Professional Documents

Culture Documents

Auto LED Article

Uploaded by

ekatsaros-1Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Auto LED Article

Uploaded by

ekatsaros-1Copyright:

Available Formats

Automotive & Assembly EXTRANET

Chain Lightning: Charting the Evolving

Automotive LED Value Chain

Coming shifts in the automotive LED value chain promise structural

industry changes that players should position themselves for now.

By Yoshie Fujii, Willem Strijbosch, Oliver Vogler, Florian Wunderlich, and Dominik

Wee

Automakers worldwide have seen the light and it's shining on light-emitting diode

(LED) technology. Of the total market for automotive lighting USD 19 billion at

the fixture level today LED products already make up about USD 4 billion of the

total. Furthermore, the automotive LED market continues to develop rapidly on a

content-per-car basis despite the economic downturn, with vehicle interior

applications leading the way. For example, LEDs are already found in about 70

percent of interior indicator lights and 25 percent of instrument display backlights

(Exhibit 1). Currently, the largest exterior applications are center high-mounted

stop lamps (CHMSLs) at 20 percent penetration, and brake and tail lights at

about 10 percent each. The automotive LED supplier landscape remains highly

fragmented at the module level and dealing with modules will likely have

significant impact on the value chain.

Four Key LED Trends

Four major trends are shaping the LED market, with the first three affecting

overall market development and the final one focused on the lighting value chain

and automotive aftermarket.

Trend #1: Per-vehicle lighting value will increase due to the continued need

for vehicle design differentiation and introduction of new applications.

Some LED applications provide car designers with unmatched flexibility in

creating new exterior and interior lighting styling treatment, thus commanding

significant price premiums. One notable comparison of innovative LED

headlamps and high-intensity-discharge (HID) Xenon lighting revealed that the

LED solution was more than twice as expensive as Xenon. New LED applications

include enhanced night vision and head-up displays, and new features are also

being introduced, such as active light bending for front lights that allow drivers to

"see" around corners or "communicating" brake lights that can pulse-out

messages.

1/9

http://autoassembly.mckinsey.com

McKinsey & Company, Inc.

Automotive & Assembly EXTRANET

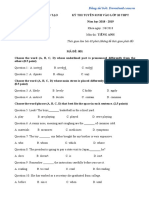

Exhibit 1:

Interior automotive light segments currently see high LED

penetration levels

Total market at

LED market at

Interior

Exterior

Application

Examples

fixture level

USD billion, 2009

Description

fixture level

USD billion, 2009

LED penetration3

Percent, 2009

Headlamp

A lamp to illuminate the road ahead

(low beam, high beam, fog lamps)

DRL1

On the front of car, switched on automatically when vehicle is moving forward

Side lights

Markers on the vehicle side, also known

as position or parking lights

Turning

Lights

Signal lights mounted near the left and

right front and rear corners of a vehicle

CHMSL2

A central brake lamp, mounted higher than

the car's left and right brake lamps

Tail Light

Rear position lamps, typically combined

with break lights

Break light

Brake lamps, typically combined with tail

lights

Backlighting

Backlighting of LCD displays and simpler

backlighting, e.g. to illuminate cluster dials

0.8

0.3

32

Illumination

Light a physical space, e.g., main cabin,

glove compartment or trunk

0.7

0.1

17

Indication

6.9

Other indication lights in car body

2 Center high-mounted stop lamp

1.5

2.2

1.1

2.5

<1

0.1

<1

12

0.6

0.6

40

15

1.1

1.4

0.8

0.3

Total

1 Daylight running lamp

1.9

<1

15

0.2

19

75

4

3 Penetration based on number of cars

SOURCE: Automotive Lighting, IMS 2009, SupplierBusiness, press search, McKinsey LED market model

Trend #2: LED adoption rates will vary significantly depending upon

application. LED market penetration will be uneven through 2015, with new

applications (e.g., headlamps and daytime running lamps) growing rapidly from

very small bases, while CHMSL and indicator light growth will slow as LEDs

become the dominant solution in these applications (Exhibit 2).

Growth will come from increased LED lighting content in cars, which will

overwhelm expected decreases in average selling prices (ASPs). For example,

the global automotive lighting market in 2007 was just over USD 20 billion and is

expected to grow at 3.5 percent annually to USD 27.1 billion by 2015. Most of

this growth will come from the higher value of LED content in cars, which will be

nearly twice the size of predicted declines in LED ASPs (Exhibit 3).

2/9

http://autoassembly.mckinsey.com

McKinsey & Company, Inc.

Automotive & Assembly EXTRANET

Exhibit 2:

In 2015, CHMSL and DRL will have the highest penetration,

while headlamp will only achieve about 6%

LED automotive lighting penetration rates1

Percent

2007

80

60

Indication

70

75

CHMSL2

20

64

56

Tail light

12

50

Brake light

Backlighting

12

25

50

48

Illumination

12

42

38

DRL3

40

Side light

20

Turning light

Headlamp

0

2007

08

09

10

11

12

13

14

2015

19

<<1

CHMSL2 and DRL

with highest

exterior

penetration

increase

(regulation driven)

Headlamp only

with ~6% in 2015

Interior lighting

with penetration

rates from ~40%

up to ~75%

2015

1 Luminaire level, including after-market; global penetration rates 2 Center high-mounted stop lamp 3 Daylight running lamp

SOURCE: McKinsey LED market model

Exhibit 3:

Growth waterfall shows that biggest proportion comes from LED

penetration even net of LED ASP decrease

x Correspond

CAGR

Automotive lighting market (incl. traditional and LED)

USD billions

1.4

5.0

9.7

20.6

0.6

27.1

2.7

Total market Increase

2007

of yearly

cars sold

1.5

Higher

Decrease of Decrease of Growth in

lighting value traditional

LED ASP

aftermarket

in cars from ASP

LED penetration

4.5

-0.6

-2.2

0.3

Total market

2015

3.5

SOURCE: McKinsey

3/9

http://autoassembly.mckinsey.com

McKinsey & Company, Inc.

Automotive & Assembly EXTRANET

Today, many drivers and OEMs prefer LED lighting solutions for a number of

reasons:

Design and performance: LEDs provide design flexibility, better

packaging, and better dimming and turn-on speed performance.

Energy and CO2 savings: LEDs offer better power efficiency and

significantly longer life cycles. They have also proven extremely durable

in automotive use because of their innate shock resistance.

Cost: Cost remains a hurdle in some areas, such as headlamp

applications, but continued cost decreases and proven superior quality

and durability have made LEDs the new industry standard in terms of

end-customer value.

Regulation: LED lighting demand has benefited from government

regulations that specify requirements for headlamps and other

applications. Governments are also enacting new vehicle lighting

mandates, such as the European Union's requirement for daytime running

lights (DRLs) beginning in 2011.

Overall penetration will increase as LEDs reach cost parity with conventional

solutions, such as halogen lighting. Beyond regulatory mandates, LED lights will

continue to enter the market incrementally as each new generation of cars takes

increasing advantage of their performance and stylistic differentiation potential.

3) Cost-based LED substitution for halogen and HID Xenon headlamps will

not occur until the end of the decade. Currently, comparable LEDs cost about

100 percent more than halogen headlamps and 150 percent more than HID

Xenon solutions (i.e., achieving comparable performance to HID Xenon

headlamps requires a much more expensive LED solution than for lowerperformance halogen technology). Based upon a model developed by McKinsey

& Company, LEDs of comparable performance will ultimately achieve cost parity

with both halogen and HID Xenon technologies, but not until the 2020 timeframe.

Until then, the vehicles that feature LED headlamps are trading off the often

significantly higher costs against the ability to offer the innovative styling and

design solutions that customers demand.

4) The aftermarket for LEDs will lag behind the overall automotive lighting

market. Aftermarket demand for automotive LED lighting will grow more slowly

than the overall vehicle lighting market. This is due to the technology's greater

durability compared to that of traditional lamps, which will offset higher average

selling prices. Burned out bulbs and damage from accidents are the two main

4/9

http://autoassembly.mckinsey.com

McKinsey & Company, Inc.

Automotive & Assembly EXTRANET

sources of traditional aftermarket lighting demand. The significantly greater

durability of LEDs will effectively stunt replacement demand going forward,

leaving collision repair as the main demand driver.

The Impact on LED Industry Structure

Given the four LED trends mentioned, managers can anticipate changes in

industry dynamics that will likely lead to a number of structural changes in the

supply industry. First, the upstream portion of the automotive LED value chain

will become commoditized due to scale and learning curve effects as volume

rise, but the degree to which this occurs will depend upon the strategies of the

"Big 5" LED producers. While scale will drive down costs, it won't become a

"biggest-takes-all" business, since the advantages of scale in the LED industry

are not as pronounced as those in the semiconductor sector due to lower fixed

costs. If the Big 5 continue to own intellectual property (IP) rights despite high IP

litigation costs, they will prevent competition and the current oligopoly market

structure will remain. If, on the other hand, they expand cross-licensing, the

market will become fragmented in the short term, but scale effects will drive

consolidation in the long term.

Second, room still exists for chipmakers and packagers interested in supplying

premium LED chips for automotive lighting applications. As observed in the

semiconductor industry, these automotive-focused fabricators typically offer the

higher quality demanded in safety-related and recall-prone automotive lighting

systems by adding extra process steps and more inspections, and by scheduling

additional maintenance compared to non-automotive "fab" plants. The trade-off is

higher cost, which automakers are compelled to pay.

Third, the lighting industry profit pool will migrate from chip making/packaging to

modules and fixtures (Exhibit 4). By 2020, chip production will become

increasingly commoditized and thus, less profitable. Also, new entrants from Asia

will speed the commoditization shift. The inclusion of "smart lighting" functionality

on the LED module will boost its value, as will improved heat management

substrates. Also, tier-one supplier branding efforts and improved thermal

management solutions should keep margins attractive and thus, increase their

LED market share.

5/9

http://autoassembly.mckinsey.com

McKinsey & Company, Inc.

Automotive & Assembly EXTRANET

Exhibit 4:

Value-add shift from upstream to downstream

expected

Total profit pool ( billions)

Higher/lower expected

share of profits

Profit pool development for automotive LED lighting

Percent

Epi/chip

Package

Module

Tier-1 mfg.1

Total

100

LED

lighting

today

28

46

19

0.2

100

LED

Lighting

"2020"

5-10

Rationale

for LED

development until

"2020"

Commoditization of

chip production

expected

semicon-like

increase of

competition with

only a few

profitable players in

the end

New entrants (like

TSMC or

Samsung) will

"professionalize"

epi process

~5

Despite commoditization in industry,

packaging can

keep profit share

due increase of

white light / highbrightness

applications (e.g.,

headlamps)

New entrants from

Asia for low-end

business (e.g.,

interior) expected

~60

~30

Additional functionalities (e.g., "smart

lights") to be included

on LED module

Improved heat

management on

substrate level

improves margins

~0.7

Designing

("branding") of

fixtures, combined

with improved size

and heat management solutions keep

margins attractive

and increase LED

market share

"R&D ownership" for

overall system

improves margins

1 Luminaire level

Source: Company Web sites, IMS, Amadeus, team analysis

And, because tier-one suppliers will likely take on a leading role, LED module

specialists will probably disappear. Lighting-focused tier-one companies have

specific product design and quality-related strengths that pure module players

and integrated LED manufacturers lack. LED technology allows for more design

differentiation, upon which tier-one suppliers can capitalize by having in-house

module capability. Furthermore, tier-one suppliers can source quality LED chips

at lower cost by leveraging their inherently larger volumes compared to the

typically more fragmented module players. The alternative direct cooperation

between LED manufacturers and automakers seems unlikely without also

tying-in tier-one suppliers, which typically supply large portions of interior or

exterior systems.

Finally, the tier-one supplier market will become more consolidated, especially

when it comes to mature geographies and established technologies. Scale will

become an increasingly important avenue for driving down cost and only a few

tier-one players will be able to secure heavy demand. Furthermore, the growing

consolidation among OEMs will increase price pressure on tier-one suppliers.

This same type of consolidation occurred when the automotive airbag industry

reached the commoditization phase, resulting in three global players now

controlling the airbag industry.

6/9

http://autoassembly.mckinsey.com

McKinsey & Company, Inc.

Automotive & Assembly EXTRANET

These shifts mean that the automotive LED industry will change from its current

value chain from chipmaker to module specialist to tier-one supplier to a

situation in which integrated tier-one suppliers with in-house module-making

abilities take over the module role, while auto-focused chipmakers provide LED

chips of the required quality. Alternatively, for largely commoditized products

(e.g., interior lamps), a large-scale lighting specialist with chip-making capabilities

could produce standardized, cost-competitive modules while the tier-one supplier

focuses on cost reduction.

Strategies for Integrated LED Manufacturers and Tier-One Players

To position themselves to take advantage of impending LED value chain shifts,

integrated LED manufacturers, tier-one suppliers, and OEMs have a number of

choices to make.

LED manufacturers should develop new applications by integrating their products

with electronic components such as sensors, while maintaining close

communication with OEMs and end customers. They can also pursue a stretch

goal to reduce chip and module costs twice as quickly as currently predicted,

striving to, for example, reach cost parity with halogen technology by 2014 rather

than 2020 (Exhibit 5). Or, they can aggressively lobby for regulations mandating

LED use in specific applications (e.g., DRLs, CHMSLs, or brake lights) based

upon their increased safety (i.e., reliability) or superior CO2 abatement properties.

LED makers could also pursue a value chain play, working directly with OEMs

instead of through tier-one suppliers. This strategy can be risky, however, since

LED suppliers must guard against earning tier-one margin levels, which can be

half the size of their current ones.

7/9

http://autoassembly.mckinsey.com

McKinsey & Company, Inc.

Automotive & Assembly EXTRANET

Exhibit 5:

Significantly accelerating future cost reductions

implies decisive action along main cost drivers

-x%

Cost structure LED headlamp

ASP to OEM USD/car

Aggressive

cost-down

Base case

ASP 2009

Chip+

Package

Module

Fixture

ASP 2015

58

14

40

178

-8% p.a.

-16%

-5%

-5%

Cost driver

(% of total)

Proposed cost-down measures

(% annual reduction until 2015)

Capital (16%)

Labor (30%)

Materials (41%)

Others (13%)

Driver (56%)

Plastic bracket (38%)

Assembly (6%)

Drive development of low-cost

standardized driver electronics

(-20% p.a.)

Housing, cooling,

reflector (80%)

Assembly (5%)

Overhead and

profit (15%)

Standardize module and pursue

rigorous design-to-cost program

(-12% p.a.)

290

290

61 -17%

30

72

127

-14%

-10%

Avg. annual

reduction

-13% p.a.

Migrate to larger wafer-sizes,

improve yield and binning rate

(-20% p.a.)

Drive automization and consider

further relocate to low-cost

countries (-20% p.a.)

Use scale to renegotiate

materials costs (-15% p.a.)

At EUR ~125 parity to xenon:

reduction of -13% p.a. is realistic

target considering US DoE roadmap of -20% p.a. for general

lighting luminaires

1 Base case: ASP reductions of -16% p.a. for chip/package at constant margins and -5% p.a. for downstream production steps (source iSupply, IMS)

SOURCE: McKinsey

LED makers must also guard against the threat of backward integration by tierone suppliers and watch out for "attacks" from backlighting players with natural

cost advantages, which could precipitate price wars. In either case, it will be

critical to establish long-standing relationships with tier-one players and be

involved in product development early on.

Tier-one suppliers also have a number of options open to them; many similar to

those available to LED makers. Like LED players, tier-one suppliers can

aggressively go after LED chip and module costs, or attempt to shape regulation

to their advantage. They can develop new applications that integrate with other

electronics systems or enter adjacent segments, such as car customization,

public transportation, or street lighting. They can also expand their business to

provide standardized LED modules to pure tier-one suppliers or actually

backward integrate into modules.

At the same time, tier-ones must guard against being squeezed-out by the

forward-integration moves of LED manufacturers or becoming too dependent

upon a few chip suppliers with large market shares and significant amounts of

market power.

8/9

http://autoassembly.mckinsey.com

McKinsey & Company, Inc.

Automotive & Assembly EXTRANET

Finally, OEMs should pursue a targeted LED option strategy, designing attractive

LED solutions for DRL, CHMSL, or interior applications, and driving the customer

adoption rates of existing high-margin options by offering them in attractive

bundles. They can also strive to offer break-through functionality in new vehicle

options by brainstorming with chipmakers or systems integrators on true

innovations. OEMs can further attempt to attract new chipmakers into the

automotive industry to increase price pressure.

Automakers can also mitigate a number of risks (e.g., new regulations that make

current vehicle options mandatory) and thus, squeeze margins or have dominant

upstream players take on attacker roles and forward-integrate, thus gaining

market power. Other risks involve dealing with price hikes caused by the

industry's cyclical nature and facing profit and/or market share losses caused by

OEMs' slow reaction and long development lead times.

***

Expected changes will present challenges and opportunities for players in the

automotive LED value chain. Some participants, such as module specialists, may

soon find themselves crowded out by tier-one players seeking to capture greater

value. At the same time, others will have to invest and forge cooperative

relationships in order to position themselves to claim a larger portion of this

migrating industry profit pool.

Copyright 2010 McKinsey & Company, Inc.

All rights reserved.

9/9

http://autoassembly.mckinsey.com

McKinsey & Company, Inc.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Ray Kroc's Visionary Leadership at McDonald'sDocument4 pagesRay Kroc's Visionary Leadership at McDonald'sViknesh Kumanan100% (1)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Housing Backlog: An Assessment of The Practicality of A Proposed Plan or MethodDocument4 pagesHousing Backlog: An Assessment of The Practicality of A Proposed Plan or MethodJoey AlbertNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Why EIA is Important for Development ProjectsDocument19 pagesWhy EIA is Important for Development Projectsvivek377No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Assign 01 (8612) Wajahat Ali Ghulam BU607455 B.ed 1.5 YearsDocument8 pagesAssign 01 (8612) Wajahat Ali Ghulam BU607455 B.ed 1.5 YearsAima Kha KhanNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- 1) Anuj Garg Vs Hotel Association of India: Article 15Document26 pages1) Anuj Garg Vs Hotel Association of India: Article 15UriahNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- PPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerDocument40 pagesPPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerVishwajeet GhoshNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- ITMS (Intelligent Transit Management System) : 1. Name of Project: 2. BackgroundDocument6 pagesITMS (Intelligent Transit Management System) : 1. Name of Project: 2. Backgroundashish dhakalNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Journalism of Courage: Wednesday, January 11, 2023, New Delhi, Late City, 24 PagesDocument24 pagesJournalism of Courage: Wednesday, January 11, 2023, New Delhi, Late City, 24 PagesVarsha YenareNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Đề thi tuyển sinh vào lớp 10 năm 2018 - 2019 môn Tiếng Anh - Sở GD&ĐT An GiangDocument5 pagesĐề thi tuyển sinh vào lớp 10 năm 2018 - 2019 môn Tiếng Anh - Sở GD&ĐT An GiangHaiNo ratings yet

- BP - Electrical PermitDocument2 pagesBP - Electrical PermitDwinix John CabañeroNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- WADVDocument2 pagesWADVANNA MARY GINTORONo ratings yet

- Sunrise Conveyors Maintenance OfferDocument3 pagesSunrise Conveyors Maintenance OfferRampwalker ConveyorNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Learn Financial Accounting Fast with TallyDocument1 pageLearn Financial Accounting Fast with Tallyavinash guptaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Surface Chemistry Literature List: Literature On The SubjectDocument5 pagesSurface Chemistry Literature List: Literature On The SubjectMasih SuryanaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Tech Refresh & Recycle Program: 2,100PB+ of Competitive GearDocument1 pageTech Refresh & Recycle Program: 2,100PB+ of Competitive GearRafi AdamNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 09 - 7th EIRAC Plenary - Sustainable Chain ManagementDocument17 pages09 - 7th EIRAC Plenary - Sustainable Chain ManagementpravanthbabuNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- SodaPDF Converted DokumenDocument4 pagesSodaPDF Converted Dokumenzack almuzNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Case View With Rajat Gandhi - P2P Lending in India: Delivering Disruptive Innovation in Alternate Lending SpaceDocument16 pagesCase View With Rajat Gandhi - P2P Lending in India: Delivering Disruptive Innovation in Alternate Lending SpaceETCASESNo ratings yet

- How Zagreb's Socialist Experiment Finally Matured Long After Socialism - Failed ArchitectureDocument12 pagesHow Zagreb's Socialist Experiment Finally Matured Long After Socialism - Failed ArchitectureAneta Mudronja PletenacNo ratings yet

- Quicho - Civil Procedure DoctrinesDocument73 pagesQuicho - Civil Procedure DoctrinesDeanne ViNo ratings yet

- How To Configure User Accounts To Never ExpireDocument2 pagesHow To Configure User Accounts To Never ExpireAshutosh MayankNo ratings yet

- MTWD HistoryDocument8 pagesMTWD HistoryVernie SaluconNo ratings yet

- SimpleDocument3 pagesSimpleSinghTarunNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Architecture FirmDocument23 pagesArchitecture Firmdolar buhaNo ratings yet

- Murder in Baldurs Gate Events SupplementDocument8 pagesMurder in Baldurs Gate Events SupplementDavid L Kriegel100% (3)

- Vodafone service grievance unresolvedDocument2 pagesVodafone service grievance unresolvedSojan PaulNo ratings yet

- 2016-2017 Course CatalogDocument128 pages2016-2017 Course CatalogFernando Igor AlvarezNo ratings yet

- Eep306 Assessment 1 FeedbackDocument2 pagesEep306 Assessment 1 Feedbackapi-354631612No ratings yet

- Usui MemorialDocument6 pagesUsui MemorialstephenspwNo ratings yet

- PEST Analysis of the Indian Pharmaceutical IndustryDocument8 pagesPEST Analysis of the Indian Pharmaceutical IndustryAnkush GuptaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)