPC, which includes the RBI Governor, one executive director from the RBI and

five external members. Out of the five external members, two will be appointed by the

Governor and three will be by the government. Clearly, the government wants to have a say

in the monetary policy decision-making whereas Rajan appointed committee is tilted in

favour of the RBIs independence.

Internationalisation of the Rupee

Many were surprised when on the very first day of assuming office in September last year,

Rajan talked about internationalisation of rupee. "This might be a strange time to talk about it,

but we have to think beyond the next few months," said Rajan. It actually means acceptability

of the Indian rupee for settlement of cross border transactions globally like the dollar. Rajan

spoke about internationalisation when he was actually expected to do some fire fighting to

save the rupee from depreciating against the US dollar. The rupee breached the 68 mark last

August against the dollar. "That may be his long term plan," says Rohit Wahi, CEO and

Country Head, FirstRand Bank India. Internationalisation is a sensitive issue as it first

involves capital account convertibility. This might make the rupee volatile and it might

businesstoday.intoday.in/storyprint/203626

4/6

3/9/14

How practical are Raghuram Rajan's radical ideas? : Business Today

eventually depreciate because of a large current account deficit. A report authored by two

RBI executives in May 2010 said: "It depends on market forces, i.e., how much faith the

market has in that currency, which in turn depends on various factors, such as size of the

economy, level of financial development, stability, etc."

Distressed Assets

Rajan is quick to spot the growing non performing asset (NPA) menace in the banking

sector. While his measures for early detection of bad debt are laudable, the second leg of

NPA resolution, which depends on the courts, requires an overhaul of the legal system. The

RBI plans to take up with the government concrete suggestions on reining in NPAs. These

include creation of additional debt recovery tribunals, creating special cadre of officers and a

separate bench for speedy disposal of NPA-related cases. Recommendations may also be

made to the government to expedite setting up of special benches in every high court for

corporate cases. "But these things will take years," says an official of an asset

reconstruction company.

The governor wants to reduce the SLR

(statutory liquidity ratio), which requires

banks to invest 23 per cent of the deposits

in government securities. "This (reduction)

cannot be done overnight, of course. As

government finances improve, the scope of

such reduction will increase," said Rajan in

his very first media interaction. The banks

today hold 28 per cent SLR, more than the

stipulated amount, because of shrinking

lending opportunities in an economic

slowdown. "Commercially speaking, banks

are finding it more comfortable to hold risk

free G-Sec," says Sabnavis.

Separately, Rajans idea of allowing fund

transfers by way of an SMS system also

looks ambitious. "It actually requires

installation of encrypted software in every

handset," says Uttam Nayak, Country Head

at Visa India. And thats a challenging task to

have such an encryption with handset

manufactures spread over different

geographies.

Clearly, Rajan is not looking at band-aid

India can leverage payment technologies to bring

solutions to fix the larger structural issues

about financial inclusion: Raj Jain, CMD, RS Software

(India) Ltd

and has set an ambitious agenda for the

central bank. Can he pull if off? For the moment, Rajan exudes confidence that he can ring in

far reaching reforms.

Print

Close

URL for this article :

http://businesstoday.intoday.in/story/how-practical-raghuram-rajans-radical-ideas-are/1/203626.html

businesstoday.intoday.in/storyprint/203626

5/6

You might also like

- Un Isdr Hnadbook Good Building DesignDocument1 pageUn Isdr Hnadbook Good Building DesignAbhishek SinghNo ratings yet

- School Timings Summer: 5 April To 31 October 2017 Monday - Friday Monday - Saturday Friday (Prior To 2Document1 pageSchool Timings Summer: 5 April To 31 October 2017 Monday - Friday Monday - Saturday Friday (Prior To 2Abhishek SinghNo ratings yet

- PGP30 Summers AsianPaints RGDocument2 pagesPGP30 Summers AsianPaints RGAbhishek Singh100% (1)

- London 2011Document32 pagesLondon 2011Amandine JayéNo ratings yet

- S.No. Roll No. Member 1 Member 2 SchoolDocument1 pageS.No. Roll No. Member 1 Member 2 SchoolAbhishek SinghNo ratings yet

- Marketing Case - 2014Document4 pagesMarketing Case - 2014Abhishek SinghNo ratings yet

- Handbook On Good Building Design and ConstructionDocument100 pagesHandbook On Good Building Design and Constructionmujati100% (3)

- Uber Analytics Test Updates To QuestionsDocument1 pageUber Analytics Test Updates To QuestionsAbhishek SinghNo ratings yet

- EECS 490 Lecture16Document15 pagesEECS 490 Lecture16WinsweptNo ratings yet

- An Introduction To Digital Image Processing With MatlabDocument233 pagesAn Introduction To Digital Image Processing With Matlabitssiraj100% (3)

- Matlab HelpDocument6 pagesMatlab HelpAbhishek SinghNo ratings yet

- Work MeasurementDocument38 pagesWork MeasurementAbhishek SinghNo ratings yet

- RISAT Progress ReportDocument15 pagesRISAT Progress ReportAbhishek SinghNo ratings yet

- Matlab HelpDocument6 pagesMatlab HelpAbhishek SinghNo ratings yet

- Mbark Design ManagmntDocument2 pagesMbark Design ManagmntAbhishek SinghNo ratings yet

- Mbark Dangerous DecemberDocument2 pagesMbark Dangerous DecemberAbhishek SinghNo ratings yet

- Mbark Don T TakeDocument2 pagesMbark Don T TakeAbhishek SinghNo ratings yet

- Gmail - Ola Share Receipt For OSN389572965Document2 pagesGmail - Ola Share Receipt For OSN389572965Abhishek SinghNo ratings yet

- RISAT Progress ReportDocument15 pagesRISAT Progress ReportAbhishek SinghNo ratings yet

- Mbark Direct MarktngDocument3 pagesMbark Direct MarktngAbhishek SinghNo ratings yet

- Institute Watch - IIM IndoreDocument5 pagesInstitute Watch - IIM IndoreAbhishek SinghNo ratings yet

- Mbark Coping StreeDocument2 pagesMbark Coping StreeAbhishek SinghNo ratings yet

- MBark-In Search of The CEOsDocument1 pageMBark-In Search of The CEOsAbhishek SinghNo ratings yet

- Institute Watch FmsDocument4 pagesInstitute Watch FmsAbhishek SinghNo ratings yet

- News Round Up - Outcome Budget PublishedDocument1 pageNews Round Up - Outcome Budget PublishedAbhishek SinghNo ratings yet

- Revision:: Solid Formula For SuccessDocument2 pagesRevision:: Solid Formula For SuccessAbhishek SinghNo ratings yet

- Catch 22: India's Apparent Volte-Face Against Iran in The Global ForumDocument2 pagesCatch 22: India's Apparent Volte-Face Against Iran in The Global ForumAbhishek SinghNo ratings yet

- Should Youth Indulge in Politics?: - V. K. DevDocument1 pageShould Youth Indulge in Politics?: - V. K. DevAbhishek SinghNo ratings yet

- Primary Focus Is Not Investor or Market But Consumers - Rajan - The HinduDocument2 pagesPrimary Focus Is Not Investor or Market But Consumers - Rajan - The HinduAbhishek SinghNo ratings yet

- The FM's Successor Is in Trouble - Business LineDocument2 pagesThe FM's Successor Is in Trouble - Business LineAbhishek SinghNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Retirement and Dissolution of Firm Class TestDocument2 pagesRetirement and Dissolution of Firm Class TestHarish RajputNo ratings yet

- Mcom Exam Form Acknowledgment - Sem 3 PDFDocument2 pagesMcom Exam Form Acknowledgment - Sem 3 PDFMansi KotakNo ratings yet

- CPChap 1Document38 pagesCPChap 1Phương DaoNo ratings yet

- Assignment of Banking Company 22-23Document6 pagesAssignment of Banking Company 22-23DARK KING GamersNo ratings yet

- RiskDocument3 pagesRiskChaucer19No ratings yet

- The SIX SENSE (Karvy Demat Scam)Document12 pagesThe SIX SENSE (Karvy Demat Scam)Pranav TaleNo ratings yet

- Intermediate Accounting CH 4 SolutionsDocument65 pagesIntermediate Accounting CH 4 SolutionsTracy Wright100% (1)

- UPSC - Candidate's Application Details (Registration-Id: 117..Document1 pageUPSC - Candidate's Application Details (Registration-Id: 117..rajat singhNo ratings yet

- Barwa Real Estate Balance Sheet Particulars Note NoDocument28 pagesBarwa Real Estate Balance Sheet Particulars Note NoMuhammad Irfan ZafarNo ratings yet

- Annex E.1 (Cir1030 - 2019)Document2 pagesAnnex E.1 (Cir1030 - 2019)michael lababoNo ratings yet

- The Following Data Pertain To Lincoln Corporation On December 31Document8 pagesThe Following Data Pertain To Lincoln Corporation On December 31Jhianne Mae Albag100% (1)

- S Ep JFX 3 Wa El Al GS2Document8 pagesS Ep JFX 3 Wa El Al GS2Danda RavindraNo ratings yet

- Ch07 ShowDocument57 pagesCh07 ShowBagus ZijlstraNo ratings yet

- FAR-1stPB 10.22Document8 pagesFAR-1stPB 10.22Harold Dan AcebedoNo ratings yet

- SV39786361600 2023 10Document6 pagesSV39786361600 2023 10ioanateodorabaisanNo ratings yet

- Bank Reconciliation Assignment 2Document8 pagesBank Reconciliation Assignment 2Caira De AsisNo ratings yet

- Prudential Norms On Income Recognition, Asset Classification and Provisioning Pertaining To Advances - Projects Under Implementation PDFDocument2 pagesPrudential Norms On Income Recognition, Asset Classification and Provisioning Pertaining To Advances - Projects Under Implementation PDFPraveer MoreyNo ratings yet

- Budget SheetDocument10 pagesBudget Sheetshrestha.aryxnNo ratings yet

- Vikram Singh Negi SBI Bank StatementDocument4 pagesVikram Singh Negi SBI Bank StatementArushi SinghNo ratings yet

- Group Assignment Questions GB30703 - Set 1Document2 pagesGroup Assignment Questions GB30703 - Set 1March ClaNo ratings yet

- Summary of Grades Gwa CalculatorDocument4 pagesSummary of Grades Gwa CalculatorRenelyn FiloteoNo ratings yet

- Loan Contract OrnopiaDocument5 pagesLoan Contract OrnopiaaizhelarcipeNo ratings yet

- Certificate of Final Tax Withheld at Source: Kawanihan NG Rentas InternasDocument5 pagesCertificate of Final Tax Withheld at Source: Kawanihan NG Rentas InternasBrianSantiagoNo ratings yet

- Complete Guide To Value InvestingDocument59 pagesComplete Guide To Value InvestingPaulo TrickNo ratings yet

- LK TPM 31 Mar 2023 PDFDocument67 pagesLK TPM 31 Mar 2023 PDFAnonymous waj9QU06No ratings yet

- PSSSB Patwari Fee 2023Document1 pagePSSSB Patwari Fee 2023Sahil AroraNo ratings yet

- Lec 1 After Mid TermDocument9 pagesLec 1 After Mid TermsherygafaarNo ratings yet

- Green Shoe OptionDocument34 pagesGreen Shoe OptionAbhishek GuptaNo ratings yet

- BRC PDFDocument1 pageBRC PDFஇனி ஒரு விதி செய்வோம்No ratings yet

- Chapter 3Document8 pagesChapter 3Nigussie BerhanuNo ratings yet