Professional Documents

Culture Documents

A Tale of Two Counties Facing Possible Property Tax Increases Graphic

Uploaded by

Morgan Yarnik0 ratings0% found this document useful (0 votes)

5 views1 pageGraphic for "A Tale of Two Counties Facing Possible Property Tax Increases" story.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGraphic for "A Tale of Two Counties Facing Possible Property Tax Increases" story.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageA Tale of Two Counties Facing Possible Property Tax Increases Graphic

Uploaded by

Morgan YarnikGraphic for "A Tale of Two Counties Facing Possible Property Tax Increases" story.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

A Tale of Two Counties

Facing Possible Property

Tax Increases

For the past three years, Frisco ISD's property tax rates have

remained stable, but this May the school district passed a $775

million bond to add 14 new schools to accommodate the inflow of

students, according to the Frisco ISD website.

Frisco ISD's tax rates for the past 5 years

Due to the passage of the school district's bond, tax payers could

be seeing an increase in the I&S portion of the total property tax

rate in 2015. A graph below shows the school district's tax rates for

the last five years, according to Frisco ISD's tax rate history.

1.4

0.42

0.42

1.04

0.42

1.00

1.04

0.39

1.00

0.42

0.39

1.1

1.00

Tax rates in $ per $100 Appraised Value

1.2

1.04

1.3

1

0.9

0.8

0.7

0.6

0.5

0.4

0.3

0.2

0.1

0

2009

2010

2011

M&O

2012

2013

2014

I&S

Average appraised home values in Denton

and Collin for the past 5 years

In 2013, homes in Collin and Denton Counties were appraised

approximately $12,000 higher than in 2012. This year, homes in

both counties have have been appraised almost $25,000 higher

than in 2013. This increase in appraisal values has allowed

property tax rates to remain stable for the past three years,

according to Richard Wilkinson, Frisco ISD's deputy business

superintendent.

2009

Denton County

Collin County

$320375

2010

Denton County

Collin County

$311542

2011

Denton County

Collin County

$315197

2012

Denton County

Collin County

$317188

2013

Denton County

Collin County

$330887

2014

Denton County

Collin County

$356342

$263777

$262518

$263826

$265674

$277113

$303315

0

50000

100000

150000

200000

250000

300000

350000

Average Appraisal Values

Frisco ISD's current tax rate compared to

neighboring cities' school district tax rates

Frisco ISD has the second lowest school district property tax rate

in the area and is only one cent higher than Plano ISD's school

district property tax rate. The property tax rates, displayed in the

graph below, were collected from each school district's website.

Frisco ISD $1.46

Prosper ISD $1.67

Plano ISD $1.45

Allen ISD $1.64

Lewisville ISD $1.48

0.2

0.4

0.6

0.8

1.2

1.4

1.6

School District Property Tax Rates Per $100 Appraised Value

What should I expect my

bill to look like when

Frisco ISD's property tax

rates increase?

$7,812

Current approximate property tax

bill for Denton County

homeowner in 2014, according

to certified totals reports.

$6,793

Current approximate property tax

bill for a Collin County

homeowner in 2014, according

to certified totals reports.

$0.03

If the school district increases

the I&S portion of the tax rate

$0.03 cents from the current

$1.46, homeowners will be

paying a tax rate of $1.49.

$7,919

The average Denton homeowner

will be paying approximately

$107 more due to the increase in

school district property tax rates.

$6,884

The average Collin homeowner

will be paying approximately

$91 more due to the increase in

school district property tax rates.

Create infographics

You might also like

- Should Municipal Bonds be a Tool in Your Retirement Planning Toolbox?From EverandShould Municipal Bonds be a Tool in Your Retirement Planning Toolbox?No ratings yet

- 2012 Tax Rate ReportDocument88 pages2012 Tax Rate ReportZoe GallandNo ratings yet

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransFrom EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransNo ratings yet

- Property Tax Reform PresentationDocument29 pagesProperty Tax Reform PresentationStatesman JournalNo ratings yet

- Property Tax and Income - Brief - FINALDocument9 pagesProperty Tax and Income - Brief - FINALThe GazetteNo ratings yet

- Chris Fick League of Oregon Cities Mayors Open Forum September 27, 2012Document20 pagesChris Fick League of Oregon Cities Mayors Open Forum September 27, 2012Statesman JournalNo ratings yet

- Good Jobs First Study On CPS AbatementsDocument17 pagesGood Jobs First Study On CPS AbatementsMadeline MitchellNo ratings yet

- Dallas County Property Tax Reform Letter 7.13.17Document1 pageDallas County Property Tax Reform Letter 7.13.17Naomi MartinNo ratings yet

- Harrisburg School District Budget SY 19-20Document23 pagesHarrisburg School District Budget SY 19-20PennLiveNo ratings yet

- Tax Cap Impact VariesDocument2 pagesTax Cap Impact VariesJon CampbellNo ratings yet

- Abbott's Latest "Working Document" On School FinanceDocument44 pagesAbbott's Latest "Working Document" On School FinancedmnpoliticsNo ratings yet

- DART Financial Outlook Review: March 23, 2010Document31 pagesDART Financial Outlook Review: March 23, 2010rodgermjonesNo ratings yet

- Seattle Property Tax BreakdownDocument13 pagesSeattle Property Tax BreakdownWestSeattleBlog0% (1)

- Tax Activity Key Explains Key Tax ConceptsDocument5 pagesTax Activity Key Explains Key Tax Conceptsj leeNo ratings yet

- Shamong - 1228Document16 pagesShamong - 1228elauwitNo ratings yet

- 121 Midterm 2 Fall 12 TaxDocument9 pages121 Midterm 2 Fall 12 Taxthangdongquay152No ratings yet

- TRC News and Notes 3-15-12Document2 pagesTRC News and Notes 3-15-12James Van BruggenNo ratings yet

- Levyfactsheet FinalDocument2 pagesLevyfactsheet Finalapi-251362692No ratings yet

- How School Funding WorksDocument20 pagesHow School Funding WorksCarolyn UptonNo ratings yet

- Return ExcessDocument2 pagesReturn ExcessJesse Franklin SrNo ratings yet

- TRC News and Notes 4-11-12Document1 pageTRC News and Notes 4-11-12James Van BruggenNo ratings yet

- The Truth About Education FundingDocument2 pagesThe Truth About Education FundingKim SchmidtnerNo ratings yet

- Levy Brochure 2013-15 WebDocument2 pagesLevy Brochure 2013-15 WebldearmoreNo ratings yet

- The Following Data Depict The Fiscal Characteristics of Two SchoolDocument1 pageThe Following Data Depict The Fiscal Characteristics of Two SchoolAmit PandeyNo ratings yet

- BUSN380 Week 3 TCO 3 Problem Set 3 - Cost of CreditDocument3 pagesBUSN380 Week 3 TCO 3 Problem Set 3 - Cost of CreditsctutorNo ratings yet

- Westerville Issue 10 Myth Busters NewsletterDocument1 pageWesterville Issue 10 Myth Busters NewsletterTiffany Taylor HimmelreichNo ratings yet

- 3-6 CertiorarisDocument4 pages3-6 Certiorarisapi-261762676No ratings yet

- 2011 Ladonia ProfileDocument5 pages2011 Ladonia ProfileTCOG Community & Economic DevelopmentNo ratings yet

- Exhibit 2 - Revenue SheetsDocument7 pagesExhibit 2 - Revenue SheetsKevinOhlandtNo ratings yet

- By The Numbers: What Government Costs in North Carolina Cities and Counties FY 2006Document45 pagesBy The Numbers: What Government Costs in North Carolina Cities and Counties FY 2006John Locke FoundationNo ratings yet

- SC Tax Bill Comparison 2015Document1 pageSC Tax Bill Comparison 2015Bill SpitzerNo ratings yet

- Property Tax Cap - 745pm PDFDocument16 pagesProperty Tax Cap - 745pm PDFjspectorNo ratings yet

- Aiken Fact SheetDocument2 pagesAiken Fact SheetSteve CouncilNo ratings yet

- TRC News and Notes 3-1-12Document1 pageTRC News and Notes 3-1-12James Van BruggenNo ratings yet

- For Immediate Release - Wake County Budget Unsustainable, 6-3-18Document3 pagesFor Immediate Release - Wake County Budget Unsustainable, 6-3-18WakeCitizensNo ratings yet

- 04 - Taxes (Practice)Document2 pages04 - Taxes (Practice)j leeNo ratings yet

- Introduced Budget InformationDocument3 pagesIntroduced Budget InformationAndrew CasaisNo ratings yet

- Accurate Referendum Facts and Information - 5.9.16Document17 pagesAccurate Referendum Facts and Information - 5.9.16KevinOhlandtNo ratings yet

- Detroit and The Property Tax: Strategies To Improve Equity and Enhance RevenueDocument52 pagesDetroit and The Property Tax: Strategies To Improve Equity and Enhance RevenueWDET 101.9 FMNo ratings yet

- To: From: CC: Date: ReDocument11 pagesTo: From: CC: Date: ReBrad TabkeNo ratings yet

- Guide To Property TaxesDocument6 pagesGuide To Property TaxesveenstrateamNo ratings yet

- Pennsylvania State Budget PresentationDocument20 pagesPennsylvania State Budget PresentationNathan BenefieldNo ratings yet

- Blog Budget PresentationDocument22 pagesBlog Budget Presentationapi-282246902No ratings yet

- Local Property Tax ReformDocument2 pagesLocal Property Tax ReformTPPFNo ratings yet

- Override FlyerDocument2 pagesOverride FlyerJeffrey N. RoyNo ratings yet

- Investing in A Better TexasDocument37 pagesInvesting in A Better TexasChris PriceNo ratings yet

- Fact Sheet: Which Counties Spend The Most of Your Tax Dollars?Document7 pagesFact Sheet: Which Counties Spend The Most of Your Tax Dollars?Steve CouncilNo ratings yet

- Community Budget Workshop 2011 Slides Presented by Mayor Leo Wiegman (Updated With Moody's Bond Rating 3/2/2011)Document19 pagesCommunity Budget Workshop 2011 Slides Presented by Mayor Leo Wiegman (Updated With Moody's Bond Rating 3/2/2011)crotondemsNo ratings yet

- Shamong - 1221Document16 pagesShamong - 1221elauwitNo ratings yet

- Pa Nov 2016Document6 pagesPa Nov 2016Vikram rajputNo ratings yet

- Greenberg Letter To Seminole Board of County CommissionersDocument1 pageGreenberg Letter To Seminole Board of County CommissionersJacob EngelsNo ratings yet

- HB 1776, The Property Tax Independence Act: A Solution That Makes Sense For PennsylvaniaDocument6 pagesHB 1776, The Property Tax Independence Act: A Solution That Makes Sense For PennsylvaniaOctorara_ReportNo ratings yet

- Teamsters Local 320 Summer NewsletterDocument8 pagesTeamsters Local 320 Summer NewsletterForward GallopNo ratings yet

- New Tax Information For New HomeownersDocument1 pageNew Tax Information For New HomeownersO'Connor AssociateNo ratings yet

- Colorado Schools Transparency TemplateDocument5 pagesColorado Schools Transparency Templatehardhat760No ratings yet

- FAQ Facilities Bond IssueDocument6 pagesFAQ Facilities Bond IssueWKYC.comNo ratings yet

- Cox Connects Education Scholarships: Application RequirementsDocument6 pagesCox Connects Education Scholarships: Application Requirementsapi-25993403No ratings yet

- PR - County Government Releases Preliminary Revenue Projections For Fiscal Year 2015 - Dec 2013Document2 pagesPR - County Government Releases Preliminary Revenue Projections For Fiscal Year 2015 - Dec 2013lrbrennanNo ratings yet

- Arizona Tax Credit in The FoothillsDocument2 pagesArizona Tax Credit in The FoothillsAnonymous qhAtQKUruNo ratings yet

- A Tale of Two Counties Facing Possible Property Tax IncreasesDocument5 pagesA Tale of Two Counties Facing Possible Property Tax IncreasesMorgan YarnikNo ratings yet

- Fluoride Free AustinDocument3 pagesFluoride Free AustinMorgan YarnikNo ratings yet

- Fluoride Concentration LevelsDocument1 pageFluoride Concentration LevelsMorgan YarnikNo ratings yet

- Fluoride Free AustinDocument5 pagesFluoride Free AustinMorgan YarnikNo ratings yet

- Your Payment History: Hai ! Ini Adalah Bil Anda Untuk Bulan NovemberDocument3 pagesYour Payment History: Hai ! Ini Adalah Bil Anda Untuk Bulan Novemberkhair kamilNo ratings yet

- Us American BinDocument21 pagesUs American BinPhan Văn BìnhNo ratings yet

- Collector v. UstDocument2 pagesCollector v. UstEynab PerezNo ratings yet

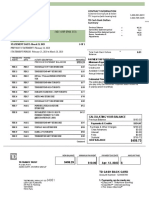

- H0070A0005731710 labelAndInvoiceMergeDocument2 pagesH0070A0005731710 labelAndInvoiceMergeAnupam SinghNo ratings yet

- Exempted Supplies Under GSTDocument127 pagesExempted Supplies Under GSTmonikaNo ratings yet

- Invoice20200845240058CBN4514017082045 24005 8Document1 pageInvoice20200845240058CBN4514017082045 24005 8Ayu MangNo ratings yet

- Mesfin Betru PDFDocument83 pagesMesfin Betru PDFchuchuNo ratings yet

- Revenue Circular Amends Real Property Transfer RequirementsDocument1 pageRevenue Circular Amends Real Property Transfer RequirementsReymund BumanglagNo ratings yet

- TD Cash Back Card: 256 Rue Du Faubourg Saint-Martin 75010 ParisDocument2 pagesTD Cash Back Card: 256 Rue Du Faubourg Saint-Martin 75010 ParisIPTV NumberOneNo ratings yet

- Tax Compliance and Self-Assessment Models ExploredDocument16 pagesTax Compliance and Self-Assessment Models ExploredarekdarmoNo ratings yet

- StatementDocument7 pagesStatementJaved AliNo ratings yet

- Bank of America StatementDocument12 pagesBank of America StatementAmin Sahil0% (1)

- Channel Partner Empanelment Form: Latest Photograph of Authorized SignatoryDocument5 pagesChannel Partner Empanelment Form: Latest Photograph of Authorized SignatoryGreen ValleyNo ratings yet

- L63 MobDocument35 pagesL63 MobLove AmbienceNo ratings yet

- Final Revision in General Schedule of Fees and Charges W e F 1st May 2022Document2 pagesFinal Revision in General Schedule of Fees and Charges W e F 1st May 2022AbhiNo ratings yet

- Binder1 PDFDocument5 pagesBinder1 PDFSaad Raza KhanNo ratings yet

- Status Update: Features of CREATEDocument18 pagesStatus Update: Features of CREATEMarkie GrabilloNo ratings yet

- Telugu and I HaveDocument7 pagesTelugu and I HaveSunidhi KNo ratings yet

- Lic Ecs Mandate Form EnglishDocument3 pagesLic Ecs Mandate Form EnglishpajipitarNo ratings yet

- CFAS: Petty Cash Fund AccountingDocument3 pagesCFAS: Petty Cash Fund AccountingSteffanie OlivarNo ratings yet

- Calculate Completing A 1040Document2 pagesCalculate Completing A 1040api-4921774500% (1)

- Money Meter Track Your Mandatory and Voluntary ExpensesDocument1 pageMoney Meter Track Your Mandatory and Voluntary ExpensesEstaban A GonsalvesNo ratings yet

- Wells Fargo Everyday CheckingDocument4 pagesWells Fargo Everyday Checkingpeter.pucciNo ratings yet

- Official Letter No. 3346Document2 pagesOfficial Letter No. 3346Quang TrinhNo ratings yet

- Invoice: Order Details Billing SummaryDocument2 pagesInvoice: Order Details Billing SummaryOussama AkkariNo ratings yet

- MR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDDocument1 pageMR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDSharanu HosamaniNo ratings yet

- SUYOG2604Document1 pageSUYOG2604vishalNo ratings yet

- Tax invoice for headphonesDocument1 pageTax invoice for headphonesSachin FfNo ratings yet

- Marbill PDFDocument1 pageMarbill PDFLucaNo ratings yet

- Transaction Statement: Account Number: 1661104000037563 Date: 2023-09-24 Currency: INRDocument20 pagesTransaction Statement: Account Number: 1661104000037563 Date: 2023-09-24 Currency: INRMOHAMMAD IQLASHNo ratings yet