Professional Documents

Culture Documents

Mobile Money and The Economy

Uploaded by

The New Vision0 ratings0% found this document useful (0 votes)

61 views6 pagesOpening Remarks by Prof. Emmanuel Tumusiime-Mutebile

Governor, Bank of Uganda at workshop on the Economics of

Mobile Money

Sheraton Hotel Kampala

Rwenzori Ballroom

February 12, 2015

Original Title

Mobile Money and the Economy (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentOpening Remarks by Prof. Emmanuel Tumusiime-Mutebile

Governor, Bank of Uganda at workshop on the Economics of

Mobile Money

Sheraton Hotel Kampala

Rwenzori Ballroom

February 12, 2015

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

61 views6 pagesMobile Money and The Economy

Uploaded by

The New VisionOpening Remarks by Prof. Emmanuel Tumusiime-Mutebile

Governor, Bank of Uganda at workshop on the Economics of

Mobile Money

Sheraton Hotel Kampala

Rwenzori Ballroom

February 12, 2015

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

BANK OF UGANDA

Mobile Money and the Economy

Opening Remarks by Prof. Emmanuel Tumusiime-Mutebile

Governor, Bank of Uganda at workshop on the Economics of

Mobile Money

Sheraton Hotel Kampala

Rwenzori Ballroom

February 12, 2015

Representatives of the Private Sector Stakeholders,

Academicians, Policy Analysts and Practitioners,

Ladies and Gentlemen.

Good morning.

I would like to begin by welcoming everyone to this conference on

the economics of mobile money and to welcome especially all those

who have made the effort to come here from abroad to share with

us your experience and expertise. I am sure that it will prove to be a

very interesting and fruitful conference, and will prove valuable to

you whatever your field of work. I would also like to thank the

International Growth Centre and the United Nations Capital

Development Fund for joining with the Bank of Uganda to organize

the conference. I would also like to thank everyone who has

prepared presentations for the conference. Although the issues

which we will debate at this conference clearly have global

relevance, holding it here in East Africa is particularly apt, because

this region has been at the forefront of the mobile money revolution

over the last six years.

The rapid growth of mobile money in East Africa is a phenomenon

which has few precedents in the history of finance and banking and

which has implications which are likely to prove profound, for the

financial sector, for business, for the general public and for public

policy. Trying to understand what these implications might be

provides the motivation for this conference, which brings together

1

academics, practitioners from industry and policy makers. In the

four sessions which will follow we will hear and discuss both the

results

of

academic

research

and

the

views

of

industry

professionals.

Mobile banking has already had a major impact on broadening

access to basic financial services in East Africa. The benefits in

terms of financial inclusion will themselves have important

economic consequences, for business and household welfare. But I

think that we are probably still only at the beginning of the

transformation which mobile banking will create in our economy

and society. In the rest of these remarks I will highlight what I think

are some of the key issues which we need to study and debate if we

are to better understand the changes which mobile money will bring

about and their implications.

The first and probably most complex issue I want to highlight is the

impact that mobile banking will eventually have on traditional

banking. For more than a century, finance has been dominated by a

traditional banking model in which customers hold deposit

accounts in banks and receive a range of services from their bank.

Mobile banking is already peeling away some of these services from

banks, notably payment services. How many more types of financial

service will migrate from traditional banks to mobile banking, or to

some form of internet banking, in the future? And as commercial

banks lose their traditional dominance in the markets for these

services, will traditional banking remain commercially viable? For

example, will people eventually hold the money they require for

transactions purposes entirely in the form of electronic money,

rendering cash and non interest bearing demand deposits in banks

largely redundant? Will banks, as a consequence, be forced to adopt

radically different business models focusing only on financial

services which cannot easily be delivered electronically?

Secondly, such transformations in the way in which financial

services are delivered matter profoundly for public policy, not least

because traditional banks play a central role in the way in which

monetary policy is implemented by central banks and are the focus

of financial regulation.

I will make a few remarks about both

monetary policy and financial regulation.

The current business model of mobile banking in East Africa

implies a substitution of cash for bank deposits, and hence a larger

money multiplier, because all virtual money sold to customers has

to be backed up by deposits in the partner bank of the mobile

money provider. Mobile money may also affect the velocity of

circulation of money: in principle one might expect velocity to rise if

mobile money makes retail payments transactions easier for

customers.

However, if more radical mobile banking business models are

eventually developed in which mobile money becomes a substitute

for demand deposits in banks, the ability of central banks to control

interest rates could be undermined. This is because central banks

control short term interest rates by varying the liquidity available

for commercial banks to meet their reserve requirements. But if

mobile money eventually leads to a diminution of the role which

commercial banks play in the financial system, the interest rate

transmission mechanism, which relies on movements in short term

inter-bank rates being transmitted along the yield curve to all other

interest rates in the economy, will be weakened, which in turn will

weaken the transmission mechanism of monetary policy. Central

banks

will, therefore,

need to develop alternative

tools

for

influencing interest rates in the economy.

Financial regulation has focused on commercial banks largely for

two reasons; they are the financial institutions in which are held

the bulk of the financial savings of ordinary people and they play a

central role in the economys payments system. For both these

reasons, commercial banks are much more important to the

stability of the financial system and the delivery of essential

financial services to the economy than any other type of financial

institution. As I have already noted, mobile banking is already

providing a partial substitute for the retail payments services of

banks and could eventually challenge the dominance of banks in

4

the provision of other types of services, including deposits. If so,

prudential regulation which is focused on ensuring the soundness

of the banking system may no longer be sufficient to protect the

safety of customers savings or the systemic stability of the financial

system and the preservation of its critical functions.

Finally I want to stress the vital importance of carrying out high

quality research on these issues. This is the only way we will

improve our understanding of what is a very complex and rapidly

changing phenomenon. I am pleased, therefore, that we will end

this conference with a discussion on the directions of a future

research agenda.

I wish everyone a very productive conference.

Thank you for listening.

You might also like

- Three Challenges For The Banking Sector: TwitterDocument7 pagesThree Challenges For The Banking Sector: TwitterDeepak SachdevNo ratings yet

- Money and BankingDocument15 pagesMoney and BankingRimsha KhanNo ratings yet

- Video PDFDocument35 pagesVideo PDFKapil PokhrelNo ratings yet

- Microfinance and Mobile Banking: The Story So Far: No. 62 July 2010Document16 pagesMicrofinance and Mobile Banking: The Story So Far: No. 62 July 20109415351296No ratings yet

- The Current State and Future of Mobile Banking in EuropeDocument16 pagesThe Current State and Future of Mobile Banking in EuropepaulojooliveiraNo ratings yet

- Drivers of Change in Banking IndustriesDocument3 pagesDrivers of Change in Banking IndustriesPatrick Njuguna100% (1)

- Mobile Banking Project ProposalDocument35 pagesMobile Banking Project ProposalSimon Muteke85% (13)

- Mobile Banking ProjectDocument60 pagesMobile Banking ProjectPankajSinghYadav100% (2)

- Retail BankingDocument13 pagesRetail Bankingankit161019893980No ratings yet

- Mobile Banking in BangladeshDocument31 pagesMobile Banking in BangladeshCoral AhmedNo ratings yet

- Mobile Banking Use: A Comparative Study Between Bangladesh and USDocument12 pagesMobile Banking Use: A Comparative Study Between Bangladesh and USSaqeef RayhanNo ratings yet

- Mobile BankingDocument17 pagesMobile BankingSuchet SinghNo ratings yet

- The End of Banking: Money, Credit, And the Digital RevolutionFrom EverandThe End of Banking: Money, Credit, And the Digital RevolutionRating: 4 out of 5 stars4/5 (1)

- 1.retail Banking: DefinitionDocument50 pages1.retail Banking: DefinitionAshish Anil MataiNo ratings yet

- Chapter OneDocument7 pagesChapter OneBlaise KrisNo ratings yet

- K C Chakrabarty: Mobile Commerce, Mobile Banking - The Emerging ParadigmDocument7 pagesK C Chakrabarty: Mobile Commerce, Mobile Banking - The Emerging ParadigmLinny ElangoNo ratings yet

- Banking Trends, October 2014, EFMADocument27 pagesBanking Trends, October 2014, EFMAlc1560pintoNo ratings yet

- M-Banking in India - Regulations and Rationale : K. C. ChakrabartyDocument4 pagesM-Banking in India - Regulations and Rationale : K. C. ChakrabartyeexploreerNo ratings yet

- Hillsmbero 1Document36 pagesHillsmbero 1pmthogoNo ratings yet

- 1par Regular (New)Document8 pages1par Regular (New)Daw Aye NweNo ratings yet

- TMP DAFEDocument11 pagesTMP DAFEnithiananthiNo ratings yet

- 1 (I) Explain The Main Types of Banking InnovationsDocument4 pages1 (I) Explain The Main Types of Banking InnovationsJackson KasakuNo ratings yet

- Financial Inclusion in Nigeria: The Challenges of Banks and Mobile Money Operators (Mmos)Document15 pagesFinancial Inclusion in Nigeria: The Challenges of Banks and Mobile Money Operators (Mmos)Hermenegildo LuisNo ratings yet

- Design and Implementation of Mobile Banking SystemDocument25 pagesDesign and Implementation of Mobile Banking SystemAyoola OladojaNo ratings yet

- Role of Financial AdvisorsDocument3 pagesRole of Financial AdvisorsMukesh SarojNo ratings yet

- Macroeconomic AnalysisDocument7 pagesMacroeconomic AnalysisRishu GuptaNo ratings yet

- ROLE OF BANKS IN ECONOMIC DEVELOPMENTDocument25 pagesROLE OF BANKS IN ECONOMIC DEVELOPMENTZabed HossenNo ratings yet

- MoblileDocument3 pagesMoblilenandu2887No ratings yet

- NOVAAFRICA 2015 Working Paper 1Document28 pagesNOVAAFRICA 2015 Working Paper 1SantialvaritoCrackNo ratings yet

- Mobile BankingDocument8 pagesMobile Bankingapi-19917160No ratings yet

- Mobile Banking ReportDocument57 pagesMobile Banking ReportAntonyNo ratings yet

- Evolution of Banking TechnologyDocument31 pagesEvolution of Banking TechnologyPooja LalwaniNo ratings yet

- The Effects of Alternative Banking Channels On Profitability of Commercial Banks-Case of The Co-Operative Bank of KenyaDocument6 pagesThe Effects of Alternative Banking Channels On Profitability of Commercial Banks-Case of The Co-Operative Bank of KenyatheijesNo ratings yet

- Review of MicrofinanceDocument4 pagesReview of MicrofinanceanshllNo ratings yet

- What Is A Bank? How Does A Bank Differ From Most Other Financial-Service Providers?Document4 pagesWhat Is A Bank? How Does A Bank Differ From Most Other Financial-Service Providers?Anh ThưNo ratings yet

- 12 03 29 RBI Paper On MBankingDocument9 pages12 03 29 RBI Paper On MBankingvivekanandsNo ratings yet

- GP CoreDocument133 pagesGP CoreDivya GanesanNo ratings yet

- My ProjectDocument38 pagesMy ProjectRidwan BamideleNo ratings yet

- CATDocument7 pagesCATJackson KasakuNo ratings yet

- Research Paper On Indian Banking SectorDocument7 pagesResearch Paper On Indian Banking Sectoriimytdcnd100% (1)

- Strategic Corporate Banking Developing MarketsDocument21 pagesStrategic Corporate Banking Developing Marketsvijayant_1No ratings yet

- Banking Law Project Sakshi DagurDocument16 pagesBanking Law Project Sakshi DagurBharat Joshi100% (1)

- Mobile BankingDocument79 pagesMobile BankingSubramanya Dg0% (1)

- Technology in Banking: An Instrument For Economic GrowthDocument8 pagesTechnology in Banking: An Instrument For Economic Growthsantoshsa_1987No ratings yet

- Banking TrendsDocument18 pagesBanking TrendsSiya SunilNo ratings yet

- Q) Explain in Detail The Role and Importance of Financial Institutions and Banks in The Emerging New Environment of Privatization and Globalization in India?Document8 pagesQ) Explain in Detail The Role and Importance of Financial Institutions and Banks in The Emerging New Environment of Privatization and Globalization in India?Amit BahadurNo ratings yet

- Banking Services in The Republic of UzbekistanDocument9 pagesBanking Services in The Republic of UzbekistanAcademic JournalNo ratings yet

- Delivery of Retail Banking Services EvolutionDocument13 pagesDelivery of Retail Banking Services EvolutionPhilip K BugaNo ratings yet

- Tahmina Akter 9095Document20 pagesTahmina Akter 9095Parvin AkterNo ratings yet

- Original Project 1Document13 pagesOriginal Project 1fatinNo ratings yet

- Digital Imperative in BankingDocument16 pagesDigital Imperative in BankingMatthew IrwinNo ratings yet

- Indian Banking Sector Towards The Next OrbitDocument17 pagesIndian Banking Sector Towards The Next OrbitKalyan Raman VadlamaniNo ratings yet

- CHAPTER ONE - FiveDocument21 pagesCHAPTER ONE - FiveFira ManNo ratings yet

- Embracing Fintech: Speech Given by Dave Ramsden, Deputy Governor Markets & BankingDocument5 pagesEmbracing Fintech: Speech Given by Dave Ramsden, Deputy Governor Markets & BankingHao WangNo ratings yet

- E BankingDocument64 pagesE BankingmaarzzbNo ratings yet

- Mobile Phone Banking Usage Experiences in Kenya byDocument16 pagesMobile Phone Banking Usage Experiences in Kenya byAury KashkashNo ratings yet

- Committee On Payment and Settlement Systems: Policy Issues For Central Banks in Retail PaymentsDocument54 pagesCommittee On Payment and Settlement Systems: Policy Issues For Central Banks in Retail PaymentsUjjwal Kumar DasNo ratings yet

- Fintech-banking sectorDocument17 pagesFintech-banking sectorhimanshu bhattNo ratings yet

- Understand Banks & Financial Markets: An Introduction to the International World of Money & FinanceFrom EverandUnderstand Banks & Financial Markets: An Introduction to the International World of Money & FinanceRating: 4 out of 5 stars4/5 (9)

- President Museveni End of Year Message 2023Document11 pagesPresident Museveni End of Year Message 2023The New VisionNo ratings yet

- President Museveni's 2023/24 Budget SpeechDocument7 pagesPresident Museveni's 2023/24 Budget SpeechThe New Vision0% (1)

- President Museveni's CHOGM Business SpeechDocument12 pagesPresident Museveni's CHOGM Business SpeechThe New VisionNo ratings yet

- Gen. Muhoozi Kainerugaba's Speech at Thank You Concert in EntebbeDocument3 pagesGen. Muhoozi Kainerugaba's Speech at Thank You Concert in EntebbeThe New VisionNo ratings yet

- President Museveni's End of Year AddressDocument34 pagesPresident Museveni's End of Year AddressThe New VisionNo ratings yet

- Final Admission List of Students To Government Health Training CollegesDocument298 pagesFinal Admission List of Students To Government Health Training CollegesThe New VisionNo ratings yet

- List of Successful Candidates General Duties & DriversDocument25 pagesList of Successful Candidates General Duties & DriversThe New VisionNo ratings yet

- State of The Nation Address 2023Document51 pagesState of The Nation Address 2023The New VisionNo ratings yet

- Executive Order No. 3 of 2023Document18 pagesExecutive Order No. 3 of 2023The New VisionNo ratings yet

- President Museveni's Speech As Uganda Celebrated 60 Years of IndependenceDocument31 pagesPresident Museveni's Speech As Uganda Celebrated 60 Years of IndependenceThe New VisionNo ratings yet

- State of The Nation Address 2022Document32 pagesState of The Nation Address 2022The New VisionNo ratings yet

- President Museveni's Heroes Day 2022 SpeechDocument9 pagesPresident Museveni's Heroes Day 2022 SpeechThe New VisionNo ratings yet

- President's Statement To Kampala Bomb BlastsDocument3 pagesPresident's Statement To Kampala Bomb BlastsThe New VisionNo ratings yet

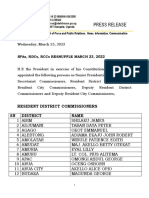

- SPAs, RDCS, RCCs ReshuffledDocument12 pagesSPAs, RDCS, RCCs ReshuffledThe New Vision100% (3)

- President Museveni's Speech On World Teachers Day 2020Document12 pagesPresident Museveni's Speech On World Teachers Day 2020The New VisionNo ratings yet

- 58TH Independence Anniversary Speech by President Yoweri MuseveniDocument13 pages58TH Independence Anniversary Speech by President Yoweri MuseveniGCICNo ratings yet

- Dorothy Kisaka Inauguration SpeechDocument9 pagesDorothy Kisaka Inauguration SpeechThe New Vision100% (1)

- Ruling Aine Godfrey Kaguta Sodo V NRM & AnotherDocument23 pagesRuling Aine Godfrey Kaguta Sodo V NRM & AnotherThe New VisionNo ratings yet

- First Lady's Address On The Reopening of SchoolsDocument9 pagesFirst Lady's Address On The Reopening of SchoolsThe New Vision100% (1)

- Presidential Address On The National LockDownDocument22 pagesPresidential Address On The National LockDownMujuni Raymond Carlton QataharNo ratings yet

- H.E. The President's Message To BuzukuuluDocument25 pagesH.E. The President's Message To BuzukuuluThe New Vision100% (1)

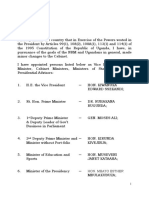

- Cabinet 2019/20Document13 pagesCabinet 2019/20The New Vision80% (5)

- 2018 State of The Nation Address UgandaDocument30 pages2018 State of The Nation Address UgandaThe Independent MagazineNo ratings yet

- President Museveni's CPC SpeechDocument15 pagesPresident Museveni's CPC SpeechThe New Vision100% (1)

- Salva Kiir Easter MessageDocument3 pagesSalva Kiir Easter MessageThe New VisionNo ratings yet

- Private Admission List 2017/18Document1,052 pagesPrivate Admission List 2017/18The New Vision95% (19)

- President Yoweri Museveni's Speech at TICADDocument10 pagesPresident Yoweri Museveni's Speech at TICADThe New VisionNo ratings yet

- New RDCs & Deputy RDCsDocument16 pagesNew RDCs & Deputy RDCsThe New Vision100% (2)

- President Museveni's Address To The Mozambique ParliamentDocument16 pagesPresident Museveni's Address To The Mozambique ParliamentThe New VisionNo ratings yet

- President Yoweri Museveni's Speech at The Commissioning of The Hoima-Tanga PipelineDocument8 pagesPresident Yoweri Museveni's Speech at The Commissioning of The Hoima-Tanga PipelineThe New Vision100% (1)

- The Ramayana and The Sacred Palm Trees of Sumeria, Mesopotamia, Assyria and PhoeniciaDocument7 pagesThe Ramayana and The Sacred Palm Trees of Sumeria, Mesopotamia, Assyria and PhoeniciaNeeta RainaNo ratings yet

- Wallace, 2009Document20 pagesWallace, 2009florNo ratings yet

- Recommender Systems Research GuideDocument28 pagesRecommender Systems Research GuideSube Singh InsanNo ratings yet

- History of Early ChristianityDocument40 pagesHistory of Early ChristianityjeszoneNo ratings yet

- Work, Energy and Power: Checkpoint 1 (p.194)Document12 pagesWork, Energy and Power: Checkpoint 1 (p.194)U KILLED MY DOGNo ratings yet

- The 4Ps of Labor: Passenger, Passageway, Powers, and PlacentaDocument4 pagesThe 4Ps of Labor: Passenger, Passageway, Powers, and PlacentaMENDIETA, JACQUELINE V.No ratings yet

- Size, Scale and Overall Proportion of Form, Basic Understanding of Various Shapes, Inter-Relationship of Visual FormsDocument17 pagesSize, Scale and Overall Proportion of Form, Basic Understanding of Various Shapes, Inter-Relationship of Visual FormsJabbar AljanabyNo ratings yet

- Teaching Islamic Traditions by SlidesgoDocument48 pagesTeaching Islamic Traditions by SlidesgoCallista Naira AzkiaNo ratings yet

- OutliningDocument17 pagesOutliningJohn Mark TabbadNo ratings yet

- Military Divers ManualDocument30 pagesMilitary Divers ManualJohn0% (1)

- Electrical Power System Protection BookDocument2 pagesElectrical Power System Protection BookHimanshu Kumar SagarNo ratings yet

- Class Homework Chapter 1Document9 pagesClass Homework Chapter 1Ela BallıoğluNo ratings yet

- Grimoire of Baphomet A-Z EditionDocument18 pagesGrimoire of Baphomet A-Z EditionTheK1nGp1N100% (1)

- Bach Invention No9 in F Minor - pdf845725625Document2 pagesBach Invention No9 in F Minor - pdf845725625ArocatrumpetNo ratings yet

- 6 Lesson Writing Unit: Personal Recount For Grade 3 SEI, WIDA Level 2 Writing Kelsie Drown Boston CollegeDocument17 pages6 Lesson Writing Unit: Personal Recount For Grade 3 SEI, WIDA Level 2 Writing Kelsie Drown Boston Collegeapi-498419042No ratings yet

- State of Indiana, County of Marion, SS: Probable Cause AffidavitDocument1 pageState of Indiana, County of Marion, SS: Probable Cause AffidavitIndiana Public Media NewsNo ratings yet

- Class Namespace DesciptionDocument9 pagesClass Namespace DesciptionĐào Quỳnh NhưNo ratings yet

- Georgetown University NewsletterDocument3 pagesGeorgetown University Newsletterapi-262723514No ratings yet

- M04 - Conditional Obligations and Reciprocal Obligations PDFDocument12 pagesM04 - Conditional Obligations and Reciprocal Obligations PDFTam GarciaNo ratings yet

- Unit 2 - BT MLH 11 - KeyDocument2 pagesUnit 2 - BT MLH 11 - KeyttyannieNo ratings yet

- AdmitCard 1688037Document1 pageAdmitCard 1688037P.Supreeth ReddyNo ratings yet

- Class 7 Summer Vacation PDFDocument4 pagesClass 7 Summer Vacation PDFPrince RajNo ratings yet

- A StarDocument59 pagesA Starshahjaydip19912103No ratings yet

- Agile Process ModelsDocument15 pagesAgile Process ModelsShadrack KimutaiNo ratings yet

- C4 - Learning Theories and Program DesignDocument43 pagesC4 - Learning Theories and Program DesignNeach GaoilNo ratings yet

- Financial Management-Capital BudgetingDocument39 pagesFinancial Management-Capital BudgetingParamjit Sharma100% (53)

- Prof 7 - Capital Market SyllabusDocument10 pagesProf 7 - Capital Market SyllabusGo Ivanizerrckc100% (1)

- Burton Gershfield Oral History TranscriptDocument36 pagesBurton Gershfield Oral History TranscriptAnonymous rdyFWm9No ratings yet

- CH 2 Short Questions IXDocument2 pagesCH 2 Short Questions IXLEGEND REHMAN OPNo ratings yet

- Group Handling - Pre Registration Activity: Submited To-Submitted byDocument12 pagesGroup Handling - Pre Registration Activity: Submited To-Submitted byharshal kushwahNo ratings yet