Professional Documents

Culture Documents

2014 Enterprise Cloud Adoption Survey

Uploaded by

Pallavi ReddyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2014 Enterprise Cloud Adoption Survey

Uploaded by

Pallavi ReddyCopyright:

Available Formats

Enterprise Cloud Adoption Survey 2014:

Summary of Results

March 2014

Content

Executive summary

Detailed findings

Appendix demographics

Proprietary & Confidential. 2014, Everest Global, Inc.

Context and methodology

Context and

objectives

Cloud Connect and Everest Group conducted the third annual Enterprise Cloud Adoption survey

The results of the survey will be presented at the Cloud Connect Summit @ Interop in Las

Vegas on March 31 and April 1, 2014

Primary objectives of the survey:

Identify broad-based cloud adoption patterns

Identify the value derived from cloud services for enterprises

Identify decision-making patterns for cloud adoption

Methodology

Cloud Connect and Everest Group jointly created an online survey for the purpose of this study

Survey invitations were sent by e-mail to three primary groups of cloud market stakeholders:

Cloud enterprises: Enterprises that have adopted or are seeking to adopt cloud solutions

Cloud service providers: Providers of cloud solutions (products and services), including

ISVs (Independent Software Vendors) and service providers

Cloud advisors: Consultants and third-party advisors who work with cloud enterprises and

provide guidance on cloud adoption strategies

Survey responses were aggregated and analyzed; wherever possible and insightful, viewpoints

from different market constituents have been contrasted

The focus of the study is on evaluating the viewpoint of the cloud enterprise. Given the sample

size of cloud enterprises and the random sampling methodology, analysis by different segments

within the enterprise community has been presented wherever possible and meaningful

Proprietary & Confidential. 2014, Everest Global, Inc.

Enterprise cloud adoption: Distilling hype from reality

Primary findings of the survey

Cloud hype

Cloud reality

Enterprises are still experimenting with cloud

Enterprises are investing significantly in cloud

Cloud is primarily a technology play

Cloud is emerging as a strategic differentiator

Security concerns are history

Security concerns are declining, but alive

Cloud consumption is simple

Meaningful external help needed to adopt cloud

The CIO is irrelevant

The battle is on to regain the lost glory

Proprietary & Confidential. 2014, Everest Global, Inc.

Key findings (page 1 of 3)

Is cloud a strategic differentiator?...A resounding yes!

Hype: Enterprises are still experimenting with cloud and therefore,

spending little money

Reality: Around 58% of the enterprises spend more than 10% of their

annual IT budgets on cloud services. This reflects that enterprises

are realizing the value proposition of cloud

Hype: Cloud is relevant only for technology needs

Reality: About 56% of enterprises consider cloud to be a strategic

differentiator which enables operational excellence and accelerated

innovation

Across verticals, enterprises are faced with a multitude of challenges

that compel them to transform their operating models. For example:

Financial institutions are grappling with evolving regulatory

environments, poor financial health, and the need for multi-channel

capabilities to grow their customer base. With increasing pressures

to improve cost-to-income ratios and reduce time-to-market,

financial institutions are looking at cloud services to accelerate

innovation

The retail industry continues to evolve as millennial consumers

expect multi-modal delivery and payment options, digital shopping

experience, etc. Retailers are also faced with the challenge of

optimizing their infrastructure costs to manage seasonality and

leveraging cloud services to improve operational efficiencies

Percentage of annual IT spending on cloud solutions / services

2014; Percentage of responses

Less than 5%

29%

5 to 10%

13%

Greater than 10%

58%

Percentage of enterprises that consider cloud to be a strategic

differentiator

2014; Percentage of responses

Others

Proprietary & Confidential. 2014, Everest Global, Inc.

44%

56%

Cloud is a strategic

differentiator

Key findings (page 2 of 3)

Will better security perception continue to drive private cloud adoption? Not

for long

Hype: Security concerns are a thing of the past

Reality: Enterprises still consider better security / greater control

over assets and data to be one of the most important factors in opting

for private cloud solutions. However, this scenario is expected to

change as public cloud providers are making considerable investments

to strengthen their security architecture

Enterprises now have limited interest in private vs. public debate

The emerging belief is that as long as business and regulatory

requirements are met, the deployment model is irrelevant

The IT environments of enterprises in the future should be

looked at as a hybrid mix, rather than a binary private/public cloud

environment

Hype: Cloud consumption is simple

Reality: More than 65% of enterprises believe they need external

help to deploy cloud solutions

Most enterprises lack internal IT skills and expertise to deploy

and manage private cloud solutions

They are likely to engage third-party service providers, especially

for consulting services and implementation of private cloud

Reasons for preference of private cloud solutions

2014; Percentage of responses

74%

Better security

53%

Lower TCO

44%

Greater flexibility

Infrastructure scalability

19%

Customizability (hardware,

networks, and storage)

36%

Percentage of organizations that are likely to leverage

external help for setup and management of private clouds

2014; Percentage of responses

Not likely to leverage

external help

Cloud solution providers need to adopt a business process approach

while assisting enterprises in their adoption journey. The business

case for process improvement is more important than focusing on

deployment models

Proprietary & Confidential. 2014, Everest Global, Inc.

33%

67%

Likely to leverage

external help

(lack of internal talent)

Key findings (page 3 of 3)

Are CIOs irrelevant? They are fighting hard and regaining lost glory

Hype: The CIO is no longer relevant

Stakeholder involvement in cloud solution purchase

2014; Percentage of mentions in responses

Reality: With the increasing adoption of cloud services for critical

workloads, CIOs are regaining lost ground

Business Units (BUs) / CMOs have increasingly become key

stakeholders in cloud adoption owing to the fact that various

workloads earmarked for cloud migration are directly linked with

sales and marketing operations

However, as cloud adoption matures beyond vanity consumption to

mission-critical workloads, business owners are realizing that

they cannot work without IT

Consequently, CIOs are fighting, and winning the battle for

relevance. Over 75% of enterprises believe that the role of IT is

increasing or is unchanged

However, CIOs need to reinvent themselves to engage and

collaborate with business users

Need to broaden their horizon and go beyond the ease of

access vs. tight control debate

Need to accept the thankless job of introducing a sense of

sanity in the anarchy of cloud everywhere

We believe it takes just one disaster with business owners using cloud

services to understand the value of CIO and the IT function. A number

of businesses are learning this the hard way

40%

IT function

24%

C-level executives

18%

Business units

14%

Finance/procurement function

No formal effort to develop

enterprise cloud strategy

5%

Role of corporate IT as pertaining to cloud services

2014; Percentage of responses

Relevance unchanged

Relevance decreasing

Proprietary & Confidential. 2014, Everest Global, Inc.

23%

21%

55%

Relevance increasing

Content

Executive summary

Detailed findings

Appendix demographics

Proprietary & Confidential. 2014, Everest Global, Inc.

Cloud computing is emerging as a strategic business

differentiator, which is why enterprises are spending on it

Percentage of annual IT spending on cloud solutions/services

2014; Percentage of responses

Less than 5%

5 to 10%

29%

13%

Greater than 10%

58%

Percentage of organizations that consider cloud

to be a strategic differentiator

2014; Percentage of responses

Cloud spending will continue to grow as more

enterprises recognize the value preposition. A

significant number of fence sitters will be

converted soon, and the industry will witness

a step change in cloud spend

Relative perception of what cloud helps an enterprise achieve

2014; Mean rating

1 = Dont agree; . 4 = Strongly agree

Operational excellence

Others 44%

56% Cloud is a strategic

differentiator

Product leadership

Customer intimacy

Accelerated innovation

Source:

3.5

3.0

2.9

3.4

Everest Group Cloud Connect Enterprise Cloud Adoption Survey 2014

Proprietary & Confidential. 2014, Everest Global, Inc.

BFSI1 and technology are the leading industry verticals for

cloud adoption

Existing cloud adoption by industries2

2014; Percentage of respondents

BFSI

45%

Technology

37%

Retail, distribution, and CPG

33%

Online business

28%

Media & entertainment

28%

Healthcare & life sciences

20%

Electronics & hi-tech

17%

Telecom

17%

Education services

15%

Professional services

13%

Public sector

11%

Manufacturing

Energy & utilities

Travel and transportation

1

2

Source:

10%

7%

6%

Banking, Financial Services, and Insurance

Indicates percentage of respondents who believe the respective vertical to be amongst the top three industries driving cloud adoption

Everest Group Cloud Connect Enterprise Cloud Adoption Survey 2014

Proprietary & Confidential. 2014, Everest Global, Inc.

10

Contrary to popular belief of a preferred cloud model,

enterprises are consuming a variety of cloud solutions; the

future is hybrid

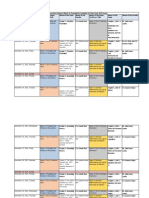

Enterprise cloud adoption trends by cloud layer

2013; Percentage of responses

Software as a

Service (SaaS)

Platform as a

Service (PaaS)

Public cloud (IaaS)

Private cloud (IaaS)

Business Process as

a Service (BPaaS)

Already adopted

Adoption in distant future

Already adopted

Adoption in distant future

Adoption in near future

Others

Adoption in near future

Others

6%

Source:

56%

22%

15%

18%

17%

35%

30%

10%

13%

Public cloud (IaaS)

35%

42%

Private cloud (IaaS)

16%

28%

21%

35%

33%

25%

21%

Software as a

Service (SaaS)

Platform as a

Service (PaaS)

33%

25%

16%

26%

21%

Hybrid cloud (IaaS)

Enterprise cloud adoption trends by cloud layer

2014; Percentage of responses

Business Process as

a Service (BPaaS)

With enterprises increasingly

adopting a variety of cloud

solutions, a significant portion

of them will have hybrid IT

environments in the future

Hybrid cloud (IaaS)

8%

56%

17%

19%

14%

31%

29%

26%

27%

29%

18%

26%

14%

19%

17%

15%

17%

15%

31%

37%

35%

32%

35%

32%

Everest Group Cloud Connect Enterprise Cloud Adoption Survey 2014

Proprietary & Confidential. 2014, Everest Global, Inc.

11

A large number of enterprises have migrated different

workloads to cloud

Enterprise cloud adoption trends by workload

2013; Percentage of responses

Already migrated

Future migration planned

Already migrated

Future migration planned

Currently migrating

Others

Currently migrating

Others

Custom business

applications

ERP

Application development/

test environment

Collaboration and content

management platforms

E-commerce and

online tools

Business

intelligence/analytics

Source:

Enterprise cloud adoption trends by workload

2014; Percentage of responses

23%

17%

27%

34%

17%

13%

27%

Custom business

applications

ERP

44%

30%

21%

23%

26%

18%

30%

21%

14%

Application development/

test environment

Collaboration and content

management platforms

31%

26%

15%

19%

E-commerce and

online tools

31%

29%

36%

30%

Business

intelligence/analytics

20%

15%

27%

38%

16%

11%

22%

15%

13%

50%

33%

27%

25%

33%

25%

29%

27%

12%

19%

21%

13%

21%

43%

45%

Everest Group Cloud Connect Enterprise Cloud Adoption Survey 2014

Proprietary & Confidential. 2014, Everest Global, Inc.

12

however, their indifference towards private/public debate is

apparent in the shift in preferences across workloads

Cloud deployment model enterprise preferences

Percentage of responses

Private cloud

Indifferent

2013

2014

Application development / test environment

63%

20%

18%

49%

Disaster recovery / storage / data archiving

Custom business applications

functional / non industry-specific

60%

26%

15%

47%

55%

26%

70%

ERP finance & accounting

56%

Custom business applications industry-specific

51%

ERP SCM/procurement

62%

ERP human capital management

E-commerce and online tools

56%

E-mail/collaboration

60%

19%

18% 12%

23%

64%

Business intelligence/analytics

Public cloud

21%

22% 14%

24%

22%

26%

26%

25%

26%

19%

47%

26%

34%

28%

46%

26%

34%

43%

20%

30%

39%

27%

34%

38%

27%

38%

23%

16%

38%

17%

38%

29%

33%

14%

38%

29%

33%

Collaboration and content management platforms

48%

28%

24%

36%

CRM/marketing automation

48%

30%

23%

31%

Web apps / websites

49%

28%

23%

28%

33%

28%

26%

38%

33%

36%

30%

43%

Enterprises now view cloud as a consumption model and have limited interest to debate the deployment model

Source:

Everest Group Cloud Connect Enterprise Cloud Adoption Survey 2014

Proprietary & Confidential. 2014, Everest Global, Inc.

13

Platform service providers are aggressively targeting the

public cloud market to offer full suite of services

Market success and enterprise awareness quotient of public cloud providers

2013 and 2014 combined

Major Players

High

AWS

Microsoft

Market success

Contenders

Emerging

Players

Google

Rackspace

HP

IBM

AT&T

Verizon-Terremark

Joyent

Savvis

GoGrid

CSC

Low

Low

Note:

Source:

Enterprise awareness quotient

High

Market success denotes the quantum of enterprises using or considering cloud solutions from the respective service providers. Enterprise awareness quotient

denotes the quantum of enterprises currently aware of (but not necessarily planning to use) cloud solutions from the respective service providers

Everest Group Cloud Connect Enterprise Cloud Adoption Survey 2014

Proprietary & Confidential. 2014, Everest Global, Inc.

14

Private cloud continues to thrive due to a perception of better

security, however, the lack of internal talent within

enterprises may hinder broad-based adoption

Reasons for preference of private cloud solutions

2014; Percentage of responses

Challenges for private cloud adoption

2014; Percentage of responses

Yes

Better security / more control over

assets & data as compared to public

cloud solutions

53%

Lower TCO

Greater flexibility (ability to provision

services and resources quickly)

Ability to rapidly scale infrastructure

capacity up or down

Ability to customize performance of

hardware, networks, and storage

No

74%

Others

44%

19%

33%

67%

Lack of

internal talent

36%

With increasing investments from public cloud providers in enhancing their security levels, the public vs. private debate is likely

to diminish

Source:

Everest Group Cloud Connect Enterprise Cloud Adoption Survey 2014

Proprietary & Confidential. 2014, Everest Global, Inc.

15

With the increasing adoption of cloud services for critical

workloads, CIOs are regaining ground they had lost earlier

Stakeholder involvement in cloud solution purchase

2014; Percentage of mentions in responses

40%

24%

18%

14%

CIOs now have a real

opportunity to

demonstrate their true

value to business

stakeholders

5%

IT function

C-level executives

Business units

Finance function

No formal effort to

develop enterprise

cloud strategy

Role of corporate IT as pertaining to cloud services

2014; Percentage of responses

Relevance unchanged 23%

Relevance decreasing

Source:

21%

55% Relevance increasing

As cloud moves beyond low hanging fruits to

strategic workloads, business users are realizing

that they cannot consume meaningful cloud services

without an active participation of the IT function.

Over 75% of enterprises believe that the relevance

of IT is increasing or is unchanged

Everest Group Cloud Connect Enterprise Cloud Adoption Survey 2014

Proprietary & Confidential. 2014, Everest Global, Inc.

16

Content

Executive summary

Detailed findings

Appendix demographics

Proprietary & Confidential. 2014, Everest Global, Inc.

17

Survey demographics

Responses by geography

Number of respondents

100% = 213

100% = 213

LATAM

Third-party cloud

solution providers

EMEA

32%

Enterprise / cloud

service buyers

Advisory

43% professionals

15%

APAC 16%

25%

3%

66%

North America

Responses by job title

100% = 213

Senior Vice Presidents

Vice Presidents

8%

8%

34%

Senior Managers

Directors 22%

29%

CXOs

Source:

Everest Group Cloud Connect Enterprise Cloud Adoption Survey 2014

Proprietary & Confidential. 2014, Everest Global, Inc.

18

About Cloud Connect

Cloud Connect, produced by UBM Tech, is the defining event of the cloud-enabled

enterprise and the only venue where attendees learn how to leverage the cloud

ecosystem to develop new services, revenue streams, and business models. As both

a conference and an exhibition, Cloud Connect's goal is to chart the course of cloud

computing's development by bringing together enterprise technology and business

stakeholders with cloud service providers and solution innovators. Cloud Connect

offers in-depth boot camps, panel discussions, and access to a host of industry

experts, all designed to help organizations weigh their cloud options and drive

business transformation. For more information visit: www.cloudconnectevent.com

Proprietary & Confidential. 2014, Everest Global, Inc.

19

At a glance

With a fact-based approach driving outcomes, Everest Group counsels

organizations with complex challenges related to the use and delivery of the

next generation of global services

Through its practical consulting, original research, and industry resource

services, Everest Group helps clients maximize value from delivery strategies,

talent and sourcing models, technologies, and management approaches

Established in 1991, Everest Group serves users of global services, providers

of services, country organizations, and private equity firms in six continents

across all industry categories

Dallas (Headquarters)

info@everestgrp.com

+1-214-451-3000

New York

info@everestgrp.com

+1-646-805-4000

Toronto

canada@everestgrp.com

+1-647-557-3475

London

unitedkingdom@everestgrp.com

+44-207-129-1318

Delhi

india@everestgrp.com

+91-124-284-1000

Stay connected

Websites

www.everestgrp.com

research.everestgrp.com

Twitter

@EverestGroup

@Everest_Cloud

Blogs

www.sherpasinblueshirts.com

www.gainingaltitudeinthecloud.com

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Seven Seals of Revelation and The SevenDocument14 pagesThe Seven Seals of Revelation and The Sevenyulamula100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Gartner Market Share Consulting 2018 2019 PDFDocument18 pagesGartner Market Share Consulting 2018 2019 PDFPallavi ReddyNo ratings yet

- Hybrid 2.0: The Next-Gen Work Model Is Here To StayDocument27 pagesHybrid 2.0: The Next-Gen Work Model Is Here To StayPallavi Reddy100% (1)

- Protecting Legacy The Value of A Family OfficeDocument25 pagesProtecting Legacy The Value of A Family OfficeRavi BabuNo ratings yet

- Industrial/Organi Zational Psychology: Alday, Angeli Camille M. - 2P2Document51 pagesIndustrial/Organi Zational Psychology: Alday, Angeli Camille M. - 2P2SteffanyNo ratings yet

- Epidemiological Cutoff Values For Antifungal Susceptibility TestingDocument36 pagesEpidemiological Cutoff Values For Antifungal Susceptibility Testingdadrrui100% (1)

- 2018 Cambridge Lower Second Progression Test Science Stage 8 QP Paper 2 - tcm143-430409Document16 pages2018 Cambridge Lower Second Progression Test Science Stage 8 QP Paper 2 - tcm143-430409AnisahNo ratings yet

- Zombie Exodus Safe Haven GuideDocument148 pagesZombie Exodus Safe Haven GuidejigglepopperNo ratings yet

- The Importance of Strategy and Data ManagementDocument4 pagesThe Importance of Strategy and Data ManagementPallavi ReddyNo ratings yet

- Ws Washington Tech Fed Reg ComplianceDocument12 pagesWs Washington Tech Fed Reg CompliancePallavi ReddyNo ratings yet

- Ey Integrity Compliance EthicsDocument4 pagesEy Integrity Compliance EthicsPallavi ReddyNo ratings yet

- Get More Bang For Your Buck:: Adjusting Prepay Approaches To Match The Changing LandscapeDocument11 pagesGet More Bang For Your Buck:: Adjusting Prepay Approaches To Match The Changing LandscapePallavi ReddyNo ratings yet

- Will Your Club Be Compliant When The Revenuers Come!: ClubfactsandfiguresDocument2 pagesWill Your Club Be Compliant When The Revenuers Come!: ClubfactsandfiguresPallavi ReddyNo ratings yet

- Managing Compliance Financial RisksDocument4 pagesManaging Compliance Financial RisksPallavi ReddyNo ratings yet

- Financial Crime and Compliance in A Socially Distanced EconomyDocument2 pagesFinancial Crime and Compliance in A Socially Distanced EconomyPallavi ReddyNo ratings yet

- Ws Washington Tech Fed Reg ComplianceDocument12 pagesWs Washington Tech Fed Reg CompliancePallavi ReddyNo ratings yet

- Managing Compliance Financial RisksDocument4 pagesManaging Compliance Financial RisksPallavi ReddyNo ratings yet

- Section 117: Ensuring Compliance Through Systems and ProcessesDocument3 pagesSection 117: Ensuring Compliance Through Systems and ProcessesPallavi ReddyNo ratings yet

- Gartner Market Share Consulting 2018 2019 PDFDocument18 pagesGartner Market Share Consulting 2018 2019 PDFPallavi ReddyNo ratings yet

- Blockchain Technology Overview ExplainedDocument69 pagesBlockchain Technology Overview ExplainedPallavi ReddyNo ratings yet

- Gartner Market Share Consulting 2018 2019 PDFDocument18 pagesGartner Market Share Consulting 2018 2019 PDFPallavi ReddyNo ratings yet

- R 001129 CDocument6 pagesR 001129 CPallavi ReddyNo ratings yet

- Omarini Article Published 76769-288169-1-SMDocument15 pagesOmarini Article Published 76769-288169-1-SMPallavi ReddyNo ratings yet

- AI OnePager EN Feb2019 AODA2Document2 pagesAI OnePager EN Feb2019 AODA2Pallavi ReddyNo ratings yet

- Blockchain Technology Overview: NISTIR 8202Document68 pagesBlockchain Technology Overview: NISTIR 8202Joel Eljo Enciso SaraviaNo ratings yet

- Artificial IntelligenceDocument9 pagesArtificial IntelligencePallavi ReddyNo ratings yet

- Max India AR 2018 19Document323 pagesMax India AR 2018 19Pallavi ReddyNo ratings yet

- Annual ReportDocument73 pagesAnnual ReportPallavi ReddyNo ratings yet

- 1996a557 PDFDocument9 pages1996a557 PDFAqil AzNo ratings yet

- AFI FinTech SR AW Digital 0Document32 pagesAFI FinTech SR AW Digital 0Pallavi ReddyNo ratings yet

- Ve Fsi Training Brief f18627pr 201911 enDocument3 pagesVe Fsi Training Brief f18627pr 201911 enPallavi ReddyNo ratings yet

- Fti DataDocument6 pagesFti DataPallavi ReddyNo ratings yet

- MScThesis Tim Schreiber Thijn VrielinkDocument98 pagesMScThesis Tim Schreiber Thijn VrielinkPallavi ReddyNo ratings yet

- Capgemini BDA SVP Abstract 2018 01 08Document3 pagesCapgemini BDA SVP Abstract 2018 01 08Pallavi ReddyNo ratings yet

- Issue 9 - FSI Newsletter - June 2019Document8 pagesIssue 9 - FSI Newsletter - June 2019Pallavi ReddyNo ratings yet

- Newly Constructed Masculinity' in Mahesh Dattani's Dance Like A ManDocument4 pagesNewly Constructed Masculinity' in Mahesh Dattani's Dance Like A ManIJELS Research JournalNo ratings yet

- PremiumpaymentReceipt 10663358Document1 pagePremiumpaymentReceipt 10663358Kartheek ChandraNo ratings yet

- Class 9 - Half Yearly Examination - 2023 - Portions and BlueprintDocument16 pagesClass 9 - Half Yearly Examination - 2023 - Portions and BlueprintSUBRAMANI MANOHARANNo ratings yet

- Format For Handout - Comparative Models of EducationDocument5 pagesFormat For Handout - Comparative Models of EducationAdrian AsiNo ratings yet

- Demo TeachingDocument22 pagesDemo TeachingCrissy Alison NonNo ratings yet

- System Bus in Computer Architecture: Goran Wnis Hama AliDocument34 pagesSystem Bus in Computer Architecture: Goran Wnis Hama AliGoran WnisNo ratings yet

- 1.9 Bernoulli's Equation: GZ V P GZ V PDocument1 page1.9 Bernoulli's Equation: GZ V P GZ V PTruong NguyenNo ratings yet

- Psyclone: Rigging & Tuning GuideDocument2 pagesPsyclone: Rigging & Tuning GuidelmagasNo ratings yet

- UNIVERSIDAD NACIONAL DE COLOMBIA PALMIRA ENGLISH PROGRAMDocument1 pageUNIVERSIDAD NACIONAL DE COLOMBIA PALMIRA ENGLISH PROGRAMAlejandro PortoNo ratings yet

- Slope Stability Analysis MethodsDocument5 pagesSlope Stability Analysis MethodsI am AngelllNo ratings yet

- KOREADocument124 pagesKOREAchilla himmudNo ratings yet

- Land Equivalent Ratio, Growth, Yield and Yield Components Response of Mono-Cropped vs. Inter-Cropped Common Bean and Maize With and Without Compost ApplicationDocument10 pagesLand Equivalent Ratio, Growth, Yield and Yield Components Response of Mono-Cropped vs. Inter-Cropped Common Bean and Maize With and Without Compost ApplicationsardinetaNo ratings yet

- NCERT Solutions For Class 12 Flamingo English Lost SpringDocument20 pagesNCERT Solutions For Class 12 Flamingo English Lost SpringHarsh solutions100% (1)

- User Manual: C43J890DK C43J892DK C49J890DK C49J892DKDocument58 pagesUser Manual: C43J890DK C43J892DK C49J890DK C49J892DKGeorge FiruțăNo ratings yet

- Encrypt and decrypt a file using AESDocument5 pagesEncrypt and decrypt a file using AESShaunak bagadeNo ratings yet

- Liquid Air Energy Storage Systems A - 2021 - Renewable and Sustainable EnergyDocument12 pagesLiquid Air Energy Storage Systems A - 2021 - Renewable and Sustainable EnergyJosePPMolinaNo ratings yet

- 2000 T.R. Higgins Award Paper - A Practical Look at Frame Analysis, Stability and Leaning ColumnsDocument15 pages2000 T.R. Higgins Award Paper - A Practical Look at Frame Analysis, Stability and Leaning ColumnsSamuel PintoNo ratings yet

- Chapter 1-The Indian Contract Act, 1872, Unit 1-Nature of ContractsDocument10 pagesChapter 1-The Indian Contract Act, 1872, Unit 1-Nature of ContractsALANKRIT TRIPATHINo ratings yet

- Sri Lanka, CBSLDocument24 pagesSri Lanka, CBSLVyasIRMANo ratings yet

- SRT95 Engine Power TakeoffDocument20 pagesSRT95 Engine Power TakeoffoktopusNo ratings yet

- Important instructions on judicial procedure from Narada SmritiDocument6 pagesImportant instructions on judicial procedure from Narada SmritirohitNo ratings yet

- Feyzin Oil Refinery DisasterDocument8 pagesFeyzin Oil Refinery DisasterDavid Alonso Cedano EchevarriaNo ratings yet

- Food 8 - Part 2Document7 pagesFood 8 - Part 2Mónica MaiaNo ratings yet

- LSAP 423 Tech Data 25kVA-40KVA - 3PH 400VDocument1 pageLSAP 423 Tech Data 25kVA-40KVA - 3PH 400Vrooies13No ratings yet

- Bioav 3Document264 pagesBioav 3Sabiruddin Mirza DipuNo ratings yet